China Goldlink Capital Group is committed to building a fully licensed, multi-functional financial boutique supermarket. We provide clients with professional, meticulous and butler-style wealth management services. China Goldlink Capital assists high-quality enterprises to be listed on Hong Kong Stock Exchange by providing related financial services, and furnishes enterprises with multi-platform financing channels such as equity financing and bond financing. Through China Goldlink Capital, clients can easily accomplish global asset allocation, achieve long-term, stable high returns and create a safest haven for families.

What is Goldlink Securities?

Goldlink Securities is a comprehensive brokerage firm regulated by the SFC of Hong Kong, offering a wide range of trading options, including stocks, bonds, funds, and derivatives, through an advanced trading platform and user-friendly mobile apps. The firm employs robust security measures to ensure client fund safety and data protection. However, the lack of detailed research resources and limited customer support hours are notable drawbacks.

Pros and Cons of Goldlink Securities

Goldlink Securities Limited offers a comprehensive suite of services backed by regulatory oversight and advanced security measures. The company is regulated by the SFC, providing clients with confidence in its compliance and operational integrity. It employs advanced encryption technologies and robust account security measures to protect client funds and information. However, the current emptiness of its 'Research Center' and the lack of detailed information on insurance coverage for client funds are notable drawbacks. Additionally, potential users might find the platform's customer support limited to office hours restrictive.

Is Goldlink Securities safe?

Regulation:

Goldlink Securities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The SFC is a reputable financial regulatory body that ensures the company adheres to stringent regulatory standards, providing a level of trust and assurance for clients. This regulation includes compliance with financial and operational guidelines aimed at protecting investors and maintaining market integrity.

Funds Safety:

Goldlink Securities takes several measures to ensure the safety of client funds. It includes insurance coverage for client accounts, although the specific insurance amount is not detailed. This insurance is designed to protect client funds in the event of unforeseen circumstances, adding an extra layer of security for investors.

Safety Measures:

To protect the storage and transfer of funds, Goldlink Securities employs advanced encryption technologies. These measures are crucial in safeguarding against unauthorized access and cyber threats. Additionally, the company implements robust account security measures to prevent information leaks and ensure the confidentiality of client data. These precautions include multi-factor authentication, regular security audits, and continuous monitoring of systems to detect and mitigate potential security breaches.

Overall, Goldlink Securities Limited appears to take comprehensive steps to ensure the safety and security of its clients' funds and information, bolstered by regulatory oversight and advanced security measures.

What are securities to trade with Goldlink Securities?

Goldlink Securities Limited, a wholly-owned subsidiary of China Goldlink Capital Group Limited, provides clients with an extensive array of trading options through its one-stop trading platform. The company is dedicated to delivering a comprehensive suite of investment products tailored to meet diverse client needs.

Stocks: Goldlink Securities offers a robust selection of equities from mainland China, Hong Kong, and global markets. Clients can trade shares of various companies listed on major stock exchanges, gaining access to a wide range of industries and sectors. This diversity allows investors to build well-rounded portfolios that align with their financial goals and risk tolerance.

Bonds: The company provides access to both government and corporate bonds, enabling clients to invest in fixed-income securities that offer regular interest payments and principal repayment at maturity. Bonds from different regions, including mainland China and Hong Kong, as well as international markets, are available, offering opportunities for income generation and portfolio diversification.

Funds: Clients can choose from a variety of mutual funds and exchange-traded funds (ETFs) that cater to different investment strategies and risk profiles. These funds are managed by professional fund managers and provide exposure to a wide range of asset classes, including equities, bonds, and commodities.

Derivatives: Goldlink Securities offers a selection of derivative products such as options, futures, and warrants. These financial instruments allow clients to hedge their positions, speculate on price movements, and enhance their trading strategies. The availability of derivatives across multiple markets, including mainland China and Hong Kong, provides additional flexibility and opportunities for sophisticated investors.

Other Investment Products: In addition to the traditional asset classes, Goldlink Securities provides access to a variety of other investment products. These may include structured products, real estate investment trusts (REITs), and alternative investments, offering clients further avenues for portfolio diversification and risk management.

By offering a comprehensive set of trading options across multiple markets, Goldlink Securities Limited ensures that clients have the tools and resources needed to achieve their investment objectives effectively. The company's commitment to providing a wide range of securities and investment products highlights its dedication to meeting the diverse needs of its clientele.

