Score

山形證券

https://www.yamagatashoken.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

YAMAGATA SECURITIES CO., LTD

Abbreviation

山形證券

Platform registered country and region

Company address

Company website

https://www.yamagatashoken.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.27%

Margin Trading

YES

Regulated Countries

1

Products

5

| Yamagata Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Fees | Domestic Stocks: 0.270% - 1.100%, 10% consumption tax |

| Mutual Funds Offered | Yes |

Yamagata Securities Information

Yamagata Securities is a well-known financial services provider headquartered in Yamagata, Japan. Yamagata Securities was established in 2007 and is regulated by the Financial Services Agency of Japan. The company provides professional services in fully paid securities lending, bonds and fixed income, futures, options and stocks.

Pros & Cons of Yamagata Securities

| Pros | Cons |

|

|

| |

|

Wide range of products: Provides a comprehensive range of investment products, including fully paid securities lending, bonds, futures, options and stocks.

Regulated by FSA: Regulated by the Financial Services Agency of Japan.

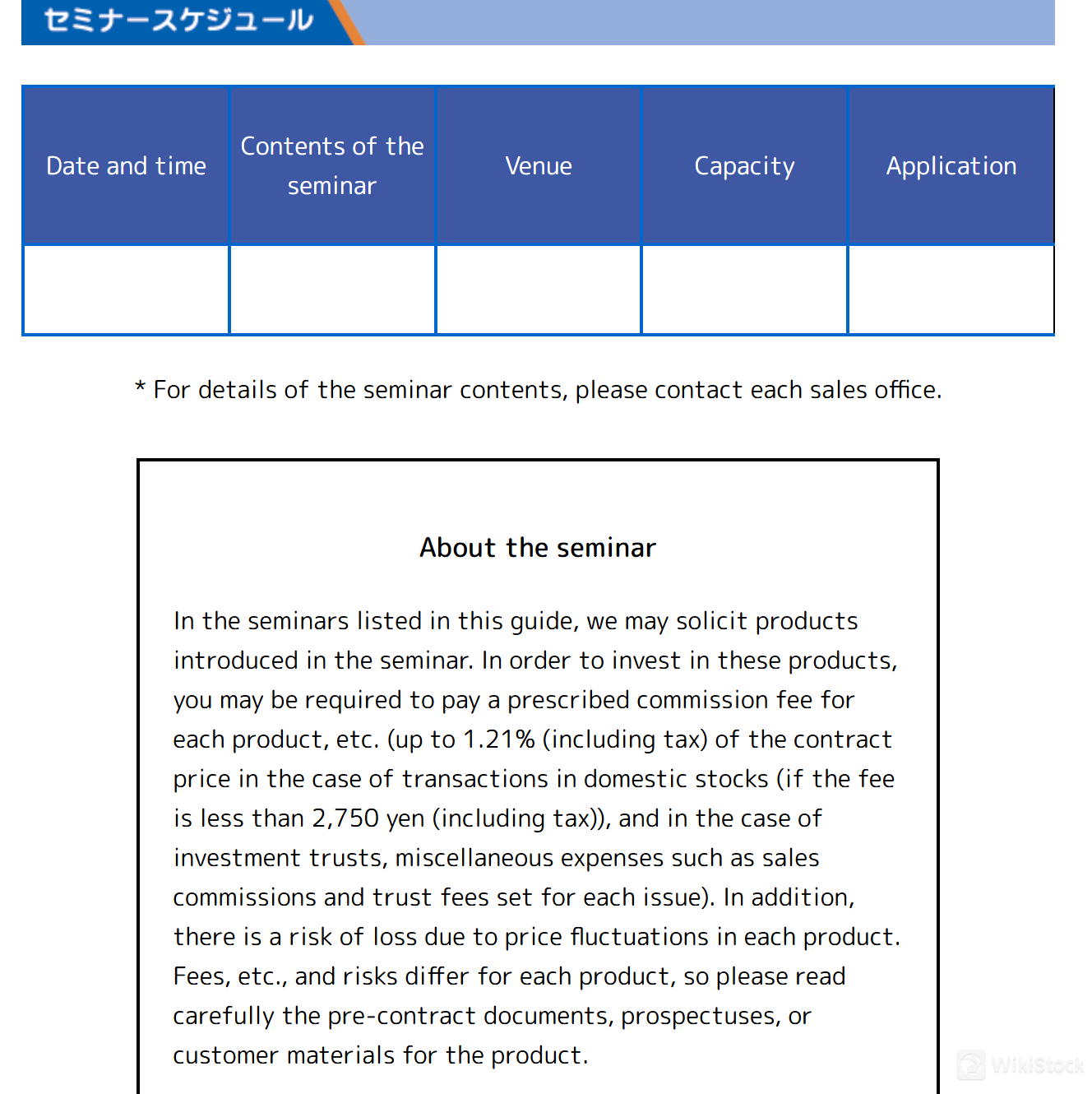

Rich customer education resources: Provides investor education resources such as seminars and workshops to help customers make informed decisions.

