天眼评分

评分指数

券商鉴定

影响力

C

影响力指数 NO.1

Japan

Japan交易品种

7

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

交易牌照

拥有1个交易牌照

FSARegulated

JapanSecurities Trading License

券商信息

更多

公司全称

One Asia Securities Co.,Ltd

公司简称

ワンアジア証券

平台注册国家、地区

公司地址

随时想查就查

WikiStock APP

互联网基因

基因指数

APP评分

券商特色

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

Products

7

| One Asia Securities |  |

| WikiStocks Rating | ⭐⭐⭐ |

| Fees | Consignment Fees:Securities and Margin Trading:From 0.165% to 1.210%;Index Futures and Options:From 0.011% to 0.088%Commissions:Index Futures and Options:From 0.66% to 4.40% |

| Interests on uninvested cash | 1.43% |

| Mutual Funds Offered | Yes |

One Asia Securities Information

One Asia Securities offers mutual funds and interests on uninvested cash, providing its clients with some investment options beyond traditional securities.

However, details on its trading fees and mobile app platform are not clear, which limits some users who prefer transparent fee structures and mobile trading capabilities.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | No Mobile APP |

| Various Trading Securities(Including Stocks,Forex and others) | High Commissions(Max as 4.4%) |

| Continue Updating News | No Unique Trading Platform |

Pros:

One Asia Securities is regulated by the Financial Services Agency (FSA), ensuring compliance with financial regulations and standards which enhances investor protection. They offer a broad range of trading securities, including stocks and forex, providing diverse investment opportunities. Additionally, the company continuously updates news, keeping their clients informed on market trends and economic events.

Cons:

The absence of a mobile app will inconvenience traders who prefer managing their investments on the go. Also, the fee structure remains unclear, which will cause potential clients to hesitate as they cannot easily estimate trading costs. Furthermore, One Asia Securities lacks a unique trading platform, which limits the trading experience compared to competitors who offer customized trading environments.

Is One Asia Securities Safe?

Regulations:

One Asia Securities is rigorously regulated by the Japan Financial Services Agency (FSA), which is tasked with overseeing all financial service providers within the country.The firm holds a license with the Kanto Local Finance Bureau (License No. 関東財務局長(金商)第201号), which underscores its adherence to established financial regulations.

Funds Safety:

Regarding the safety of client funds, One Asia Securities adheres to the rules and guidelines set forth by the Japan Securities Dealers Association and the Japan Investor Protection Fund, of which it is a member (Fund No. 291).

This membership indicates that the client's funds are under a protective umbrella, aimed at securing investments and providing recourse in the event of financial discrepancies. However, specific details about insurance coverage amounts for client accounts are not explicitly mentioned in the provided documents.

Safety Measures:

One Asia Securities is committed to protecting client data and employs several security measures. The company has a Personal Information Protection Declaration, which includes adherence to privacy laws and guidelines, secure handling of personal data at every processing stage, and rigorous organizational, human, and technical safety measures.

These include access controls, encryption technologies, and protocols to prevent unauthorized data access or breaches. They also ensure regular training for employees on data handling and have strict procedures for dealing with external service providers to maintain data integrity and security.

What are securities to trade with One Asia Securities?

One Asia Securities offers a variety of securities trading options to accommodate the diverse needs of its clients. Here's an overview of the available securities for trading with One Asia Securities:

- Domestic Stocks Spot Trading: Clients can engage in spot trading of listed stocks across the nation, providing access to a wide array of Japanese equities.

- Domestic Stocks Margin Trading: This service is specifically available for institutional credit stocks, although general credit facilities are not offered.

- Index Futures & Options Trading: For those interested in derivatives, One Asia Securities provides the opportunity to trade index futures and options on the Osaka Securities Exchange (OSE) and Tokyo Stock Exchange (TSE).

- Foreign Stocks: The firm also enables trading of stocks listed on the Hong Kong market, offering an entry point for clients looking to invest in international equities.

