Score

盈寶證券

https://winbull.hk/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Surpassed 23.54% brokers

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02214

Brokerage Information

More

Company Name

WINBULL SECURITIES INTERNATIONAL HONG KONG LIMITED

Abbreviation

盈寶證券

Platform registered country and region

Company address

Company website

https://winbull.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 43013

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

China Hong Kong

2903067.49%Others

1062424.70%Ghana

11412.65%China

11342.64%Thailand

10842.52%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Trading Fee

$1.3

Platform Service Fee

HK$10

Commission Rate

0%

Minimum Deposit

$1,300

Funding Rate

5.6%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| WINBULL SECURITIES |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | $1,000 |

| Fees | $0.0039 per share of stock trading, 6.6% annually on financing transactions, HKD 50 of IPO Subscription Fee and so on |

| Account Fees | HKD 100~500 (Account Management) |

| App/Platform | The Wealth Treasure Securities APP |

| Promotions | New Client Bonus (HKD 4,000+) |

| Customer Support | Phone, email, fax, live chat |

What is WINBULL SECURITIES?

WINBULL SECURITIES, licensed by the SFC, offers a robust platform for global investors seeking comprehensive investment solutions. Headquartered in Hong Kong with branches in Guangzhou and Shenzhen, it provides a user-friendly Wealth Treasure Securities app accessible on both iOS and Android, facilitating seamless trading of U.S. stocks, IPOs, and Hong Kong stocks.

| Pros | Cons |

| Regulatory Compliance | High Minimum Deposit |

| Segregation of Client Assets | New Entrant |

| User-Friendly Trading Platform | Complex Fee Structure |

Regulatory Compliance: Licensed by the Securities and Futures Commission of Hong Kong (SFC) with Type 1, 4, and 9 licenses. This ensures the brokerage operates under strict regulatory oversight, providing a level of security for investors.

Segregation of Client Assets: Client funds and securities are held separately from the companys own assets, reducing the risk of misuse or misappropriation. This setup enhances investor protection.

Investment Options: Offers a comprehensive range of investment products including U.S. stocks, IPOs, and Hong Kong stocks. This diversity allows investors to access both domestic and international markets.

User-Friendly Trading Platform: Provides the Wealth Treasure Securities app, which is accessible on both iOS and Android platforms. The app is designed to be versatile and user-friendly.

Cons:High Minimum Deposit: A high minimum deposit requirement of $1,000 can be a barrier for smaller investors or those who are just starting out. It limits accessibility to potential clients who may not have substantial capital to invest initially.

New Entrant: Launched in March 2022, which means its relatively new compared to more established brokerage firms. Newer firms may face challenges in building a solid reputation and trust initially.

Complex Fee Structure: A complex fee structure can lead to confusion and surprise costs for clients. It may be challenging for investors to fully understand what they are being charged for various services, potentially leading to dissatisfaction or distrust.

Is WINBULL SECURITIES Safe?

Minimum Investment Amount: $1,000

Lock-in Period: None

WINBULL SECURITIES Platforms Review

Customer Service

WINBULL SECURITIES operates under the oversight of the Securities and Futures Commission (SFC) with License No. BRG131. The SFC, as Hong Kong's financial regulator, plays a crucial role in maintaining and enhancing the integrity and stability of the city's securities and futures markets. This regulatory framework aims to safeguard the interests of investors and ensure the overall health of the financial industry.

One of the key assurances provided by WINBULL SECURITIES is the segregation of client assets. This means that client funds and securities are held separately from the company's own assets, reducing the risk of misappropriation or misuse. Additionally, clients benefit from coverage under the Hong Kong Investor Compensation Fund (ICF). The ICF provides a safeguard by compensating eligible investors if a brokerage firm fails to fulfill its financial obligations due to insolvency or other specified reasons.

What are Securities to Trade with WINBULL SECURITIES?

WINBULL SECURITIES provides access to U.S. stocks, enabling investors to trade shares of American companies listed on major exchanges such as the NYSE and NASDAQ.

