スコア

レーティング

会社鑑定

影響力

C

影響力指数 NO.1

中国

中国取引品種

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

取引商ライセンス

2件ライセンスを保有

香港、中国SFC証券取引ライセンス

香港、中国SFCファンド管理ライセンス

会社情報

More

会社名

Golden Century International Holdings Group Limited

社名略語

金禧国际

会社登録国・地域

会社のウェブサイト

http://www.gci.com.hk/いつでも確認することが可能です

WikiStock APP

前回の検出: 2024-12-22

- 自称、香港、中国Securities and Futures Commission of Hongkongのライセンスを取得していると述べている証券会社(ライセンス番号:BJD406)を調査の結果、クローンと疑われます。取引を検討の際には、リスクを十分に考慮してください!

- 自称、香港、中国Securities and Futures Commission of Hongkongのライセンスを取得していると述べている証券会社(ライセンス番号:BJD407)を調査の結果、クローンと疑われます。取引を検討の際には、リスクを十分に考慮してください!

経営分析

金禧国际決算カレンダー

通貨: HKD

サイクル

H1 FY2023 会社情報

2024/12/22

収益(前年比)

78.45M

+895.18%

EPS(株当たり利益)(前年比)

-<0.01

+29.13%

金禧国际決算予測

通貨: HKD

- 日付サイクル1株当たり純利益/予測値

- 2022/03/252021/FY-0.037/0

- 2021/03/262020/FY-0.080/0

- 2020/03/312019/FY-0.720/0

インターネット遺伝子

遺伝子インデックス

アプリのスコア

会社特徴

コミッション率

0.15%

New Stock Trading

Yes

Margin Trading

YES

規制されている国数量

1

| Century INTL |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Account Minimum | Not mentioned |

| Fees | 0.15% of each transaction amount online |

| Account Fees | Late payment fee: 13% for cash account, 8% for margin account |

| Interests on Uninvested Cash | Not mentioned |

| Margin Interest Rates | Not mentioned |

| Mutual Funds Offered | Not mentioned |

| App/Platform | Securities online trading system |

| Promotions | Not mentioned |

Century INTL Information

世纪国际是全球资本金融服务平台,间接拥有两家持有证监会牌照的机构,为投资者提供证券和期货合约经纪服务、证券和期货合约咨询、资产管理等专业服务。为企业提供股权投资、资本运作、并购等全生命周期的金融服务。

Century INTL的优点和缺点

| 优点 | 缺点 |

| 多样化的投资选择 | 可疑的克隆指定 |

| 账户选项 | 有限的客户服务信息 |

| 研究和分析 | |

| 清晰的费用结构 |

优点:

多样化的投资选择:世纪国际声称提供广泛的可交易证券,包括股票、固定收益和与中国市场相关的工具。

账户选项:世纪国际为不同投资者风险配置提供两种账户类型(现金账户和保证金账户)。

研究和分析:世纪国际重点关注中国投资证券的战略分析和研究。

清晰的费用结构:世纪国际在其网站上详细列出了与交易方式和交易金额相关的费用,没有隐藏费用。

缺点:

可疑的克隆指定:最令人担忧的红旗是将世纪国际指定为“可疑克隆”。这严重怀疑他们的合法性,并暗示他们可能在模仿真实的、持牌的实体。彻底独立验证至关重要。

有限的客户服务信息:虽然他们提供联系信息,但缺少有关客户服务时间、响应时间或在线聊天支持的详细信息。

世纪国际是否安全?

监管

Century INTLの規制状況は複雑な状況を示しています。同社は香港証券先物委員会(SFC)からライセンスを取得しており、ファンドマネジメントのライセンス番号はBJD406であり、証券取引のライセンス番号はBJD407です。しかし、ファンドマネジメントライセンスの隣に「疑わしいクローン」という用語があることは警戒すべき事項です。

Century INTLで取引できる証券とは?

