CHIEF Accounts

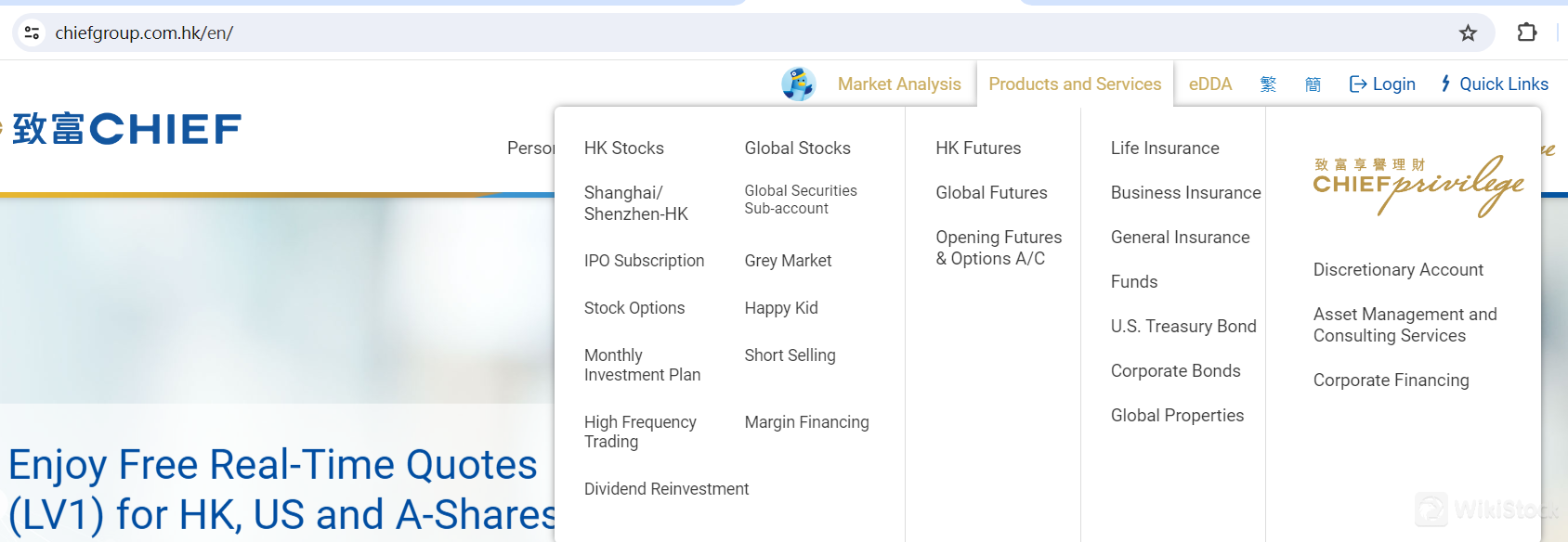

CHIEF offers several account types to cater to different investment needs:

Securities Account: This account allows for trading in Hong Kong stocks, U.S. stocks, and stocks through the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect programs. It's suitable for investors looking to diversify their portfolios with access to multiple stock markets.

