Assestment

Marka ng Indeks

Appraisal ng Brokerage

Impluwensiya

A

Index ng Impluwensiya BLG.1

Japan

JapanMga Produkto

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Nalampasan ang 69.53% (na) broker

Lisensya sa seguridad

kumuha ng 1 (mga) lisensya sa seguridad

FSAKinokontrol

JapanLisensya sa Pagkalakal ng Seguridad

Mga Pandaigdigang Upuan

![]() Nagmamay-ari ng 1 (na) upuan

Nagmamay-ari ng 1 (na) upuan

Japan NSE

Jトラストグローバル証券株式会社

Impormasyon sa Brokerage

More

Kumpanya

J TRUST GLOBAL SECURITIES CO., LTD

Pagwawasto

JTG証券

Rehistradong bansa at rehiyon ng platform

address ng kumpanya

Website ng kumpanya

https://www.jtg-sec.co.jp/Suriin kahit kailan mo gusto

WikiStock APP

Mga Serbisyo sa Brokerage

Gene ng Internet

Index ng Gene

Rating ng APP

Mga tampok ng brokerage

New Stock Trading

Yes

Margin Trading

YES

Mga Reguladong Bansa

1

Mga produkto

5

| JTG Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Mga Bayad | Mga Bayad sa Transaksyon, Iba't ibang Gastos |

| Mga Bayad sa Account | Libreng Pagbubukas |

| Mga Porsyento ng Margin Interest | Institutional Margin Trading: 2.80% (Taunang Porsyento) |

| Pangkalahatang Margin Trading: 4.0% (Taunang Porsyento) | |

| Mga Inaalok na Mutual Funds | 5,000 yen o higit pa bawat investment trust sa mga yunit ng 1 yen |

| App/Platform | Smart Stocks, JTG Trader Premium |

| Promosyon | Investment Trusts at Foreign Bond Purchase Campaigns |

Impormasyon ng JTG Securities

Ang JTG Securities ay isang Japanese brokerage firm na may punong tanggapan sa Shibuya, Tokyo, na sumusuporta sa mga online na serbisyo ng pagbubukas at pag-login ng account. Ang JTG Securities ay rehistrado sa Kanto Local Finance Bureau (Financial Instruments) No. 35. Nag-aalok ito ng malawak na hanay ng mga produkto sa pananalapi. Kasama sa mga serbisyo nito ang domestic at international stock trading, bagong at umiiral na mga bond, investment trusts, futures at options trading, at foreign stock trading.

Mga Kapakinabangan at Kadahilanan ng JTG Securities

| Mga Kapakinabangan | Mga Kadahilanan |

|

|

|

|

|

Mga Kapakinabangan:

Malawak na Hanay ng mga Produkto sa Pananalapi: Nag-aalok ang JTG Securities ng malawak na seleksyon ng mga produkto sa pananalapi, kasama ang domestic at international stocks, bonds, investment trusts, futures, options, at foreign stocks.

Kumpetitibong Foreign Exchange Spreads: Nag-aalok ang brokerage ng kumpetitibong foreign exchange spreads para sa iba't ibang mga currency, na nagpapabuti sa transparency at posibleng nagpapababa ng mga gastos sa trading para sa mga kliyente.

Pagpapatupad sa mga Patakaran: Rehistrado sa Kanto Local Finance Bureau (Financial Instruments) No. 35, sumusunod ang JTG Securities sa mga pamantayan ng regulasyon na itinakda ng mga Japanese financial authorities.

Mga Kadahilanan:

Mga Pagsasaalang-alang sa Merkado: Bagaman nag-aalok ang JTG Securities ng foreign stock trading, ang kanilang pangunahing focus ay nasa Japanese market. Maaring limitado nito ang mga pagpipilian para sa mga kliyente na naghahanap ng malawak na hanay ng mga internasyonal na oportunidad sa investment.

Komplikadong Estratehiya ng mga Bayarin: Ang estratehiya ng mga bayarin ng JTG Securities ay komplikado, kasama ang mga bayad sa transaksyon, mga bayad sa pagmamantini ng account, at iba pang mga bayarin sa serbisyo. Dapat maingat na suriin ng mga kliyente ang mga bayaring ito upang lubos na maunawaan ang mga gastos ng kanilang investment.

Ang JTG Securities Ba ay Ligtas?

Ang JTG Securities ay regulated ng Japan Financial Services Agency (FSA), na may registration number na No. 関東財務局長(金商)第35号. Ang regulasyong ito ay nagpapahiwatig na sumusunod ang JTG Securities sa mahigpit na mga regulasyon at pamantayan ng Japanese financial regulations na naglalayong protektahan ang mga mamumuhunan at mapanatiling integro ang merkado. Ang pagbabantay ng FSA ay nagtitiyak na ang JTG Securities ay nag-ooperate nang may transparency, pananagutan, at matatag na mga pamamaraan sa pamamahala ng panganib.

