Score

八十二証券

https://www.82sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Japan

JapanProducts

6

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Surpassed 66.75% brokers

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

HACHIJUNI SECURITIES Co.,Ltd

Abbreviation

八十二証券

Platform registered country and region

Company address

Company website

https://www.82sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

八十二証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2024/02/08

Revenue(YoY)

42.49B

-15.20%

EPS(YoY)

13.07

-24.23%

八十二証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/02/082024/Q353.395B/0

- 2023/08/032024/Q148.306B/0

- 2023/02/022023/Q360.041B/0

- 2022/07/282023/Q152.312B/0

- 2022/01/272022/Q339.698B/0

Internet Gene

Gene Index

APP Rating

| Hachijuni Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | Stock trading commission: up to 0.6325% of the contract price with additional fee |

| Investment trust application fee: 0.5% | |

| Account Fees | 3,300 yen (tax included) per year |

| App/Platform | Online trading platform |

Hachijuni Securities Information

Hachijuni Securities Co., Ltd., established in May 1948, is a securities provider that became a wholly owned subsidiary of Hachijuni Bank in April 2006, now part of the Hachijuni Group. Hachijuni Securities emphasizes the expertise of its personnel, comprising securities analysts, technical analysts, and financial planners, offering comprehensive advice to novice customers entering asset management transactions. The institution offers a variety of financial products, including stocks, investment trusts, and bonds.

Pros & Cons of Hachijuni Securities

| Pros | Cons |

| Established History | Limited Information on Specific Investment Strategies |

| Regulated by FSA | |

| Multiple Market offerings |

- Established History: With a history spanning over seven decades, Hachijuni Securities demonstrates longevity and experience in the financial industry.

- Regulated by FSA: Hachijuni Securities operates under the regulatory oversight of the Japan Financial Services Agency and holds a Japan Securities Trading License. This regulatory oversight can provide clients with a sense of security and assurance that the firm operates within the bounds of official regulations and standards.

- Multiple Market offerings: Hachijuni Securities provides clients with a variety of financial products to choose from, including stocks, investment trusts, and bonds.

- Limited Information on Specific Investment Strategies: The firm provides limited information on specific investment strategies or performance, impacting investors' ability to fully assess the suitability of their investment options.

Is Hachijuni Securities Safe?

- Regulatory Sight: Hachijuni Securities operates under the regulatory oversight of the Japan Financial Services Agency (No.21), holding a JapanSecurities Trading License. This regulatory authority ensures that financial institutions comply with relevant laws and regulations to protect investors and maintain market integrity.

- User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

- Security Measures: So far we haven't found any information about the security measures for this broker.

What are Securities to Trade with Hachijuni Securities?

Hachijuni Securities provides a range of products to its clients. These products include stocks, investment trusts, and bonds.

Stocks are ownership stakes in a company, allowing investors to participate in the company's performance and potentially receive dividends.

Investment trusts are pooled funds that invest in a diversified portfolio of assets, managed by professional fund managers.

Bonds are debt instruments issued by companies or governments, with investors lending money in exchange for regular interest payments and the return of the principal at maturity.

Hachijuni Securities Accounts

Hachijuni Securities offers two types of accounts for investors: Domestic account and Foreign Account.

With the Domestic account, clients can access and trade stocks, bonds, and other securities listed on local exchanges, providing them with opportunities to diversify their portfolios within their familiar market environment.

On the other hand, the Foreign Account allows investors to access a wider range of investment opportunities in global markets, enabling them to take advantage of international growth and potential currency fluctuations.

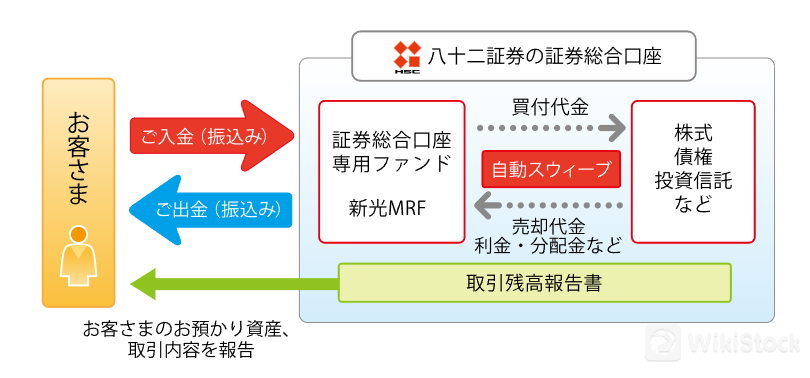

Additionally, a securities comprehensive account is a service that automatically manages funds in a single account. This includes:

- Funds deposited by customers

- Proceeds from the sale of stocks

- Interest and dividends

When purchasing or withdrawing stocks, the funds are automatically used from the account. This eliminates the need to manually transfer funds between different accounts.