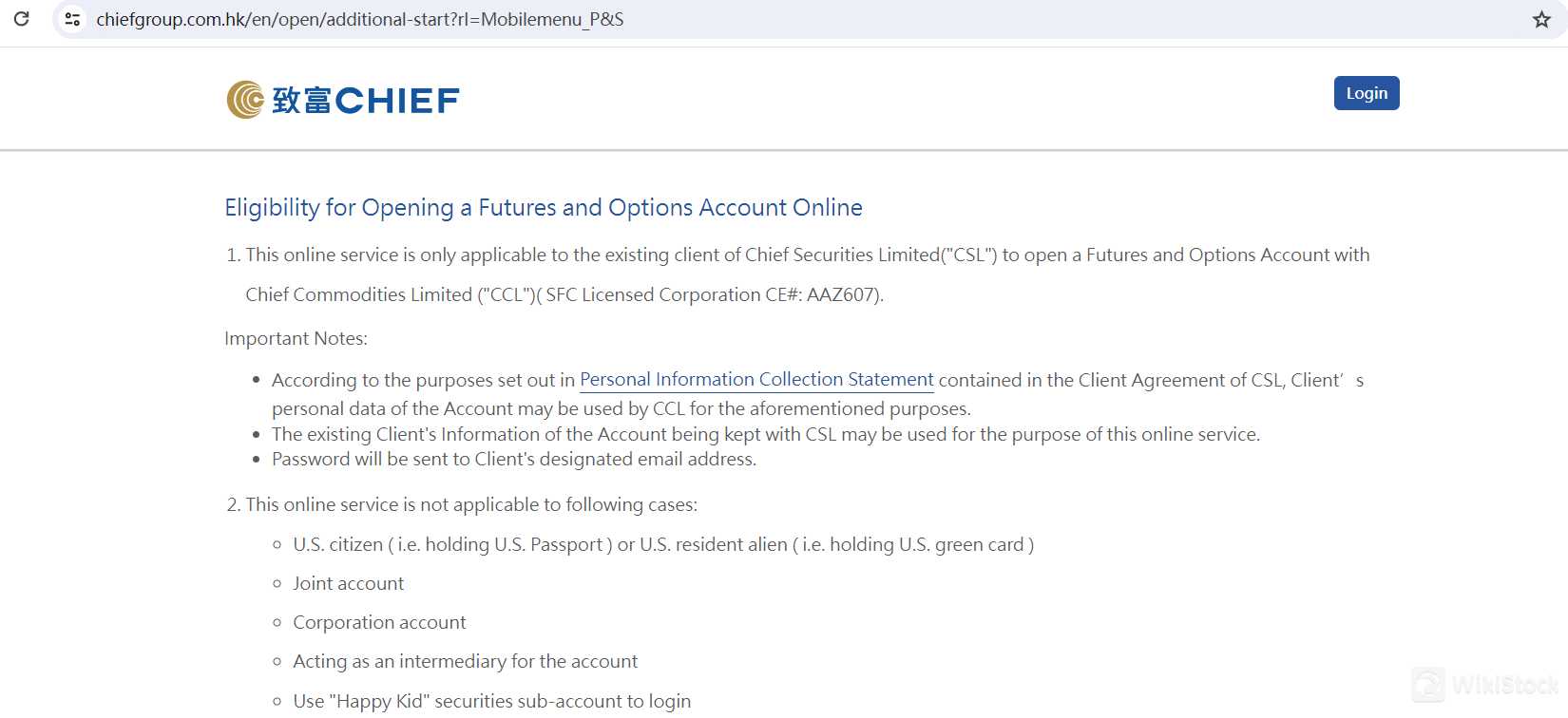

Futures and Options Account: Designed for trading in futures and options, this account type provides access to various global futures markets. It's ideal for investors interested in hedging, speculation, or leveraging market movements. CHIEF offers both Hong Kong futures and global futures options.

Stock Options Account: This account is specifically for trading Hong Kong stock options. It is suitable for investors who want to trade options to manage risk or leverage their positions with potentially lower capital requirements compared to direct stock investments.

Cash Account: A standard account for general securities trading with real-time transaction capabilities. This type of account is suitable for everyday investors looking for straightforward trading options without the complexities of margin trading.

Margin Account: This account allows for trading on margin, enabling investors to borrow funds to increase their buying power. It's ideal for more experienced traders who want to leverage their positions in the stock market.

Wealth Management Account: his account provides comprehensive financial management services, including asset management and financial planning. It's tailored for clients seeking a holistic approach to managing their investments and achieving long-term financial goals.

Corporate and Institutional Accounts:

CHIEF also offers specialized accounts for corporate and institutional investors, providing tailored services to meet the unique needs of businesses and large organizations.

