คะแนน

めぶき証券

http://www.mebuki-sec.co.jp/

Website

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

B

ดัชนีอิทธิพล NO.1

ประเทศญี่ปุ่น

ประเทศญี่ปุ่นความหลากหลาย

8

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

FSAอยู่ในการกำกับดูแล

ประเทศญี่ปุ่นใบอนุญาตซื้อขายหลักทรัพย์

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Mebuki Securities Co., Ltd

ชื่อย่อบริษัท

めぶき証券

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

http://www.mebuki-sec.co.jp/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

1.430%

New Stock Trading

Yes

Margin Trading

YES

ประเทศที่ได้รับการควบคุม

1

หมายเหตุ: ข้อมูลที่ให้ไว้ในบทวิจารณ์นี้อาจมีการเปลี่ยนแปลงเนื่องจากการอัปเดตบริการและนโยบายของ บริษัท อยู่เสมอ นอกจากนี้ วันที่ที่สร้างบทวิจารณ์นี้อาจเป็นปัจจัยที่สำคัญในการพิจารณา เนื่องจากข้อมูลอาจเปลี่ยนแปลงตั้งแต่นั้น ดังนั้น อ่าน者ควร ตรวจสอบข้อมูลที่อัปเดตโดยตรงกับ บริษัท ก่อนตัดสินใจหรือดำเนินการใด ๆ ความรับผิดชอบในการใช้ข้อมูลที่ให้ไว้ในบทวิจารณ์นี้อยู่กับผู้อ่านเท่านั้น

ในบทวิจารณ์นี้หากมีความขัดแย้งระหว่างภาพและเนื้อหาข้อความ ควรให้ความสำคัญกับเนื้อหาข้อความ อย่างไรก็ตาม เราขอแนะนำให้คุณเปิดเว็บไซต์อย่างเป็นทางการเพื่อขอคำปรึกษาเพิ่มเติม

| MEBUKI |  |

| คะแนน WikiStock | ⭐⭐⭐⭐ |

| ค่าคอมมิชชั่น | หุ้นภายในประเทศ กองทุน ETF REITs และหลักทรัพย์ทางสิทธิ์: 500,000 เยนหรือต่ำกว่า: 1.430% (ขั้นต่ำ 2,750 เยน) แตกต่างขึ้นอยู่กับจำนวนสัญญา |

| หุ้นต่างประเทศ: ค่าคอมมิชชั่นภายในประเทศ: จำนวนสัญญาในประเทศ × 0.25%; ค่าคอมมิชชั่นของหน่วยงานภายในประเทศ: แตกต่างขึ้นอยู่กับจำนวนสัญญา | |

| ค่าธรรมเนียมการจัดการบัญชี | ฟรี |

| เสนอกองทุนรวม | ใช่ |

| แอป / แพลตฟอร์ม | ไม่ได้กล่าวถึง |

| โปรโมชั่น | มี |

ข้อมูล MEBUKI

MEBUKI เป็นผู้ให้บริการบริการทางการเงินที่ได้รับการควบคุมโดยองค์กรที่รับรองในการซื้อขายหลักทรัพย์และการลงทุนที่มีความแข็งแกร่ง บริษัทให้บริการแก่นักลงทุนทั้งในประเทศและต่างประเทศด้วยผลิตภัณฑ์การซื้อขายที่ครอบคลุมอย่างครบวงจร รวมถึง หุ้นภายในประเทศและต่างประเทศ กองทุน ETF และ REITs รวมถึง พันธบัตรและกองทุนตลาดเงิน นอกจากบริการทางการเงินทางธุรกิจ MEBUKI ยังให้บริการสัมมนาการศึกษาอบรมอบรมอบริการที่ครอบคลุมทั้งการบริหารจัดการสินทรัพย์และแนวโน้มของตลาด

ข้อดีและข้อเสีย

| ข้อดี | ข้อเสีย |

| การควบคุมโดยองค์กร (FSA) | ข้อมูลจำกัดเกี่ยวกับอัตราดอกเบี้ยเงินกู้ |

| ช่วงหลากหลายของผลิตภัณฑ์การซื้อขาย | รายละเอียดแอป / แพลตฟอร์มที่ไม่ระบุ |

| สัมมนาการศึกษา | |

| โครงสร้างค่าธรรมเนียมโปร่งใส |

ข้อดี

การควบคุมโดยองค์กร (FSA): MEBUKI ได้รับการควบคุมโดยหน่วยงานบริการทางการเงิน (FSA) ที่รับรองความเป็นไปตามมาตรฐานที่เข้มงวดสำหรับการปกป้องผู้ลงทุนและความเป็นธรรมในตลาด