Hachijuni Securities Fees Review

- Stock Trading Commission

Online Trading

| Contract price | Commission fee (tax included) |

| If the amount is less than 1 million yen | 0.6325% of the contract price |

| Over 1 million yen and up to 1.5 million yen | 0.495% + 1,375 yen |

| Over 1.5 million yen and up to 2.5 million yen | 0.4675% + 1,788 yen |

| Over 2.5 million yen and up to 3 million yen | 0.4565% + 2,063 yen |

| Over 3 million yen and up to 5 million yen | 0.44% + 2,558 yen |

| Over 5 million yen and up to 10 million yen | 0.3575% + 6,683 yen |

| Over 10 million yen and up to 20 million yen | 0.2475% + 17,683 yen |

| Over 20 million yen and up to 30 million yen | 0.22% + 23,183 yen |

| Over 30 million yen and up to 40 million yen | 0.165% + 39,683 yen |

| Over 40 million yen and up to 50 million yen | 0.1375% + 50,683 yen |

| Over 50 million yen | 121,000 yen flat rate |

Note: If the amount equivalent to 0.6325% of the contract price is less than 1,375 yen, the amount will be 1,375 yen. The fee (tax included) you pay may differ from the calculation result based on the above fee rate due to rounding.

Face to Face Trading

| Contract price | Commission fee (tax included) |

| If the amount is less than 1 million yen | 1.265% of the contract price (Note 1) |

| Over 1 million yen and up to 1.5 million yen | 0.99% + 2,750 yen |

| Over 1.5 million yen and up to 2.5 million yen | 0.935% + 3,575 yen |

| Over 2.5 million yen and up to 3 million yen | 0.913% + 4,125 yen |

| Over 3 million yen and up to 5 million yen | 0.88% + 5,115 yen |

| Over 5 million yen and up to 10 million yen | 0.715% + 13,365 yen |

| Over 10 million yen and up to 20 million yen | 0.495% + 35,365 yen |

| Over 20 million yen and up to 30 million yen | 0.44% + 46,365 yen |

| Over 30 million yen and up to 40 million yen | 0.33% + 79,365 yen |

| Over 40 million yen and up to 50 million yen | 0.275% + 101,365 yen |

| Over 50 million yen | Flat rate of 242,000 yen |

Note:

If the amount equivalent to 1.265% of the contract price is less than 2,750 yen, the fee will be 2,750 yen.

The commission for online trading is 50% off that for face-to-face trading.

The commission for buying and selling shares less than one unit is an amount prorated according to the ratio of the number of shares traded to the commission for the contract price of one unit share.

The commission (tax included) you pay may differ from the calculation result based on the above commission rate due to rounding.

- Investment Trust Application Fee: A pre-tax handling fee rate of 0.5% will be deducted from the in-store handling fee

- Online Account Management Fee: 3,300 yen (tax included) per year

For eligible customers as of the end of March each year, the online trading account management fee for one year will be automatically deducted from their securities account on April 15th (or the next business day if April 15th is a holiday).

- Bank Transfer Fee:

When clients transfer money to Hachijuni Securities: Clients are responsible for the transfer fee.

When Hachijuni Securities transfers money to clients: Hachijuni Securities will cover the transfer fee.

Hachijuni Securities App Review

Hachijuni Securities offers browser software specifically designated for smartphone users operating on the iOS and Android operating systems.

Research & Education

Hachijuni Securities provides news releases, campaign information, and seminar details as part of its education and research resources for clients.

News releases offer updates on market trends, company developments, and other pertinent information to keep investors informed.

Campaign information includes details on promotions or special offers available to clients, attracting new businesses and retaining existing clients.

