Orient Securities Limited, formerly known as TradingGuru.com Securities Limited was incorporated in 2000 and has been providing reliable and professional securities trading and margin financing services to our clients.

Orient Securities Limited is a licensed broker under the Securities and Futures Ordinance with Central Entity Number AFP038 and is also a licensed participant of the Stock Exchange of Hong Kong Limited (Broker No. 3600).

Orient Securities Limited Information

Orient Securities Limited, based in the key financial hub of Hong Kong since 2000, leverages its position in the Asia-Pacific region to continuously explore new business opportunities and expand its services.

The company offers a competitive commission rate of 0.25% and provides an interest of 1.72% on uninvested cash, making it an attractive choice for investors looking for low-cost trading options.

However, the firm imposes a relatively high fee of $1,000 per year on long-term dormant accounts, which could be a deterrent for less active investors.

Pros & Cons

Pros:

Orient Securities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring a high standard of regulatory compliance and investor protection. The brokerage offers low commission rates at only 0.25%, making it a cost-effective option for traders. Additionally, it features a unique online trading platform that enhances the trading experience with innovative tools and functionalities. The firm also provides a diverse range of tradable securities, including stocks, futures, options, and more, satisfying various investment preferences and strategies.

Cons:

Despite its advantages, Orient Securities Limited imposes an extremely high fee of $1,000 per year on long-term dormant accounts, which could be a significant drawback for inactive investors. Furthermore, the brokerage does not offer broader investment services such as wealth management, financial planning, or retirement solutions, which limits the appeal for investors seeking financial services beyond trading.

Is Orient Securities Limited Safe?

Regulations:

Orient Securities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is an independent statutory body responsible for regulating the city's securities and futures markets.

With a license number AFP038, the firm operates under stringent regulatory requirements set forth by the SFC, which enhances its credibility and reliability as a broker.

Funds Safety:

Orient Securities Limited operates under the regulation of the Securities and Futures Commission (SFC) of Hong Kong.The regulatory oversight by the SFC suggests a strong adherence to financial safety standards. These standards typically include requirements for maintaining segregated accounts, which ensures that client funds are kept separate from the firm's operational funds.

Safety Measures:

Orient Securities Limited implementS robust security protocols as part of its compliance with SFC regulations.

These protocols involve the use of advanced encryption technologies to secure the storage and transmission of client funds and sensitive data. Additionally, the firm having in place stringent measures to prevent data leakage and unauthorized access to client information.

Such security measures are critical in maintaining the integrity and confidentiality of client transactions and personal details, aligning with the regulatory standards imposed by the SFC.

What are securities to trade with Orient Securities Limited?

With Orient Securities Limited, clients can trade a variety of securities that mainly include stocks.

Stocks:

Orient Securities Limited offers trading in stocks, allowing clients to invest in shares of companies listed primarily on Hong Kong's securities market. This allows investors to participate directly in the equity markets, benefiting from potential capital gains and dividends distributed by the companies in which they have invested.

Futures:

Futures trading at Orient Securities Limited enables clients to speculate on or hedge against future price movements of various financial instruments or commodities. This type of trading is particularly useful for managing risk or for investors looking to profit from predictions on the direction of market prices.

Options:

Options trading through Orient Securities Limited provides additional flexibility for traders. Options give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a set time period, offering strategies for every market condition.

Leveraged Foreign Exchange Trading:

The platform also supports leveraged foreign exchange trading, allowing clients to trade currencies with a margin of the actual transaction value. This can significantly amplify both potential gains and losses, making it a powerful tool for experienced traders who understand the risks involved.

Warrants and Callable Bull/Bear Contracts (CBBCs):

Orient Securities Limited offers warrants and Callable Bull/Bear Contracts, which are special types of securities that provide additional leverage compared to traditional stocks. Warrants allow investors to purchase the underlying stock at a specific price before the expiry date, while CBBCs offer opportunities to speculate on the rise or fall of stock prices with leveraged returns.

Orient Securities Limited Fee Review

Orient Securities Limited implements a detailed and multifaceted fee structure for its trading and custody services:

Trading Fees:

- Commission: 0.25% of the total transaction amount with a minimum charge of HK$100. Rates are negotiable for high-volume clients.

- Stamp Duty: 0.100% of the total transaction amount, with a minimum charge of HK$1.

- Transaction Levy: 0.003% of the total transaction amount.

- Transaction Fees: 0.00565% of the total transaction amount.

- Central Clearing Fee: 0.002% of the total transaction amount, with a minimum charge of HK$3.

- Indemnity Levy: Currently suspended.

