天眼评分

评分指数

券商鉴定

影响力

A

影响力指数 NO.1

德国

德国交易品种

8

现金业务、债券/固收、衍生品、证券咨询、期权、股票、指数基金、共同基金

超越了70.97%交易商

交易牌照

拥有2个交易牌照

塞浦路斯CYSEC证券交易牌照

瓦努阿图VFSC证券交易牌照

券商信息

更多

公司全称

JFD Group Ltd

公司简称

JFD

平台注册国家、地区

公司地址

随时想查就查

WikiStock APP

互联网基因

基因指数

APP评分

APP下载量

- 周期

- 下载量

- 2024-05

- 4155.86万

统计规则:数据展示为APP在当前时间过去一年的下载量。

APP地区热度

- 国家/地区下载量比例

其他

3873.92万66.10%伊朗

93.54万11.25%美国

83.41万10.03%南非

62.42万7.50%尼日利亚

42.59万5.12%

统计规则:数据展示为APP在当前时间过去一年的下载量和地区占比。

券商特色

最低入金门槛

$500

杠杆交易

是

股票多空交易

是

受监管国数量

2

| JFD |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | 从某些账户免费到根据交易类型收取的可变费用 |

| Fees | 从某些账户免费到根据交易类型收取的可变费用 |

| Account Fees | 新账户免费 |

| Interests on uninvested cash | 未指定 |

| Margin Interest Rates | 从某些账户免费到根据资产类型收取的可变费用 |

| Mutual Funds Offered | 否 |

| App/Platform | 可在iOS、Android和Web上使用 |

| Promotions | 是 |

什么是JFD?

JFD 为交易者提供灵活的账户选择,最低金额和费用根据交易类型而异,某些账户可免费使用。新账户免费,虽然未提供有关未投资现金利息的具体细节,但保证金利率也因资产而异。JFD不提供共同基金,但提供可在iOS、Android和Web上使用的强大交易平台,确保多样化和用户友好的交易体验。这种灵活性和全面的平台支持凸显了JFD对满足各种交易需求的承诺。

JFD的优缺点

JFD具有多个优点,包括受CySEC监管和遵守金融法规,提供多种资产类型,并在iOS、Android、Mac、Windows和Web上提供交易平台。然而,它也有一些缺点,如复杂的费用结构,未指定的未投资现金利息以及对特定账户类型的详细信息缺乏说明。尽管存在这些缺点,但对于寻求多样化资产和灵活平台可访问性的交易者来说,JFD仍然是一个强大的选择。

| 优点 | 缺点 |

|

|

|

|

|

|

JFD是否安全?

JFD Group Ltd 是一家在塞浦路斯证券交易委员会(CySEC)注册的经纪商。

客户资金隔离:客户资金存放在与公司自有资金分开的隔离账户中,确保客户的资金即使在JFD Group Ltd.破产的极小可能性下也能得到保护。

投资者补偿计划: JFD Group Ltd. 是塞浦路斯投资者补偿基金(ICF)的成员,为每位客户在公司破产时提供高达20,000欧元的保护。

定期审计: JFD Group Ltd. 的财务报告每年由独立审计师进行审计,确保其财务管理的透明度和责任性。

内部风险管理: JFD Group Ltd. 采用强大的风险管理框架,识别、评估和减轻与客户资金相关的潜在风险。

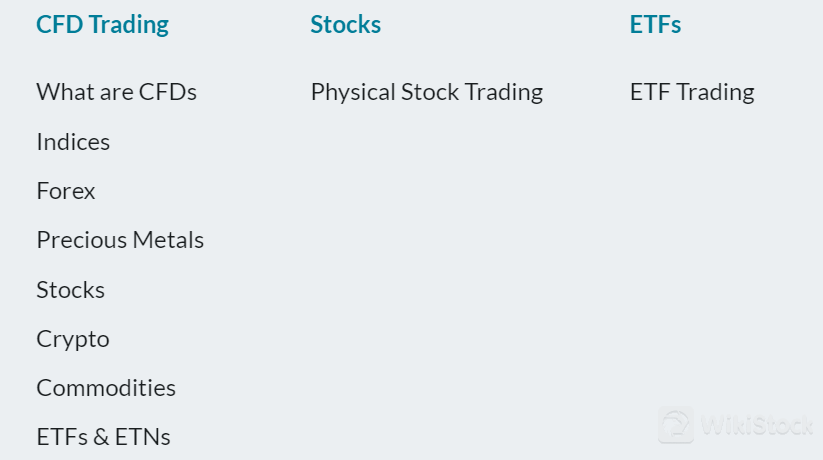

JFD交易的证券有哪些?

