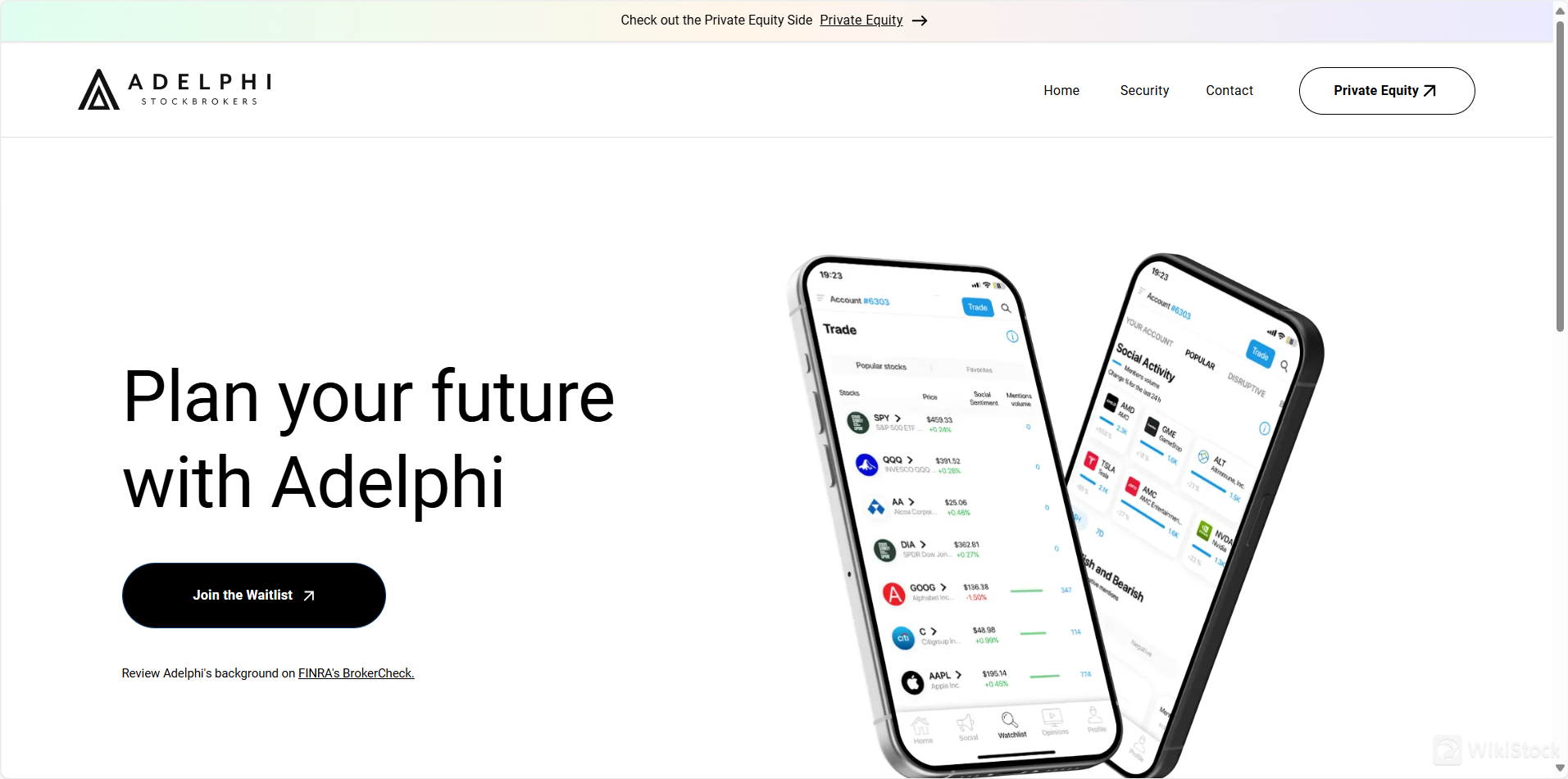

Adelphi Stock Brokers Inc. (“Adelphi,” “we,” “our,” or “us”) is a self-clearing broker dealer that offers fractional share trading through its mobile app. Fractional share trading involves buying and selling portions of whole shares of stocks or ETFs.