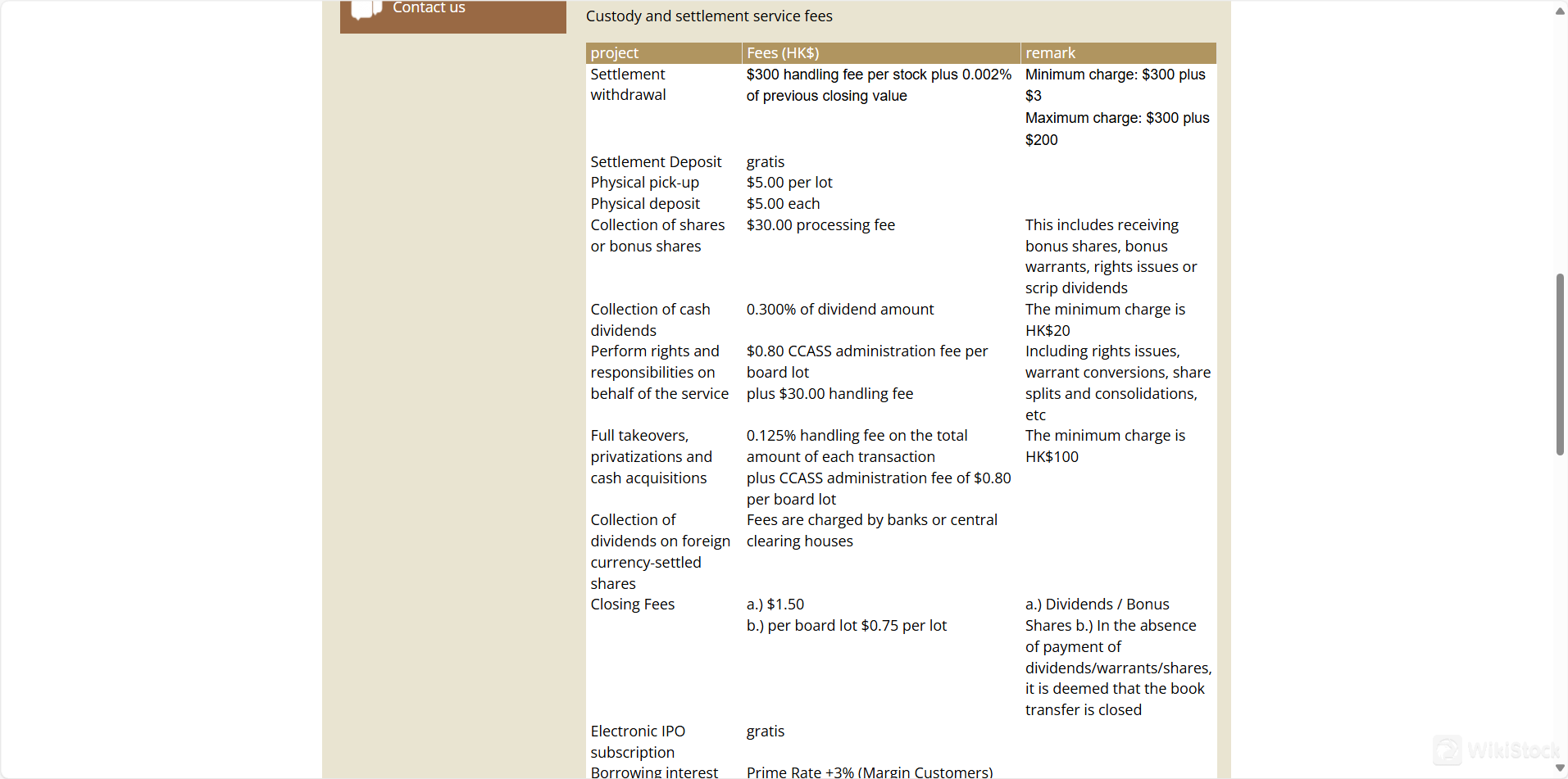

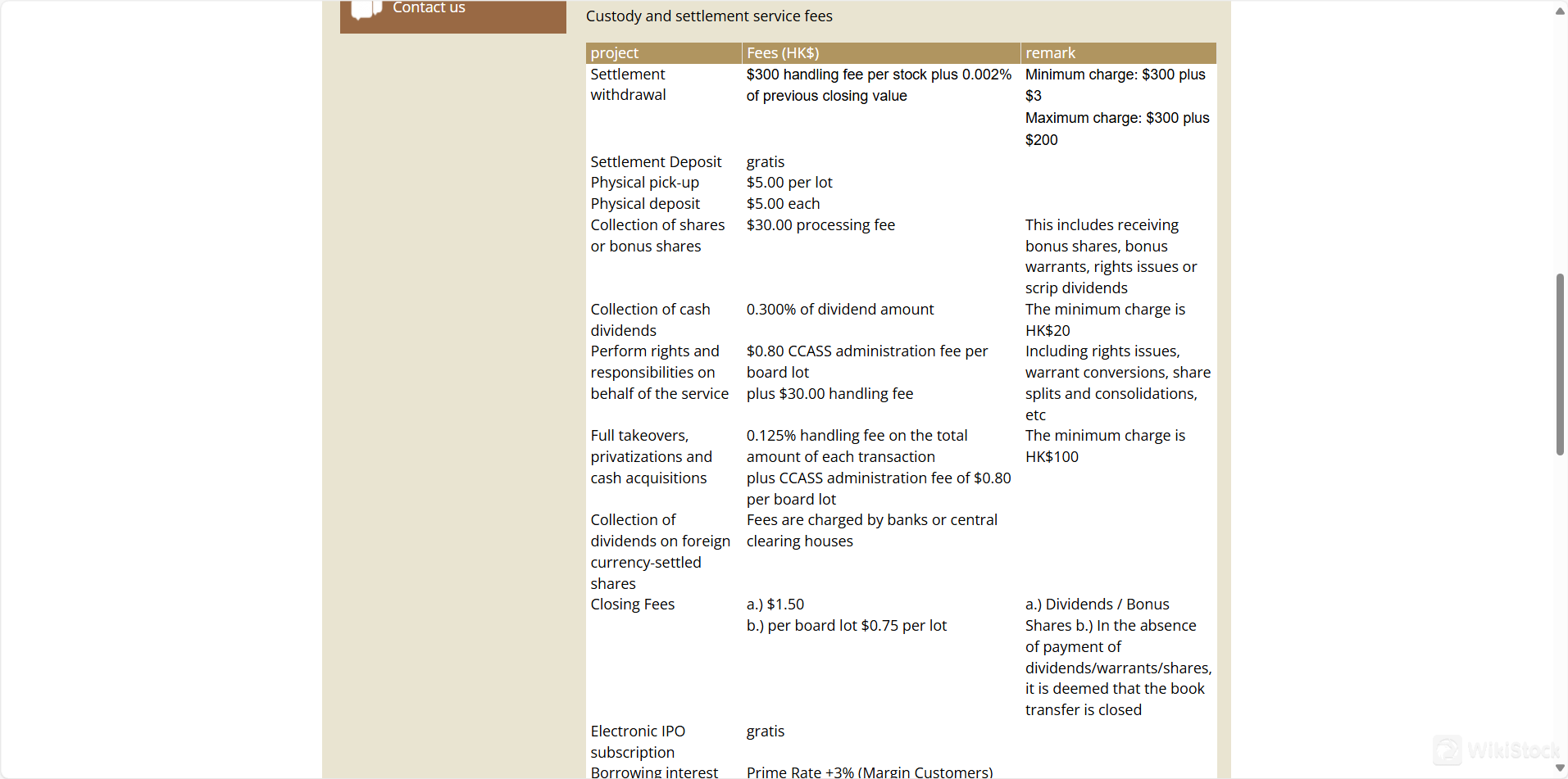

Custody and Settlement Service Fees:

- Settlement Withdrawal: HK$300 handling fee per stock plus 0.002% of the previous closing value. The minimum charge is HK$300 plus HK$3, and the maximum charge is HK$300 plus HK$200.