JFD提供多样化的交易资产,满足各种投资策略。客户可以在包括指数、外汇、贵金属、股票、加密货币、大宗商品、ETF和ETN在内的各个市场进行差价合约交易。这种广泛的资产选择使交易者能够实现投资组合的多样化,并利用多个行业和工具的市场机会。JFD全面的资产选择凸显了其提供多功能和强大的交易解决方案的承诺。

股票:直接投资上市公司,适合寻求资本增值和股息的投资者。

指数:投资代表特定市场或行业的一揽子股票,适合希望通过降低个别股票风险来获得广泛市场暴露的投资者。

外汇:交易货币对,吸引寻求全球货币波动机会的投资者,提供高流动性和潜在的显著回报。

贵金属:投资黄金、白银和其他金属,提供对抗通胀和经济不确定性的对冲,适合多样化和长期价值保全。

加密货币:比特币和以太坊等数字资产,吸引对创新金融技术和高风险、高回报机会感兴趣的投资者。

大宗商品:交易石油、天然气和农产品等实物商品,提供多样化和对冲市场波动和通胀的保护。

ETF:跟踪指数、行业、商品或其他资产的交易所交易基金,提供多样化、低成本和类似股票的交易便利。

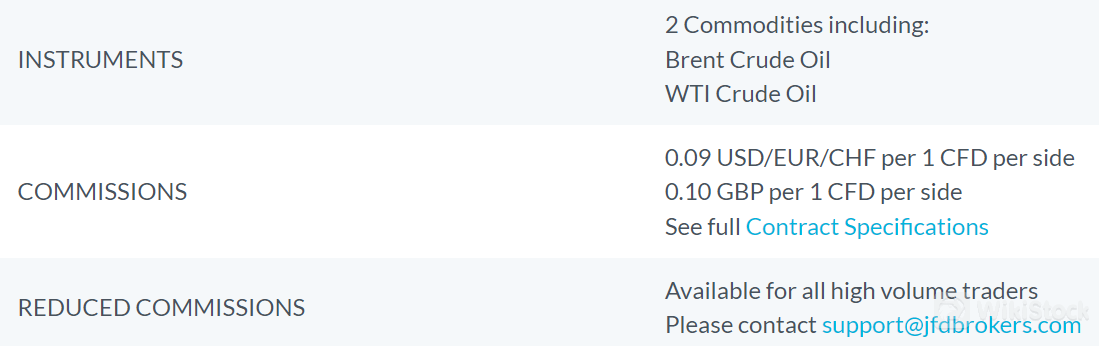

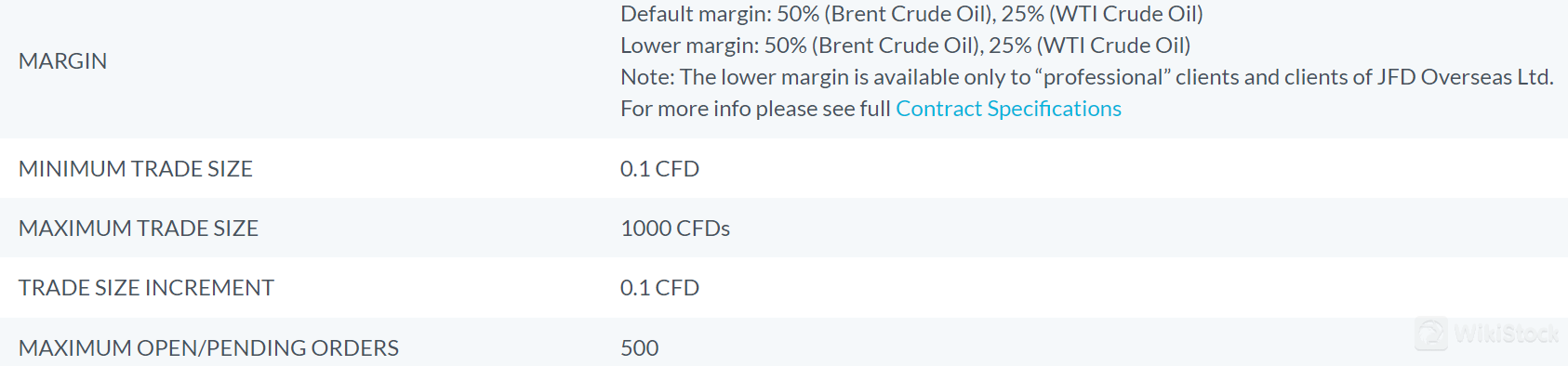

大宗商品:

合约:布伦特原油和WTI原油。

佣金:每手合约每边0.09美元/欧元/瑞士法郎,或每手合约每边0.10英镑。

保证金:布伦特原油默认保证金为50%,WTI原油为25%。布伦特原油和WTI原油的专业客户和JFD Overseas Ltd.客户可享受更低的保证金,分别为50%和25%。

降低佣金:高交易量交易者可根据要求获得。

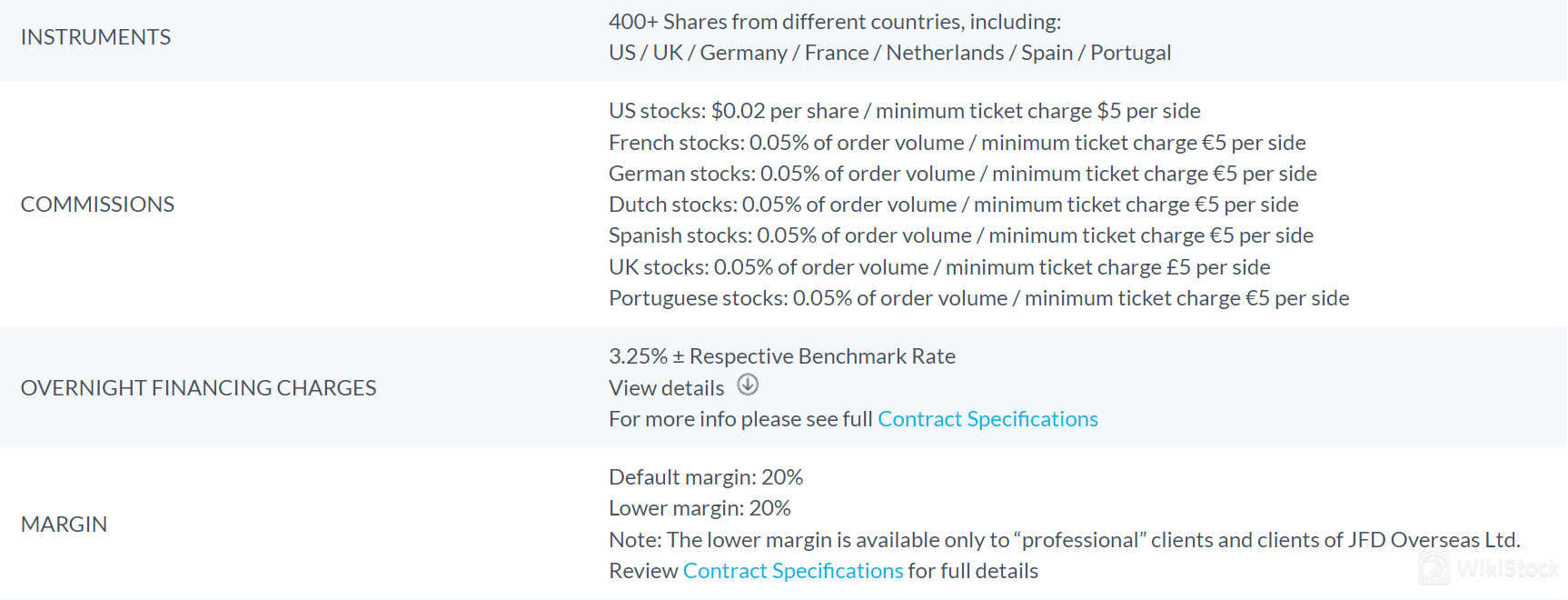

股票:

合约:来自美国、英国、德国、法国、荷兰、西班牙和葡萄牙等各个国家的400多只股票。

佣金:

美国股票:每股0.02美元,最低交易费用每边5美元。

法国、德国、荷兰、西班牙、英国和葡萄牙股票:按订单金额的0.05%,最低交易费用每边5欧元。

隔夜融资费用:3.25% ± 相应基准利率。

保证金:默认保证金为20%。专业客户和JFD Overseas Ltd.客户可享受更低的保证金。

ETF:

产品:六只ETF跟踪美国、德国、中国和印度的证券。

佣金:

美国ETF:每股0.05美元,最低票价3美元。

欧洲ETF:订单金额的0.15%,最低票价3欧元。

西班牙ETF:订单金额的0.20%,最低票价6欧元。

注意:这些费用适用于每次交易的每一方,包括开仓和平仓。

JFD费用回顾

JFD平台评测

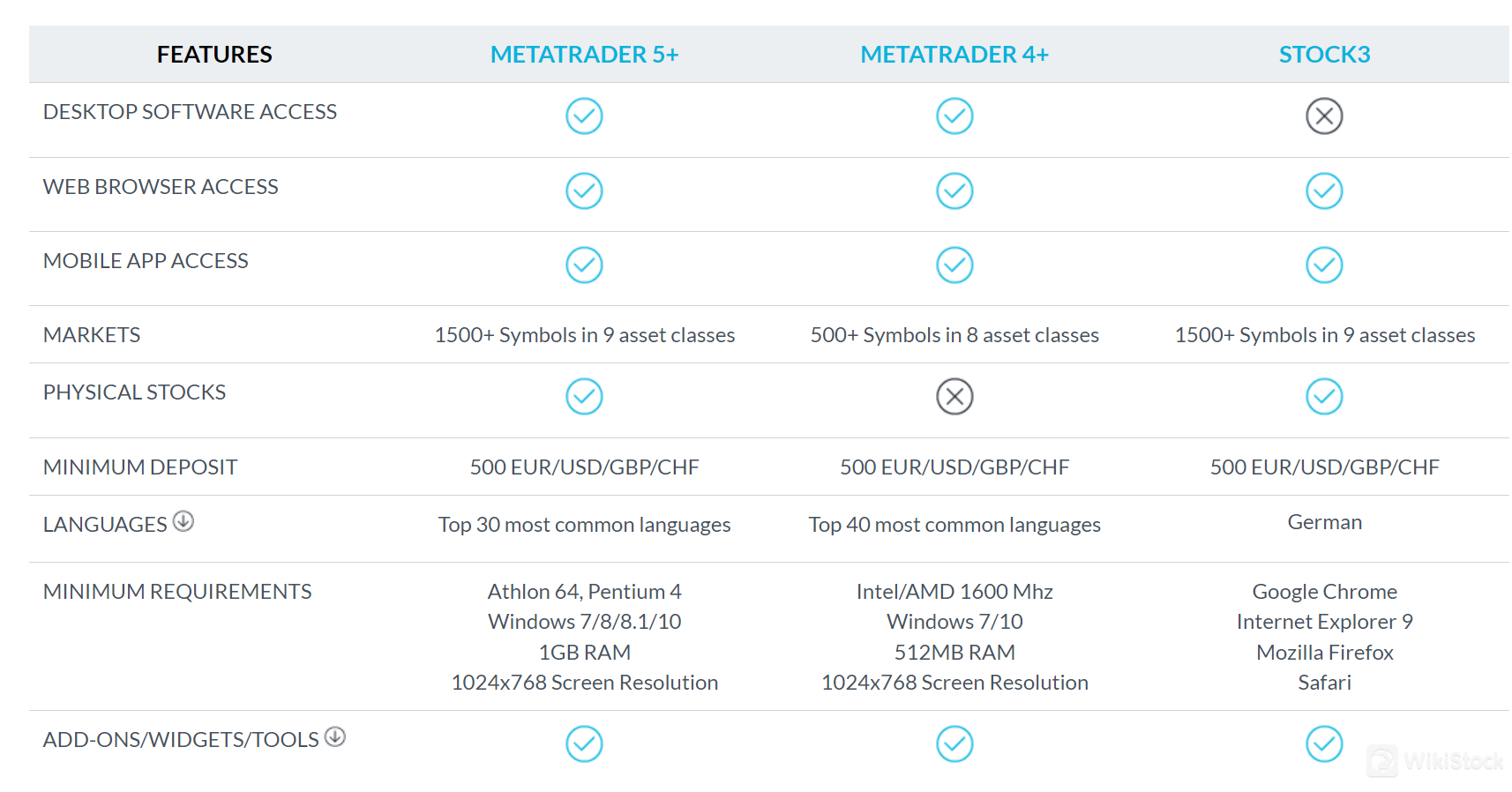

JFD提供了一套强大的交易平台,满足不同交易者的偏好。他们的产品包括备受欢迎的MetaTrader 4+ (MT4+)和MetaTrader 5+ (MT5+),都可以作为桌面和WebTrade版本使用,确保灵活性和可访问性。这些平台以其全面的交易工具、先进的图表功能和用户友好的界面而闻名。此外,JFD支持第三方平台,扩大了交易者寻求特定功能和增强交易体验的选择范围。这种多样化的平台选择凸显了JFD提供多功能和高质量交易环境的承诺。

