Score

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Surpassed 6.60% brokers

Securities license

Obtain 2 securities license(s)

SFCSuspicious Clone

China Hong Kong Securities Trading License

SFCSuspicious Clone

China Hong Kong Fund Management License

Brokerage Information

More

Company Name

Golden Century International Holdings Group Limited

Abbreviation

金禧国际

Platform registered country and region

Company website

http://www.gci.com.hk/Check whenever you want

WikiStock APP

Previous Detection: 2024-11-21

- The China Hong Kong Securities and Futures Commission of Hongkong regulation (License No.: BJD406) claimed by the brokerage firm is suspected to be a clone firm, please be aware of the risks!

- The China Hong Kong Securities and Futures Commission of Hongkong regulation (License No.: BJD407) claimed by the brokerage firm is suspected to be a clone firm, please be aware of the risks!

Brokerage Services

Business analysis

金禧国际 Earnings Calendar

Currency: HKD

Cycle

H1 FY2023 Earnings

2024/11/21

Revenue(YoY)

78.45M

+895.18%

EPS(YoY)

-<0.01

+29.13%

金禧国际 Earnings Estimates

Currency: HKD

- DateCycleEPS/Estimated

- 2022/03/252021/FY-0.037/0

- 2021/03/262020/FY-0.080/0

- 2020/03/312019/FY-0.720/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.15%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Century INTL |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Account Minimum | Not mentioned |

| Fees | 0.15% of each transaction amount online |

| Account Fees | Late payment fee: 13% for cash account, 8% for margin account |

| Interests on Uninvested Cash | Not mentioned |

| Margin Interest Rates | Not mentioned |

| Mutual Funds Offered | Not mentioned |

| App/Platform | Securities online trading system |

| Promotions | Not mentioned |

Century INTL Information

As a financial service platform for global capital, Century INTL indirectly owns two SFC licensed institutions, providing investors with securities and futures contract brokerage services, advice on securities and futures contracts, asset management and other professional services. Provide enterprises with equity investment, capital operation, the whole life cycle of acquisition such as mergers and acquisitions of financial services.

Pros & Cons of Century INTL

| Pros | Cons |

| Diverse investment options | Suspicious clone designation |

| Account options | Limited customer service information |

| Research and analysis | |

| Clear fee structure |

Pros:

Diverse investment options: Century INTL claims to offer a wide range of tradable securities, including equities, fixed income, and instruments tied to the Chinese market.

Account options: Century INTL provides two account types (cash and margin) for different investor risk profiles.

Research and analysis: Century INTL highlights strategic analysis and researches on China's investment securities.

Clear fee structure: Century INTL outlines fees associated with trading methods and transaction amounts on their website with no hidden fees.

Cons:

Suspicious clone designation: The most concerning red flag is the designation of Century INTL as a “Suspicious Clone.” This raises serious doubts about their legitimacy and suggests they might be mimicking a real, licensed entity. Thorough independent verification is crucial.

Limited customer service information: While they provide contact information, details on customer service hours, response times, or live chat support are missing.

Is Century INTL Safe?

Regulations

Century INTL's regulatory status presents a complex picture. They claim licenses from the Securities and Futures Commission of Hong Kong (SFC) under numbers BJD406 (Fund Management) and BJD407 (Securities Trading). However, the presence of the term “suspicious clone” next to the Fund Management License raises a red flag.

What are Securities to Trade with Century INTL?

Century INTL offers a wide range of tradable securities:

Equity trading: Investors can buy and sell traditional stocks through their platform.

Margin trading: It allows borrowing funds to amplify returns (and magnify losses) on stock purchases.

Underwriting: Century INTL might participate in underwriting new securities offerings, giving clients access to initial public offerings (IPOs).

Fixed income: It offers fixed-income products, which could include bonds.

Beyond these traditional options, Century INTL emphasizes investment opportunities arising from China's economic globalization. This suggests it offers exposure to Chinese stocks or other instruments tied to the Chinese market.

Century INTL Accounts

Century INTL offers two main account types for clients:

Cash account: This is a standard account where investors trade with their own deposited funds. Investors cannot borrow money from Century INTL to amplify their returns (or magnify losses).

Margin account: This account allows investors to borrow funds from Century INTL to purchase securities. This can magnify their returns, but also significantly increases risk if the investment value falls.

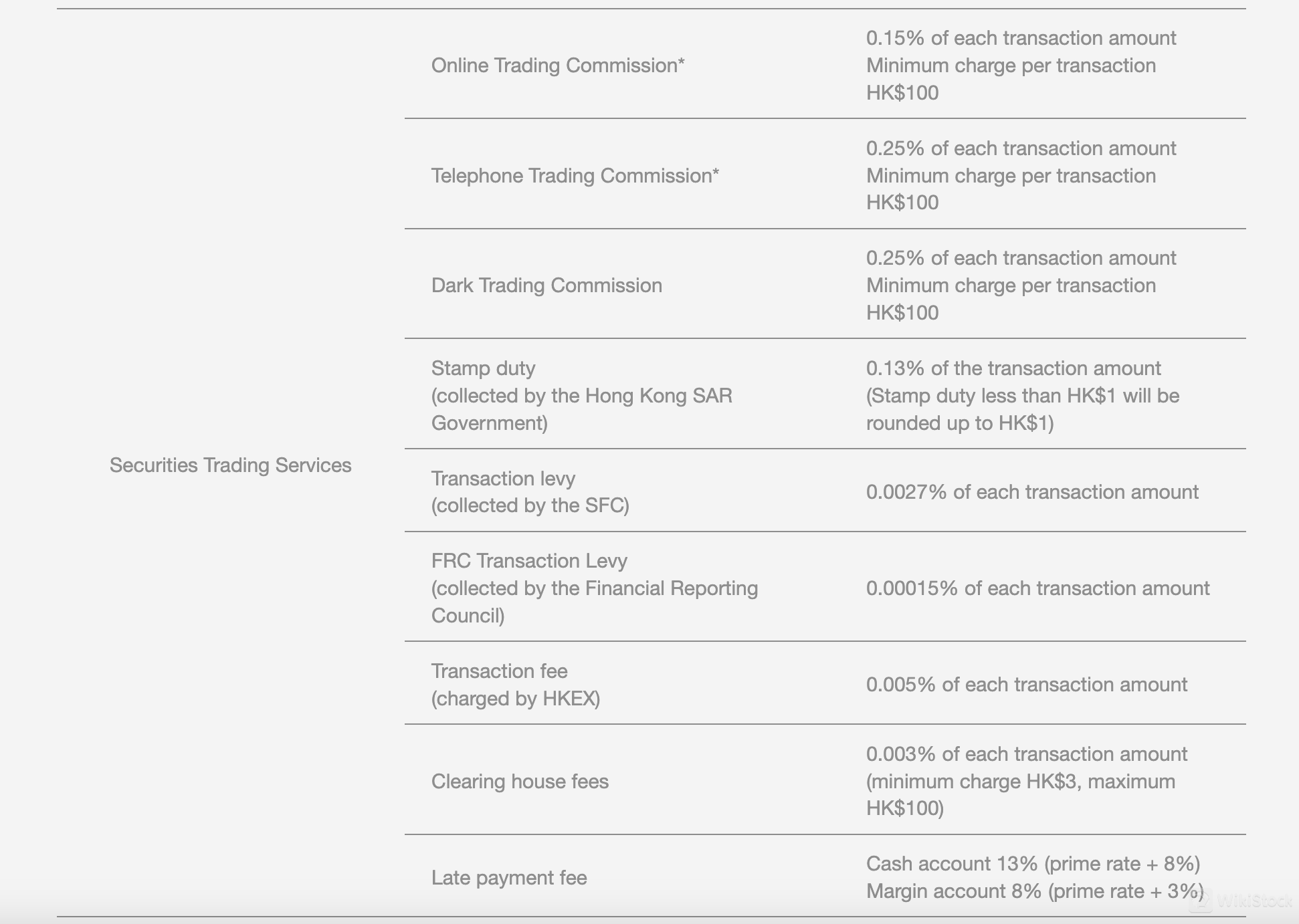

Century INTL Fees Review

Century INTL charges various fees for trading on their platform, categorized by trading method and transaction amount.

Trading commissions: Investors will incur a commission fee based on the transaction value, with a minimum charge per trade. Rates differ depending on whether you trade online (*0.15%), by phone (*0.25%), or through dark pool (*0.25%).

Government and regulatory fees: Several government and regulatory fees are applied to each transaction, including stamp duty, transaction levy, FRC transaction levy, and a transaction fee. The exact amounts will vary depending on the trade value.

Clearing house fees: A clearing house fee is charged per transaction, with a minimum and maximum amount.

Late payment fees: Late payments on cash or margin accounts will incur additional fees based on the prevailing prime rate.

Century INTL App Review

Century INTL claims to offer a “Securities online trading system,” allowing customers to buy and sell various investments electronically. However, specifics about the platform are scarce. While it facilitates online trading of stocks, bonds, and instruments tied to the Chinese market, details like mobile app availability, user interface features, research tools, or educational resources are not mentioned on their website.

Research & Education

While Century INTL emphasizes its focus on investment opportunities arising from China's economic globalization, information regarding dedicated research or educational materials seems limited. Their website highlights expertise in China's economic and capital markets. Annual financial reports and public research reports are available on the official website.

Customer Service

Century INTL offers several methods for contacting customer service:

Phone: They provide a phone number, 852-28020006, for contacting them directly.

Fax: A fax number, 852-28020368, is also available, though faxing is a less common method of communication nowadays.

Email: They offer an email address, Email: info@gci.com.hk, for written inquiries.

Conclusion

Century INTL offers a mix of investment products and touts expertise in China's growing financial markets. While this is appealing, the “Suspicious Clone” designation attached to their licenses raises serious legitimacy concerns. Furthermore, a lack of transparency regarding specific investment products and financial statements makes it difficult to assess their services and risks.

FAQs

Is Century INTL safe to trade?

The “Suspicious Clone” designation raises serious doubts about their legitimacy. Investors should verify their regulatory status with the Hong Kong SFC independently.

Is Century INTL a good platform for beginners?

Its lack of transparency and focus on complex Chinese market investments suggest they may not be suitable for beginners.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

金禧国际证券(香港)有限公司

Group Company

--

金禧国际资产管理有限公司

Group Company

Review

No ratings

Recommended Brokerage FirmsMore

Gransing

Score

CIS Group

Score

OPSL

Score

Greater China Securities

Score

CGG

Score

Orient Securities Limited

Score

Alphafin

Score

BSL

Score

Harvest Global Investments

Score

維恩金控

Score