Điểm

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Mức ảnh hưởng

C

Chỉ số ảnh hưởng NO.1

Trung Quốc

Trung QuốcSản phẩm giao dịch

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Hơn 23.54% sàn môi giới

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

SFCCó giám sát quản lý

Hồng KôngGiấy phép giao dịch chứng khoán

Ghế thành viên toàn cầu

![]() Sàn môi giới sở hữu 1

Sàn môi giới sở hữu 1

Hồng Kông HKEX

Số ghế 02214

Thông tin sàn môi giới

More

Tên công ty

WINBULL SECURITIES INTERNATIONAL HONG KONG LIMITED

Viết tắt

盈寶證券

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

https://winbull.hk/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

Lượt tải ứng dụng

- Chu kỳ

- Lượt tải

- 2024-05

- 43013

Quy tắc thống kê: Dữ liệu được hiển thị dưới dạng lượt tải trong vòng một năm.

Độ phổ biến của ứng dụng trong khu vực

- Quốc gia/Khu vựcLượt tảiTỷ lệ

Hồng Kông

2903067.49%Khác

1062424.70%Ghana

11412.65%Trung Quốc

11342.64%Thái Lan

10842.52%

Quy tắc thống kê: Dữ liệu được hiển thị dưới dạng lượt tải và tỷ lệ khu vực trong vòng một năm.

Đặc điểm môi giới

Phí giao dịch

$1.3

Phí sử dụng nền tảng

HK$10

Tỷ lệ hoa hồng

0%

Tiền nạp tối thiểu

$1,300

Lãi suất Funding

5.6%

New Stock Trading

Yes

Margin Trading

YES

Các quốc gia được quản lý

1

| WINBULL SECURITIES |  |

| Đánh giá WikiStock | ⭐⭐⭐ |

| Tài khoản tối thiểu | $1,000 |

| Phí | $0.0039 mỗi cổ phiếu giao dịch, 6.6% hàng năm trên giao dịch tài chính, HKD 50 phí đăng ký IPO và v.v. |

| Phí tài khoản | HKD 100~500 (Quản lý tài khoản) |

| Ứng dụng/Nền tảng | Ứng dụng Wealth Treasure Securities |

| Khuyến mãi | Tiền thưởng cho khách hàng mới (HKD 4,000+) |

| Hỗ trợ khách hàng | Điện thoại, email, fax, trò chuyện trực tiếp |

WINBULL SECURITIES là gì?

WINBULL SECURITIES, được cấp phép bởi Ủy ban Chứng khoán và Tương lai Hong Kong (SFC), cung cấp một nền tảng mạnh mẽ cho các nhà đầu tư toàn cầu tìm kiếm các giải pháp đầu tư toàn diện. Trụ sở chính đặt tại Hồng Kông với các chi nhánh tại Quảng Châu và Thâm Quyến, nó cung cấp ứng dụng Wealth Treasure Securities thân thiện với người dùng, có thể truy cập trên cả hai nền tảng iOS và Android, tạo điều kiện thuận lợi cho việc giao dịch liền mạch các cổ phiếu Mỹ, IPO và cổ phiếu Hồng Kông.

| Ưu điểm | Nhược điểm |

| Tuân thủ quy định | Yêu cầu tiền gửi tối thiểu cao |

| Phân tách Tài sản của Khách hàng | Nhà mới |

| Nền tảng giao dịch thân thiện với người dùng | Cấu trúc phí phức tạp |

Tuân thủ quy định: Được cấp phép bởi Ủy ban Chứng khoán và Tương lai Hong Kong (SFC) với các giấy phép Loại 1, 4 và 9. Điều này đảm bảo sàn giao dịch hoạt động dưới sự giám sát nghiêm ngặt của các quy định, mang lại mức độ an toàn cho các nhà đầu tư.

Phân tách Tài sản của Khách hàng: Quỹ và chứng khoán của khách hàng được giữ riêng biệt với tài sản của công ty, giảm rủi ro sử dụng sai mục đích hoặc lạm dụng. Cài đặt này nâng cao bảo vệ cho nhà đầu tư.

Tùy chọn Đầu tư: Cung cấp một loạt các sản phẩm đầu tư bao gồm cổ phiếu Mỹ, IPO và cổ phiếu Hồng Kông. Đa dạng này cho phép nhà đầu tư tiếp cận cả thị trường trong nước và quốc tế.

Nền tảng giao dịch thân thiện với người dùng: Cung cấp ứng dụng Wealth Treasure Securities, có thể truy cập trên cả hai nền tảng iOS và Android. Ứng dụng được thiết kế linh hoạt và thân thiện với người dùng.

Nhược điểm:Yêu cầu tiền gửi tối thiểu cao: Yêu cầu tiền gửi tối thiểu cao là $1,000 có thể là rào cản đối với các nhà đầu tư nhỏ hơn hoặc những người mới bắt đầu. Nó giới hạn khả năng tiếp cận của các khách hàng tiềm năng không có vốn đầu tư ban đầu đáng kể.

Nhà mới: Ra mắt vào tháng 3 năm 2022, điều này có nghĩa là nó mới hơn so với các công ty môi giới đã được thành lập hơn. Các công ty mới hơn có thể đối mặt với thách thức trong việc xây dựng uy tín và niềm tin ban đầu.

Cấu trúc phí phức tạp: Cấu trúc phí phức tạp có thể dẫn đến sự nhầm lẫn và chi phí bất ngờ cho khách hàng. Điều này có thể làm khó cho nhà đầu tư hiểu rõ họ đang bị tính phí cho các dịch vụ khác nhau, có thể dẫn đến sự không hài lòng hoặc không tin tưởng.

WINBULL SECURITIES là an toàn không?

Số tiền đầu tư tối thiểu: $1,000

Khoảng thời gian khóa: Không

Đánh giá các nền tảng của WINBULL SECURITIES

Dịch vụ khách hàng

WINBULL SECURITIES hoạt động dưới sự giám sát của Ủy ban Chứng khoán và Hợp đồng tương lai (SFC) với Giấy phép Số BRG131. SFC, là cơ quan quản lý tài chính của Hồng Kông, đóng vai trò quan trọng trong việc duy trì và nâng cao tính toàn vẹn và ổn định của thị trường chứng khoán và hợp đồng tương lai của thành phố. Khung pháp lý này nhằm bảo vệ lợi ích của nhà đầu tư và đảm bảo sức khỏe tổng thể của ngành tài chính.

Một trong những cam kết quan trọng mà WINBULL SECURITIES cung cấp là sự phân tách tài sản của khách hàng. Điều này có nghĩa là tiền và chứng khoán của khách hàng được giữ riêng biệt với tài sản của công ty, giảm rủi ro việc lạm dụng hoặc sử dụng sai mục đích. Ngoài ra, khách hàng được hưởng lợi từ Quỹ Bồi thường Nhà đầu tư Hồng Kông (ICF). ICF cung cấp một biện pháp bảo vệ bằng cách bồi thường cho nhà đầu tư đủ điều kiện nếu một công ty môi giới không thực hiện đúng nghĩa vụ tài chính do phá sản hoặc các lý do cụ thể khác.

Các loại Chứng khoán để Giao dịch với WINBULL SECURITIES?

WINBULL SECURITIES cung cấp quyền truy cập vào cổ phiếu Mỹ, cho phép nhà đầu tư giao dịch cổ phiếu của các công ty Mỹ được niêm yết trên các sàn giao dịch chính như NYSE và NASDAQ.

Ngoài ra, WINBULL SECURITIES tạo điều kiện cho việc tham gia Đợt phát hành cổ phiếu công khai (IPO), cung cấp cơ hội đầu tư vào các công ty mới niêm yết. IPO có thể mang lại tiềm năng sinh lợi lớn, đặc biệt đối với nhà đầu tư tìm kiếm cơ hội tăng trưởng giai đoạn đầu.

Hơn nữa, công ty cung cấp quyền truy cập vào cổ phiếu Hồng Kông, cho phép nhà đầu tư giao dịch cổ phiếu được niêm yết trên Sở giao dịch chứng khoán Hồng Kông (HKEX). Điều này bao gồm các công ty được niêm yết trên Bảng chính và Thị trường Doanh nghiệp Tăng trưởng (GEM).

Đánh giá Phí của WINBULL SECURITIES

WINBULL SECURITIES tính một loạt các khoản phí liên quan đến dịch vụ giao dịch và quản lý đầu tư của mình. Các khoản phí này có thể được phân loại thành phí giao dịch, phí tài trợ, phí đăng ký, phí hạng thành viên và các khoản phí khác.

Phí Giao dịch: Đối với giao dịch cổ phiếu Mỹ, công ty tính một khoản phí bao gồm chi phí giao dịch. Ngoài ra, một khoản phí giao dịch là 0,0039 đô la Mỹ trên mỗi cổ phiếu được thu trong quá trình giao dịch thực tế do sàn giao dịch, thanh lý, giám sát, v.v.

Phí Tài trợ: WINBULL SECURITIES tính một lãi suất tài trợ 6,6% trên tài trợ biên, cao hơn so với trung bình ngành. Lãi suất này được áp dụng cho số tiền vay từ công ty môi giới để mua chứng khoán theo biên, và khách hàng chịu trách nhiệm trả lại khoản vay cộng lãi suất.

Phí Đăng ký: Đối với việc tham gia Đợt phát hành cổ phiếu công khai (IPO), khách hàng phải trả một khoản phí đăng ký. Phí này thay đổi tùy thuộc vào loại đơn và người nhận phí. Phí này bao gồm các chi phí quản lý liên quan đến xử lý và quản lý đơn đăng ký IPO.

Phí Hạng thành viên: Công ty có thể cung cấp các hạng thành viên khác nhau, mỗi hạng có các lợi ích và phí liên quan riêng. Các chi tiết cụ thể về các hạng thành viên này và các khoản phí liên quan không được cung cấp trong thông tin tham khảo, nhưng thông thường được thiết kế để khuyến khích mức đầu tư hoặc hoạt động giao dịch cao hơn.

Các khoản phí khác: WINBULL SECURITIES tính các khoản phí khác nhau cho các dịch vụ như quản lý tài khoản, sao kê thay thế và séc trả về.

Phí Quản lý: Phí quản lý được tính bởi WINBULL SECURITIES dựa trên mức độ rủi ro của danh mục đầu tư. Lịch trình phí được chi tiết, với các tỷ lệ phần trăm khác nhau áp dụng cho danh mục rủi ro thấp đến trung bình, rủi ro trung bình và rủi ro trung bình đến cao.

Minimum Investment and Lock-In Period: WINBULL SECURITIES chỉ định một số tiền đầu tư tối thiểu là $1,000 và cho biết không có khoảng thời gian khóa đầu tư.

| Loại Phí | Số tiền (HKD) | |

| Phí Giao Dịch Cổ Phiếu Mỹ | Phí giao dịch trên mỗi cổ phiếu | $0.0039 |

| Phí Tài Trợ | 6.6% hàng năm trên giao dịch tài trợ | |

| Phí Đăng Ký IPO | Đăng ký cổ phiếu mới (Điện tử) | 50 |

| Phí Tài Trợ Ký Quỹ | Tài trợ ký quỹ (Điện tử) | 100 |

| Quản Lý Tài Khoản | Thư Xác Nhận Tài Khoản | 300 |

| Quản Lý Tài Khoản | Hủy Tài Khoản Trong 6 Tháng Sau Khi Mở | 500 |

| Khác | Trả lại séc/Stop thanh toán | 100 |

Thông tin bổ sung:

Ứng dụng Wealth Treasure Securities của WINBULL SECURITIES cung cấp một nền tảng giao dịch thân thiện với người dùng và linh hoạt, có thể truy cập được cho cả người dùng iOS và Android. Với sự dễ dàng có sẵn trên Apple Store, Google Play và qua APK, nó đảm bảo tính sẵn có rộng rãi cho các nhà giao dịch trên các thiết bị khác nhau.

Nền tảng này có một loạt các tính năng giao dịch toàn diện, cho phép người dùng thực hiện giao dịch một cách hiệu quả và quản lý danh mục đầu tư của họ một cách mượt mà. Nó cung cấp dữ liệu thị trường thời gian thực, công cụ biểu đồ tiên tiến và danh sách theo dõi có thể tùy chỉnh.

WINBULL SECURITIES cung cấp bốn cấp độ tài khoản: Vi, V2, V3 và VA.

Vi: Đây là tài khoản cơ bản, phù hợp cho nhà đầu tư mới với khối lượng giao dịch thấp hơn. Nó có yêu cầu tối thiểu nhưng cũng có tỷ lệ hoa hồng và phí nền tảng cao hơn.

V2: Một bước tiến từ Vi, cung cấp tỷ lệ hoa hồng và phí nền tảng thấp hơn một chút. Yêu cầu tối thiểu 5 giao dịch để đủ điều kiện.

V3: Cấp độ này phục vụ cho những nhà giao dịch hoạt động nhiều hơn với tổng tài sản vượt quá HKD$300,000. Nó có tỷ lệ hoa hồng thấp nhất (bao gồm không có hoa hồng trên cổ phiếu Hong Kong) và lãi suất ký quỹ.

VA: Hạng mục VIP dành cho nhà đầu tư có khối lượng giao dịch lớn hoặc được chỉ định là khách hàng VIP. Nó cung cấp những lợi ích độc quyền như kênh giao dịch tùy chỉnh, giới hạn tài chính đặc biệt và phần thưởng sinh nhật.

| Tính năng | Vi | V2 | V3 | VA |

| Yêu cầu tối thiểu | Mở tài khoản | 5 giao dịch | Tổng tài sản ≥ HKD$300,000 | Khách hàng VIP |

| Phí giao dịch cổ phiếu Hong Kong | 0.03% (tối thiểu HKD$2) | 0.02% (tối thiểu HKD$2) | 0% | 0.25% (tối thiểu HKD$2) |

| Phí nền tảng cổ phiếu Hong Kong | HKD$15 mỗi giao dịch | HKD$10 mỗi giao dịch | HKD$10 mỗi giao dịch | HKD$10 mỗi giao dịch |

| Phí giao dịch cổ phiếu Mỹ | USD$0.0049 mỗi cổ phiếu (tối thiểu USD$0.99 mỗi giao dịch) | USD$0.0039 mỗi cổ phiếu (tối thiểu USD$0.99 mỗi giao dịch) | USD$0 | USD$0.0049 mỗi cổ phiếu (tối thiểu USD$0.99 mỗi giao dịch) |

| Phí nền tảng cổ phiếu Mỹ | USD$0.0049 mỗi cổ phiếu (tối thiểu USD$0.99 mỗi giao dịch) | USD$0.0049 mỗi lô (tối thiểu USD$0.99 mỗi giao dịch) | USD$0.0049 mỗi cổ phiếu (tối thiểu USD$0.99 mỗi giao dịch) | USD$0.0049 mỗi cổ phiếu (tối thiểu USD$0.99 mỗi giao dịch) |

| Lãi suất ký quỹ | 6.60% | 6.60% | 5.60% | 8.60% |

| Phí Dark Pool | 0.03% (tối thiểu HKD$2) | 0.02% (tối thiểu HKD$2) | 0% | 0% |

| Phí nền tảng Dark Pool | HKD$15 mỗi giao dịch | HKD$15 mỗi giao dịch | HKD$15 mỗi giao dịch | HKD$15 mỗi giao dịch |

| Bảng giá thời gian thực cổ phiếu Hong Kong | Miễn phí 6 tháng khi mở tài khoản, sau đó phụ thuộc vào mức tài sản | Phụ thuộc vào mức tài sản | Phụ thuộc vào mức tài sản | Phụ thuộc vào mức tài sản |

| Bảng giá thời gian thực cổ phiếu Mỹ | Miễn phí 6 tháng khi mở tài khoản, sau đó phụ thuộc vào mức tài sản | Phụ thuộc vào mức tài sản | Phụ thuộc vào mức tài sản | Phụ thuộc vào mức tài sản |

| Tỷ lệ tài trợ IPO | Lên đến 10 lần | Lên đến 20 lần | Lên đến 20 lần | Lên đến 20 lần |

| Kênh Giao dịch Tùy chỉnh | Không có | Không có | Không có | Có |

| Quà Sinh nhật | Không có | 50 điểm + 1 phiếu cổ phiếu SPCE | 100 điểm + 3 phiếu cổ phiếu SPCE | 100 điểm + 3 phiếu cổ phiếu SPCE |

WINBULL SECURITIES cung cấp một loạt các phương thức gửi tiền và rút tiền để đáp ứng nhu cầu đa dạng của khách hàng. Đối với việc gửi tiền, họ chấp nhận gửi tiền e-DDA, cung cấp các tùy chọn điện tử tiện lợi để chuyển tiền. Họ cũng tiếp nhận gửi tiền qua Internet Banking, ATM và chuyển tiền tại quầy, với hạn chế chuyển tiền của bên thứ ba hoặc gửi tiền mặt trực tiếp để đảm bảo an ninh và tuân thủ quy định.

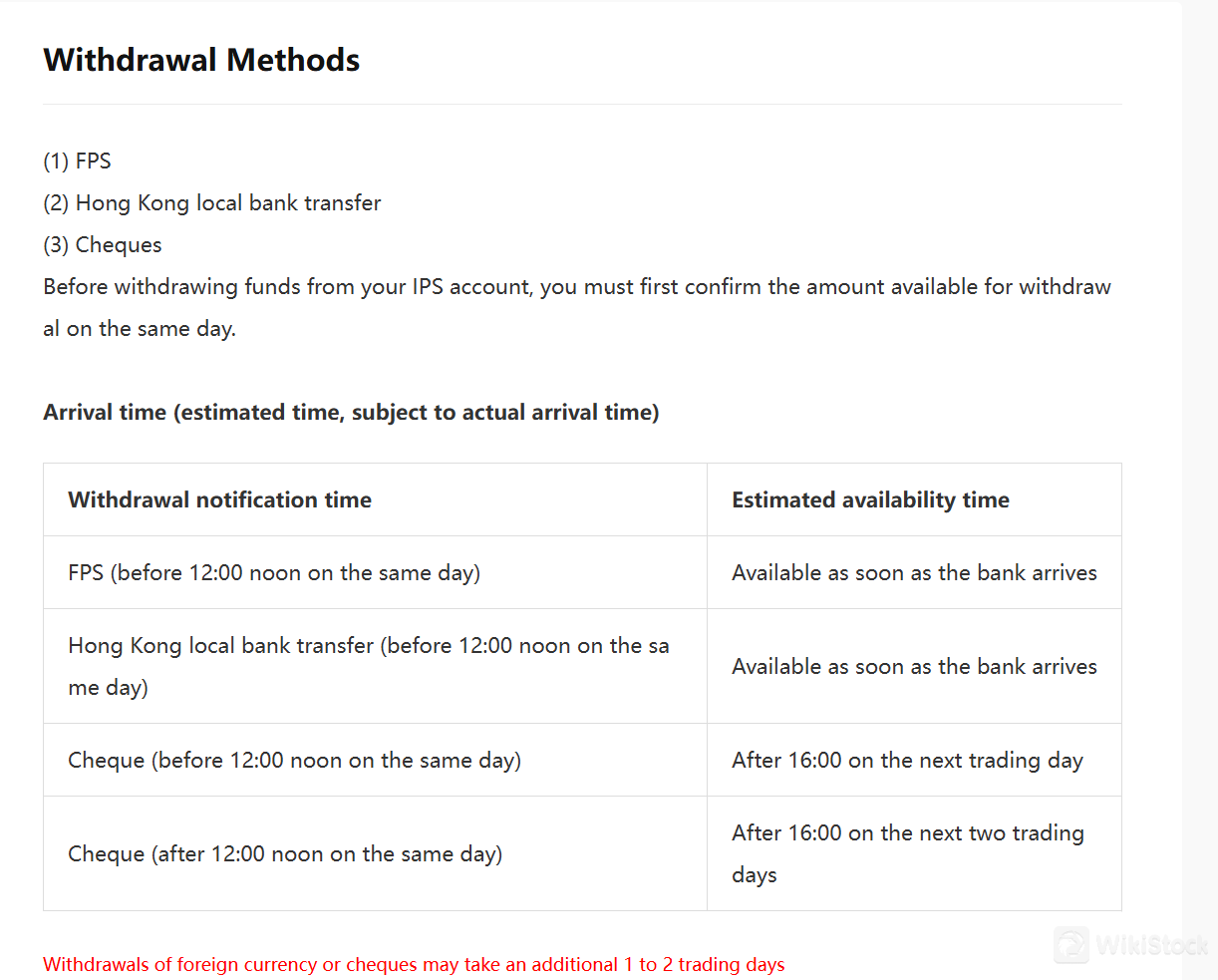

Công ty hỗ trợ Hệ thống Thanh toán Nhanh (FPS) cho cả việc gửi tiền và rút tiền, cung cấp thời gian xử lý nhanh chóng khi được khởi tạo trước buổi trưa cùng ngày. Các giao dịch FPS được ghi nhận vào tài khoản ngay khi chúng đến ngân hàng, đảm bảo tiếp cận hiệu quả với số tiền gửi. Ngoài ra, chuyển khoản ngân hàng địa phương Hong Kong cũng có sẵn, cung cấp một lựa chọn đáng tin cậy khác để chuyển tiền nhanh chóng trong hệ thống ngân hàng địa phương.