Cons:Lack of technology and innovation: Lack of online market analysis and trading platforms, limited resources or investment in digital tools.

Is Yamagata Securities Safe?

Yamagata Securities can be considered safe. Yamagata Securities is regulated by the Japan Financial Services Agency (FSA) under license number 東北財務局長(金商)第3号 (Tohoku Finance Bureau Director of Finance (Securities) No. 3). This regulatory oversight ensures compliance with stringent financial standards and safeguards investor interests.

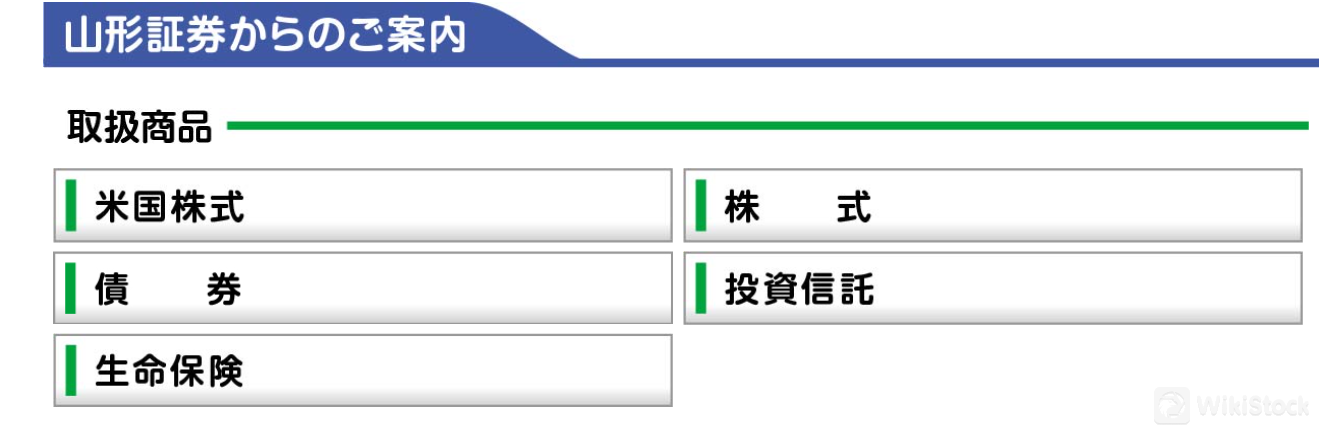

What are Securities to Trade with Yamagata Securities?

Yamagata Securities offers a diverse range of securities for trading, including domestic and foreign stocks, domestic bonds such as Japanese Government Bonds (JGBs) and General Corporate Bonds (SB), investment trusts managed by various companies, and underwriting of life and medical insurance through partnerships like Tokio Marine & Nichido Life Insurance Co., Ltd. They also facilitate trading in U.S. stocks.

