What is Pacific Foundation Securities Limited?

Founded in 1988, Pacific Foundation Securities Limited is regulated by Hong Kong's Securities and Futures Commission (SFC). The firm provides a platform for accessing initial public offerings (IPOs) and offers fee-free opening of Securities Accounts. However, it does not facilitate forex and cryptocurrency trading, and its customer support options are limited, with no live chat and basic educational resources available.

Pros and Cons of Pacific Foundation Securities Limited?

Pacific Foundation Securities Limited, overseen by Hong Kong's Securities and Futures Commission (SFC), stands as a reliable brokerage firm offering a comprehensive platform tailored for both individual investors and corporate entities. The firm distinguishes itself by facilitating access to initial public offerings (IPOs) and ensuring a straightforward process with fee-free Securities Account opening.

However, Pacific Foundation Securities Limited does not support forex and crypto trading, which may limit diversification options for some investors. Additionally, the absence of live chat support and the availability of only limited educational resources could potentially pose challenges for clients seeking immediate assistance or in-depth learning opportunities.

Is Pacific Foundation Securities Limited safe?

Regulations

Pacific Foundation Securities Limited is currently licensed by the Securities and Futures Commission (SFC) under license number AAE696.

What are securities to trade with Pacific Foundation Securities Limited?

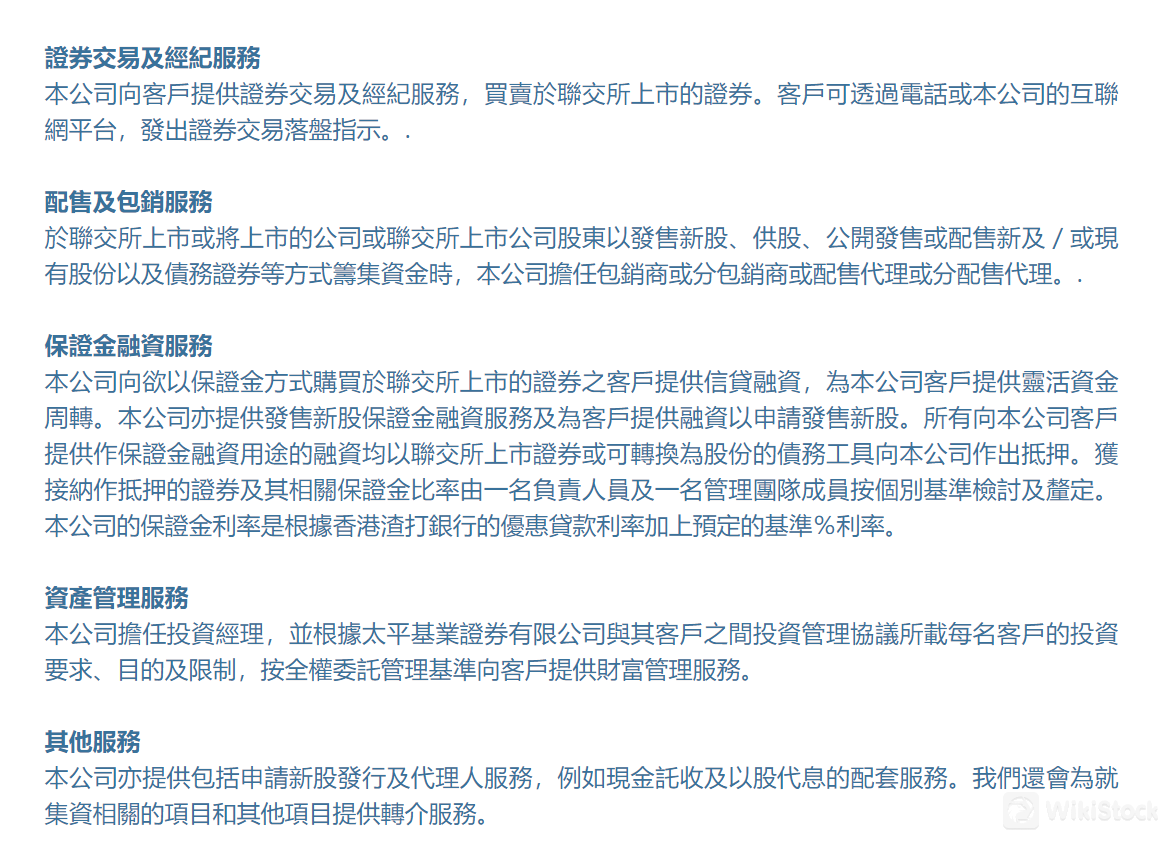

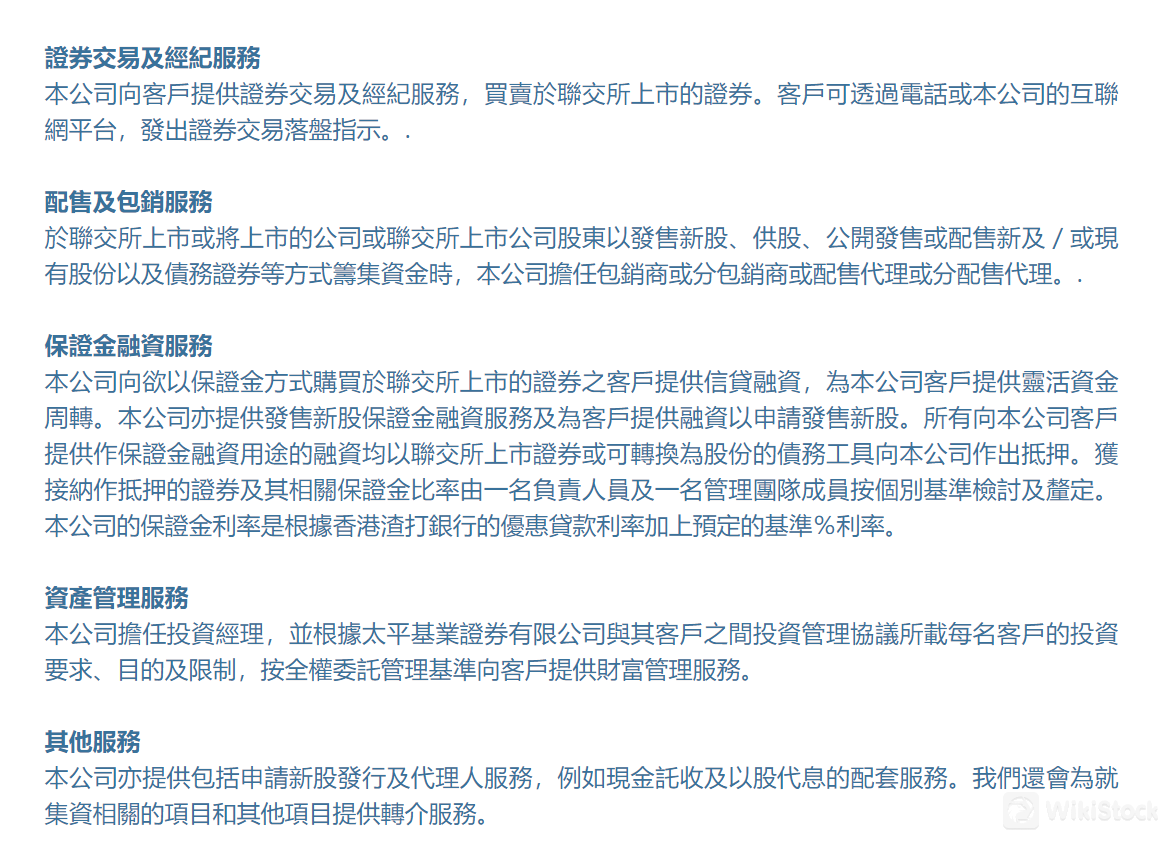

Pacific Foundation Securities Limited offers a range of financial services tailored to meet the needs of their clients. Their services include:

Securities Trading and Brokerage Services: The company provides securities trading and brokerage services for securities listed on the Hong Kong Stock Exchange (HKEX). Clients can place trading orders via telephone or the companys online platform.