Đối với việc rút tiền, WINBULL SECURITIES xử lý rút tiền FPS một cách nhanh chóng, với số tiền trở nên có sẵn trong cùng ngày nếu được yêu cầu trước buổi trưa. Chuyển khoản ngân hàng địa phương Hong Kong cũng tuân theo cùng một thời gian để có sẵn.

Ngân phiếu được chấp nhận cho cả việc gửi tiền và rút tiền, với thời gian cụ thể để có sẵn tùy thuộc vào thời gian gửi tiền. Ngân phiếu được gửi trước buổi trưa thường có sẵn sau 16:00 vào ngày giao dịch tiếp theo, trong khi những ngân phiếu được gửi sau buổi trưa có thể mất đến hai ngày giao dịch tiếp theo để có sẵn số tiền.

WINBULL SECURITIES cung cấp trò chuyện trực tiếp. Với trò chuyện trực tiếp, khách hàng có thể nhận được câu trả lời nhanh chóng cho các câu hỏi của họ và nhận được sự trợ giúp với bất kỳ vấn đề nào mà họ có thể gặp phải.

Khách hàng có thể đến văn phòng hoặc liên hệ với dịch vụ khách hàng bằng thông tin được cung cấp dưới đây:

Ngày giao dịch 09:00-18:00

Điện thoại: +852 2370 9538

Email: services@winbull.hk, info@winbull.hk

Địa chỉ: Unit A, 26/F, United Centre, 95 Queensway, Hong Kong

Kết luận

Tóm lại, WINBULL SECURITIES tuân thủ nghiêm ngặt quy định của SFC và phân tách tài sản của khách hàng, điều quan trọng cho sự tin tưởng và an toàn của khách hàng. Tuy nhiên, công ty đối mặt với những thách thức như yêu cầu gửi tiền tối thiểu cao, cấu trúc phí phức tạp và là một người mới gia nhập vào thị trường. Khách hàng nên cân nhắc kỹ những yếu tố này, cân nhắc sự mạnh mẽ của công ty cùng với nhược điểm của nó, để xác định xem nó phù hợp với mục tiêu và sở thích đầu tư của họ.

Câu hỏi thường gặp (FAQs)

WINBULL SECURITIES có được quy định không?

Có. Nó được quy định bởi SFC.

Có những nền tảng nào được cung cấp bởi WINBULL SECURITIES?

Nó cung cấp ứng dụng Wealth Treasure Securities.

Bao lâu sau khi đầu tư thành công thì tiền được bắt đầu đầu tư?

Số tiền của bạn sẽ được đầu tư trong vòng 1-2 ngày làm việc sau khi đầu tư được xác nhận, và bạn có thể xem tiến độ đầu tư của danh mục của mình trên ứng dụng Wealth Savings.

Yêu cầu gửi tiền tối thiểu cho WINBULL SECURITIES là bao nhiêu?

Số tiền gửi tiền ban đầu tối thiểu để mở tài khoản là 1.000 đô la.

Cảnh báo rủi ro

Thông tin được cung cấp dựa trên đánh giá chuyên gia của WikiStock về dữ liệu trang web của sàn giao dịch và có thể thay đổi. Ngoài ra, giao dịch trực tuyến có rủi ro lớn, có thể dẫn đến mất toàn bộ số tiền đầu tư, vì vậy việc hiểu rõ các rủi ro liên quan trước khi tham gia là rất quan trọng.

Thông tin khác

Registered region

Hồng Kông

Số năm kinh doanh

2-5năm

Sản phẩm giao dịch

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

瑞达国际

Điểm

Huajin International

Điểm

CLSA

Điểm

Sanfull Securities

Điểm

DL Securities

Điểm

嘉信

Điểm

GF Holdings (HK)

Điểm

China Taiping

Điểm

Capital Securities

Điểm

乾立亨證券

Điểm