Điểm

Atlantic Capital Markets

https://atlanticmarkets.co.uk/

Website

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Sản phẩm giao dịch

4

Futures、Investment Advisory Service、Options、Stocks

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

FCACó giám sát quản lý

Vương quốc AnhGiấy phép giao dịch chứng khoán

Thông tin sàn môi giới

More

Tên công ty

Atlantic Capital Markets Ltd

Viết tắt

Atlantic Capital Markets

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

https://atlanticmarkets.co.uk/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

Đặc điểm môi giới

New Stock Trading

Yes

Margin Trading

YES

Long-Short Equity

YES

Các quốc gia được quản lý

1

| Hirogin Securities |  |

| Đánh giá WikiStock | ⭐⭐⭐ |

| Phí | Giao dịch CFD trên cổ phiếu: 0,20%, tối thiểu £20,00 mỗi giao dịch |

| Quỹ chung được cung cấp | Có |

| Ứng dụng/Nền tảng | Ứng dụng nghiên cứu |

| Dịch vụ khách hàng | Điện thoại: +44 1209 316 171, +44 1872 229 000 |

Thông tin về Atlantic Capital Markets

Atlantic Capital Markets là một công ty môi giới được FCA quy định, nổi tiếng với dịch vụ đạt giải thưởng và hỗ trợ cá nhân hóa cho khách hàng. Chuyên về tư vấn đa tài sản, công ty cung cấp quyền truy cập vào các thị trường toàn cầu và các nền tảng giao dịch tiên tiến.

Ưu điểm & Nhược điểm của Atlantic Capital Markets

| Ưu điểm | Nhược điểm |

| Khung pháp lý mạnh mẽ | Kênh liên hệ hạn chế |

| Được công nhận về xuất sắc | |

| Thông tin thị trường toàn diện |

- Khung pháp lý mạnh mẽ: Công ty môi giới được hưởng lợi từ môi trường quy định nghiêm ngặt của FCA, giữ vững tính chính trực trong hoạt động và xây dựng niềm tin trong các nhà đầu tư.

- Được công nhận về xuất sắc: Atlantic Capital Markets đã được vinh danh với nhiều giải thưởng, là minh chứng cho cam kết về chất lượng dịch vụ và sự hài lòng của khách hàng.

- Thông tin thị trường toàn diện: Công ty trang bị cho khách hàng của mình các nghiên cứu sâu sắc và cảnh báo giao dịch thời gian thực, nâng cao khả năng của họ trong việc đưa ra quyết định đầu tư có căn cứ. Công ty cung cấp một ứng dụng nghiên cứu riêng, đảm bảo tính truy cập và tiện lợi trong quản lý danh mục đầu tư. Nhược điểm:

- Kênh liên hệ hạn chế: Chỉ hỗ trợ qua điện thoại. Các kênh liên hệ khác như trò chuyện trực tiếp và hỗ trợ qua email không có sẵn.

- Cổ phiếu: Atlantic Capital Markets cho phép khách hàng giao dịch cổ phiếu cá nhân, mang lại cho họ cơ hội tham gia vào vốn sở hữu của các công ty trong các ngành và thị trường khác nhau.

- ETFs (Quỹ giao dịch trên sàn): Đây là quỹ đầu tư được giao dịch trên sàn chứng khoán, tương tự như cổ phiếu cá nhân. Chúng cung cấp sự đa dạng hóa và một cách dễ dàng để theo dõi hiệu suất của các chỉ số thị trường hoặc ngành cụ thể.

- Quỹ hỗn hợp: Đây là các quỹ được huy động từ nhiều nhà đầu tư để đầu tư vào chứng khoán như cổ phiếu, trái phiếu và tài sản khác. Chúng được quản lý bởi các quản lý quỹ chuyên nghiệp.

- Trái phiếu & Thu nhập cố định: Atlantic Capital Markets cung cấp quyền truy cập vào trái phiếu, đó là các giấy nợ cho phép nhà đầu tư cho vay tiền cho một thực thể và nhận lãi suất.

- Tùy chọn: Đây là các công cụ tài chính tương lai cho phép người mua có quyền, nhưng không bắt buộc, mua hoặc bán một tài sản cơ bản với giá cố định trong một khoảng thời gian nhất định.

- Hợp đồng tương lai: Đó là các hợp đồng để mua hoặc bán một hàng hóa hoặc công cụ tài chính cụ thể với giá cố định vào một thời điểm nhất định trong tương lai.

