We are an independent stockbroker and investment manager authorised and regulated by the Financial Conduct Authority. We are a member of the London Stock Exchange and the Personal Investment Management & Financial Advice Association and we offer a range of investment services to private individuals, trusts, charities, pension funds and corporate clients.

Farley & Thompson Information

Established in 1938, Farley & Thompson is a brokerage firm regulated by the UK Financial Conduct Authority (FCA). The firm offers a broad range of personalized services, including Discretionary and Advisory Portfolio Management, Custody Plus for self-directed investors, and specialized services for retirement planning, estate management, and tax-efficient investments. Their commitment to client protection is evident through the maintenance of segregated accounts, advanced encryption technologies, and regular audits, providing a secure environment for investors.

However, Farley & Thompson has some drawbacks. The brokers trading fees and account options are not detailed on their website and their customer service is limited to business hours, potentially inconveniencing clients who need assistance outside of these times.

Pros and Cons of Farley & Thompson

Farley & Thompson excels in regulatory compliance and client fund safety. As a firm regulated by the UK Financial Conduct Authority (FCA), they adhere to stringent regulatory standards. Additionally, their diverse range of services caters to various investor needs, from portfolio management to retirement planning and estate management, ensuring clients receive personalized and professional investment support.

Despite its strengths, Farley & Thompson has some limitations. The broker's account options are not provided on their website. Their customer service, although responsive and knowledgeable, is only available during business hours, which may not accommodate all clients' schedules.

Is Farley & Thompson safe?

Regulations

Farley & Thompson is officially licensed and regulated by The United Kingdom Financial Conduct Authority (FCA) under license number 461601.

Funds Safety

Farley & Thompson ensures the safety of client funds through stringent regulatory compliance and adherence to best practices in the industry. As a member of the Financial Conduct Authority (FCA), the broker is obligated to maintain segregated client accounts, ensuring that client funds are kept separate from the company's operating funds. This segregation is crucial in protecting client assets in the unlikely event of the broker's insolvency.

Safety Measures

In terms of safety measures, Farley & Thompson employs robust security protocols to safeguard client information and transactions. The broker utilizes advanced encryption technologies to protect data transmitted through its online platforms. Furthermore, regular audits and compliance checks are conducted to ensure adherence to regulatory standards and to maintain the integrity of their operations. The firms commitment to regulatory compliance and client protection measures demonstrates its dedication to providing a secure trading environment.

Services

Farley & Thompson offers a wide range of services, catering to diverse investment preferences and strategies.

- Discretionary Portfolio Management: Farley & Thompsons Discretionary Portfolio Management is a personalized service where investment specialists manage clients' portfolios on their behalf. This service is suitable for a wide range of investors, including individuals, trusts, charities, and pension accounts. The firm's investment experts take full responsibility for making investment decisions, allowing clients to benefit from professional management tailored to their financial goals and risk tolerance.

- Advisory Portfolio Management: The Advisory Portfolio Management service offered by Farley & Thompson is designed for investors who wish to be actively involved in their investment decisions. This service caters to individual clients as well as corporate and pension investors. Clients receive expert advice and recommendations from the firm's investment professionals but retain ultimate control over their investment choices, ensuring that their portfolios align with their personal objectives and preferences.

- Custody Plus: Farley & Thompsons Custody Plus is an execution-only trading service tailored for investors who have a clear understanding of the stock market and wish to manage their own investments. This service is ideal for knowledgeable investors who prefer to make their own trading decisions without advisory input. Custody Plus provides a secure and efficient platform for executing trades while ensuring that clients' assets are held safely in custody.

- Investing for Retirement: Farley & Thompson recognizes the evolving nature of the retirement market and offers specialized services to help clients navigate these changes. With the decline in final salary pensions and the gradual increase in the state pension age, the firm provides tailored investment strategies to support clients' retirement planning. These services are designed to help individuals maximize their retirement savings and ensure financial security in their later years.

- AIM IHT Portfolio Service: The AIM Portfolio service from Farley & Thompson is designed to help clients shelter part of their estate from Inheritance Tax (IHT). By investing in shares listed on the Alternative Investment Market (AIM), clients can potentially reduce their IHT liabilities, ensuring that more of their wealth is preserved for their loved ones. This service combines tax efficiency with professional portfolio management, offering a strategic approach to estate planning.

- Client Estate & Probate Service: Farley & Thompson‘s Estate & Probate service is designed to support clients during the difficult time of losing a loved one. Acting as an executor can be overwhelming, and this service provides extensive assistance in managing the estate and probate process. The firm’s experts handle the complexities of estate administration, ensuring that the process is carried out smoothly and in accordance with legal requirements, providing clients with peace of mind during a challenging period.