Additionally, WINBULL SECURITIES facilitates participation in Initial Public Offerings (IPOs), providing opportunities to invest in newly listed companies. IPOs can offer potential for significant returns, particularly for investors seeking early-stage growth opportunities.

Moreover, the firm offers access to Hong Kong stocks, allowing investors to trade shares listed on the Hong Kong Stock Exchange (HKEX). This includes companies listed on the Main Board and the Growth Enterprise Market (GEM).

WINBULL SECURITIES Fees Review

WINBULL SECURITIES charges a range of fees associated with its trading services and investment management. These fees can be categorized into trading fees, financing charges, subscription fees, membership tier charges, and miscellaneous fees.

Trading Fees: For U.S. stock trading, the company charges a fee that covers the cost of transactions. Additionally, a transaction fee of $0.0039 per share is levied during the actual transaction process due to exchange, clearing, supervision, etc.

Financing Charges: WINBULL SECURITIES charges a financing rate of 6.6% on margin financing, which is higher than the industry average. This rate is applied to the amount borrowed from the brokerage to purchase securities on margin, and the client is responsible for repaying the loan plus interest.

Subscription Fees: For participating in Initial Public Offerings (IPOs), clients are charged a subscription fee. The fee varies depending on the type of application and the recipient of the fee. This fee covers the administrative costs associated with processing and managing IPO applications.

Membership Tier Charges: The company may offer different tiers of membership, each with its own set of benefits and associated fees. The specific details of these tiers and associated charges are not provided with reference information, but they are typically designed to incentivize higher levels of investment or trading activity.

Miscellaneous Fees: WINBULL SECURITIES charges various miscellaneous fees for services such as account management, replacement statements, and returned checks.

Management Fees: The management fee charged by WINBULL SECURITIES is based on the risk level of the investment portfolio. The fee schedule is detailed, with different percentages applied to low- to medium-risk, medium-risk, and medium- to high-risk portfolios.

Minimum Investment and Lock-In Period: WINBULL SECURITIES specifies a minimum investment amount of $1,000 and indicates that there is no lock-up period for investments.

| Fee Type | Amount (HKD) | |

| U.S. Stock Trading Fee | Transaction fee per share | $0.0039 |

| Financing Charges | 6.6% annually on financing transactions | |

| IPO Subscription Fee | Application for new shares (Electronic) | 50 |

| Margin Financing Fee | Margin financing (Electronic) | 100 |

| Account Management | Account Confirmation Letter | 300 |

| Account Management | Cancel Account Within 6 Months of Opening | 500 |

| Others | Returned Check/Stop Payment | 100 |

Additional Information:

The Wealth Treasure Securities app by WINBULL SECURITIES offers a user-friendly and versatile trading platform accessible to both iOS and Android users. With easy availability on the Apple Store, Google Play, and via APK, it ensures broad accessibility to traders across various devices.

The platform boasts a comprehensive range of trading features, allowing users to execute trades efficiently and manage their investment portfolios seamlessly. It offers real-time market data, advanced charting tools, and customizable watchlists.

WINBULL SECURITIES offers four account tiers: Vi, V2, V3, and VA.

Vi: This is the basic account, suitable for new investors with lower trading volume. It has the minimum requirements but also higher commission rates and platform fees.

V2: A step up from Vi, offering slightly lower commission rates and platform fees. Requires a minimum of 5 trades to qualify.

V3: This tier caters to more active traders with total assets exceeding HKD$300,000. It boasts the lowest commission rates (including zero commission on Hong Kong stocks) and margin interest rates.