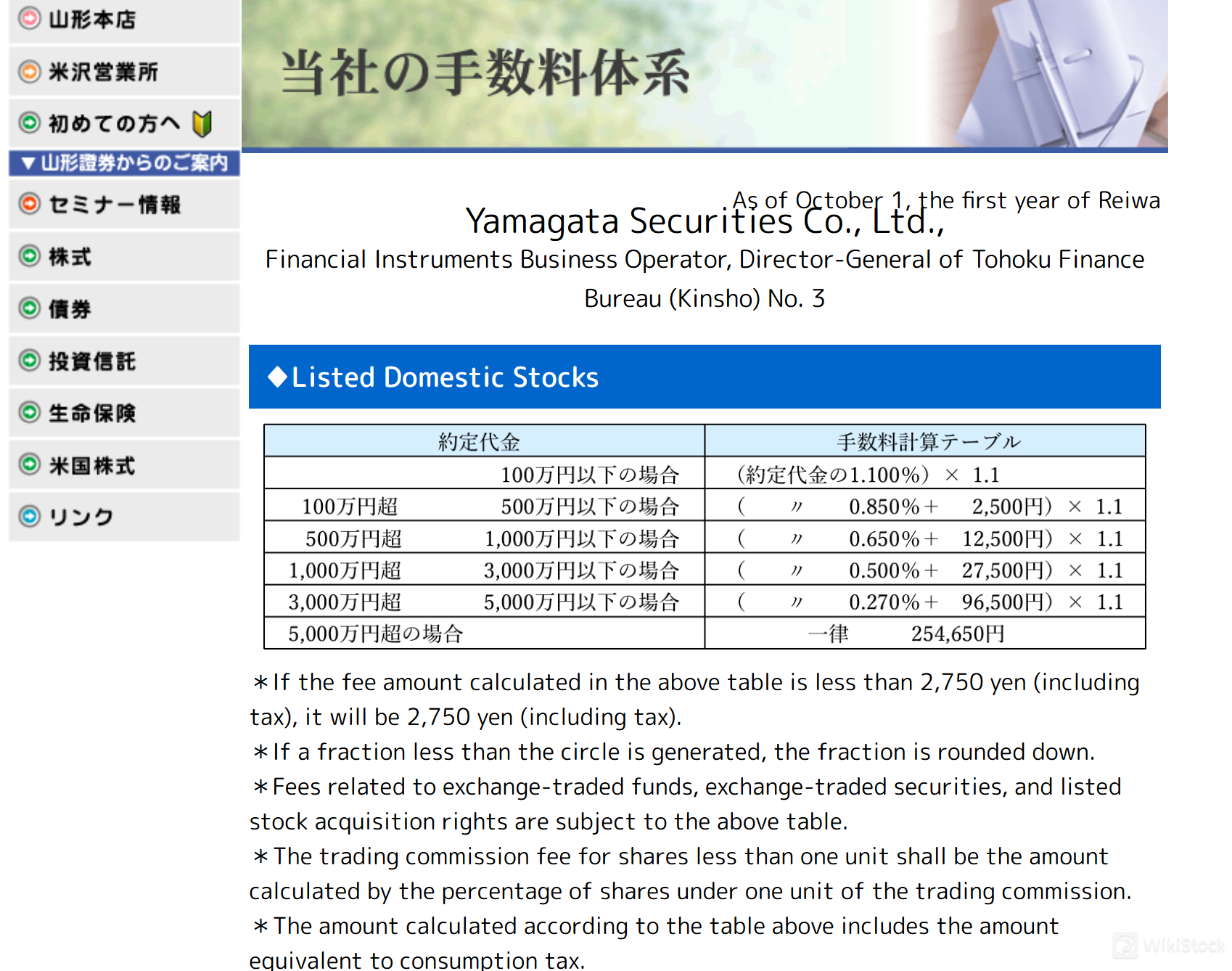

Yamagata Securities Fees Review

Yamagata Securities charges different fees for different products depending on the transaction amount.

Yamagata Securities charges a fee of 0.270% to 1.100% of the transaction amount, plus a 10% consumption tax, for domestic stocks. For amounts exceeding 50,000,000 yen, a fixed fee of 254,650 yen is charged.

For listed new stock warrants, the fee ranges from 0.293% to 0.950% of the transaction amount plus a fixed amount, all multiplied by 1.1, with a minimum fee of 2,750 yen and a maximum fixed fee of 253,330 yen for amounts exceeding 50,000,000 yen.

For listed foreign stocks, domestic transaction fees range from 1.000% to 0.400% of the transaction amount plus a fixed amount, also multiplied by 1.1, with a minimum fee of 2,750 yen, and other foreign transaction fees apply. These fees include consumption tax and are rounded up to decimal points in Japanese yen.

Note: Please refer to this link for fee details: https://www.yamagatashoken.co.jp/tesuryo/index.html

Research & Education

Yamagata Securities provides educational resources for investors. They hold seminars to introduce products to investors. Yamagata Securities teaches clients effective investment strategies and current market trends. They share detailed research reports, market analysis, and investment insights.

Customer Service

Customers can contact the customer service team at the head office directly at 023-631-7711 or the Yonezawa sales office at 0238-23-2450.

Conclusion

Yamagata Securities is regulated by the Financial Services Agency (FSA) of Japan and offers a comprehensive range of investment products, including domestic and foreign stocks, bonds, investment trusts and insurance products. The company enhances customer knowledge and decision-making capabilities through seminars. However, the company lacks a convenient online trading platform and market analysis tools.

Q&A

What types of securities can I trade with Yamagata Securities?

Domestic and foreign stocks, domestic bonds such as Japanese Government Bonds (JGBs) and General Corporate Bonds (SB), investment trusts, and underwriting of life and medical insurance products.

Is Yamagata Securities regulated?

AYes, Yamagata Securities is regulated by the Japan Financial Services Agency (FSA) under license number 東北財務局長(金商)第3号 (Tohoku Finance Bureau Director of Finance (Securities) No. 3).

Is Yamagata Securities a good platform for beginners?

Yes, Yamagata Securities offers educational seminars and workshops to help investors understand effective investment strategies, market trends, and product introductions.

How can I participate in Yamagata Securities' seminars?

To attend seminars hosted by Yamagata Securities, you can inquire about upcoming events and register through their sales offices.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

内藤証券株式会社

Score

Ichiyoshi Securities

Score

広田証券

Score

丸八証券株式会社

Score

ひろぎん証券

Score

三木証券

Score

JTG証券

Score

JIA証券

Score

山和証券株式会社

Score

八十二証券

Score