- Domestic Stocks Spot Trading:

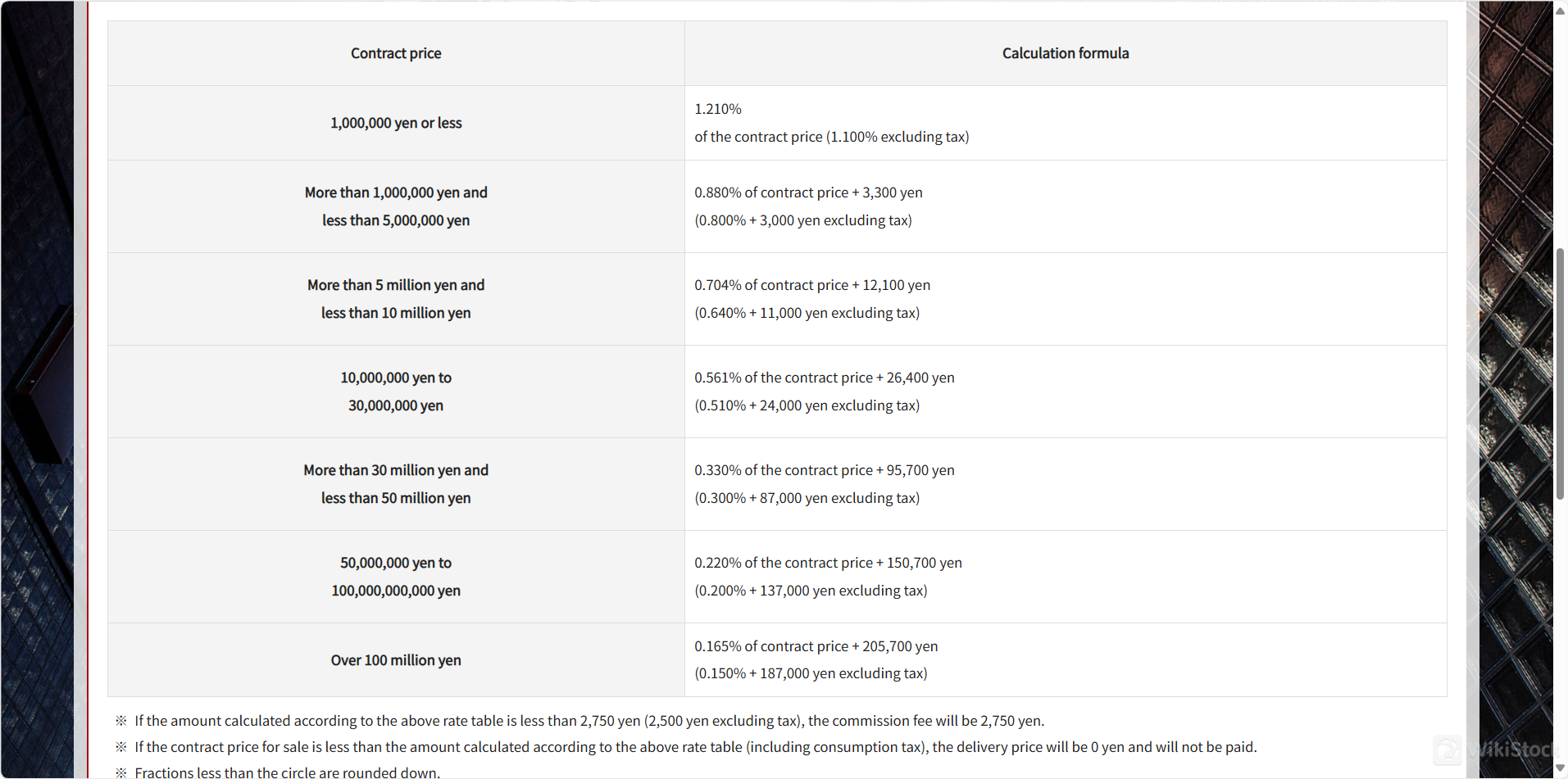

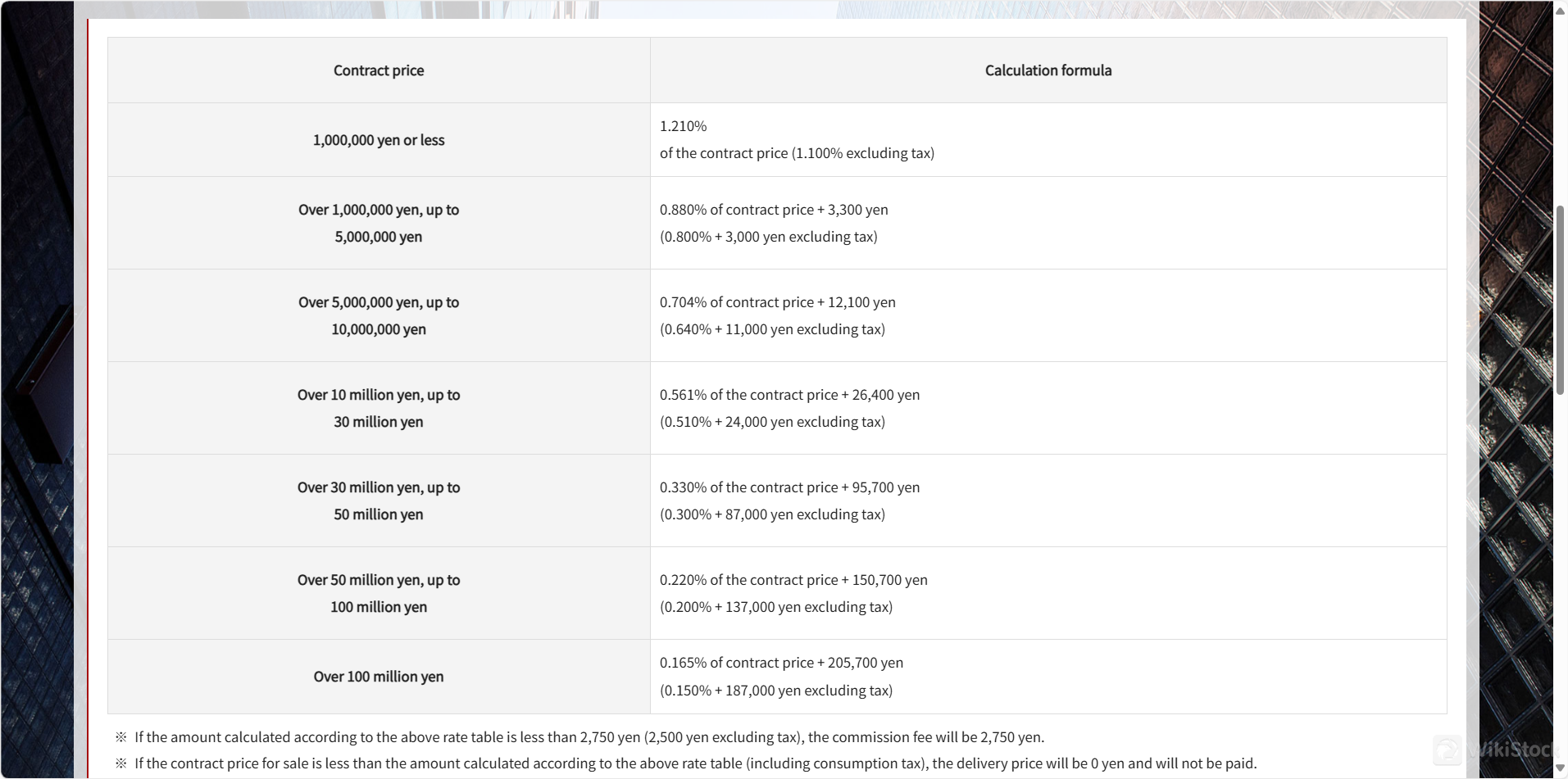

- Up to 1,000,000 yen: 1.210% of the contract price (1.100% excluding tax)