CHIEF Fees Review

CHIEF provides various account types with specific fee structures. Here's a detailed review of their fees:

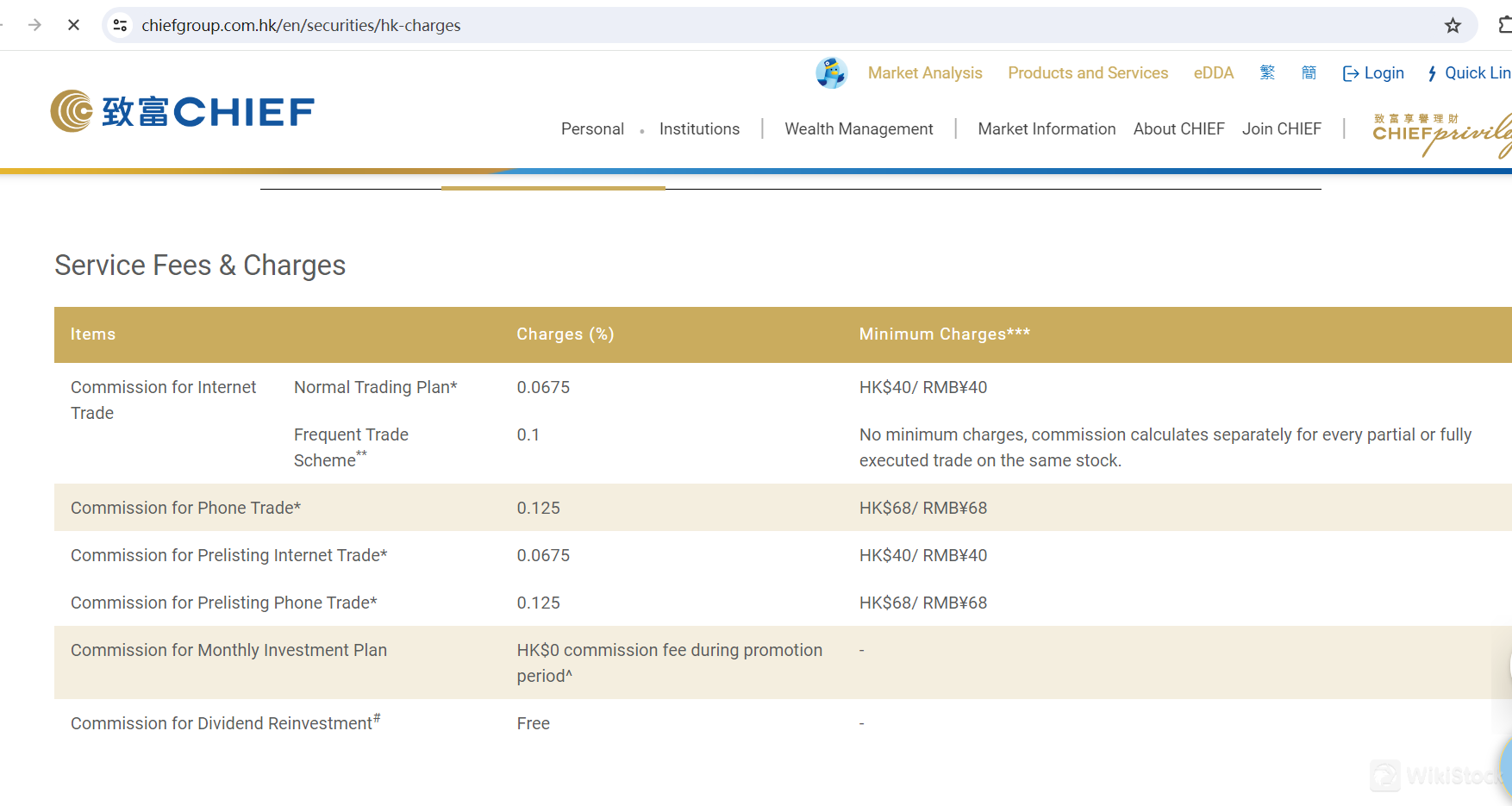

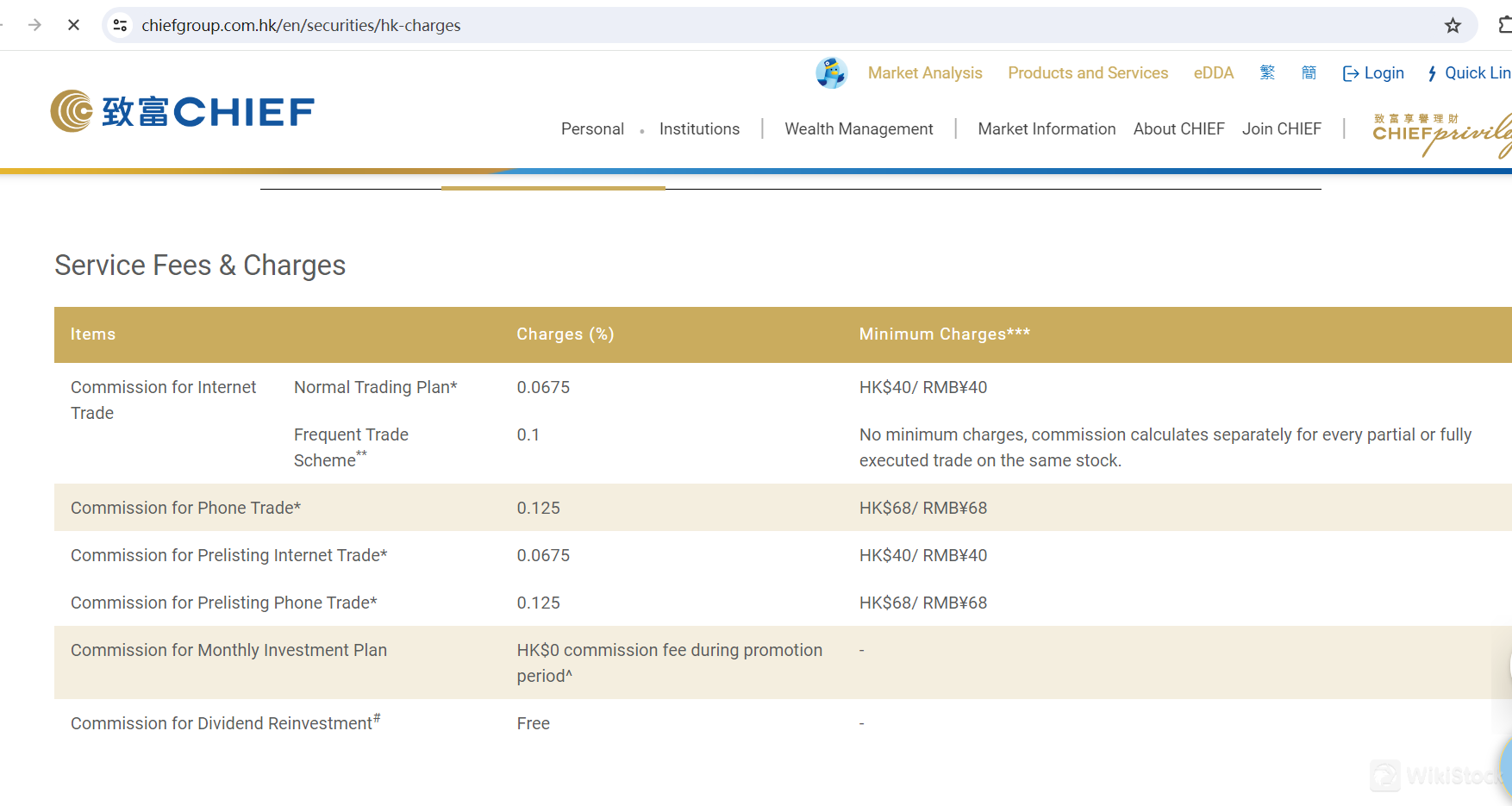

Hong Kong Stocks:

Commission for Internet Trade: 0.0675% with a minimum charge of HK$40 or RMB¥40.

Frequent Trade Scheme: 0.1% with no minimum charges. This scheme calculates commission separately for each partial or fully executed trade on the same stock.

Commission for Phone Trade: 0.125% with a minimum charge of HK$68 or RMB¥68.

Dividend Reinvestment: Free, but clients need to pay stamp duty, SFC transaction levy, HKEX trading fee, and CCASS stock settlement fee.

Futures and Options:

HSI Futures: HK$30 per contract for day trading via the internet, with an additional trading fee of HK$10 and a transaction levy of HK$0.54.

MHI Futures: HK$12 per contract for day trading via the internet, with a trading fee of HK$3.5 and a transaction levy of HK$0.1.

Stock Futures: HK$5 per contract for day trading via the internet, with tiered transaction levies.

Frequent Trade Online Trading Commission Plan:

Provides a flat commission rate of 0.1% for online trading of Hong Kong stocks, Shanghai-Hong Kong Stock Connect, and Shenzhen-Hong Kong Stock Connect. The minimum charge can be as low as HK$0.01. This plan does not combine trades, so the commission is charged for every partial or fully executed trade individually.

Monthly Investment Plan:

Offers a HK$0 commission fee during the promotion period for the first HK$10,000 of each stock contribution amount for online applications made before December 31, 2024. Clients still need to pay stamp duty, HKEX trading fee, SFC transaction levy, and CCASS stock settlement fee.

CHIEF App Review

CHIEF's mobile application offers a comprehensive trading platform with real-time quotes for Hong Kong, U.S., and A-shares. The app supports trading of stocks, futures, and options, including those through the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect programs. It features robust portfolio management tools, customizable watchlists, and market alerts, making it suitable for both novice and experienced investors. The app's user-friendly interface and multilingual support enhance its accessibility, while its real-time data and efficient trading functionalities are highly praised by users.

Despite its strengths, some users have reported occasional bugs and glitches, and there are calls for additional features such as advanced charting tools. Overall, Chief Trader is valued for its reliability, security, and ease of use, making it a solid choice for investors looking to manage their portfolios and execute trades on the go. Continuous updates based on user feedback could further improve the app's functionality and user experience.

Research and Eduation

CHIEF offers a range of research and education resources to help investors make informed decisions. Their research resources include detailed market reports, company analyses, and real-time market data. These reports cover a variety of financial instruments, providing insights into market trends and economic indicators. Regularly published research reports by their team of analysts offer expert recommendations on investment opportunities.

For education, CHIEF provides an Investment Education Zone with materials on stock, futures, and options trading, as well as financial planning. They offer tutorials, webinars, and a comprehensive glossary to enhance investors' understanding. The platform also provides regular market news updates to keep investors informed about important events. These resources aim to empower investors with the knowledge and tools needed to succeed in the financial markets.