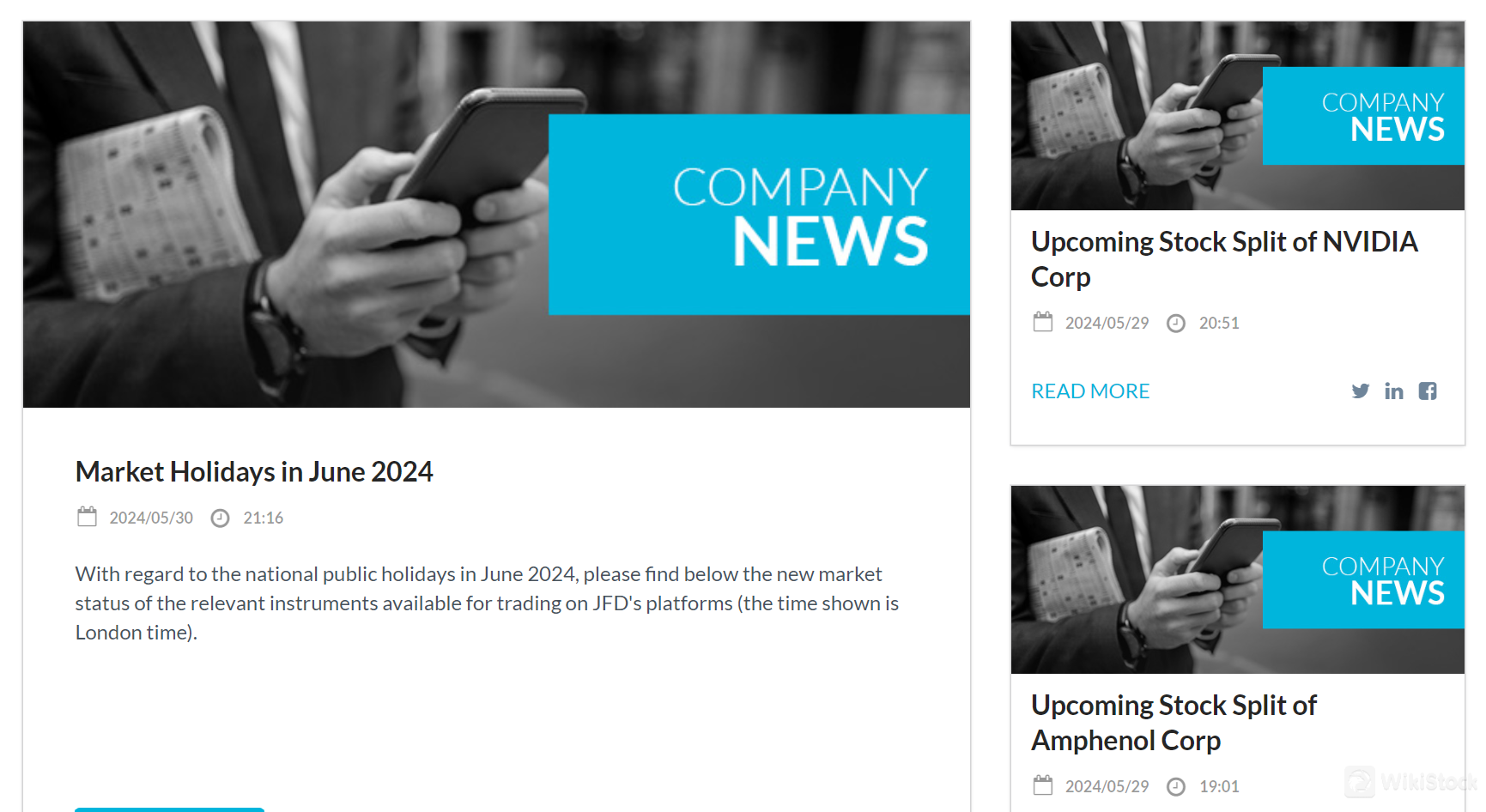

研究和教育

JFD强调通过提供全面的研究和教育资源来进行明智的交易。通过其公司新闻栏目,JFD及时提供市场发展、金融趋势和经济事件的相关更新。这个资源帮助交易者及时了解关键信息,支持明智的交易决策,增强市场理解。JFD对研究和教育的承诺反映了其致力于为客户提供成功交易所需的知识。

客户服务

JFD提供全面的客户支持,以确保无缝的交易体验。客户可以通过电话+49 40 87408688、电子邮件support@jfdbrokers.com,或通过在线聊天联系。电话和在线聊天支持在交易时间内从周日23:00 CET到周五23:00 CET提供全天候帮助。此外,除塞浦路斯银行假日外,所有其他JFD部门的工作时间为周一至周五08:00至17:00 CET。这个广泛的支持框架凸显了JFD对客户满意度和响应式服务的承诺。

结论

总之,JFD以其在CySEC的全面合规性和包括股票、指数、外汇、贵金属、加密货币、大宗商品、ETF和ETN在内的多样化资产选择脱颖而出。JFD提供了适用于iOS、Android、Mac、Windows和Web的强大交易平台,满足寻求灵活性和广泛投资选择的投资者需求。无论是寻求战略资产多样化的经验丰富的投资者,还是寻求易于使用的交易解决方案的初学者,JFD将监管安全与广泛的市场机会相结合。

常见问题

JFD是否安全可靠?

是的,JFD Group Ltd.受塞浦路斯证券交易委员会(CySEC)监管,客户资金与公司自有资金分开存放。它还是塞浦路斯投资者补偿基金(ICF)的成员,以保护客户资金免受破产风险。此外,JFD定期接受审计,并采取内部风险管理措施。