- Over 1,000,000 yen to less than 5,000,000 yen: 0.880% of contract price + 3,300 yen (0.800% + 3,000 yen excluding tax)

- Over 5,000,000 yen to less than 10,000,000 yen: 0.704% of contract price + 12,100 yen (0.640% + 11,000 yen excluding tax)

- 10,000,000 yen to 30,000,000 yen: 0.561% of the contract price + 26,400 yen (0.510% + 24,000 yen excluding tax)

- Over 30,000,000 yen to less than 50,000,000 yen: 0.330% of the contract price + 95,700 yen (0.300% + 87,000 yen excluding tax)

- 50,000,000 yen to 100,000,000,000 yen: 0.220% of the contract price + 150,700 yen (0.200% + 137,000 yen excluding tax)

- Over 100 million yen: 0.165% of contract price + 205,700 yen (0.150% + 187,000 yen excluding tax)

- Same tiered structure as Domestic Stocks Spot Trading for contract prices and fees.

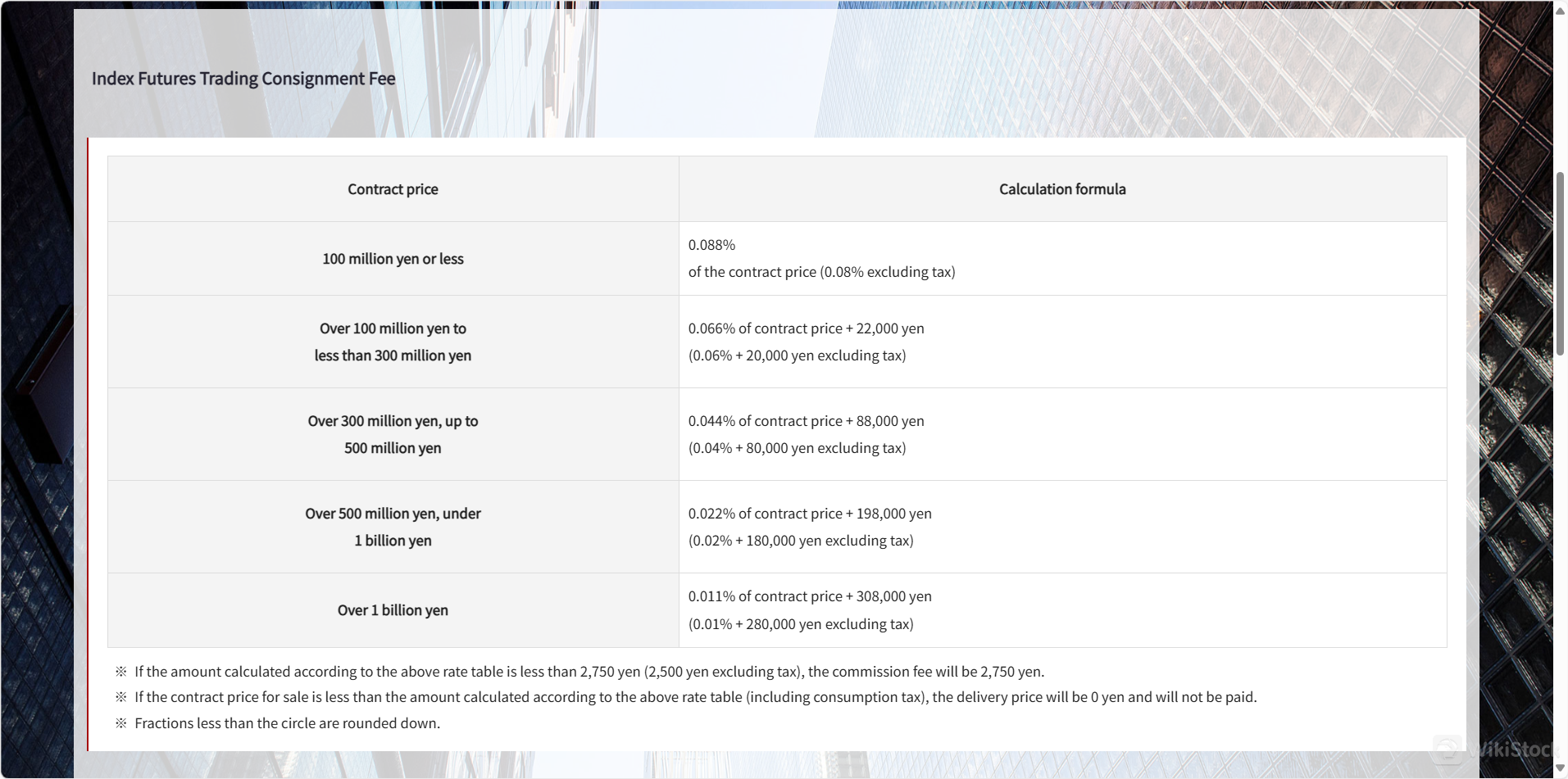

- 100 million yen or less: 0.088% of the contract price (0.08% excluding tax)

- Over 100 million yen to less than 300 million yen: 0.066% of contract price + 22,000 yen (0.06% + 20,000 yen excluding tax)

- Over 300 million yen up to 500 million yen: 0.044% of contract price + 88,000 yen (0.04% + 80,000 yen excluding tax)

- Over 500 million yen to under 1 billion yen: 0.022% of contract price + 198,000 yen (0.02% + 180,000 yen excluding tax)

- Over 1 billion yen: 0.011% of contract price + 308,000 yen (0.01% + 280,000 yen excluding tax)