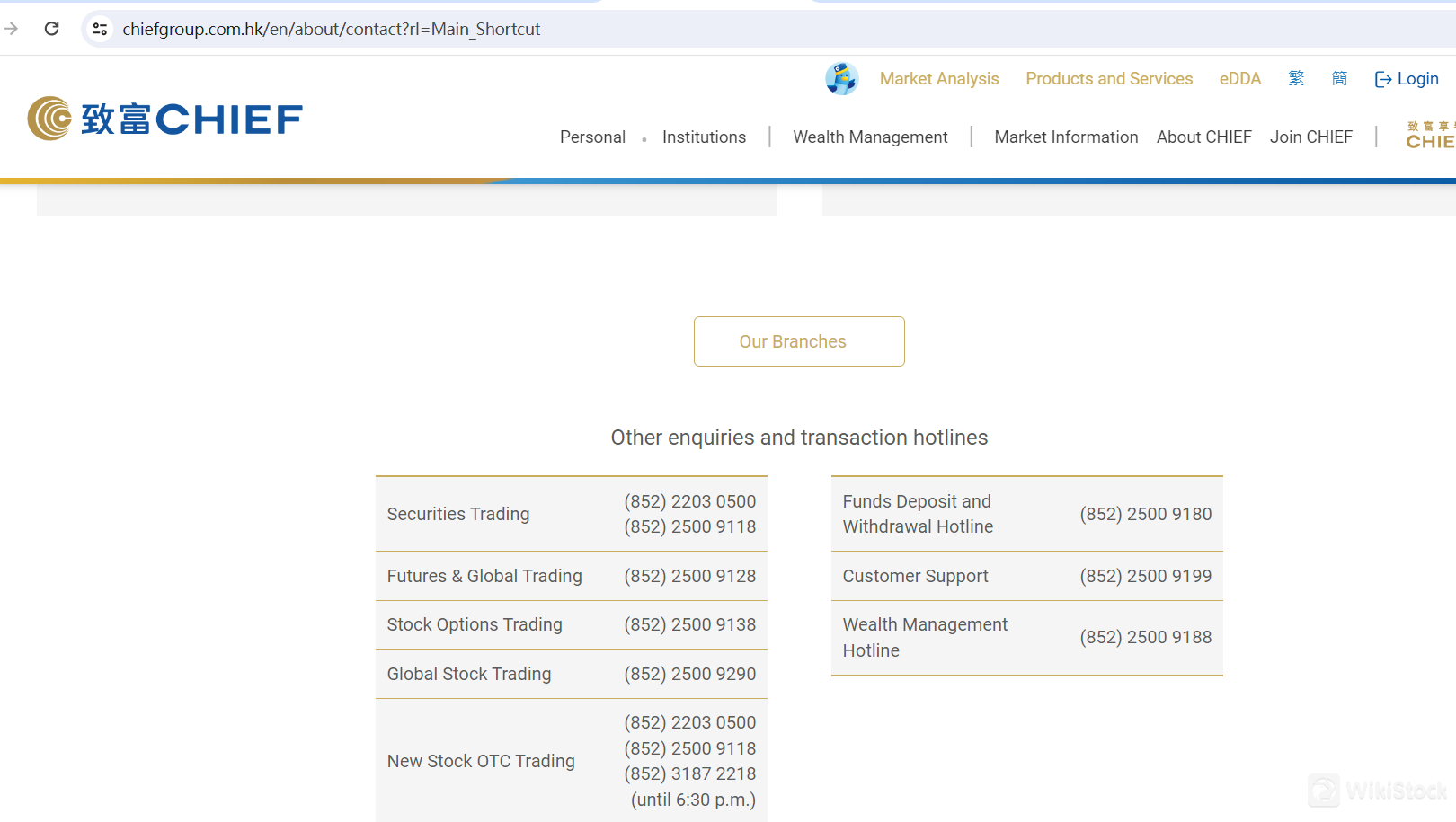

Customer Service

CHIEF offers comprehensive customer support to cater to a wide range of client needs. They provide multiple channels for contact, including an official WhatsApp line and a customer support hotline at (852) 2500 9199. For general inquiries, clients can emailinfo@chiefgroup.com.hk, while customer support-related emails can be directed to cs@chiefgroup.com.hk. The main office and Chief Privilege Centre are located at 5/F, World-Wide House, 19 Des Voeux Road Central, Hong Kong, ensuring a centralized location for in-person support.