Ano ang mga Securities na Maaring I-trade sa JTG Securities?

Nag-aalok ang JTG Securities ng malawak na hanay ng mga securities para sa pag-trade. Ang mga kliyente ay maaaring mag-trade ng domestic stocks sa pamamagitan ng spot trading. Ang margin trading ay nagbibigay-daan sa mga mamumuhunan na gamitin ang pera o mga stocks bilang collateral upang palawakin ang kanilang kakayahan sa pamumuhunan. Magagamit din ang mga exchange-traded funds (ETFs). Ang mga real estate investment trusts (REITs) ay nagbibigay ng access sa mga portfolio ng real estate. Pinapadali ng JTG Securities ang pakikilahok sa mga initial public offerings (IPOs) at public offerings (POs), na nagbibigay ng access sa mga bagong listahan at mga stocks ng mga bagong listahan at umiiral na mga kumpanya.

Sa espasyo ng bond, nag-aalok ang JTG Securities ng mga domestic at foreign bond options, kasama ang mga convertible bonds (CBs) na maaaring i-convert sa mga stocks sa ilalim ng tiyak na mga kondisyon. Bukod dito, magagamit ang mga investment trusts na nag-aalok ng mga piniling pondo mula sa Japan at ibang bansa na tumutugon sa iba't ibang mga layunin sa pamumuhunan at mga paboritong panganib. Nag-aalok ang JTG Securities ng mga foreign stocks mula sa mga pangunahing merkado tulad ng Estados Unidos, Indonesia, Singapore, at China.