- Settlement Deposit: Free of charge.

- Physical Pickup: HK$5.00 per lot.

- Physical Deposit: HK$5.00 each.

- Collection of Shares or Bonus Shares: HK$30.00 processing fee.

- Collection of Cash Dividends: 0.300% of the dividend amount, with a minimum charge of HK$20.

- Performing Rights and Responsibilities on Behalf of the Service: HK$0.80 CCASS administration fee per board lot plus HK$30.00 handling fee.

- Full Takeovers, Privatizations, and Cash Acquisitions: 0.125% handling fee on the total transaction amount plus CCASS administration fee of HK$0.80 per board lot, with a minimum charge of HK$100.

- Collection of Dividends on Foreign Currency-Settled Shares: Fees charged by banks or central clearing houses.

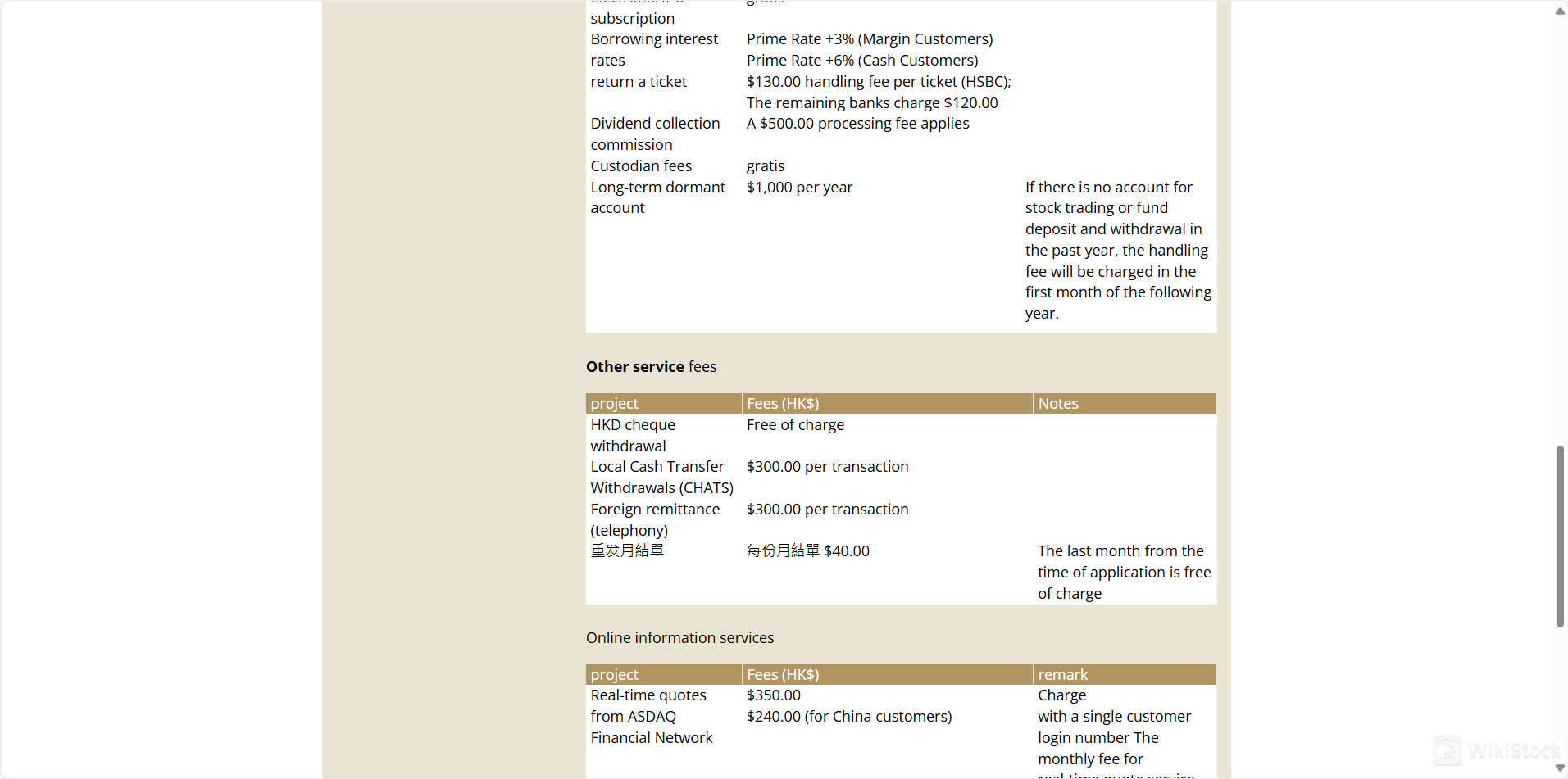

Other Service Fees:

- Local Cash Transfer Withdrawals (CHATS): HK$300.00 per transaction.

- Foreign Remittance (Telephony): HK$300.00 per transaction.

- Reissue of Monthly Statements: HK$40.00 per statement, with the last month from the time of application free of charge.

Online Information Services:

- Real-time Quotes from ASDAQ Financial Network: HK$350.00, or HK$240.00 for China customers. These fees are charged per customer login number and are deducted monthly from the clients securities account.

Long-term Dormant Account Fee:

- A significant fee of HK$1,000 per year is charged if there has been no stock trading or fund deposit and withdrawal activity in the past year.

