Score

岩井コスモ証券

https://www.iwaicosmo.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

A

Influence Index NO.1

Japan

JapanProducts

8

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Surpassed 78.05% brokers

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Global Seats

![]() Owns 2 seat(s)

Owns 2 seat(s)

Japan FSE

岩井コスモ証券株式会社

Japan NSE

岩井コスモ証券株式会社

Brokerage Information

More

Company Name

IwaiCosmo Securities Co.,Ltd.

Abbreviation

岩井コスモ証券

Platform registered country and region

Company address

Company website

https://www.iwaicosmo.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

岩井コスモ証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2024/01/25

Revenue(YoY)

5.92B

+18.55%

EPS(YoY)

60.07

+51.89%

岩井コスモ証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/01/252024/Q35.923B/0

- 2023/07/202024/Q15.711B/0

- 2023/01/262023/Q34.996B/0

- 2022/07/212023/Q14.624B/0

- 2022/01/272022/Q35.476B/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.44%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| IwaiCosmo Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Founded | 1944 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Products | Domestic stocks, initial public offerings, foreign stocks, bond, forex, stock CFDs, investment trust |

| Fees (spot trading for stocks) | Face-to-Face Transactions and Plusnet: 0.1-9.99% + fixed rate ranging from 0-JPY 183,060 depending on trading volume, with 10% tax levied |

| Protected Custody Account: 0.1-9.99% + fixed rate ranging from 0-JPY 189,700 depending on trading volume, with 10% tax levied | |

| Customer Service | Head office: 1-8-12 Imabashi, Chuo-ku, Osaka |

| TEL: 0120-318-611 / 0120-405-546 during weekdays 8:00-17:00 | |

| Email: wmaster@iwaicosmo.co.jp, fxmaster@iwaicosmo.co.jp | |

| Social media: YouTube, LINE |

IwaiCosmo Securities Information

Established in 1944 with roots dating back to 1915, IwaiCosmo Securities operates across Japan with numerous branch offices. It offers a diverse array of investment products including domestic stocks, IPOs, foreign stocks, bonds, Forex, stock CFDs, and investment trusts.

The firm provides transparent fee structures and educational resources. Regulated by Japan's Financial Services Agency (FSA) under license number Director-General of the Finance Bureau (Kinsho) No. 15, IwaiCosmo Securities upholds rigorous standards of integrity and credibility in its financial services.

For more detailed information, you can visit their official website: https://www.iwaicosmo.co.jp/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | High Trading Fees |

| Diverse Investment Products | |

| Educational Resources | |

| Established History | |

| Branch Network |

- Regulatory Oversight: Regulated by the Japan Financial Services Agency (FSA), ensuring adherence to strict financial standards and investor protection.

- Diverse Investment Products: IwaiCosmo Securities offers a wide range of investment options including domestic and foreign stocks, bonds, Forex, stock CFDs, and investment trusts.

- Educational Resources: They provide educational seminars and market insights, enhancing investor knowledge and decision-making abilities.

- Established History: With roots dating back to 1915 and formal establishment in 1944, IwaiCosmo Securities brings extensive experience and credibility in the financial services industry.

- Branch Network: Numerous branch offices across Japan provide localized support and accessibility for clients. Cons:

- High Trading Fees: Though transparent, the trading fees charged by the company are high compared to some competitors, impacting cost-conscious investors.

- Is IwaiCosmo Securities regulated by any financial authority?

- Yes, IwaiCosmo Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA), with license no. Director-General of the Finance Bureau (Kinsho) No. 15.

- What types of products does IwaiCosmo Securities provide?

- Domestic stocks, initial public offerings, foreign stocks, bond, forex, stock CFDs and investment trust.

- Is IwaiCosmo Securities suitable for beginners?

- No, though IwaiCosmo Securities is well regulated by FSA and offers educational resources for newcomers, its high trading fees can hinder beginners who prefer to start small.

