Nilai

Atlantic Capital Markets

https://atlanticmarkets.co.uk/

Website

Peringkat indeks

Penilaian Broker

Produk

4

Futures、Investment Advisory Service、Options、Stocks

Lisensi sekuritas

dapatkan 1 lisensi sekuritas

FCATeregulasi

Kerajaan InggrisLisensi Perdagangan Sekuritas

Informasi Pialang

More

Nama perusahaan

Atlantic Capital Markets Ltd

Singkatan

Atlantic Capital Markets

Negara dan wilayah terdaftar platform

Alamat perusahaan

Situs Perusahaan

https://atlanticmarkets.co.uk/Periksa kapanpun Anda mau

WikiStock APP

Layanan Broker

Gene Internet

Indeks Gene

Peringkat APP

Fitur broker

New Stock Trading

Yes

Margin Trading

YES

Long-Short Equity

YES

Negara yang Diatur

1

| Hirogin Securities |  |

| Peringkat WikiStock | ⭐⭐⭐ |

| Biaya | CFD perdagangan saham: 0,20%, min. £20,00 per perdagangan |

| Reksa Dana yang Ditawarkan | Ya |

| Aplikasi/Platform | Aplikasi penelitian |

| Layanan Pelanggan | Telepon: +44 1209 316 171, +44 1872 229 000 |

Informasi Atlantic Capital Markets

Atlantic Capital Markets adalah perusahaan pialang yang diatur oleh FCA, dikenal karena layanan yang memenangkan penghargaan dan dukungan klien yang personal. Spesialis dalam penasihat multi-aset, perusahaan ini menawarkan akses ke pasar global dan platform perdagangan canggih.

Kelebihan & Kekurangan Atlantic Capital Markets

| Kelebihan | Kekurangan |

| Kerangka Regulasi yang Kuat | Saluran Kontak Terbatas |

| Keunggulan yang Diakui | |

| Wawasan Pasar yang Komprehensif |

- Kerangka Regulasi yang Kuat: Pialang ini mendapatkan manfaat dari lingkungan regulasi yang ketat dari FCA, yang menjaga integritas operasinya dan membangun kepercayaan di kalangan investor.

- Keunggulan yang Diakui: Atlantic Capital Markets telah mendapatkan penghargaan-penghargaan, menjadi bukti komitmennya terhadap kualitas layanan dan kepuasan klien.

- Wawasan Pasar yang Komprehensif: Perusahaan ini menyediakan riset mendalam dan peringatan perdagangan real-time kepada kliennya, meningkatkan kemampuan mereka dalam membuat pilihan investasi yang terdidik. Perusahaan ini juga menawarkan aplikasi riset yang didedikasikan, yang memastikan aksesibilitas dan kenyamanan dalam mengelola portofolio investasi. Kekurangan:

- Saluran Kontak Terbatas: Hanya dukungan telepon yang tersedia. Saluran kontak lain seperti live chat dan dukungan email tidak tersedia.

- Saham: Atlantic Capital Markets memungkinkan klien untuk berdagang saham individu, memberi mereka eksposur terhadap ekuitas berbagai perusahaan di berbagai sektor dan pasar.

- ETF (Exchange-Traded Funds): Ini adalah dana investasi yang diperdagangkan di bursa saham, mirip dengan saham individu. Mereka menawarkan diversifikasi dan cara yang mudah untuk melacak kinerja indeks pasar atau sektor tertentu.

- Reksa Dana: Ini adalah kumpulan dana yang dikumpulkan dari banyak investor untuk berinvestasi dalam sekuritas seperti saham, obligasi, dan aset lainnya. Mereka dikelola oleh manajer investasi profesional.

- Obligasi & Pendapatan Tetap: Atlantic Capital Markets memberikan akses ke obligasi, yang merupakan surat utang yang memungkinkan investor meminjam uang kepada entitas tertentu dengan imbalan pembayaran bunga.

- Opsi: Ini adalah derivatif keuangan yang memberikan hak kepada pembeli, tetapi bukan kewajiban, untuk membeli atau menjual aset yang mendasarinya dengan harga yang ditentukan dalam jangka waktu tertentu.