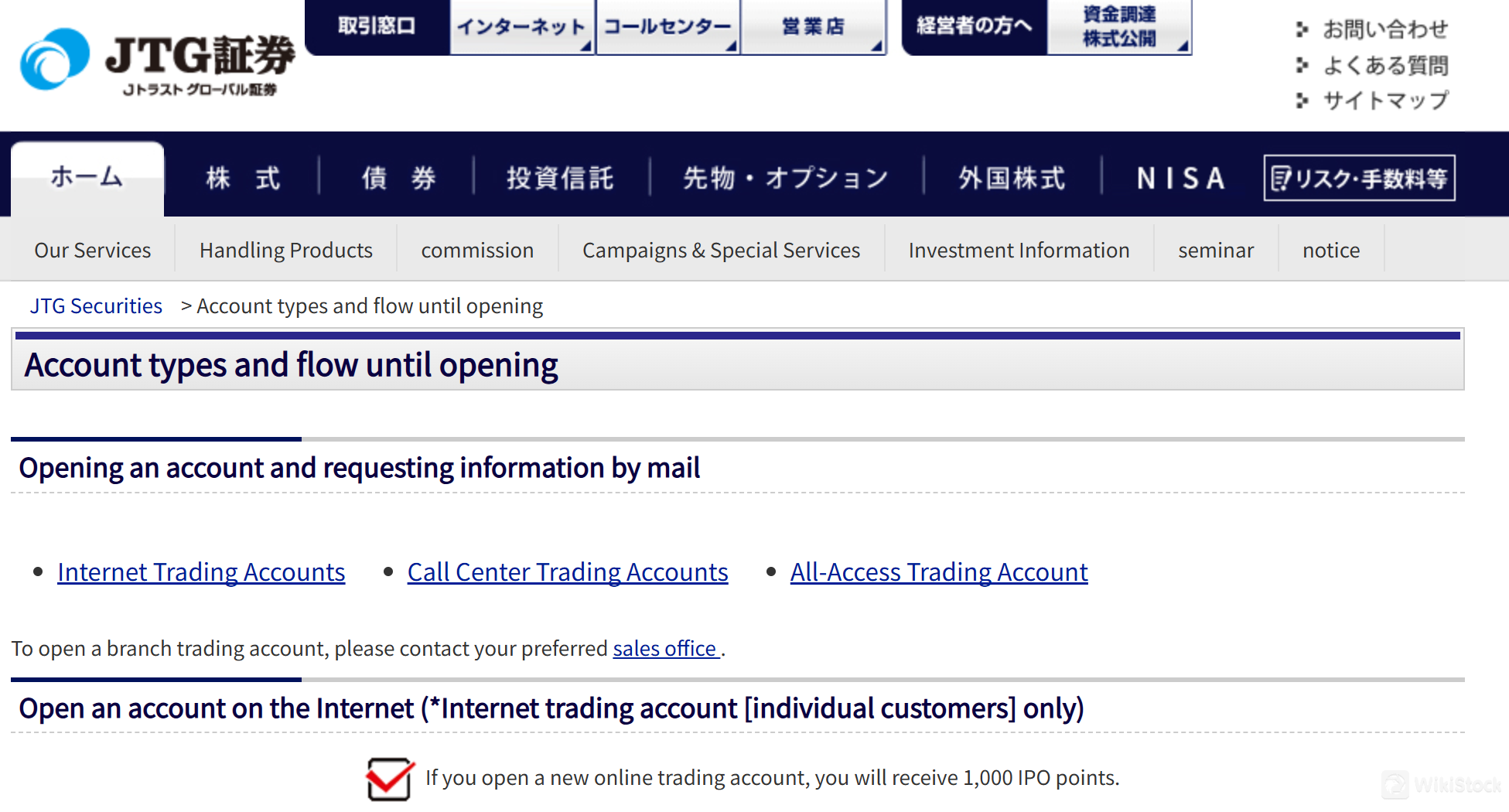

Mga Account ng JTG Securities

Nag-aalok ang JTG Securities ng tatlong uri ng mga trading account. Ang Internet Trading Account ay nagbibigay ng kaginhawahan sa mga kliyente na magpatupad ng mga trade online. Ito ay nagbibigay-daan sa mga mamumuhunan na epektibong pamahalaan ang kanilang mga investment mula saanman na mayroong access sa internet. Ang Call Center Trading Account ay nagbibigay ng alternatibo para sa mga kliyente na mas gusto ang mag-trade sa pamamagitan ng telepono. Ang uri ng account na ito ay nagbibigay-daan sa mga mamumuhunan na makipag-ugnayan nang direkta sa isang broker o kinatawan sa trading upang magpatupad ng mga order at makatanggap ng personal na tulong. Bukod dito, nag-aalok din ang JTG Securities ng All-Access Trading Account. Pinagsasama ng account na ito ang mga tampok ng parehong Internet at Call Center Trading accounts.

