คะแนน

華業證券

http://grandchina.hk/tc/index.php#

Website

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

D

ดัชนีอิทธิพล NO.1

ฮ่องกงจีน

ฮ่องกงจีนความหลากหลาย

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

ฮ่องกงจีน HKEX

Seat No. 01949

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

華業證券有限公司

ชื่อย่อบริษัท

華業證券

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

http://grandchina.hk/tc/index.php#ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0.25%

New Stock Trading

Yes

Margin Trading

YES

ประเทศที่ได้รับการควบคุม

1

| Grand China Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | N/A |

| Fees | 0.25% ตามจำนวนธุรกรรมของค่าธรรมเนียมโบรกเกอร์ |

| Account Fees | HKD 1.5 ต่อล็อตสำหรับการลงทะเบียนหุ้น |

| Mutual Funds Offered | ใช่ |

| App/Platform | Grand China Hong Kong Stock Mobile Version และแพลตฟอร์มเว็บ |

| Promotions | โบนัสเปิดบัญชี |

ข้อมูล Grand China Securities

Grand China Securities เป็นบริษัทหลักทรัพย์ตัวแทนจำหน่ายที่ได้รับใบอนุญาตจากฮ่องกง พวกเขาได้รับการควบคุมจาก สำนักงานความปลอดภัยและอนามัยทางการเงิน (SFC) ของฮ่องกง หมายเลขใบอนุญาต AYX768 พวกเขานำเสนอบริการการลงทุนหลากหลายรูปแบบรวมถึงการซื้อขายหุ้นในตลาดหลักทรัพย์ฮ่องกง หุ้นสหรัฐอเมริกา และหุ้น A (หุ้นจีนในภาคบูรพา) นอกจากนี้พวกเขายังให้บริการเช่นการจัดหาเงินทุนผ่านการจำนองหลักทรัพย์ การบริหารจัดการทรัพย์สิน และการสมัครสมาชิก IPO ที่เว็บไซต์ของพวกเขา http://www.grandchina.hk/ ระบุที่อยู่ของพวกเขาที่ 50-52 ถนนควีนส์โรดเซ็นทรัล เซ็นทรัล ฮ่องกง พร้อมหมายเลขโทรศัพท์และอีเมลสำหรับการสอบถาม พวกเขายังมีแอปมือถือที่สามารถดาวน์โหลดได้

ข้อดีและข้อเสียของ Grand China Securities

| ข้อดี | ข้อเสีย |

| บริษัทหลักทรัพย์ที่ได้รับการควบคุม | ข้อมูลออนไลน์จำกัด |

| หลากหลายตัวเลือกการลงทุน | เน้นบริการโบรกเกอร์ |

| ความสะดวกสบายของแอปมือถือ | ไม่ทราบขั้นต่ำของบัญชี |

ข้อดี

บริษัทหลักทรัพย์ที่ได้รับการควบคุม: Grand China Securities เป็นบริษัทหลักทรัพย์ที่ได้รับใบอนุญาตจาก สำนักงานความปลอดภัยและอนามัยทางการเงิน (SFC) ของฮ่องกง ซึ่งมอบความปลอดภัยและการตรวจสอบให้แก่นักลงทุน

หลากหลายตัวเลือกการลงทุน: พวกเขานำเสนอการซื้อขายหุ้นในตลาดหลักทรัพย์ฮ่องกง หุ้นสหรัฐอเมริกา และหุ้น A (หุ้นจีนในภาคบูรพา) ซึ่งตอบสนองความต้องการของนักลงทุนที่สนใจในตลาดเหล่านี้

ความสะดวกสบายของแอปมือถือ: พวกเขามีแอปมือถือสำหรับการทำธุรกรรมและการจัดการพอร์ตการลงทุนของคุณได้ทุกที่

ข้อเสีย

ข้อมูลออนไลน์จำกัด: เว็บไซต์ของพวกเขาไม่ให้ข้อมูลที่ครอบคลุมอย่างละเอียดเกี่ยวกับรายละเอียดสำคัญบางอย่าง เช่น ดอกเบี้ยต่อเงินที่ไม่ลงทุน อัตราดอกเบี้ยของการจำนองหรือการเสนอกองทุนรวม สิ่งนี้อาจทำให้ยากต่อการตัดสินใจที่มีความรู้สึกมั่นใจ

เน้นบริการโบรกเกอร์: เว็บไซต์ของพวกเขาเน้นในการซื้อขายหุ้นและบริการโบรกเกอร์อื่น ๆ ไม่มีการเน้นที่แข็งแกร่งในกองทุนรวมหรือผลิตภัณฑ์การลงทุนอื่น ๆ ดังนั้นอาจไม่ใช่ตัวเลือกที่ดีที่สุดสำหรับนักลงทุนที่ต้องการหลากหลายตัวเลือก

ไม่ทราบขั้นต่ำของบัญชี: ยอดเงินขั้นต่ำของบัญชีที่จำเป็นในการเปิดบัญชีกับ Grand China Securities ไม่สามารถหาได้จากเว็บไซต์ของพวกเขา

Grand China Securities ปลอดภัยหรือไม่?

กฎระเบียบ

Grand China Securities ดำเนินการภายใต้กฎระเบียบที่เข้มงวดที่สร้างขึ้นโดย สำนักงานหลักทรัพย์และอนุพันธ์ (SFC) ในฮ่องกง เพื่อให้การปฏิบัติตามกฎหมายทางการเงินและมาตรฐานอุตสาหกรรม

ความปลอดภัยของเงินทุน

กฎระเบียบในฮ่องกงกำหนดให้โบรกเกอร์แยกเงินของลูกค้าจากเงินของตนเอง นั่นหมายความว่าเงินสดและหลักทรัพย์ของคุณควรถูกเก็บไว้ในบัญชีที่แยกออกจากธนาคารผู้เผยแพร่ซึ่งเป็นสถาบันการเงินที่ใหญ่และมีชื่อเสียง สิ่งนี้จะลดความเสี่ยงในการใช้เงินของคุณโดยโบรกเกอร์เพื่อวัตถุประสงค์ของตนเอง

มาตรการความปลอดภัย

ฮ่องกงมี Investor Protection Scheme (IPS) ที่ดูแลโดย SFC IPS นี้ให้การชดเชยแก่นักลงทุนที่มีสิทธิ์ในกรณีที่โบรกเกอร์ล้มเหลว แต่มีข้อจำกัดในจำนวนที่คุ้มครอง

หลักทรัพย์ที่ใช้ในการซื้อขายกับ Grand China Securities คืออะไร?

Grand China Securities ช่วยให้คุณซื้อขายหลากหลายหลักทรัพย์โดยเน้นในตลาดฮ่องกงและจีน

หุ้นฮ่องกง: นี่เป็นศูนย์กลางของพวกเขา ช่วยให้คุณซื้อขายหุ้นที่บัญชีซื้อขายหลักทรัพย์ฮ่องกง (HKEX)

หุ้นสหรัฐ: คุณยังสามารถซื้อขายหุ้นที่บัญชีซื้อขายหลักทรัพย์สหรัฐฯ ผ่าน Grand China Securities ได้

หุ้น A-Shares: เป็นหุ้นที่ออกโดยบริษัทที่จดทะเบียนในจีนใหญ่และซื้อขายในตลาดหุ้นเซี่ยงไฮ้ (SSE) หรือตลาดหุ้นเซินเจิ้น (SZSE)

กองทุนรวม: แม้ว่าเว็บไซต์ของพวกเขาจะไม่โฆษณากองทุนรวมโดยเฉพาะ แต่การสำรวจแสดงว่าพวกเขายังให้บริการกองทุนรวม

สินค้าฟิวเจอร์: สินค้าฟิวเจอร์เป็นเครื่องมือการเงินที่ซับซ้อนที่สามารถใช้ในการป้องกันความเสี่ยงหรือการพิสูจน์ทฤษฎี มันเกี่ยวข้องกับความเสี่ยงที่สำคัญและต้องการความเข้าใจที่ดีในแนวโน้มของตลาด

บัญชี Grand China Securities

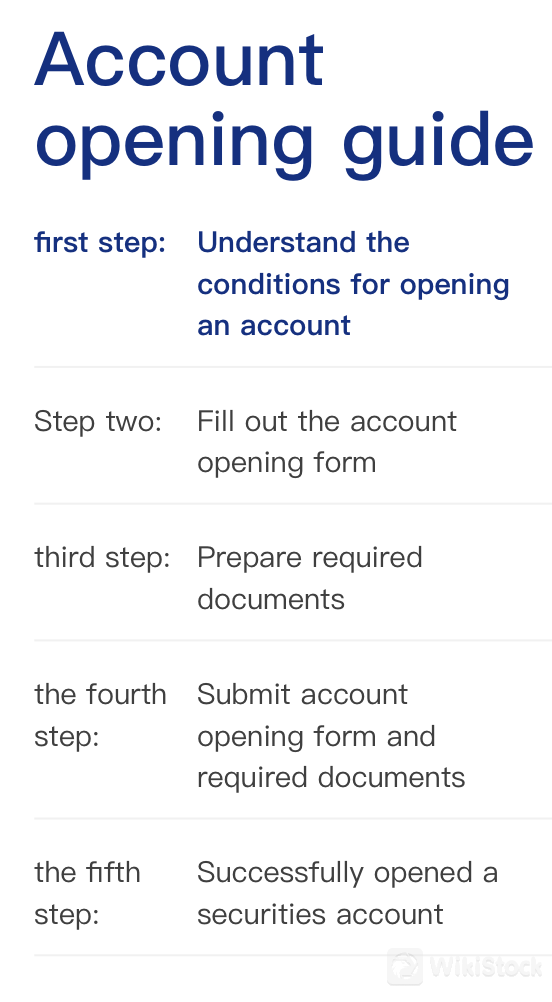

เว็บไซต์นี้มีแบบฟอร์มเปิดบัญชีแยกสำหรับบัญชีบุคคลและบริษัท ซึ่งหมายความว่าพวกเขาสนับสนุนนักลงทุนทั้งรายย่อยและสถาบัน นี่คือวิธีการเปิดบัญชีกับ Grand China Securities ขั้นตอนละเอียดดังนี้:

เข้าใจเงื่อนไขในการเปิดบัญชี

กรอกแบบฟอร์มเปิดบัญชี

ส่งแบบฟอร์มเปิดบัญชีและเอกสารที่จำเป็น

เปิดบัญชีหลักทรัพย์เรียบร้อยแล้ว

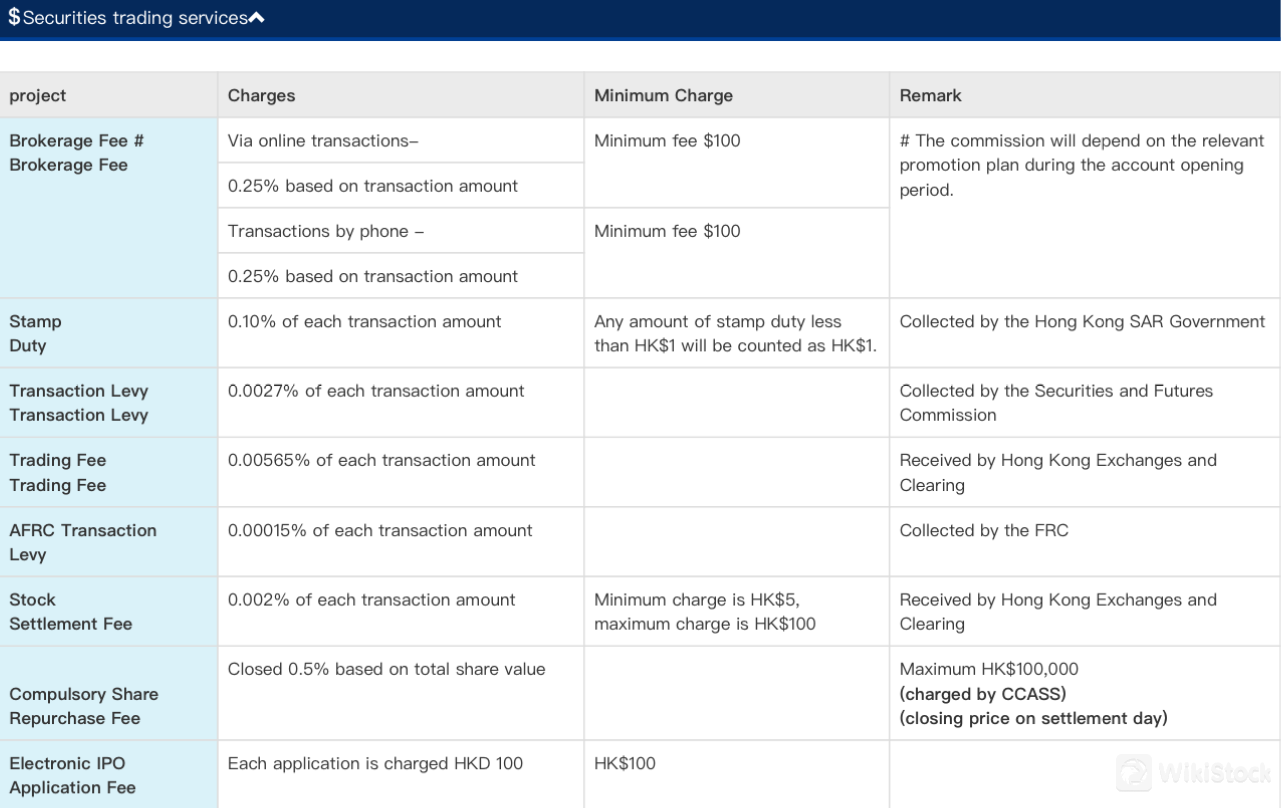

ค่าโบรกเกอร์:

ค่าธรรมเนียมขั้นต่ำ: 100 ดอลลาร์

โครงสร้างค่าธรรมเนียม: 0.25% ของมูลค่าธุรกรรม ค่าธรรมเนียมนี้อาจแตกต่างกันไปขึ้นอยู่กับข้อเสนอโปรโมชั่นที่มีให้เมื่อคุณเปิดบัญชี

ค่าธรรมเนียมการทำธุรกรรม:

อากรแสตมป์: 0.10% ของจำนวนธุรกรรม (จำนวนอากรแสตมป์น้อยกว่า 1 ดอลลาร์ฮ่องกงจะนับเป็น 1 ดอลลาร์ฮ่องกง)

ค่าธรรมเนียมการซื้อขายหุ้น: 0.00565% ของจำนวนธุรกรรม

ค่าธรรมเนียมการทำธุรกรรม: 0.0027% ของจำนวนธุรกรรม

ค่าธรรมเนียมการทำธุรกรรม AFRC: 0.00015% ของจำนวนธุรกรรม

ค่าธรรมเนียมการตั้งค่าหุ้น: 0.002% ของจำนวนธุรกรรม โดยมีขั้นต่ำเป็น 5 ดอลลาร์ฮ่องกงและสูงสุดเป็น 100 ดอลลาร์ฮ่องกง

ค่าธรรมเนียมอื่น ๆ:

อาจมีค่าธรรมเนียมเพิ่มเติมขึ้นอยู่กับประเภทบัญชีหรือบริการที่ใช้เฉพาะ ตัวอย่างเช่นอาจมีค่าธรรมเนียมสำหรับการฝากเงินและถอนเงินหรือใบรับรองหุ้นทางกายภาพ

อินเตอร์เฟซที่ง่ายและใช้งานง่ายสำหรับการทำธุรกรรมหุ้น

เข้าถึงข้อมูลหุ้นและแผนภูมิราคาหุ้นแบบเรียลไทม์สำหรับหุ้นฮ่องกง

สามารถดูข่าวทางการเงิน ข้อมูลบริษัท และการเสนอขายหุ้นใหม่ได้

ติดตามผลการดำเนินงานและการถือหุ้นในพอร์ตโฟลิโอของคุณ

ผู้ให้บริการวิจัยจากภายนอก: Grand China Securities มีการวิจัยตลาดหุ้น การวิเคราะห์ และเนื้อหาการศึกษา คุณสามารถสำรวจทรัพยากรเหล่านี้เพื่อเสริมสร้างการวิจัยที่คุณอาจทำผ่าน Grand China Securities

คู่มือต่างๆ: Grand China Securities มีการให้คู่มือต่างๆ เช่น คู่มือเปิดบัญชี คู่มือฝากถอนเงิน คู่มือการทำธุรกรรม เป็นต้น

Grand China Securities ค่าธรรมเนียมรีวิว

Grand China Securities App Review

Grand China Securities มีแอปพลิเคชันสำหรับความสะดวกในการซื้อขายร่วมกับแพลตฟอร์มเว็บของพวกเขา

แอปพลิเคชันมือถือ: พวกเขามีแอปที่ชื่อว่า "Grand China Hong Kong Stock Mobile Version" สามารถดาวน์โหลดได้จาก Google Play Store และ App Store