ช่วงหลากหลายของผลิตภัณฑ์การซื้อขาย: มีการเสนอเลือกสรรค์อย่างครอบคลุมรวมถึงหุ้นภายในประเทศและต่างประเทศ ETF REITs พันธบัตรและกองทุนตลาดเงิน

สัมมนาการศึกษา: ให้สัมมนามีคุณค่าเกี่ยวกับการบริหารจัดการสินทรัพย์และความเข้าใจตลาด เพื่อเสริมสร้างความรู้ให้กับลูกค้าเพื่อให้สามารถตัดสินใจการลงทุนที่มีความรู้สึกมั่นใจ

โครงสร้างค่าธรรมเนียมโปร่งใส: ระบุค่าธรรมเนียมคอมมิชชั่นสำหรับหลักทรัพย์ต่าง ๆ โดยชัดเจน เพื่อส่งเสริมความโปร่งใสและความชัดเจนในค่าใช้จ่ายในการซื้อขาย

ข้อเสีย

ข้อมูลจำกัดเกี่ยวกับอัตราดอกเบี้ยเงินกู้: ไม่ได้ระบุรายละเอียดเฉพาะเกี่ยวกับอัตราดอกเบี้ยเงินกู้ซึ่งอาจมีผลต่อลูกค้าที่ต้องการเลเวอเรจสำหรับวัตถุประสงค์ในการซื้อขาย

รายละเอียดแอป/แพลตฟอร์มไม่ได้ระบุ: ข้อมูลเกี่ยวกับแพลตฟอร์มการซื้อขายหรือแอปพลิเคชันมือถือไม่ได้ระบุ ส่งผลกระทบต่อความเข้าถึงและประสบการณ์ของนักลงทุนที่มีความชำนาญด้านเทคโนโลยี

MEBUKI ปลอดภัยหรือไม่?

MEBUKI ได้รับการกำกับดูแลโดยการกำกับดูแลของ หน่วยงานบริการทางการเงิน (FSA) โครงสร้างกฎระเบียบนี้รับรองว่า บริษัทปฏิบัติตามมาตรฐานที่เข้มงวดเพื่อปกป้องนักลงทุนและรักษาความสมบูรณ์ของตลาดทางการเงิน โดยปฏิบัติตามกฎระเบียบ MEBUKI รับรองว่าการดำเนินงานของบริษัทจะเป็นไปด้วยความมืออาชีพและความรับผิดชอบอย่างสูงสุด ซึ่งสร้างความเชื่อมั่นให้กับลูกค้าและผู้มีส่วนได้ส่วนเสีย