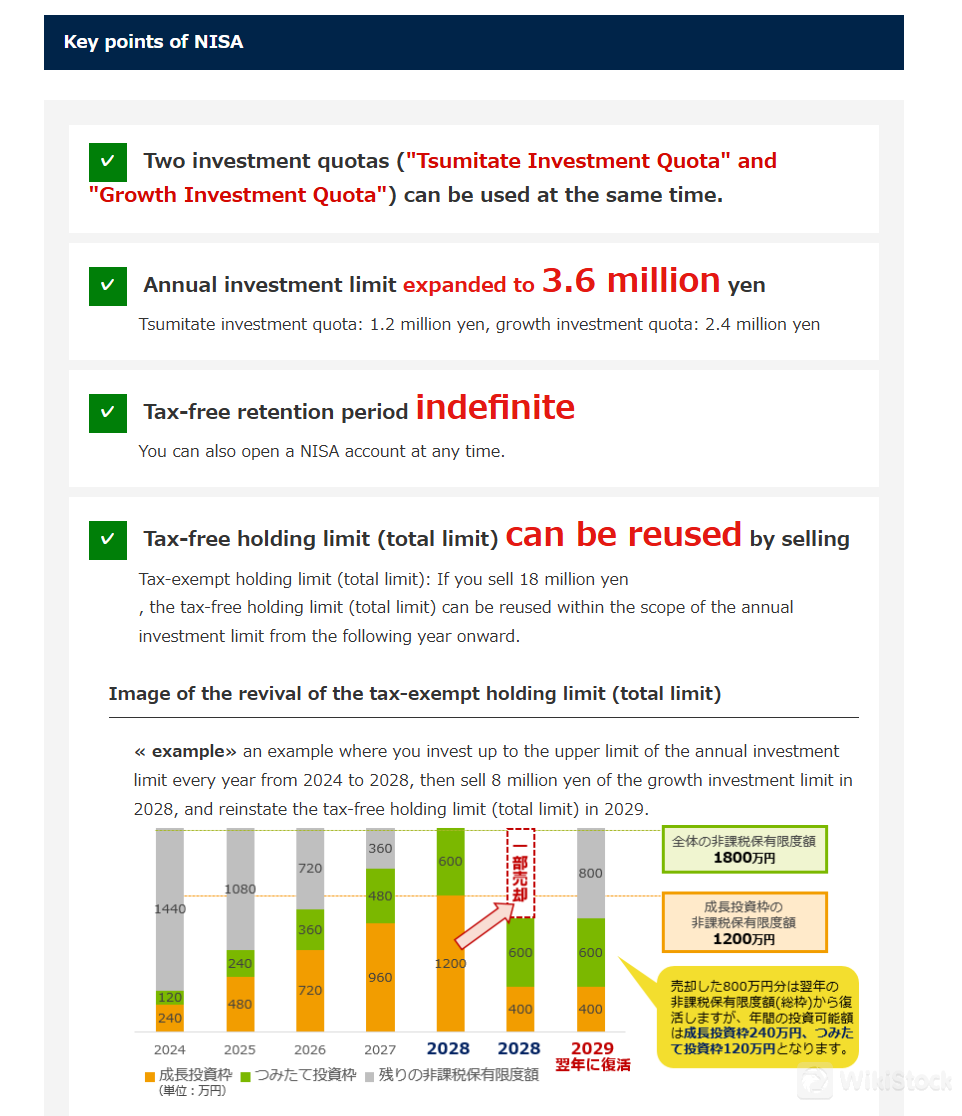

- What are the benefits of the new NISA system offered by IwaiCosmo Securities?

- The New NISA system provides extended tax benefits, indefinite tax-exempt holding periods, and increased annual investment limits for flexible asset formation.

Is It Safe?

Regulation:

IwaiCosmo Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Finance Bureau (Kinsho) No. 15, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores IwaiCosmo Securities's commitment to integrity and credibility in its services.

Safety Measures:

IwaiCosmo Securities prioritizes robust security measures to ensure customer confidence in trading. They employ SSL/TLS encryption for secure communication, safeguarding personal and transactional data from unauthorized access.

Customers can set separate login passwords and PINs, with automatic lockout features for enhanced account protection. Their trading screens feature automatic timeouts to prevent unauthorized access due to inactivity.

What are Securities to Trade with IwaiCosmo Securities?

IwaiCosmo Securities offers a robust lineup of investment products across multiple categories.

In domestic stocks, they specialize in initial public offerings (IPOs) and a diverse range of listed companies, leveraging their strong underwriting expertise.

For global opportunities, their foreign stocks include top selections from major economies such as the US, providing access to leading international markets.

In the fixed income segment, they offer a variety of bonds, including government and corporate options, catering to investors seeking stable returns.

Their investment trusts are carefully curated with detailed search functionalities and performance rankings, facilitating informed investment decisions tailored to individual financial objectives.

For active traders, IwaiCosmo Securities provides FX margin trading for currency speculation and CFDs on stock indices, offering tools to capitalize on market movements.

