Score

ほくほくTT証券

https://www.hokuhokutt.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

6

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Hokuhoku Tokai Tokyo Securities Co.,Ltd.

Abbreviation

ほくほくTT証券

Platform registered country and region

Company address

Company website

https://www.hokuhokutt.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

ほくほくTT証券 Earnings Calendar

Currency: JPY

Cycle

Q3 FY2024 Earnings

2024/01/29

Revenue(YoY)

41.79B

+16.70%

EPS(YoY)

39.24

+6.78%

ほくほくTT証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/01/292024/Q348.915B/0

- 2023/07/302024/Q144.095B/0

- 2023/01/302023/Q342.843B/0

- 2022/07/282023/Q150.942B/0

- 2022/01/302022/Q346.729B/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.265%

Margin Trading

YES

Regulated Countries

1

Products

6

| Hokuhoku Tokai Tokyo Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 2016 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Domestic Stocks/REITs/ETFs, Foreign Stocks, Domestic Bonds, Foreign currency Denominated Bonds, Domestic Mutual Funds, Foreign Mutual Funds, Structured Bonds, Hokuhoku Fund Wrap |

| Commission | Commissions for stocks trading: 0.088-1.265% plus fixed rate depending on trading volume, min 2750 yen |

| Commissions for trading stocks in Hokuhoku TT Direct: 0.0528-0.561% plus fixed rate depending on trading volume, min 1650 yen | |

| Commissions for the purchase and sale of convertible bonds (CBs): 0.11-1.1% plus fixed rate depending on trading volume, min 2750 yen | |

| Local commission: United States- 0.25% of the contract price plus various fix rate depending on sell or buy; Hong Kong- 0.3% of the contract price; Europe- 0.5% of the contract price | |

| Fees | Domestic agency fee: 0.11-1.43% of overseas settlement fee plus fix rate depending on settlement price etc. |

| Customer Service | Head office: 1-8-10 Marunouchi, Toyama City, Toyama Prefecture Toyama Marunouchi Building 6th Floor |

| Tel: 076-471-8164 during weekdays 9:00-17:00 (Office hours 9:00-16:00) | |

| Fax: 076-432-7181 |

Hokuhoku Tokai Tokyo Securities Information

Established in 2016 with six offices across Japan, Hokuhoku Tokai Tokyo Securities offers a diverse range of investment products, including Domestic Stocks/REITs/ETFs, Foreign Stocks, Domestic Bonds, Foreign Currency Denominated Bonds, Domestic Mutual Funds, Foreign Mutual Funds, Structured Bonds, and Hokuhoku Fund Wrap.

Clients access market insights via Hokuhoku TT Securities TV, with detailed fund information. It also offers transparent fee structures, for example, stock trading commissions range from 0.088% to 1.265%, plus fixed rates based on trading volume (min 2750 yen).

Regulated by the Japan Financial Services Agency (FSA) under license number Director-General of the Hokuriku Finance Bureau (Kinsho) No. 24, Hokuhoku Tokai Tokyo Securities maintains high standards of integrity and credibility in its financial operations.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Online Support |

| Wide Range of Investment Products | |

| Transparent Fee Structure | |

| Market Insights | |

| New NISA System Participation |

- Regulated by FSA: Regulated by the Japan Financial Services Agency (FSA), ensuring adherence to strict financial standards and investor protection.

- Wide Range of Investment Products: Offers diverse investment options including Domestic Stocks/REITs/ETFs, Foreign Stocks, Bonds, Mutual Funds, and Structured Bonds.

- Transparent Fee Structure: Provides clear and upfront information on commission fees for trading.

- Market Insights: Access to up-to-date market conditions and key indicators through Hokuhoku TT Securities TV.

- New NISA System Participation: Offers benefits under the New NISA system, including extended tax benefits and flexibility in investment quotas, suitable for long-term asset formation. Cons:

- Limited Customer Service Channels: Relies primarily on phone contact, fax and physical address for customer support, with limited availability of email, live chat, or social media platforms, which is not fully enough to meet modern customer service expectations.

- Fees for Trading Domestic Stocks (Stocks, ETFs, J-REITs)

- Fees for Trading Stocks in Hokuhoku TT Direct

- Fees for Trading Convertible Bonds (CBs)

- Fees for Stock Index Options Trading

- Fees for Trading Foreign Stocks

- Domestic Agency Fee (Tax Included)

- Local Commission Fee (Varies by Market)

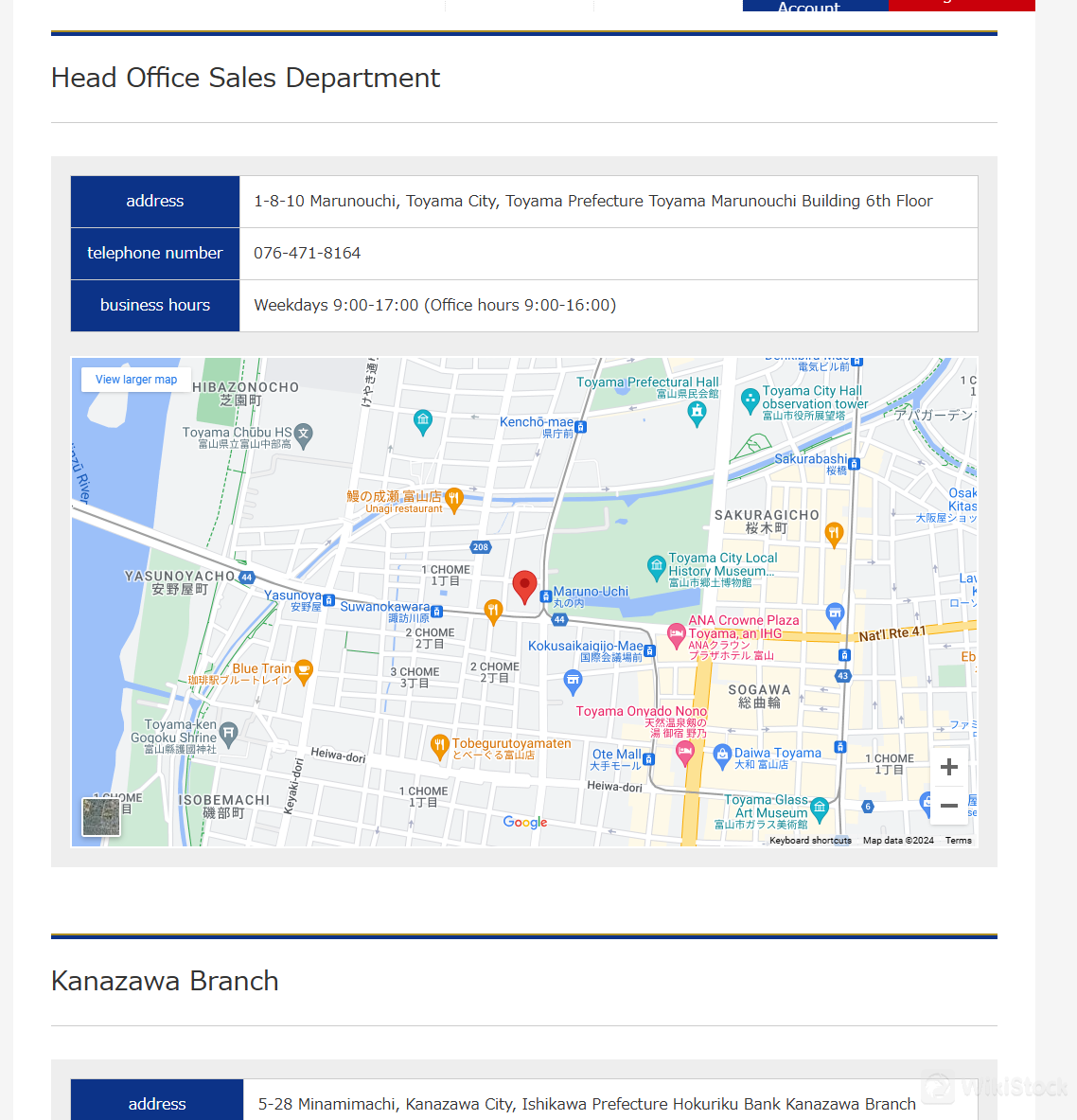

- Tottori head office: 1-8-10 Marunouchi, Toyama City, Toyama Prefecture Toyama Marunouchi Building 6th Floor

- Kanazawa Branch: 5-28 Minamimachi, Kanazawa City, Ishikawa Prefecture Hokuriku Bank Kanazawa Branch

- Fukui Branch: 1-7-15 Chuo, Fukui City, Fukui Prefecture, Hokuriku Bank Fukui Branch 2nd Floor

- Sapporo Branch: Hokkaido Sapporo City Chuo-ku Odori Nishi 2-5 Hokuhoku Sapporo Building 3rd Floor

- Asahikawa Branch: Asahikawa City, Hokkaido 9-228 2-Jo-dori Asahikawa Dōgin Building 5th Floor

- Obihiro Branch: Hokkaido Bank Nishigojo Branch 20-1 Nishi 5 Jo Minami, Obihiro City, Hokkaido

TEL: 0155-66-7490, Weekdays 9:00-17:00 (Counter business hours 9:00-12:30 13:30-15:00), need to make a reservation in advance when visiting

- Is Hokuhoku Tokai Tokyo Securities regulated by any financial authority?

- Yes, it operates under the regulatory oversight of the Japan Financial Services Agency (FSA), with license no. Director-General of the Hokuriku Finance Bureau (Kinsho) No. 24.

- What types of products does Hokuhoku Tokai Tokyo Securities provide?

- Domestic Stocks/REITs/ETFs, Foreign Stocks, Bonds, Mutual Funds, and Structured Bonds, etc.

- Is Hokuhoku Tokai Tokyo Securities suitable for beginners?

- Yes, it is suitable for beginners due to its FSA regulation and comprehensive range of investment products, transparent fee structures, and access to market insights through Hokuhoku TT Securities TV.

- What are the benefits of the New NISA system offered by Hokuhoku Tokai Tokyo Securities?

- The New NISA system provides extended tax benefits, indefinite tax-exempt holding periods, and increased annual investment limits for flexible asset formation.

- What are the fees associated with trading stocks and other securities at Hokuhoku Tokai Tokyo Securities?

- Commission fees for trading stocks charged by Hokuhoku vary between 0.088% to 1.265% of the transaction value, with additional fixed fees depending on the trading volume.

Is It Safe?

Regulation:

Hokuhoku Tokai Tokyo Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Hokuriku Finance Bureau (Kinsho) No. 24, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Hokuhoku Tokai Tokyo Securities's commitment to integrity and credibility in its services.

Safety Measures:

Hokuhoku Tokai Tokyo Securities ensures client confidentiality and regulatory compliance through rigorous privacy policies, safeguarding personal data from unauthorized access. Their robust AML policies include thorough customer verification, continuous monitoring, and reporting of suspicious activities to prevent financial crimes.

What are Securities to Trade with Hokuhoku Tokai Tokyo Securities?

Hokuhoku Tokai Tokyo Securities offers a comprehensive range of financial products and services designed to meet the diverse needs of their clients.

Their offerings in the domestic stock market include stocks listed on the Tokyo Stock Exchange (TSE), Osaka Exchange (OSE), Meisho, JASDAQ, and other emerging markets, alongside real estate investment trusts (REITs) and exchange-traded funds (ETFs).

For investors interested in international opportunities, they provide information on foreign stocks across major markets in Europe, the United States, and Asia.

In the realm of fixed income, Hokuhoku TT Direct offers domestic bonds, encompassing interest-bearing government bonds, individual government bonds, publicly offered local government bonds, and corporate bonds.

They also cater to those interested in foreign currency-denominated bonds, providing options in various currencies such as US dollars, euros, Australian dollars, New Zealand dollars, Brazilian real, and South African rand.

For mutual fund investors, Hokuhoku TT Direct offers n domestic mutual funds, including those managed in foreign stocks and bonds, as well as foreign mutual funds denominated in currencies like US dollars and euros.

They also provide structured bonds, which feature unique mechanisms not found in traditional bonds.

Additionally, through their Hokuhoku Fund Wrap service, they offer personalized asset management solutions tailored to individual investment goals and preferences.

Fees Review

Hokuhoku Tokai Tokyo Securities provides a detailed and transparent fee structure for trading various financial products, such as domestic and foreign stocks, ETFs, REITs, convertible bonds, stock index options, and foreign stocks etc. The fees are based on the contract price and vary depending on the type of transaction. Below is an overview of some of the fees for different trading activities.

| Contract Price | Basic Fee (Tax Included) |

| Minimum Fee | 2,750 yen |

| 1,000,000 yen or less | 1.26500% of the contract price, 2,750 yen if less |

| 1,000,000 yen to 2,000,000 yen | 0.93500% of the contract price + 3,300 yen |

| 2,000,000 yen to 3,000,000 yen | 0.90750% of the contract price + 3,850 yen |

| 3,000,000 yen to 4,000,000 yen | 0.85800% of the contract price + 5,335 yen |

| 4,000,000 yen to 5,000,000 yen | 0.84700% of the contract price + 5,775 yen |

| 5,000,000 yen to 10,000,000 yen | 0.72600% of the contract price + 11,825 yen |

| 10,000,000 yen to 30,000,000 yen | 0.58300% of the contract price + 26,125 yen |

| 30,000,000 yen to 50,000,000 yen | 0.27500% of the contract price + 118,525 yen |

| Over 50,000,000 yen | 0.08800% of the contract price + 212,025 yen |

| Contract Price | Basic Fee (Tax Included) |

| Minimum Fee | 1,650 yen |

| 1,000,000 yen or less | 0.75900% of the contract price, 1,650 yen if less |

| 1,000,000 yen to 2,000,000 yen | 0.56100% of the contract price + 1,980 yen |

| 2,000,000 yen to 3,000,000 yen | 0.54450% of the contract price + 2,310 yen |

| 3,000,000 yen to 4,000,000 yen | 0.51480% of the contract price + 3,201 yen |

| 4,000,000 yen to 5,000,000 yen | 0.50820% of the contract price + 3,465 yen |

| 5,000,000 yen to 10,000,000 yen | 0.43560% of the contract price + 7,095 yen |

| 10,000,000 yen to 30,000,000 yen | 0.34980% of the contract price + 15,675 yen |

| 30,000,000 yen to 50,000,000 yen | 0.16500% of the contract price + 71,115 yen |

| Over 50,000,000 yen | 0.05280% of the contract price + 127,215 yen |

| Contract Price | Basic Fee (Tax Included) |

| Minimum Fee | 2,750 yen |

| 1,000,000 yen or less | 1.1000% of the contract price, 2,750 yen if less |

| 1,000,000 yen to 3,000,000 yen | 0.9240% of the contract price + 1,760 yen |

| 3,000,000 yen to 5,000,000 yen | 0.8778% of the contract price + 3,146 yen |

| 5,000,000 yen to 10,000,000 yen | 0.7370% of the contract price + 10,186 yen |

| 10,000,000 yen to 30,000,000 yen | 0.5390% of the contract price + 29,986 yen |

| 30,000,000 yen to 50,000,000 yen | 0.3190% of the contract price + 95,986 yen |

| Over 50,000,000 yen | 0.1100% of the contract price + 200,486 yen |

| Transaction Price | Basic Fee (Tax Included) |

| Minimum Fee | 1,375 yen |

| 1,000,000 yen or less | 2.20000% of the transaction price, 1,375 yen if less |

| 1,000,000 yen to 3,000,000 yen | 1.65000% of the transaction price + 5,500 yen |

| 3,000,000 yen to 5,000,000 yen | 1.10000% of the transaction price + 22,000 yen |

| 5,000,000 yen to 10,000,000 yen | 0.82500% of the transaction price + 35,750 yen |

| 10,000,000 yen to 30,000,000 yen | 0.66000% of the transaction price + 52,250 yen |

| 30,000,000 yen to 50,000,000 yen | 0.49500% of the transaction price + 101,750 yen |

