India's Economy under Modi 3.0

Modi's Re-election

The 2024 Indian election saw a contest mainly between the incumbent Modi-led Bharatiya Janata Party (BJP) and the Indian National Development Inclusive Alliance (INDIA) led by the Indian National Congress. As of June 4, results showed that BJP did not achieve the “overwhelming majority” predicted by polls, leading to significant volatility in the Indian financial markets. Modi's lead was less than expected, securing fewer seats than in the 2019 election. The BJP's seat count significantly decreased, indicating that the party could no longer single-handedly control the Lok Sabha and the cabinet, adding uncertainty to India's political landscape for the next five years.

India's Fundamentals

1.Support from Indian Conglomerates

Indian conglomerates operate monopolies with national franchises, evolving into large family-owned business groups. The main families are:

Tata Family: Originating in cotton and textiles, their interests include steel, infrastructure, chemicals, consumer goods, and technology. Major companies include Tata Motors, Tata Steel, and Tata Consultancy.

Birla Family: Primarily industrial, with UltraTech Cement valued at $26.8 billion, a top-five global cement producer. Grasim Industries, valued at $13.1 billion, is India's largest viscose staple fiber exporter.

Ambani Family: Industrial-based, with ventures in retail, digital services, multimedia entertainment, and oil and gas. They operate Reliance Industries, with a market cap of $192.1 billion.

Adani Family: Starting from trade, they run India's largest private port, Mundra Port.

In 2023, these four families' listed companies accounted for 18% of the Indian stock market, with the Ambani and Tata families having the highest share.

Unlike their counterparts in Japan and South Korea, Indian conglomerates have less international influence and primarily affect domestic markets, focusing on low-end manufacturing. Their monopolies often result from state privileges, widening the income gap in India, where the richest 1% hold over 40% of the nation's wealth.

2.Demographic Dividend

Strong domestic demand due to a demographic dividend: As of November 2023, India surpassed China's population of 1.425 billion, reaching 1.426 billion to become the world's most populous country.

1.Age Structure: With a high proportion of young people, India's economy benefits from vibrant labor resources. Currently, 51.8% of Indians are under 30 (compared to 34.8% in China), while only 4.1% are over 65 (compared to 8.4% in China). India's median age is 28, versus 39 in China and the U.S. By 2030, Millennials and Gen Z will make up over 50% of the population.

However, 83% of India's unemployed are young people. Employment opportunities and adequate wages remain a challenge, as many companies lack formal contracts, paid leave, health benefits, and social security.

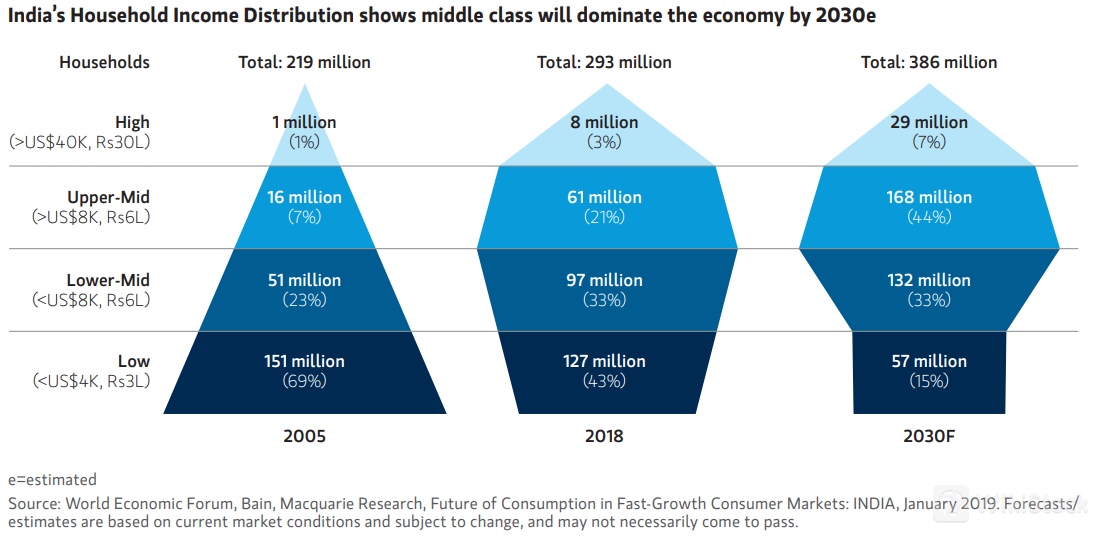

2.Class Structure: India has the world's largest middle class, expected to account for 80% of the population by 2030 and 75% of total consumers, driving demand for mid-to-high-end products. Previously, essential goods dominated consumption, but rising disposable incomes are changing consumption habits.

