Chaos International Financial Limited, an overseas wholly-owned subsidiary of Chaos Ternary Futures Co., Ltd., was founded in 2016 with the support of the parent company and shareholders. Nowadays, the company is vigorously participating in Hong Kong financial markets with brand-new image and promisingly leading Chaos group closer to an international enterprise. Upholding excellent professionalism and the spirit of integrity, the company achieves to be a first-class brokerage in Hong Kong and is committed to providing customers with comprehensive investment products and high-quality cross-border financial services.

What is Chaos International?

Chaos International shines with its regulation by the SFC in Hong Kong, offering clients peace of mind regarding security and compliance. However, it falls short by not supporting forex and cryptocurrency trading, potentially limiting trading opportunities for investors interested in these markets.

Pros and Cons of Chaos International?

Chaos International boasts regulation by the Securities and Futures Commission (SFC) in Hong Kong, ensuring adherence to stringent standards and providing clients with a sense of security and reliability. However, the platform does not support forex and cryptocurrency trading, limiting options for traders interested in these markets. One of its strengths lies in offering access to Initial Public Offerings (IPOs), providing clients with opportunities to invest in new listings. On the downside, Chaos International lacks a live chat feature, which may impede swift resolution of customer queries or concerns. Furthermore, the platform offers limited educational content, potentially hindering clients' ability to enhance their trading knowledge and skills effectively.

Is Chaos International safe?

Regulations

Chaos International is officially licensed by the Securities and Futures Commission (SFC) in Hong Kong, holding license numbers BMV833 and BJO832.

What are securities to trade with Chaos International?

Chaos International provides a diverse range of trading instruments, including HK stocks, global stocks, Shanghai Connect/Shenzhen Connect trading and HK & global futures. However, the broker does not offer forex and crypto trading.

With its membership in the Hong Kong Stock Exchange, Chaos International ensures a fast and efficient experience for trading HK stocks.

Through its global stock trading service, customers can access markets worldwide, including Hong Kong, Singapore, Japan, Australia, Europe, and the United States, via a single account.

Additionally, Chaos International facilitates securities trading through Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, enabling investors to trade eligible SSE Securities and SZSE Securities in its trading system.

Chaos International Accounts

Chaos International offers personal, organizational, and demo accounts. Personal accounts cater to individual investors, while organizational accounts serve institutions. Demo accounts provide a risk-free environment for practice and learning.

