天眼评分

评分指数

券商鉴定

影响力

D

影响力指数 NO.1

日本

日本交易品种

5

现金业务、债券/固收、衍生品、期权、股票

交易牌照

拥有1个交易牌照

日本FSA证券交易牌照

券商信息

更多

公司全称

YAMAGATA SECURITIES CO., LTD

公司简称

山形證券

平台注册国家、地区

公司地址

随时想查就查

WikiStock APP

互联网基因

基因指数

APP评分

券商特色

佣金率

0.27%

杠杆交易

是

受监管国数量

1

可交易品类

5

| 山形证券 |  |

| WikiStock 评级 | ⭐⭐⭐ |

| 费用 | 国内股票:0.270% - 1.100%,消费税10% |

| 提供的共同基金 | 是 |

山形证券信息

山形证券是一家总部位于日本山形市的知名金融服务提供商。山形证券成立于2007年,受日本金融厅监管。该公司提供全额有偿证券借贷、债券和固定收益、期货、期权和股票等专业服务。

山形证券的优点和缺点

| 优点 | 缺点 |

|

|

| |

|

产品范围广泛:提供全面的投资产品,包括全额有偿证券借贷、债券、期货、期权和股票。

受金融厅监管:受日本金融厅监管。

丰富的客户教育资源:提供投资者教育资源,如研讨会和讲习班,帮助客户做出明智的决策。

缺点:缺乏技术和创新:缺乏在线市场分析和交易平台,有限的数字工具资源或投资。

山形证券安全吗?

山形证券可以被认为是安全的。山形证券受日本金融厅监管,许可证号为東北財務局長(金商)第3号。这种监管监督确保遵守严格的金融标准,保护投资者利益。

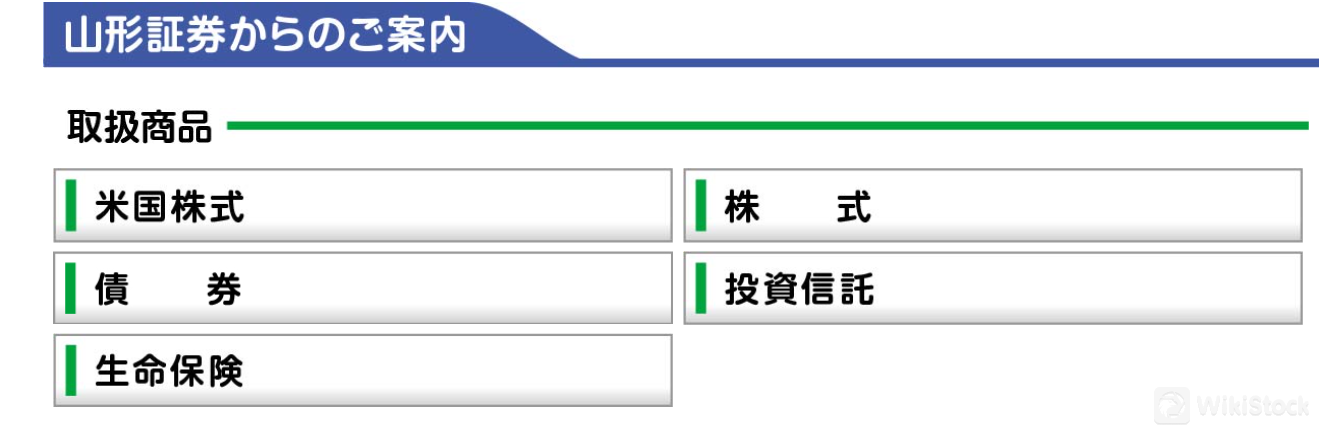

山形证券可以交易的证券有哪些?

山形证券提供多样化的交易证券,包括国内和国外股票、国内债券,如日本国债(JGBs)和一般公司债券(SB),由各公司管理的投资信托,以及通过与东京海上日动生命保险株式会社等合作伙伴合作的人寿和医疗保险承销。他们还便利美国股票交易。