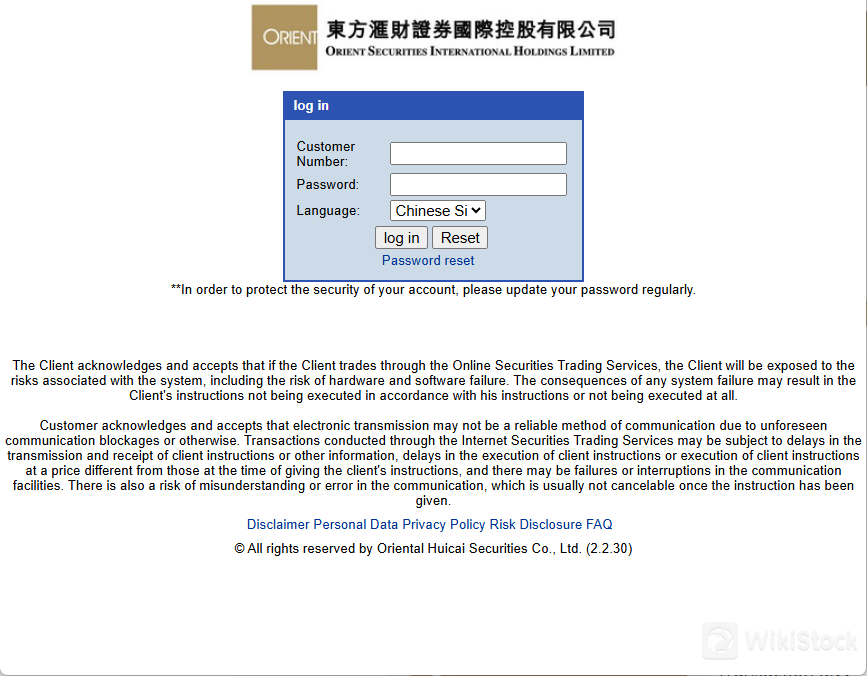

Orient Securities Limited Trading Platrform Review

Orient Securities Limited offers a robust and versatile online trading platform that meets a wide range of trading activities.

This platform is specifically designed to facilitate the trading of stocks and financial derivatives such as futures, options, and leveraged foreign exchange. It provides users with real-time market data, trading tools, and a user-friendly interface that supports efficient and informed trading decisions.

Additionally, the platform includes features like real-time quotes and integration with settlement and custodian services, making it a convenient and effective solution for both novice and experienced traders looking to navigate the dynamic financial markets of Hong Kong.

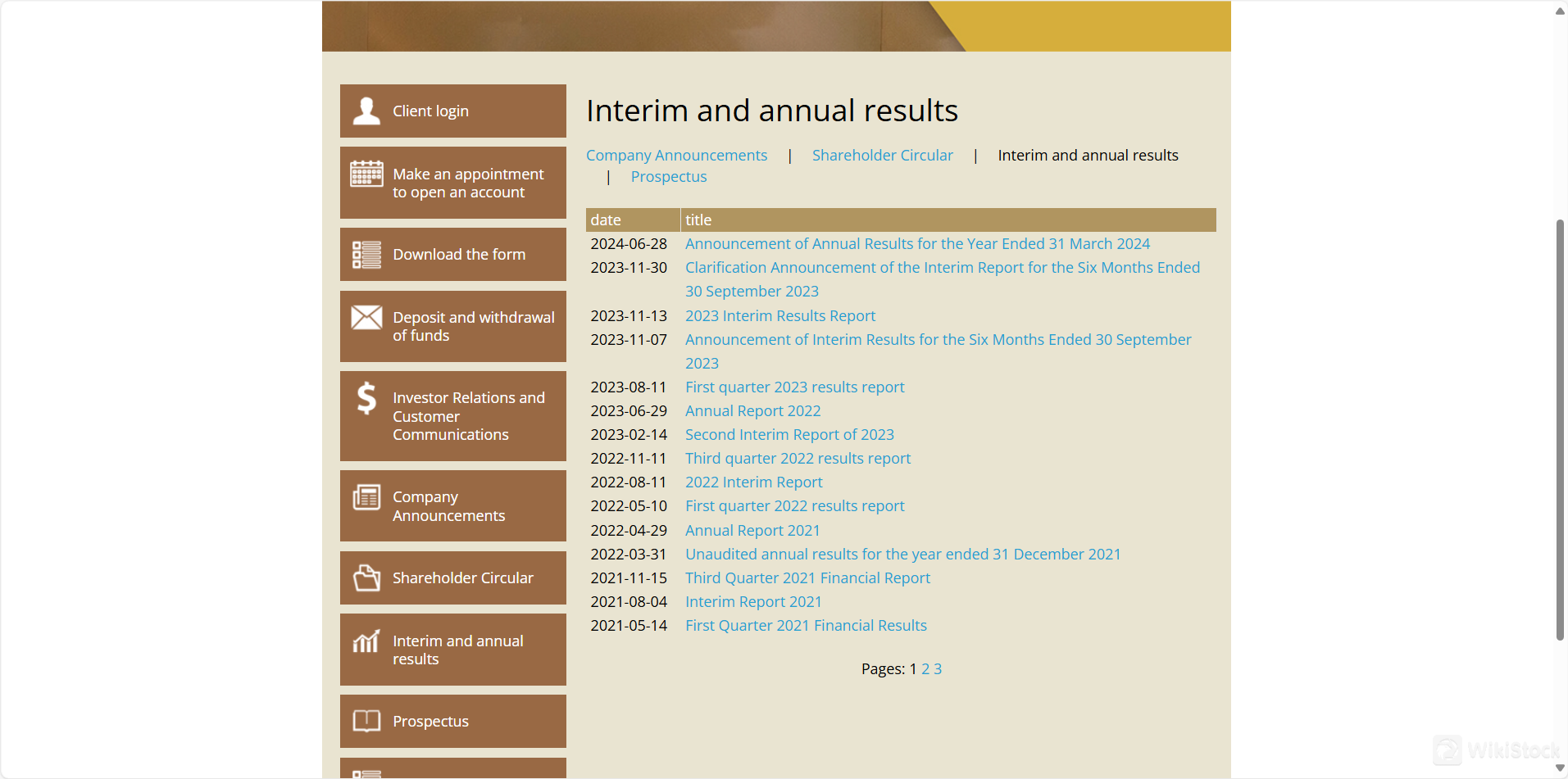

Research & Education

Orient Securities Limited provides a range of resources aimed at research and education for its clients, facilitating informed investment decisions and understanding of market dynamics:

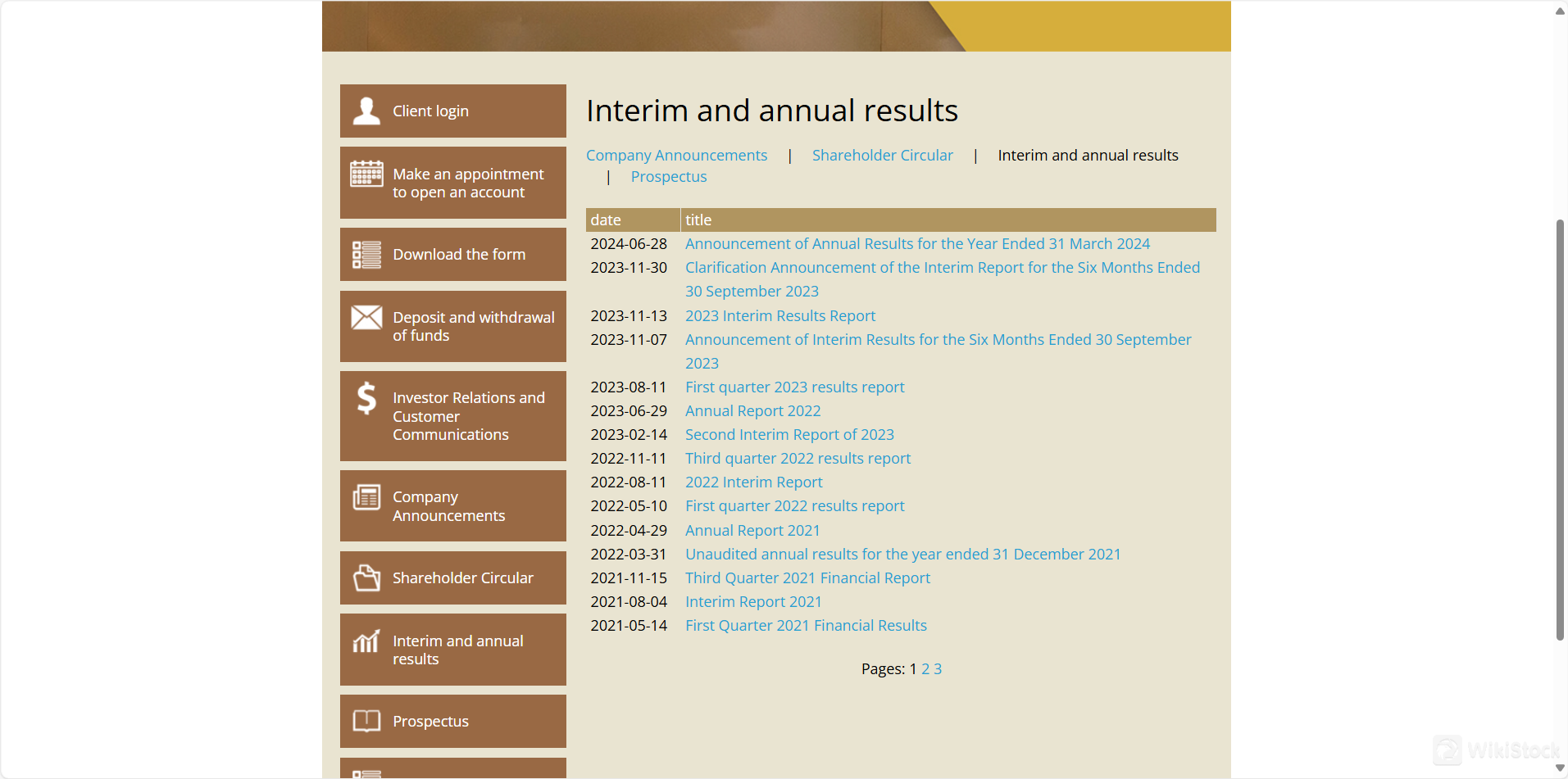

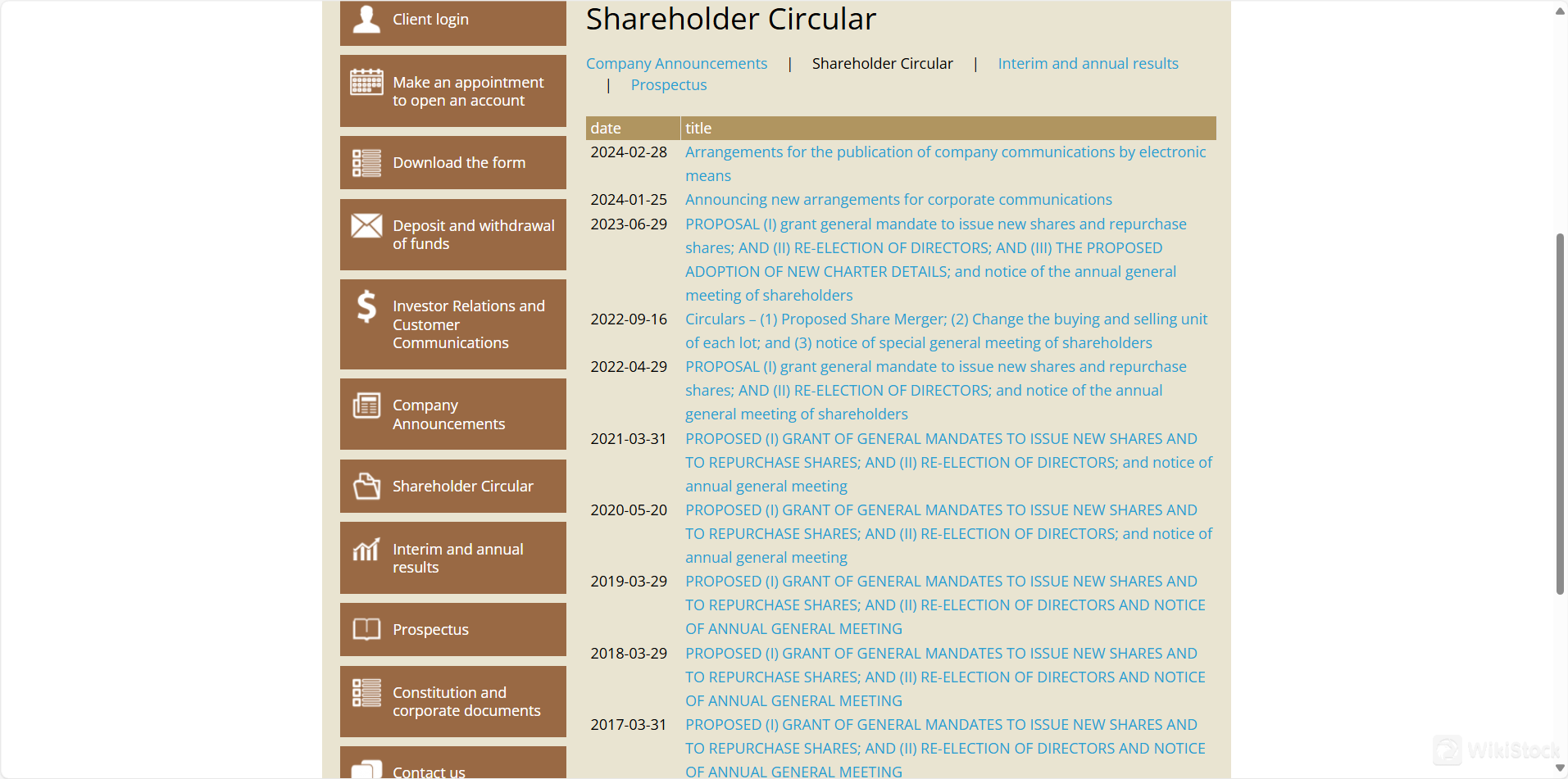

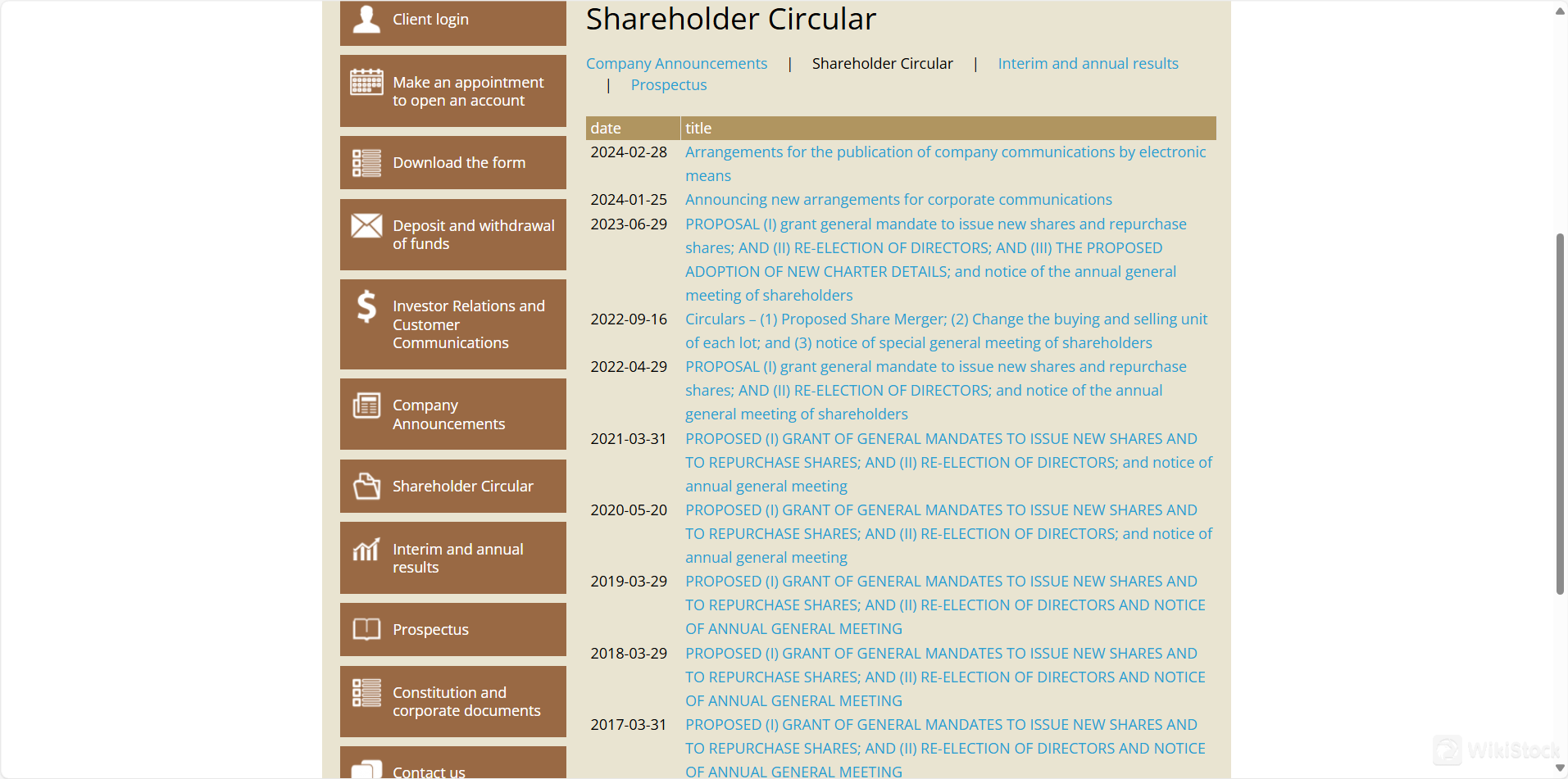

- Investor Relations and Customer Communications: Orient Securities regularly updates its clients with essential information through various communications, including performance reports and corporate announcements. These documents are crucial for investors looking to stay informed about the company's financial health and market strategies.

- Company Announcements and Performance Reports: The firm publishes detailed reports such as mid-year and annual performance reviews, alongside regular monthly reports on securities changes. These publications offer insights into the company's operations and market conditions, helping investors understand past performance and future outlooks.

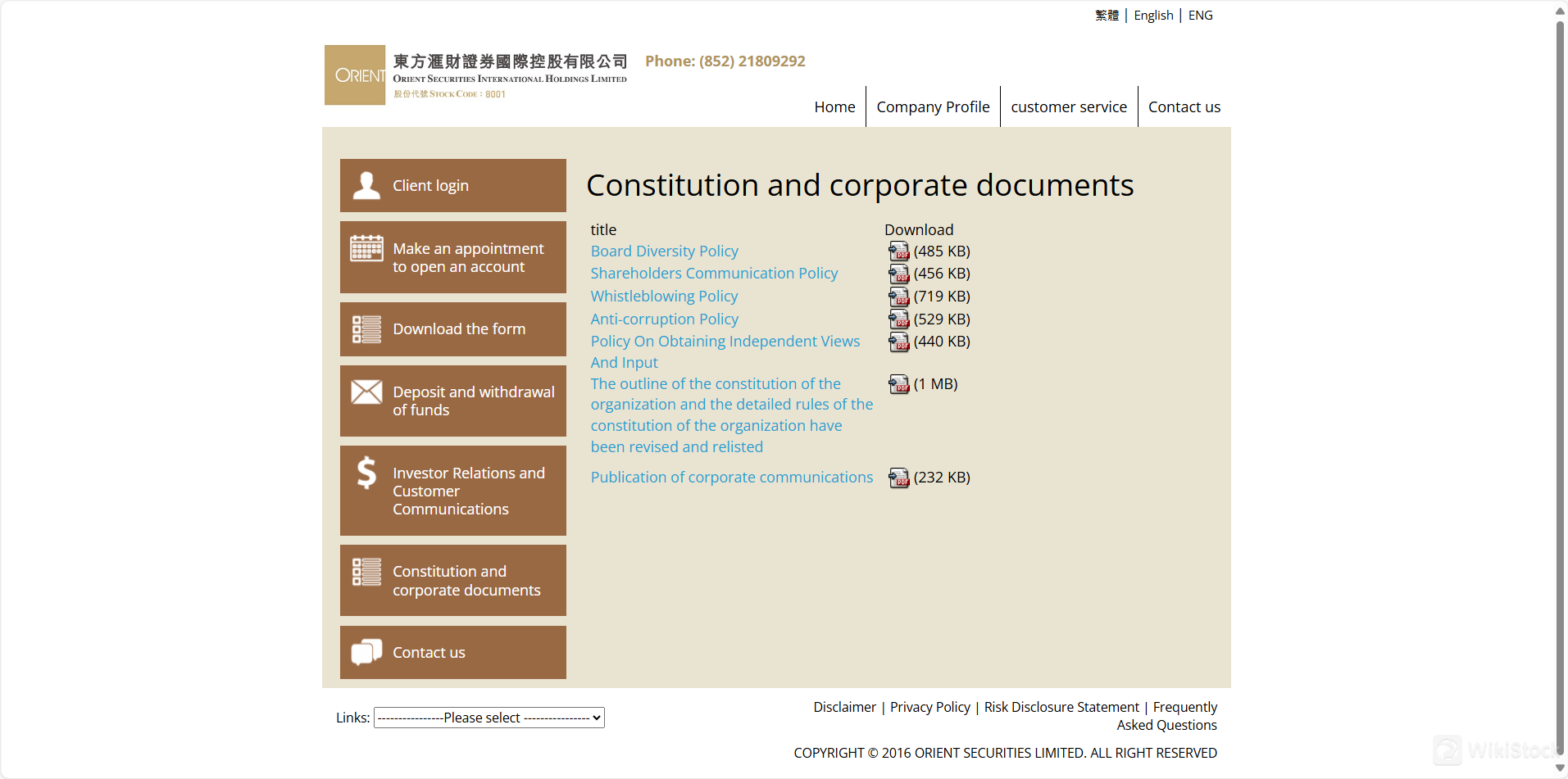

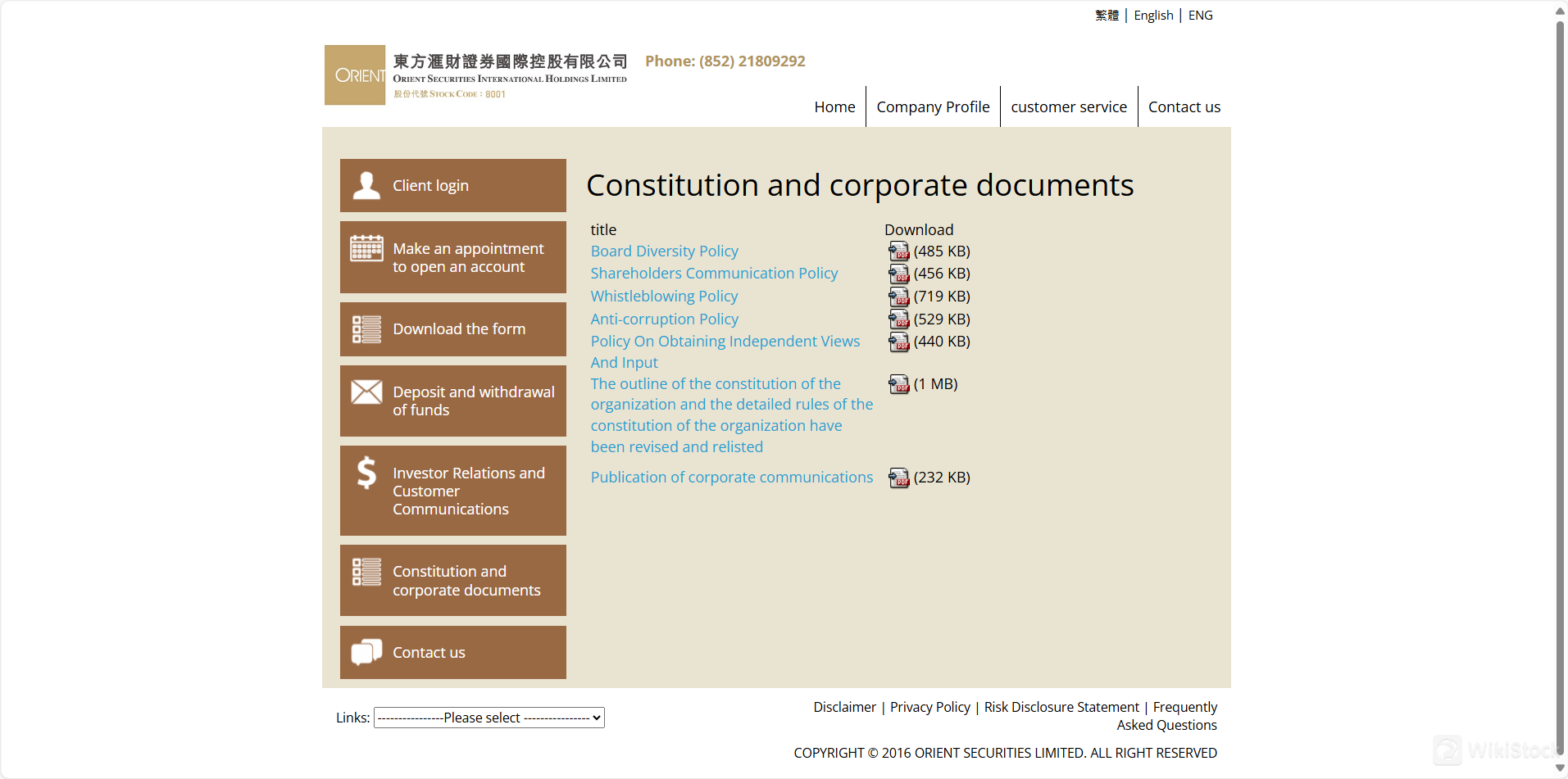

- Prospectuses and Corporate Documents: Orient Securities provides access to prospectuses and detailed corporate documents, such as the Board Diversity Policy, Shareholders Communication Policy, and Anti-corruption Policy. These documents not only outline the firm's governance structures and ethical commitments but also educate shareholders about their rights and the firm's operational principles.

