Score

西村証券株式会社

http://www.nishimura-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Nishimura Securities Co., Ltd.

Abbreviation

西村証券株式会社

Platform registered country and region

Company address

Company website

http://www.nishimura-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.11%

Long-Short Equity

YES

Regulated Countries

1

Products

5

| Nishimura Securities |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Fees | Tiered based on the transaction value |

| Account Fees | Free account opening fees |

Nishimura Securities Infomation

Nishimura Securities, established in 1955, is an investment firm headquartered in Kyoto, Japan. Founded in and serving the Kyoto and Shiga regions, they primarily focus on the local Japanese investor market. They emphasize a long-standing relationship with the community and a commitment to its development. Nishimura Securities highlights the importance of securities companies in channeling investments towards economic growth.

Pros & Cons of Nishimura Securities

| Pros | Cons |

| Fee Structure | No Trading Platform |

| Educational Opportunities | Regional Focus |

| Multiple Branch Locations | |

| Tax-Advantaged Accounts |

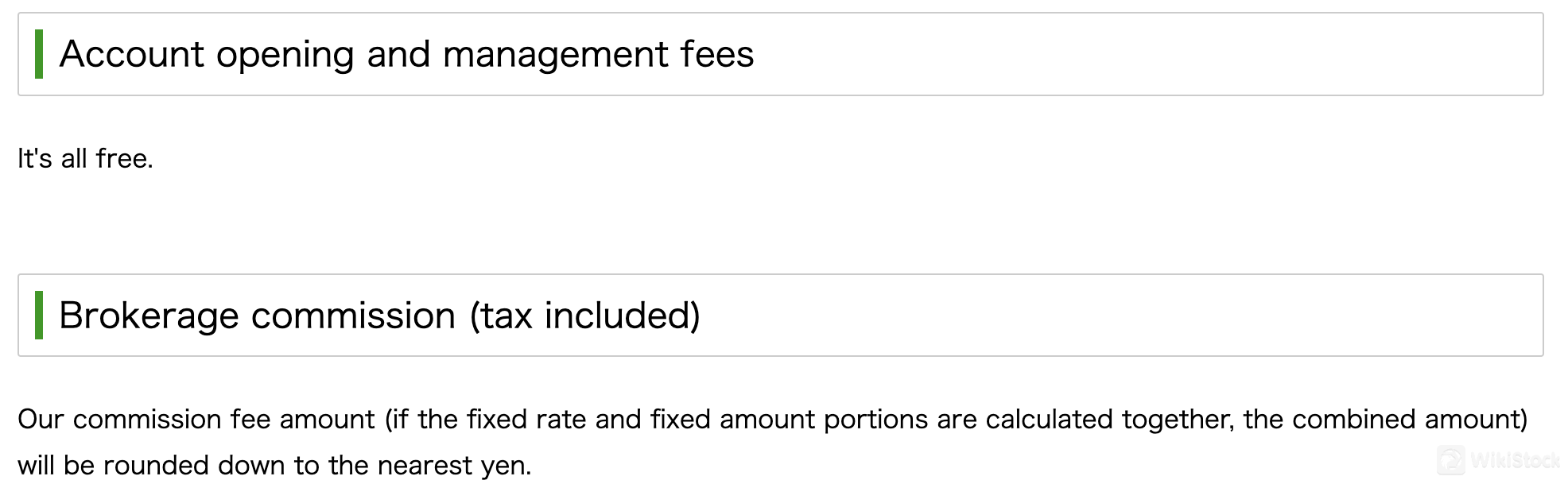

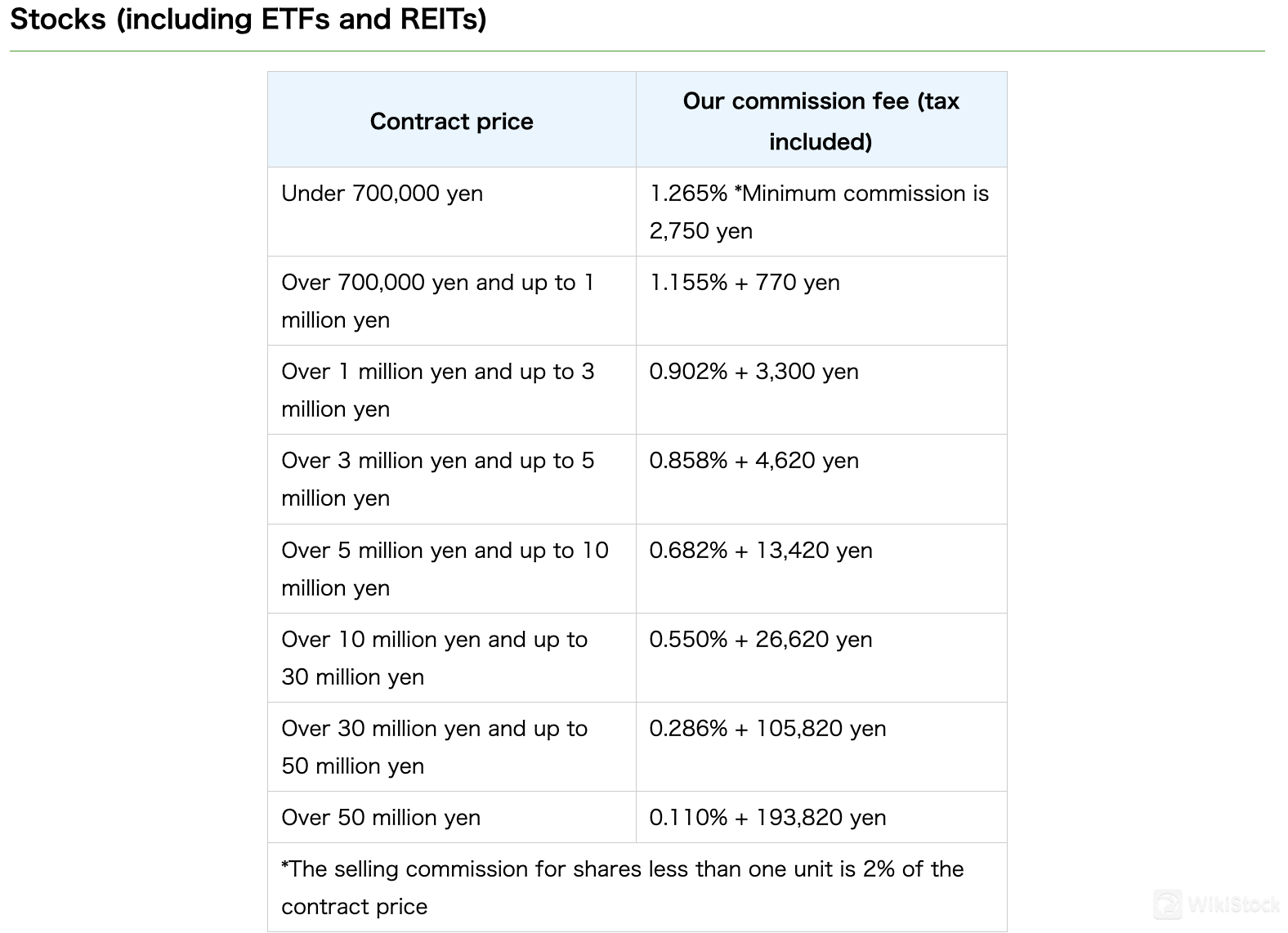

Fee Structure: Account opening and account management are free of charge. They offer commission fee structures for stock, ETF, and REIT trades, with details readily available.

