スコア

岡安証券株式会社

http://www.okayasu-sec.co.jp/

会社公式HP

レーティング

会社鑑定

影響力

C

影響力指数 NO.1

Japan

Japan取引品種

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

取引商ライセンス

1件ライセンスを保有

FSARegulated

JapanSecurities Trading License

会社情報

More

会社名

OKAYASU Securities CO.,LTD

社名略語

岡安証券株式会社

会社登録国・地域

会社所在地

会社のウェブサイト

http://www.okayasu-sec.co.jp/いつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

会社特徴

Commission Rate

0.275%

Minimum Deposit

$0

New Stock Trading

Yes

Margin Trading

YES

| Okayasu Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | 1.26500% of the contract price (min 2,750 yen) |

| Margin Interest Rates | Bidding interest rate: 1.95% per year (+0.18% from the current rate) |

| Selling interest rate: 0.00% per year |

Okayasu Securities Information

Okayasu Securities is a financial institution regulated by the Japan Financial Services Agency (FSA). The company's financial instruments business focuses on proposing suitable financial products like stocks, bonds and investment trusts. They highlight their community involvement and commitment to adapting to changing market landscapes. The company prides itself on a customer-centric approach and community-based sales activities.

Pros & Cons of Okayasu Securities

| Pros | Cons |

| Transparent fee structure | Limited margin trading options |

| Community-based sales activities | Lack of online trading performance |

| Regulated by FSA | |

| Offers various financial services |

Pros

- Transparent fee structure: The firm's clear and transparent fee structure provides clients with a comprehensive understanding of the costs associated with their financial transactions.

- Community-based sales activities: By engaging in community-based sales activities, the firm demonstrates a commitment to building strong relationships with local communities.

- Regulated by FSA: Being regulated by the Japan Financial Services Agency adds credibility to the firm's operations and assures clients of compliance with industry standards and regulations.

- Offers various financial services: This variety of services allows clients to access a comprehensive suite of financial products.

Cons

- Limited margin trading options: The firm may have limited options for margin trading, potentially restricting clients' ability to leverage their investments and maximize returns.

- Lack of Online Trading Performance: The firm does not offer a robust online trading platform or tools.

Is Okayasu Securities Safe?

- Regulatory Sight: Okayasu Securities operates under the regulatory oversight of the Japan Financial Services Agency (No.8), holding a JapanSecurities Trading License. This regulatory authority ensures that financial institutions comply with relevant laws and regulations to protect investors and maintain market integrity.

- User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

- Security Measures: So far we haven't found any information about the security measures for this broker.

What are Securities to Trade with Okayasu Securities?

Okayasu Securities offers a diverse array of investment products.

These products include stocks such as Domestic stocks for trading within Japan, Initial Public Offering (IPO) shares for newly issued companies, Futures and Options for derivatives trading, ETFs (Exchange Traded Funds) for diversified investments, REITs (Real Estate Investment Trusts) for investing in real estate, Margin Trading for leveraging investments, and Foreign Stocks for trading on international markets.

In addition, they offer various types of bonds, including government bonds issued by the Japanese government, publicly offered local government bonds issued by prefectures and municipalities, and government guaranteed bonds for added security.

Lastly, Okayasu Securities provides a range of investment trusts for clients looking to invest in professionally managed portfolios.

Okayasu Securities Accounts

Okayasu Securities offers two main types of accounts: the General Securities Account and the Margin Account.

In the General Securities Account, funds are managed in Money Reserve Funds (MRFs), consisting of highly creditworthy short-term securities like domestic and foreign public bonds. When purchasing stocks or bonds, any shortfall is automatically covered by withdrawing funds from the MRF.

Margin trading Account, on the other hand, involves providing security (customer margin) to the company as collateral to borrow funds for trading stocks. There are systematic and ordinary margin trading types, with the company handling systematic margin trading for listed stocks. Margin trading can lead to significant profits but also carries the risk of large losses if price fluctuations differ from expectations.

Okayasu Securities Fees Review

Okayasu Securities offers a transparent structure on Stock Brokerage Commission Rate (Basic) (Tax Included).

| Contract price | Commission rate |

| 800,000 yen or less | 1.26500% of the contract price |

| Over 800,000 yen and up to 1,000,000 yen | 0.99000% + 2,200 yen |

| Over 1 million yen and up to 2 million yen | 0.93500% + 2,750 yen |

| Over 2 million yen and up to 3 million yen | 0.90200% + 3,410 yen |

| Over 3 million yen and up to 5 million yen | 0.88000% + 4,070 yen |

| Over 5 million yen and up to 10 million yen | 0.56540% + 19,800 yen |

| Over 10 million yen and up to 30 million yen | 0.48730% + 27,610 yen |

| Over 30 million yen and up to 50 million yen | 0.33000% + 74,800 yen |

| Over 50 million yen | 0.27500% + 102,300 yen |

| Minimum Fee | 2,750 yen |

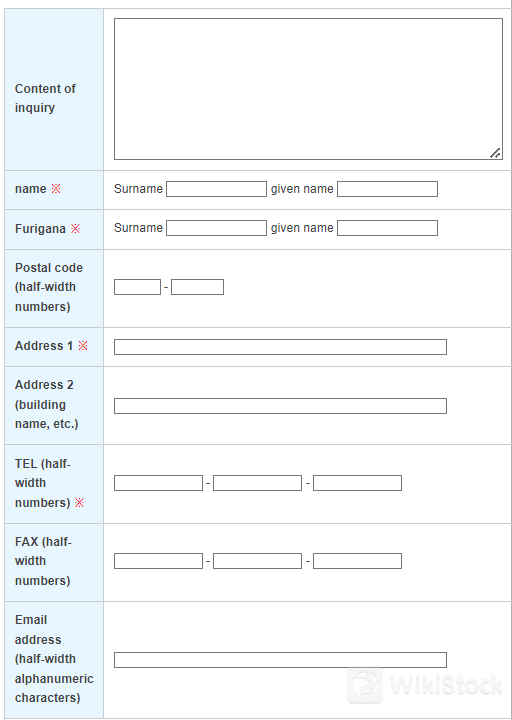

Customer Service

- Telephone: 06-7637-0001 (Main), 06-7637-0030 (Head Office Sales Department), 06-7637-0020 (Audit Department)

- Inquiry Form

- Company Address: Sawanotsuru Building, 2-1-2 Hiranomachi, Chuo-ku, Osaka-shi, Osaka 541-0046, Japan

Conclusion

In conclusion, Okayasu Securities offers a wide range of financial services, including general securities accounts and margin trading options. Their emphasis on customer-centricity, community involvement, and transparent fee structures is commendable. By providing detailed information on their services and requirements, Okayasu Securities demonstrates a commitment to transparency and relationship-building with their clients. Carefully consider your individual needs and preferences before deciding if Okayasu Securities is the right fit for you.

Q&A

What types of accounts does Okayasu Securities offer?

- It provides general securities accounts and margin trading accounts for clients.

What tradable assets does Okayasu Securities offer?

Stocks, bonds, investment trusts, foreign bonds, foreign stocks, etc.

IsOkayasu Securities regulated?

Yes. Okayasu Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA).

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

その他情報

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

評判

コメントなし

推奨する証券会社More

三菱UFJモルガン・スタンレー証券

スコア

Nissan Securities

スコア

水戸証券

スコア

東洋証券株式会社

スコア

豊証券株式会社

スコア

Kyokuto Securities

スコア

ちばぎん証券

スコア

あかつき証券

スコア

Money Partners

スコア

岩井コスモ証券

スコア