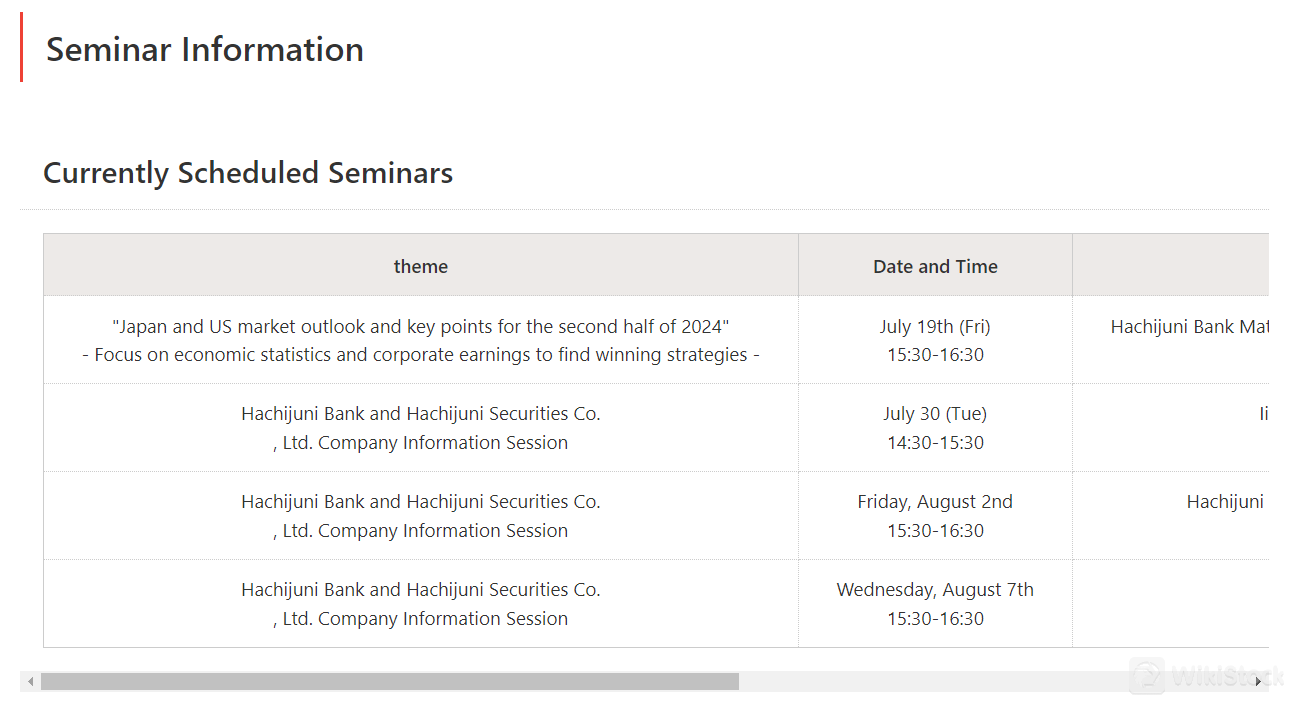

Seminar information informs clients about educational events or workshops hosted by the company to enhance their knowledge and understanding of financial markets and investment strategies.

Customer Service

Hachijuni Securities offers limited ways to connect to them.

- Tel: 0120-70-3782

- Company Address: 1F & 2F, Choei No.2 Building, 1277-2 Minamiishido-cho, Nagano-shi, Nagano 380-0824, Japan

Conclusion

Overall, Hachijuni Securities Co., Ltd. offers a range of financial products and resources to clients, including stocks, investment trusts, and bonds. The company's affiliation with Hachijuni Bank and its reported high capital adequacy ratio may suggest a level of stability in its operations. However, the educational and research resources provided by the company, such as news releases, campaign information, and seminar details, may lack in-depth analysis and comprehensive coverage. As with any financial institution, it is advisable for clients to exercise caution and conduct thorough research before engaging in transactions with Hachijuni Securities.

Q&A

Is Hachijuni Securities regulated?

Yes, it operates under the regulatory oversight of theJapan Financial Services Agency.

What types of financial products does Hachijuni Securities offer?

- Stocks, investment trusts, and bonds.

- It offers news releases, campaign information, and seminar details.

Are there any educational resources available for clients?

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

15-20 years

Commission Rate

0.1375%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Relevant Enterprises

Countries

Company name

Associations

Japan

八十二アセットマネジメント(株)

Group Company

Japan

(株)長野銀行

Group Company

Japan

(株)八十二銀行

Group Company

Download App

Review

No ratings

Recommended Brokerage FirmsMore

三菱UFJモルガン・スタンレー証券

Score

Nissan Securities

Score

水戸証券

Score

東洋証券株式会社

Score

豊証券株式会社

Score

Kyokuto Securities

Score

ちばぎん証券

Score

あかつき証券

Score

Money Partners

Score

岩井コスモ証券

Score