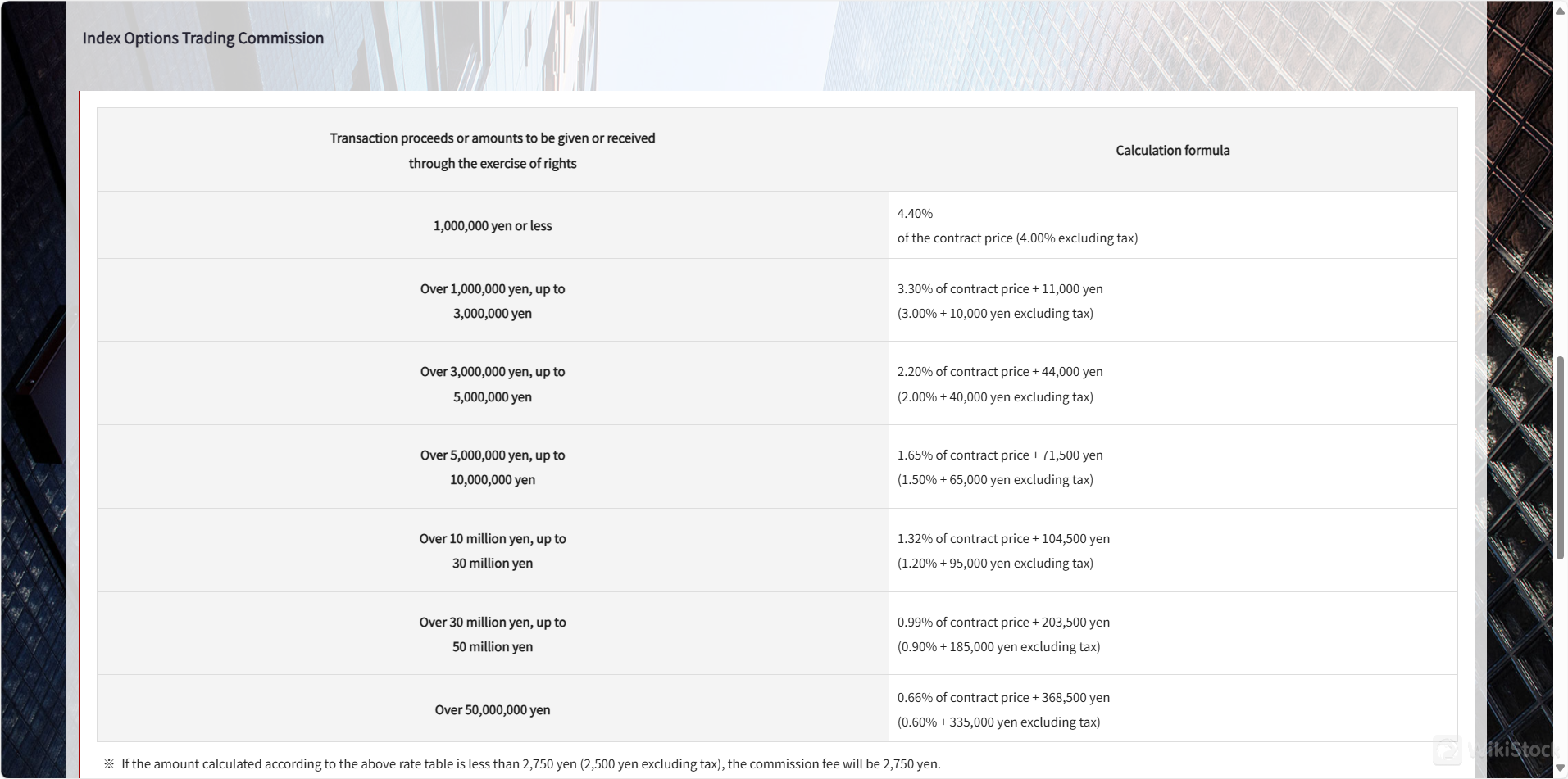

- 1,000,000 yen or less: 4.40% of the transaction proceeds (4.00% excluding tax)

- Over 1,000,000 yen to 3,000,000 yen: 3.30% of transaction proceeds + 11,000 yen (3.00% + 10,000 yen excluding tax)

- Over 3,000,000 yen to 5,000,000 yen: 2.20% of transaction proceeds + 44,000 yen (2.00% + 40,000 yen excluding tax)

- Over 5,000,000 yen to 10,000,000 yen: 1.65% of transaction proceeds + 71,500 yen (1.50% + 65,000 yen excluding tax)

- Over 10 million yen to 30 million yen: 1.32% of transaction proceeds + 104,500 yen (1.20% + 95,000 yen excluding tax)

- Over 30 million yen to 50 million yen: 0.99% of transaction proceeds + 203,500 yen (0.90% + 185,000 yen excluding tax)

- Over 50,000,000 yen: 0.66% of transaction proceeds + 368,500 yen (0.60% + 335,000 yen excluding tax)

- Interest Rate on Purchases: 2.80% per annum, charged on the contract amount from the date of delivery of the new contract to the date of the repayment commitment.

- Interest Rate on Sellers: 0% per annum, also applied from the date of delivery of the new contract to the repayment commitment.

- Margin Trading Stock Lending Fees: 1.15% per annum, charged on the contract amount similar to the interest rates above.

- Management Fee: 110 yen per unit, with a maximum of 1,100 yen per stock, charged monthly. This fee applies to both sellers and buyers in margin transactions.

- Name Transfer Fee: 55 yen per unit, including tax, charged for purchase open interest when transactions exceed the account settlement.

- No Account Management Fee: There is no fee for managing accounts that hold securities such as stock certificates or money, including foreign securities (excluding yen-denominated bonds and foreign investment trusts).

- Contracts for Deposits, Bookkeeping, and Transfer of Money and Securities: One Asia Securities ensures the safety and legality of securities transactions by keeping customer funds and securities separate from the companys assets in accordance with laws and regulations.