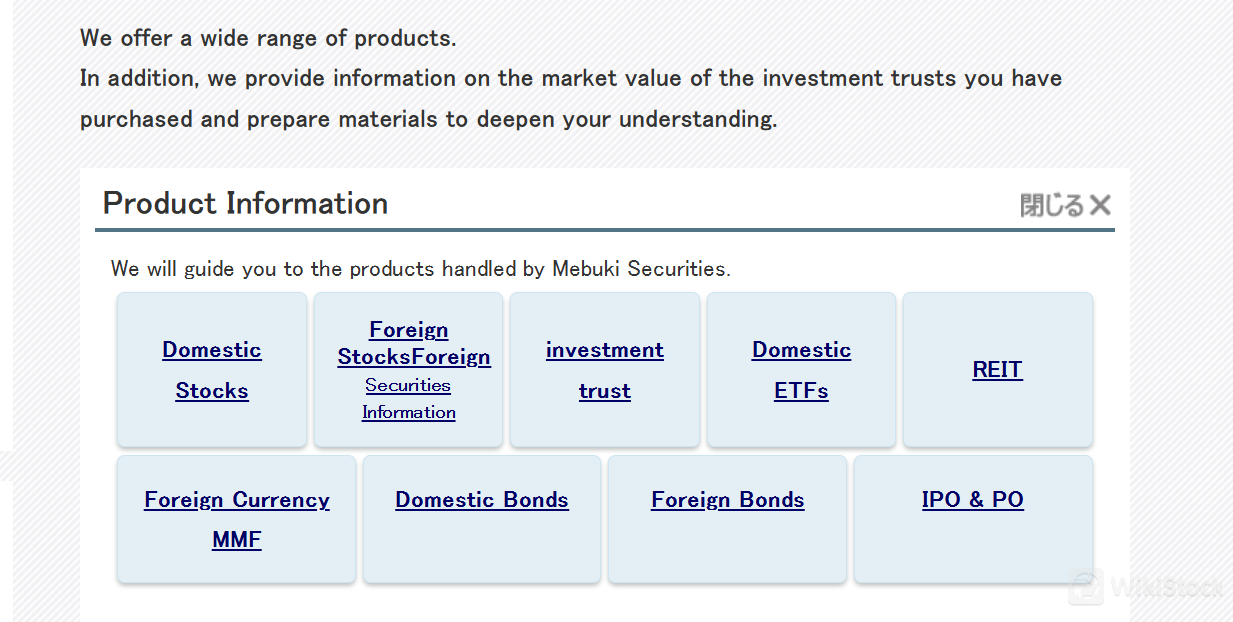

หลักทรัพย์ที่ใช้ซื้อขายกับ MEBUKI คืออะไร?

MEBUKI ให้บริการผลิตภัณฑ์การซื้อขายที่หลากหลายเพื่อตอบสนองความต้องการของนักลงทุนทั้งในประเทศและต่างประเทศ ตั้งแต่ หุ้นในประเทศ และ หลักทรัพย์ต่างประเทศ ไปจนถึง กองทุนการลงทุน ETF ในประเทศ และ กองทุนการลงทุนในอสังหาริมทรัพย์ (REITs) MEBUKI มั่นใจในการเลือกสรรผลิตภัณฑ์ที่ครอบคลุมอย่างครบถ้วนสำหรับการกระจายพอร์ต นอกจากนี้พวกเขายังมีโอกาสในการลงทุนใน กองทุนตลาดเงินต่างประเทศ (MMFs) ในสกุลเงินต่างประเทศ หุ้นในประเทศและต่างประเทศ และการเข้าร่วมใน การเสนอขายในตลาดหลักทรัพย์เพื่อจดทะเบียนครั้งแรก (IPOs) และ การเสนอขายสาธิต (POs)