| Over 50,000,000 yen | 0.33000% of the transaction price + 184,250 yen |

| Type of Transaction | Costs |

| Tokyo Stock Exchange Trading | Same as domestic stock commission fee |

| Foreign Transactions (Local Consignment) | Local Expenses (Local Commissions + Misc.) + Domestic Agency Fees |

| Domestic Over-the-Counter Trading | Included in trading price set by the Company |

| Overseas Settlement Price (Yen Conversion) | Domestic Agency Fee |

| 1,000,000 yen or less | 1.430% of the overseas settlement price |

| 1,000,000 yen to 3,000,000 yen | 1.045% of the overseas settlement price + 3,850 yen |

| 3,000,000 yen to 5,000,000 yen | 0.880% of the overseas settlement price + 8,800 yen |

| 5,000,000 yen to 10,000,000 yen | 0.770% of the overseas settlement price + 14,300 yen |

| 10,000,000 yen to 30,000,000 yen | 0.605% of the overseas settlement price + 30,800 yen |

| 30,000,000 yen to 50,000,000 yen | 0.275% of the overseas settlement price + 129,800 yen |

| Over 50,000,000 yen | 0.110% of the overseas settlement price + 212,300 yen |

| Overseas Market | Approximate Local Commission Fees |

| United States | 0.25% of the contract price + α (varies) |

| Hong Kong S.A.R | About 0.3% of the contract price |

| Europe | About 0.5% of the contract price |

These fees are subject to change, and clients are encouraged to visit the Hokuhoku Tokai Tokyo Securities website at https://www.hokuhokutt.co.jp/service/charge/#sec08 for the most up-to-date information and look up for up fees they would like to know.

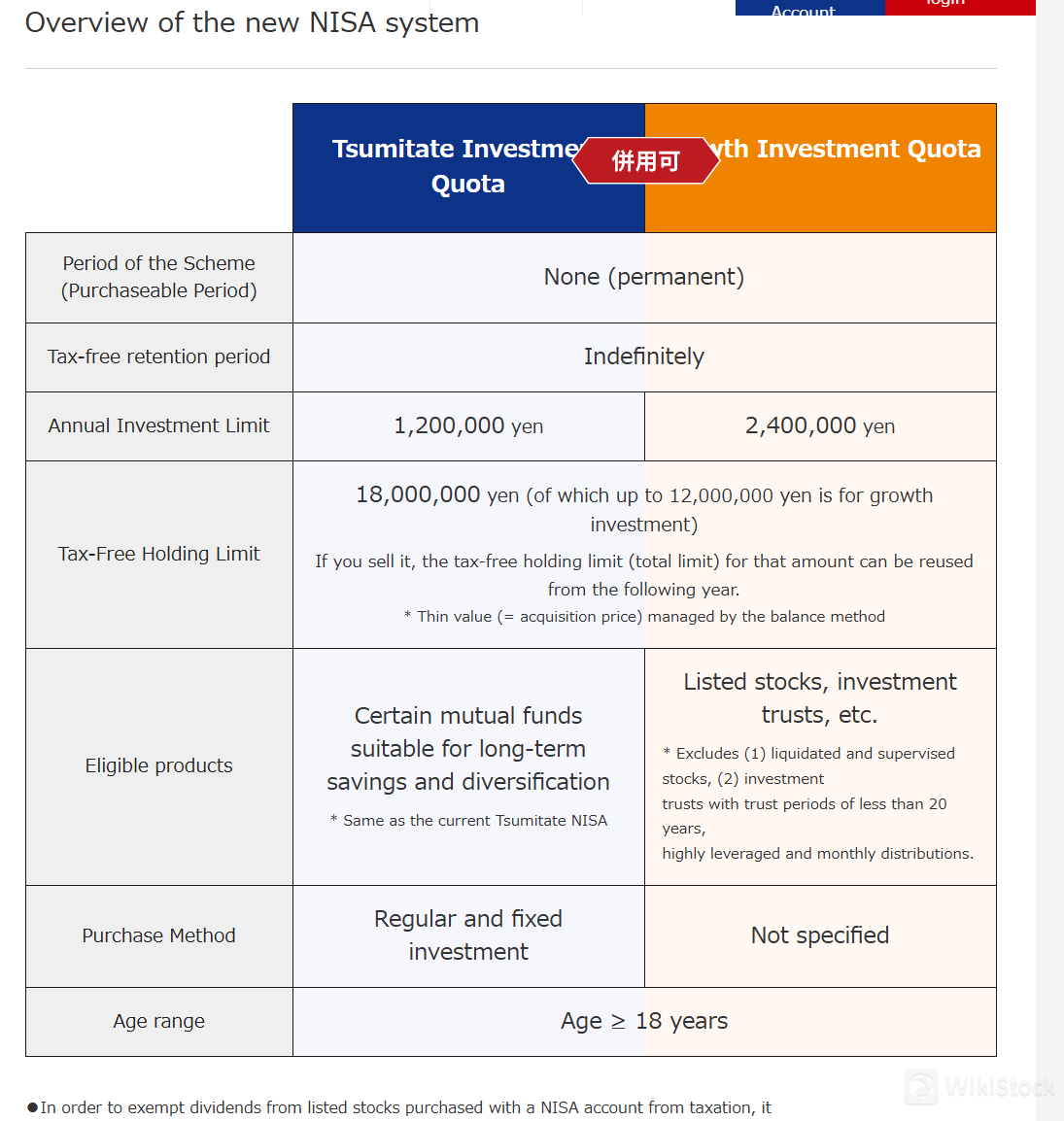

NISA System

Starting in 2024, Hokuhoku applies for the New NISA system which offers significant enhancements, including a permanent setup, an indefinite tax-exempt holding period, and increased investment limits.

Clients can invest up to 3.6 million yen annually, with 2.4 million yen for growth investments and 1.2 million yen for tsumitate investments.

The system now allows for the combined use of both investment quotas, making it more flexible for lifetime asset formation.

Additionally, the lifetime tax-exempt holding limit is set at 18 million yen, with the option to reuse the investment quota from the year following any sale.

Research & Education

Hokuhoku Tokai Tokyo Securities provides comprehensive research resources to support informed investment decisions.

Through Hokuhoku TT Securities TV, clients gain access to up-to-date market conditions and key indicators, including stock indices, bonds, and interest rates. The news distribution service ensures timely updates on market movements.

Additionally, detailed fund information and rankings are available, allowing investors to explore a wide range of investment options and compare performance metrics.

These resources empower clients with the necessary insights to navigate the financial markets effectively.

Customer Service

Hokuhoku Tokai Tokyo Securities offers customer service exclusively through phone: 0155-66-7490, FAX and physical addresses at their head office and five branches, which lack support through email, live chat, or social media. This limited approach in some cases can restrict accessibility and convenience for clients accustomed to digital communication channels.

TEL: 076-471-8164, Weekdays 9:00-17:00 (Office hours 9:00-16:00)

FAX: 076-432-7181

TEL :076-254-1811, Weekdays 9:00-17:00 (Office hours 9:00-15:00)

TEL : 0776-43-0420, Weekdays 9:00-17:00 (Office hours 9:00-16:00)

TEL : 011-231-7101, Weekdays 9:00-17:00 (Office hours 9:00-16:00)

TEL : 0166-74-3022, Weekdays 9:00-17:00 (Office hours 9:00-16:00)

Conclusion

Hokuhoku Tokai Tokyo Securities, established in 2016 and regulated by the Japan Financial Services Agency (FSA) under license number Director-General of the Hokuriku Finance Bureau (Kinsho) No. 24, offers a wide range of investment products including Domestic Stocks/REITs/ETFs, Foreign Stocks, Bonds, Mutual Funds, and Structured Bonds. They provide market insights via Hokuhoku TT Securities TV and transparent fee structures.

With active participation in the New NISA system, offering extended tax benefits and investment flexibility, Hokuhoku Tokai Tokyo Securities appears to be a trustworthy entity, maintaining high standards of regulatory compliance, integrity and client service in the financial sector.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

内藤証券株式会社

Score

Ichiyoshi Securities

Score

広田証券

Score

丸八証券株式会社

Score

ひろぎん証券

Score

三木証券

Score

JTG証券

Score

JIA証券

Score

山和証券株式会社

Score

八十二証券

Score