Fees Review

IwaiCosmo Securities applies transparent fee structures for each product. For example, for spot trading of domestic stocks, tiered fees vary based on the transaction amount and transaction channels.

Face-to-Face Transactions| Contract Price Range (JPY) | Consignment Fee (Tax Included) |

| ≤ 25,000 | (9.999% of contract price)×1.1 |

| > 25,000 ≤ 222,000 | (0% of contract price+2,500)×1.1 |

| > 222,000 ≤ 1,000,000 | (1.128% of contract price)×1.1 |

| > 1,000,000 ≤ 5,000,000 | (0.862% of contract price+2,660)×1.1 |

| > 5,000,000 ≤ 10,000,000 | (0.646% of contract price+13,460)×1.1 |

| > 10,000,000 ≤ 30,000,000 | (0.530% of contract price+25,060)×1.1 |

| > 30,000,000 ≤ 50,000,000 | (0.245% of contract price+110,560)×1.1 |

| > 50,000,000 | (0.100% of contract price+183,060)×1.1 |

| Contract Price Range (JPY) | Consignment Fee (Tax Included) |

| ≤ 25,000 | (9.999% of contract price)×1.1 |

| > 25,000 ≤ 218,000 | (0% of contract price+2,500)×1.1 |

| > 218,000 ≤ 1,000,000 | (1.150% of contract price)×1.1 |

| > 1,000,000 ≤ 5,000,000 | (0.880% of contract price+2,700)×1.1 |

| > 5,000,000 ≤ 10,000,000 | (0.660% of contract price+13,700)×1.1 |

| > 10,000,000 ≤ 30,000,000 | (0.550% of contract price+24,700)×1.1 |

| > 30,000,000 ≤ 50,000,000 | (0.250% of contract price+114,700)×1.1 |

| > 50,000,000 | (0.100% of contract price+189,700)×1.1 |

| Contract Price Range (JPY) | Consignment Fee (Tax Included) |

| ≤ 25,000 | (9.999% of contract price)×1.1 |

| > 25,000 ≤ 277,000 | (0% of contract price+2,500)×1.1 |

| > 277,000 ≤ 1,000,000 | (1.128% of contract price×80%)×1.1 |

| > 1,000,000 ≤ 5,000,000 | (0.862% of contract price+2,660×80%)×1.1 |

| > 5,000,000 ≤ 10,000,000 | (0.646% of contract price+13,460×80%)×1.1 |

| > 10,000,000 ≤ 30,000,000 | (0.530% of contract price+25,060×80%)×1.1 |

| > 30,000,000 ≤ 50,000,000 | (0.245% of contract price+110,560×80%)×1.1 |

| > 50,000,000 | (0.100% of contract price+183,060×80%)×1.1 |

Since fees are subject to change, for most up-to-date and detailed information of all its products, clients are encouraged to visit the IwaiCosmo Securities website at https://www.iwaicosmo.co.jp/service/fees/.

NISA System

IwaiCosmo Securities offers a comprehensive NISA (Nippon Individual Savings Account) system designed to promote long-term savings and investment. The new NISA, effective from January 2024, allows investors to accumulate wealth with expanded tax-free limits and an indefinite holding period for eligible financial instruments. Investors can utilize both the “Tsumitate Investment Quota” and “Growth Investment Quota,” totaling up to ¥3.6 million of investment annually, with flexibility in product choices like investment trusts and listed stocks.

This system encourages strategic financial planning and tax-efficient investing, reinforcing IwaiCosmo Securities' commitment to enhancing client wealth management solutions.

Research & Education

IwaiCosmo Securities offers robust educational resources designed to cater to investors of all levels, including beginners. These resources feature valuable insights such as the “Kitahama Online Seminar” hosted by Shoichi Arisawa, General Manager of the Investment Research Department. This seminar provides in-depth analysis and market perspectives to help investors understand current trends and make informed decisions.

Additionally, resources like “US Stock Digest” and “Japan Stock Topics” offer detailed insights into the market conditions of U.S. and Japan stocks respectively, ensuring investors stay updated with relevant market developments.

Moreover, IwaiCosmo Securities also provides comprehensive educational resources tailored for beginners in investing. Their initiatives empower new investors with essential knowledge and practical insights to navigate financial markets confidently. These resources include easy-to-understand explanations of investment products like stocks, FX (foreign exchange), and CFDs (contracts for difference), etc.

Customer Services

Iwai Cosmo Securities offers customer support via physical address,phone and email, with a detailed FAQ section on their website. They engage clients through YouTube for informational content and utilize LINE for quick inquiries, ensuring accessible and responsive service.