Century INTLは幅広い取引可能な証券を提供しています:

株式取引:投資家は伝統的な株式をプラットフォームを通じて売買することができます。

信用取引:株式の購入時にリターンを増幅(損失も増幅)するために資金を借りることができます。

アンダーライティング:Century INTLは新しい証券の公開に参加することがあり、クライアントに初期公開株式(IPO)へのアクセスを提供します。

固定収益:債券を含む固定収益商品を提供しています。

これらの伝統的なオプションに加えて、Century INTLは中国の経済グローバリゼーションから生じる投資機会に重点を置いています。これは、中国株式や中国市場に関連する他の金融商品への露出を提供していることを示唆しています。

Century INTLの口座

Century INTLはクライアント向けに2つの主要な口座タイプを提供しています:

現金口座:これは投資家が自分の預け入れた資金で取引する標準的な口座です。投資家はCentury INTLから資金を借りてリターンを増幅(損失も増幅)することはできません。

信用口座:この口座では、投資家はCentury INTLから資金を借りて証券を購入することができます。これによりリターンが増幅されますが、投資価値が下落した場合にはリスクも大幅に増加します。

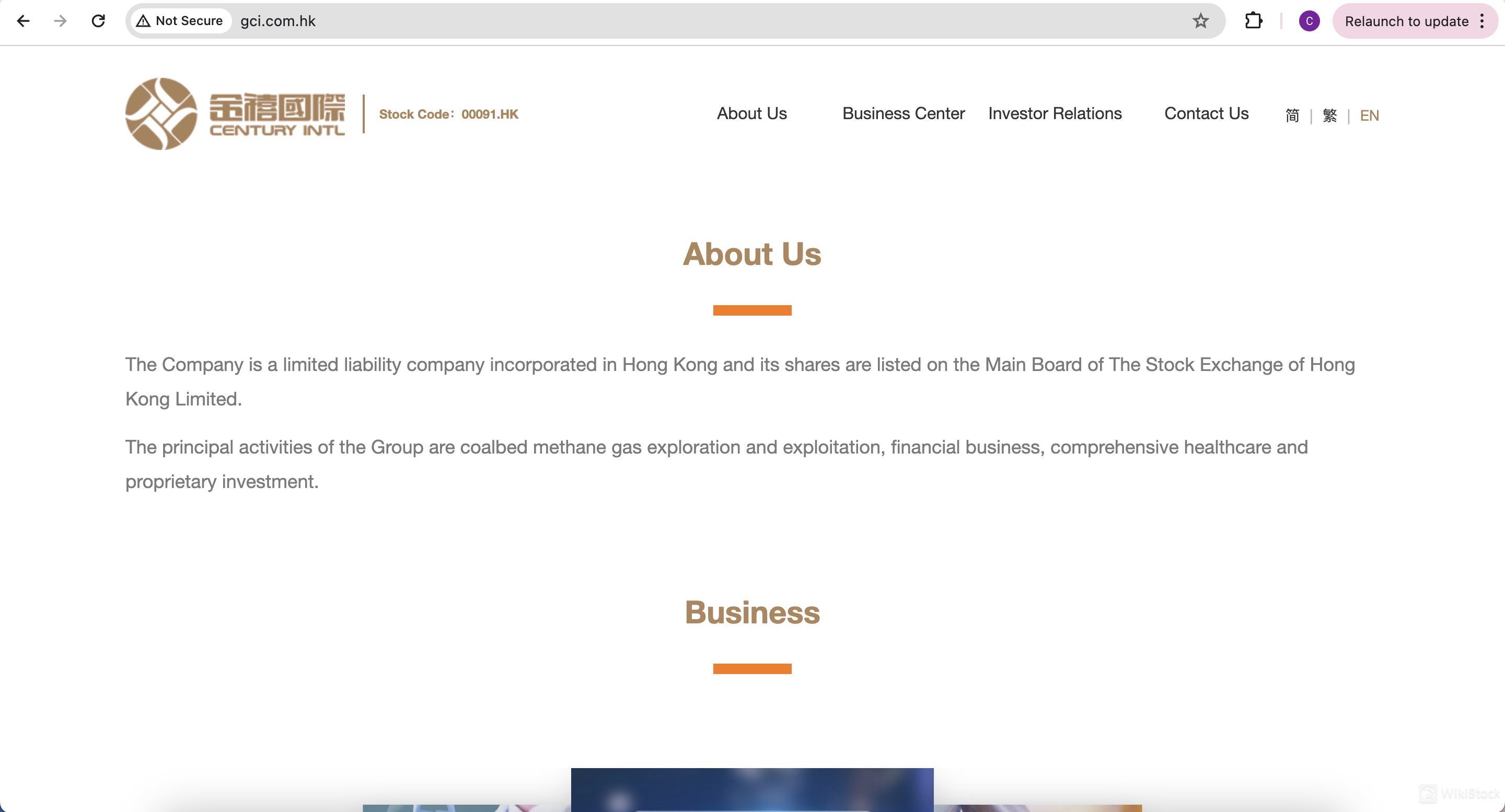

Century INTLの手数料レビュー

Century INTLはプラットフォーム上での取引に対して、取引方法と取引金額によってさまざまな手数料を請求しています。

取引手数料:投資家は取引価値に基づいて手数料を支払うことになります。取引ごとに最低料金が設定されています。オンラインで取引する場合(*0.15%)、電話で取引する場合(*0.25%)、またはダークプールを通じて取引する場合(*0.25%)によって料率が異なります。

政府および規制手数料:各取引には印紙税、取引手数料、FRC取引手数料、および取引手数料などの政府および規制手数料が適用されます。具体的な金額は取引価値によって異なります。

清算所手数料:取引ごとに清算所手数料が請求されます。最低金額と最大金額が設定されています。

遅延支払手数料:現金口座または信用口座の遅延支払いは、現行のプライムレートに基づいて追加の手数料が発生します。

Century INTLアプリのレビュー

Century INTLは「証券オンライン取引システム」を提供しており、顧客がさまざまな投資を電子的に購入および売却できるようにしています。ただし、プラットフォームに関する具体的な情報はほとんどありません。株式、債券、および中国市場に関連する金融商品のオンライン取引を容易にする一方で、モバイルアプリの利用可能性、ユーザーインターフェースの機能、リサーチツール、教育リソースなどの詳細はウェブサイトには記載されていません。

