Score

城利證券有限公司

http://www.venusskyinvestment.com/

Website

Rating Index

Brokerage Appraisal

Products

1

Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02172

Brokerage Information

More

Company Name

Cityline Securities Limited

Abbreviation

城利證券有限公司

Platform registered country and region

Company address

Company website

http://www.venusskyinvestment.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Cityline Securities |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Fees | Commission Charges: 0.25% on the transaction amount |

| Account Fees | Free stock custody fee |

| App/Platform | Online trading paltform |

Cityline Securities Infomation

Cityline Securities Limited, founded in 2019, is a licensed Hong Kong brokerage firm. They specialize in securities trading (Type I activity), which encompasses buying and selling various investment products for clients. Their services include acting as a broker for stock trades, underwriting new security issuances, and placing securities with investors.

Pros & Cons of Cityline Securities

| Pros | Cons |

| Variety of Investment Options | Limited Educational Resources |

| Regulated Brokerage | Not 24/7 support |

| Two-Factor Authentication | Limited geographic focus |

| Simple and user-friendly mobile app |

Pros:

Variety of Investment Options: Cityline offers stocks, bonds, and mutual funds, for a wider range of investment strategies compared to brokers focused solely on stocks.

Regulated Brokerage: Regulation by the Securities and Futures Commission of Hong Kong (SFC) provides a layer of oversight and security for investments.

Two-Factor Authentication: 2FA adds an extra layer of security to protect customers' accounts from unauthorized access.

Cons:

Limited Educational Resources: The lack of regarding educational resources or research tools suggests Cityline is be ideal for beginner investors who need guidance.

Not 24/7 support: Unlike some competitors, Cityline Securities does not offer 24/7 customer service support.

Limited geographic focus: Their primary focus on the Hong Kong market may not be suitable for investors seeking broader global diversification.

Is Cityline Securities Safe?

Regulation

Cityline Securities is regulated by the Securities and Futures Commission of Hong Kong (SFC) under license number BNB391. This regulatory oversight helps ensure Cityline operates within a defined framework and adheres to established standards.

Safety Measures

Cityline Securities offers two-factor authentication (2FA) as a safety measure to help protect your account. This adds an extra layer of security beyond just your password. When enabled, 2FA typically requires a secondary code in addition to your password during login attempts. This code can be generated by a dedicated software token on your phone or another compatible device.

What are Securities to Trade with Cityline Securities?

Cityline Securities offers stock and some other products trading for individual investors.

Stocks: Investors can trade stocks listed on various exchanges through Cityline. This allows them to invest in individual companies and potentially profit from their growth.

Bonds: Cityline now includes bonds as tradable securities. Bonds are loans investors make to a company or government. In return, they pay investors a fixed interest rate over a set period and return the principal amount at maturity. Bonds can provide a steadier income stream compared to stocks, but generally offer lower returns.

Mutual Funds: Cityline offers access to mutual funds, which are professionally managed investment pools. Mutual funds combine assets like stocks, bonds, or commodities, allowing investors to diversify their holdings with a single investment.