Head office: 1-8-12 Imabashi, Chuo-ku, Osaka.

TEL: 0120-318-611 / 0120-405-546 during weekdays 8:00-17:00.

Email: wmaster@iwaicosmo.co.jp; fxmaster@iwaicosmo.co.jp.

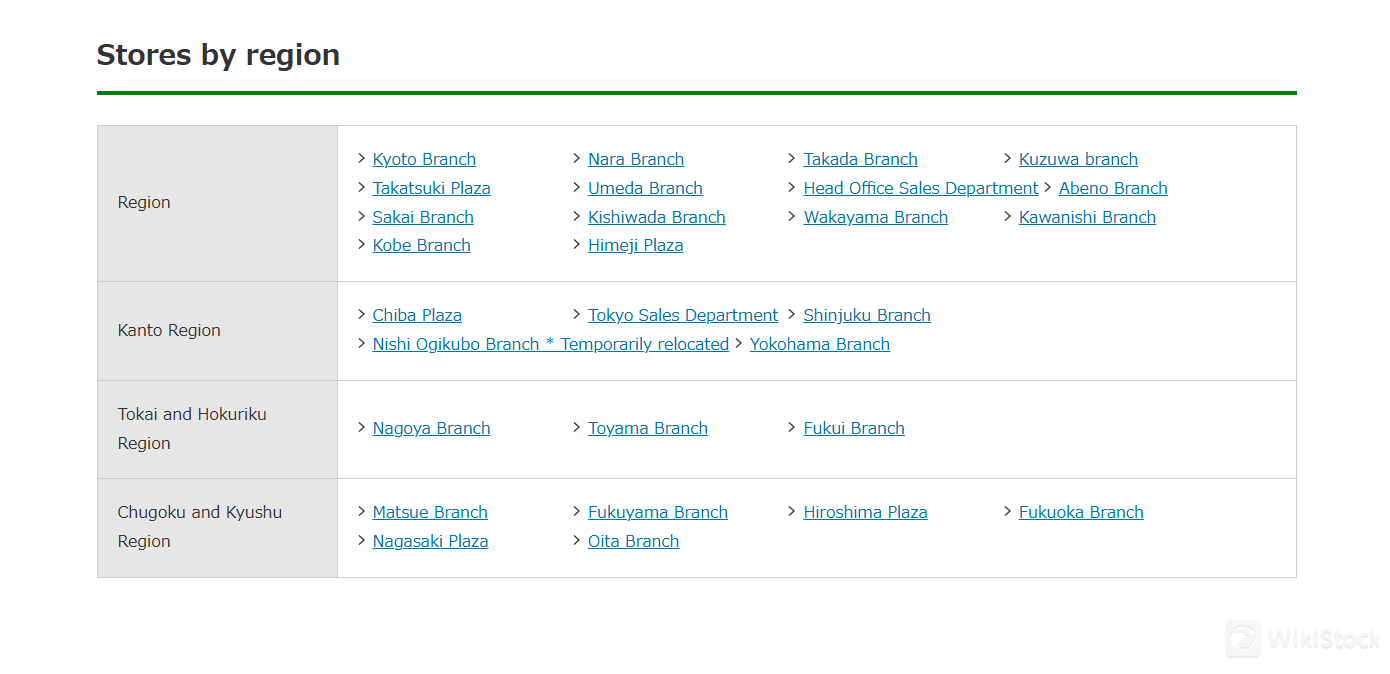

Fore more details about the address/phone of its branch offices across Japan, you can visit https://www.iwaicosmo.co.jp/shop/ and look up for the exact info you want to know.

Conclusion

IwaiCosmo Securities, established in 1944 and regulated by the Japan Financial Services Agency (FSA) under license number Director-General of the Finance Bureau (Kinsho) No. 15, offers a wide range of investment products including domestic stocks, initial public offerings, foreign stocks, bond, forex, stock CFDs and investment trust.

With active participation in the New NISA system, offering extended tax benefits and investment flexibility, IwaiCosmo Securities appears to be a trustworthy entity, maintaining high standards of regulatory compliance, integrity and client service in the financial sector.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

Ichiyoshi Securities

Score

広田証券

Score

丸八証券株式会社

Score

ひろぎん証券

Score

三木証券

Score

JTG証券

Score

JIA証券

Score

山和証券株式会社

Score

寿証券

Score

八十二証券

Score