Placement and Underwriting Services: For companies listed or about to be listed on the HKEX, or for shareholders of listed companies looking to raise funds through new shares, rights issues, public offerings, or placements of new and/or existing shares and debt securities, the company acts as an underwriter, sub-underwriter, placement agent, or sub-placement agent.

Margin Financing Services: The company offers credit financing to clients wishing to purchase securities listed on the HKEX on margin, providing flexible funding solutions. They also offer margin financing services for new share offerings, allowing clients to apply for new share subscriptions using financing. All financing provided for margin purposes is secured by HKEX-listed securities or debt instruments convertible into shares. The acceptable securities for collateral and their corresponding margin ratios are reviewed and determined on an individual basis by a responsible officer and a member of the management team. The margin interest rate is based on the Standard Chartered Bank (Hong Kong) prime rate plus a predetermined percentage.

Asset Management Services: Acting as an investment manager, the company provides wealth management services on a discretionary basis according to the investment requirements, objectives, and constraints of each client as stipulated in the investment management agreements between Pacific Foundation Securities Limited and its clients.

Other Services: The company also offers additional services such as new share issuance applications and agency services, including cash collection and scrip dividends. They provide referral services for fundraising-related projects and other projects.

Pacific Foundation Securities Limited Accounts

Pacific Foundation Securities Limited offers two types of accounts for both individual and corporate clients:

Cash Account: This type of account allows clients to buy and sell securities using funds that are immediately available in the account.

Margin Account: A margin account enables clients to borrow funds from the brokerage firm to purchase securities, using the securities in the account as collateral. This type of account allows for leveraging investments and potentially increasing purchasing power, but it also involves risks, including the possibility of margin calls if the value of securities declines.