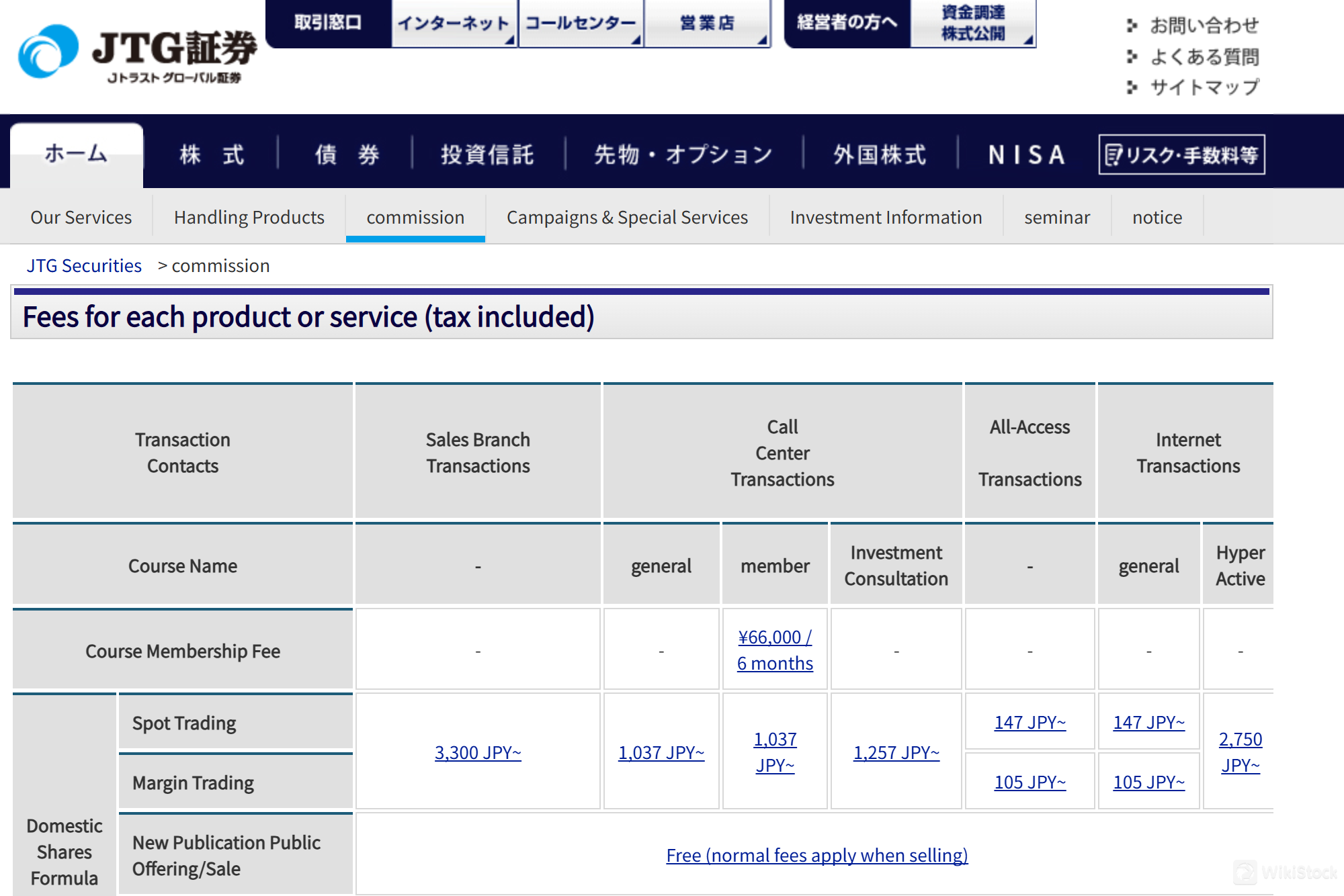

Pagsusuri sa mga Bayarin ng JTG Securities

Nag-aaplay ang JTG Securities ng iba't ibang mga komisyon at bayarin sa kanilang mga serbisyo sa pag-trade. Para sa mga transaksyon na may kinalaman sa domestic stocks, nag-iiba ang mga bayarin depende sa paraan ng pag-trade—kung ito ay sa pamamagitan ng spot trading, margin trading, o IPOs. Ang mga bayarin sa spot trading ay nagsisimula sa mga 3,300 JPY, kasama ang karagdagang bayarin para sa margin trading at mga transaksyon na mas mababa sa isang yunit ng shares. Ang futures trading tulad ng Nikkei 225 Futures at Options ay may mga bayarin batay sa mga presyo ng kontrata, habang ang mga foreign stocks tulad ng U.S., Indonesian, Singaporean, at Chinese stocks ay sumasailalim sa isang flat fee na 1,650 JPY bawat trade, plus mga lokal na bayarin ng ahensya at mga foreign exchange spread.

Tungkol sa margin trading, nagpapataw ang JTG Securities ng isang management fee sa mga stocks, na umaabot mula 11 sen hanggang 1,100 JPY bawat share, depende sa kung sumusunod sila sa unit share system. Bukod dito, ang mga interest rate sa margin ay itinakda sa 2.80% taun-taon para sa institutional margin trading at 4.0% para sa general margin trading. Ang mga rate na ito ay nag-aapply sa mga pondo na hiniram para sa mga leveraged trading activities, na nakaaapekto sa kabuuang gastos ng pagmamaintain ng mga positions sa loob ng panahon. Para sa eksaktong mga detalye sa lahat ng mga bayarin at komisyon, maaari mong tingnan ang kumpletong fee schedule ng JTG Securities o makipag-ugnayan sa kanilang customer service nang direkta.

Pagsusuri sa JTG Securities App

Ang JTG Securities ay nag-aalok ng aplikasyong Smart Stocks. Ang Smart Stocks ay isang mobile application na dinisenyo para sa iOS at Android platforms. Nagbibigay ito ng access sa real-time na market data, pinapayagan ang mga gumagamit na magmonitor ng mga presyo ng stocks, mag-analyze ng mga chart, maglagay ng mga order, at pamahalaan ang mga investment kahit saan at kahit kailan. Sinusuportahan ng Smart Stocks ang iba't ibang mga feature, tulad ng automatic trading functions, order corrections, at mga update sa market information.