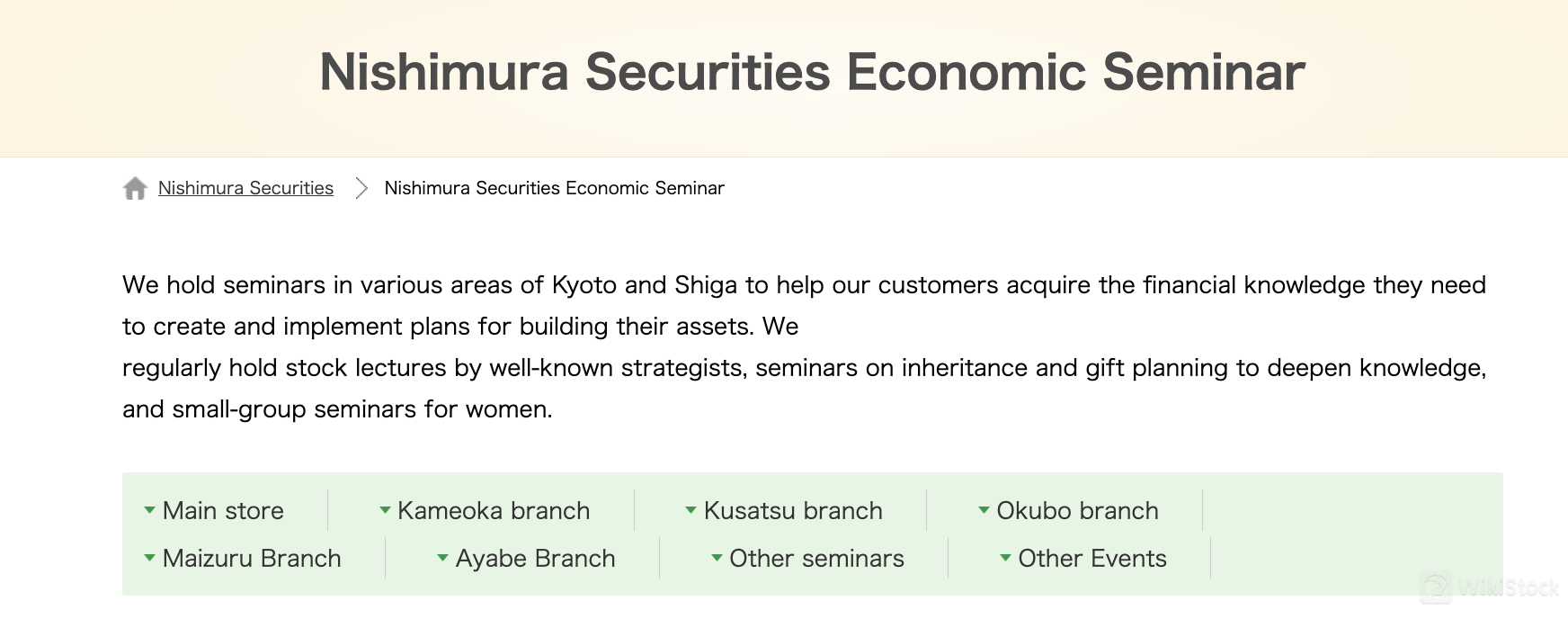

Educational Opportunities: Nishimura Securities provides various seminars and workshops to enhance client financial literacy.

Multiple Branch Locations: Nishimura Securities has branches spread across Kyoto and Shiga, offering convenience for in-person consultations.

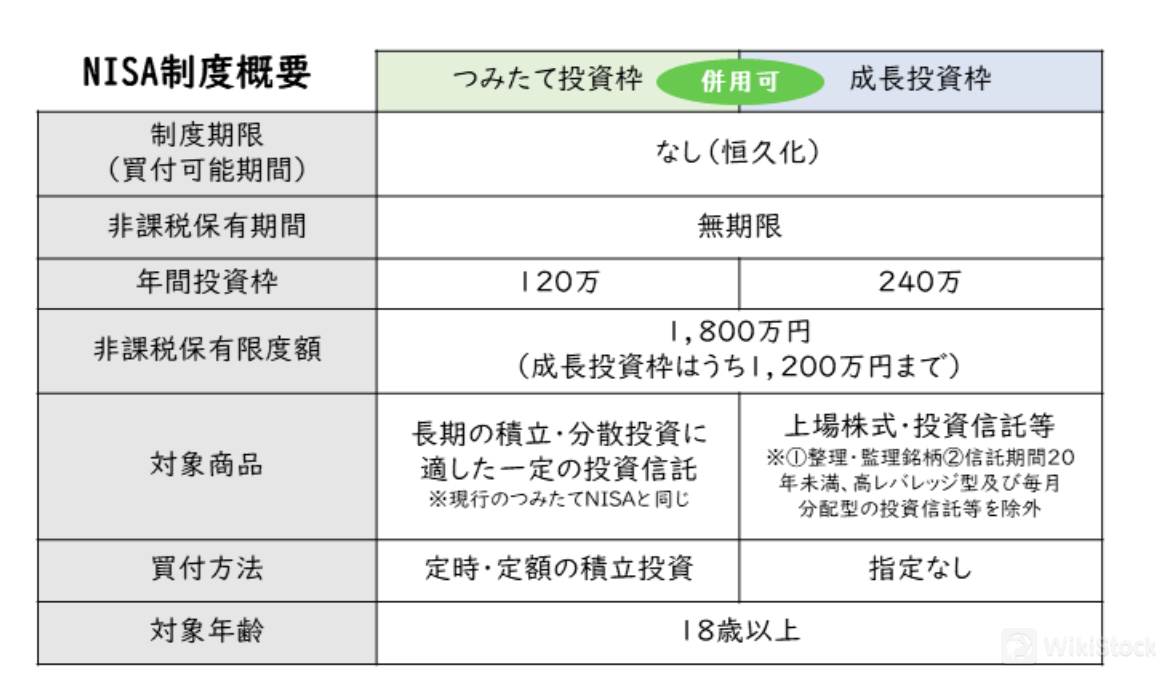

Tax-Advantaged Accounts: Nishimura Securities offers NISA accounts, allowing clients to invest in specific Japanese assets with tax benefits.

Cons:No Trading Platform: Nishimura Securities does not offer an online trading platform or app.

Regional Focus: Nishimura Securities' services primarily target the Kyoto and Shiga regions, limiting accessibility for investors outside those areas.

Is Nishimura Securities Safe?

Regulation

Nishimura Securities Company is regulated by the Japanese Financial Services Agency (FSA). This means that they are subject to the JFSA's rules and regulations, which are designed to protect investors and ensure the stability of the financial system. Nishimura Securities' license number is Kinki Financial Bureau Director (Securities) License No. 26.

What are Securities to Trade with Nishimura Securities?

Nishimura Securities offers a range of investment products for their clients.

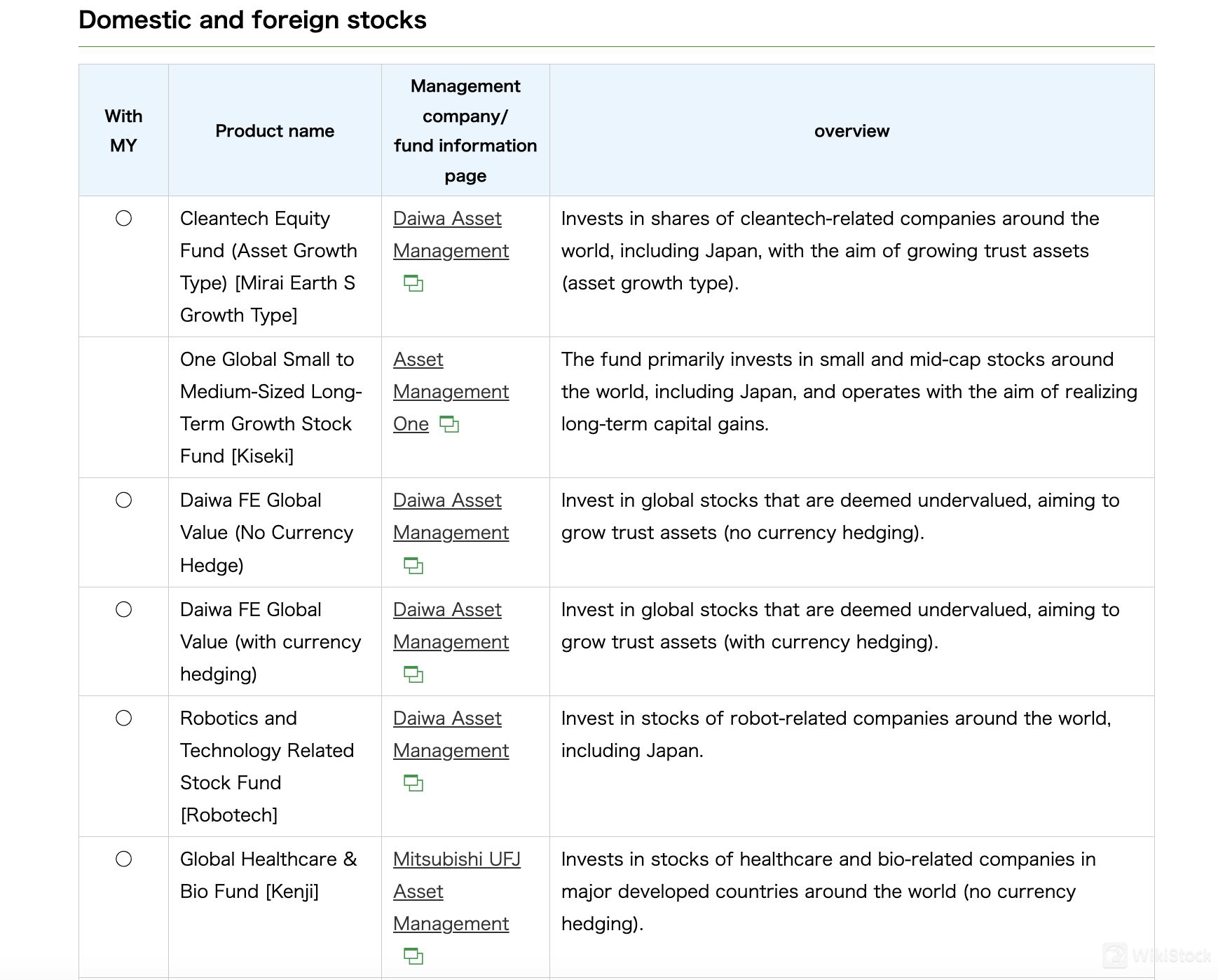

Equities: Both domestic and foreign stocks are available for trading.