Pacific Foundation Securities Limited Fees Review

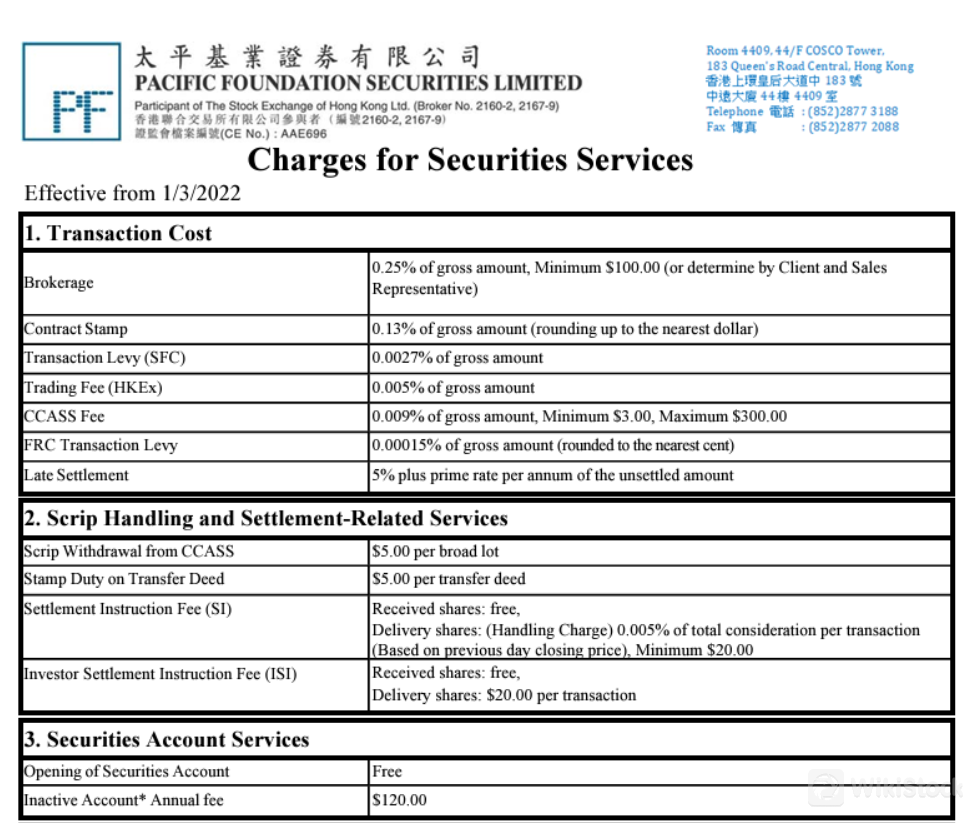

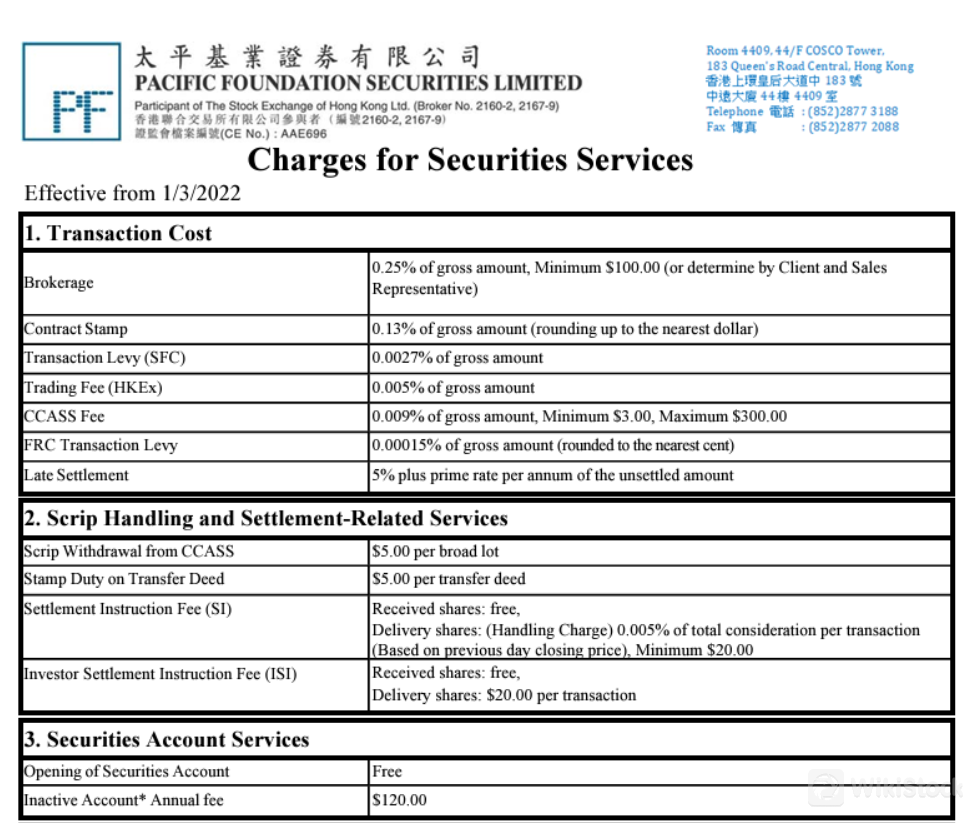

Pacific Foundation Securities Limited charges a Transaction Cost that includes a brokerage fee of 0.25% of the gross amount, with a Minimum $100.00 determined by the Client and Sales Representative. A Contract Stamp fee of 0.13% of the gross amount is rounded up to the nearest dollar. An SFC Transaction Levy of 0.0027% of the gross amount applies, along with a Trading Fee on HKEx of 0.005% of the gross amount. Additionally, there's a CCASS Fee of 0.009% of the gross amount, with a Minimum $3.00 and a Maximum $300.00. A FRC Transaction Levy of 0.00015% of the gross amount is rounded to the nearest cent. Late Settlement incurs a 5% charge plus the prime rate per annum on the unsettled amount.

For Scrip Handling and Settlement-Related Services, withdrawal from CCASS is $5.00 per broad lot. Stamp Duty on Transfer Deed is $5.00 per transfer deed. Settlement Instruction Fee (SI) for received shares is free, while for delivery shares, a Handling Charge of 0.005% of the total consideration per transaction (based on the previous day's closing price) applies, with a Minimum $20.00. The Investor Settlement Instruction Fee (ISI) is $20.00 per transaction for delivery shares.