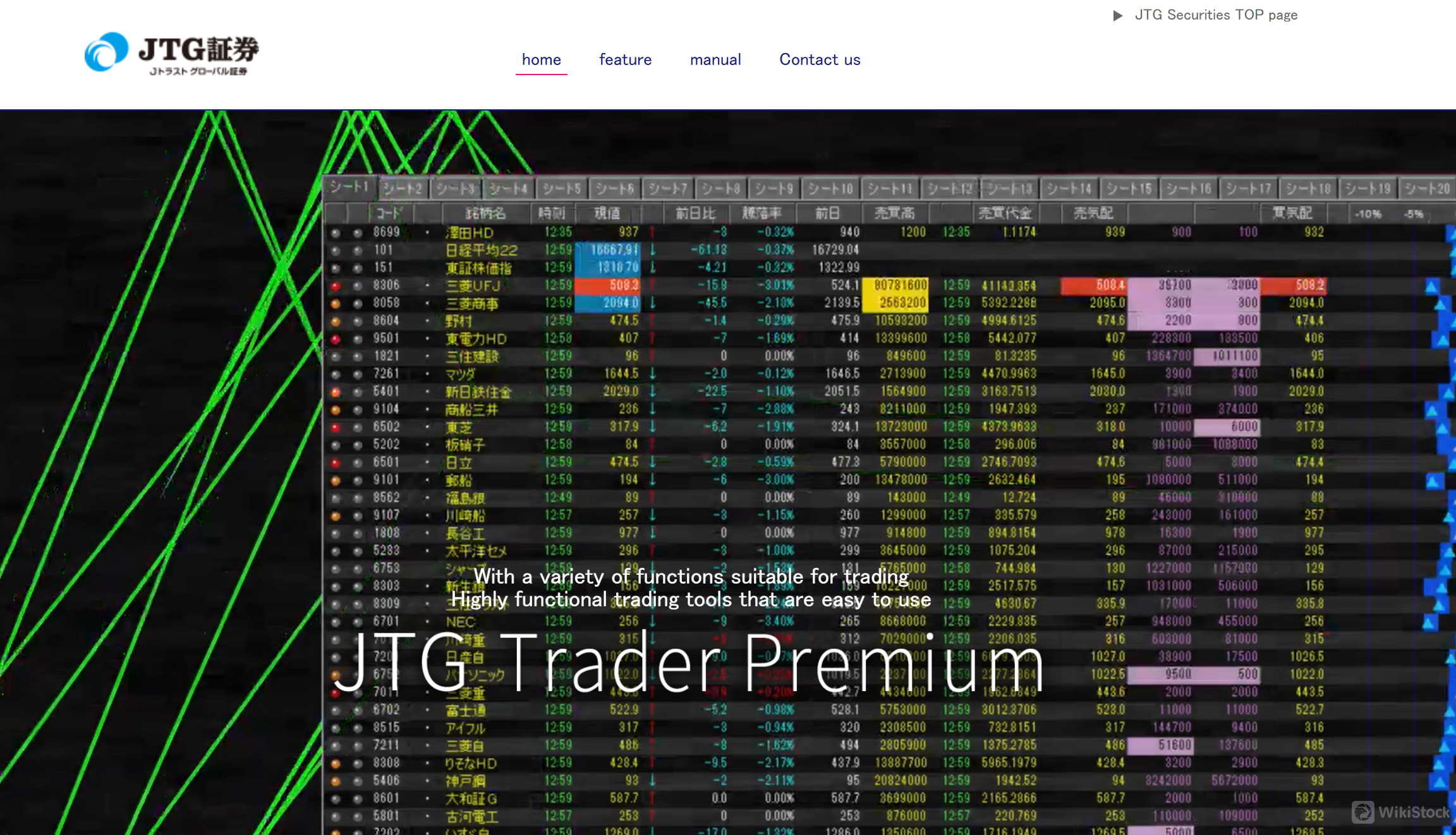

Ang JTG Trader Premium ay isang komprehensibong trading platform na ibinibigay ng JTG Securities. Nagbibigay ang JTG Trader Premium ng access sa iba't ibang mga financial instrument, kasama ang mga stocks, bonds, futures, options, at forex. Mayroon itong user-friendly na interface at mga advanced na feature. Nagbibigay ito ng mga powerful na charting tools, customizable dashboards, kakayahan sa technical analysis, at real-time na market data streaming.

Pananaliksik at Edukasyon

Ang JTG Securities ay nag-aalok ng mga seminar, webinar, at mga workshop sa iba't ibang mga paksa mula sa basic financial literacy hanggang sa advanced na mga trading strategies. Ang mga educational program na ito ay dinisenyo upang matugunan ang mga pangangailangan ng mga mamumuhunan sa lahat ng antas, nagbibigay sa kanila ng mga kasanayan at kaalaman na kinakailangan upang maayos na mag-navigate sa mga kumplikasyon ng mga financial markets. Bukod dito, pinapalaganap ng JTG Securities ang proactive investment education sa pamamagitan ng regular na mga update at commentary tungkol sa mga kaganapan sa market.

Serbisyo sa mga Customer

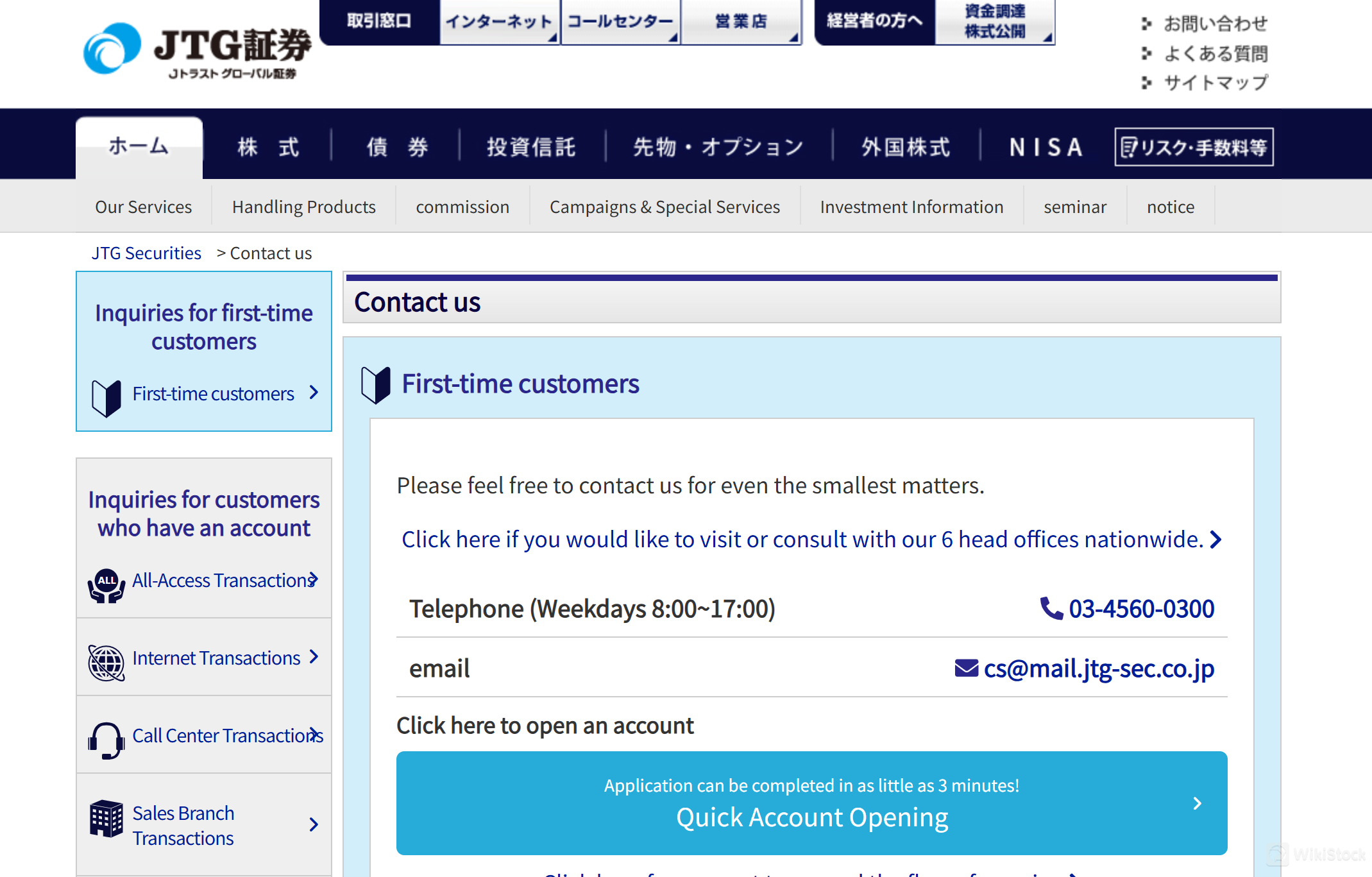

Para sa mga unang beses na bibili, nag-aalok ang JTG Securities ng direktang suporta sa pamamagitan ng telepono sa 03-4560-0300 at email sa cs@mail.jtg-sec.co.jp. Ang mga mayroon nang account ay nagtatamasa ng dedikadong serbisyo sa 0120-68-1605, na nagbibigay ng agarang tulong sa mga katanungan at transaksyon na may kinalaman sa account. Ang mga customer ng call center trading account ay nagtatamasa ng dedikadong suporta sa 03-4560-0350, na nagpapadali ng mga trading operation at nag-aaddress ng mga partikular na pangangailangan ng account.

Ang mga katanungan na may kinalaman sa mga branch ay hinaharap sa pamamagitan ng mga itinakdang contact numbers, na nagbibigay ng lokal na suporta ayon sa pangangailangan ng mga regional na customer. Para sa pangkalahatang mga komento at katanungan, may alternatibong linya na available sa 03-4560-0259 upang harapin ang iba't ibang mga hindi account-specific na mga tanong at feedback. Para sa mga online na pakikipag-ugnayan, aktibo ang JTG Securities sa mga social media platform tulad ng Facebook at YouTube.

Konklusyon

Ang JTG Securities ay nag-aalok ng malawak na hanay ng mga serbisyong pinansyal. Sa tulong ng isang malakas na platform at malawak na access sa market, ang mga kliyente ay maaaring sumali sa iba't ibang mga oportunidad sa investment tulad ng mga stocks, bonds, derivatives, at iba pa. Ang kumpanya ay nagbibigay-diin sa transparency at customer-centricity. Ang mga bayad at komisyon ng JTG Securities ay kompetitibo, at bagaman nag-iiba ito ayon sa produkto at serbisyo, malinaw ang mga gastos sa transaksyon. Ang mga margin trading options ay nagpapalawak pa ng potensyal sa investment. Ang commitment ng JTG Securities sa technological innovation ay ipinapakita sa pamamagitan ng kanilang mobile app na Smart Stocks at trading platform na JTG Trader Premium. Bukod dito, may regulatory compliance ang JTG Securities.

Mga Madalas Itanong (FAQs)

Paano ko mabubuksan ang isang account sa JTG Securities?

