Grandly Financial Group was formed in 2013, with the mission to provide a comprehensive range of investor services. We pledge to offer secure, complete, efficient and personalized financial services to our clients through our two licensed corporations, Grandly Financial Services Ltd and Smart Grandly Asset Management Ltd.

What is Grandly Financial Group?

Grandly Financial Group offers low-cost trading with user-friendly apps for both desktop and mobile, catering to global futures and options investors. It is known for its comprehensive customer support and detailed research resources. However, detailed insurance coverage information is not readily available.

Pros and Cons of Grandly Financial Group

Grandly Financial Services Group offers a robust range of trading products and services with a focus on futures and securities. It is regulated by the Securities and Futures Commission (SFC) in Hong Kong, ensuring compliance with high regulatory standards. The group also provides comprehensive customer support and advanced trading platforms for both desktop and mobile users. However, detailed information about the insurance coverage for client funds is not readily available, and some fees may be relatively high compared to other service providers.

Is Grandly Financial Group safe?

Regulation

Grandly Financial Services Group is regulated by the Securities and Futures Commission (SFC) in Hong Kong, ensuring compliance with stringent financial regulations and standards.

Funds Safety: Grandly Financial Services Group provides insurance for client account funds, though specific coverage amounts were not detailed in the provided information. It is advisable to contact them directly for precise details regarding the insurance coverage for client funds.

Safety Measures: The company employs encryption technologies to secure the storage of funds and prevent unauthorized access. Additionally, they implement robust account security measures to protect user information from potential breaches and leaks. These measures ensure that client data and funds are safeguarded against cyber threats and unauthorized access.

For more detailed information, contacting Grandly Financial Services Group directly or visiting their official website when accessible would provide further insights into their safety protocols and insurance specifics.

What are securities to trade with Grandly Financial Group?

Grandly Financial Services Group offers a comprehensive suite of trading products, focusing on both futures and securities. Their futures trading services encompass a variety of financial instruments, catering to diverse market needs and allowing clients to engage in both speculative and hedging activities. This includes futures contracts on commodities, indices, currencies, and interest rates, providing opportunities for traders to capitalize on market movements or manage risks associated with price volatility. The futures trading platform is designed to support high-frequency trading and sophisticated strategies, ensuring that clients have the tools and resources necessary to succeed in a dynamic market environment.

In the securities market, Grandly provides access to an extensive range of stocks, bonds, and other equity products, facilitating investments across a multitude of sectors and geographies. This wide array of securities enables investors to build diversified portfolios tailored to their individual investment goals and risk tolerance. Grandly's offerings include blue-chip stocks, emerging market equities, government and corporate bonds, and other financial instruments that offer varying levels of risk and return.

The company‘s services are designed to meet the needs of both individual investors and institutional clients. Individual investors can benefit from user-friendly trading platforms, comprehensive research and analysis tools, and personalized customer support. Institutional clients, on the other hand, can leverage Grandly’s advanced trading solutions, customized investment strategies, and dedicated account management services.

Overall, Grandly Financial Services Group ensures a versatile and robust trading experience, with a focus on innovation, reliability, and client satisfaction. Their commitment to providing high-quality trading services and products makes them a trusted partner for investors looking to navigate the complexities of the financial markets.

Grandly Financial Group Fees Review

Hong Kong Securities

For transaction commission, Grandly Financial Services Group charges a rate of 0.25% on the gross amount of the transaction, with a minimum fee of HK$100. Stamp duty is levied at 0.1% of the gross amount, rounded up to the nearest dollar.

The transaction levy imposed by the Securities and Futures Commission (SFC) is 0.0027% of the gross amount, with a minimum charge of HK$0.01. Additionally, the Hong Kong Exchanges and Clearing Limited (HKEx) trading fee is set at 0.00565% of the gross amount, also with a minimum charge of HK$0.01.

For stock settlement, the Hong Kong Securities Clearing Company Limited (HKSCC) charges 0.002% of the gross amount, with the fees ranging from a minimum of HK$2 to a maximum of HK$100. The Accounting and Financial Reporting Council (AFRC) transaction levy is 0.00015% of the gross amount, with a minimum fee of HK$0.01. The investor compensation levy has been waived since 2005 until further notice.

The Italian Financial Transaction Tax applies to Italian companies listed in Hong Kong, charging 0.1% on the net settlement amount.

Scrip Handling and Settlement Services

Depositing physical stock incurs a fee of HK$5 per transfer deed. Withdrawing physical stock from CCASS costs HK$5 per board lot, with a minimum charge of HK$50. The settlement instruction fee for depositing stock via CCASS is waived, whereas withdrawing stock incurs a fee of 0.002% of the market value per stock based on the previous closing price, with fees ranging from a minimum of HK$2 to a maximum of HK$100. Grandly also charges HK$300 per stock for this service.

Investor settlement instruction fees are waived for stock deposits but cost HK$300 per instruction for stock withdrawals. Compulsory share buybacks are charged at 0.5% of the securities value on the settlement day, with a maximum fee of HK$100,000.

Nominee Services & Corporate Actions

The registration and transfer fee by HKSCC is HK$1.50 per board lot. Collection of cash dividends or scrip dividends is charged at 0.5% of the gross dividend, with a minimum fee of HK$20 and a maximum of HK$10,000. Receiving bonus issues, share consolidations, splits, rights, or warrants exercises incurs a fee of HK$50 per transaction.

Changing the registration of shares at the share registrar costs HK$5 per board lot, with a minimum charge of HK$100.

Other Services (including Margin and IPO Subscription Financing)

For IPO cash subscriptions, there is a non-refundable application fee of HK$50. Financing subscriptions for IPOs have a non-refundable application fee of HK$100. The annual interest rate for IPO financing varies depending on the specific IPO.

Margin financing interest rates are negotiable and determined based on individual agreements with clients.

Global Futures

Commissions for trading on global futures exchanges vary. For the Chicago Board of Trade (CBOT), the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and other similar exchanges, the commission is US$8 per contract per side for electronic orders and US$16 for phone orders.

Additional Charges

Overdue settlement interest for securities cash accounts is calculated at the Bank of China (Hong Kong) Prime rate plus 6% per annum. Negative balance interest for futures accounts is charged at 8% per annum. Certificates of account balance cost HK$200 each.

A semi-annual account maintenance fee of HK$100 is applied to inactive accounts with a balance of less than HK$1,000 and no stock holdings. Re-sending copies of daily and monthly statements is waived for the past six months but costs HK$100 per statement for older periods. Account statement postage costs HK$50 per statement. The fee for stock segregated accounts with statement services is HK$10 per month per account.