Regarding Securities Account Services, opening a Securities Account is free, but an Inactive Account incurs an annual fee of $120.00.

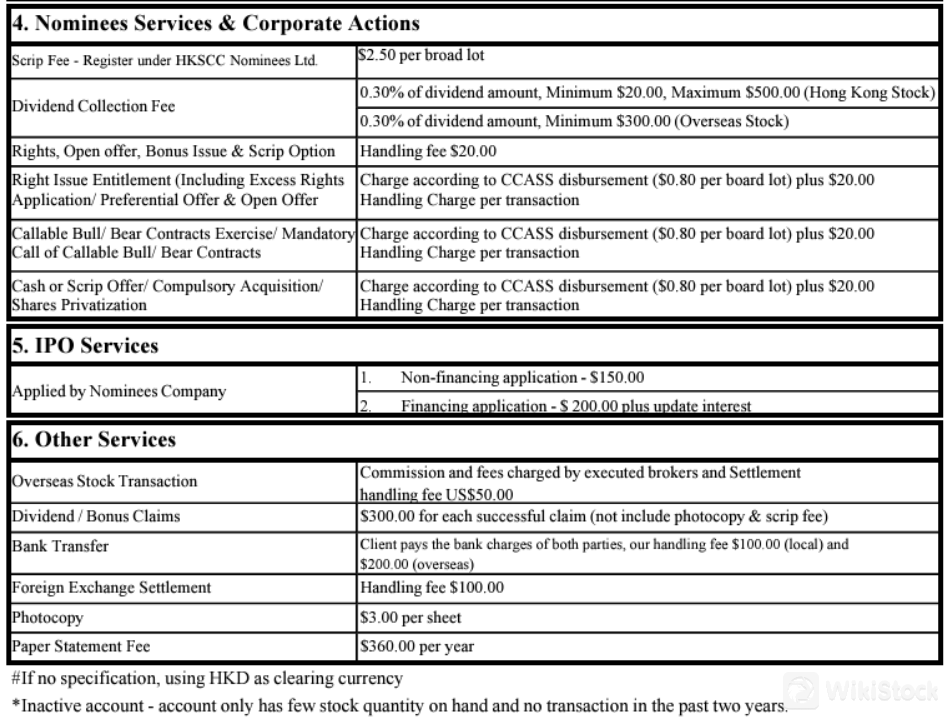

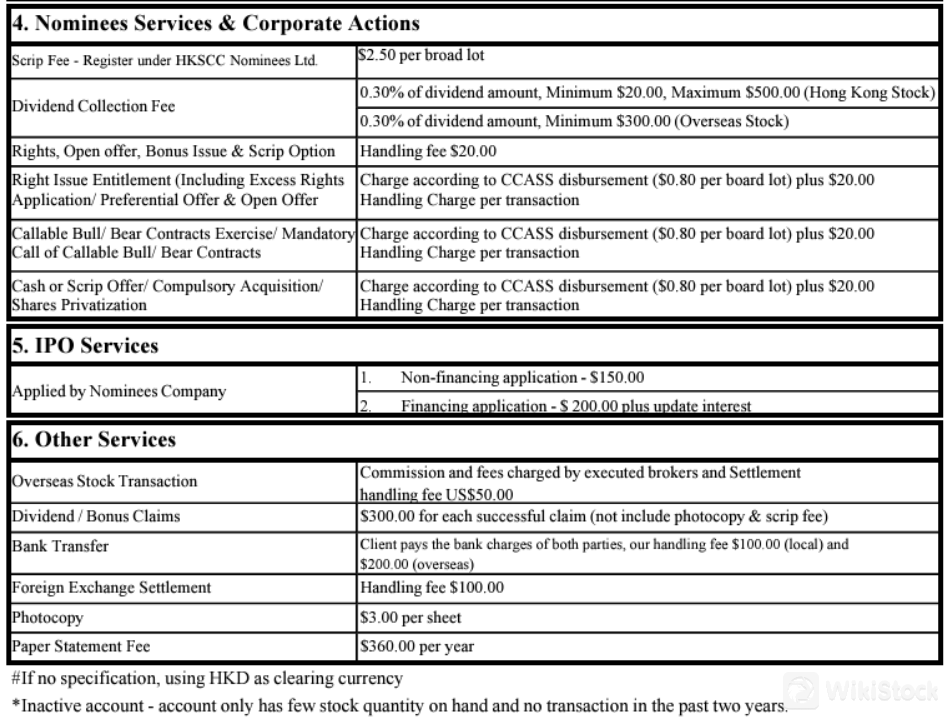

Under Nominees Services & Corporate Actions, registering under HKSCC Nominees Ltd. involves a Scrip Fee of $2.50 per broad lot. Dividend Collection Fee is 0.30% of the dividend amount, with a Minimum $20.00 and a Maximum $500.00 for Hong Kong Stock; for Overseas Stock, the minimum is $300.00. A Handling fee of $20.00 applies for Rights, Open Offer, Bonus Issue & Scrip Option. Charges for Right Issue Entitlement, Callable Bull/Bear Contracts, Cash or Scrip Offer, Compulsory Acquisition, and Shares Privatization include CCASS disbursement of $0.80 per board lot plus a $20.00 Handling Charge per transaction.

For IPO Services, Non-financing applications by Nominees Company incur a $150.00 fee, while Financing applications are $200.00 plus updated interest.

Other Services offered by Pacific Foundation Securities Limited include handling fees for Overseas Stock Transactions of US$50.00, Dividend/Bonus Claims charged at $300.00 for each successful claim (excluding photocopy and scrip fee), and Bank Transfer fees where clients cover bank charges for both parties and pay a handling fee of $100.00 locally or $200.00 overseas. A Handling fee of $100.00 applies to Foreign Exchange Settlement. The fee for Photocopy is $3.00 per sheet, and a Paper Statement Fee amounts to $360.00 per year.

Pacific Foundation Securities Limited App Review

Pacific Foundation Securities Limited offers a comprehensive trading platform catering to both individual and corporate clients. This platform includes an online trading platform and mobile apps, providing convenient access to a wide range of financial instruments.

Customer Service