VA: The VIP tier for high-volume investors or those designated as VIP clients. It offers exclusive benefits like custom trading channels, special financing limits, and birthday rewards.

| Feature | Vi | V2 | V3 | VA |

| Minimum Requirement | Account opening | 5 trades | Total assets ≥ HKD$300,000 | VIP client |

| Hong Kong Stock Commission | 0.03% (min. HKD$2) | 0.02% (min. HKD$2) | 0% | 0.25% (min. HKD$2) |

| Hong Kong Stock Platform Fee | HKD$15 per trade | HKD$10 per trade | HKD$10 per trade | HKD$10 per trade |

| US Stock Commission | USD$0.0049 per share (min. USD$0.99 per trade) | USD$0.0039 per share (min. USD$0.99 per trade) | USD$0 | USD$0.0049 per share (min. USD$0.99 per trade) |

| US Stock Platform Fee | USD$0.0049 per share (min. USD$0.99 per trade) | USD$0.0049 per lot (min. USD$0.99 per trade) | USD$0.0049 per share (min. USD$0.99 per trade) | USD$0.0049 per share (min. USD$0.99 per trade) |

| Margin Interest Rate | 6.60% | 6.60% | 5.60% | 8.60% |

| Dark Pool Commission | 0.03% (min. HKD$2) | 0.02% (min. HKD$2) | 0% | 0% |

| Dark Pool Platform Fee | HKD$15 per trade | HKD$15 per trade | HKD$15 per trade | HKD$15 per trade |

| Hong Kong Real-time Quotes | 6 months free with account opening, then depends on asset level | Depends on asset level | Depends on asset level | Depending on asset level |

| US Real-time Quotes | 6 months free with account opening, then depends on asset level | Depends on asset level | Depends on asset level | Depends on asset level |

| IPO Financing Ratio | Up to 10 times | Up to 20 times | Up to 20 times | Up to 20 times |

| Custom Trading Channel | Not available | Not available | Not available | Yes |

| Birthday Gift | Not available | 50 points + 1 SPCE stock coupon | 100 points + 3 SPCE stock coupons | 100 points + 3 SPCE stock coupons |

WINBULL SECURITIES offers a variety of deposit and withdrawal methods to cater to the diverse needs of its clients. For deposits, they accept e-DDA deposits, which provide convenient electronic options for transferring funds. They also accommodate deposits through Internet Banking, ATMs, and counter transfers, with a restriction against third-party transfers or direct cash deposits to ensure security and compliance.