ADELPHI Information

Adelphi is a well-rated brokerage firm that offers a range of investment options including mutual funds, private placements, stocks, and ETFs through its user-friendly Adephi app available on iOS and Google platforms.

The firm provides access to exclusive investment opportunities in various sectors like Energy, FinTech, AI, BioTech, and Cyber Security, with an interest rate of 1.43% on uninvested cash.

However, detailed fee information and account fees are not readily available, which could be a drawback for potential investors.

Pros & Cons

Pros:

Adelphi is regulated by FINRA, ensuring compliance with industry standards and enhancing trust. The firm places a strong emphasis on security, using advanced encryption and authentication methods to protect client data. It boasts robust fintech capabilities and offers a diverse range of tradable securities, including mutual funds, private placements, stocks, and ETFs. Additionally, Adelphi charges 0 commission on trades, making it a cost-effective option for investors.

Cons:

Despite its strengths, Adelphi has notable drawbacks. It lacks an online trading platform, which can be inconvenient for users who prefer digital trading. The service comes with a $9.99 monthly fee, which will be a deterrent for some potential clients. Furthermore, there is no clear customer support mechanism in place, potentially leaving users without immediate assistance when needed.

Is ADELPHI Safe?

Regulations:

Adelphi Stock Brokers Inc. is regulated by the Financial Industry Regulatory Authority (FINRA) in the United States(license number:CRD#: 309048/SEC#: 8-70519). Established in 2007, FINRA is a non-governmental organization responsible for overseeing the trading practices of the over-the-counter markets and the operations of investment banks. FINRA's primary function is to strengthen investor protection and market integrity through efficient regulation and technical support.

Funds Safety:

Adelphi ensures the safety of client funds through several key measures. As a member of the Securities Investor Protection Corporation (SIPC), Adelphi protects brokerage accounts up to $500,000, including up to $250,000 in cash, in case of broker-dealer insolvency.

This coverage provides a safety net for investors, safeguarding their assets against potential losses due to the firm's financial instability. Additionally, Adelphi employs industry-standard encryption protocols to secure data in transit and at rest, ensuring that personal and financial information is protected from unauthorized access.

Two-factor authentication (2FA) adds an extra layer of security to client accounts, requiring a code sent to the client's phone or email in addition to a password for login. Furthermore, Adelphi conducts regular security audits and system monitoring to detect and respond to any suspicious activity, thereby maintaining a robust security infrastructure to protect client funds and information.

Safety Measures:

Adelphi employs various encryption technologies to ensure the security of funds storage. All data is encrypted in transit and at rest using industry-standard protocols and algorithms. Additionally, Adelphi offers two-factor authentication (2FA) to provide an extra layer of security for user accounts. The company also monitors its systems and networks 24/7 for any suspicious or malicious activity and performs regular security audits and tests to ensure the effectiveness of its security measures.

What are securities to trade with ADELPHI?

Adelphi offers a variety of securities for trading, including stocks, ETFs, mutual funds, and private placements.

Stocks: Adelphi provides access to trading in a wide range of publicly traded stocks, allowing investors to buy and sell shares of individual companies.

ETFs: Investors can trade Exchange-Traded Funds (ETFs) through Adelphi, which offer diversified exposure to various sectors, markets, and asset classes.

Mutual Funds: Adelphi offers mutual funds, enabling investors to invest in professionally managed portfolios that pool money from many investors to purchase a variety of securities.

Private Placements: Adelphi connects investors with issuers of private securities in sectors.

- Energy: Adelphi offers private placement opportunities in the energy sector, providing investors with access to exclusive projects and companies focused on innovative energy solutions. These investments aim to generate income and grow portfolio value while supporting advancements in sustainable and renewable energy technologies.

- FinTech: Adelphi connects investors with private securities in the FinTech sector, offering opportunities to invest in cutting-edge financial technology companies. These investments can help diversify portfolios and capitalize on the growth and innovation within the rapidly evolving financial services industry.

- Artificial Intelligence: Adelphi's private placements in artificial intelligence allow investors to support and benefit from companies at the forefront of AI technology. These investments focus on the development of advanced AI applications, offering potential high returns and exposure to a transformative sector.

- BioTech & Pharma: Adelphi provides private equity opportunities in the biotech and pharmaceutical industries, enabling investors to participate in the growth of companies developing groundbreaking medical treatments and technologies. These investments offer the potential for substantial returns while supporting advancements in healthcare.

- Cannabis: Adelphi offers private placement options in the cannabis sector, giving investors access to emerging companies within this rapidly growing industry. These investments can diversify portfolios and provide opportunities for significant returns as the legal cannabis market continues to expand.

- Cyber Security: Adelphi's private placements in cybersecurity connect investors with companies dedicated to protecting digital information and infrastructure. These investments offer the potential for high returns by supporting businesses that develop essential security solutions in an increasingly digital world.

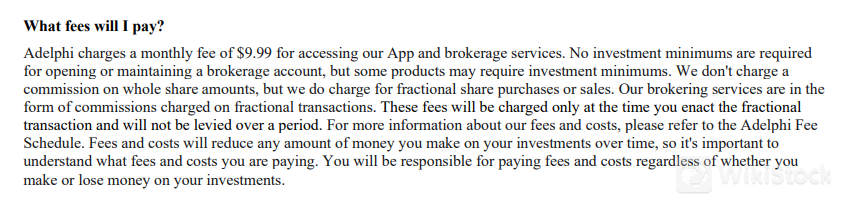

ADELPHI Fee Review

ADELPHI provides a rough fee structure for its users.

- Monthly Fee: $9.99 for accessing the app and brokerage services.

- Investment Minimums:

- No minimums required for opening or maintaining a brokerage account.

- Some products will have specific investment minimum requirements.

- Commission on Whole Shares: No commission charged.

- Commission on Fractional Shares:

- Fees applied to purchases or sales of fractional shares.

- Charged only at the time of the transaction, not levied over a period.

- Impact on Investments:

- Fees and costs will reduce the amount of money made on investments over time.