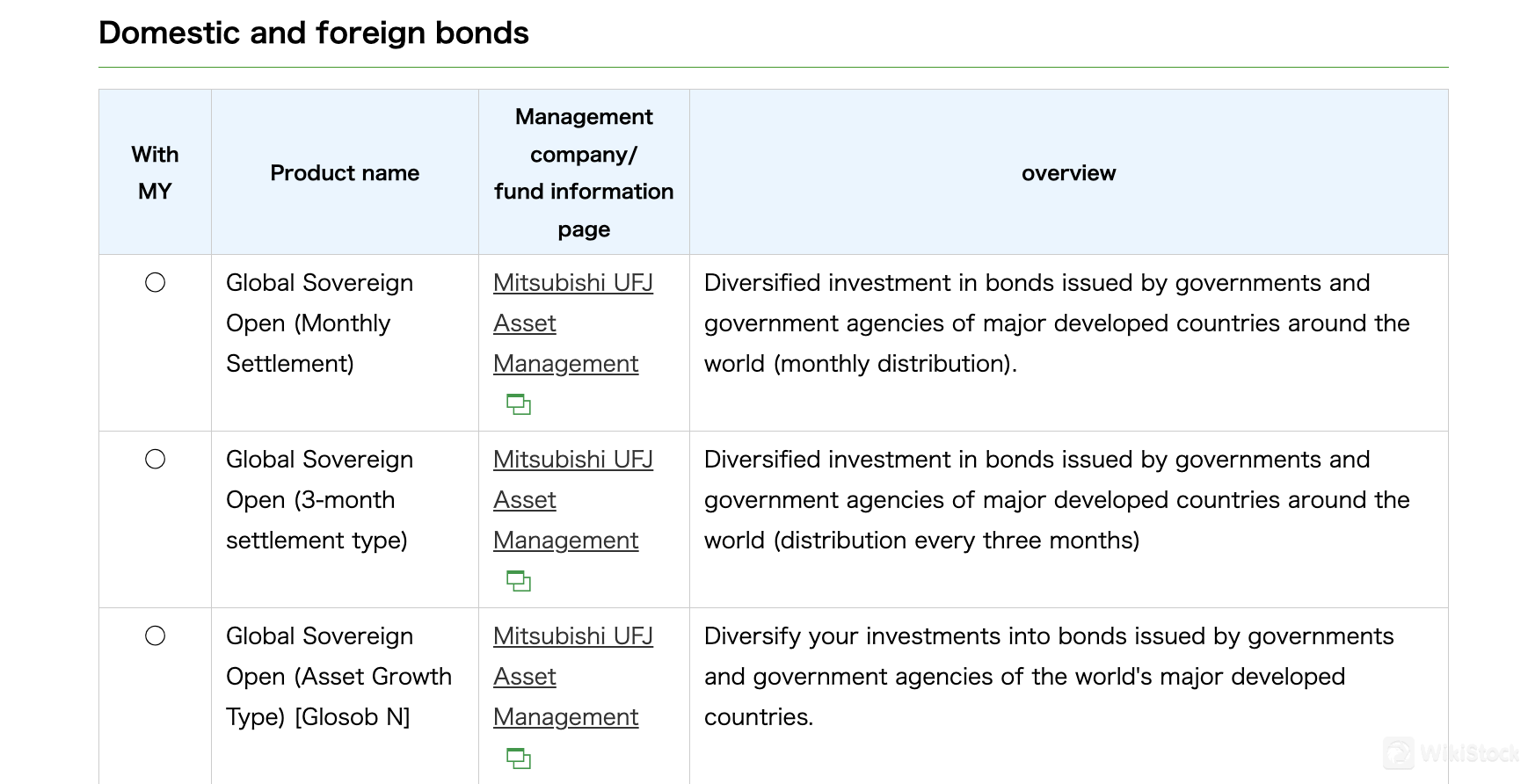

Fixed Income: They offer investment opportunities in domestic and foreign bonds.