รีวิวค่าธรรมเนียม MEBUKI

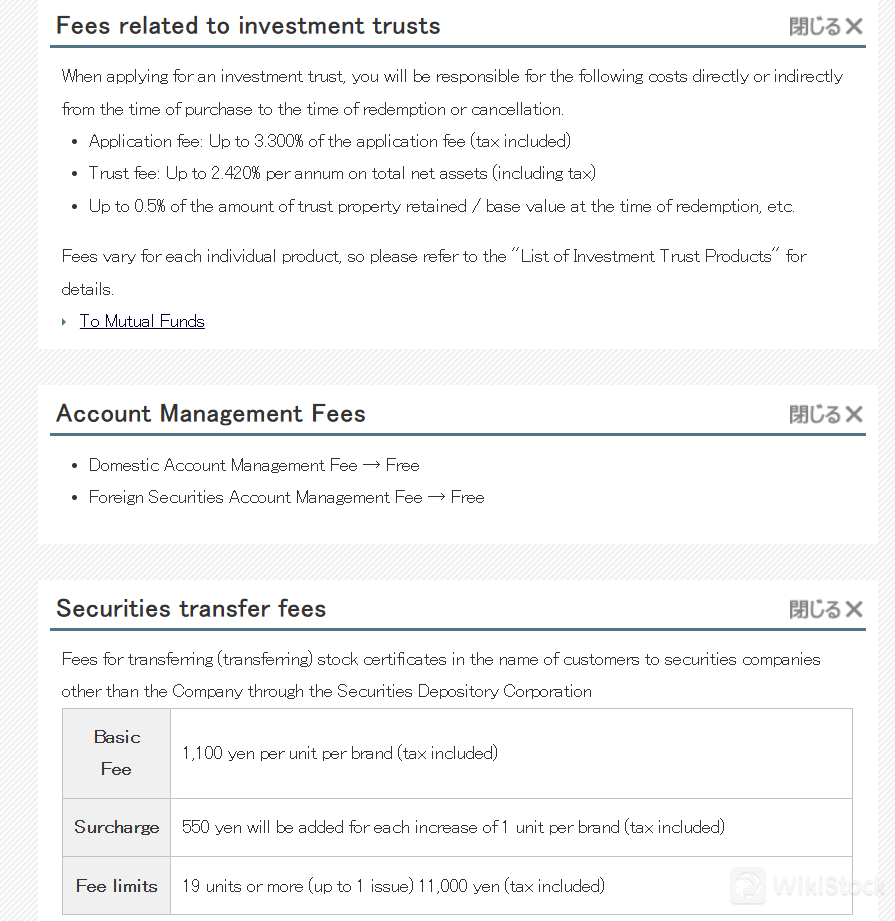

MEBUKI มีโครงสร้างค่าธรรมเนียมโปร่งใสสำหรับการซื้อขายหลายประเภทของหลักทรัพย์ เพื่อให้ความชัดเจนและความยืดหยุ่นให้แก่นักลงทุน

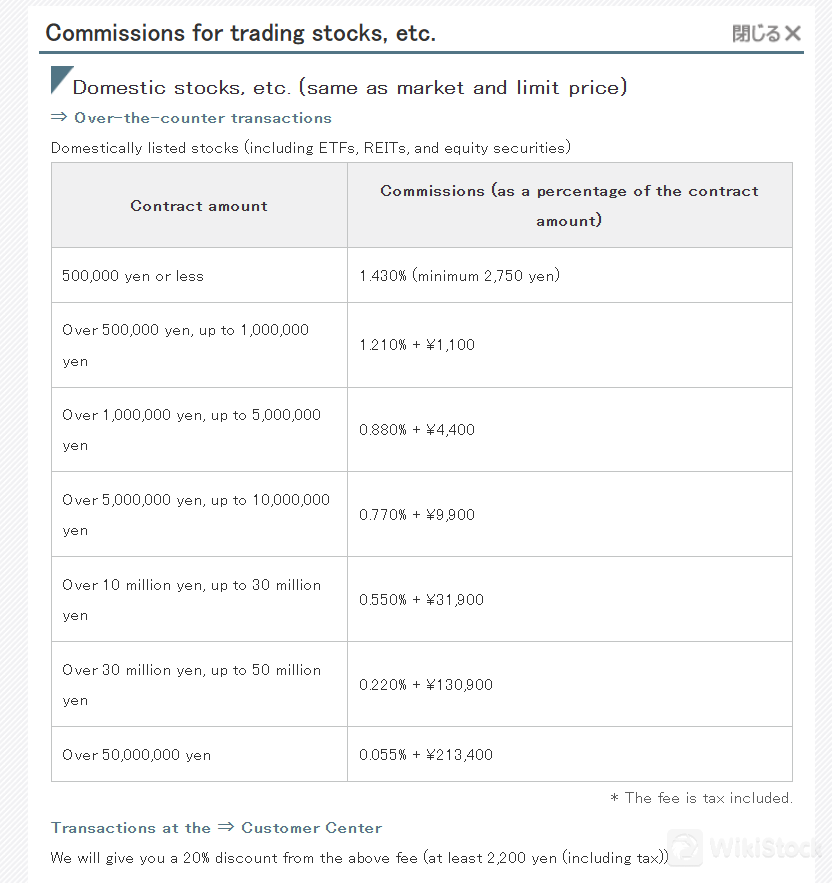

หุ้นในประเทศ กองทุน ETF REITs และหลักทรัพย์ทางทุน

- จำนวนสัญญา:

- ¥500,000 หรือต่ำกว่า: 1.430% (ขั้นต่ำ ¥2,750)