リサーチ&教育

中国の経済グローバリゼーションから生じる投資機会に焦点を当てるセンチュリーINTLは、専門の調査や教育資料に関する情報は限られているようです。同社のウェブサイトでは、中国の経済と資本市場における専門知識を強調しています。年次財務報告書や公開調査報告書は公式ウェブサイトで入手できます。

カスタマーサービス

センチュリーINTLでは、以下の方法でカスタマーサービスに連絡することができます:

電話:直接連絡するための電話番号852-28020006が提供されています。

ファックス:ファックス番号852-28020368も利用可能ですが、現在ではファックスは一般的なコミュニケーション手段ではありません。

メール:書面での問い合わせには、メールアドレスinfo@gci.com.hkが提供されています。

結論

センチュリーINTLは、投資商品の幅広い提供と中国の成長する金融市場における専門知識を謳っています。これは魅力的ですが、ライセンスに付された「Suspicious Clone」の指定は、その信頼性について深刻な懸念を引き起こします。さらに、具体的な投資商品や財務諸表に関する透明性の欠如は、彼らのサービスとリスクを評価するのが困難になります。

よくある質問

センチュリーINTLは取引に安全ですか?

「Suspicious Clone」の指定は、その信頼性について深刻な疑念を引き起こします。投資家は、香港SFCとの規制状況を独自に確認する必要があります。

センチュリーINTLは初心者に適したプラットフォームですか?

透明性の欠如と複雑な中国市場への焦点から判断すると、初心者には適していないかもしれません。

リスク警告

提供される情報は、WikiStockの専門家によるブローカーのウェブサイトデータの評価に基づいており、変更される可能性があります。また、オンライン取引には大きなリスクが伴い、投資資金の全額損失につながる可能性があるため、関連するリスクを理解してから取引に参加することが重要です。

その他情報

登記国

香港、中国

経営時間

5-10年

取引可能商品

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

関連企業

国

会社名

関連企業

--

金禧国际证券(香港)有限公司

グループ会社

--

金禧国际资产管理有限公司

グループ会社

評判

コメントなし

推奨する証券会社More

SWHYHK

スコア

Ever-Long

スコア

VC

スコア

Funderstone

スコア

国都香港

スコア

Cinda International

スコア

恒大證券

スコア

GoFintech

スコア

寶新金融

スコア

Anuenue

スコア