Grandly Financial Group App Review

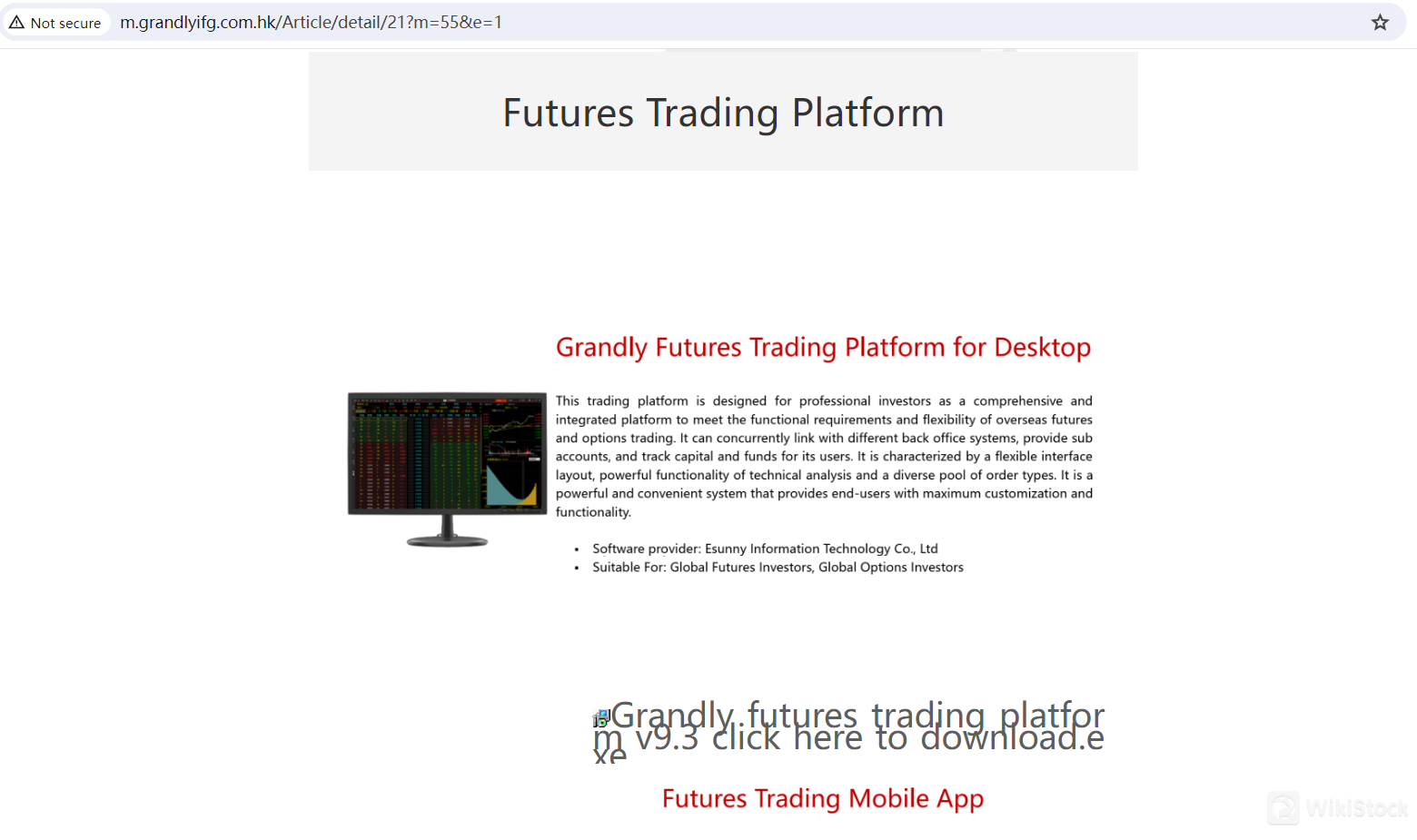

Futures Trading Platform: Grandly offers a desktop trading platform designed for professional investors in futures and options. This comprehensive and integrated platform meets the functional requirements and flexibility needed for overseas trading. It supports different back office systems, provides subaccounts, and tracks capital and funds. The platform features a flexible interface layout, powerful technical analysis tools, and a diverse pool of order types, providing maximum customization and functionality for end-users. The software is provided by Esunny Information Technology Co., Ltd., and is suitable for global futures and options investors.

Futures Trading Mobile App: The mobile app, also developed by Esunny Information Technology Co., Ltd., is available for both iOS and Android systems. It is tailored for global futures and options investors, allowing them to trade anytime and anywhere.

Online Trading for Futures and Securities: Grandly also provides online trading capabilities for both futures and securities, ensuring a versatile trading experience for its users.

Research and Eduation

Grandly Financial Services Group offers a comprehensive research and education section known as 'Insight.' This section is designed to provide investors with valuable information and analyses to aid in their investment decisions. It includes the following features:

Daily Briefs: These provide concise, daily updates on market trends, economic events, and key financial news, helping investors stay informed about the latest developments.

Grandly Spotlight: This feature offers in-depth analyses and insights into specific market events, sectors, or investment opportunities. It aims to highlight potential investment strategies and opportunities for investors.

Reports: Grandly provides detailed reports covering various financial markets, economic forecasts, and investment strategies. These reports are prepared by their team of experts and offer comprehensive analyses to guide investors in making informed decisions.

The 'Insight' section is a valuable resource for both novice and experienced investors, providing timely and relevant information to support their trading and investment activities.

Customer Service

Grandly Financial Services Group provides comprehensive customer support to its clients, ensuring they have access to assistance whenever needed. Their customer support features include:

China Free Hotline: Grandly offers a dedicated hotline for clients in China, reachable at 400-120-9003. This provides direct and immediate support for any inquiries or issues.

Office Location: Clients can visit their office located at Room 1403, 14/F, Yue Xiu Building, 160-174 Lockhart Road, Wan Chai, Hong Kong. This physical location offers an opportunity for face-to-face consultations and support.

Email Support: For written inquiries or detailed assistance, clients can email Grandly at info@grandlyifg.com. This allows for detailed responses and record-keeping of communication.

WeChat Connection: Clients can also connect with Grandly through WeChat, enabling convenient and instant communication via a popular messaging platform.

These support options ensure that clients can receive help through multiple channels, enhancing their overall experience with Grandly Financial Services Group.

Conclusion

Grandly Financial Group is a reputable financial services provider regulated by the Securities and Futures Commission (SFC) in Hong Kong. It offers comprehensive trading products, including futures and securities, supported by advanced trading platforms and detailed research resources. Known for its robust customer support, the company ensures a versatile and reliable trading experience. However, potential clients should seek detailed information about insurance coverage for funds, which is not readily provided.

FAQs

Is Grandly Financial Group safe to trade?

Yes, Grandly Financial Group is regulated by the Securities and Futures Commission (SFC) in Hong Kong, ensuring compliance with stringent financial regulations and standards.

Is Grandly Financial Group a good platform for beginners?

Grandly Financial Group offers user-friendly trading platforms, comprehensive research and education resources, and robust customer support, making it a good choice for beginners.

Is Grandly Financial Group legit?

Yes, Grandly Financial Group is a legitimate financial services provider, fully regulated by the SFC, ensuring high standards of operation and client protection.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--