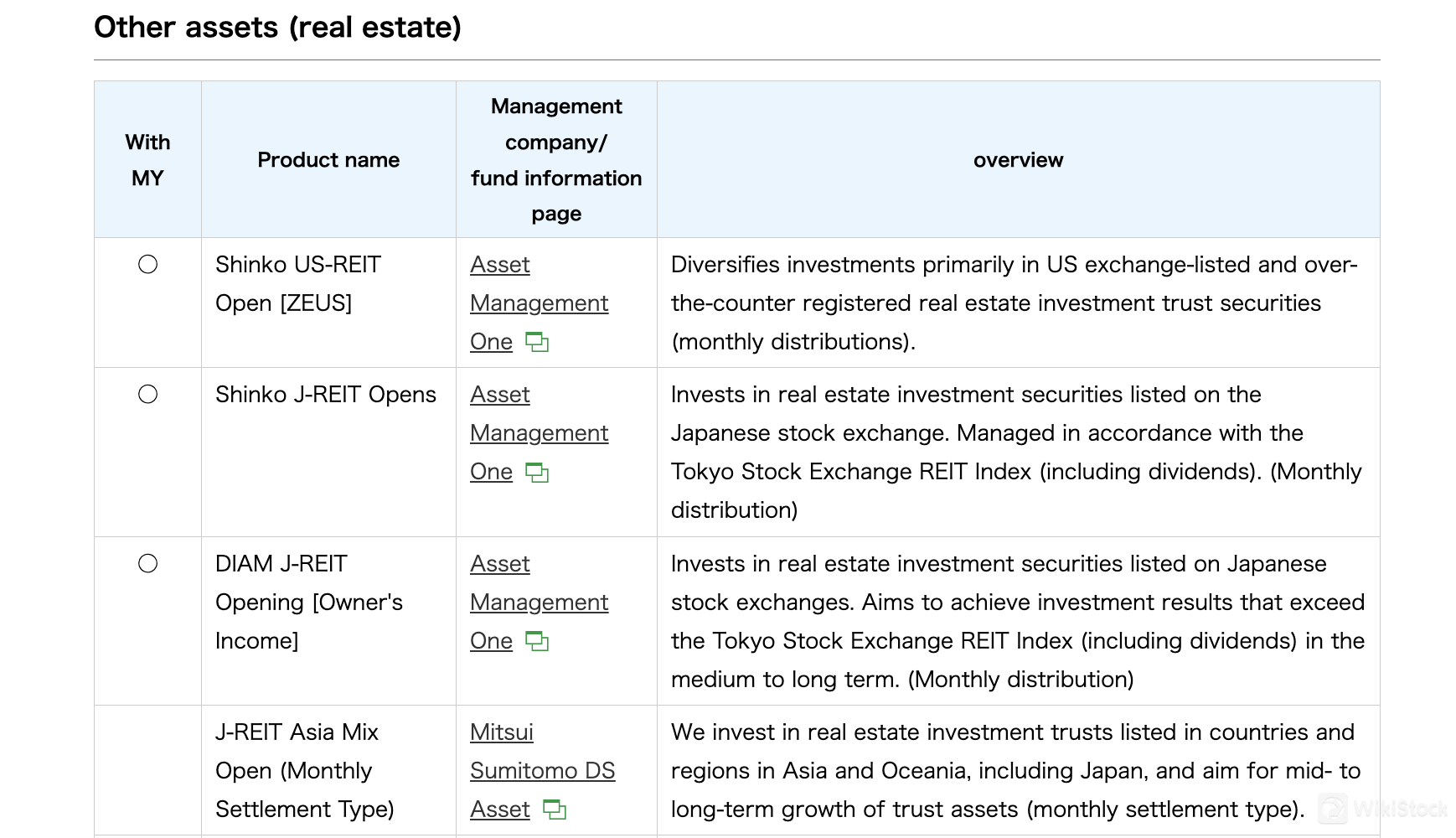

Alternative Investments: “Other assets” are listed, including real estate investment products.