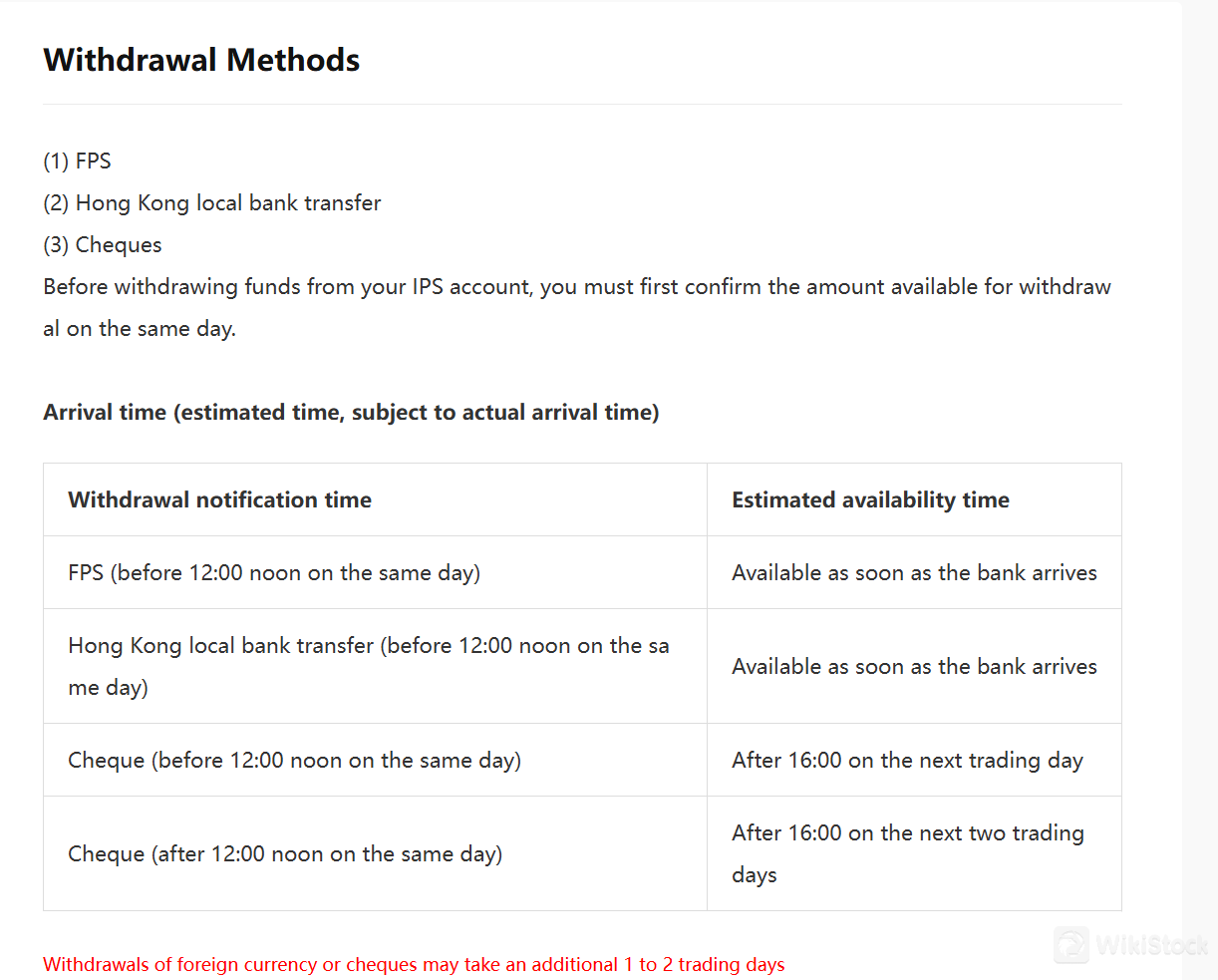

The company supports Fast Payment System (FPS) for both deposits and withdrawals, offering quick processing times when initiated before noon on the same day. FPS transactions are credited to accounts as soon as they arrive at the bank, ensuring efficient access to deposited funds. Additionally, Hong Kong local bank transfers are available, providing another reliable option for transferring funds swiftly within the local banking system.

For withdrawals, WINBULL SECURITIES processes FPS withdrawals promptly, with funds becoming available on the same day if requested before noon. Hong Kong local bank transfers also follow a similar timeline for availability.

Cheques are accepted for both deposits and withdrawals, with specific timelines for availability depending on the time of deposit. Cheques deposited before noon are typically available after 16:00 on the next trading day, while those deposited after noon may take until the following two trading days for funds to become available.

WINBULL SECURITIES offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have.

Customers can visit their office or get in touch with customer service line using the information provided below:

Trading day 09:00-18:00

Telephone: +852 2370 9538

Email: services@winbull.hk, info@winbull.hk

Address: Unit A, 26/F, United Centre, 95 Queensway, Hong Kong

Conclusion

In conclusion, WINBULL SECURITIES offers strong regulatory compliance under by SFC and segregation of client assets, which are crucial for client trust and safety. However, it faces challenges such as a high minimum deposit requirement, a complex fee structure, and being a new entrant in the market. Clients should consider these factors carefully, balancing the company's strengths with its limitations, to determine if it aligns with their investment goals and preferences.

Frequently Asked Questions (FAQs)

Is WINBULL SECURITIES regulated?

Yes. It is regulated by SFC.

What are platforms offered by WINBULL SECURITIES?

It provides the Wealth Treasure Securities APP.

How long does it take for the funds to start investing after successful investment?

Your funds will be invested within 1-2 working days after the investment is confirmed, and you can see the investment progress of your portfolio on the Wealth Savings App.

What is the minimum deposit for WINBULL SECURITIES?

The minimum initial deposit to open an account is $1,000.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

SWHYHK

Score

Ever-Long

Score

VC

Score

Funderstone

Score

国都香港

Score

Cinda International

Score

恒大證券

Score

GoFintech

Score

寶新金融

Score

Anuenue

Score