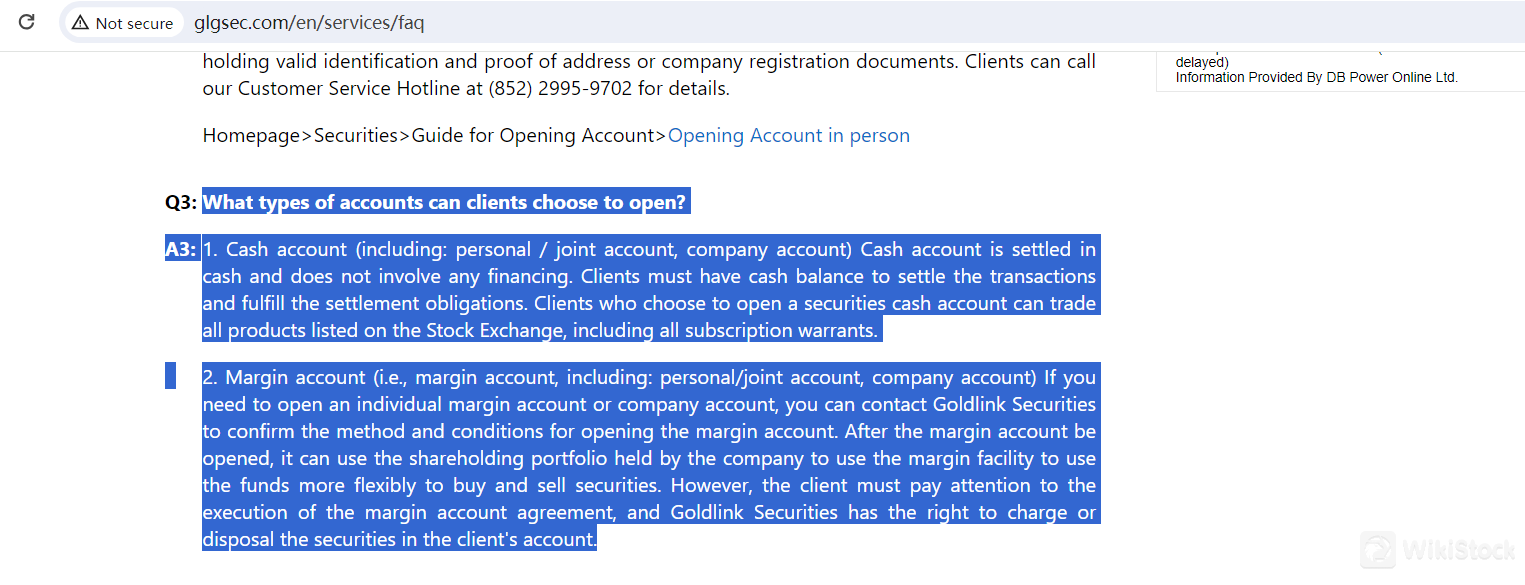

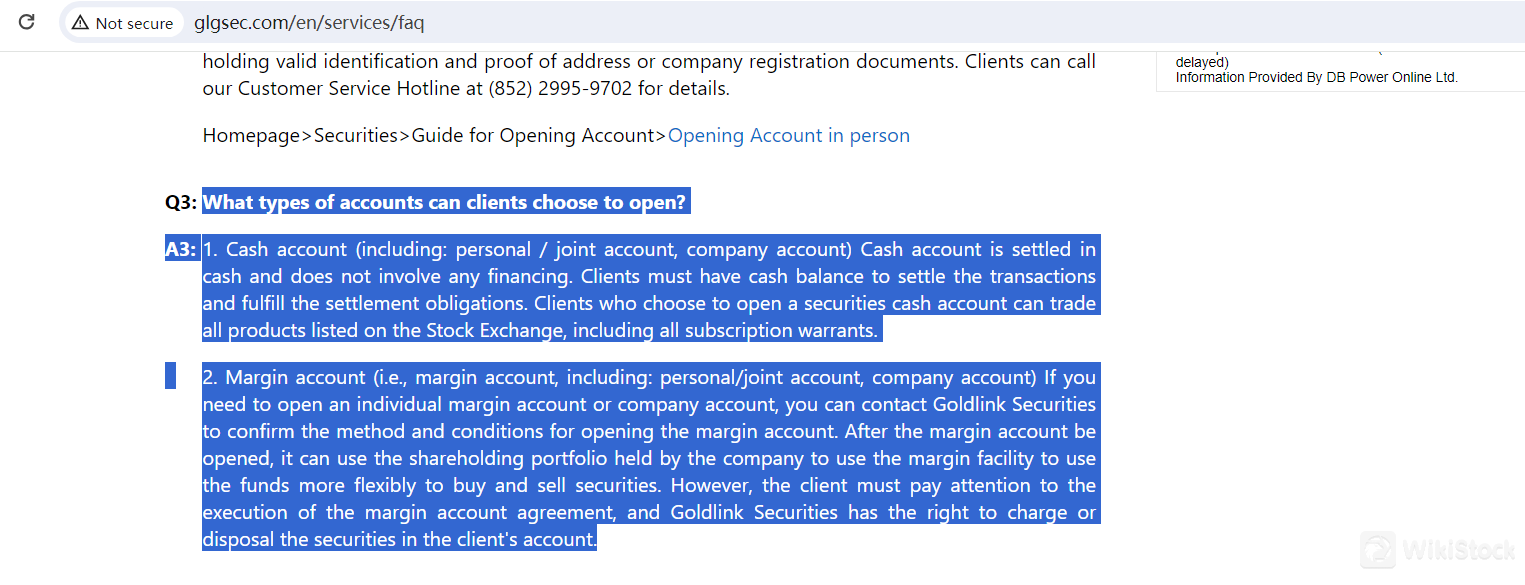

Goldlink Securities Accounts

Cash Account:

Goldlink Securities Limited offers a Cash Account, which can be opened as either a personal/joint account or a company account. This type of account requires clients to settle transactions in cash without involving any financing. Clients must have sufficient cash balances to cover their transactions and meet settlement obligations. The Cash Account allows clients to trade all products listed on the Stock Exchange, including subscription warrants, providing a straightforward and transparent trading experience. This account type is ideal for investors who prefer to manage their investments with available funds, avoiding the complexities associated with borrowing and interest charges.

Margin Account:

For those seeking more flexibility in their trading activities, Goldlink Securities offers a Margin Account, available as both personal/joint accounts and company accounts. This account type enables clients to leverage their existing shareholding portfolio to obtain a margin facility, allowing them to use borrowed funds to buy and sell securities. This can significantly enhance purchasing power and investment opportunities. However, clients must adhere to the terms of the margin account agreement, as Goldlink Securities retains the right to charge or dispose of the securities in the client's account if necessary. The Margin Account is suitable for investors looking to maximize their investment potential through leveraged trading, though it comes with higher risks and the need for careful management to avoid margin calls.

Both account types are supported by Goldlink Securities' advanced trading platforms and comprehensive services, ensuring clients have the tools and resources necessary to achieve their investment goals efficiently and effectively.

