Comprehensive Review of Fidelity

Basic Introduction

Fidelity is one of the largest stock brokerage firms in the United States, specializing in commission-free trading of stocks and ETFs. Fidelity allows clients to trade in 25 countries and supports currency exchanges in 20 currencies. Its web trading platform is robust and suitable for novice investors. However, compared to its competitors, the account opening process may be slower. Additionally, some mutual fund fees are higher, and margin trading is relatively expensive.

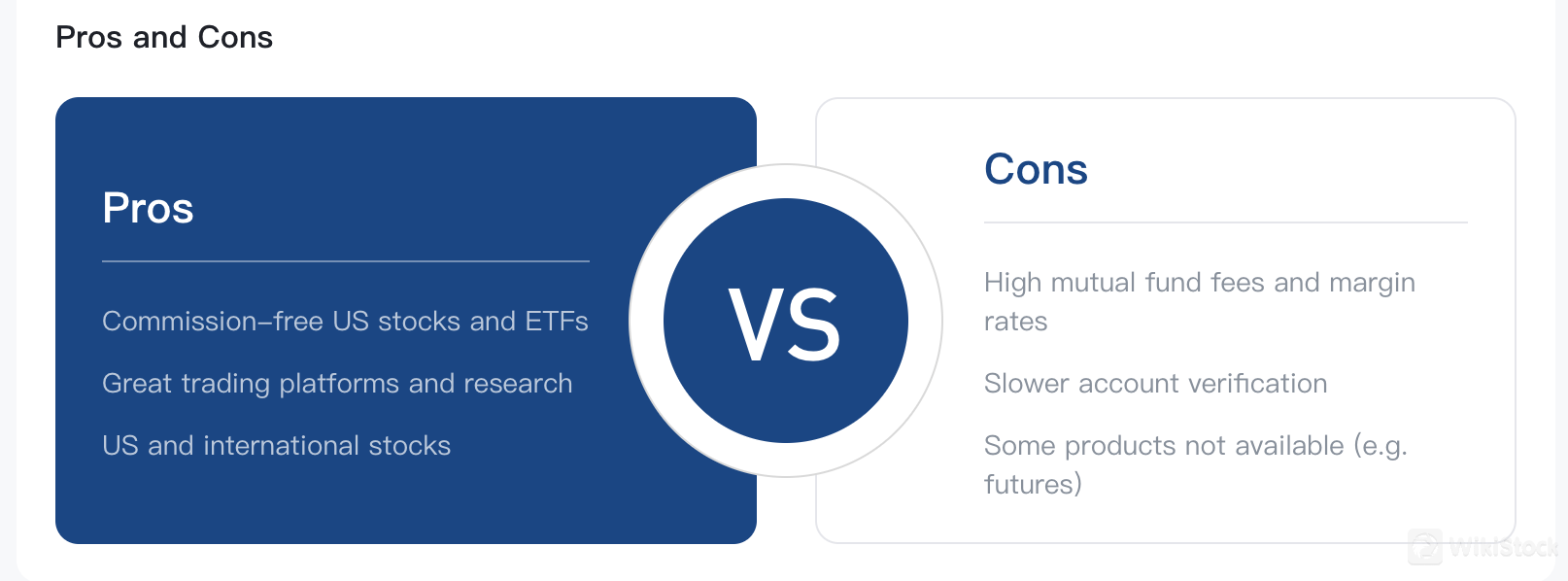

Pros and Cons Comparison

Fidelity's strengths include cost-effectiveness: zero-commission trading on U.S. stocks and ETFs, low bond fees, and no inactivity fees. Fidelity also supports fractional share trading, which is user-friendly for casual investors. The comprehensive trading platform and research tools are designed with a clear and intuitive interface, making it easy for investors to get started. Stocks are available from both U.S. and international markets, with fast order execution.

Fidelity's drawbacks include commission-free trading limited to stocks and ETFs only, higher fees on some mutual funds, and relatively high margin requirements. Another consideration is the longer account verification period, which delays trading for users. Additionally, certain products such as futures are not supported for trading.

Image Source: WikiStock

Fees

Trading Fees

Fidelity is renowned for its zero-commission trading, meaning users incur no trading fees when trading stocks and ETFs on the platform.

Different from other brokers, Fidelity does not charge additional fees for low-priced stock trades. It also does not accept payment for order flow (PFOF) and states that eligible orders receive price improvement amounts.

Image Source: Fidelity

High Margin Requirements

Fidelity's margin rates for U.S. dollars are higher than the industry average. Rates are calculated based on a base rate plus tiered markup, with a markup of 1.25% for balances between $0 to $25,000.

Low Options Commissions

Fidelity charges approximately half the industry average for U.S. stock index options. The cost per contract is $0.65.

Other Fees

Fidelity does not charge account maintenance fees or withdrawal fees. Fidelity differentiates its product offerings with several zero-expense ratio mutual funds, helping investors save costs. For example, FNILX, FZIPX, FZROX, and FZILX do not require minimum deposits and have no management fees. The trading fee for mutual fund purchases is $49.95 or $75, with redemptions being free of charge.

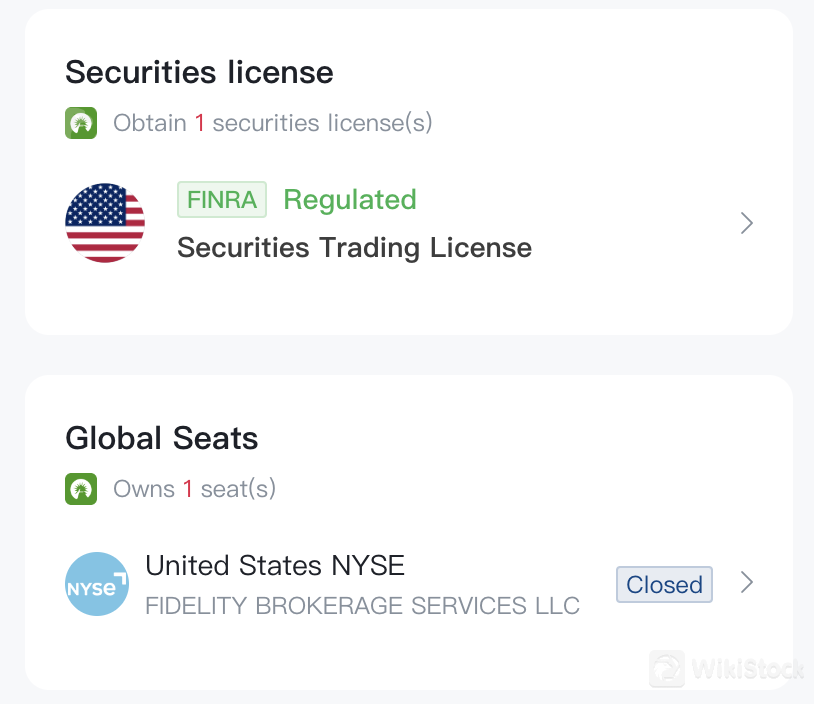

Security

Fidelity is regulated by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Fidelity's clients are primarily top financial institutions and are protected by the U.S. Investor Protection Plan. This protection prevents losses of cash and securities in the event of broker bankruptcy.

It's important to note that Fidelity does not have a negative balance protection plan and does not hold a banking license.

Image Source: WikiStock

Fidelity has insurance provided by the Securities Investor Protection Corporation (SIPC). In the event of broker failure, SIPC provides up to $500,000 (including up to $250,000 in cash). Fidelity also purchases additional broker failure insurance, providing up to $1.9 million in cash per account and unlimited securities, with a total broker coverage of $1 billion.

Account Opening

Opening a Fidelity account is straightforward but may take time for verification. For most countries, there is no minimum deposit requirement.

The process typically involves registering an account, providing identity verification information, verifying the account, depositing funds, and beginning trading.

To begin, visit Fidelity's official website or app and click the “Register” button. Fill in necessary personal details such as name, email address, and phone number. To comply with financial regulations, provide identity verification documents such as scanned copies or photos of identification (e.g., passport or driver's license) and proof of residence (e.g., utility bills or bank statements).

Once these steps are completed, users wait for Fidelity to verify the account. After verification, users can fund their accounts and start trading. Fidelity accepts various deposit methods including credit cards, debit cards, bank transfers, and e-wallets.

Trading Platforms

Fidelity supports mobile app, web-based, and desktop trading platforms.

Web-based Platform: The web platform offers a spacious interface displaying extensive information and functionalities. It allows for customization (including icons, workspaces, etc.), offers various order types, and provides clear fee reports. However, the platform may load slowly.

Desktop Platform: Fidelity offers the self-developed Active Trader Pro desktop trading platform, designed for active traders and experienced investors. As a complement to its web platform, it integrates rich research functionalities and offers high flexibility. Similar to its web and mobile counterparts, the desktop version is available in English only.

Mobile App Platform: The mobile app features two-step verification for enhanced security and supports biometric login technologies, which are user-friendly for operations. Fidelity provides a free Symantec VIP access app for verification, generating a random 6-digit code or allowing SMS login. Due to smaller screens, the app's interface is typically more concise but noteworthy for its excellent search capabilities and diverse order types. The mobile app is ideal for quick trading operations on mobile devices, offering more timely market information and real-time quotes.

Product Variety

Fidelity offers a wide range of trading products: stocks, ETFs, international stocks, etc., but does not support forex and futures trading. Stocks and ETFs cover extensive markets including U.S. (NYSE, NASDAQ, AMEX) and numerous international exchanges, with trading support in 16 currencies.

For most individual investors, these products sufficiently cover primary investment needs, though they lack options for investors seeking diversified experiences.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP