Điểm

めぶき証券

http://www.mebuki-sec.co.jp/

Website

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Mức ảnh hưởng

B

Chỉ số ảnh hưởng NO.1

Nhật Bản

Nhật BảnSản phẩm giao dịch

8

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

FSACó giám sát quản lý

Nhật BảnGiấy phép giao dịch chứng khoán

Thông tin sàn môi giới

More

Tên công ty

Mebuki Securities Co., Ltd

Viết tắt

めぶき証券

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

http://www.mebuki-sec.co.jp/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

Đặc điểm môi giới

Tỷ lệ hoa hồng

1.430%

New Stock Trading

Yes

Margin Trading

YES

Các quốc gia được quản lý

1

Lưu ý: Thông tin được cung cấp trong bài đánh giá này có thể thay đổi do việc cập nhật liên tục các dịch vụ và chính sách của công ty. Ngoài ra, ngày tạo bài đánh giá cũng có thể là một yếu tố quan trọng cần xem xét, vì thông tin có thể đã thay đổi kể từ đó. Do đó, độc giả được khuyến nghị luôn xác minh thông tin cập nhật trực tiếp với công ty trước khi đưa ra bất kỳ quyết định hoặc hành động nào. Trách nhiệm về việc sử dụng thông tin được cung cấp trong bài đánh giá này hoàn toàn thuộc về độc giả.

Trong bài đánh giá này, nếu có xung đột giữa hình ảnh và nội dung văn bản, nội dung văn bản sẽ được ưu tiên. Tuy nhiên, chúng tôi khuyến nghị bạn mở trang web chính thức để được tư vấn thêm.

| MEBUKI |  |

| Đánh giá WikiStock | ⭐⭐⭐⭐ |

| Phí giao dịch | Cổ phiếu trong nước, ETF, REIT và Chứng khoán vốn: 500.000 yên hoặc ít hơn: 1,430% (tối thiểu ¥2,750), thay đổi dựa trên số hợp đồng |

| Cổ phiếu nước ngoài: Phí môi giới địa phương: Số hợp đồng địa phương × 0,25%; Phí đại lý trong nước: thay đổi dựa trên số hợp đồng | |

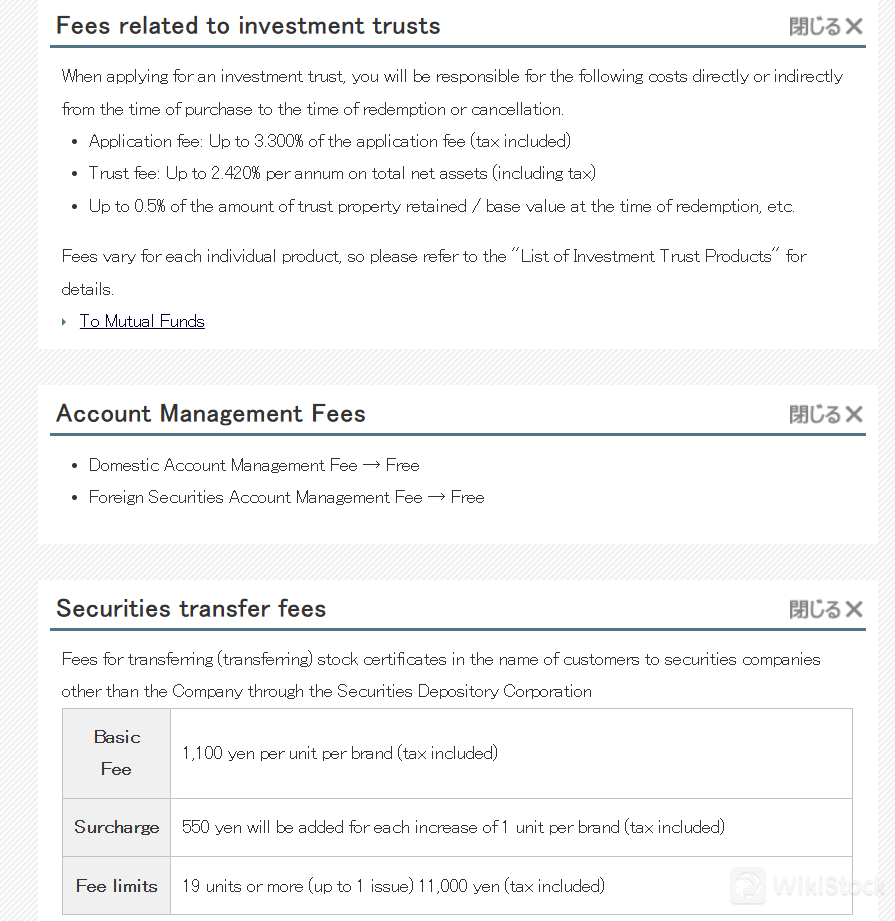

| Phí quản lý tài khoản | Miễn phí |

| Quỹ hỗ trợ | Có |

| Ứng dụng/Nền tảng | Không được đề cập |

| Khuyến mãi | Có |

Thông tin MEBUKI

MEBUKI là một nhà cung cấp dịch vụ tài chính được quy định được công nhận với các giải pháp giao dịch chứng khoán và đầu tư mạnh mẽ. Công ty phục vụ cả nhà đầu tư trong nước và quốc tế với một loạt sản phẩm giao dịch đa dạng, bao gồm cổ phiếu trong nước và nước ngoài, quỹ đầu tư như ETF và REIT, cũng như trái phiếu và quỹ thị trường tiền tệ. Ngoài dịch vụ giao dịch, MEBUKI còn cung cấp các buổi hội thảo giáo dục toàn diện giúp khách hàng hiểu rõ về quản lý tài sản và xu hướng thị trường.

Ưu điểm & Nhược điểm

| Ưu điểm | Nhược điểm |

| Quản lý giám sát (FSA) | Thông tin hạn chế về tỷ lệ ký quỹ |

| Danh mục sản phẩm giao dịch đa dạng | Chi tiết ứng dụng/Nền tảng không được chỉ định |

| Buổi hội thảo giáo dục | |

| Cấu trúc phí minh bạch |

Ưu điểm

Quản lý giám sát (FSA): MEBUKI được quản lý bởi Cơ quan Dịch vụ Tài chính (FSA), đảm bảo tuân thủ các tiêu chuẩn nghiêm ngặt về bảo vệ nhà đầu tư và tính toàn vẹn của thị trường.

Danh mục sản phẩm giao dịch đa dạng: Cung cấp một lựa chọn toàn diện bao gồm cổ phiếu trong nước và nước ngoài, ETF, REIT, trái phiếu và quỹ thị trường tiền tệ.

Buổi hội thảo giáo dục: Cung cấp các buổi hội thảo giá trị về quản lý tài sản và những hiểu biết về thị trường, giúp khách hàng có kiến thức để đưa ra quyết định đầu tư thông minh.

Cấu trúc phí minh bạch: Rõ ràng chỉ ra các khoản phí giao dịch cho các chứng khoán khác nhau, thúc đẩy sự minh bạch và rõ ràng trong chi phí giao dịch.

Nhược điểm

Thông tin hạn chế về tỷ lệ ký quỹ: Không cung cấp thông tin cụ thể về lãi suất ký quỹ, điều này có thể ảnh hưởng đến khách hàng cần sử dụng đòn bẩy cho mục đích giao dịch.

Chi tiết ứng dụng/nền tảng không được chỉ định: Thông tin về nền tảng giao dịch hoặc ứng dụng di động không được đề cập, ảnh hưởng đến tính khả dụng và trải nghiệm người dùng đối với nhà đầu tư thông thái về công nghệ.

MEBUKI có an toàn không?

MEBUKI được quản lý bởi sự giám sát của Cơ quan Dịch vụ Tài chính (FSA). Khung quản lý này đảm bảo công ty tuân thủ các tiêu chuẩn nghiêm ngặt nhằm bảo vệ nhà đầu tư và duy trì tính toàn vẹn của thị trường tài chính. Bằng việc tuân thủ các quy định, MEBUKI đảm bảo hoạt động của mình được tiến hành với sự chuyên nghiệp và trách nhiệm tuyệt đối, gieo niềm tin vào khách hàng và các bên liên quan.

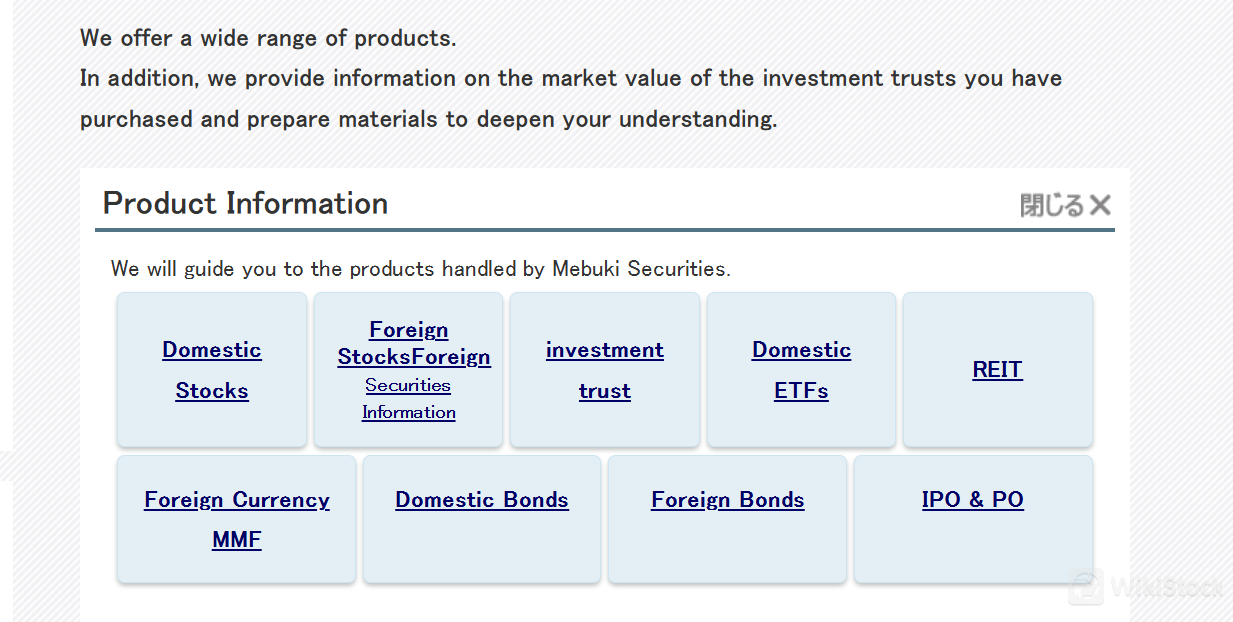

Các chứng khoán để giao dịch với MEBUKI là gì?

MEBUKI cung cấp một loạt các sản phẩm giao dịch đa dạng được thiết kế để đáp ứng nhu cầu của cả nhà đầu tư trong nước và quốc tế. Từ cổ phiếu trong nước và chứng khoán nước ngoài đến quỹ đầu tư, ETF trong nước và quỹ đầu tư bất động sản (REITs), MEBUKI đảm bảo một lựa chọn toàn diện để đa dạng hóa danh mục đầu tư. Ngoài ra, họ còn cung cấp cơ hội trong quỹ tiền tệ thị trường nước ngoài (MMFs), trái phiếu trong nước và nước ngoài, và tham gia vào đợt phát hành công cộng ban đầu (IPO) và đợt phát hành công cộng (PO).

Đánh giá phí MEBUKI

MEBUKI cung cấp một cấu trúc phí minh bạch cho việc giao dịch các loại chứng khoán khác nhau, đảm bảo sự rõ ràng và linh hoạt cho nhà đầu tư.

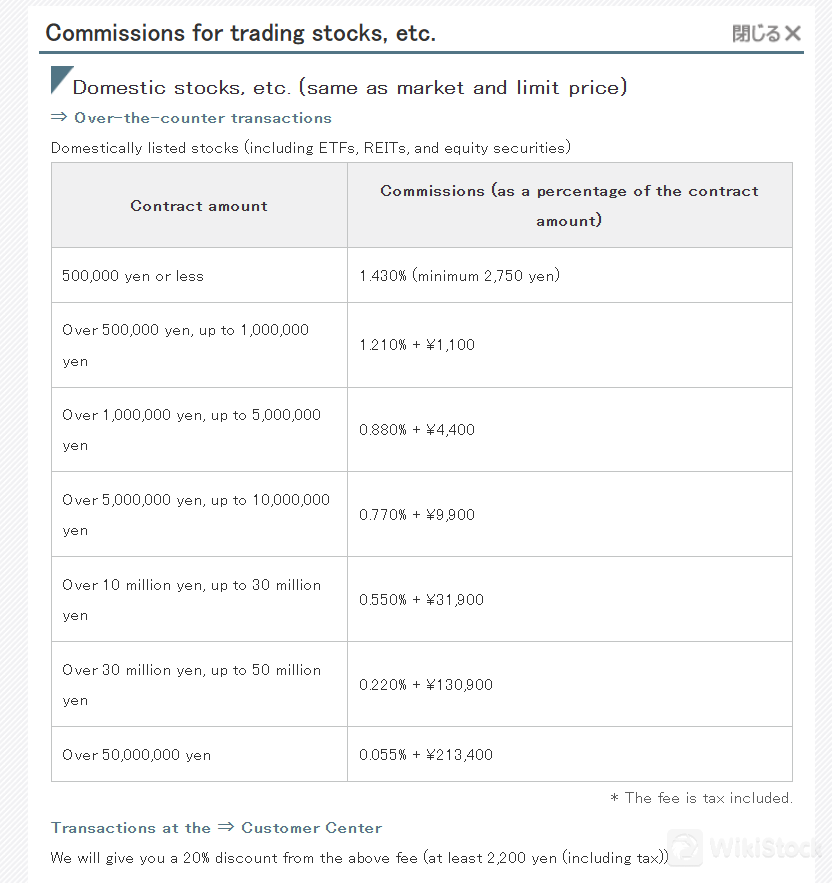

Cổ phiếu trong nước, ETF, REITs và Chứng khoán vốn

- Số hợp đồng:

- ¥500,000 hoặc ít hơn: 1.430% (tối thiểu ¥2,750)

- Trên ¥500,000 đến ¥1,000,000: 1.210% + ¥1,100

- Trên ¥1,000,000 đến ¥5,000,000: 0.880% + ¥4,400

- Trên ¥5,000,000 đến ¥10,000,000: 0.770% + ¥9,900

- Trên ¥10,000,000 đến ¥30,000,000: 0.550% + ¥31,900

- Trên ¥30,000,000 đến ¥50,000,000: 0.220% + ¥130,900

- Trên ¥50,000,000: 0.055% + ¥213,400

- Giao dịch tại Trung tâm Khách hàng: Giảm 20% so với các khoản phí trên (tối thiểu ¥2,200 bao gồm thuế)

- Dưới một đơn vị cổ phiếu:

- Giao dịch ngoài quầy: (Số hợp đồng) × 1.65% (bao gồm thuế)

- Giao dịch tại Trung tâm Khách hàng: Giảm 20% cho giao dịch tại cửa hàng

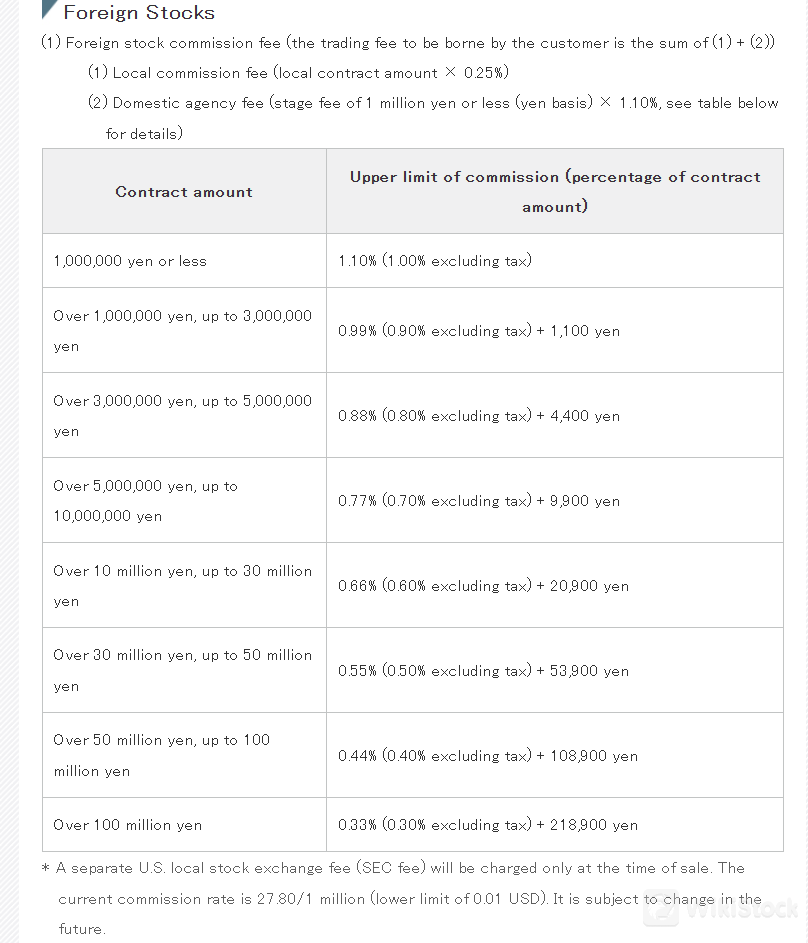

Cổ phiếu nước ngoài

- Phí hoa hồng địa phương: Số hợp đồng địa phương × 0.25%

- Phí đại lý trong nước: Thay đổi dựa trên số hợp đồng:

- ¥1,000,000 hoặc ít hơn: 1.10% (1.00% trừ thuế)

- Trên ¥1,000,000 đến ¥3,000,000: 0.99% (0.90% trừ thuế) + ¥1,100

- Trên ¥3,000,000 đến ¥5,000,000: 0.88% (0.80% trừ thuế) + ¥4,400

- Trên ¥5,000,000 đến ¥10,000,000: 0.77% (0.70% trừ thuế) + ¥9,900

- Trên ¥10,000,000 đến ¥30,000,000: 0.66% (0.60% trừ thuế) + ¥20,900

- Trên ¥30,000,000 đến ¥50,000,000: 0.55% (0.50% trừ thuế) + ¥53,900

- Trên ¥50,000,000 đến ¥100,000,000: 0.44% (0.40% trừ thuế) + ¥108,900

- Trên ¥100,000,000: 0.33% (0.30% trừ thuế) + ¥218,900

- Phí bổ sung: Phí giao dịch sàn chứng khoán địa phương Mỹ riêng biệt (phí SEC) được tính vào thời điểm bán hàng, hiện tại là 27.80/1 triệu (tối thiểu 0.01 USD).

Nghiên cứu & Giáo dục

MEBUKI xuất sắc trong việc cung cấp tài liệu giáo dục toàn diện thông qua các buổi hội thảo của mình. Là một nhà lãnh đạo trong ngành tài chính, Mebuki Securities cung cấp những hiểu biết quý giá về chiến lược quản lý tài sản, bao gồm dự báo thị trường, báo cáo đầu tư và cập nhật về sản phẩm mới. Các buổi hội thảo của họ được thiết kế để trang bị cho khách hàng kiến thức giúp nâng cao hiểu biết về thị trường tài chính và cơ hội đầu tư.

Dịch vụ khách hàng

Khách hàng có thể liên hệ để được hỗ trợ qua điện thoại tại số 0120-41-1414.

Kết luận

Tóm lại, MEBUKI nổi lên như một lựa chọn đáng tin cậy trong lĩnh vực dịch vụ tài chính, cung cấp một nền tảng mạnh mẽ cho cả nhà đầu tư trong nước và quốc tế. Sự đa dạng về các sản phẩm giao dịch của công ty cung cấp nhiều cơ hội cho việc đa dạng hóa danh mục với tài liệu giáo dục toàn diện. Tuy nhiên, cần lưu ý nhược điểm như thông tin hạn chế về tỷ lệ ký quỹ và các nền tảng giao dịch.

Câu hỏi thường gặp

MEBUKI có phù hợp cho người mới bắt đầu không?

Có, MEBUKI phù hợp cho người mới bắt đầu nhờ cấu trúc phí minh bạch và tài liệu giáo dục.

MEBUKI có đáng tin cậy không?

Có, MEBUKI được quy định bởi FSA.

Loại chứng khoán nào tôi có thể giao dịch với MEBUKI?

Chứng khoán trong nước và nước ngoài, ETF, REIT, trái phiếu, quỹ thị trường tiền tệ và cơ hội trong IPO và PO.

Có sẵn các khuyến mãi hoặc ưu đãi nào với MEBUKI không?

MEBUKI cung cấp giảm giá 20% phí giao dịch cho các giao dịch được tiến hành tại Trung tâm Khách hàng của họ, với mức giảm giá tối thiểu được quy định.

Cảnh báo rủi ro

Thông tin được cung cấp dựa trên đánh giá chuyên gia của WikiStock về dữ liệu trang web của sàn giao dịch và có thể thay đổi. Ngoài ra, giao dịch trực tuyến có rủi ro lớn, có thể dẫn đến mất toàn bộ số vốn đầu tư, vì vậy việc hiểu rõ các rủi ro liên quan trước khi tham gia là rất quan trọng.

Thông tin khác

Registered region

Nhật Bản

Số năm kinh doanh

5-10năm

Sản phẩm giao dịch

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Tải ứng dụng

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

内藤証券株式会社

Điểm

Ichiyoshi Securities

Điểm

広田証券

Điểm

丸八証券株式会社

Điểm

ひろぎん証券

Điểm

三木証券

Điểm

JTG証券

Điểm

JIA証券

Điểm

山和証券株式会社

Điểm

八十二証券

Điểm