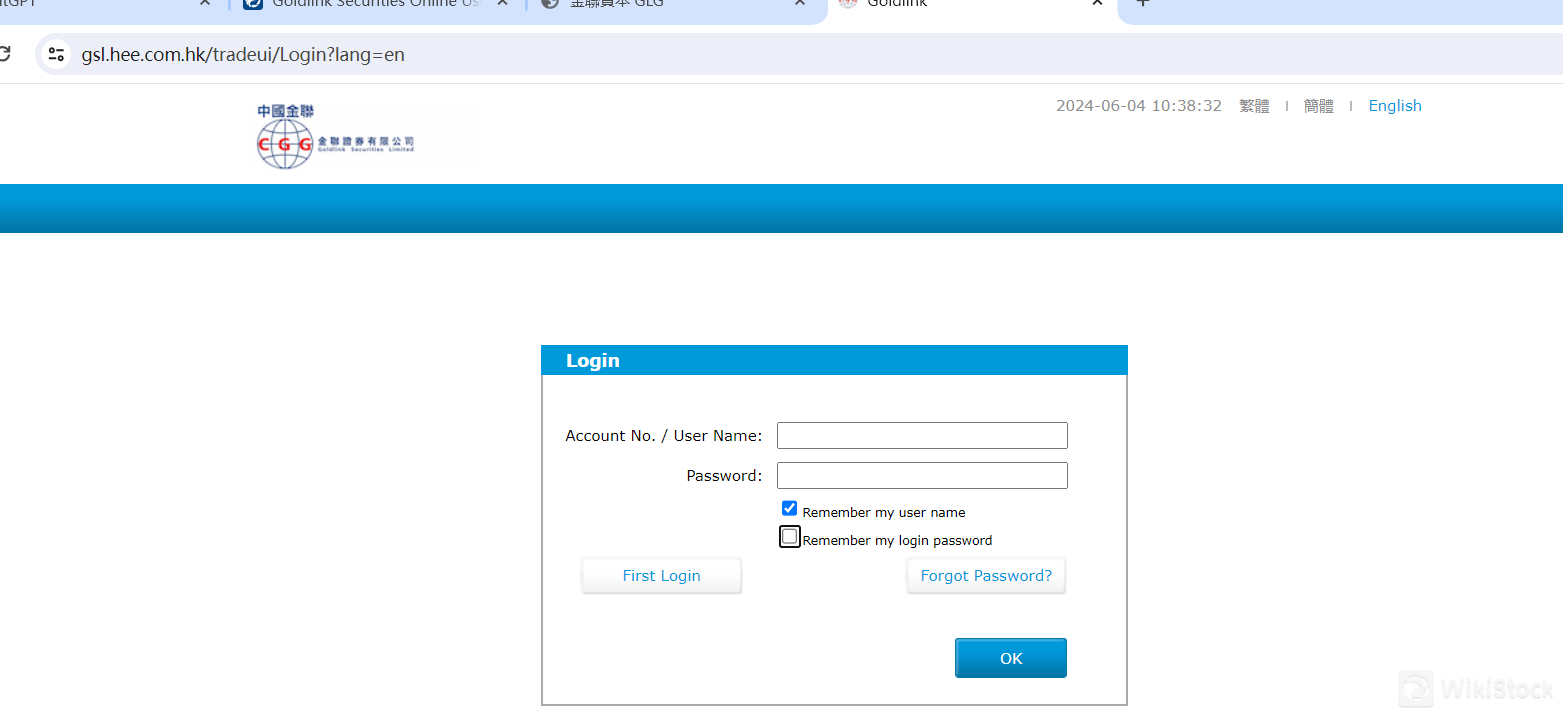

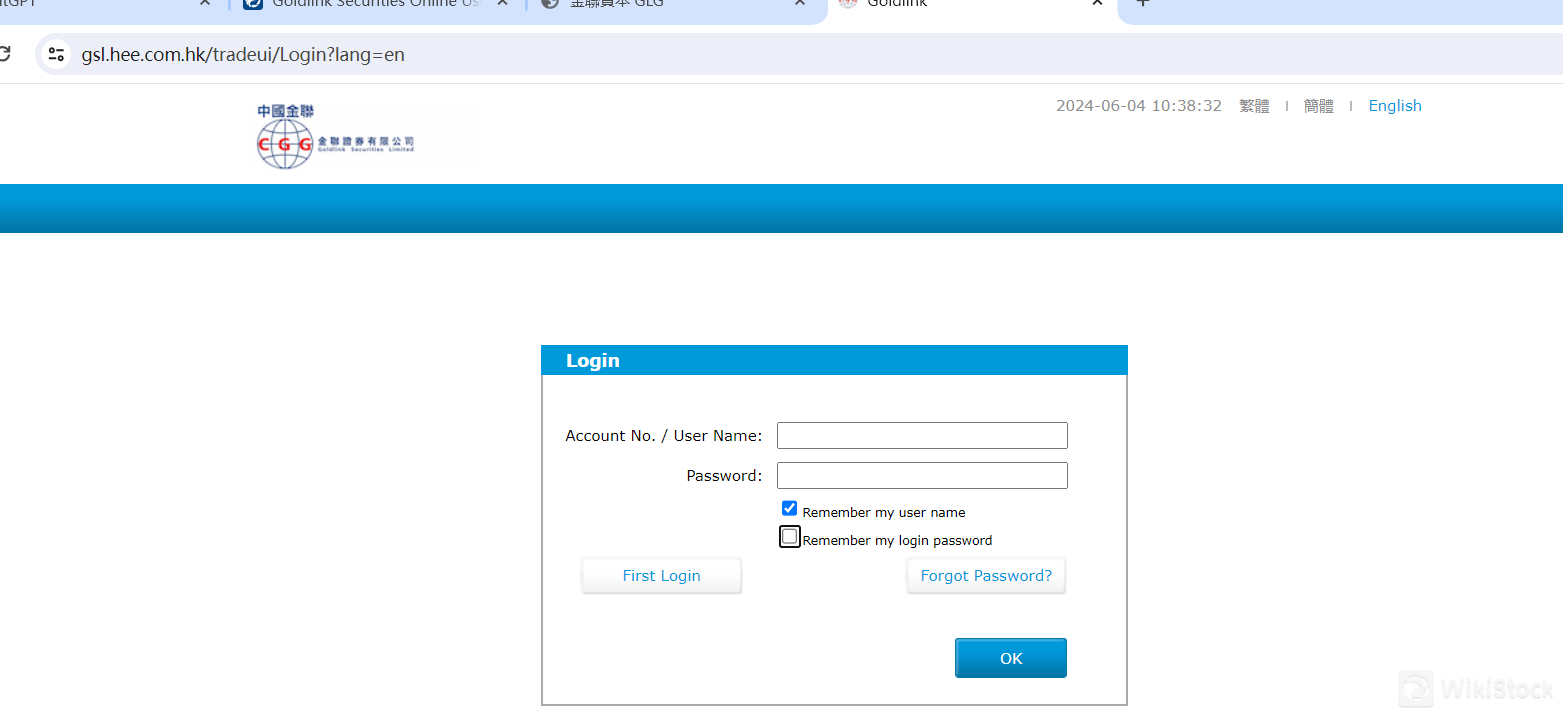

Goldlink Securities App Review

Goldlink Securities Limited offers a robust and versatile trading platform designed to meet the diverse needs of its clients. This platform includes both an Online Trading System and Mobile Apps, providing seamless access to global financial markets and a wide range of trading options.

Online Trading System:

The Online Trading System by Goldlink Securities is a comprehensive, user-friendly platform that caters to both novice and experienced investors. It allows clients to trade a variety of securities, including stocks, bonds, funds, and derivatives, across mainland China, Hong Kong, and international markets. The platform is equipped with advanced features such as real-time market data, sophisticated charting tools, and detailed research reports, empowering clients to make informed investment decisions. Additionally, the system offers robust security measures to protect client information and transactions, ensuring a safe and reliable trading experience. The intuitive interface and powerful functionalities make the Online Trading System an essential tool for managing investments efficiently.

Mobile Apps:

Complementing the Online Trading System, Goldlink Securities provides Mobile Apps that offer the convenience of trading on the go. Available for both iOS and Android devices, these apps deliver the full suite of trading services directly to clients' smartphones or tablets. The Mobile Apps are designed with a focus on ease of use, featuring a clean, intuitive interface that makes it easy to execute trades, monitor portfolios, and access market information from anywhere. Clients can receive real-time notifications, view live prices, and execute trades with just a few taps. The apps also incorporate advanced security protocols to ensure that all transactions and personal data remain secure. Whether clients are commuting, traveling, or simply away from their desktops, the Mobile Apps provide the flexibility and accessibility needed to stay connected to the markets at all times.

By offering both an Online Trading System and Mobile Apps, Goldlink Securities ensures that clients have access to a comprehensive and versatile trading platform. This dual approach enables investors to manage their portfolios effectively, regardless of their location or preferred method of trading, ensuring a seamless and efficient investment experience.

Research and Eduation