In 2019, most Indian families cooked at home, with food spending accounting for a quarter of GDP, while dining out and delivery services comprised only 10% of food consumption. By 2023, urbanization, more women in the workforce, digitalization, and higher incomes have accelerated dining out and delivery services. Luxury goods, gold, and jewelry consumption are also rising, with India being the second-largest global consumer of gold in 2023, importing 687 tons.

Image Source: World Economic Forum

3.Outsourcing Strategy and IT Talent Development

Software outsourcing is crucial to India's economy, exports, and tech industry. From $4 million in software exports in 1980 to $6 billion in 2000, India reached $193 billion in software exports by 2022-2023. IT software and services contribute $126 billion, BPO services $52 billion, software product development $5.1 billion, and engineering services $9 billion. CEOs of companies like Google, Microsoft, IBM, Adobe, Nokia, Motorola, and NetApp are Indian, highlighting India's influence in IT due to its large young labor force, high English proficiency, and focus on IT talent development.

Modi's Economic Policies

Structural Reform Priorities of Modi-led BJP in 2024:

1.Enhance the “Make in India” initiative, focusing on pharmaceuticals, medical devices, electric vehicles, green energy, and electronics.

2.Potentially restart labor market reforms initiated in 2019, promoting liberalization of land and labor markets.

3.Continue emphasizing energy transition, prioritizing solar energy (including rooftop solar), “green molecules” (hydrogen, ammonia, methanol), batteries and EVs, and nuclear energy, especially small modular reactors.

4.Accelerate infrastructure modernization, investing heavily in physical and digital infrastructure, including highways, railways, airports, and ports.

During Modi's previous terms, infrastructure development surged, extending highways by 60%, introducing modern semi-high-speed trains like Vande Bharat Express, and incorporating smaller cities into airline networks. Airports are also being modernized. With India's current urbanization rate at 35.9% compared to China's 66.16%, further infrastructure investment is likely.

Modi's policies aim to make India a “global manufacturing hub,” potentially boosting sectors like real estate, automotive, energy, and infrastructure, which saw over 20% growth in the first five months of the year.

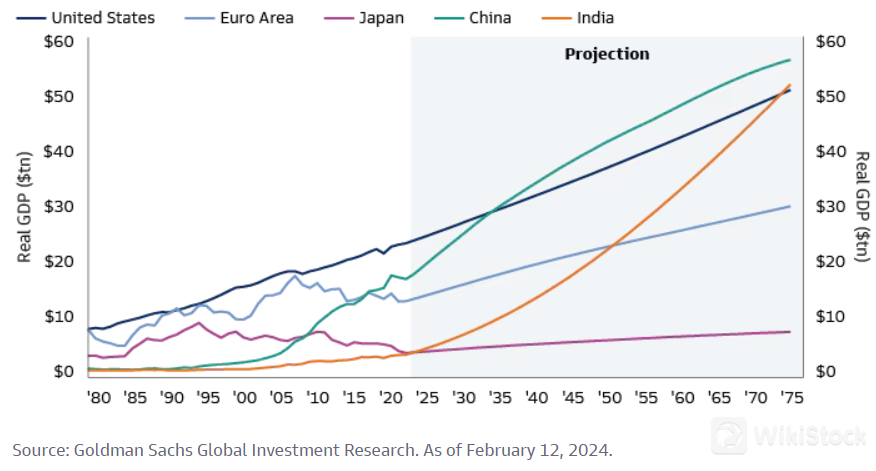

Image Source: Goldman Sachs Research

Policy Continuity and Market Impact

Goldman Sachs strategist Sunil Koul believes the formation of a new government and the retention of most key ministers “broadly confirm policy continuity.” India remains a macroeconomically stable market with expected continued earnings growth, driving the stock market higher. On June 14, Indian stock indices reached new highs, with the total market capitalization surpassing $5 trillion for the first time, growing by $1 trillion in the past six months alone.

India's two major stock exchanges are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE, established in 1875, has the SENSEX 30 index as its benchmark, comprising 30 major companies. The NSE, established in 1992 and trading since 1994, has the NIFTY 50 index, representing 50 of the largest and most active companies across 13 economic sectors. The NSE Nifty 50 index closed at a record high on June 14, marking an unprecedented ninth consecutive year of growth. As of January 22, 2024, India's stock market capitalization surpassed Hong Kong's, becoming the world's fourth-largest stock market.

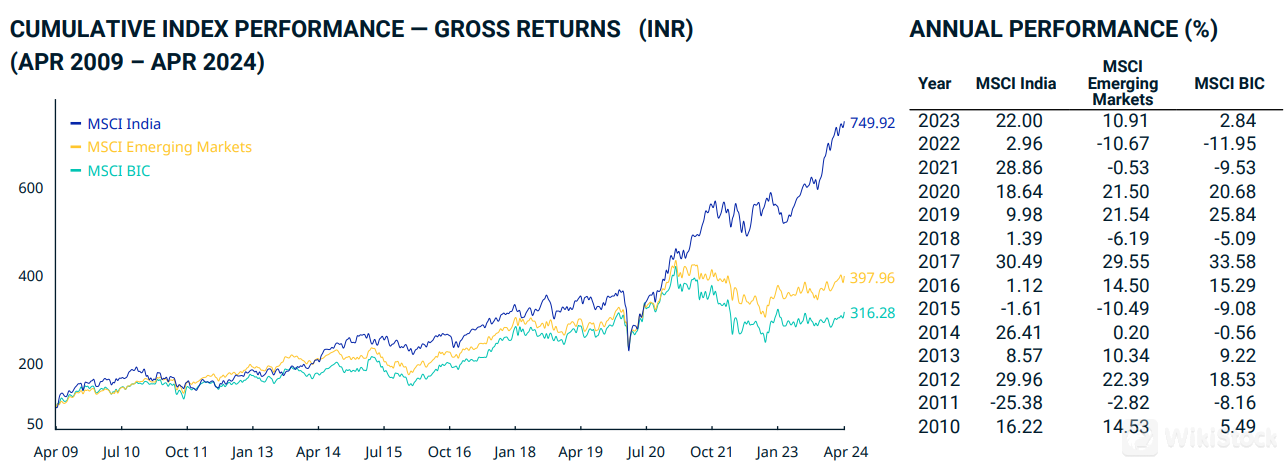

By the end of May, the MSCI India Index had risen over 9%, outperforming the MSCI Emerging Markets Index by about 7%. India currently has 100 stocks with market caps over $10 billion, up from 30 pre-pandemic.

Image Source: MSCI Research

India's private equity market has shown resilience, likely due to its low correlation with global indices and a diversified portfolio of large-cap and small-cap stocks. In the first half of 2023, private equity investment in India grew by 10% to $16.5 billion, with accelerated acquisition activity in healthcare. India achieved a historic high in its global IPO market share in 2023, surpassing Hong Kong. Private credit activity is also rising, with over 50 global and domestic private credit alternative investment funds (AIFs) registered in the past five years. During this period, private credit investments grew from 5% to 16% of total alternative investments in India.

Summary and Predictions

India's GDP grew by 6.7% in 2022 and 6.4% in 2023. Goldman Sachs predicts 6.7% growth in 2024. India's GDP surpassed the UK's in the 2023 fiscal year, becoming the world's fifth-largest economy. Morgan Stanley forecasts India will overtake Germany and Japan within five years to become the third-largest economy. With a mature stock market as the fourth-largest globally and a middle-class market expected to comprise 30% of the population by 2047, India's rising disposable income and middle-class growth position it as a potential consumption powerhouse. Under Modi's economic policies, infrastructure development, stock market growth, and GDP are likely to see further advancement.

Author: Haolan

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP