Assestment

岩井コスモ証券

https://www.iwaicosmo.co.jp/

Website

Marka ng Indeks

Appraisal ng Brokerage

Impluwensiya

A

Index ng Impluwensiya BLG.1

Japan

JapanMga Produkto

8

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Nalampasan ang 78.05% (na) broker

Lisensya sa seguridad

kumuha ng 1 (mga) lisensya sa seguridad

FSAKinokontrol

JapanLisensya sa Pagkalakal ng Seguridad

Mga Pandaigdigang Upuan

![]() Nagmamay-ari ng 2 (na) upuan

Nagmamay-ari ng 2 (na) upuan

Japan FSE

岩井コスモ証券株式会社

Japan NSE

岩井コスモ証券株式会社

Impormasyon sa Brokerage

More

Kumpanya

IwaiCosmo Securities Co.,Ltd.

Pagwawasto

岩井コスモ証券

Rehistradong bansa at rehiyon ng platform

address ng kumpanya

Website ng kumpanya

https://www.iwaicosmo.co.jp/Suriin kahit kailan mo gusto

WikiStock APP

Mga Serbisyo sa Brokerage

Pagsusuri ng negosyo

岩井コスモ証券 Kalendaryo ng Mga Kita

Pera: JPY

Ikot

Q3 FY2024 Mga kita

2024/01/25

Kita(YoY)

5.92B

+18.55%

EPS(YoY)

60.07

+51.89%

岩井コスモ証券 Mga Pagtantya sa Mga Kita

Pera: JPY

- PetsaIkotKita/Tinantyang

- 2024/01/252024/Q35.923B/0

- 2023/07/202024/Q15.711B/0

- 2023/01/262023/Q34.996B/0

- 2022/07/212023/Q14.624B/0

- 2022/01/272022/Q35.476B/0

Gene ng Internet

Index ng Gene

Rating ng APP

Mga tampok ng brokerage

Rate ng komisyon

0.44%

New Stock Trading

Yes

Margin Trading

YES

Mga Reguladong Bansa

1

| IwaiCosmo Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Itinatag | 1944 |

| Rehistradong Rehiyon | Japan |

| Regulatory Status | FSA |

| Mga Produkto | Domestic stocks, initial public offerings, foreign stocks, bond, forex, stock CFDs, investment trust |

| Mga Bayarin (spot trading para sa mga stocks) | Face-to-Face Transactions and Plusnet: 0.1-9.99% + fixed rate ranging from 0-JPY 183,060 depending on trading volume, with 10% tax levied |

| Protected Custody Account: 0.1-9.99% + fixed rate ranging from 0-JPY 189,700 depending on trading volume, with 10% tax levied | |

| Customer Service | Head office: 1-8-12 Imabashi, Chuo-ku, Osaka |

| TEL: 0120-318-611 / 0120-405-546 during weekdays 8:00-17:00 | |

| Email: wmaster@iwaicosmo.co.jp, fxmaster@iwaicosmo.co.jp | |

| Social media: YouTube, LINE |

IwaiCosmo Securities Impormasyon

Itinatag noong 1944 na may mga pinagmulan na nagbabalik hanggang 1915, ang IwaiCosmo Securities ay nag-ooperate sa buong Japan na may maraming branch office. Nag-aalok ito ng iba't ibang uri ng mga produkto sa pamumuhunan kabilang ang domestic stocks, IPOs, foreign stocks, bonds, Forex, stock CFDs, at investment trusts.

Ang kumpanya ay nagbibigay ng transparent na mga istraktura ng bayarin at mga mapagkukunan ng edukasyon. Regulated ng Japan's Financial Services Agency (FSA) sa ilalim ng lisensyang bilang Director-General of the Finance Bureau (Kinsho) No. 15, pinapanatili ng IwaiCosmo Securities ang matatag na pamantayan ng integridad at kredibilidad sa kanilang mga serbisyong pinansyal.

Para sa mas detalyadong impormasyon, maaari mong bisitahin ang kanilang opisyal na website: https://www.iwaicosmo.co.jp/ o makipag-ugnayan nang direkta sa kanilang customer service.

Mga Kalamangan at Disadvantage

| Mga Kalamangan | Mga Disadvantage |

| Regulated by FSA | Mataas na Bayad sa Pagkalakal |

| Magkakaibang Produkto ng Pamumuhunan | |

| Mga Mapagkukunan ng Edukasyon | |

| Matagal na Kasaysayan | |

| Sangay na Network |

- Regulatory Oversight: Regulated by the Japan Financial Services Agency (FSA), ensuring adherence to strict financial standards and investor protection.

- Magkakaibang Produkto ng Pamumuhunan: Nag-aalok ang IwaiCosmo Securities ng malawak na hanay ng mga pagpipilian sa pamumuhunan kabilang ang lokal at dayuhang mga stock, bond, Forex, stock CFDs, at investment trusts.

- Mga Mapagkukunan ng Edukasyon: Nagbibigay sila ng mga seminar sa edukasyon at mga pananaw sa merkado, na nagpapalakas sa kaalaman ng mga mamumuhunan at kakayahan sa paggawa ng desisyon.

- Matagal na Kasaysayan: Na may mga pinagmulan noong 1915 at pormal na itinatag noong 1944, nagdadala ang IwaiCosmo Securities ng malawak na karanasan at kredibilidad sa industriya ng mga serbisyong pinansyal.

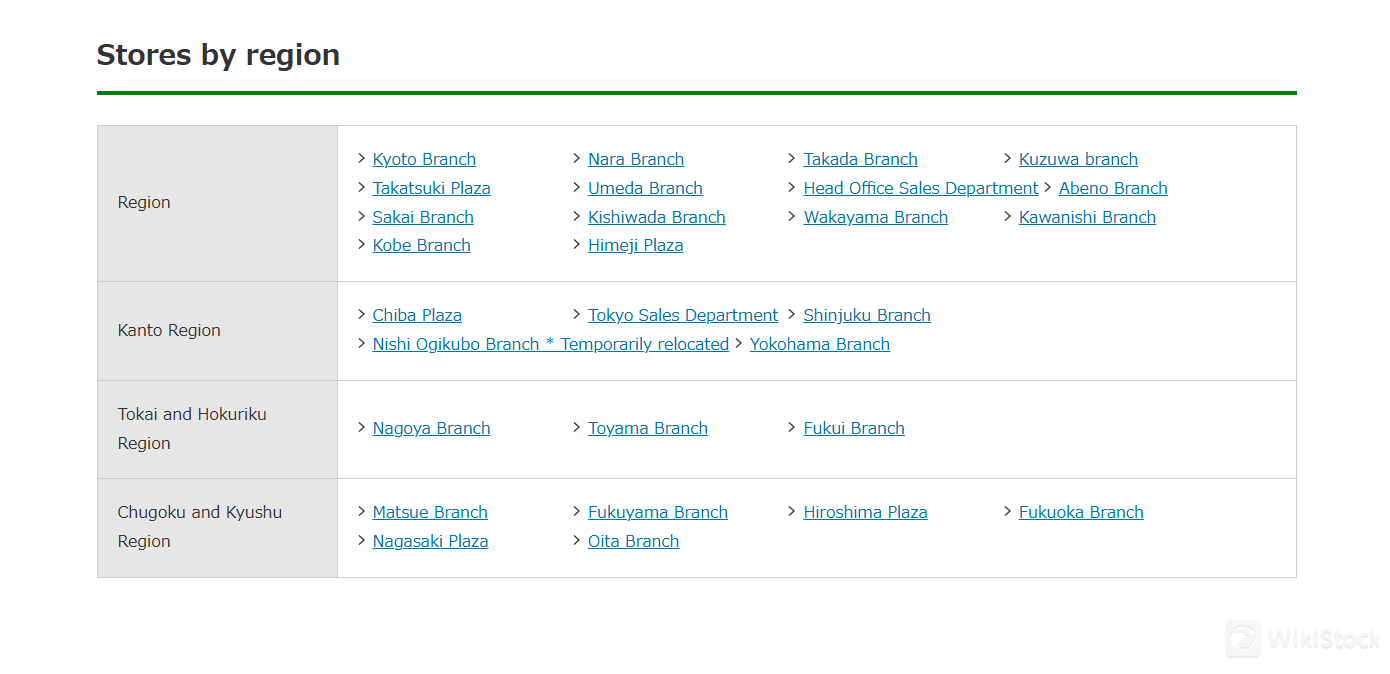

- Sangay na Network: Maraming sangay na opisina sa buong Hapon ang nagbibigay ng lokal na suporta at pagiging accessible para sa mga kliyente. Mga Disadvantage:

- Mataas na Bayad sa Pagkalakal: Bagaman transparente, mataas ang bayad sa pagkalakal na ipinapataw ng kumpanya kumpara sa ilang mga katunggali, na nagdudulot ng epekto sa mga mamumuhunang may pag-iisip sa gastos.

- Isinasailalim ba ng IwaiCosmo Securities sa regulasyon ng anumang awtoridad sa pinansya?

- Oo, ang IwaiCosmo Securities ay sumusunod sa regulasyon ng Japan Financial Services Agency (FSA), na may lisensyang bilang Director-General of the Finance Bureau (Kinsho) No. 15.

- Ano-ano ang mga uri ng mga produkto na ibinibigay ng IwaiCosmo Securities?

- Mga lokal na stock, initial public offerings, dayuhang stock, bond, forex, stock CFDs, at investment trust.

- Ang IwaiCosmo Securities ba ay angkop para sa mga nagsisimula?

- Hindi, bagaman maayos na niregula ng FSA ang IwaiCosmo Securities at nag-aalok ito ng mga mapagkukunan ng edukasyon para sa mga baguhan, maaaring hadlangan ng mataas nitong bayad sa pag-trade ang mga nagsisimulang mas gusto ang magsimula nang maliit.

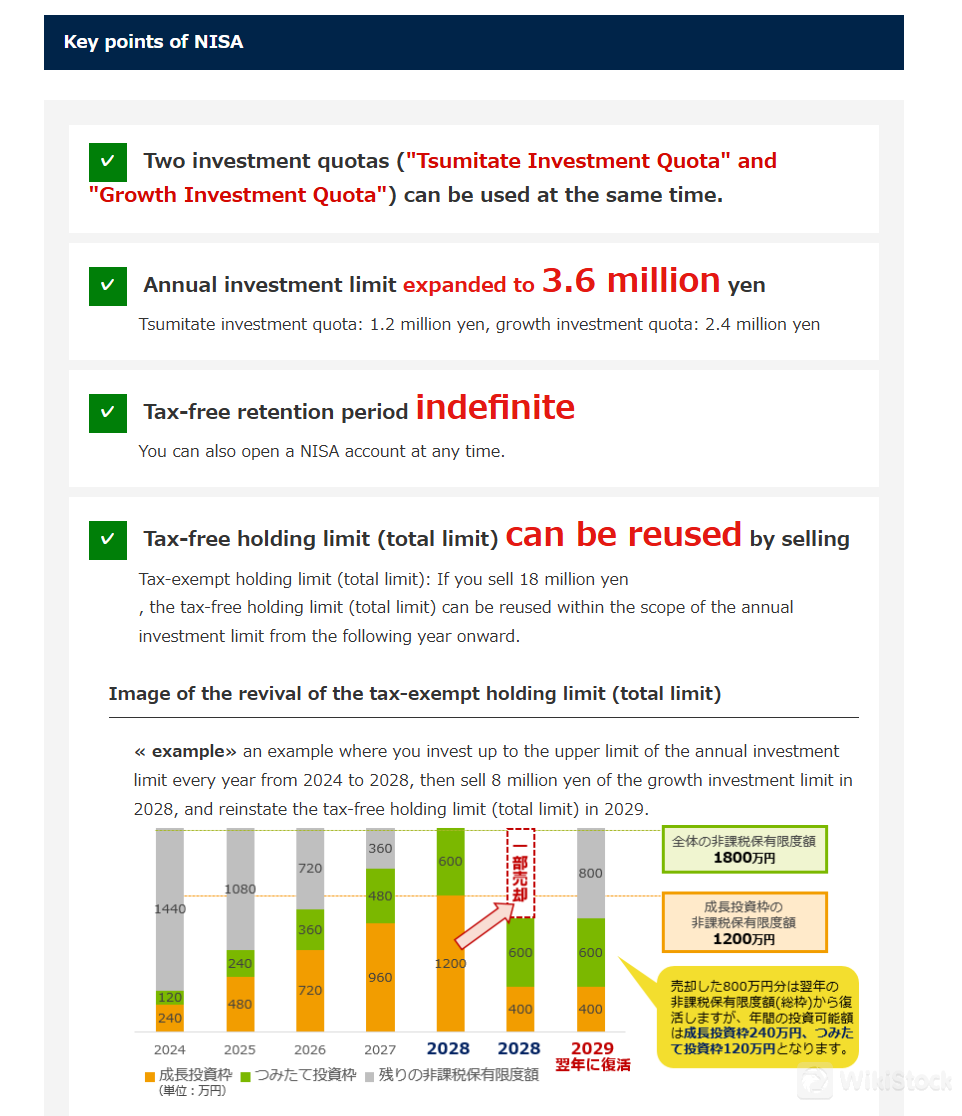

- Ano ang mga benepisyo ng bagong sistema ng NISA na inaalok ng IwaiCosmo Securities?

- Ang bagong sistema ng NISA ay nagbibigay ng pinalawak na mga benepisyo sa buwis, walang hanggang panahon ng paghawak na hindi pinapatawan ng buwis, at pinalakihang mga limitasyon sa taunang pamumuhunan para sa maliksi at malayang pagbuo ng mga ari-arian.

Ito Ba ay Ligtas?

Regulasyon:

Ang IwaiCosmo Securities ay sumusunod sa regulasyon ng Japan Financial Services Agency (FSA) na may lisensya bilang Director-General of the Finance Bureau (Kinsho) No. 15, na nagpapakita ng kanilang dedikasyon sa pagpapanatili ng pinakamataas na pamantayan sa mga operasyon sa pinansya. Ang pagsunod sa regulasyon na ito ay nagpapakita ng integridad at kredibilidad ng IwaiCosmo Securities sa kanilang mga serbisyo.

Mga Hakbang sa Kaligtasan:

Inuuna ng IwaiCosmo Securities ang malalakas na hakbang sa seguridad upang tiyakin ang kumpiyansa ng mga customer sa pagkalakal. Gumagamit sila ng SSL/TLS encryption para sa ligtas na komunikasyon, na nagtatanggol sa personal at transaksyonal na data mula sa hindi awtorisadong pag-access.

Maaaring mag-set ang mga customer ng hiwalay na mga password sa pag-login at mga PIN, na mayroong mga tampok ng awtomatikong pagkakandado para sa pinahusay na proteksyon ng account. Ang kanilang mga screen sa pagkalakal ay may mga awtomatikong timeouts upang maiwasan ang hindi awtorisadong pag-access dahil sa kawalan ng aktibidad.

Ano ang mga Securities na Maaring Ikalakal sa IwaiCosmo Securities?

Nag-aalok ang IwaiCosmo Securities ng malakas na lineup ng mga produkto sa pamumuhunan sa iba't ibang kategorya.

Sa mga lokal na stock, sila ay espesyalista sa initial public offerings (IPOs) at iba't ibang mga listadong kumpanya, na ginagamit ang kanilang malakas na kakayahan sa underwriting.

Para sa mga pandaigdigang oportunidad, ang kanilang dayuhang stock ay kasama ang mga pangunahing pagpipilian mula sa mga malalaking ekonomiya tulad ng US, na nagbibigay ng access sa mga nangungunang pandaigdigang merkado.

Sa segment ng fixed income, nag-aalok sila ng iba't ibang mga bonds, kasama ang mga opsyon ng pamahalaan at korporasyon, na hinaharap ang mga mamumuhunang naghahanap ng matatag na kita.

Ang kanilang mga investment trusts ay maingat na pinili na may mga detalyadong paghahanap at mga ranking sa performance, na nagpapadali sa mga desisyon sa pamumuhunan na naaayon sa indibidwal na mga layunin sa pinansyal.

Para sa mga aktibong mangangalakal, nagbibigay ang IwaiCosmo Securities ng FX margin trading para sa pagsasaliksik ng salapi at CFDs sa mga stock index, na nag-aalok ng mga tool upang magamit ang mga paggalaw sa merkado.

Pagsusuri ng mga Bayad

IwaiCosmo Securities ay nag-aaplay ng transparente na mga istraktura ng bayarin para sa bawat produkto. Halimbawa, para sa spot trading ng domestic stocks, ang mga bayarin ay nag-iiba batay sa halaga ng transaksyon at mga channel ng transaksyon.

Mga Transaksyon sa Mukha| Saklaw ng Presyo ng Kontrata (JPY) | Bayad sa Pagkonsigna (Kasama ang Buwis) |

| ≤ 25,000 | (9.999% ng presyo ng kontrata)×1.1 |

| > 25,000 ≤ 222,000 | (0% ng presyo ng kontrata+2,500)×1.1 |

| > 222,000 ≤ 1,000,000 | (1.128% ng presyo ng kontrata)×1.1 |

| > 1,000,000 ≤ 5,000,000 | (0.862% ng presyo ng kontrata+2,660)×1.1 |

| > 5,000,000 ≤ 10,000,000 | (0.646% ng presyo ng kontrata+13,460)×1.1 |

| > 10,000,000 ≤ 30,000,000 | (0.530% ng presyo ng kontrata+25,060)×1.1 |

| > 30,000,000 ≤ 50,000,000 | (0.245% ng presyo ng kontrata+110,560)×1.1 |

| > 50,000,000 | (0.100% ng presyo ng kontrata+183,060)×1.1 |

| Saklaw ng Presyo ng Kontrata (JPY) | Bayad sa Pagkonsigna (Kasama ang Buwis) |

| ≤ 25,000 | (9.999% ng presyo ng kontrata)×1.1 |

| > 25,000 ≤ 218,000 | (0% ng presyo ng kontrata+2,500)×1.1 |

| > 218,000 ≤ 1,000,000 | (1.150% ng presyo ng kontrata)×1.1 |

| > 1,000,000 ≤ 5,000,000 | (0.880% ng presyo ng kontrata+2,700)×1.1 |

| > 5,000,000 ≤ 10,000,000 | (0.660% ng presyo ng kontrata+13,700)×1.1 |

| > 10,000,000 ≤ 30,000,000 | (0.550% ng presyo ng kontrata+24,700)×1.1 |

| > 30,000,000 ≤ 50,000,000 | (0.250% ng presyo ng kontrata+114,700)×1.1 |

| > 50,000,000 | (0.100% ng presyo ng kontrata+189,700)×1.1 |

| Saklaw ng Presyo ng Kontrata (JPY) | Bayad sa Pagkonsigna (Kasama ang Buwis) |

| ≤ 25,000 | (9.999% ng presyo ng kontrata)×1.1 |

| > 25,000 ≤ 277,000 | (0% ng presyo ng kontrata+2,500)×1.1 |

| > 277,000 ≤ 1,000,000 | (1.128% ng presyo ng kontrata×80%)×1.1 |

| > 1,000,000 ≤ 5,000,000 | (0.862% ng presyo ng kontrata+2,660×80%)×1.1 |

| > 5,000,000 ≤ 10,000,000 | (0.646% ng presyo ng kontrata+13,460×80%)×1.1 |

| > 10,000,000 ≤ 30,000,000 | (0.530% ng presyo ng kontrata+25,060×80%)×1.1 |

| > 30,000,000 ≤ 50,000,000 | (0.245% ng presyo ng kontrata+110,560×80%)×1.1 |

| > 50,000,000 | (0.100% ng presyo ng kontrata+183,060×80%)×1.1 |

Dahil ang mga bayarin ay maaaring magbago, inirerekomenda sa mga kliyente na bisitahin ang website ng IwaiCosmo Securities sa https://www.iwaicosmo.co.jp/service/fees/ para sa pinakabagong at detalyadong impormasyon tungkol sa lahat ng kanilang mga produkto.

NISA System

Nag-aalok ang IwaiCosmo Securities ng komprehensibong sistema ng NISA (Nippon Individual Savings Account) na idinisenyo upang magpromote ng pangmatagalang pag-iimpok at pamumuhunan. Ang bagong NISA, na epektibo simula Enero 2024, ay nagbibigay-daan sa mga mamumuhunan na mag-ipon ng kayamanan na may pinalawak na mga limitasyon sa pagkakatax-free at isang walang hanggang panahon ng paghawak para sa mga kwalipikadong mga instrumento ng pananalapi. Ang mga mamumuhunan ay maaaring gamitin ang parehong "Tsumitate Investment Quota" at "Growth Investment Quota," na umaabot hanggang sa ¥3.6 milyon ng pamumuhunan taun-taon, na may kakayahang pumili ng mga produkto tulad ng investment trusts at listed stocks.

Ang sistemang ito ay nagpapalakas sa estratehikong plano sa pinansyal at tax-efficient na pamumuhunan, na nagpapatibay sa pangako ng IwaiCosmo Securities na mapabuti ang mga solusyon sa pamamahala ng kayamanan ng kanilang mga kliyente.

Research & Education

Nag-aalok ang IwaiCosmo Securities ng malalakas na mga mapagkukunan sa edukasyon na idinisenyo upang matugunan ang mga mamumuhunan sa lahat ng antas, kasama na ang mga nagsisimula pa lamang. Ang mga mapagkukunan na ito ay naglalaman ng mahahalagang kaalaman tulad ng "Kitahama Online Seminar" na pinangungunahan ni Shoichi Arisawa, Pangkalahatang Tagapamahala ng Investment Research Department. Ang seminar na ito ay nagbibigay ng malalim na pagsusuri at mga perspektiba sa merkado upang matulungan ang mga mamumuhunan na maunawaan ang kasalukuyang mga trend at gumawa ng mga pinagbasehang desisyon.

Bukod dito, ang mga mapagkukunan tulad ng "US Stock Digest" at "Japan Stock Topics" ay nagbibigay ng detalyadong kaalaman tungkol sa kalagayan ng merkado ng mga stock sa Estados Unidos at Hapon, na nagbibigay ng kasiguraduhan na mananatiling updated ang mga mamumuhunan sa mga kaugnay na pag-unlad sa merkado.

Bukod pa rito, nagbibigay din ang IwaiCosmo Securities ng kumpletong mapagkukunan ng edukasyon na inilaan para sa mga nagsisimula sa pag-iinvest. Ang kanilang mga inisyatiba ay nagbibigay ng mahalagang kaalaman at praktikal na pananaw upang matiyak na magagampanan ng mga bagong mamumuhunan ang mga pamilihan ng pinansyal nang may tiwala. Kasama sa mga mapagkukunan na ito ang mga madaling maunawaang paliwanag tungkol sa mga produkto ng pamumuhunan tulad ng mga stock, FX (foreign exchange), at CFDs (contracts for difference), at iba pa.

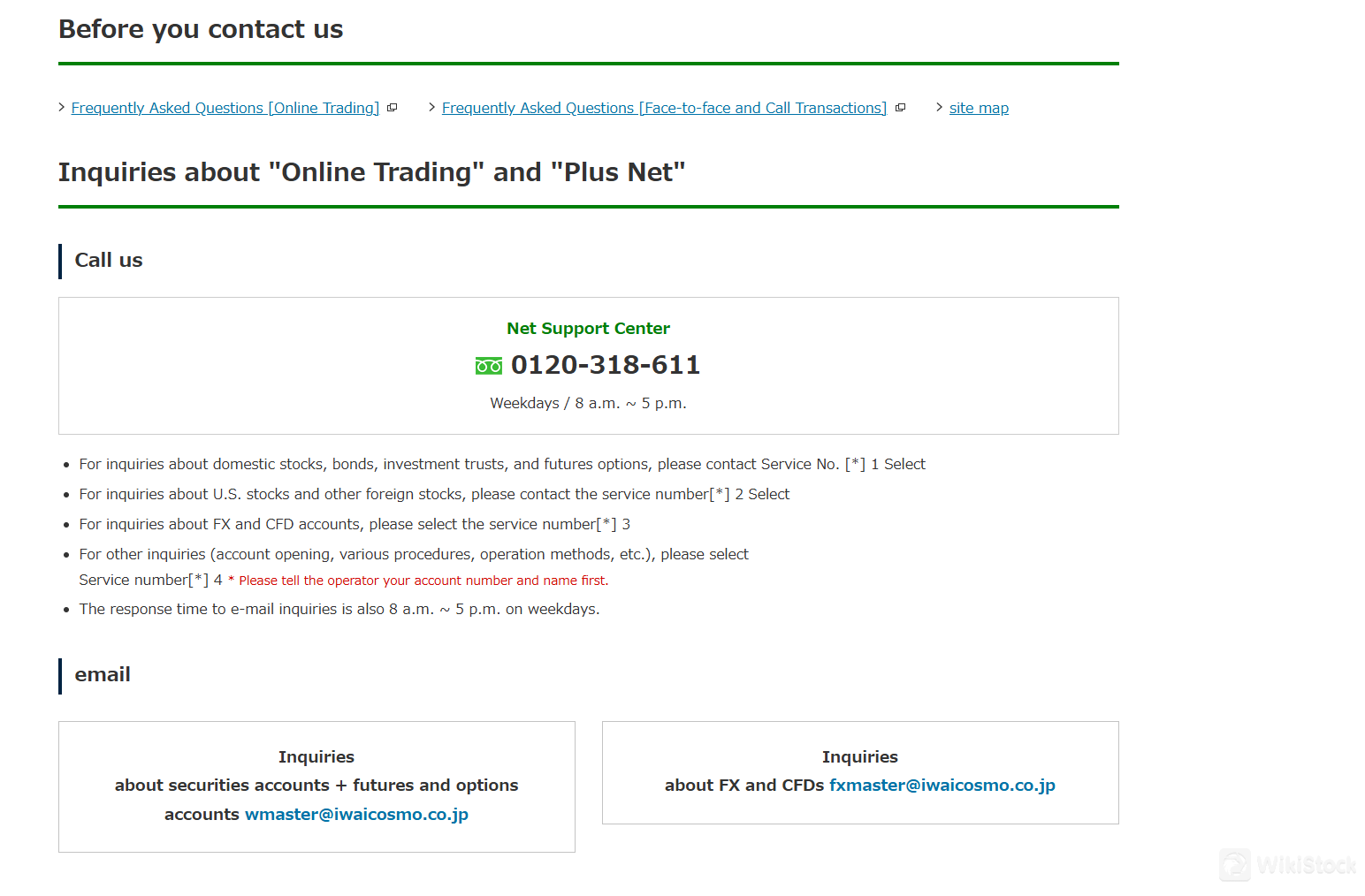

Serbisyong Pangkustomer

Nag-aalok ang Iwai Cosmo Securities ng suporta sa mga kustomer sa pamamagitan ng pisikal na address,telepono at email, kasama ang detalyadong seksyon ng mga madalas itanong (FAQ) sa kanilang website. Nakikipag-ugnayan sila sa mga kliyente sa pamamagitan ng YouTube para sa impormatibong nilalaman at gumagamit ng LINE para sa mabilis na mga katanungan, na nagbibigay ng madaling-access at responsableng serbisyo.

Tanggapan ng punong tanggapan: 1-8-12 Imabashi, Chuo-ku, Osaka.

TEL: 0120-318-611 / 0120-405-546 tuwing mga araw ng linggo 8:00-17:00.

Email: wmaster@iwaicosmo.co.jp; fxmaster@iwaicosmo.co.jp.

Para sa karagdagang mga detalye tungkol sa address/telepono ng mga sangay nito sa buong Hapon, maaari kang bumisita sa https://www.iwaicosmo.co.jp/shop/ at hanapin ang eksaktong impormasyon na nais mong malaman.

Konklusyon

Ang IwaiCosmo Securities, na itinatag noong 1944 at isinasaayos ng Japan Financial Services Agency (FSA) sa ilalim ng lisensyang bilang Director-General of the Finance Bureau (Kinsho) No. 15, ay nag-aalok ng malawak na hanay ng mga produkto sa pamumuhunan kabilang ang mga lokal na stock, initial public offerings, dayuhang stock, bond, forex, stock CFDs, at investment trust.

Sa aktibong pakikilahok sa New NISA system, na nag-aalok ng mga pinalawak na benepisyo sa buwis at pagiging maliksi sa pamumuhunan, tila mapagkakatiwalaang entidad ang IwaiCosmo Securities na pinanatili ang mataas na pamantayan ng pagsunod sa regulasyon, integridad, at serbisyo sa mga kliyente sa sektor ng pinansyal.

Mga Madalas Itanong (FAQs)

Babala sa Panganib

Ang online trading ay may malaking panganib, at maaaring mawala mo ang lahat ng iyong ininvest na kapital. Hindi ito angkop para sa lahat ng mga mangangalakal o mamumuhunan. Mangyaring tiyakin na nauunawaan mo ang mga panganib na kasama nito at tandaan na ang impormasyong ibinigay sa pagsusuri na ito ay maaaring magbago dahil sa patuloy na pag-update ng mga serbisyo at patakaran ng kumpanya.

iba pa

Rehistradong bansa

Japan

Taon sa Negosyo

10-15 taon

Mga produkto

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Review

Walang ratings

Inirerekomendang Mga Brokerage FirmMore

Ichiyoshi Securities

Assestment

広田証券

Assestment

丸八証券株式会社

Assestment

ひろぎん証券

Assestment

三木証券

Assestment

JTG証券

Assestment

JIA証券

Assestment

山和証券株式会社

Assestment

寿証券

Assestment

八十二証券

Assestment