Safety Measures:

ABCI Securities employs robust security measures to protect client assets and personal information.

These include encryption protocols to safeguard data during transmission and stringent authentication procedures to prevent unauthorized access. Additionally, the platform employs firewalls and intrusion detection systems to monitor and defend against potential cyber threats. Regular security audits and updates ensure that systems remain resilient against evolving risks.

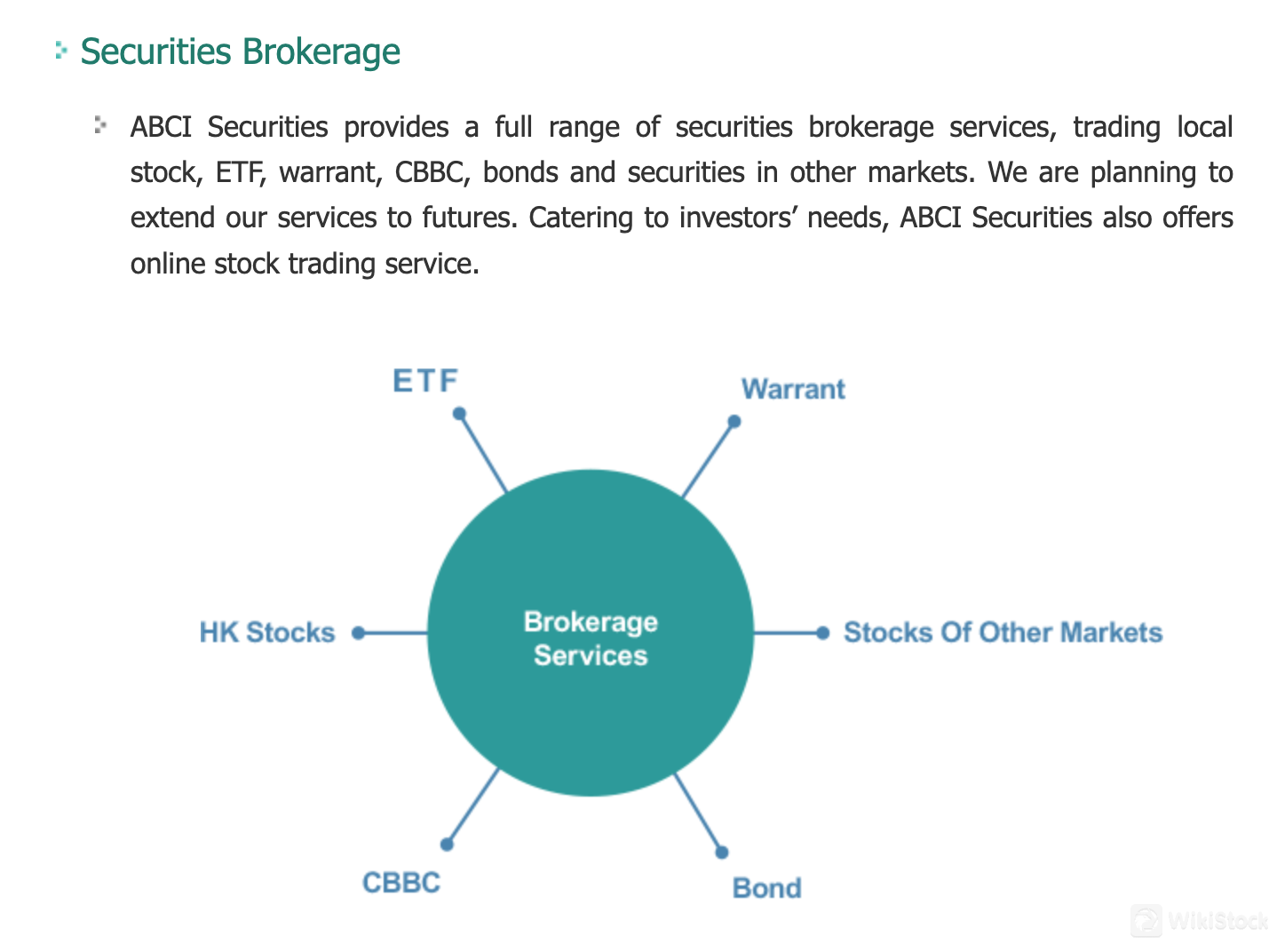

What are securities to trade with ABCI Securities?

ABCI Securities offers a wide array of tradable securities to meet the varied investment needs of clients. These include local stocks, exchange-traded funds (ETFs), warrants, callable bull/bear contracts (CBBCs), bonds, and securities from other markets.

Local stocks provide opportunities for investors to participate in the Hong Kong stock market, accessing a wide range of companies across different sectors. ETFs offer exposure to diversified portfolios of assets, providing a convenient way to invest in specific market segments or themes. Warrants and CBBCs allow investors to leverage their positions or speculate on market movements with defined risk parameters.

Moreover, ABCI Securities facilitates trading in bonds and securities from other markets, enabling clients to diversify their portfolios beyond local markets. The inclusion of futures in their upcoming services will further expand the range of investment opportunities available to clients, potentially attracting investors interested in derivative products.

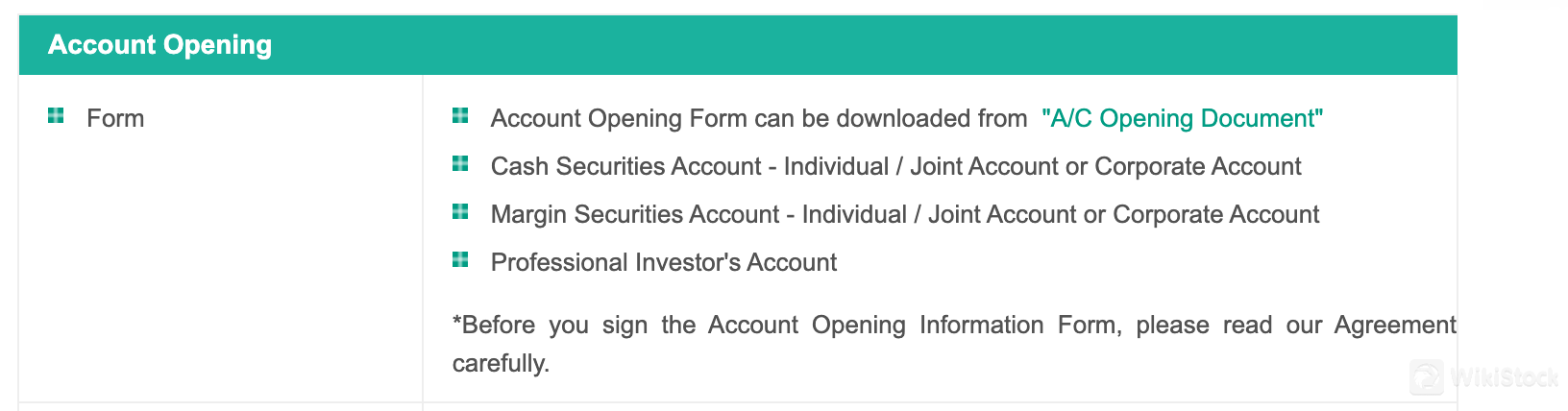

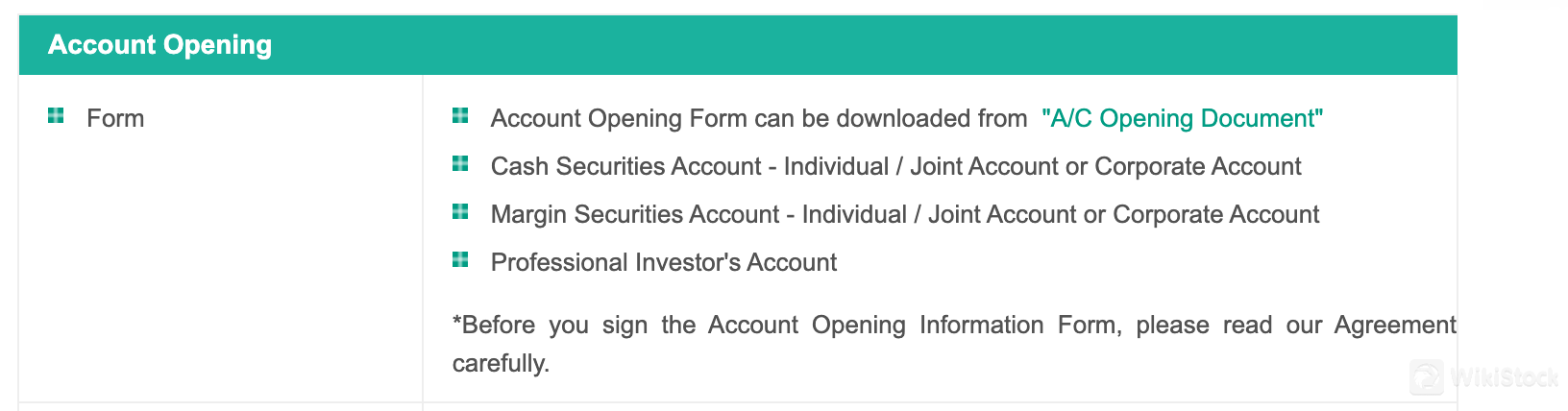

ABCI Securities Accounts

ABCI Securities offers a variety of account types tailored to different investor needs and preferences.

The Cash Securities Account is suitable for individuals, joint account holders, or corporate entities interested in trading securities with cash funds. This account type is ideal for investors seeking to execute trades without leveraging borrowed funds.

For those looking to trade on margin, the Margin Securities Account provides the option to borrow funds from the broker to invest in securities. This account type is available to individual investors, joint account holders, or corporate entities. Margin accounts can be beneficial for investors seeking to amplify their trading potential, but they also entail higher risk due to leverage.