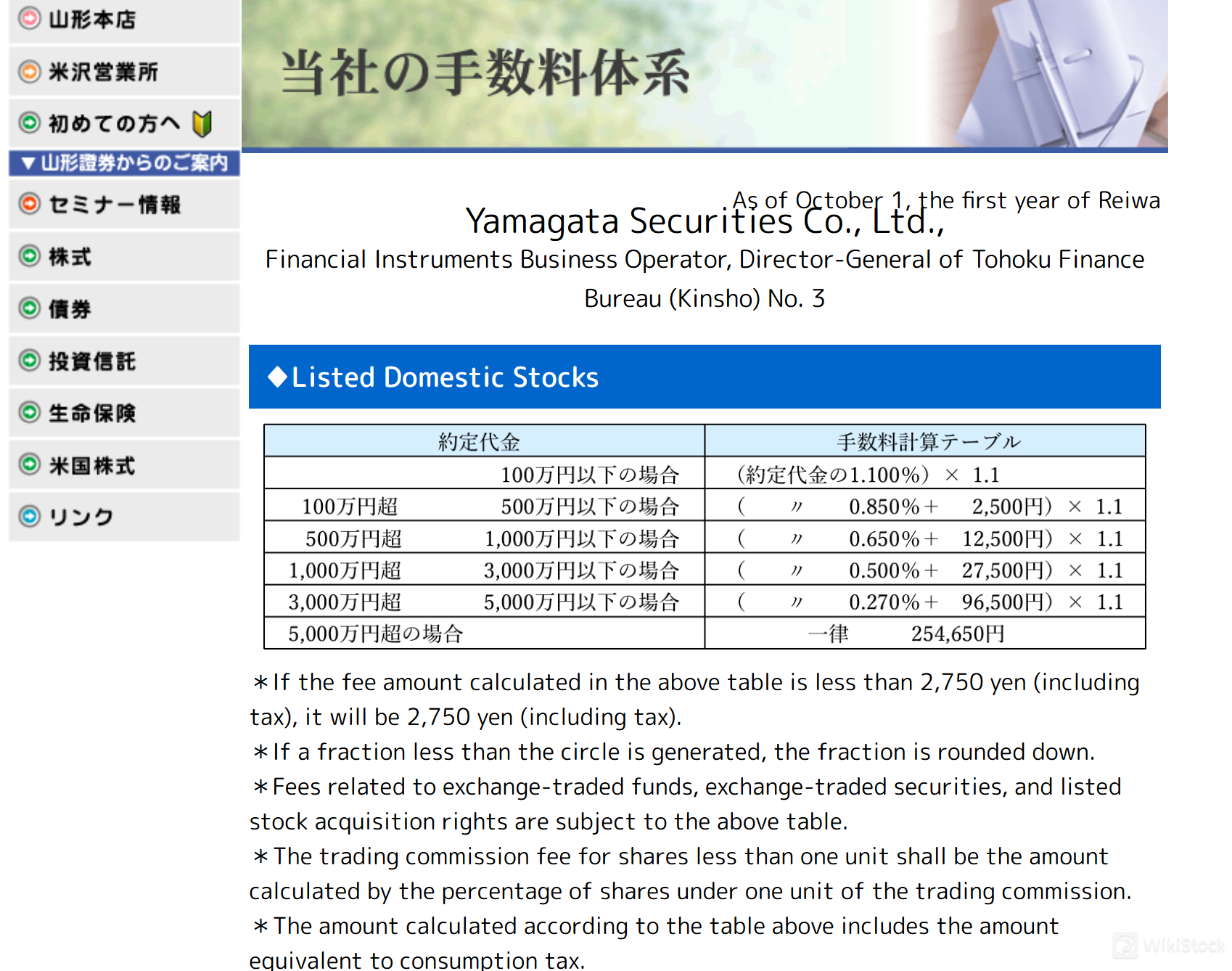

山形证券费用评价

山形证券根据交易金额的不同收取不同的费用。

山形证券对国内股票收取0.270%至1.100%的交易金额费用,加上10%的消费税。对于超过5,000万日元的金额,收取固定费用254,650日元。

对于上市的新股权证,费用范围为交易金额的0.293%至0.950%加上一个固定金额,全部乘以1.1,最低费用为2,750日元,超过5,000万日元的金额的最高固定费用为253,330日元。

对于上市的外国股票,国内交易费用范围为交易金额的1.000%至0.400%加上一个固定金额,同样乘以1.1,最低费用为2,750日元,其他外国交易费用另行适用。这些费用包括消费税,并以日元小数点四舍五入。

注意:请参考此链接获取详细费用信息:https://www.yamagatashoken.co.jp/tesuryo/index.html

研究与教育

山形证券为投资者提供教育资源。他们举办研讨会向投资者介绍产品。山形证券教授客户有效的投资策略和当前市场趋势。他们分享详细的研究报告、市场分析和投资见解。

客户服务

客户可以直接联系总公司的客户服务团队,电话为023-631-7711,或联系米泽销售办事处,电话为0238-23-2450。

结论

山形证券受日本金融厅(FSA)监管,提供包括国内外股票、债券、投资信托和保险产品在内的全面投资产品。该公司通过研讨会提升客户的知识和决策能力。然而,该公司缺乏便捷的在线交易平台和市场分析工具。

问答

我可以用山形证券交易哪些证券?

国内外股票、日本政府债券(JGBs)和一般公司债券(SB)等国内债券、投资信托以及寿险和医疗保险产品的承销。

山形证券是否受监管?

是的,山形证券受日本金融厅(FSA)监管,许可证号为東北財務局長(金商)第3号。

山形证券是否适合初学者使用?

是的,山形证券提供教育研讨会和工作坊,帮助投资者了解有效的投资策略、市场趋势和产品介绍。

我如何参加山形证券的研讨会?

要参加山形证券举办的研讨会,您可以咨询即将举行的活动并通过他们的销售办事处进行注册。

风险警示

所提供的信息基于WikiStock对经纪公司网站数据的专业评估,可能会有变化。此外,网上交易存在重大风险,可能导致投资资金的全部损失,因此在参与之前了解相关风险至关重要。

其他信息

注册地

日本

经营时间

20年以上

可交易品类

现金业务、债券/固收、衍生品、期权、股票

评价

暂无评价

推荐券商更多

Money Partners

天眼评分

岩井コスモ証券

天眼评分

内藤証券株式会社

天眼评分

Ichiyoshi Securities

天眼评分

広田証券

天眼评分

丸八証券株式会社

天眼评分

ひろぎん証券

天眼评分

三木証券

天眼评分

JTG証券

天眼评分

八十二証券

天眼评分