Pacific Foundation Securities Limited is dedicated to providing exceptional customer service to meet the diverse needs of its clients. Located at Room 4409, 44/F, Cosco Tower, 183 Queen's Road Central, Sheung Wan, Hong Kong, the company ensures accessibility and convenience for its customers. Clients can easily reach out to the company through various contact methods, including email at info@pfs.com.hk, telephone at (852) 2877 3188, and fax at (852) 2877 2088.

Conclusion

Pacific Foundation Securities Limited is highlighted by its regulation under Hong Kong's Securities and Futures Commission, offering convenient access to initial public offerings (IPOs) and fee-free opening of Securities Accounts. It appeals to investors interested in IPO opportunities and straightforward account management. However, the firm does not facilitate forex or cryptocurrency trading, and its customer support options are limited, lacking live chat and comprehensive educational resources.

FAQs

Is Pacific Foundation Securities Limited safe to trade?

Pacific Foundation Securities Limited is licensed by the Securities and Futures Commission (SFC). However, information about funds safety and specific safety measures is not available.

Is Pacific Foundation Securities Limited a good platform for beginners?

While Pacific Foundation Securities Limited offers versatile trading platforms, it lacks comprehensive educational resources, which may hinder beginners seeking guidance and learning opportunities.

Is Pacific Foundation Securities Limited legit?

Pacific Foundation Securities Limited holds a valid license from the Securities and Futures Commission (SFC) under license number AAE696, ensuring its legitimacy and adherence to regulatory standards.

Risk Warning

The details are sourced from WikiStock's expert analysis of the brokerage's website data and are subject to updates. Engaging in online trading carries significant risks, including the potential for complete loss of invested capital, underscoring the importance of understanding these risks thoroughly before participation.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

--