Additionally, ABCI Securities offers the Professional Investor's Account, designed for investors who meet specific criteria for professional status. This account type offers access to certain investment opportunities or services tailored to the needs of experienced or institutional investors.

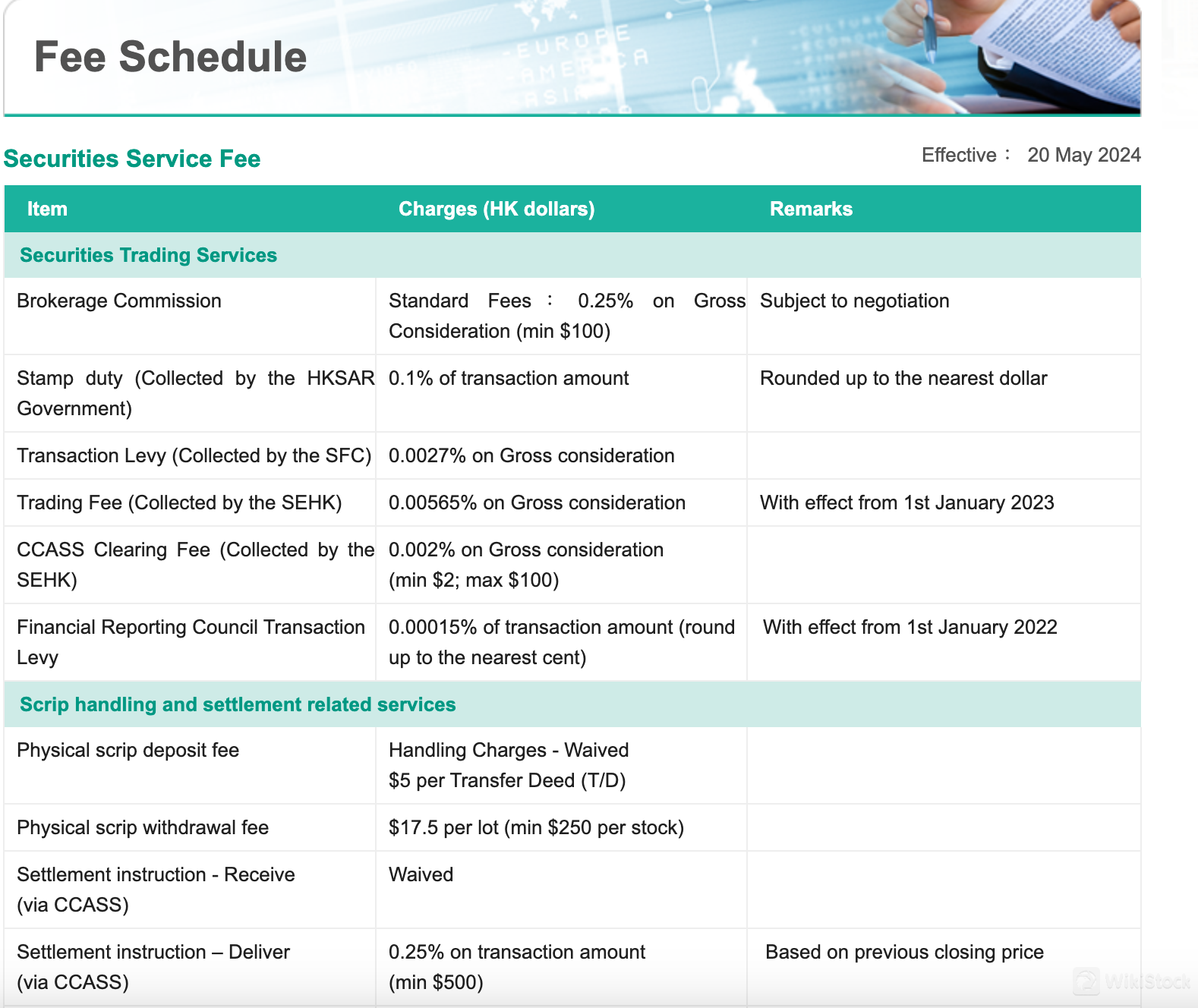

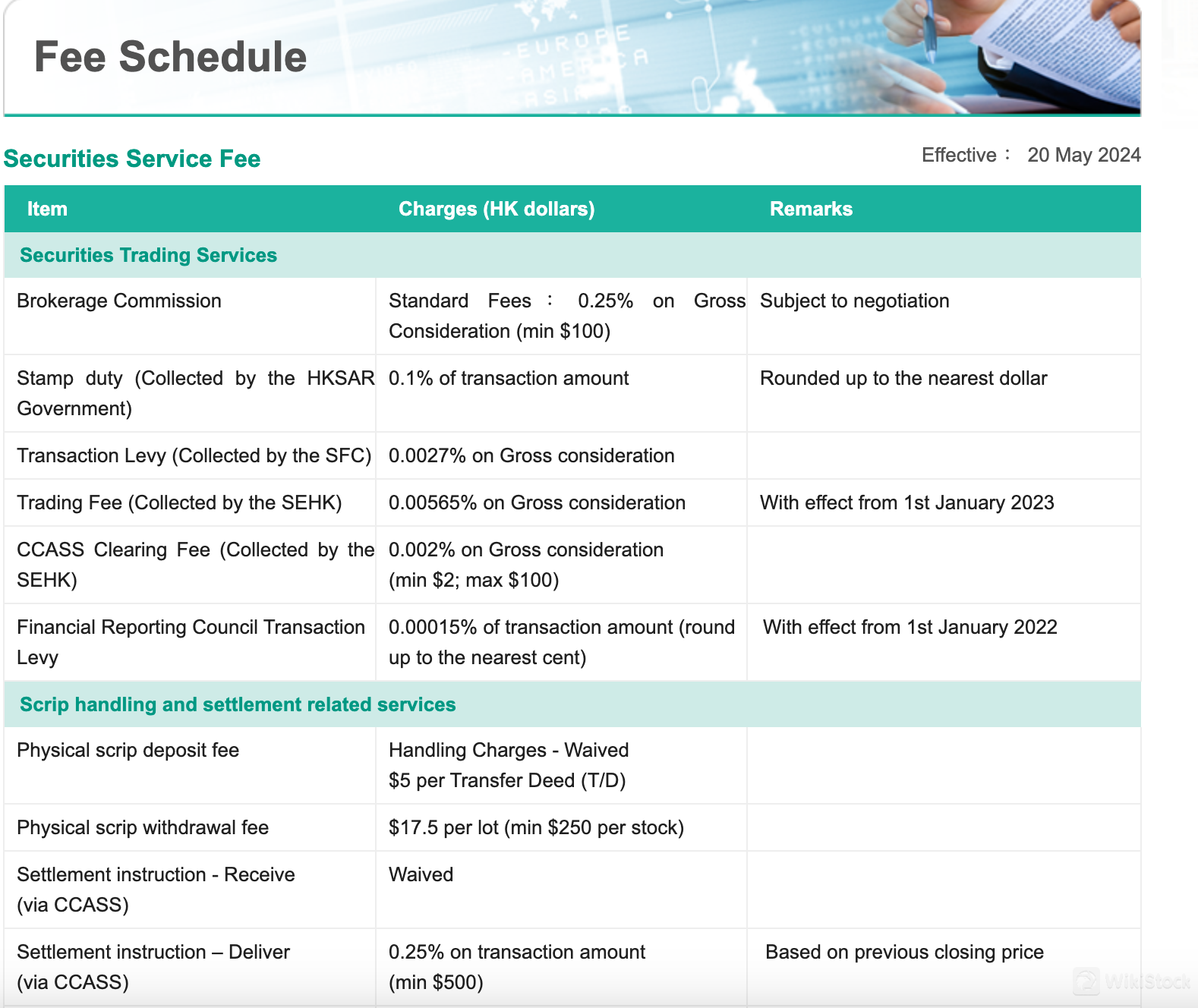

ABCI Securities Fees Review

Securities Trading Fees:

ABCI Securities charges a standard brokerage commission of 0.25% on the gross consideration for securities trading. This fee comes with a minimum charge of $100. Stamp duty, collected by the HKSAR Government, amounts to 0.1% of the transaction amount, rounded up to the nearest dollar. Additionally, there is a transaction levy of 0.0027% on gross consideration, a trading fee of 0.00565% on gross consideration, and a CCASS clearing fee ranging from $2 to $100, depending on the transaction amount. The Financial Reporting Council transaction levy stands at 0.00015% of the transaction amount.

Scrip Handling and Settlement Fees:

ABCI Securities imposes various fees for scrip handling and settlement services. For instance, there is a fee of $17.5 per lot for physical scrip withdrawal, while the settlement instruction fee is 0.25% on the transaction amount, with a minimum of $500.

Account Related Fees:

Regarding account-related fees, ABCI Securities charges $200 per application for account balance or asset confirmation. Transactions involving HKD/CNY/USD cheque payments incur no charges, while CHATS handling attracts a fee of $150 or its equivalent in dollars per application. Similarly, remittance handling incurs a fee of $200 or its equivalent in dollars per application, plus any applicable correspondent bank charges. There is also a charge of $200 per cheque for stop cheque payments and returned cheques.

Comparing these fees with those of popular brokers, ABCI Securities tends to fall within the average to slightly high range. While its brokerage commission is typical, some fees, such as the settlement instruction fee and certain account-related charges, lean toward the higher end.

