Tesla, The Legend from 0-100

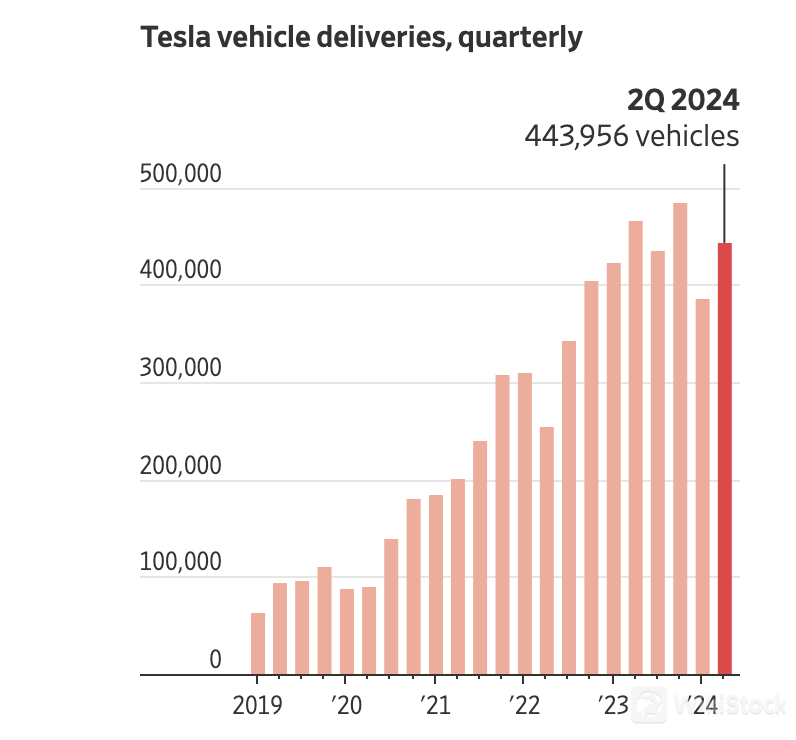

As of yesterday (July 9th), Tesla's stock price has risen continuously for ten days, erasing its year-to-date depreciation and rising by 5.6% for the year (as of writing). This sustained increase is attributed to Tesla's second-quarter delivery numbers exceeding expectations, coupled with overall improvements across Tesla's operations, which have fueled further upward momentum in its stock price.

Image Source: Tesla

Tesla's development is inseparable from Elon Musk's leadership, and Musk's position as the world's richest person is closely tied to Tesla's growth. Musk joined Tesla a year after its founding, initially as an investor and chairman, later assuming the role of Tesla co-founder. He became Tesla's CEO in 2008 and successfully led the company to its IPO two years later, overseeing Tesla's market value soar from 2020 to 2021, and becoming the world's richest person in September 2021.

Background and Overview of Tesla

Tesla is an American automotive and energy company headquartered in California, founded in 2003. The company is renowned for advancing electric vehicle technology and renewable energy solutions, aiming to drive global transition towards sustainable energy. Tesla was established to address environmental and energy challenges faced by the traditional automotive industry. Its first electric vehicle was produced in partnership with Lotus, with Tesla providing the engine and Lotus handling the vehicle production beyond the engine, resulting in the Tesla Roadster, launched in 2008. It redefined the automotive industry with high performance and zero-emission driving experience.

Tesla not only manufactures electric vehicles but also focuses on developing energy storage systems and solar products. Its Powerwall home battery storage system and Solar Roof solar tiles are flagship products of its energy division, aimed at providing renewable energy solutions and energy independence options.

Tesla leads in technological innovation and has actively promoted the adoption and market development of electric vehicles through its global network of supercharging stations and advancements in autonomous driving technology. As a high-tech company, Tesla is not just an automaker; its innovations in renewable energy and advanced driving technologies continue to expand its influence on future energy and transportation.