Goldlink Securities Limited claims to provide a dedicated section called the 'Research Center' on its platform. However, this section is currently empty, rendering it useless for clients seeking insights and analyses to support their trading and investment decisions. The promised research reports, including market analysis, sector reviews, and company-specific studies, are notably absent. As a result, clients are left without the up-to-date and comprehensive information needed to stay informed about market trends and make well-informed investment choices. This empty section undermines the company's commitment to offering valuable resources for its clients.

Customer Service

Goldlink Securities Limited offers customer support through a dedicated Customer Service Hotline, available at (852) 2995-9702 during office hours from Monday to Friday, 9:00 am to 5:30 pm. Clients can also reach out via email at info@glgsec.com for assistance with any queries or issues. This support structure ensures that clients have access to help and information when needed, facilitating a smoother trading and investment experience.

Conclusion

Goldlink Securities Limited, a subsidiary of China Goldlink Capital Group Limited, offers a comprehensive suite of investment services regulated by the Securities and Futures Commission (SFC) of Hong Kong. With advanced security measures and a versatile trading platform that includes both an Online Trading System and Mobile Apps, the company provides access to a wide range of securities such as stocks, bonds, funds, and derivatives across multiple markets. However, the absence of detailed research resources and limited customer support hours are notable drawbacks. Overall, Goldlink Securities aims to deliver a robust and secure trading experience, catering to diverse client needs.

FAQs

Is Goldlink Securities safe to trade?

Yes, Goldlink Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong. This regulation ensures that the company adheres to stringent financial and operational guidelines, providing a high level of trust and assurance for clients. Additionally, Goldlink Securities employs advanced security measures to protect client funds and information.

Is Goldlink Securities a good platform for beginners?

Goldlink Securities offers a user-friendly trading platform that includes both an Online Trading System and Mobile Apps. These platforms provide access to a wide range of securities, real-time market data, and advanced charting tools, making it suitable for beginners. However, the current lack of detailed research resources might be a drawback for those who rely heavily on market analysis and insights.

Is Goldlink Securities legit?

Yes, Goldlink Securities is a legitimate brokerage firm regulated by the SFC of Hong Kong. The company's compliance with regulatory standards ensures its legitimacy and operational integrity.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Malaysia

MalaysiaObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--