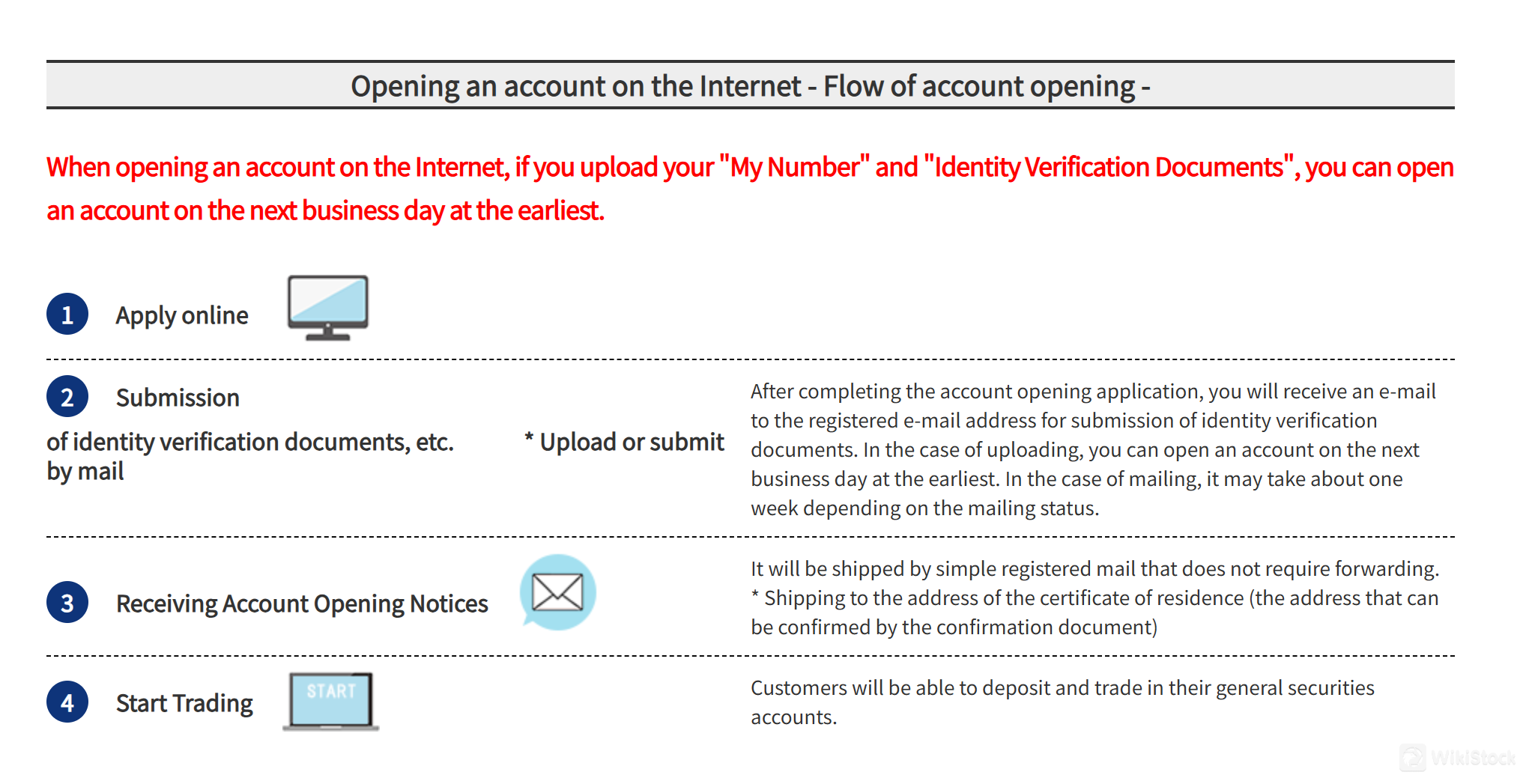

Upang mabuksan ang isang account sa JTG Securities, bisitahin ang kanilang website at piliin ang online application para sa individual internet trading accounts o pumili ng quick account opening. Punan ang form, isumite ang mga kinakailangang dokumento tulad ng "My Number" at ID verification, at maghintay ng kumpirmasyon upang magsimula sa pag-trade. Para sa mga corporate o specialized accounts, makipag-ugnayan nang direkta sa JTG Securities para sa tailor-fit na gabay.