Financial Performance

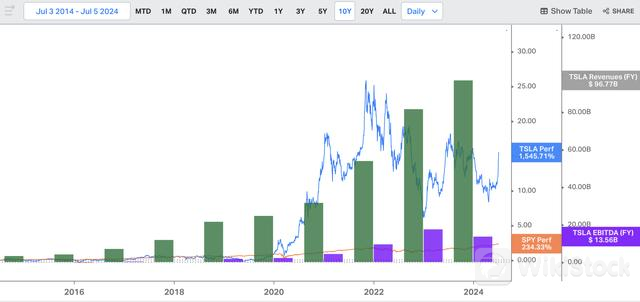

Tesla's growth trajectory (NASDAQ: TSLA) has been remarkable. Over the past decade, the company has not only achieved rapid financial performance growth but also delivered substantial returns to shareholders.

In terms of revenue, Tesla achieved a compound annual growth rate of 41%, resulting in its total revenue growing over 29 times in just a decade. This achievement not only demonstrates the company's strong performance in the electric vehicle market but also highlights its exceptional capabilities in technology innovation and market expansion.

In terms of profitability, Tesla's EBITDA (earnings before interest, taxes, depreciation, and amortization) growth has been astonishing, with a compound annual growth rate of 77%, increasing its EBITDA nearly 300 times. This indicates Tesla's breakthroughs not only in revenue growth but also in effectively enhancing its profit capabilities, showcasing significant progress in operational efficiency and cost control.

Image Source: Sina Finance

Market Performance

Over the past decade, Tesla's stock price has surged over 1500%, far outperforming the S&P 500 index, which saw a return of just over 230% during the same period. This reflects significant investment returns for Tesla shareholders and underscores the market's optimistic outlook on Tesla's future potential and growth prospects. In the first half of the year, Tesla's stock price experienced a sharp decline due to negative news such as intense competition among global carmakers and natural disasters. However, higher-than-expected delivery numbers in the second quarter drove the stock price up. Tesla has seen a continuous ten-day increase, erasing the year's decline and rising by 5.6%.

The recent upward trend indicates that investors generally believe in improving prospects for this electric vehicle manufacturer. Beyond higher-than-expected deliveries, advancements in battery storage and other factors have also driven the continuing upward trend.

Firstly, Tesla deployed energy storage products totaling 9.4 gigawatt-hours (GWh) during the second quarter. This includes battery energy storage systems, typically used for storing solar energy or grid electricity for daily use or backup. This increase may be driven by Tesla's expansion in energy storage and growing market demand. Secondly, Tesla's vehicle delivery numbers exceeded expectations, demonstrating strong market demand for its products. Efficient production and supply chain management enable Tesla to meet customer order demands promptly, thereby enhancing investor confidence in the company's growth potential. Finally, Tesla's rollout of its autonomous driving taxi program is progressing smoothly. An announcement on August 8 will detail how the company plans to achieve profitability through autonomous driving technology, further inspiring investor optimism. This program not only showcases Tesla's leadership in future technological innovation but also paves the way for diversified revenue streams in the future.

In addition, Brian Lasher, founder of BFR Research, pointed out that the downward trend in Wall Street's profit expectations for Tesla has slowed, indicating a sustained improvement in the market's optimism towards the company's profitability. This change not only reflects Tesla's efforts in cost management and efficiency improvement but also demonstrates market recognition of its long-term strategy and development prospects.

Future Trends

As the electric vehicle market matures, Tesla faces increasingly fierce competition. Musk has been continuously lowering Tesla's prices, which has also reduced profit margins. This led to Tesla's profit margin being only 5.5% in the first quarter of this year. To improve profitability, Musk had to reduce costs through global layoffs to increase profit margins.

Image Source: The Wall Street Journal

Even with price wars, Tesla needs to be wary of challenges from Chinese electric vehicle companies such as BYD, Nio, and XPeng, which are enhancing competitiveness by offering more advanced technology, longer battery life, and lower prices.

Facing challenges from global carmakers, Musk stated that later this year or next year, Tesla will offer lower-priced models. Moreover, Musk is also trying to rekindle investor enthusiasm by betting on robotics and artificial intelligence. He stated at Tesla's annual shareholder meeting in June that these technologies could potentially increase Tesla's market value to $30 trillion.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP