คะแนน

T G Securities

http://www.tgshk.com/

Website

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

C

ดัชนีอิทธิพล NO.1

ประเทศจีน

ประเทศจีนความหลากหลาย

2

Futures、Stocks

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

ฮ่องกงจีน HKEX

Seat No. 01755

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

T G Securities Limited

ชื่อย่อบริษัท

T G Securities

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

http://www.tgshk.com/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

ดาวน์โหลดแอป

- รอบ

- ดาวน์โหลด

- 2024-05

- 1040

กฎ: ข้อมูลที่แสดงคือการดาวน์โหลดแอปในหนึ่งปีก่อนหน้าปัจจุบัน

ความนิยมในระดับภูมิภาคของแอป

- ประเทศ/ภูมิภาคดาวน์โหลดอัตราส่วน

อื่น ๆ

1040100.00%

กฎ: ข้อมูลจะแสดงเป็นการดาวน์โหลดและส่วนแบ่งภูมิภาคของแอปในหนึ่งปีก่อนปัจจุบัน

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0.08%

New Stock Trading

Yes

ประเทศที่ได้รับการควบคุม

1

ผลิตภัณฑ์ทางการเงิน

2

| T G Securities |  |

| คะแนน WikiStock | ⭐⭐⭐⭐ |

| ยอดเงินฝากขั้นต่ำ | ราคาตั้งแต่ฟรีสำหรับบัญชีบางประเภทถึงค่าธรรมเนียมที่แปรผันตามประเภทการทำธุรกรรม |

| ค่าธรรมเนียม | ราคาตั้งแต่ฟรีสำหรับบัญชีบางประเภทถึงค่าธรรมเนียมที่แปรผันตามประเภทการทำธุรกรรม |

| ค่าธรรมเนียมบัญชี | ฟรีสำหรับบัญชีใหม่ |

| ดอกเบี้ยเงินสดที่ไม่ได้ลงทุน | ไม่ได้ระบุ |

| อัตราดอกเบี้ยเงินยืม | ไม่ได้ระบุ |

| กองทุนรวมที่มีการเสนอ | ไม่ |

| แอป/แพลตฟอร์ม | มีให้บน iOS, Android, และเว็บ |

| โปรโมชั่น | ใช่ |

ที่ T G Securities คืออะไร?

T G Securities ให้บริการหลากหลายตัวเลือกบัญชีที่มียอดเงินฝากขั้นต่ำที่แตกต่างกัน บางบัญชีไม่มีค่าใช้จ่ายเริ่มต้นในขณะที่บัญชีอื่นเสียค่าธรรมเนียมขึ้นอยู่กับประเภทการทำธุรกรรม บัญชีใหม่สามารถเพลิดเพลินไปกับการยกเว้นค่าธรรมเนียมได้และแพลตฟอร์มสามารถเข้าถึงได้ผ่านแอป iOS, Android, และเว็บ อย่างไรก็ตาม ไม่ได้เปิดเผยรายละเอียดเฉพาะเกี่ยวกับอัตราดอกเบี้ยสำหรับเงินสดที่ไม่ได้ลงทุนและอัตราดอกเบี้ยของมาร์จิ้น นอกจากนี้พวกเขาไม่มีการเสนอกองทุนรวม ความพร้อมใช้งานของแอปของพวกเขาบนแพลตฟอร์มหลักทำให้สะดวกสบายในการเข้าถึงสำหรับลูกค้า แสดงถึงความมุ่งมั่นในการให้บริการซื้อขายที่ทันสมัยและสะดวกสบาย

ข้อดีและข้อเสียของ T G Securities

T G Securities ที่ได้รับการควบคุมโดย SFC และเป็นไปตามกฎระเบียบทางการเงิน มีบริการหลากหลายและสามารถเข้าถึงได้บนแพลตฟอร์ม iOS, Android, Mac, Windows, และเว็บ อย่างไรก็ตาม มีโครงสร้างค่าธรรมเนียมที่ซับซ้อน ขาดทรัพยากรการศึกษาและไม่ระบุอัตราดอกเบี้ยเงินสดที่ไม่ได้ลงทุน ซึ่งอาจเป็นอุปสรรคสำหรับบางนักลงทุน

| ข้อดี | ข้อเสีย |

|

|

|

|

|

|

T G Securities ปลอดภัยหรือไม่?

T G Securities Limited เป็นตัวแทนจำหน่ายหลักทรัพย์ที่ลงทะเบียนกับ สำนักงานคณะกรรมการหลักทรัพย์และอนุพันธ์ (SFC) ของฮ่องกง

TGS เป็นสมาชิกของตลาดหลักทรัพย์ฮ่องกง (HKSE) ซึ่งหมายความว่า TGS อยู่ภายใต้กฎระเบียบของตลาดหลักทรัพย์ฮ่องกงที่ออกแบบมาเพื่อปกป้องผู้ลงทุน

TGS ยังเข้าร่วมโครงการค่าเสียหายของนักลงทุน (ICS) ของ SFC โครงการ ICS ให้ความคุ้มครองสูงสุดถึง 1,000,000 ดอลลาร์ฮ่องกงต่อนักลงทุนในกรณีที่บริษัทหลักทรัพย์ที่ได้รับใบอนุญาตจาก SFC ล้มละลาย

นอกจากมาตรการกำกับดังกล่าว TGS ยังมีมาตรการภายในของตนเองเพื่อป้องกันเงินลูกค้า ซึ่งรวมถึง:

ใช้แพลตฟอร์มการซื้อขายที่ปลอดภัย

ใช้เทคโนโลยีการเข้ารหัสเพื่อป้องกันข้อมูลลูกค้า

มีทีมผู้จัดการความเสี่ยงที่มีประสบการณ์

หลักทรัพย์ที่ใช้ในการซื้อขายกับ T G Securities คืออะไร?

T G Securities ให้บริการซื้อขายหลักทรัพย์ เช่น หุ้น ตัวเลือก และสินค้าอนาคต ผลิตภัณฑ์เหล่านี้ช่วยให้นักลงทุนสามารถสร้างพอร์ตหลากหลายและเลือกตัวเลือกความเสี่ยง-ผลตอบแทนที่แตกต่างกันได้ อย่างไรก็ตาม ไม่มีการให้ผลิตภัณฑ์เช่น สินค้าอนุพันธ์ ฟอเร็กซ์ และสกุลเงินดิจิตอล

หุ้น: การลงทุนโดยตรงในบริษัทที่มีการจดทะเบียนในตลาดหลักทรัพย์ เหมาะสำหรับนักลงทุนที่ต้องการเพิ่มมูลค่าทุนและเงินปันผล

ตัวเลือก: ให้นักลงทุนที่มีประสบการณ์มากขึ้นมีตัวเลือกกลยุทธ์มากขึ้น ช่วยให้พวกเขาป้องกันความเสี่ยงหรือพิเศษโดยการซื้อสิทธิ์หรือหน้าที่

บัญชี T G Securities

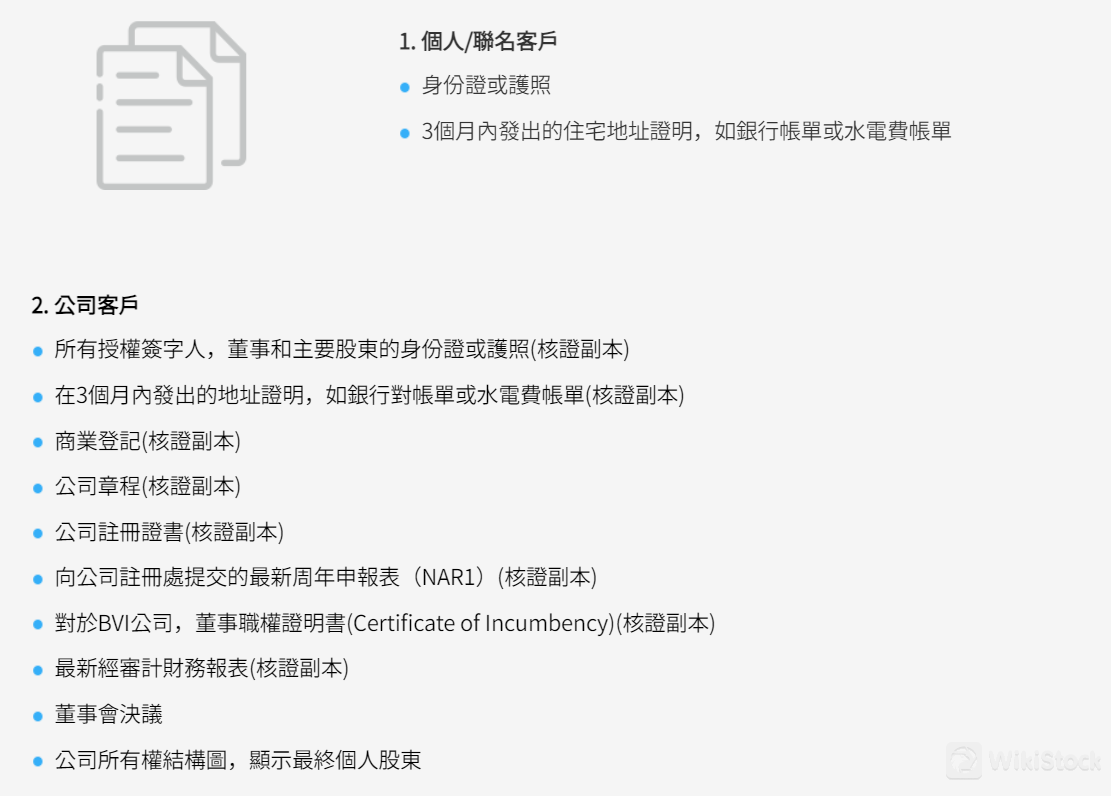

T G Securities มีบัญชีสองประเภทเพื่อตอบสนองความต้องการของลูกค้าที่หลากหลาย: บัญชีบุคคล/ร่วมมือและบัญชีบริษัท บัญชีบุคคล/ร่วมมือถูกออกแบบเพื่อนักลงทุนส่วนบุคคลหรือผู้ถือร่วมที่ต้องการจัดการการลงทุนของพวกเขาอย่างมีประสิทธิภาพ ในทางกลับกัน บัญชีบริษัทถูกออกแบบสำหรับธุรกิจและองค์กรที่ต้องการซื้อขายและจัดการทรัพย์สินของพวกเขาอย่างมีประสิทธิภาพ แต่ละประเภทของบัญชีถูกออกแบบให้มีเครื่องมือและการสนับสนุนที่จำเป็นสำหรับประสบการณ์การซื้อขายที่ราบรื่น โดยให้ลูกค้าสามารถเข้าถึงผลิตภัณฑ์ทางการเงินและบริการต่างๆ ที่เข้ากันได้กับความต้องการเฉพาะของพวกเขา

บทวิจารณ์ค่าธรรมเนียม T G Securities

การซื้อขายหุ้นฮ่องกง: ค่าคอมมิชชั่น 0.08% พร้อมค่าธรรมเนียมขั้นต่ำ 50 ดอลลาร์ฮ่องกง

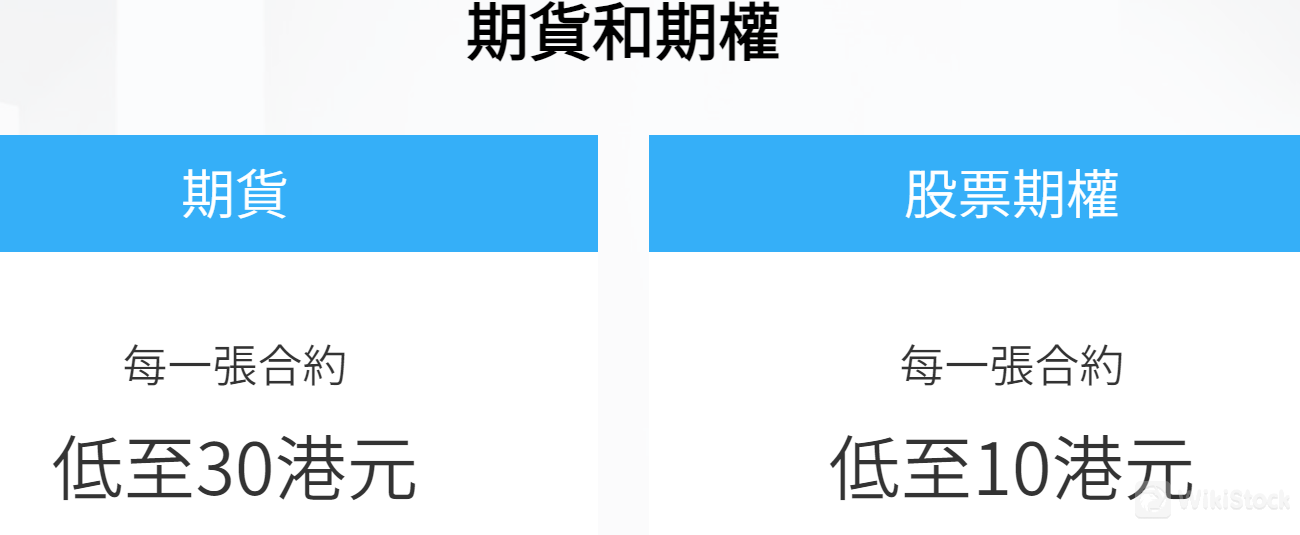

การซื้อขายสินค้าอนาคต: ค่าธรรมเนียมต่ำสุดเพียง 30 ดอลลาร์ฮ่องกงต่อสัญญา

การซื้อขายตัวเลือกหุ้น: ค่าใช้จ่ายเริ่มต้นตั้งแต่ 10 ดอลลาร์ฮ่องกงต่อสัญญา

การซื้อขายหุ้น A: อัตราค่าคอมมิชชั่น 0.08% พร้อมค่าธรรมเนียมขั้นต่ำ 50 หยวนจีน

บทวิจารณ์แอป T G Securities

T G Securities แอปพลิเคชันมือถือเป็นแพลตฟอร์มการซื้อขายที่ทันสมัยและใช้งานง่ายที่ออกแบบมาสำหรับนักเทรดที่ต้องการเคลื่อนที่ไปพร้อมกับการซื้อขาย มันให้ประสบการณ์การซื้อขายที่ครอบคลุมทั้งหมด มีให้บริการบนอุปกรณ์ iOS และ Android เพื่อให้สะดวกต่อการเข้าถึงตลาดได้ทุกเวลาทุกที่ นอกจากแอปพลิเคชันบนมือถือแล้ว T G Securities ยังมีการให้บริการแพลตฟอร์มและเครื่องมือที่หลากหลายสำหรับอุปกรณ์และระบบปฏิบัติการที่แตกต่างกัน เช่น แพลตฟอร์มการซื้อขายผ่านเว็บ และแอปพลิเคชันที่เฉพาะเจาะจงสำหรับ Mac และ Windows ความหลากหลายนี้ทำให้ผู้ใช้ทุกคน ไม่ว่าจะเลือกอุปกรณ์ใด สามารถเข้าถึงบริการการซื้อขายได้อย่างราบรื่น