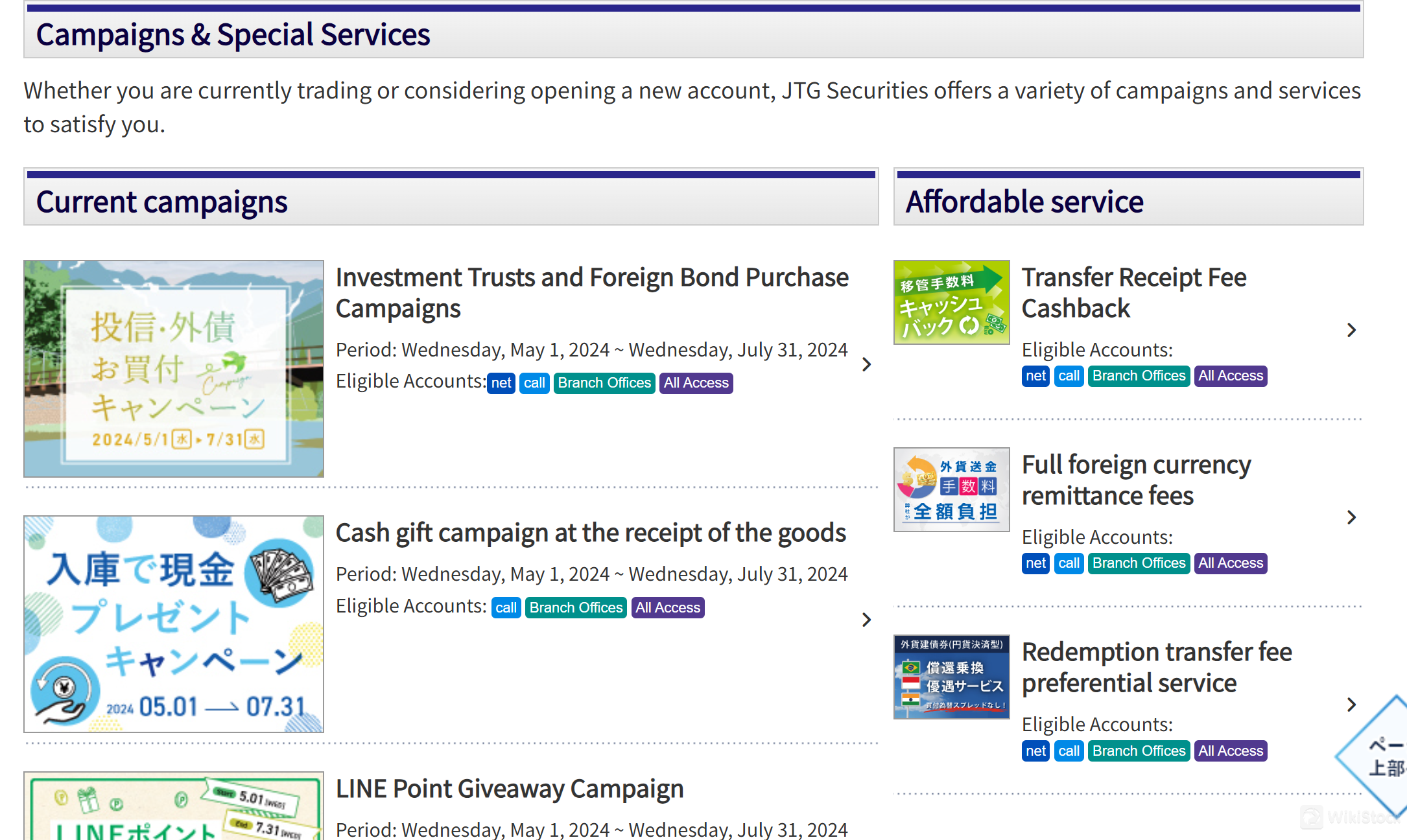

Mayroon bang espesyal na mga promosyon o insentibo ang JTG Securities para sa mga bagong customer?

Ang JTG Securities ay nagpapatakbo ng mga kampanya at espesyal na serbisyo na kasama ang mga benepisyo tulad ng cash gifts, fee rebates, at iba pang mga bonus para sa mga kwalipikadong account. Tingnan ang kanilang promotions page o makipag-ugnayan direkta sa kanilang customer service upang malaman ang pinakabagong mga alok para sa mga bagong customer.

Babala sa Panganib

Ang impormasyong ibinigay ay batay sa ekspertong pagtatasa ng WikiStock sa mga datos ng website ng brokerage at maaaring magbago. Bukod dito, ang online trading ay may malalaking panganib na maaaring magresulta sa kabuuang pagkawala ng ininvest na pondo, kaya mahalaga ang pag-unawa sa mga kaakibat na panganib bago sumali.

iba pa

Rehistradong bansa

Japan

Taon sa Negosyo

2-5 taon

Mga produkto

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Mga Kaugnay na Negosyo

Bansa

Pangalan ng Kumpanya

Mga Asosasyon

Japan

Jトラスト株式会社

Gropo ng Kompanya

Review

Walang ratings

Inirerekomendang Mga Brokerage FirmMore

三菱UFJモルガン・スタンレー証券

Assestment

Nissan Securities

Assestment

水戸証券

Assestment

東洋証券株式会社

Assestment

豊証券株式会社

Assestment

Kyokuto Securities

Assestment

ちばぎん証券

Assestment

あかつき証券

Assestment

Money Partners

Assestment

岩井コスモ証券

Assestment