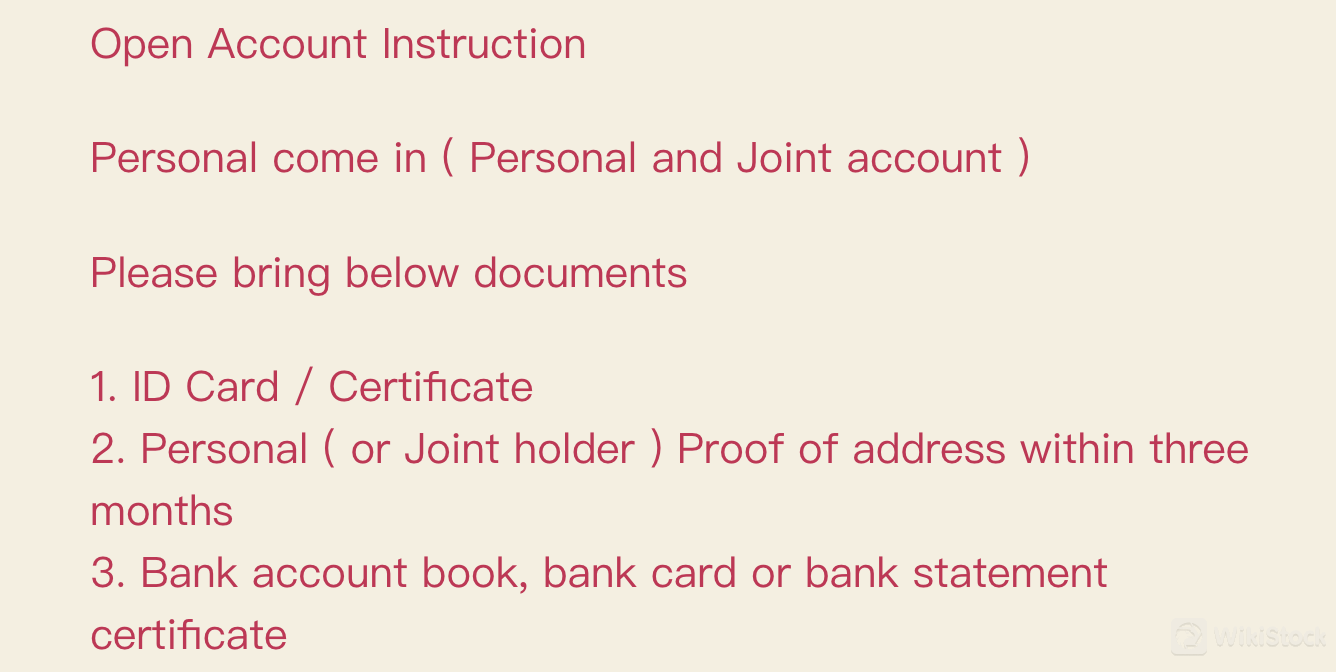

Cityline Securities Accounts

Cityline Securities offers at least two types of accounts:

Personal Account: This is the standard account for individual investors.

Joint Account: This allows two or more people to hold an account together.

Customers need to bring an ID card/certificate, personal ( or Joint holder ) proof of address within three months and a bank account book, bank card, or bank statement certificate to open accounts.