- Stock Exchange Filings and Regulatory Updates: By keeping a transparent record of all filings and updates in line with the Hong Kong Stock Exchange requirements, Orient Securities ensures that both potential and current investors have access to legally required disclosures and financial data.

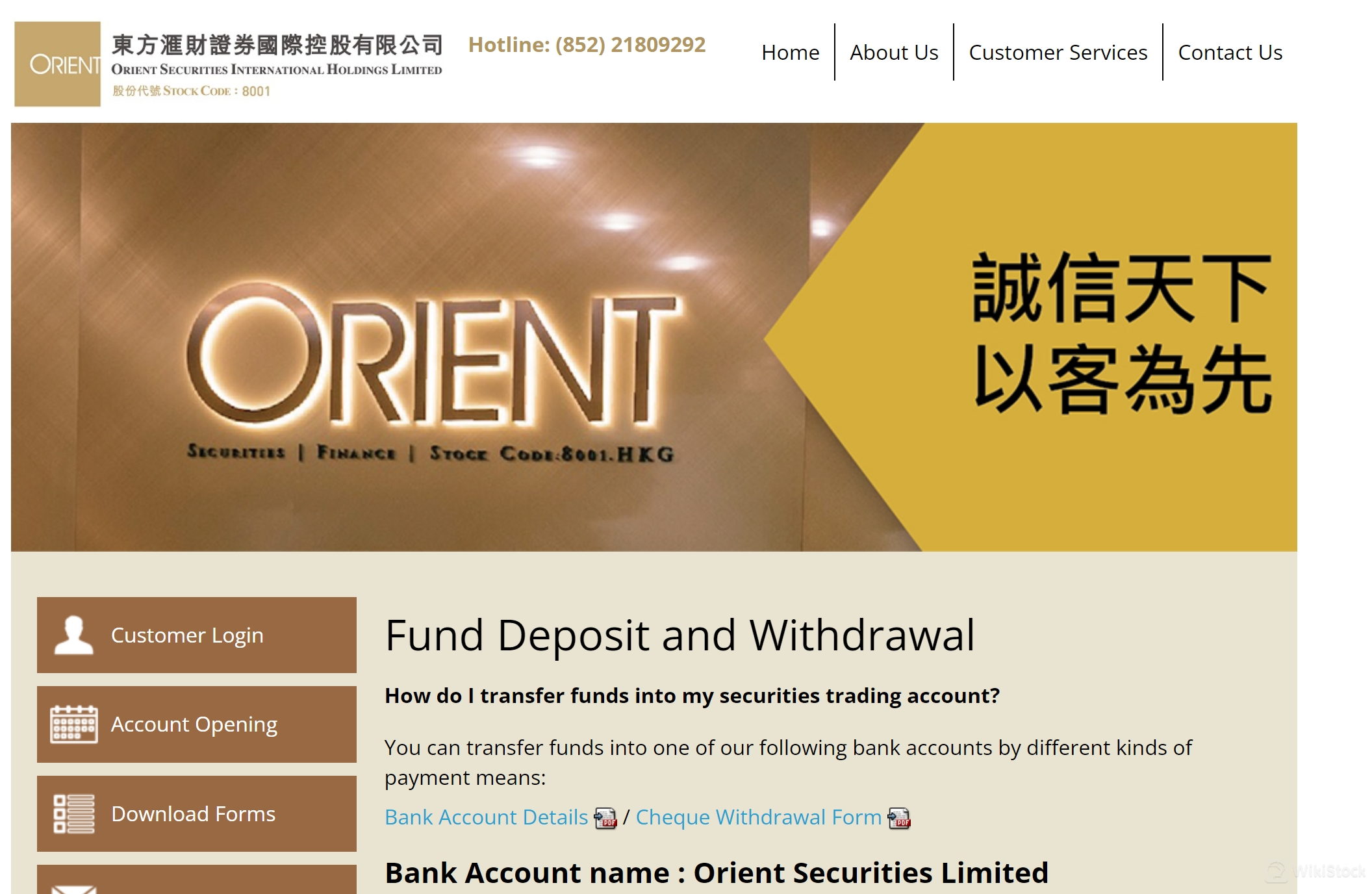

Customer Service

Orient Securities Limited provides customer support from their office located at Unit B, 8/F, Hip Shing Hong Centre, 55 Des Voeux Road Central, Hong Kong. Clients can reach out to their customer service team via phone at 2180 9292 or by fax at 2180 9288.

For additional support or inquiries, customers can also email the team at cs@orientsec.com.hk. This multi-channel support ensures that clients have various ways to contact Orient Securities for assistance with their accounts, trading activities, or any general questions they have.

Conclusion

Orient Securities Limited, based in Hong Kong, offers a range of financial services including trading in stocks, futures, options, and other derivatives.

With robust regulatory oversight by the Securities and Futures Commission (SFC), the company ensures high standards of compliance and security.

Clients benefit from an advanced online trading platform, diverse trading options, and a variety of educational and informational resources to support informed investment decisions.

The company's customer support is readily accessible via multiple channels, providing assistance and fostering client relationships.

FAQs

- What types of securities can I trade with Orient Securities Limited?

You can trade a variety of securities with Orient Securities Limited, including stocks, futures, options, and leveraged foreign exchange.

- How can I contact customer support at Orient Securities Limited?

Customer support can be reached at their office phone number 2180 9292, via fax at 2180 9288, or through email at cs@orientsec.com.hk.

- What measures does Orient Securities Limited take to ensure the safety of my investments?

Orient Securities Limited is regulated by the SFC, which ensures adherence to strict regulatory standards.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

Owns 1 seat(s)

China Hong Kong

China Hong Kong