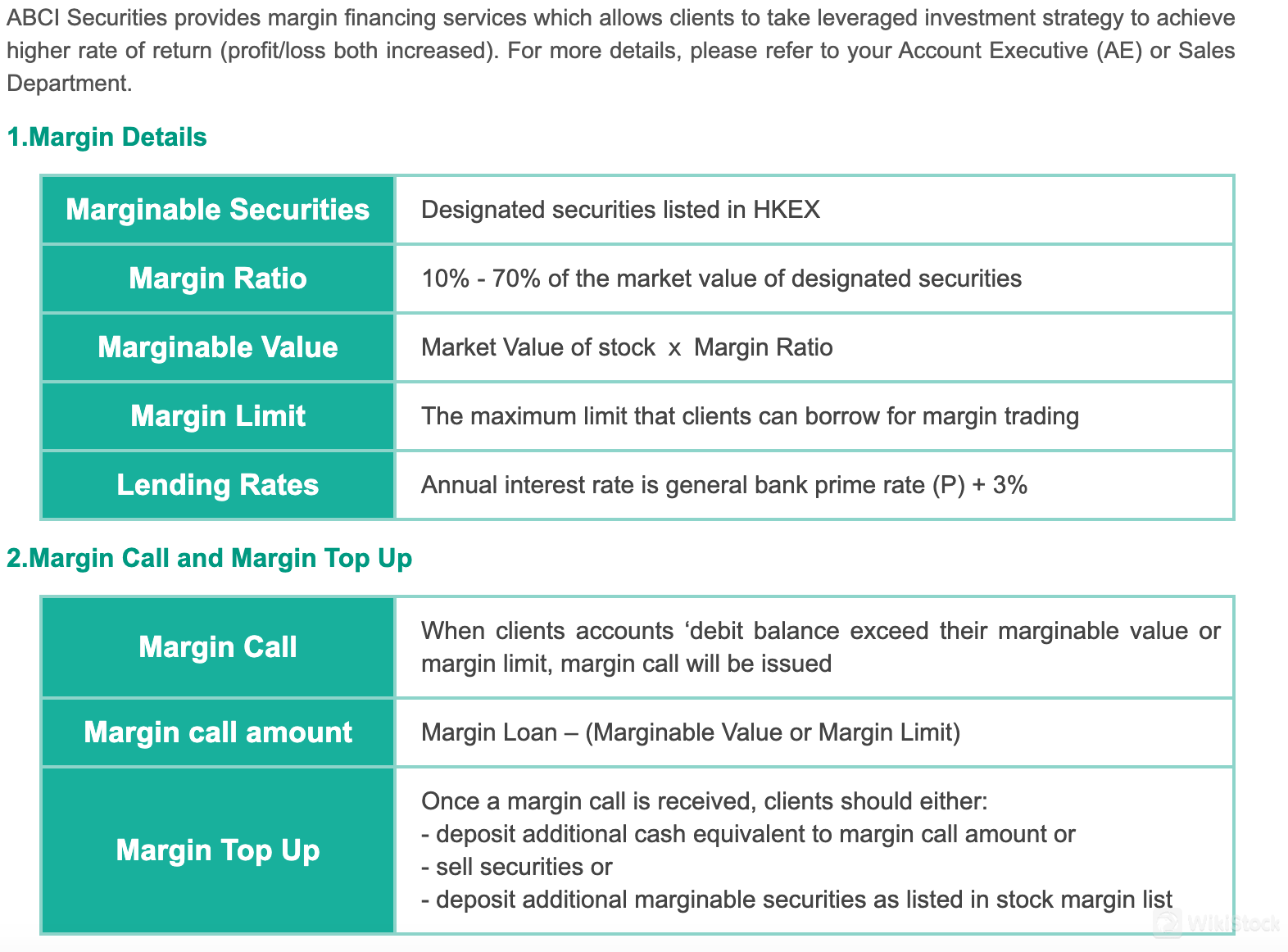

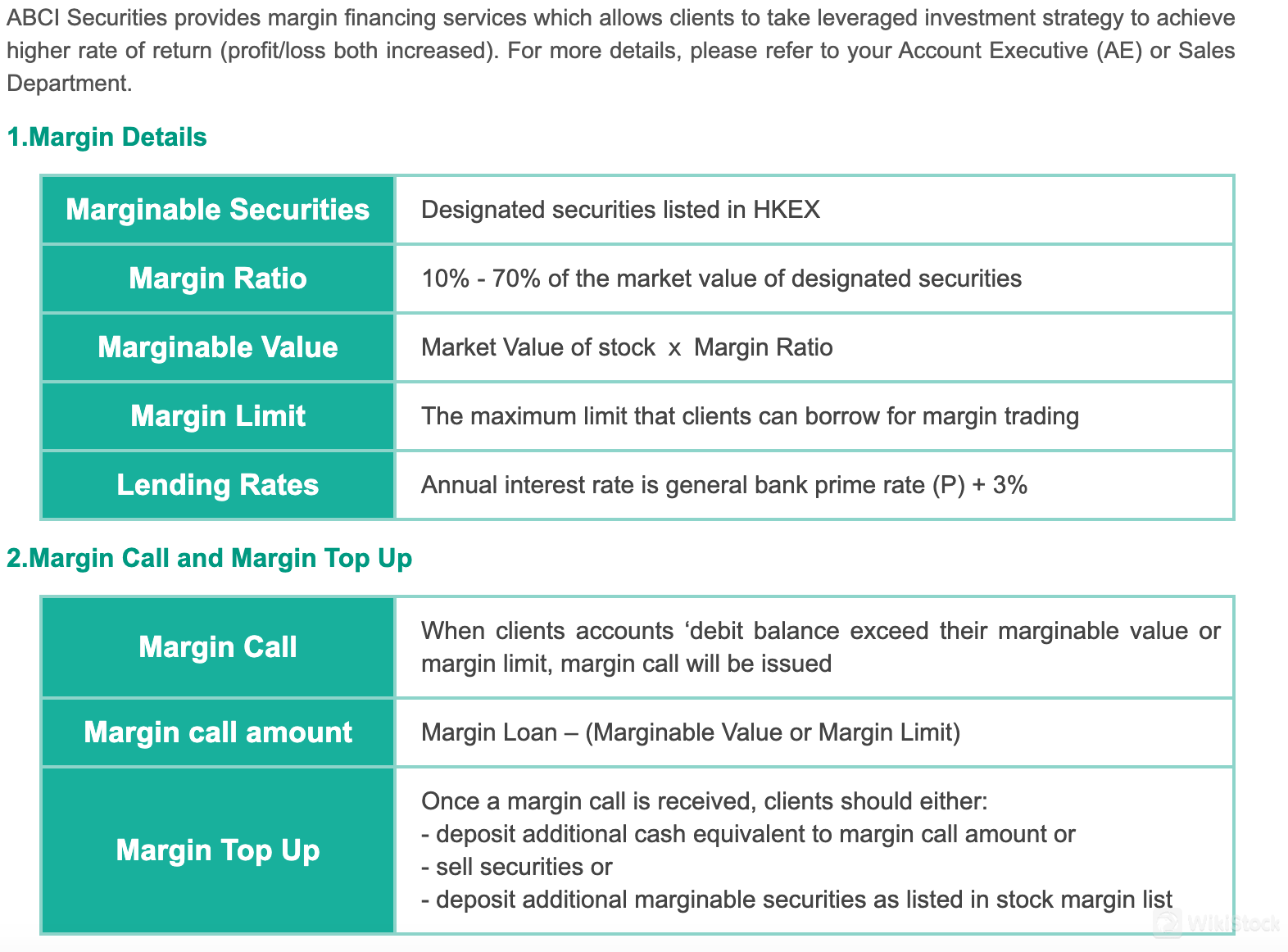

ABCI Securities offers margin trading on designated securities listed in HKEX with a margin ratio ranging from 10% to 70% of the market value. The marginable value is calculated as the market value of stock multiplied by the margin ratio. The annual interest rate is the general bank prime rate plus 3%.