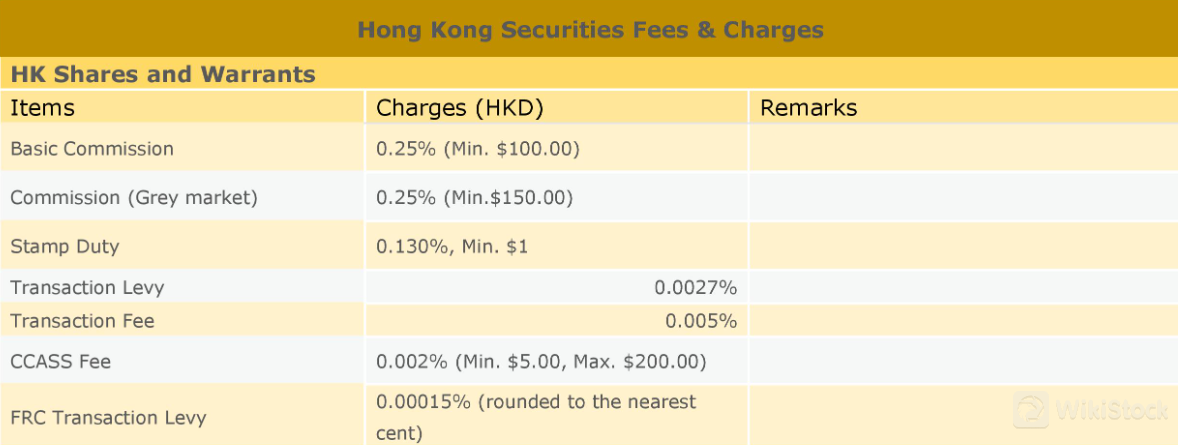

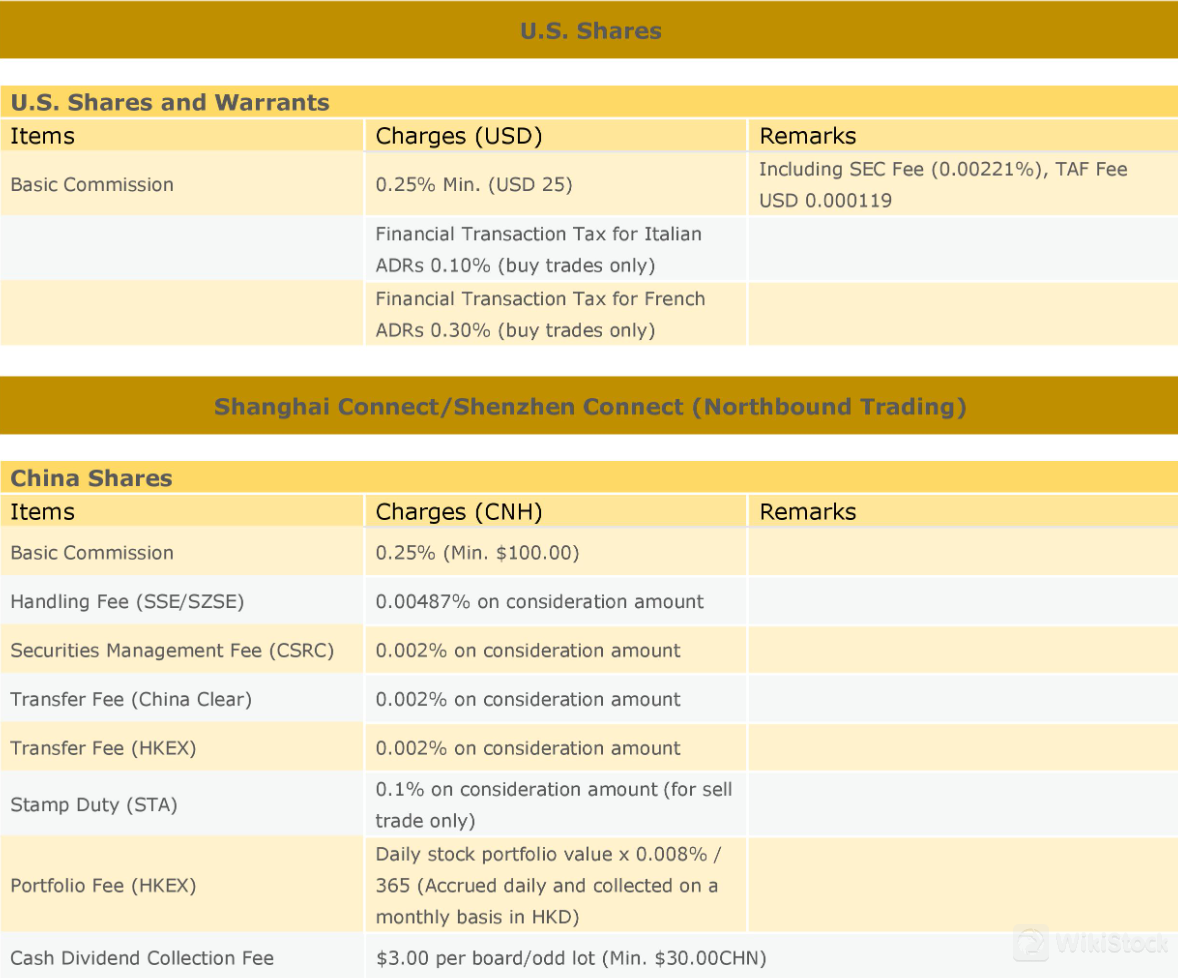

Chaos International Fees Review

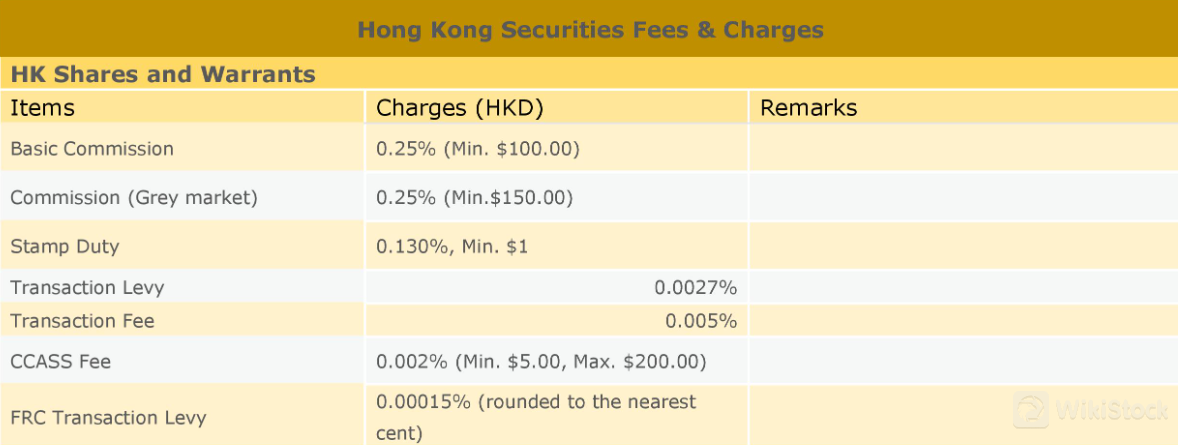

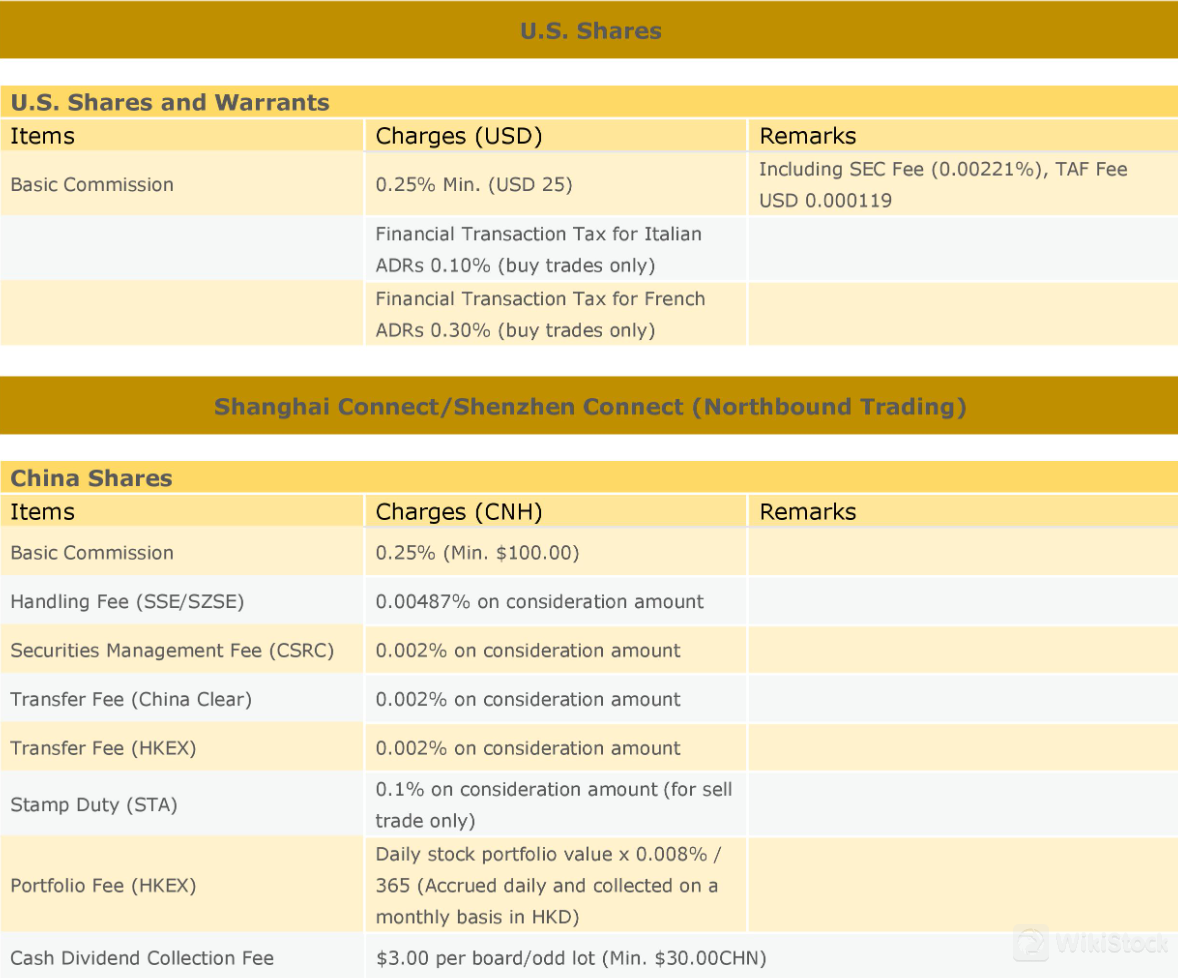

Chaos International presents a detailed structure of fees and charges across different trading markets to ensure transparency for its clients.

For Hong Kong shares and warrants, the basic commission is set at 0.25%, with a minimum of HK$100.00. Grey market commission follows the same rate but with a minimum of HK$150.00. Stamp duty is charged at 0.130%, with a minimum of HK$1, while transaction levy stands at 0.0027%. Additionally, there's a transaction fee of 0.005% and a CCASS fee of 0.002%, ranging from a minimum of HK$5.00 to a maximum of HK$200.00.

U.S. shares and warrants incur a basic commission of 0.25%, with a minimum of USD$25.00, alongside additional fees like SEC Fee and TAFFee. Notably, financial transaction taxes apply to Italian and French ADRs.

For Shanghai and Shenzhen Connect (Northbound Trading) dealing with China shares, the basic commission is consistent at 0.25%, with a minimum of CNH$100.00. Other charges include handling fees, securities management fees, transfer fees, and stamp duty.

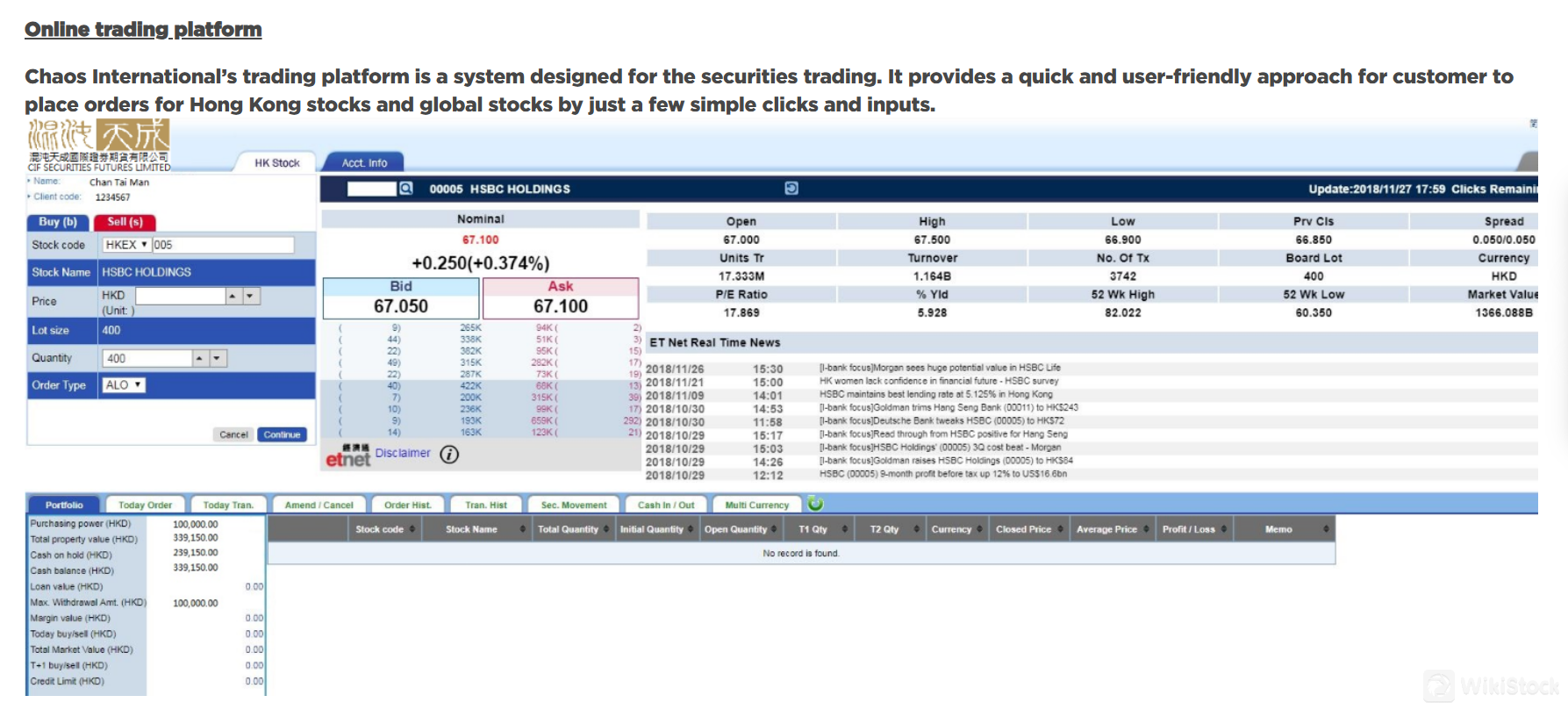

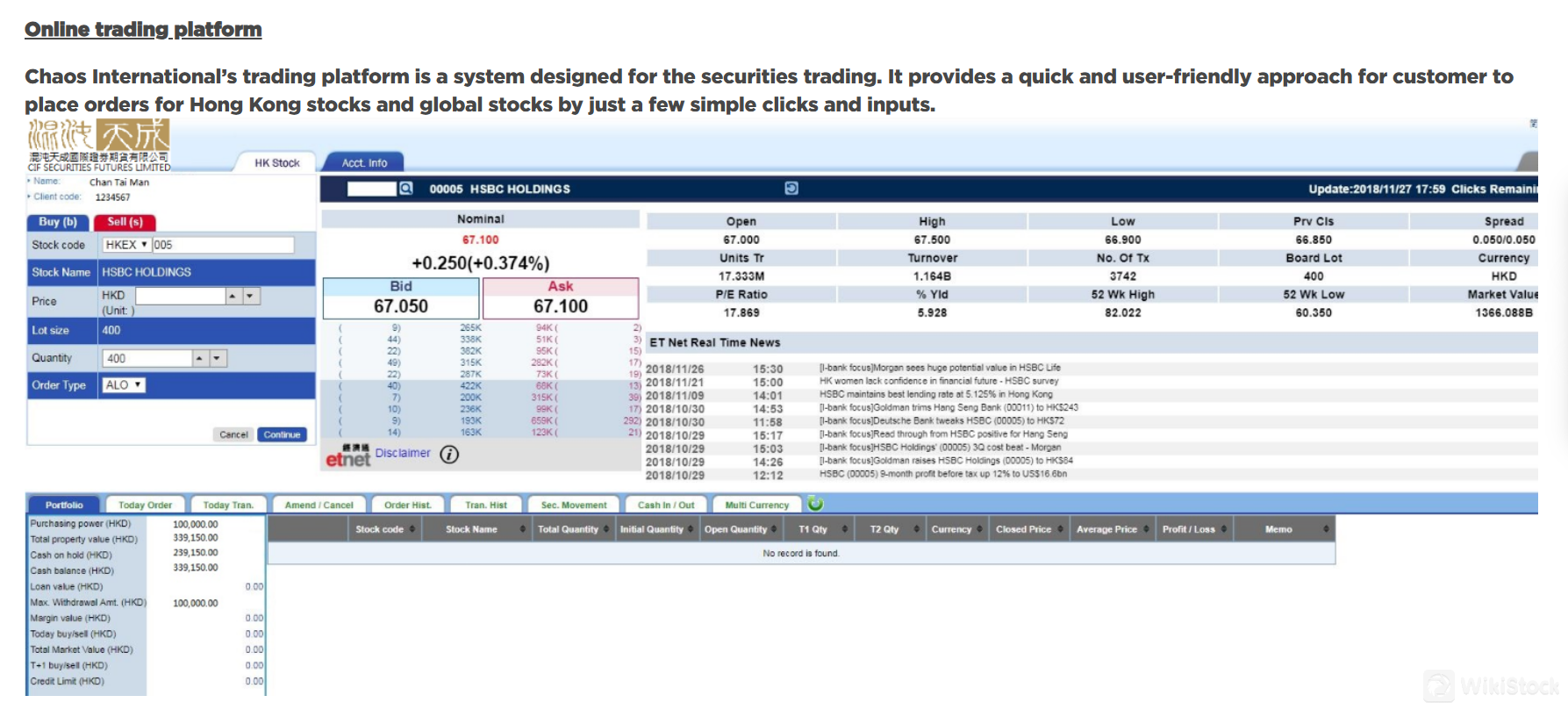

Chaos International App Review

Chaos International's online trading platform offers a quick and user-friendly interface, enabling customers to place orders for both Hong Kong and global stocks with just a few simple clicks and inputs. The platform is optimized for efficiency, ensuring a smooth and intuitive trading experience for users.

Additionally, Chaos International provides specialized futures trading software.

Customer Service

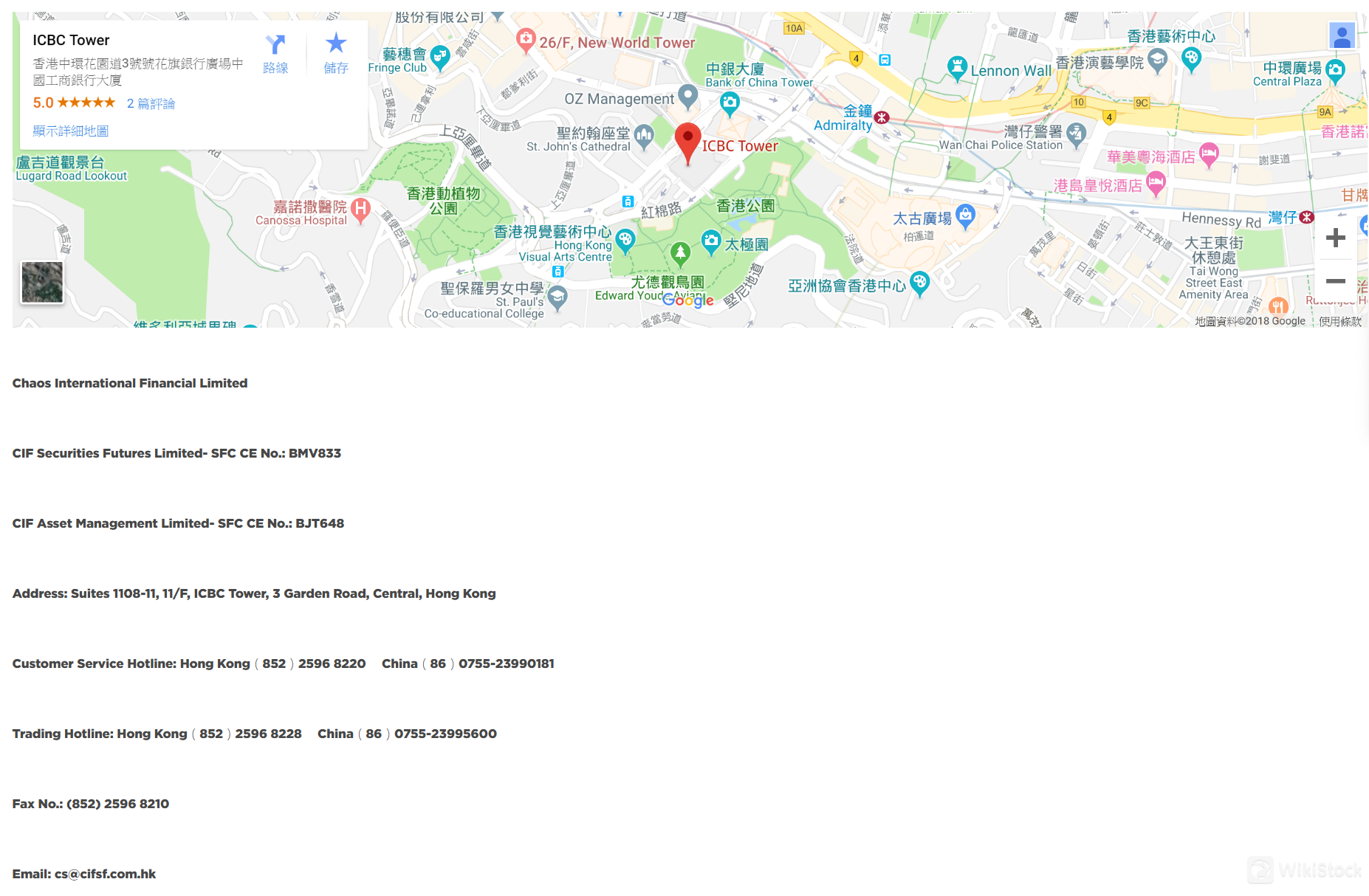

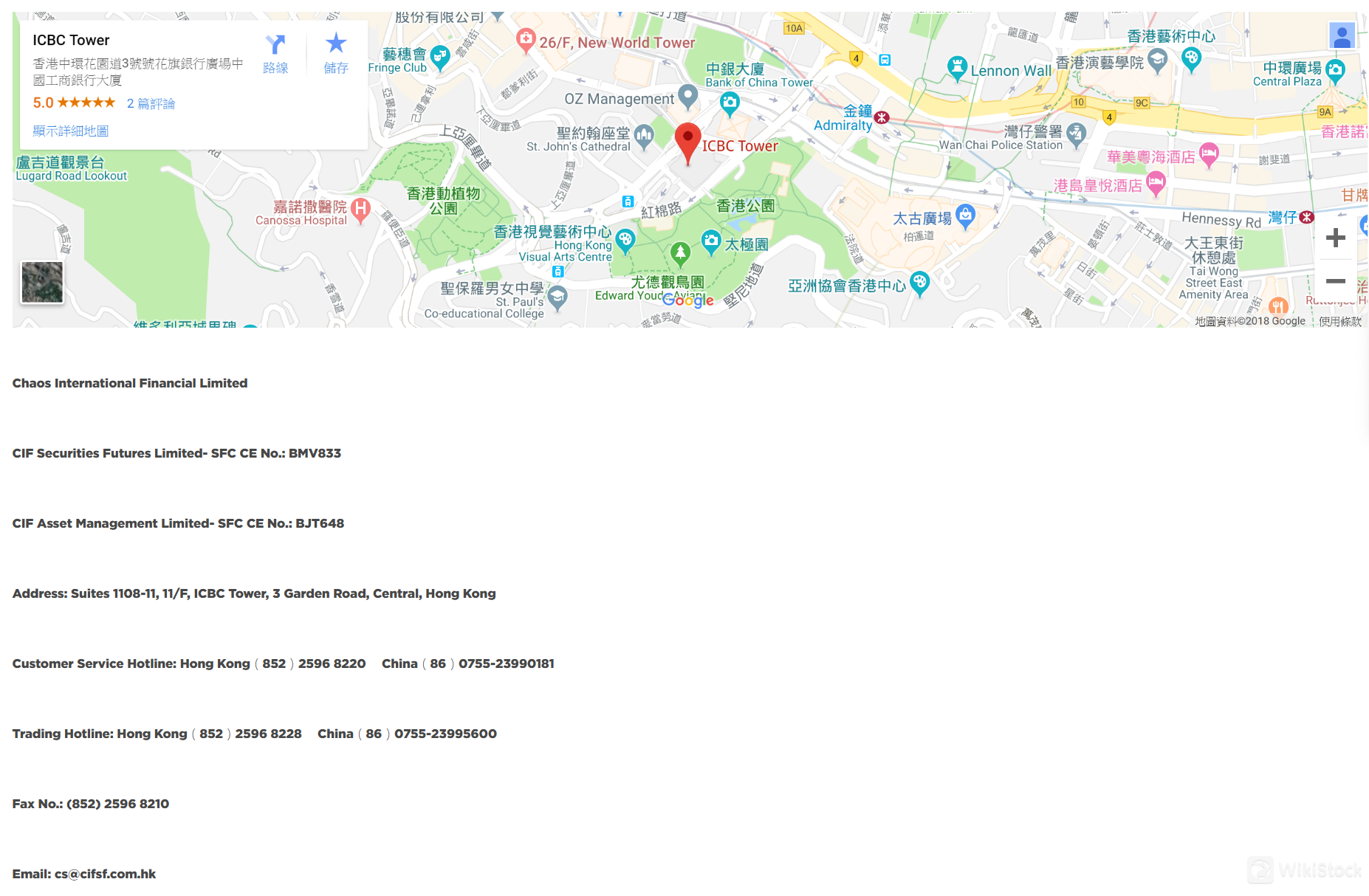

Customers can reach out to the customer service hotline in Hong Kong at (852) 2596 8220 or in China at (86) 0755-23990181. For trading inquiries, clients can contact the trading hotline in Hong Kong at (852) 2596-8228 or in China at (86) 0755-23995600. Additionally, inquiries can be made via fax at (852) 2596-8210 or through email at cs@cifsf.com.hk.

Conclusion

Chaos International stands out with its regulation by the Securities and Futures Commission (SFC) in Hong Kong, ensuring reliability and compliance for investors. Its offering of access to Initial Public Offerings (IPOs) provides opportunities for investors seeking new listings. This brokerage is well-suited for investors who prioritize regulatory oversight and are interested in participating in IPOs.

FAQs

Is Chaos International safe for trading?

Chaos International is officially licensed by the Securities and Futures Commission (SFC) in Hong Kong, providing a regulatory framework for investor protection. However, specific information regarding fund safety and safety measures is currently unavailable.

Is Chaos International suitable for beginners?

While Chaos International offers two trading platforms, it lacks comprehensive educational resources, which may present challenges for beginners seeking guidance and learning opportunities in the complex world of trading.

Is Chaos International legitimate?

Yes, Chaos International is legitimate, holding official licenses issued by the Securities and Futures Commission (SFC) in Hong Kong, with license numbers BMV833 and BJO832.

Risk Warning

The details presented are derived from WikiStock's proficient analysis of the brokerage's website data and may be subject to updates. Moreover, engaging in online trading carries significant risks, including the potential for complete loss of invested funds. Therefore, it is imperative to thoroughly understand the associated risks before participating in any trading activities.

United States

United StatesObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

Positive

Positive