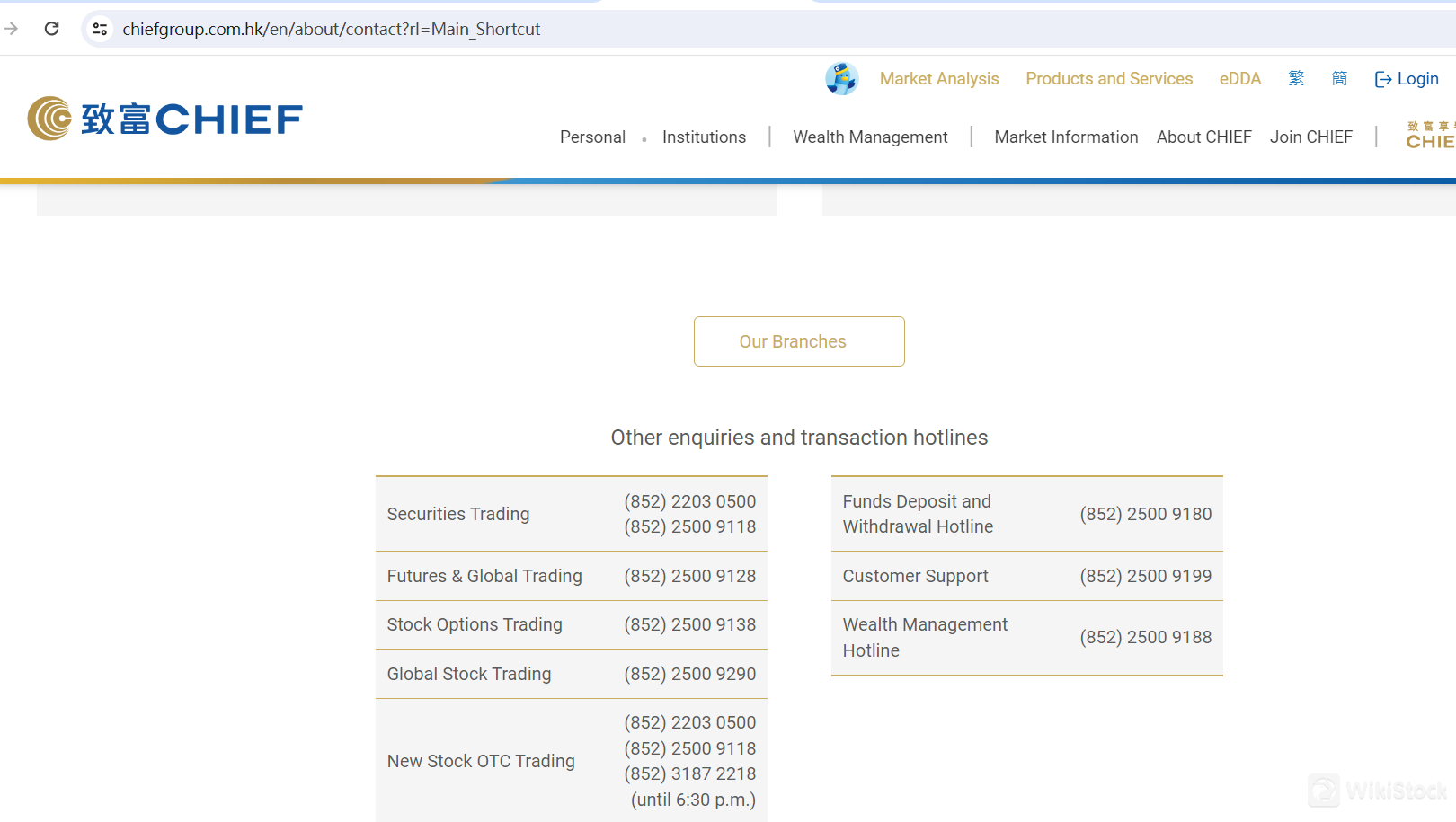

In addition to general support, CHIEF has dedicated hotlines for various services. These include securities trading, futures and global trading, stock options trading, global stock trading, new stock OTC trading, and funds deposit and withdrawal. Each service has its own specific contact numbers, allowing clients to get specialized assistance. For wealth management inquiries, the hotline is (852) 2500 9188. CHIEF also provides an online form for inquiries, suggestions, compliments, or complaints, ensuring that all customer feedback is addressed promptly.

Conclusion

CHIEF is a well-regulated financial services provider known for its low fees and user-friendly trading app that offers a wide range of trading products, including stocks, futures, and options. The platform also provides comprehensive customer support and robust security measures. However, it occasionally experiences app bugs and has relatively high minimum charges for certain trades.

FAQs

Is CHIEF safe to trade?

Yes, CHIEF is considered safe to trade. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which ensures that the company adheres to strict regulatory standards. The company also employs advanced encryption technologies and two-factor authentication to protect client funds and personal information. Additionally, client funds are segregated from the companys assets, and there is insurance coverage for client accounts.

Is CHIEF a good platform for beginners?

CHIEF is a good platform for beginners due to its user-friendly trading app, comprehensive educational resources, and robust customer support. The platform offers tutorials, webinars, and detailed market reports to help new investors learn about trading. However, beginners should be aware of the relatively high minimum charges for certain trades and consider these costs in their investment strategy.

Is CHIEF legit?

Yes, CHIEF is a legitimate financial services provider. It holds various licenses under the SFC, confirming its compliance with regulatory requirements. The company's legitimacy is further supported by its long-standing presence in the market and the extensive range of services it offers to both individual and institutional investors.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

Positive

Positive