Cityline Securities Fees Review

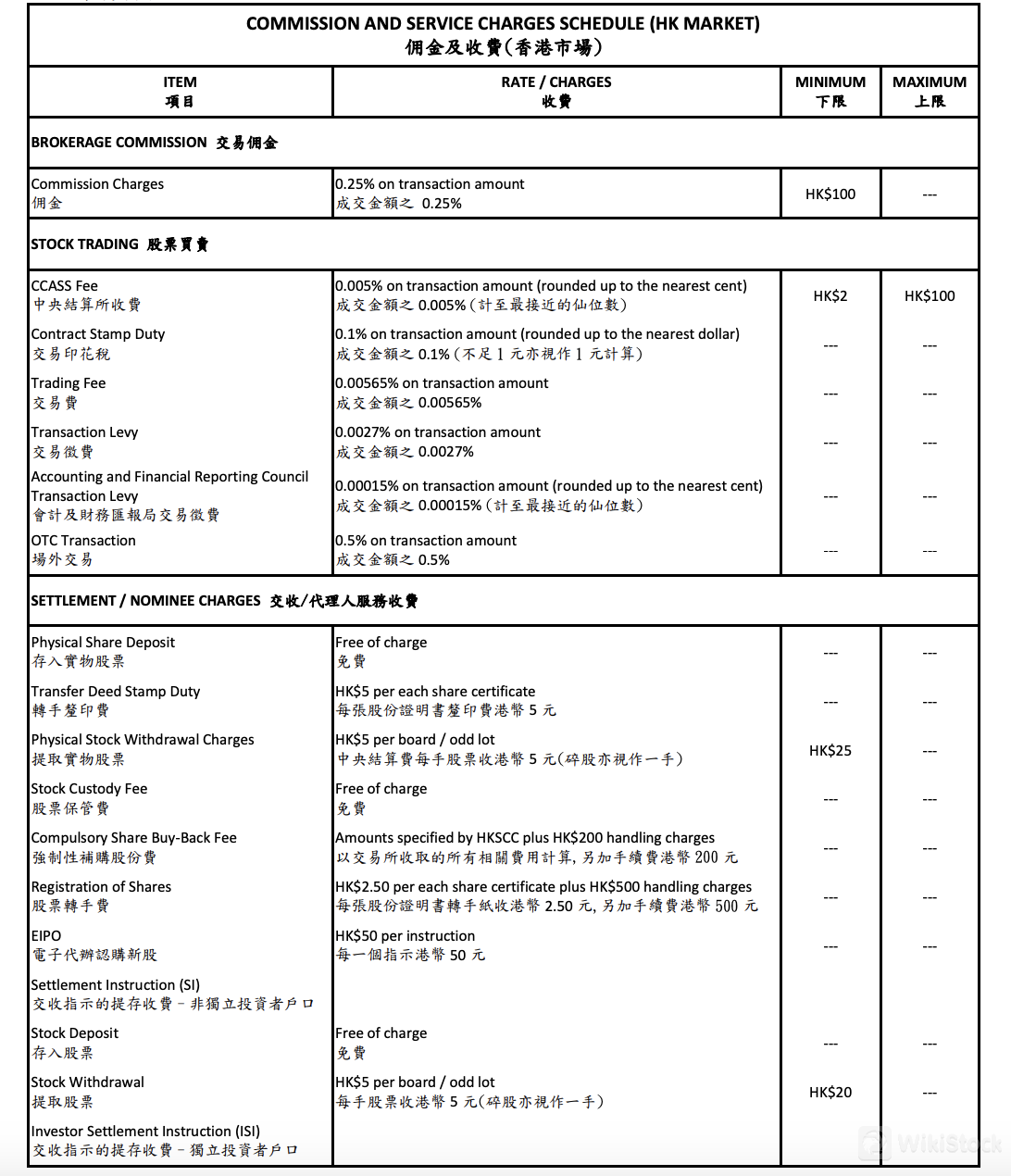

Cityline Securities charges various fees associated with trading activities.

Brokerage Commission: A flat fee of 0.25% is charged on the transaction amount for all trades.

Stock Trading Fees: Several additional fees apply to stock trades, including a CCASS Fee (0.005% of transaction amount), Contract Stamp Duty (0.1% of transaction amount), Trading Fee (0.00565% of transaction amount), Transaction Levy (0.0027% of transaction amount), and an Accounting and Financial Reporting Council Transaction Levy (0.00015% of transaction amount).

Over-the-Counter (OTC) Transactions: A higher commission rate of 0.5% is applied to transactions involving OTC stocks.

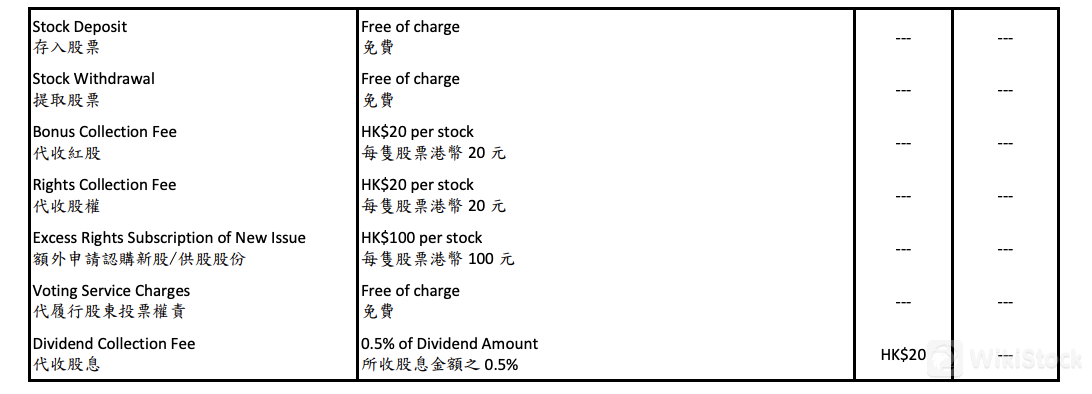

Settlement and Nominee Services: Cityline offers some complimentary services related to settlement and nominee accounts, including free physical share deposits, stock custody, stock deposits, and stock withdrawals.

Customer Service

Cityline Securities offers customer service through phone, email, and physical address. Service hours are weekdays (Monday to Friday) from 9:00 am to 5:30 pm Hong Kong time.

Tel: 2270 6000

Email: cs@cityline-securities.com

Address: Unit No.2101, 21/F, 68 Yee Wo Street, Causeway Bay, Hong Kong

Operation Time: Monday – Friday, 9:00 am – 5:30 pm

Conclusion

Cityline Securities emerges as a Hong Kong-based brokerage firm offering stock trading, bonds, and mutual funds for individual investors. They has a regulation under the Securities and Futures Commission of Hong Kong (SFC) and provide customer service through phone and email.

FAQs

Is Cityline Securities a good platform for beginners?

Information on features crucial for beginners, like minimum investment amounts or educational resources, is unclear.

Is Cityline Securities legit?

Yes. Cityline has been operating for a while (founded in 2019) and is regulated by the SFC, which suggests legitimacy.

Is Cityline Securities good for investing/retirement?

Cityline offers stocks, bonds, and mutual funds, which are suitable for various investment strategies, including long-term investing for retirement.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Commission Rate

0.25%

Regulated Countries

1

Products

Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

SPDBI

Score

CFSG

Score

HRIF

Score

中州國際

Score

Fair Eagle Securities

Score

Well Link Securities

Score

Hang Seng Bank

Score

Wocom

Score

Hantec

Score

GNFG

Score