ADELPHI Trading Platrform Review

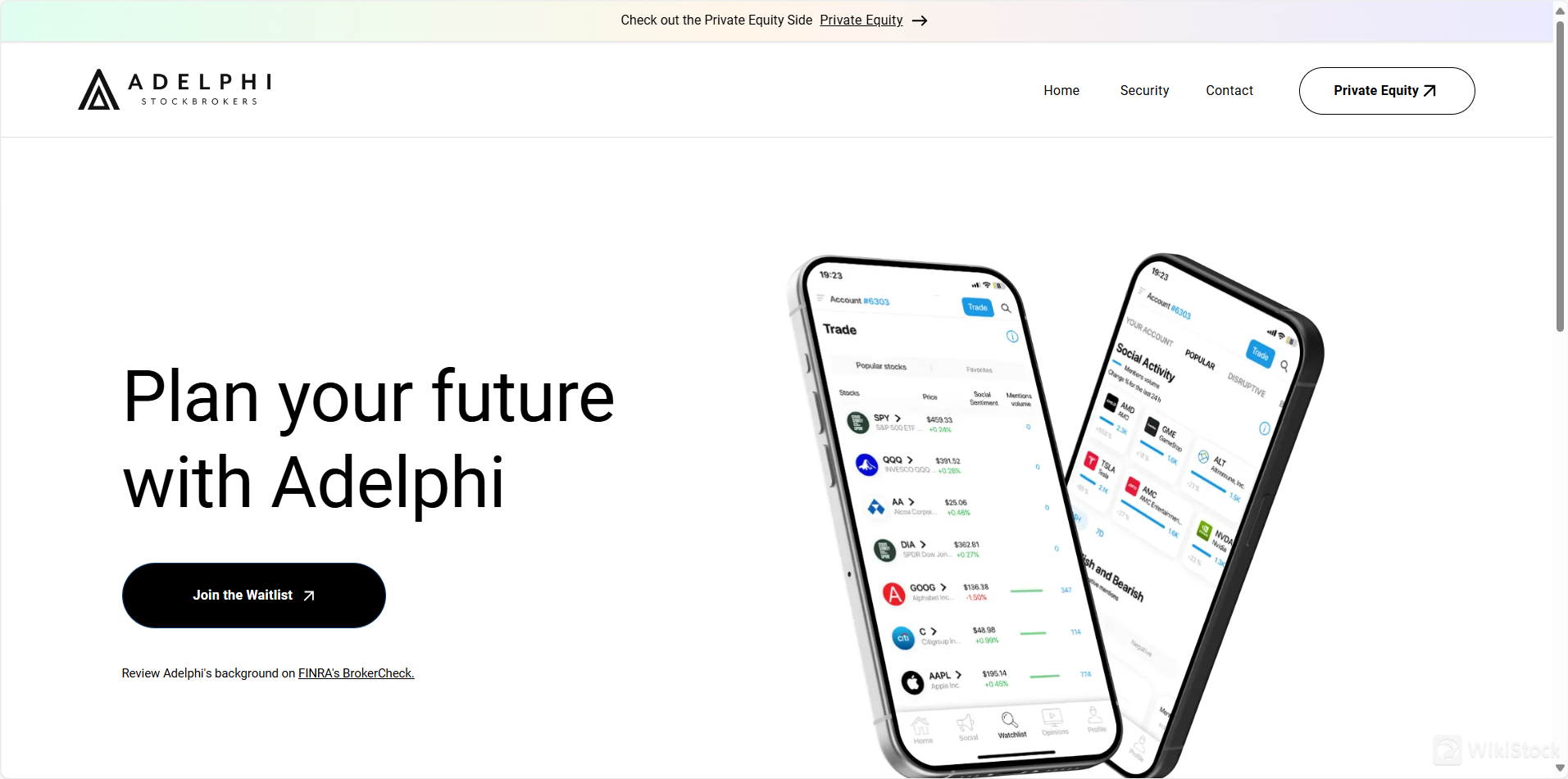

Adelphi offers a unique mobile app available on both iOS and Google Play, providing investors with convenient access to a variety of financial services.

The app supports fractional share trading, allowing users to buy and sell portions of whole shares of stocks or ETFs. This feature enables investors to diversify their portfolios with smaller amounts of capital. The app also includes advanced order management tools, real-time market data, and a user-friendly interface designed for both novice and experienced traders.

Through the app, users can access their accounts, view their investment portfolios, and execute trades easily. Additionally, the Adelphi app incorporates robust security measures, including encryption and two-factor authentication, to ensure the safety and privacy of user information.

Customer Support

Adelphi offers customer support through an online messaging system available via their mobile application and website.

Users can reach out to their assigned financial professional for any questions or concerns about their accounts. In case of significant business disruptions that render the app inaccessible, customers can email Adelphi at info@adelphis.co to manage their trades with a registered representative.

Additionally, for any issues with investments or financial professionals, customers can contact Adelphi at compliance@adelphis.co or utilize the SEC and FINRA complaint programs for further assistance.

Conclusion

Adelphi Stock Brokers Inc. is a self-clearing broker-dealer regulated by FINRA, offering a diverse range of investment services including mutual funds, private placements, stocks, and ETFs.

While it charges a monthly fee of $9.99 for its app and brokerage services, it boasts strong security measures and multiple tradable securities.

However, it lacks an online trading platform and clear customer support channels. With a strong focus on financial education and transparent fee structures, Adelphi aims to provide support to its clients.

FAQs

- What types of investment services does Adelphi offer?

Adelphi offers brokerage services through its mobile app, allowing users to buy and sell listed securities, ETFs, ADRs, and fractional shares.

- What are the fees associated with Adelphi's services?

Adelphi charges a monthly fee of $9.99 for accessing its app and brokerage services. While there are no commissions on whole share transactions, fractional share purchases or sales incur a fee.

- How does Adelphi ensure the security of my investments?

Adelphi employs industry-standard encryption protocols to protect your data, offers two-factor authentication for account access, and continuously monitors its systems for suspicious activities. Additionally, it is a member of SIPC, which insures brokerage accounts up to $500,000, including up to $250,000 for cash.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)