- เกิน ¥500,000 ถึง ¥1,000,000: 1.210% + ¥1,100

- เกิน ¥1,000,000 ถึง ¥5,000,000: 0.880% + ¥4,400

- เกิน ¥5,000,000 ถึง ¥10,000,000: 0.770% + ¥9,900

- เกิน ¥10,000,000 ถึง ¥30,000,000: 0.550% + ¥31,900

- เกิน ¥30,000,000 ถึง ¥50,000,000: 0.220% + ¥130,900

- เกิน ¥50,000,000: 0.055% + ¥213,400

- ธุรกรรมที่ศูนย์บริการลูกค้า: ลด 20% จากค่าธรรมเนียมด้านบน (ขั้นต่ำ ¥2,200 รวมภาษี)

- น้อยกว่าหน่วยหุ้น 1 หน่วย:

- ธุรกรรมตลาดนอก: (จำนวนสัญญา) × 1.65% (รวมภาษี)

- ธุรกรรมที่ศูนย์บริการลูกค้า: ลด 20% ในการซื้อขายในร้าน

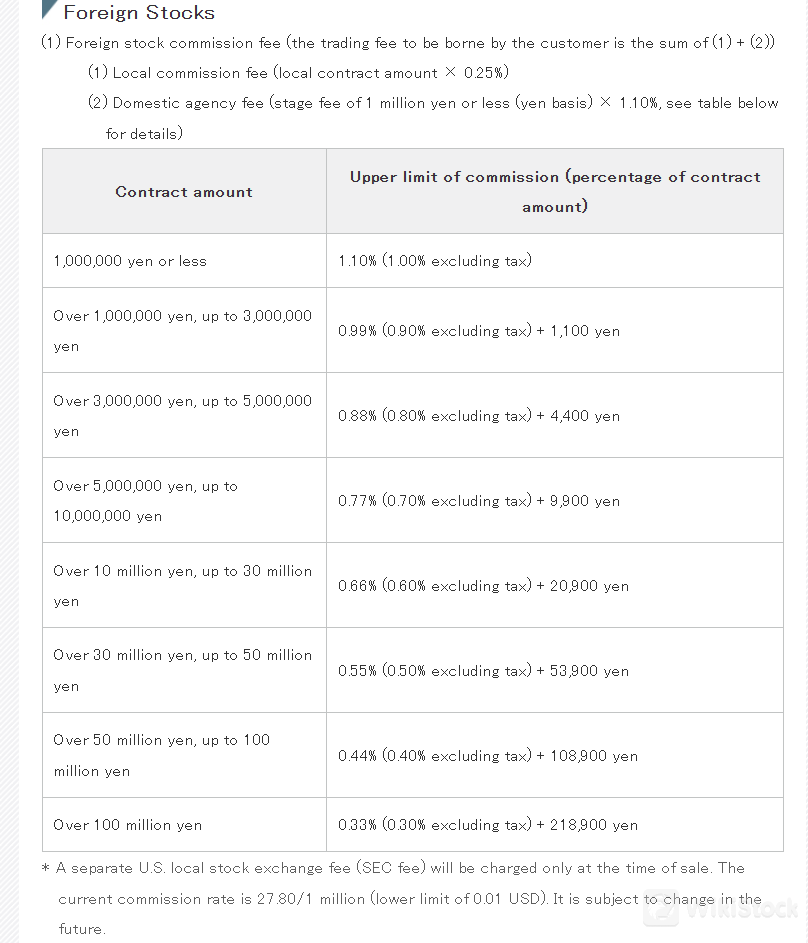

หุ้นต่างประเทศ

- ค่าคอมมิชชั่นท้องถิ่น: จำนวนสัญญาในท้องถิ่น × 0.25%

- ค่าบริการในประเทศ: ขึ้นอยู่กับจำนวนสัญญา:

- ¥1,000,000 หรือต่ำกว่า: 1.10% (1.00% ยกเว้นภาษี)