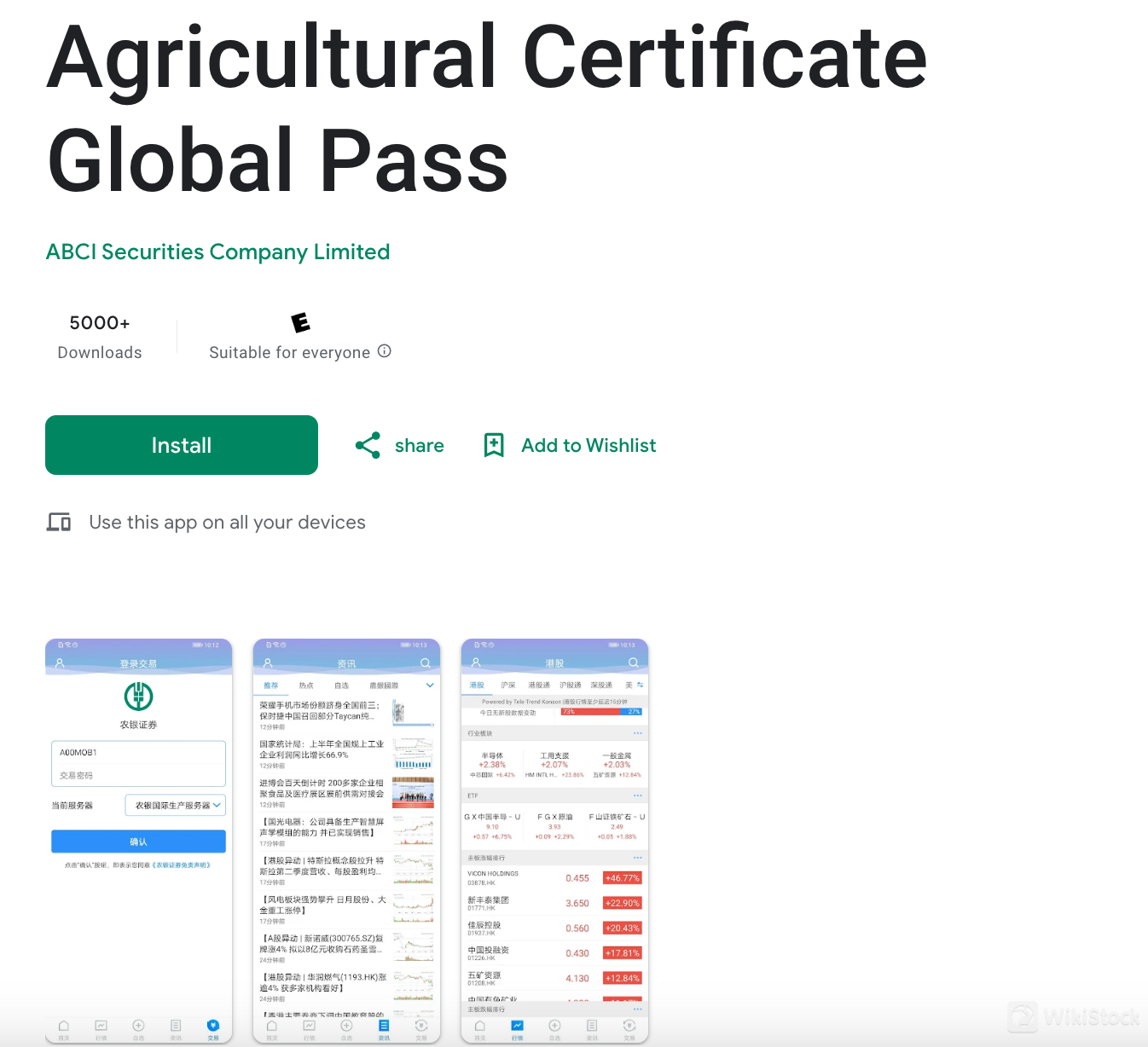

ABCI Securities App Review

App view

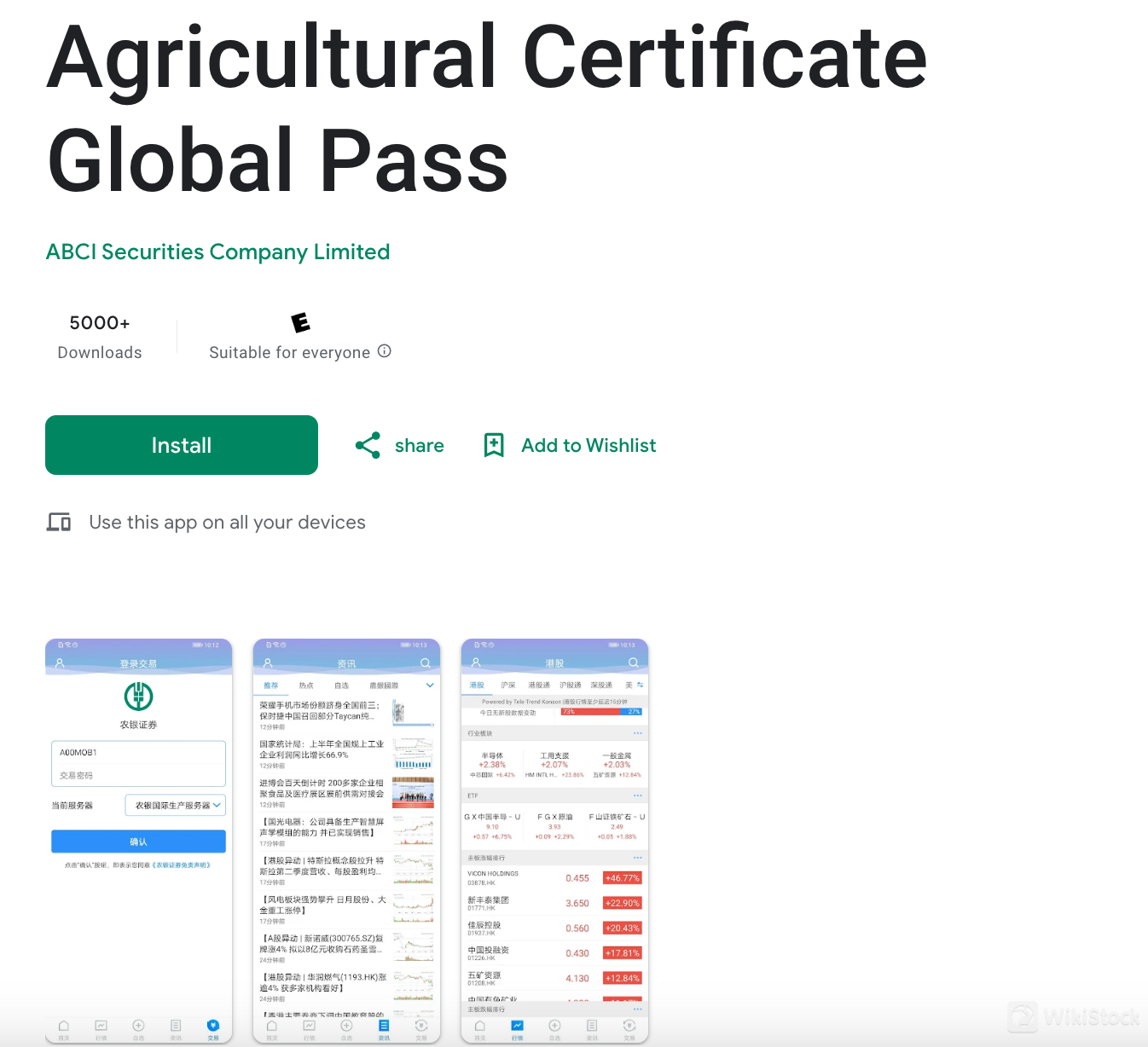

ABCI Securities' app Agricultural Certificate Global Pass offers a range of features tailored for investors.

Utilizing streaming technology, it provides real-time data push, ensuring data is automatically refreshed without the need to manually refresh pages.

The app incorporates big market style and flow control technology, closely resembling the Hong Kong stock market, and monitors changes in buying and selling seats in real time.

It covers market conditions and news from Shanghai, Shenzhen, and Hong Kong, with over 1,500 daily news updates. The app is user-friendly, automatically selecting the fastest server connection and aligning with user habits. It also offers daily chart analysis, screen control functions, and detailed information sorting for various data items, including warrants and CBBCs.

To download the app, users can search for “ABCI Securities” on their respective app stores and follow the installation instructions.

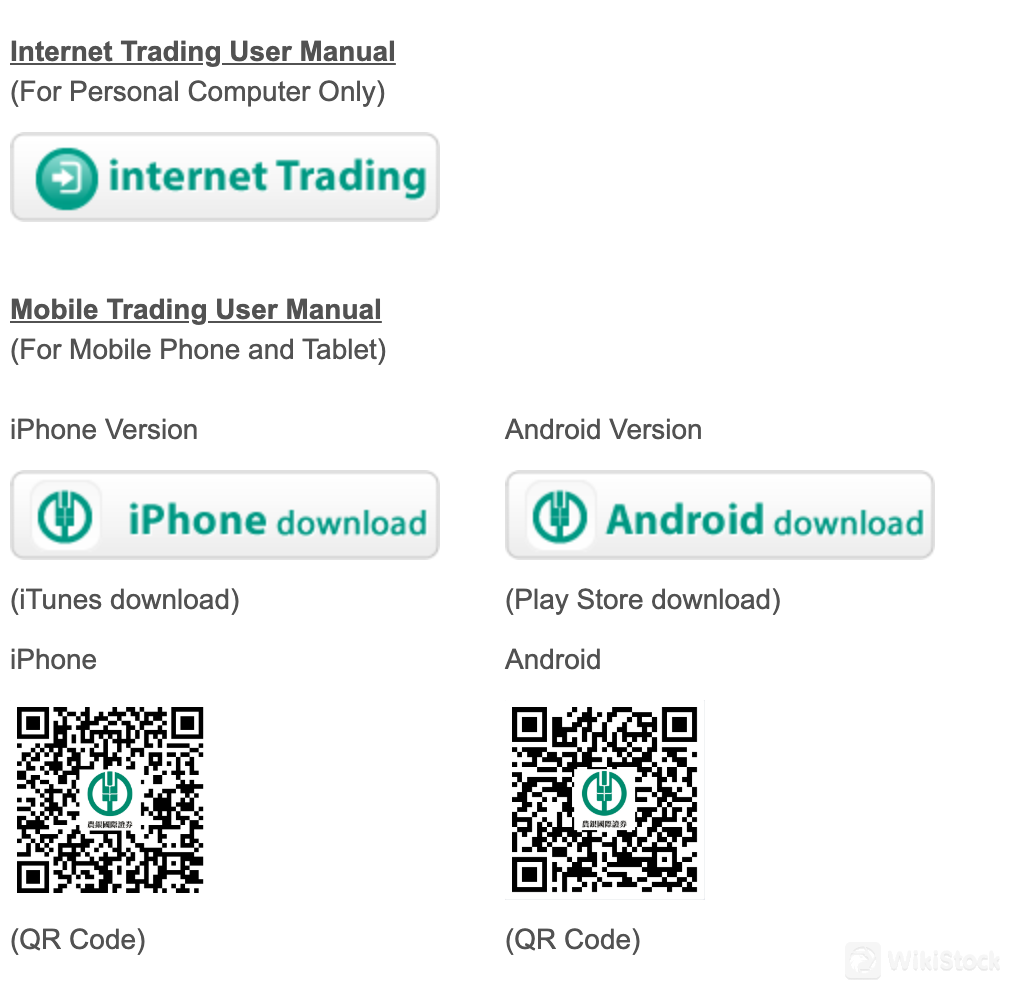

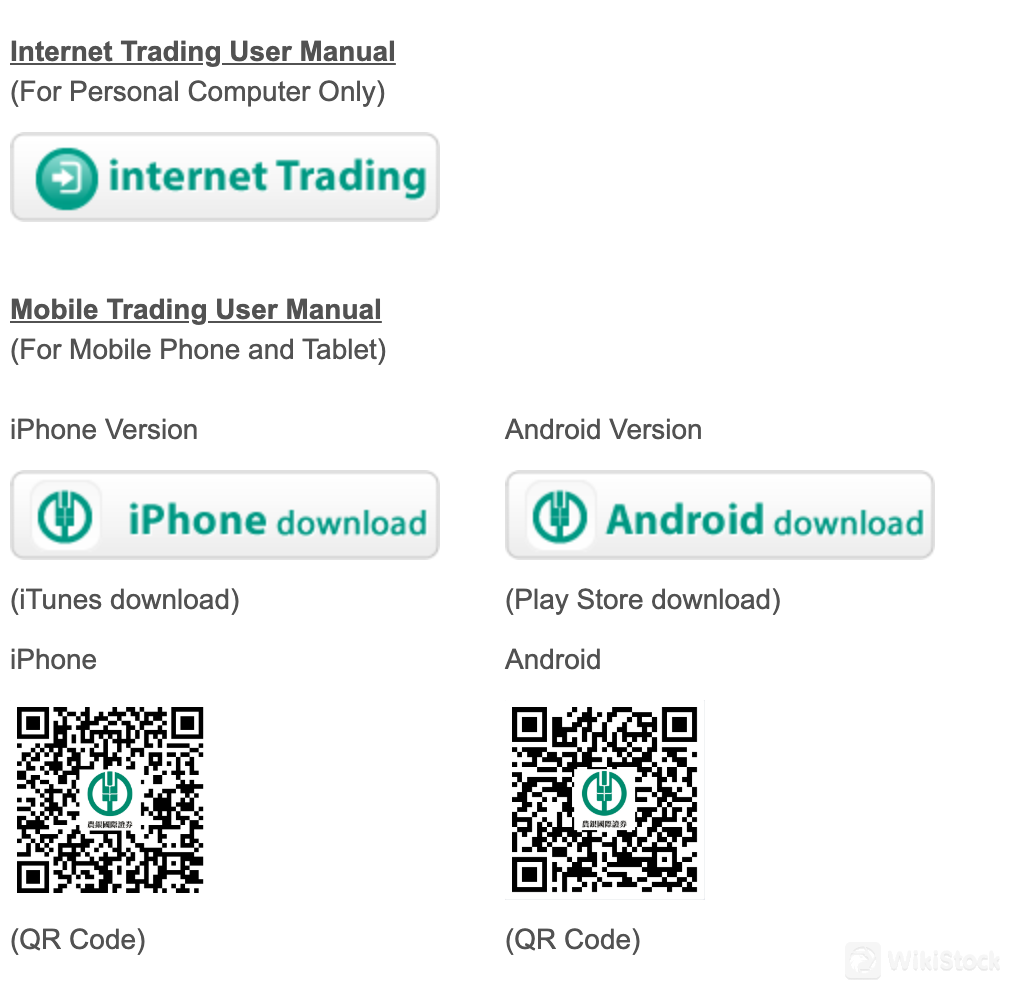

ABCI Securities also offers a PC version of their Internet Trading platform, accompanied by a user manual specifically designed for personal computer use.

Users can expect guidance on account setup, security measures, order placement, technical analysis tools, and other functionalities essential for online trading.

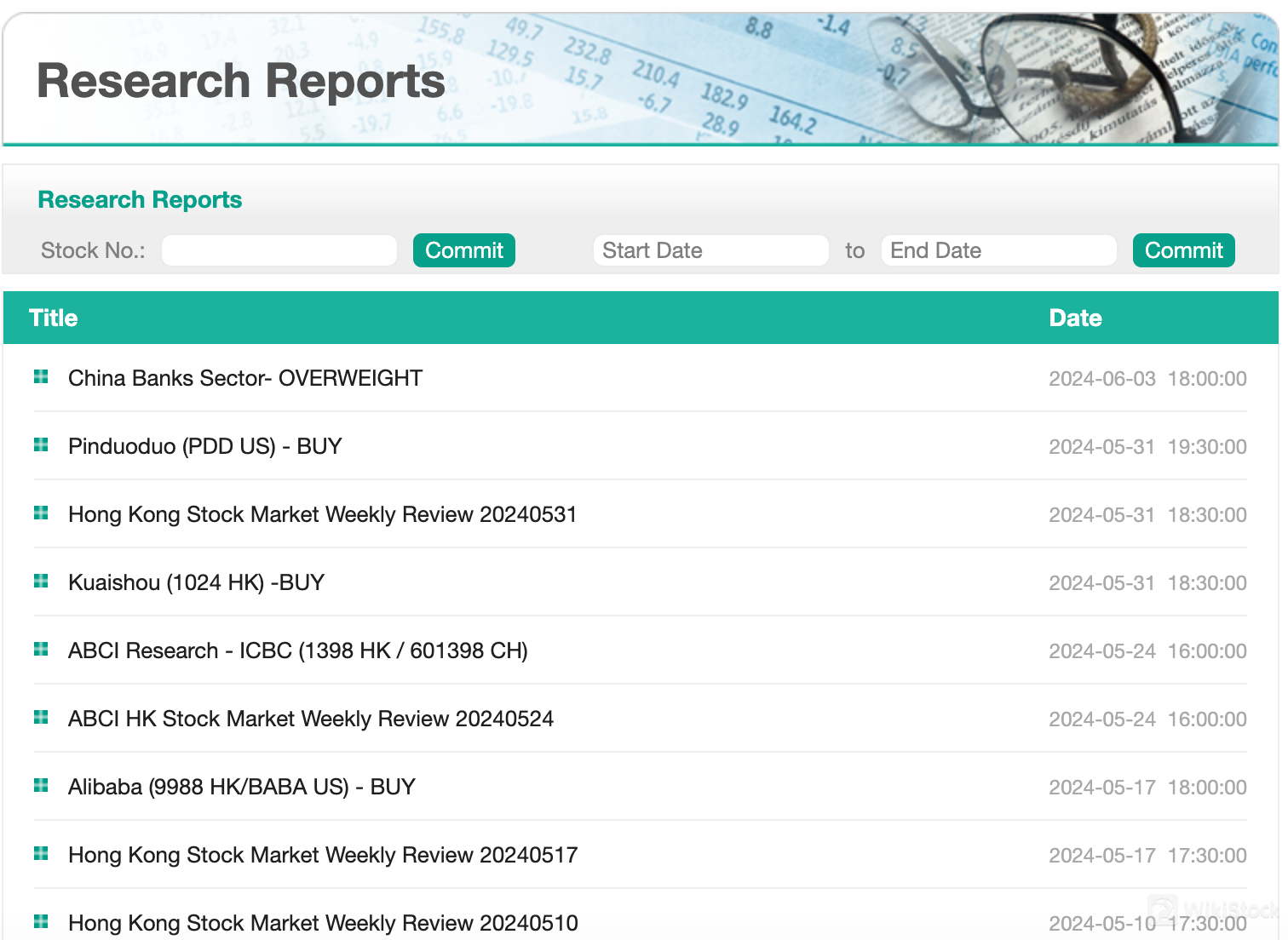

Research & Education

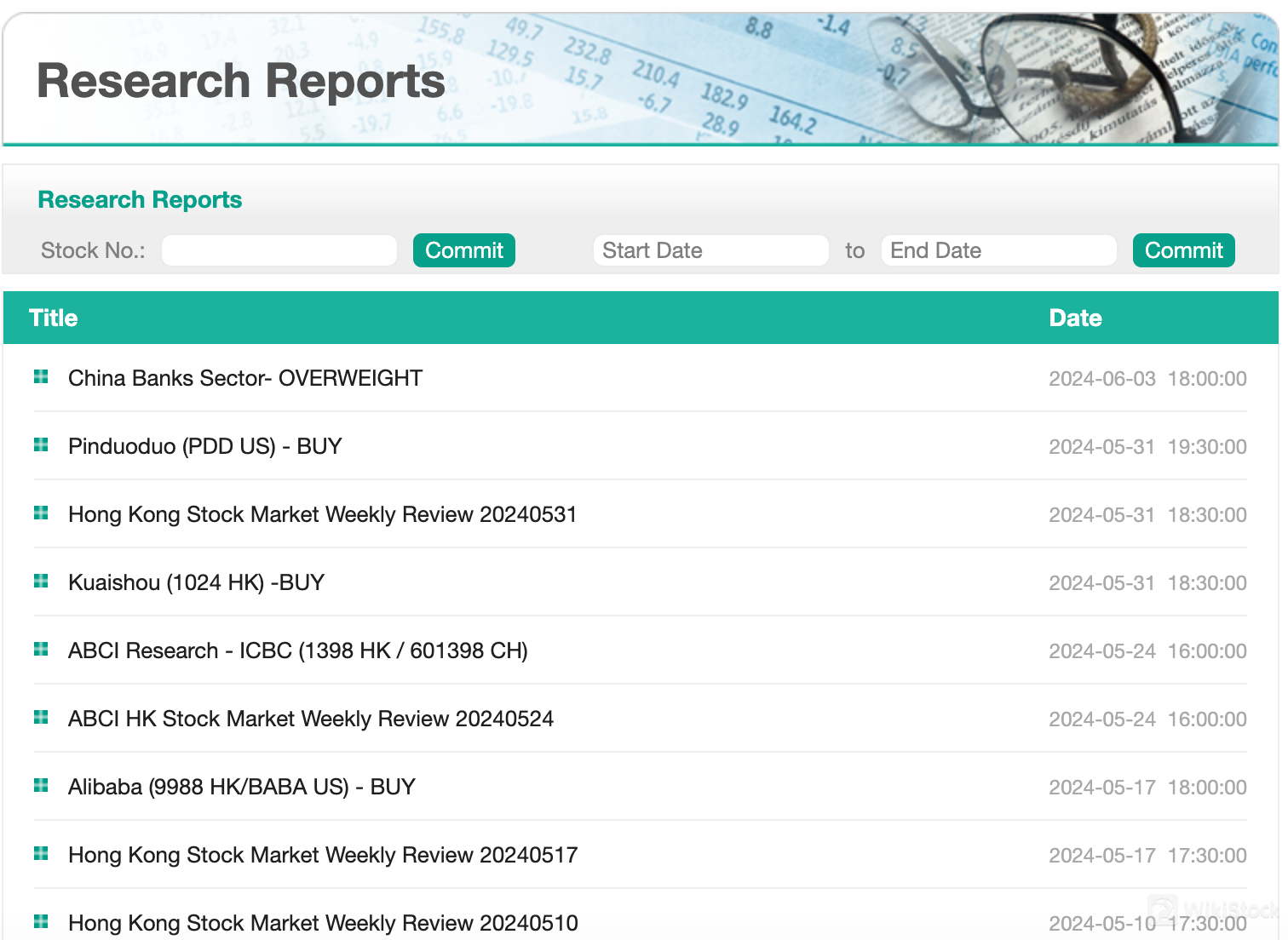

ABCI Securities provides valuable educational resources and research reports to empower investors.

Their educational offerings include essential tools like stock quotes, technical analysis information, and updates on IPOs.

Moreover, their research reports stand out for their timeliness and actionable recommendations, offering insights into recent market trends and opportunities.

By leveraging these resources, investors can make informed decisions and navigate the complexities of the market with confidence. With a commitment to providing high-quality support and guidance, ABCI Securities demonstrates a dedication to empowering investors and fostering success in their financial endeavors.

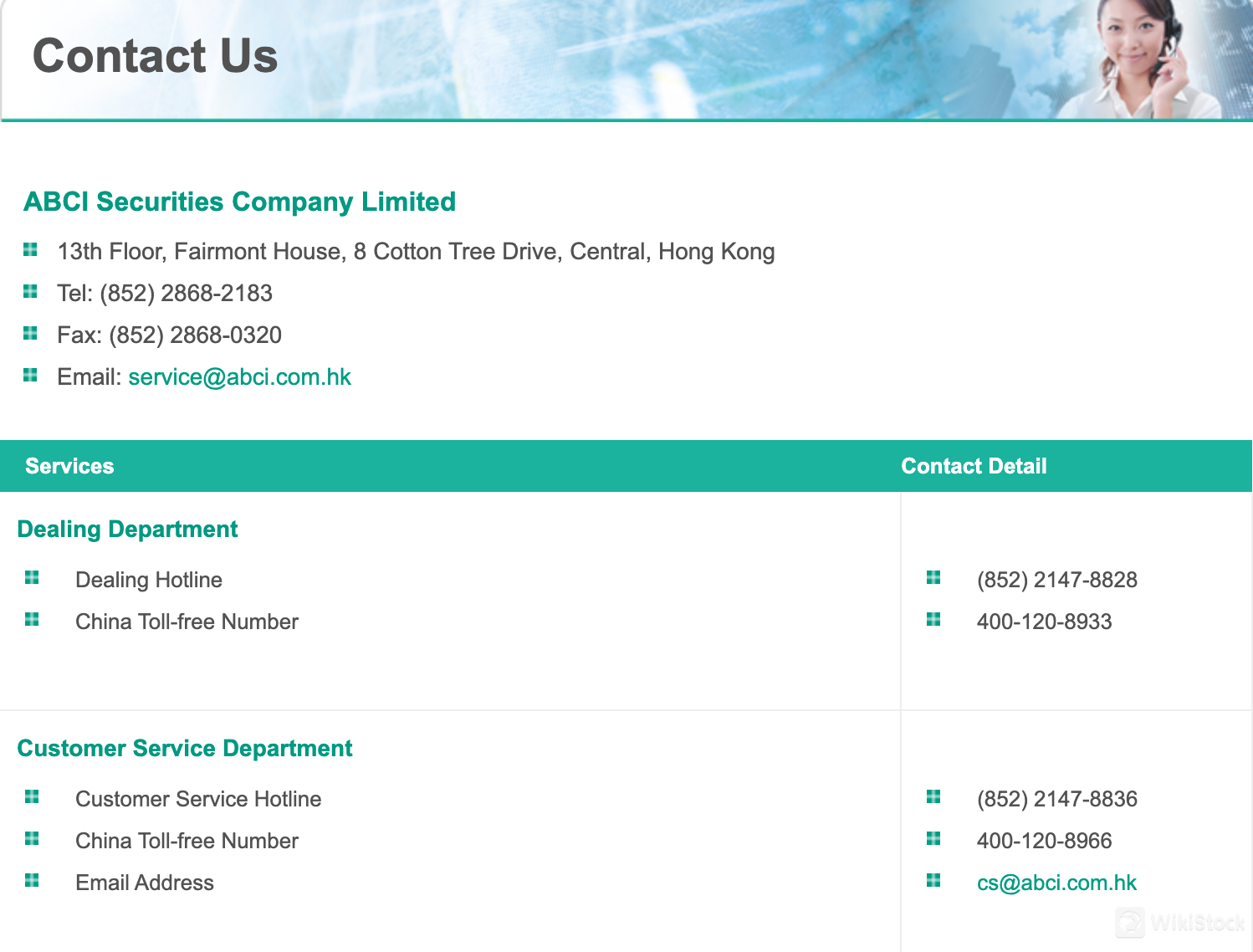

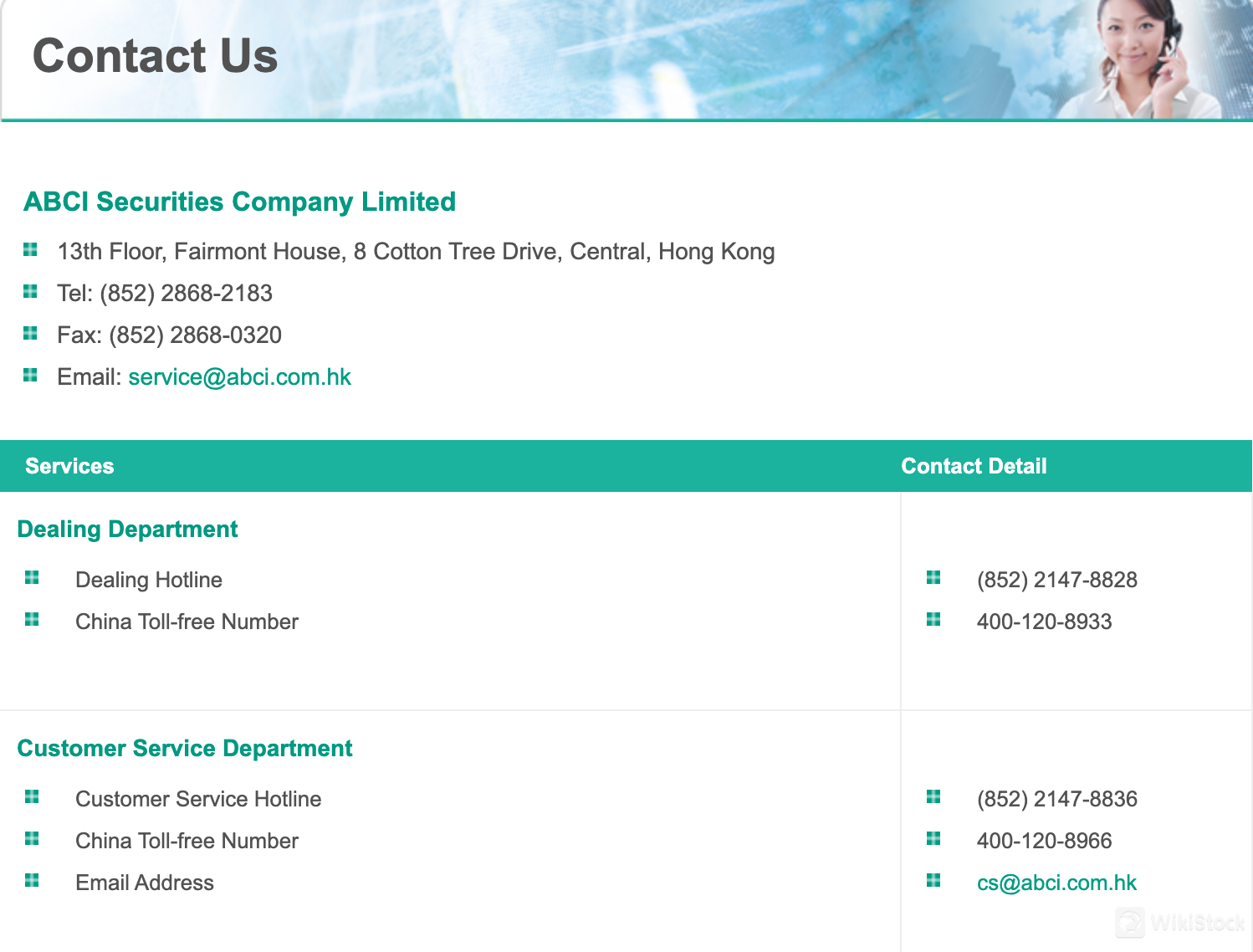

Customer Service

ABCI Securities provides comprehensive customer support services to assist clients with their inquiries and needs.

The Dealing Department can be reached via hotline at (852) 2147-8828 or the toll-free number 400-120-8933. For general inquiries and assistance, the Customer Service Department offers a hotline at (852) 2147-8836, toll-free number 400-120-8966, and email support atcs@abci.com.hk. The Settlement Department handles deposit-related matters and can be contacted at (852) 2147-8868 or through email at settlement@abci.com.hk.

Customer service is available during office hours from Monday to Friday, 08:45 am to 5:45 pm, excluding Saturdays, Sundays, and Hong Kong public holidays.

Conclusion

ABCI Securities offers a regulated platform, providing assurance to investors, while its provision of research reports and educational resources enhances informed decision-making. Accessible customer service and a mobile platform ensure convenient trading experiences.

However, the commission rate of 0.25% may deter cost-conscious investors. Additional fees, such as settlement instruction fees, can impact overall costs.

Despite these drawbacks, ABCI Securities is suitable for a wide range of investors, especially those prioritizing regulatory security, educational support, and access to a wide range of tradable securities.

FAQs

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

![ABCI Securities [图片] WikiStock Rating ? Account Minimum No specified minimum deposit Fees (Trading Fees) 0.25% brokerage commission Account Fees Settlement Instruction Fee: 0.25% on transaction amount (min $500) Account Balance/Asset Confirmation:$200 per application Interests on Uninvested Cash HKD savings deposit rate: 0.875% Margin Interest Rates Bank prime rate plus 3% Mutual Funds Offered N/A App/Platform Agricultural Certificate Global Pass app Promotion YES What is ABCI Securities? ABCI Securities offers a range of tradable securities including local stocks, ETFs, warrants, and CBBCs, complemented by services like margin trading. They charge a commission rate of 0.25% on trades. Established in Hong Kong, they operate during standard office hours from Monday to Friday. Regulated by the Securities and Futures Commission (SFC), ABCI Securities ensures adherence to regulatory standards. [图片] Pros and Cons The regulatory oversight provided by the Securities and Futures Commission (SFC) in Hong Kong offers a significant advantage for investors using ABCI Securities. This regulatory security ensures that the brokerage operates within established guidelines, safeguarding investors' interests and enhancing trust in the platform. Additionally, ABCI Securities' provision of research reports and educational resources enriches the investment experience, empowering users with valuable insights to make informed decisions. The accessibility of customer service channels further enhances the overall user experience, providing assistance and support whenever needed. However, the commission rate of 0.25% may be perceived as relatively high compared to some competitors, potentially deterring cost-conscious investors. Moreover, while ABCI Securities offers various tradable securities, there are additional fees charged, such as the settlement instruction fee and account-related charges, which could impact the overall cost-effectiveness of using the platform. 暂时无法在飞书文档外展示此内容 Is ABCI Securities Safe? 1. Regulations: ABCI Securities holds one securities license, specifically the Securities Trading License, regulated by the Securities and Futures Commission (SFC) of China Hong Kong. The license number is ACX411. This indicates that ABCI Securities is authorized and overseen by the SFC, ensuring compliance with the relevant regulatory standards and guidelines governing securities trading activities within the region. [图片] 2. Funds Safety: ABCI Securities does not offer insurance on customer account balances. However, clients' assets are safeguarded through regulatory measures and segregation of funds. 3. Safety Measures: ABCI Securities employs robust security measures to protect client assets and personal information. These include encryption protocols to safeguard data during transmission and stringent authentication procedures to prevent unauthorized access. Additionally, the platform employs firewalls and intrusion detection systems to monitor and defend against potential cyber threats. Regular security audits and updates ensure that systems remain resilient against evolving risks. What are securities to trade with ABCI Securities? ABCI Securities offers a wide array of tradable securities to meet the varied investment needs of clients. These include local stocks, exchange-traded funds (ETFs), warrants, callable bull/bear contracts (CBBCs), bonds, and securities from other markets. Local stocks provide opportunities for investors to participate in the Hong Kong stock market, accessing a wide range of companies across different sectors. ETFs offer exposure to diversified portfolios of assets, providing a convenient way to invest in specific market segments or themes. Warrants and CBBCs allow investors to leverage their positions or speculate on market movements with defined risk parameters. Moreover, ABCI Securities facilitates trading in bonds and securities from other markets, enabling clients to diversify their portfolios beyond local markets. The inclusion of futures in their upcoming services will further expand the range of investment opportunities available to clients, potentially attracting investors interested in derivative products. [图片] ABCI Securities Accounts ABCI Securities offers a variety of account types tailored to different investor needs and preferences. The Cash Securities Account is suitable for individuals, joint account holders, or corporate entities interested in trading securities with cash funds. This account type is ideal for investors seeking to execute trades without leveraging borrowed funds. For those looking to trade on margin, the Margin Securities Account provides the option to borrow funds from the broker to invest in securities. This account type is available to individual investors, joint account holders, or corporate entities. Margin accounts can be beneficial for investors seeking to amplify their trading potential, but they also entail higher risk due to leverage. Additionally, ABCI Securities offers the Professional Investor's Account, designed for investors who meet specific criteria for professional status. This account type offers access to certain investment opportunities or services tailored to the needs of experienced or institutional investors. [图片] ABCI Securities Fees Review - Commissions and Fees Securities Trading Fees: ABCI Securities charges a standard brokerage commission of 0.25% on the gross consideration for securities trading. This fee comes with a minimum charge of $100. Stamp duty, collected by the HKSAR Government, amounts to 0.1% of the transaction amount, rounded up to the nearest dollar. Additionally, there is a transaction levy of 0.0027% on gross consideration, a trading fee of 0.00565% on gross consideration, and a CCASS clearing fee ranging from $2 to $100, depending on the transaction amount. The Financial Reporting Council transaction levy stands at 0.00015% of the transaction amount. Scrip Handling and Settlement Fees: ABCI Securities imposes various fees for scrip handling and settlement services. For instance, there is a fee of $17.5 per lot for physical scrip withdrawal, while the settlement instruction fee is 0.25% on the transaction amount, with a minimum of $500. Account Related Fees: Regarding account-related fees, ABCI Securities charges $200 per application for account balance or asset confirmation. Transactions involving HKD/CNY/USD cheque payments incur no charges, while CHATS handling attracts a fee of $150 or its equivalent in dollars per application. Similarly, remittance handling incurs a fee of $200 or its equivalent in dollars per application, plus any applicable correspondent bank charges. There is also a charge of $200 per cheque for stop cheque payments and returned cheques. Comparing these fees with those of popular brokers, ABCI Securities tends to fall within the average to slightly high range. While its brokerage commission is typical, some fees, such as the settlement instruction fee and certain account-related charges, lean toward the higher end. Fee Type Amount Brokerage Commission 0.25% on Gross Consideration (min $100) Stamp Duty 0.1% of transaction amount Transaction Levy 0.0027% on Gross consideration Trading Fee 0.00565% on Gross consideration CCASS Clearing Fee 0.002% on Gross consideration (min $2; max $100) Settlement Instruction Fee 0.25% on transaction amount (min $500) Account Balance/Asset Confirmation $200 per application HKD/CNY/USD Cheque Payment Waived CHATS Handling Charges (local transfer) $150 or dollars equivalent for each application Remittance Handling Charges $200 or dollars equivalent for each application (Plus correspondent banks charges if applicable) [图片] - Margin Interest Rate ABCI Securities offers margin trading on designated securities listed in HKEX with a margin ratio ranging from 10% to 70% of the market value. The marginable value is calculated as the market value of stock multiplied by the margin ratio. The annual interest rate is the general bank prime rate plus 3%. [图片] ABCI Securities App Review 1. App view ABCI Securities' app Agricultural Certificate Global Pass offers a range of features tailored for investors. Utilizing streaming technology, it provides real-time data push, ensuring data is automatically refreshed without the need to manually refresh pages. The app incorporates big market style and flow control technology, closely resembling the Hong Kong stock market, and monitors changes in buying and selling seats in real time. It covers market conditions and news from Shanghai, Shenzhen, and Hong Kong, with over 1,500 daily news updates. The app is user-friendly, automatically selecting the fastest server connection and aligning with user habits. It also offers daily chart analysis, screen control functions, and detailed information sorting for various data items, including warrants and CBBCs. To download the app, users can search for ABCI Securities on their respective app stores and follow the installation instructions. [图片] ABCI Securities also offers a PC version of their Internet Trading platform, accompanied by a user manual specifically designed for personal computer use. Users can expect guidance on account setup, security measures, order placement, technical analysis tools, and other functionalities essential for online trading. [图片] Research & Education ABCI Securities provides valuable educational resources and research reports to empower investors. Their educational offerings include essential tools like stock quotes, technical analysis information, and updates on IPOs. Moreover, their research reports stand out for their timeliness and actionable recommendations, offering insights into recent market trends and opportunities. By leveraging these resources, investors can make informed decisions and navigate the complexities of the market with confidence. With a commitment to providing high-quality support and guidance, ABCI Securities demonstrates a dedication to empowering investors and fostering success in their financial endeavors. [图片] Customer Service ABCI Securities provides comprehensive customer support services to assist clients with their inquiries and needs. The Dealing Department can be reached via hotline at (852) 2147-8828 or the toll-free number 400-120-8933. For general inquiries and assistance, the Customer Service Department offers a hotline at (852) 2147-8836, toll-free number 400-120-8966, and email support at cs@abci.com.hk. The Settlement Department handles deposit-related matters and can be contacted at (852) 2147-8868 or through email at settlement@abci.com.hk. Customer service is available during office hours from Monday to Friday, 08:45 am to 5:45 pm, excluding Saturdays, Sundays, and Hong Kong public holidays. [图片] Conclusion ABCI Securities offers a regulated platform, providing assurance to investors, while its provision of research reports and educational resources enhances informed decision-making. Accessible customer service and a mobile platform ensure convenient trading experiences. However, the commission rate of 0.25% may deter cost-conscious investors. Additional fees, such as settlement instruction fees, can impact overall costs. Despite these drawbacks, ABCI Securities is suitable for a wide range of investors, especially those prioritizing regulatory security, educational support, and access to a wide range of tradable securities. FAQs 1. Is it safe to trade on Jarvis Investment Management? Jarvis Investment Management is regulated and adheres to strict security protocols, ensuring the safety of your investments and personal information. 2. Is Jarvis Investment Management a good platform for beginners? Yes, Jarvis Investment Management offers educational resources and user-friendly tools, making it suitable for beginners to learn and start investing. 