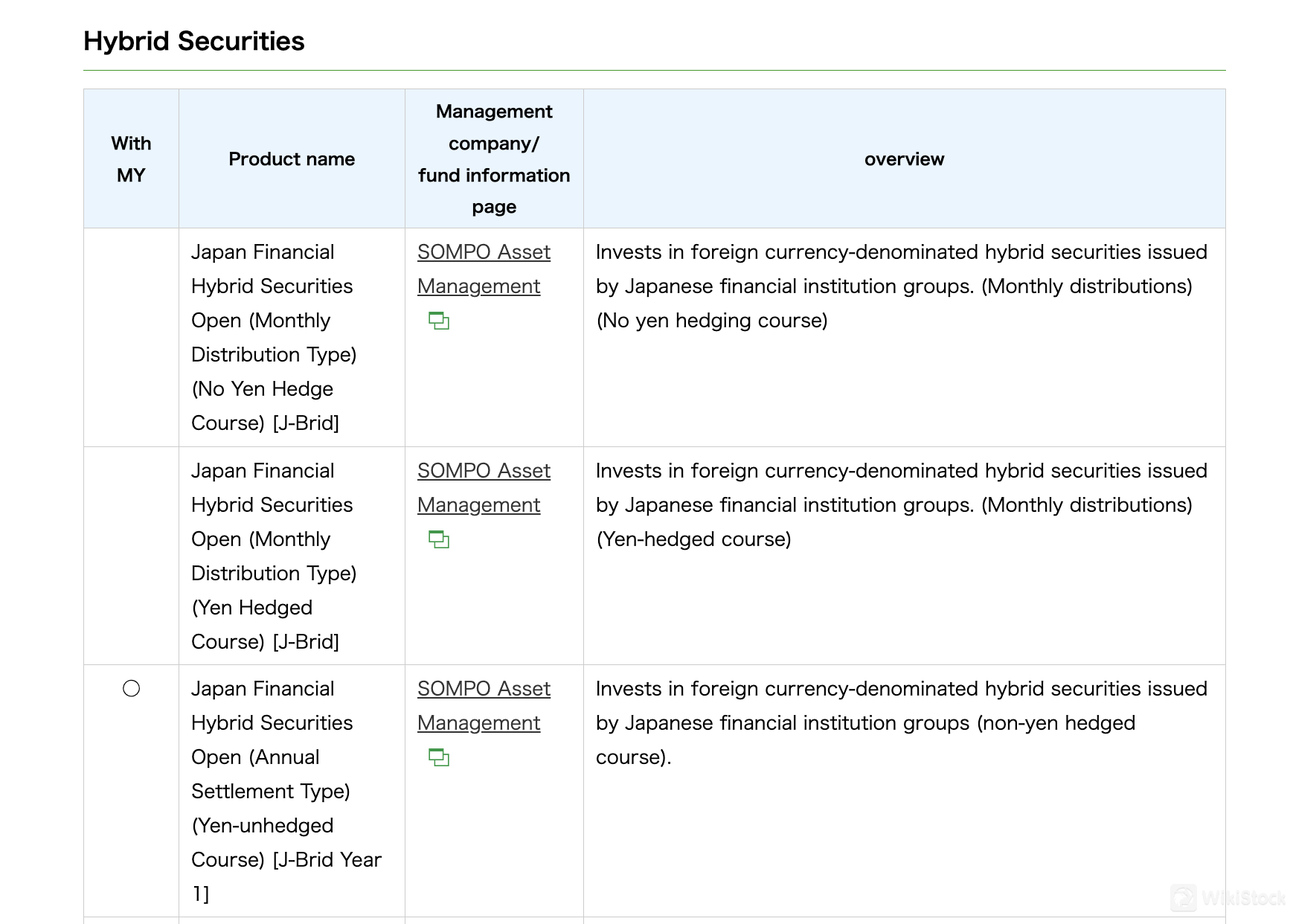

Hybrid Securities: These are complex financial instruments combining features of stocks and bonds.

Nishimura Securities Accounts

Nishimura Securities offers two account types for investors:

General Securities Trading Account: This is the standard account type for most trading activities.

NISA Account (tax-exempt account): This account allows clients to invest in certain Japanese stocks and investment trusts with tax benefits.

Nishimura Securities Fees Review

Nishimura Securities offers a commission fee structure for stock, ETF, and REIT trades.

Account Opening and Management: These services are free of charge.

Commission Fees: They are tiered based on the transaction value and include tax. The total fee is rounded down to the nearest yen.

Minimum Commission: A minimum commission of 2,750 yen applies regardless of the transaction value.

Here are some specific examples:

Transactions under 700,000 yen incur a 1.265% commission fee, with the minimum fee applied if lower.

Transactions between 1 million yen and 3 million yen would have a commission fee ranging from 0.902% + 3,300 yen to 0.858% + 4,620 yen.

Research & Education

Nishimura Securities offers a variety of educational opportunities for their clients, focusing on building financial knowledge and supporting informed investment decisions.

Client Seminars: They hold seminars across Kyoto and Shiga on various topics, including stock market analysis by renowned strategists, inheritance and gift planning to aid financial security, women's investment workshops, and small group sessions to encourage participation and address questions.

Company Information Sessions: They host “IR Company Information Sessions for Individual Investors” which provide a unique platform. Listed company managers directly address investors, offering insights into their companies' policies and vision. This firsthand information helps investors make informed decisions based on factors beyond just financial data.

Main Store Events: Their main store features a dedicated event space where they host. Investment-focused workshops with a limited number of participants, fostering a comfortable environment for beginners to ask questions.