- เกิน ¥1,000,000 ถึง ¥3,000,000: 0.99% (0.90% ยกเว้นภาษี) + ¥1,100

- เกิน ¥3,000,000 ถึง ¥5,000,000: 0.88% (0.80% ยกเว้นภาษี) + ¥4,400

- เกิน ¥5,000,000 ถึง ¥10,000,000: 0.77% (0.70% ยกเว้นภาษี) + ¥9,900

- เกิน ¥10,000,000 ถึง ¥30,000,000: 0.66% (0.60% ยกเว้นภาษี) + ¥20,900

- เกิน ¥30,000,000 ถึง ¥50,000,000: 0.55% (0.50% ยกเว้นภาษี) + ¥53,900

- เกิน ¥50,000,000 ถึง ¥100,000,000: 0.44% (0.40% ยกเว้นภาษี) + ¥108,900

- เกิน ¥100,000,000: 0.33% (0.30% ยกเว้นภาษี) + ¥218,900

- ค่าธรรมเนียมเพิ่มเติม: มีค่าธรรมเนียมตลาดหลักทรัพย์ในสหรัฐฯ (ค่าธรรมเนียม SEC) ที่เรียกเก็บในเวลาขาย ปัจจุบัน 27.80/1 ล้าน (ขั้นต่ำ 0.01 ดอลลาร์สหรัฐ)

การวิจัยและการศึกษา

MEBUKI โดดเด่นในการให้บริการทรัพยากรการศึกษาอย่างครบวงจรผ่านสัมมนาของตน ในฐานะผู้นำในอุตสาหกรรมการเงิน Mebuki Securities นำเสนอความคิดเห็นที่มีคุณค่าเกี่ยวกับกลยุทธ์การจัดการทรัพย์สินรวมถึงการพยากรณ์ตลาด รายงานการลงทุน และอัพเดตเกี่ยวกับผลิตภัณฑ์ใหม่ สัมมนาของพวกเขาถูกออกแบบให้เพิ่มพูนความรู้ให้กับลูกค้าเพื่อเสริมสร้างความเข้าใจในตลาดการเงินและโอกาสในการลงทุน

บริการลูกค้า

ลูกค้าสามารถติดต่อขอความช่วยเหลือทางโทรศัพท์ที่ 0120-41-1414

สรุป

ในสรุป MEBUKI เป็นตัวเลือกที่น่าเชื่อถือในภาคบริการทางการเงิน มีแพลตฟอร์มที่แข็งแกร่งสำหรับนักลงทุนทั้งในประเทศและต่างประเทศ ชุดผลิตภัณฑ์การซื้อขายที่หลากหลายของบริษัทนี้ให้โอกาสมากมายในการกระจายพอร์ตโดยมีทรัพยากรการศึกษาอย่างครบถ้วน อย่างไรก็ตาม ความจำกัดเช่นข้อมูลอัตราเงินหลักและแพลตฟอร์มการซื้อขายควรระบุไว้

คำถามที่พบบ่อย

MEBUKI เหมาะสำหรับผู้เริ่มต้นหรือไม่?

ใช่ MEBUKI เหมาะสำหรับผู้เริ่มต้นเนื่องจากโครงสร้างค่าธรรมเนียมโปร่งใสและทรัพยากรการศึกษา

MEBUKI เป็นกิจการถูกกฎหมายหรือไม่?

ใช่ MEBUKI ได้รับการควบคุมโดย FSA

ฉันสามารถซื้อขายหลักทรัพย์ประเภทใดกับ MEBUKI ได้บ้าง?

หลักทรัพย์ภายในและต่างประเทศ กองทุน ETF REIT พันธบัตร กองทุนตลาดเงิน และโอกาสในการลงทุนใน IPO และ PO

MEBUKI มีส่วนลดหรือโปรโมชั่นใดที่ใช้งานได้หรือไม่?

MEBUKI มีส่วนลดค่าคอมมิชชั่น 20% สำหรับการทำธุรกรรมที่ดำเนินการที่ศูนย์บริการลูกค้าของพวกเขา โดยมีจำนวนส่วนลดขั้นต่ำที่ระบุ

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นไปตามการประเมินของผู้เชี่ยวชาญของ WikiStock จากข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการเสี่ยงที่สูง อาจ导致สูญเสียทั้งหมดของเงินลงทุนดังนั้นความเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะเข้ามาเกี่ยวข้องเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ประเทศญี่ปุ่น

ปีในธุรกิจ

5-10 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

ดาวน์โหลดแอป

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

内藤証券株式会社

คะแนน

Ichiyoshi Securities

คะแนน

広田証券

คะแนน

丸八証券株式会社

คะแนน

ひろぎん証券

คะแนน

三木証券

คะแนน

JTG証券

คะแนน

JIA証券

คะแนน

山和証券株式会社

คะแนน

八十二証券

คะแนน