JFD对于初学者来说是一个好的平台吗?

JFD提供了一个用户友好的交易平台,可在iOS、Android、Mac、Windows和Web上使用,使其适用于广泛的用户。然而,其复杂的费用结构和未指定的闲置现金利息可能对初学者构成挑战。总体而言,对于愿意学习和使用其功能的初学者来说,JFD可能是合适的。

JFD是否合法?

是的,JFD Group Ltd.是一家合法的经纪商,注册在CySEC,确保遵守金融监管规定,并向客户提供一系列交易资产。

T4TraJFD对于投资/退休来说好吗?

T4TraJFD,可能是与JFD相关的交易平台,由于JFD提供多样化的资产选择和合规性,因此可以适用于投资,包括退休规划。然而,个人在使用任何投资或退休目的的平台之前,应进行彻底的研究,并考虑其投资目标和风险承受能力。

风险警示

所提供的信息基于WikiStock对经纪公司网站数据的专业评估,可能会有变化。此外,网上交易涉及重大风险,可能导致投资资金的全部损失,因此在参与之前理解相关风险至关重要。

其他信息

注册地

塞浦路斯

经营时间

10-15年

可交易品类

现金业务、债券/固收、衍生品、证券咨询、期权、股票、指数基金、共同基金

相关企业

国家

公司名称

关联关系

瓦努阿图

JFD Overseas Ltd

集团公司

评价

暂无评价

推荐券商更多

Plus500

天眼评分

FXCM

天眼评分

eToro

天眼评分

Fortrade

天眼评分

Admirals

天眼评分

Swissquote 瑞讯

天眼评分

XTB

天眼评分

Trading 212

天眼评分

Hantec Financial Hantec

天眼评分

Eightcap

天眼评分