Customer Service

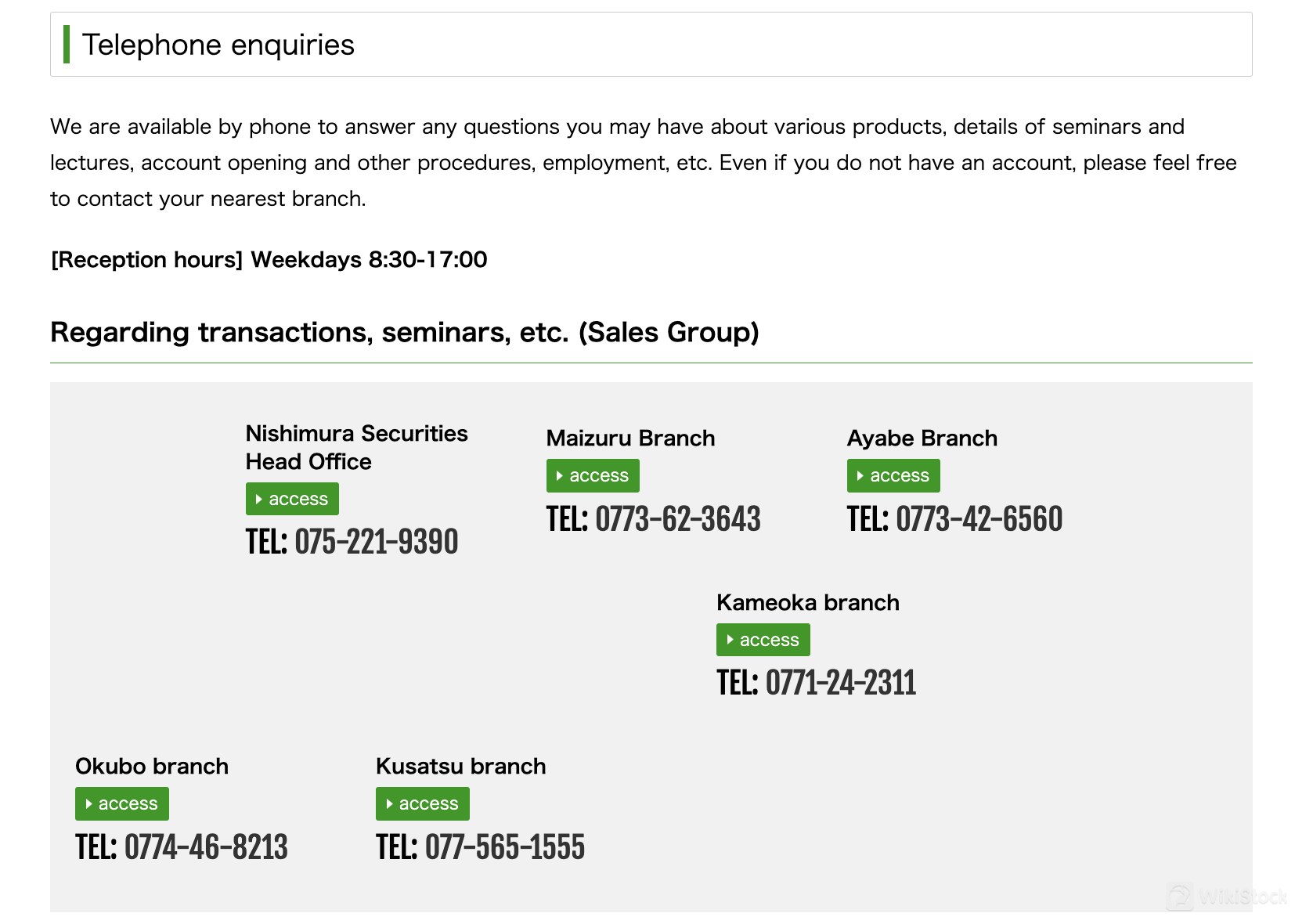

Nishimura Securities offers customer support through phone consultations at their branches.

Contact Channels: They primarily focus on phone support. Their reception hours are weekdays from 8:30 AM to 5:00 PM.

Support Topics: Their representatives can answer inquiries about various investment products, seminar and lecture details, account opening procedures, and other general questions. They can also address employment inquiries.

Branch Support: Contact information for several branches is provided, including the Head Office and branches in Maizuru, Ayabe, Kameoka, Okubo, and Kusatsu.

Conclusion

Nishimura Securities presents a unique choice for investors, particularly those located in the Kyoto and Shiga region. Their focus on local relationships, educational resources, and tax-advantaged accounts like NISA can be appealing. However, their limitations, including a lack of online presence in English and a lack of online trading platform require careful consideration.

FAQs

Is Nishimura Securities a good platform for beginners?

Nishimura Securities offers seminars and workshops on various investment topics, helpful for beginners. Physical branches in Kyoto and Shiga provide a sense of accessibility and the opportunity for in-person consultations.

Is Nishimura Securities legit?

Nishimura Securities has a Kinki Financial Bureau Director (Securities) License No. 26. This indicates they are licensed to operate as a securities broker under the jurisdiction of the Japanese Financial Services Agency (FSA).

Is Nishimura Securities good for investing/retirement?

Yes. Nishimura Securities offers various products like stocks, bonds, and real estate investment options. Nishimura Securities also offers standard accounts and tax-advantaged NISA accounts.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

静岡東海証券

Score

播陽証券

Score

三縁証券

Score

ほくほくTT証券

Score

三晃証券株式会社

Score

ワイエム証券

Score

池田泉州TT証券

Score

長野證券

Score

PayPay証券

Score

相生証券

Score