- Cho vay chứng khoán đã thanh toán đầy đủ: Dịch vụ này cho phép nhà đầu tư cho vay chứng khoán đã thanh toán đầy đủ cho nhà đầu tư hoặc tổ chức khác, thường là trao đổi lợi nhuận.

- Loại tài khoản: Trang web cụ thể đề cập đến các loại "khách hàng môi giới cổ phiếu" và "tài khoản giao dịch CFD chỉ thực hiện".

- Tính năng tài khoản:

- Môi giới cổ phiếu tư vấn: Dịch vụ này bao gồm một nhà quản lý đầu tư được chỉ định cá nhân và một đánh giá phù hợp đầy đủ. Nó cho phép khách hàng giữ quyền kiểm soát đầu tư của mình với sự tư vấn qua điện thoại có sẵn miễn phí. Có một đề xuất cho cuộc tư vấn miễn phí và xem xét danh mục miễn phí, và khả năng chuyển danh mục hiện có mà không tốn thêm chi phí.

- Tài khoản giao dịch CFD chỉ thực hiện: Tài khoản này cung cấp quyền truy cập miễn phí vào cảnh báo giao dịch trực tiếp, nghiên cứu, hướng dẫn thị trường và giao dịch, và tài liệu đào tạo. Nó được quy định đầy đủ và được phân tách, cung cấp quyền truy cập vào hơn 11.000 công cụ trên toàn cầu. Nhà quản lý quan hệ có thể thông báo cho khách hàng về các diễn biến thị trường.

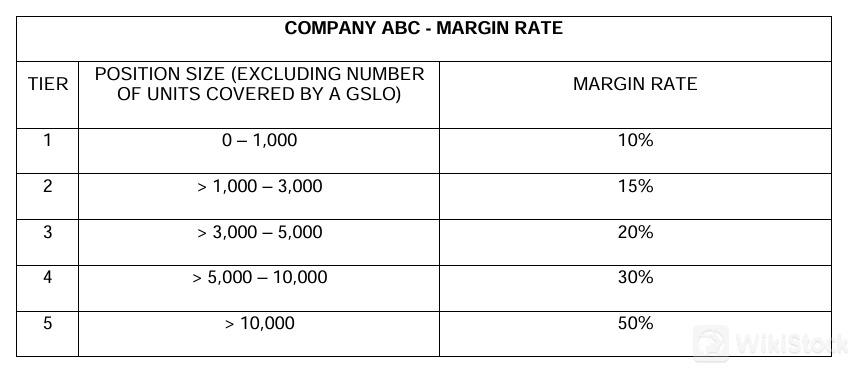

- Atlantic Capital Markets tính phí hoa hồng cho các giao dịch CFD được thực hiện liên quan đến cổ phiếu. Tỷ lệ hoa hồng thay đổi theo quốc gia và được chi tiết trong tài liệu tiết lộ chi phí. Ví dụ, đối với cổ phiếu Vương quốc Anh, tỷ lệ là 0,20% và tối thiểu là £20,00 cho mỗi giao dịch.

- Có một khoản phí cho Đặt lệnh dừng lỗ đảm bảo (GSLO), đó là một khoản phí được trả khi đặt lệnh. Phí GSLO được tính dựa trên giá trên mỗi đơn vị được hiển thị trên nền tảng và số đơn vị được giao dịch.

- Áp dụng một spread cho các giao dịch CFD, bao gồm các khoản phí của Đại lý Giới thiệu (IB). Spread có thể thay đổi tùy thuộc vào công cụ và các khoản phí IB đã thỏa thuận.

- Atlantic Capital Markets có phải là một nền tảng tốt cho người mới bắt đầu không?

- Nó tốt hơn cho nhà đầu tư trung bình đến nâng cao do tập trung vào nghiên cứu sâu.

- Atlantic Capital Markets có đáng tin cậy không?

- Đúng, đây là một công ty hợp pháp và được ủy quyền bởi FCA.

- Atlantic Capital Markets có tốt cho đầu tư/về hưu không?

- Dịch vụ tư vấn của họ có thể có lợi cho các chiến lược đầu tư dài hạn.

Atlantic Capital Markets có an toàn không?

Quy định: Atlantic Capital Markets được quy định bởi Ủy ban Hành chính Tài chính (FCA) tại Vương quốc Anh. FCA là một cơ quan quản lý tài chính đáng tin cậy, đảm bảo công ty tuân thủ các tiêu chuẩn tài chính nghiêm ngặt và quy định bảo vệ người tiêu dùng. Tình trạng quy định của công ty là "Được quy định", và nó sở hữu Số giấy phép 764562. Phạm vi kinh doanh bao gồm các công cụ tài chính khác nhau như cổ phiếu, tùy chọn, hợp đồng tương lai và dịch vụ tư vấn đầu tư, với ngày có hiệu lực của giấy phép là "2017-06-01".

Các chứng khoán để giao dịch với Atlantic Capital Markets là gì?

Atlantic Capital Markets cung cấp một loạt các công cụ tài chính để giao dịch. Các sản phẩm được môi giới cung cấp bao gồm cổ phiếu, ETFs, quỹ hỗn hợp, trái phiếu, tùy chọn, hợp đồng tương lai và cho vay chứng khoán đã thanh toán đầy đủ. Họ không cung cấp vay ký quỹ hoặc dịch vụ tư vấn đầu tư trong phạm vi kinh doanh được quy định của họ.

Môi giới cũng cung cấp dịch vụ môi giới cổ phiếu tư vấn và tài khoản giao dịch CFD (Hợp đồng chênh lệch) chỉ thực hiện, cho phép khách hàng tiếp cận một loạt các công cụ tài chính toàn cầu và có khả năng theo dõi danh mục đầu tư của họ theo thời gian thực thông qua một nền tảng trực tuyến. Hơn nữa, khách hàng có thể tận dụng cảnh báo giao dịch trực tiếp, nghiên cứu và hướng dẫn giao dịch.

Tài khoản Atlantic Capital Markets

Đánh giá phí Atlantic Capital Markets

Đánh giá ứng dụng Atlantic Capital Markets

Atlantic Capital Markets cung cấp một ứng dụng giao dịch mạnh mẽ được thiết kế để đáp ứng nhu cầu của nhà đầu tư tập trung vào di động ngày nay. Ứng dụng có thể truy cập trên cả hai nền tảng iOS và Android, cung cấp giao diện thân thiện với người dùng giúp tạo điều kiện giao dịch mượt mà trên các thiết bị khác nhau, bao gồm điện thoại thông minh và máy tính bảng. Nhà đầu tư có thể thực hiện giao dịch nhanh chóng, theo dõi diễn biến thị trường theo thời gian thực và truy cập các công cụ nghiên cứu và phân tích toàn diện trực tiếp từ ngón tay của họ.

Nghiên cứu

Atlantic Capital Markets liên tục cung cấp nghiên cứu tiên tiến và những hiểu biết về thị trường thông qua Phòng báo chí của mình, mang đến những quan điểm quý giá cho nhà đầu tư và các bên liên quan. Nghiên cứu của họ bao gồm một loạt các xu hướng kinh tế chung, phân tích cụ thể cho từng ngành và các chiến lược đầu tư được thiết kế để điều hướng trong điều kiện thị trường đang tiến triển.

Kết luận

Atlantic Capital Markets nổi bật với dịch vụ cá nhân hóa và những cung cấp nghiên cứu toàn diện, là lựa chọn mạnh mẽ cho nhà đầu tư tìm kiếm một phương pháp giao dịch và đầu tư được tùy chỉnh. Sàn giao dịch này đặc biệt phù hợp với nhà đầu tư đánh giá cao việc truy cập trực tiếp vào lời khuyên chuyên gia và một loạt các công cụ phân tích thị trường.

Câu hỏi thường gặp (FAQs)

Cảnh báo rủi ro

Thông tin được cung cấp dựa trên đánh giá chuyên gia của WikiStock về dữ liệu trang web của sàn giao dịch và có thể thay đổi. Ngoài ra, giao dịch trực tuyến có rủi ro lớn, có thể dẫn đến mất toàn bộ số vốn đầu tư, vì vậy việc hiểu rõ các rủi ro liên quan trước khi tham gia là rất quan trọng.

Thông tin khác

Registered region

Vương quốc Anh

Số năm kinh doanh

5-10năm

Sản phẩm giao dịch

Futures、Investment Advisory Service、Options、Stocks

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

James Brearley

Điểm

HGNH International

Điểm

SI Capital

Điểm

Jarvis Investment Management Ltd

Điểm

Thomas Grant & Company

Điểm

Spread Co

Điểm

BancTrust & Co.

Điểm

iDealing.com Limited

Điểm

Redmayne Bentley

Điểm

GHC Capital Markets

Điểm