- Futures: Ini adalah kontrak untuk membeli atau menjual komoditas atau instrumen keuangan tertentu dengan harga yang telah ditentukan pada waktu tertentu di masa depan.

- Peminjaman Sekuritas yang Sudah Dibayar Penuh: Layanan ini memungkinkan investor meminjamkan sekuritas yang sudah dibayar penuh kepada investor atau institusi lain, biasanya dengan imbalan biaya.

- Jenis Akun: Situs web ini secara khusus menyebutkan jenis "klien pialang saham" dan "Akun Perdagangan CFD hanya eksekusi".

- Fitur Akun:

- Penasihat Pialang Saham: Layanan ini mencakup manajer investasi yang ditugaskan secara pribadi dan penilaian kesesuaian lengkap. Ini memungkinkan klien untuk tetap mengendalikan investasi mereka dengan konsultasi melalui telepon yang tersedia tanpa biaya tambahan. Ada penawaran untuk konsultasi gratis dan tinjauan portofolio, serta kemampuan untuk mentransfer portofolio yang sudah ada tanpa biaya tambahan.

- Akun Perdagangan CFD hanya eksekusi: Akun ini memberikan akses gratis ke peringatan perdagangan langsung, riset, panduan pasar dan perdagangan, serta materi pelatihan. Akun ini sepenuhnya diatur dan terpisah, menawarkan akses ke lebih dari 11.000 instrumen secara global. Manajer hubungan dapat memberi tahu klien tentang perkembangan pasar.

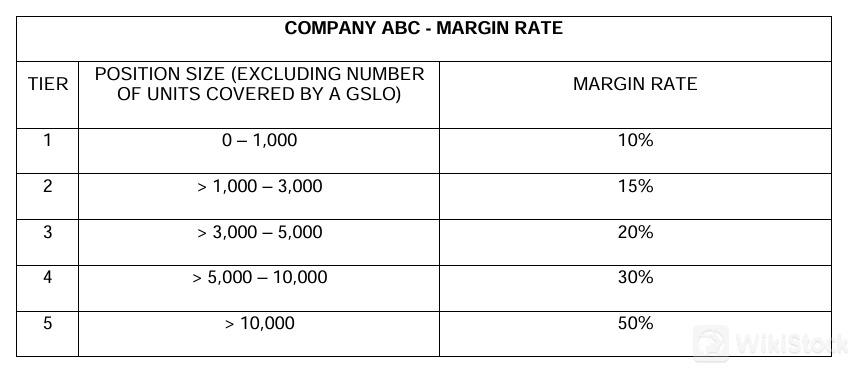

- Atlantic Capital Markets mengenakan komisi pada perdagangan CFD yang mengacu pada saham yang dieksekusi. Tarif komisi bervariasi menurut negara dan terperinci dalam dokumen Pengungkapan Biaya. Misalnya, untuk saham Inggris, tarifnya adalah 0,20% dengan biaya komisi minimum £20,00 per perdagangan.

- Juga ada biaya untuk Pesanan Jaminan Stop Loss (GSLO), yang merupakan premi yang dibayarkan saat menempatkan perdagangan. Premi GSLO dihitung berdasarkan biaya per unit yang ditampilkan di platform dan jumlah unit yang diperdagangkan.

- Spread diterapkan pada perdagangan CFD, yang mencakup biaya Introducing Broker (IB). Spread dapat bervariasi tergantung pada instrumen dan biaya IB yang disepakati.

- Apakah Atlantic Capital Markets merupakan platform yang baik untuk pemula?

- Lebih baik untuk investor tingkat menengah hingga lanjutan karena fokus pada penelitian mendalam.

- Apakah Atlantic Capital Markets legal?

- Ya, ini adalah perusahaan yang sah dan diotorisasi oleh FCA.

- Apakah Atlantic Capital Markets baik untuk investasi/pensiun?

- Layanan penasihatannya dapat bermanfaat untuk strategi investasi jangka panjang.

Apakah Atlantic Capital Markets Aman?

Regulasi: Atlantic Capital Markets diatur oleh Otoritas Perilaku Keuangan (FCA) di Inggris. FCA adalah badan regulasi keuangan yang terkemuka yang memastikan perusahaan mematuhi standar keuangan yang ketat dan peraturan perlindungan konsumen. Status regulasi perusahaan ini adalah "Teratur," dan perusahaan ini memegang Lisensi No. 764562. Ruang lingkup bisnis mencakup berbagai instrumen keuangan seperti saham, opsi, futures, dan layanan penasihat investasi, dengan tanggal efektif lisensi pada "2017-06-01."

Apa saja Efek yang Dapat Diperdagangkan dengan Atlantic Capital Markets?

Atlantic Capital Markets menawarkan berbagai instrumen keuangan untuk perdagangan. Produk yang disediakan oleh perusahaan pialang ini meliputi saham, ETF, reksa dana, obligasi, opsi, futures, dan peminjaman sekuritas yang sudah dibayar penuh. Mereka tidak menawarkan pinjaman margin atau layanan penasihat investasi sebagai bagian dari lingkup bisnis yang diatur.

Perusahaan pialang ini juga menyediakan layanan penasihat saham dan akun perdagangan CFD (Contract for Difference) hanya eksekusi, yang memberikan klien akses ke berbagai instrumen keuangan global dan kemampuan untuk memantau portofolio mereka secara real-time melalui platform online. Selain itu, klien dapat memanfaatkan peringatan perdagangan langsung, riset, dan panduan perdagangan.

Akun Atlantic Capital Markets

Tinjauan Biaya Atlantic Capital Markets

Tinjauan Aplikasi Atlantic Capital Markets

Atlantic Capital Markets menyediakan aplikasi perdagangan yang tangguh yang dirancang untuk memenuhi kebutuhan investor yang berpusat pada perangkat seluler saat ini. Tersedia di platform iOS dan Android, aplikasi ini menawarkan antarmuka yang ramah pengguna yang memfasilitasi pengalaman perdagangan yang mulus di berbagai perangkat, termasuk smartphone dan tablet. Investor dapat melakukan perdagangan dengan cepat, memantau pergerakan pasar secara real-time, dan mengakses alat riset dan analisis komprehensif langsung dari ujung jari mereka.

Penelitian

Atlantic Capital Markets secara konsisten menyajikan penelitian terkini dan wawasan pasar melalui Ruang Pers-nya, menawarkan perspektif berharga bagi investor dan pemangku kepentingan. Penelitian mereka mencakup berbagai spektrum, mencakup tren makroekonomi, analisis khusus industri, dan strategi investasi yang disesuaikan untuk menghadapi kondisi pasar yang terus berkembang.

Kesimpulan

Atlantic Capital Markets menonjolkan layanan personalisasi dan penawaran penelitian komprehensifnya, menjadikannya pilihan yang kuat bagi investor yang mencari pendekatan yang disesuaikan untuk perdagangan dan investasi. Perusahaan pialang ini terutama cocok untuk investor yang menghargai akses langsung ke saran ahli dan berbagai alat analisis pasar.

Pertanyaan yang Sering Diajukan (FAQ)

Peringatan Risiko

Informasi yang disediakan didasarkan pada evaluasi ahli WikiStock terhadap data situs web perusahaan pialang dan dapat berubah. Selain itu, perdagangan online melibatkan risiko yang signifikan, yang dapat menyebabkan kerugian total dana yang diinvestasikan, oleh karena itu memahami risiko terkait sebelum terlibat sangat penting.

Lainnya

Registered region

Kerajaan Inggris

Jam kerja

5-10 tahun

Produk

Futures、Investment Advisory Service、Options、Stocks

Review

Tidak ada rating

Perusahaan Pialang yang DirekomendasikanMore

James Brearley

Nilai

HGNH International

Nilai

SI Capital

Nilai

Jarvis Investment Management Ltd

Nilai

Thomas Grant & Company

Nilai

Spread Co

Nilai

BancTrust & Co.

Nilai

iDealing.com Limited

Nilai

Redmayne Bentley

Nilai

GHC Capital Markets

Nilai