บริการลูกค้า

T G Securities มีบริการลูกค้าที่มุ่งเน้นผ่านเส้นโทรศัพท์บริการของพวกเขาที่ (852) 2869 8870 ชั่วโมงการสนับสนุนของพวกเขาเป็นวันจันทร์ถึงวันศุกร์ 9:00 น. ถึง 18:00 น. และวันหยุดสุดสัปดาห์และวันหยุดราชการถูกกำหนดเป็นวันหยุด นี้ทำให้ลูกค้าสามารถรับความช่วยเหลือและคำแนะนำได้อย่างรวดเร็วในชั่วโมงทำการปกติ เพิ่มประสบการณ์การซื้อขายโดยมีบริการสนับสนุนที่เชื่อถือได้

สรุป

สรุปว่า T G Securities โดดเด่นด้วยการกำกับดูแลโดย SFC และการให้บริการที่หลากหลาย ทำให้เป็นตัวเลือกที่น่าเชื่อถือสำหรับนักลงทุนที่ต้องการแพลตฟอร์มการซื้อขายที่ปลอดภัยและครอบคลุม สามารถเข้าถึงได้บนอุปกรณ์หลายรูปแบบ มันเหมาะสำหรับนักลงทุนที่ชำนาญเทคโนโลยีที่ให้ความสะดวกสบาย อย่างไรก็ตาม โครงสร้างค่าธรรมเนียมที่ซับซ้อนและขาดทรัพยากรการศึกษาอาจต้องการนักลงทุนที่มีประสบการณ์มากกว่า ที่สามารถนำทางในสภาพแวดล้อมเช่นนี้ได้อย่างสะดวก

คำถามที่พบบ่อย

T G Securities ปลอดภัยในการซื้อขายหรือไม่?

ใช่ T G Securities ได้รับการกำกับดูแลโดยหน่วยงานกำกับดูแลตลาดหลักทรัพย์และอนุพันธ์ (SFC) ซึ่งรับรองความเป็นเลิศในการปฏิบัติตามกฎหมายทางการเงิน ทำให้เป็นแพลตฟอร์มที่ปลอดภัยสำหรับการซื้อขาย

T G Securities เป็นแพลตฟอร์มที่ดีสำหรับผู้เริ่มต้นหรือไม่?

T G Securities มีบริการที่หลากหลายและแพลตฟอร์มที่ใช้งานง่ายที่มีให้บริการบน iOS, Android, Mac, Windows และ Web โครงสร้างค่าธรรมเนียมที่ซับซ้อนและขาดทรัพยากรการศึกษาอาจทำให้เหมาะกับนักลงทุนที่มีประสบการณ์มากกว่า

T G Securities เป็นโบรกเกอร์ที่ถูกต้องหรือไม่?

ใช่ T G Securities เป็นบริษัทโบรกเกอร์ที่ได้รับการกำกับดูแลโดย SFC ซึ่งรับรองการปฏิบัติตามมาตรฐานและกฎหมายทางการเงินอย่างเข้มงวด

T G Securities เหมาะสำหรับการลงทุน/เกษียณหรือไม่?

T G Securities ให้แพลตฟอร์มการซื้อขายที่แข็งแกร่งและเหมาะสำหรับความต้องการการลงทุนที่หลากหลาย อย่างไรก็ตาม ขาดอัตราดอกเบี้ยที่ระบุสำหรับเงินที่ไม่ได้ลงทุนและขอบเขตของทรัพยากรการศึกษาที่จำกัดอาจต้องการการจัดการที่ใช้ความรู้และประสบการณ์ในการบริหารการลงทุนและเงินสำหรับเกษียณของตนเอง

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลจากการประเมินของผู้เชี่ยวชาญของ WikiStock จากข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการลงทุนที่มีความเสี่ยงสูง อาจ导致สูญเสียเงินลงทุนทั้งหมด ดังนั้นความเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะเข้ามาเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

15-20 ปี

ผลิตภัณฑ์ทางการเงิน

Futures、Stocks

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

SPDBI

คะแนน

CFSG

คะแนน

HRIF

คะแนน

中州國際

คะแนน

Fair Eagle Securities

คะแนน

Well Link Securities

คะแนน

Hang Seng Bank

คะแนน

Wocom

คะแนน

Hantec

คะแนน

GNFG

คะแนน