3. Is Jarvis Investment Management legit? Yes, Jarvis Investment Management is a legitimate platform regulated by relevant authorities, providing transparent services to investors. Risk Warning The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial. ABCI Securities [图片] WikiStock Rating ? Account Minimum No specified minimum deposit Fees (Trading Fees) 0.25% brokerage commission Account Fees Settlement Instruction Fee: 0.25% on transaction amount (min $500) Account Balance/Asset Confirmation:$200 per application Interests on Uninvested Cash HKD savings deposit rate: 0.875% Margin Interest Rates Bank prime rate plus 3% Mutual Funds Offered N/A App/Platform Agricultural Certificate Global Pass app Promotion YES What is ABCI Securities? ABCI Securities offers a range of tradable securities including local stocks, ETFs, warrants, and CBBCs, complemented by services like margin trading. They charge a commission rate of 0.25% on trades. Established in Hong Kong, they operate during standard office hours from Monday to Friday. Regulated by the Securities and Futures Commission (SFC), ABCI Securities ensures adherence to regulatory standards. [图片] Pros and Cons The regulatory oversight provided by the Securities and Futures Commission (SFC) in Hong Kong offers a significant advantage for investors using ABCI Securities. This regulatory security ensures that the brokerage operates within established guidelines, safeguarding investors' interests and enhancing trust in the platform. Additionally, ABCI Securities' provision of research reports and educational resources enriches the investment experience, empowering users with valuable insights to make informed decisions. The accessibility of customer service channels further enhances the overall user experience, providing assistance and support whenever needed. However, the commission rate of 0.25% may be perceived as relatively high compared to some competitors, potentially deterring cost-conscious investors. Moreover, while ABCI Securities offers various tradable securities, there are additional fees charged, such as the settlement instruction fee and account-related charges, which could impact the overall cost-effectiveness of using the platform. 暂时无法在飞书文档外展示此内容 Is ABCI Securities Safe? 1. Regulations: ABCI Securities holds one securities license, specifically the Securities Trading License, regulated by the Securities and Futures Commission (SFC) of China Hong Kong. The license number is ACX411. This indicates that ABCI Securities is authorized and overseen by the SFC, ensuring compliance with the relevant regulatory standards and guidelines governing securities trading activities within the region. [图片] 2. Funds Safety: ABCI Securities does not offer insurance on customer account balances. However, clients' assets are safeguarded through regulatory measures and segregation of funds. 3. Safety Measures: ABCI Securities employs robust security measures to protect client assets and personal information. These include encryption protocols to safeguard data during transmission and stringent authentication procedures to prevent unauthorized access. Additionally, the platform employs firewalls and intrusion detection systems to monitor and defend against potential cyber threats. Regular security audits and updates ensure that systems remain resilient against evolving risks. What are securities to trade with ABCI Securities? ABCI Securities offers a wide array of tradable securities to meet the varied investment needs of clients. These include local stocks, exchange-traded funds (ETFs), warrants, callable bull/bear contracts (CBBCs), bonds, and securities from other markets. Local stocks provide opportunities for investors to participate in the Hong Kong stock market, accessing a wide range of companies across different sectors. ETFs offer exposure to diversified portfolios of assets, providing a convenient way to invest in specific market segments or themes. Warrants and CBBCs allow investors to leverage their positions or speculate on market movements with defined risk parameters. Moreover, ABCI Securities facilitates trading in bonds and securities from other markets, enabling clients to diversify their portfolios beyond local markets. The inclusion of futures in their upcoming services will further expand the range of investment opportunities available to clients, potentially attracting investors interested in derivative products. [图片] ABCI Securities Accounts ABCI Securities offers a variety of account types tailored to different investor needs and preferences. The Cash Securities Account is suitable for individuals, joint account holders, or corporate entities interested in trading securities with cash funds. This account type is ideal for investors seeking to execute trades without leveraging borrowed funds. For those looking to trade on margin, the Margin Securities Account provides the option to borrow funds from the broker to invest in securities. This account type is available to individual investors, joint account holders, or corporate entities. Margin accounts can be beneficial for investors seeking to amplify their trading potential, but they also entail higher risk due to leverage. Additionally, ABCI Securities offers the Professional Investor's Account, designed for investors who meet specific criteria for professional status. This account type offers access to certain investment opportunities or services tailored to the needs of experienced or institutional investors. [图片] ABCI Securities Fees Review - Commissions and Fees Securities Trading Fees: ABCI Securities charges a standard brokerage commission of 0.25% on the gross consideration for securities trading. This fee comes with a minimum charge of $100. Stamp duty, collected by the HKSAR Government, amounts to 0.1% of the transaction amount, rounded up to the nearest dollar. Additionally, there is a transaction levy of 0.0027% on gross consideration, a trading fee of 0.00565% on gross consideration, and a CCASS clearing fee ranging from $2 to $100, depending on the transaction amount. The Financial Reporting Council transaction levy stands at 0.00015% of the transaction amount. Scrip Handling and Settlement Fees: ABCI Securities imposes various fees for scrip handling and settlement services. For instance, there is a fee of $17.5 per lot for physical scrip withdrawal, while the settlement instruction fee is 0.25% on the transaction amount, with a minimum of $500. Account Related Fees: Regarding account-related fees, ABCI Securities charges $200 per application for account balance or asset confirmation. Transactions involving HKD/CNY/USD cheque payments incur no charges, while CHATS handling attracts a fee of $150 or its equivalent in dollars per application. Similarly, remittance handling incurs a fee of $200 or its equivalent in dollars per application, plus any applicable correspondent bank charges. There is also a charge of $200 per cheque for stop cheque payments and returned cheques. Comparing these fees with those of popular brokers, ABCI Securities tends to fall within the average to slightly high range. While its brokerage commission is typical, some fees, such as the settlement instruction fee and certain account-related charges, lean toward the higher end. Fee Type Amount Brokerage Commission 0.25% on Gross Consideration (min $100) Stamp Duty 0.1% of transaction amount Transaction Levy 0.0027% on Gross consideration Trading Fee 0.00565% on Gross consideration CCASS Clearing Fee 0.002% on Gross consideration (min $2; max $100) Settlement Instruction Fee 0.25% on transaction amount (min $500) Account Balance/Asset Confirmation $200 per application HKD/CNY/USD Cheque Payment Waived CHATS Handling Charges (local transfer) $150 or dollars equivalent for each application Remittance Handling Charges $200 or dollars equivalent for each application (Plus correspondent banks charges if applicable) [图片] - Margin Interest Rate ABCI Securities offers margin trading on designated securities listed in HKEX with a margin ratio ranging from 10% to 70% of the market value. The marginable value is calculated as the market value of stock multiplied by the margin ratio. The annual interest rate is the general bank prime rate plus 3%. [图片] ABCI Securities App Review 1. App view ABCI Securities' app Agricultural Certificate Global Pass offers a range of features tailored for investors. Utilizing streaming technology, it provides real-time data push, ensuring data is automatically refreshed without the need to manually refresh pages. The app incorporates big market style and flow control technology, closely resembling the Hong Kong stock market, and monitors changes in buying and selling seats in real time. It covers market conditions and news from Shanghai, Shenzhen, and Hong Kong, with over 1,500 daily news updates. The app is user-friendly, automatically selecting the fastest server connection and aligning with user habits. It also offers daily chart analysis, screen control functions, and detailed information sorting for various data items, including warrants and CBBCs. To download the app, users can search for ABCI Securities on their respective app stores and follow the installation instructions. [图片] ABCI Securities also offers a PC version of their Internet Trading platform, accompanied by a user manual specifically designed for personal computer use. Users can expect guidance on account setup, security measures, order placement, technical analysis tools, and other functionalities essential for online trading. [图片] Research & Education ABCI Securities provides valuable educational resources and research reports to empower investors. Their educational offerings include essential tools like stock quotes, technical analysis information, and updates on IPOs. Moreover, their research reports stand out for their timeliness and actionable recommendations, offering insights into recent market trends and opportunities. By leveraging these resources, investors can make informed decisions and navigate the complexities of the market with confidence. With a commitment to providing high-quality support and guidance, ABCI Securities demonstrates a dedication to empowering investors and fostering success in their financial endeavors. [图片] Customer Service ABCI Securities provides comprehensive customer support services to assist clients with their inquiries and needs. The Dealing Department can be reached via hotline at (852) 2147-8828 or the toll-free number 400-120-8933. For general inquiries and assistance, the Customer Service Department offers a hotline at (852) 2147-8836, toll-free number 400-120-8966, and email support at cs@abci.com.hk. The Settlement Department handles deposit-related matters and can be contacted at (852) 2147-8868 or through email at settlement@abci.com.hk. Customer service is available during office hours from Monday to Friday, 08:45 am to 5:45 pm, excluding Saturdays, Sundays, and Hong Kong public holidays. [图片] Conclusion ABCI Securities offers a regulated platform, providing assurance to investors, while its provision of research reports and educational resources enhances informed decision-making. Accessible customer service and a mobile platform ensure convenient trading experiences. However, the commission rate of 0.25% may deter cost-conscious investors. Additional fees, such as settlement instruction fees, can impact overall costs. Despite these drawbacks, ABCI Securities is suitable for a wide range of investors, especially those prioritizing regulatory security, educational support, and access to a wide range of tradable securities. FAQs 1. Is it safe to trade on Jarvis Investment Management? Jarvis Investment Management is regulated and adheres to strict security protocols, ensuring the safety of your investments and personal information. 2. Is Jarvis Investment Management a good platform for beginners? Yes, Jarvis Investment Management offers educational resources and user-friendly tools, making it suitable for beginners to learn and start investing. 3. Is Jarvis Investment Management legit? Yes, Jarvis Investment Management is a legitimate platform regulated by relevant authorities, providing transparent services to investors. Risk Warning The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.](https://stockwzimg.tech004.com/article/2024-06-13/638538939014114765/ART638538939014114765_562266.jpg-wikistock_articlepic)