ICM Capital Fees Review

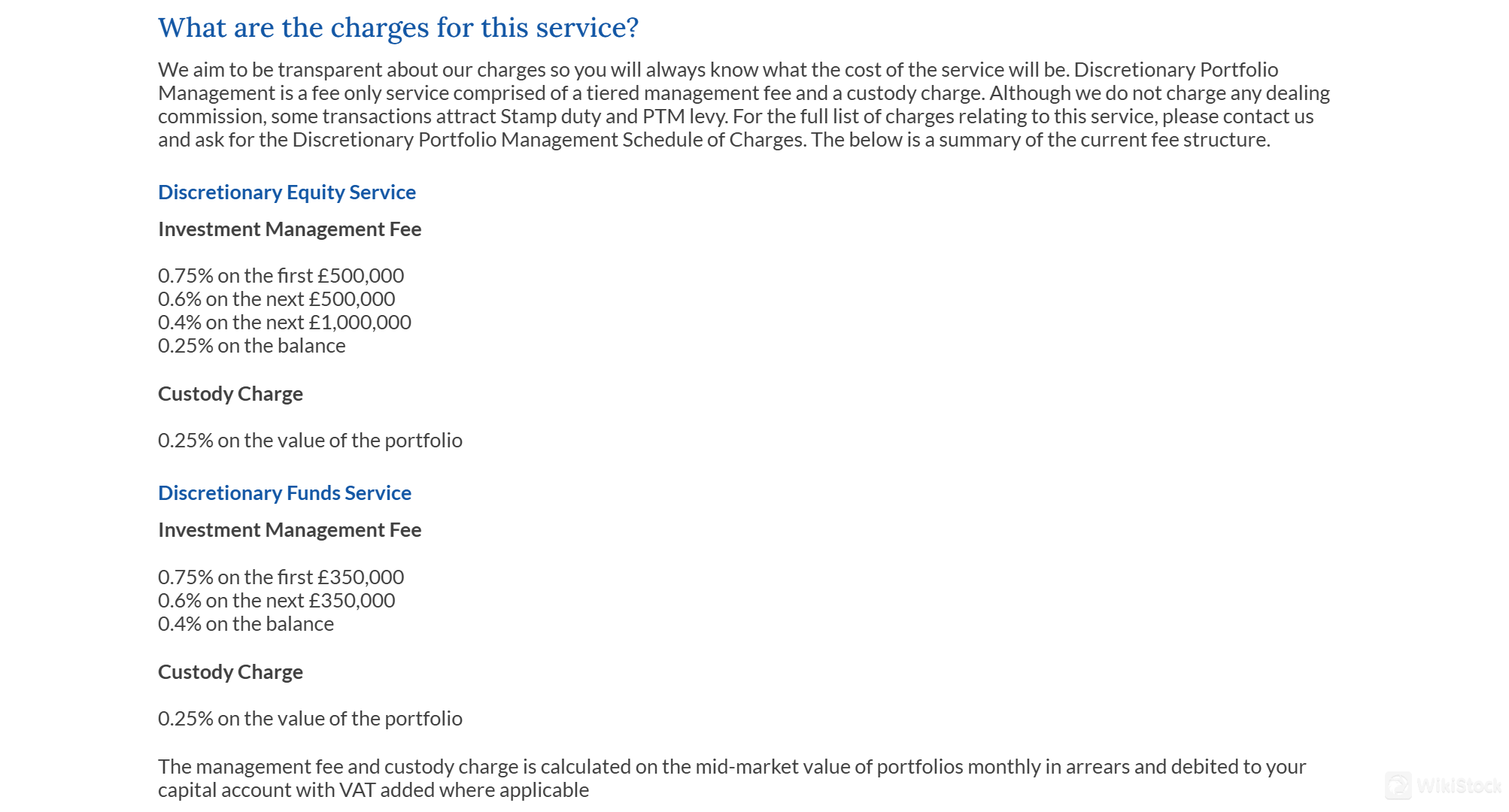

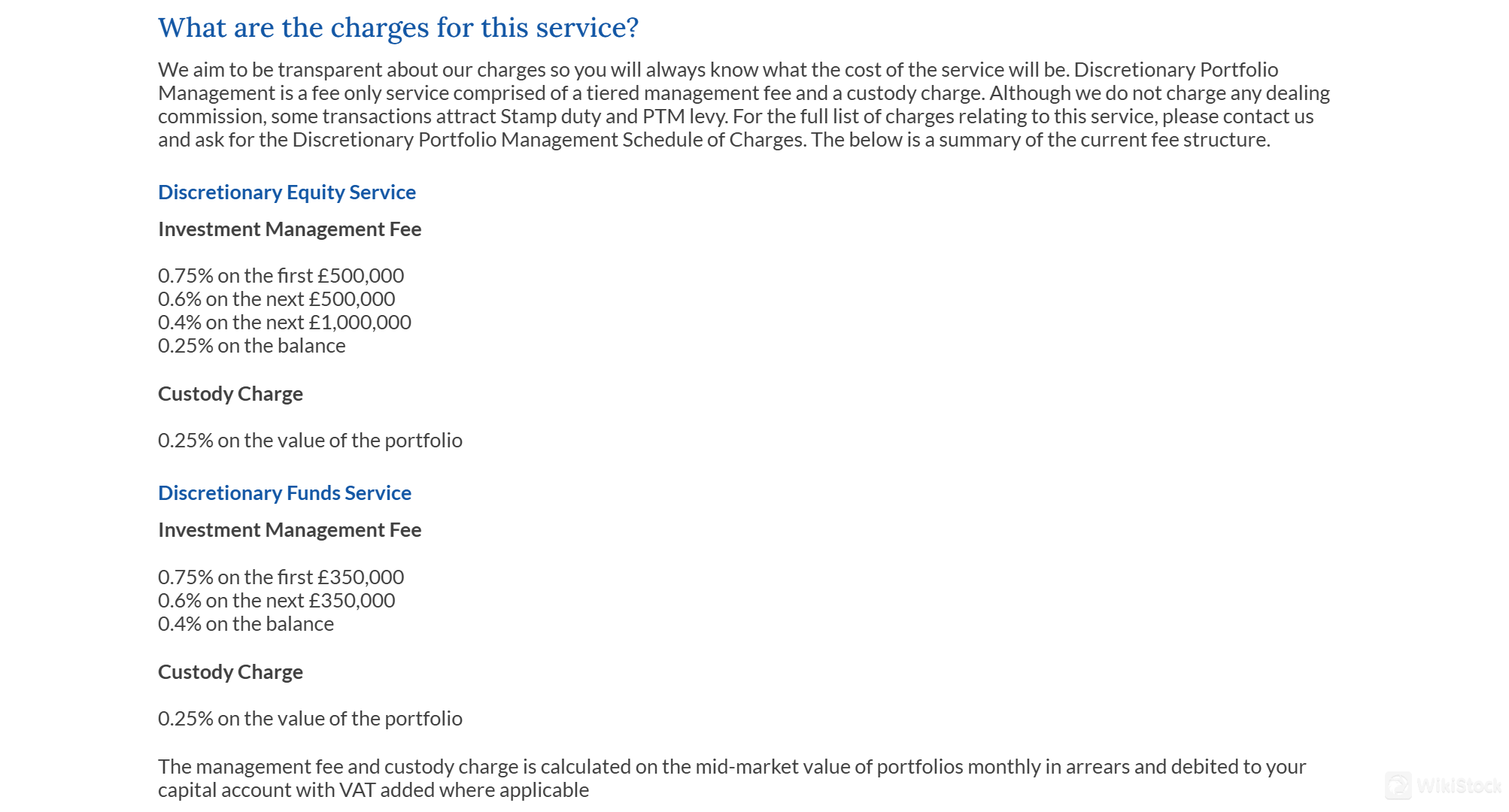

Farley & Thompson's trading fees for their Discretionary Portfolio Management service are transparent and tiered based on the portfolio value. For the Discretionary Equity Service, the investment management fee is 0.75% on the first £500,000, 0.6% on the next £500,000, 0.4% on the next £1,000,000, and 0.25% on the remaining balance, with a custody charge of 0.25% on the portfolio value. The Discretionary Funds Service has a similar structure with slightly different tiers. All fees are calculated on the mid-market portfolio value monthly in arrears and are subject to VAT where applicable. For specific details, clients are advised to contact Farley & Thompson for the full Discretionary Portfolio Management Schedule of Charges.

Research and Education

Farley & Thompson Securities offers an online security section to educate clients on recognizing phishing scams and provide guidelines for creating strong passwords and avoiding suspicious emails and websites.

- Useful Links: The broker offers helpful links for online safety. Clicking these links directs users to external websites. Action Fraud UK reports fraud and cybercrime, while the National Crime Agency (NCA) combats serious crime including cybercrime.

- FAQs: Farley & Thompson also offers a FAQ section to answer questions about online security.

Customer Service

Farley & Thompson offers excellent customer service (Monday to Friday 08:00 - 17:00) through various channels, including email (enquiries@frleyandthompson.co.uk), phone support (+01202295000), and a message box on their website. The brokers support team is responsive and knowledgeable, assisting clients with any issues they may encounter. This high level of customer support ensures that clients can resolve their problems efficiently and continue trading with minimal disruptions.

Conclusion

Farley & Thompson, established in 1938 and regulated by the FCA, offers a broad range of personalized investment services, ensuring client fund safety through advanced security measures and regular audits. The firm provides services such as Discretionary and Advisory Portfolio Management, Custody Plus, and specialized retirement and estate planning. However, the lack of detailed account options on their website and the limited availability of customer service to business hours can be inconvenient for some clients.

FAQs

Is Farley & Thompson regulated?

Yes, Farley & Thompson is regulated by the UK Financial Conduct Authority (FCA) under license number 461601, ensuring compliance with strict regulatory standards.

What customer support options are available at Farley & Thompson?

Farley & Thompson offers customer support through email, phone, and a message box on their website. Their support team is available Monday to Friday, from 08:00 to 17:00.

What educational resources does Farley & Thompson provide?

Farley & Thompson offers an online security section to educate clients on phishing scams, strong password creation, and avoiding suspicious emails and websites. They also provide useful links and a FAQ section on online security.

Risk Warning

WikiStock's expert assessment of the brokerage's website data is subject to change and should not be taken as financial advice. Online trading carries substantial risks, including the potential loss of all invested capital, and it's crucial to fully understand these risks before investing.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)