คุณสมบัติของแอปพลิเคชัน:

แพลตฟอร์มเว็บ:

Grand China Securities ยังมีแพลตฟอร์มการซื้อขายทางเว็บที่สามารถเข้าถึงได้ผ่านเว็บไซต์ของพวกเขา

การวิจัยและการศึกษา

Grand China Securities ไม่มีส่วนที่จัดสรรมาเพื่อทราบข้อมูลการวิจัยและการศึกษา นี่คือการแบ่งปันของสิ่งที่พวกเขาให้:

บริการลูกค้า

Grand China Securities ให้บริการช่องทางพื้นฐานหลายรูปแบบให้กับผู้ซื้อขาย เช่น:

โทรศัพท์: (852) 3979 6701

อีเมล: css@grandchina.hk

ที่อยู่บริษัท: ห้อง 503 อาคาร Luk Yau, 50-52 ถนนควีนส์โรดเซ็นทรัล, เซ็นทรัล, ฮ่องกง

สรุป

Grand China Securities เป็นโบรกเกอร์ฮ่องกงที่ให้บริการเพื่อการซื้อขายหุ้นฮ่องกง หุ้นสหรัฐอเมริกา และอาจมีหุ้นปันผลและสัญญาซื้อขายล่วงหน้า แม้ว่าจะมีการให้ความสามารถในการกู้ยืมผ่านบัญชีมาร์จินและเป็นไปตามกฎระเบียบของ SFC แต่เว็บไซต์ของพวกเขาขาดความโปร่งใสในรายละเอียดสำคัญ เช่น ประเภทบัญชี ค่าธรรมเนียมที่เกินค่าคอมมิชชั่นโบรกเกอร์ และทรัพยากรการศึกษา นี่อาจเหมาะสำหรับนักลงทุนฮ่องกงที่มีประสบการณ์และสามารถดำเนินงานวิจัยของตนเองได้อย่างสะดวกและให้ความสำคัญกับค่าธรรมเนียมที่ต่ำกว่า แต่หากเครื่องมือวิจัยลึกลงหรือการซื้อขายล่วงหน้าเป็นสิ่งสำคัญ ควรพิจารณาสำรวจโบรกเกอร์อื่น

คำถามที่พบบ่อย

Grand China Securities ปลอดภัยในการซื้อขายหรือไม่?

การซื้อขายกับ Grand China Securities มีคุณสมบัติความปลอดภัยบางอย่างเนื่องจากกฎระเบียบ อย่างไรก็ตาม ขาดความโปร่งใสออนไลน์ทำให้การประเมินความปลอดภัยเต็มรูปแบบยาก

Grand China Securities เป็นแพลตฟอร์มที่ดีสำหรับผู้เริ่มต้นหรือไม่?

ในขณะที่ Grand China Securities มีการเข้าถึงตลาดต่างๆ และการกู้ยืมที่เป็นไปได้ ขาดทรัพยากรการศึกษา รายละเอียดบัญชีที่ไม่ชัดเจน และค่าธรรมเนียมที่ซ่อนอยู่ ทำให้เป็นแพลตฟอร์มที่ยากต่อการเริ่มต้น

Grand China Securities เหมาะสำหรับการลงทุน/เกษียณหรือไม่?

Grand China Securities โดยให้ความสำคัญกับการซื้อขายหุ้นและบัญชีมาร์จิน อาจไม่เหมาะสำหรับการวางแผนเกษียณ การสร้างพอร์ตการเกษียณมักเป็นกลยุทธ์การซื้อและถือทรัพย์สินที่หลากหลายเช่นพันธบัตรและ ETF ซึ่งแพลตฟอร์มของพวกเขาอาจไม่สนับสนุนอย่างเต็มที่

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลจากการประเมินของผู้เชี่ยวชาญของ WikiStock ตามข้อมูลที่มีในเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการเสี่ยงที่สูง อาจ导致การสูญเสียเงินลงทุนทั้งหมด ดังนั้นความเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะเข้ามาเกี่ยวข้องเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

5-10 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

瑞达国际

คะแนน

Huajin International

คะแนน

CLSA

คะแนน

Sanfull Securities

คะแนน

DL Securities

คะแนน

嘉信

คะแนน

GF Holdings (HK)

คะแนน

China Taiping

คะแนน

Capital Securities

คะแนน

乾立亨證券

คะแนน