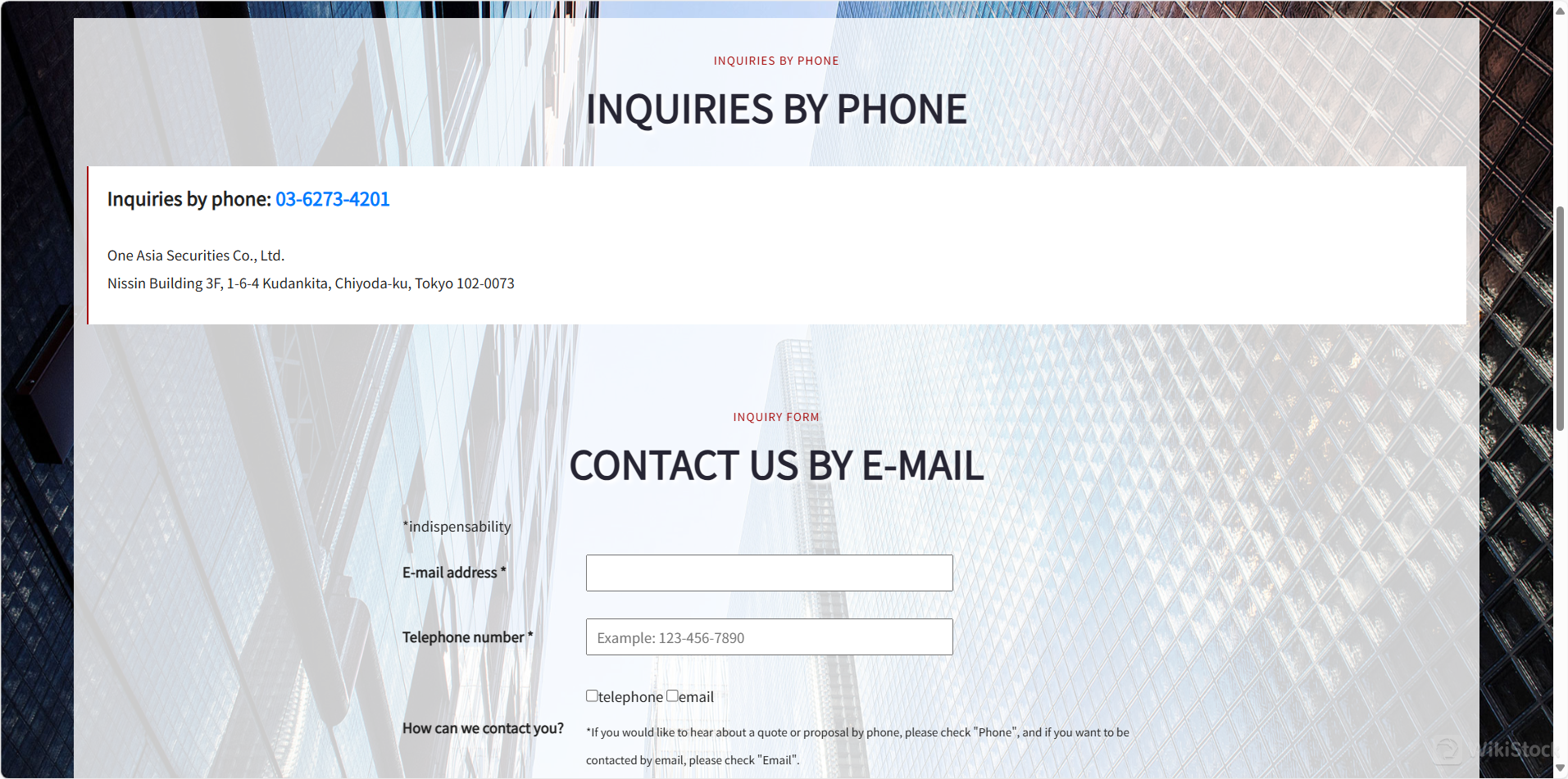

- How can I contact One Asia Securities for account opening or inquiries?

You can contact One Asia Securities by phone at 03-6273-4201 or through their email inquiry form available on their website to request information or open an account.

- What types of securities can I trade with One Asia Securities?

One Asia Securities offers a variety of trading options, including domestic stocks (spot and margin trading), foreign stocks, and derivatives like index futures and options.

- Has One Asia Securities made any recent changes to its management structure?

Yes, One Asia Securities has recently updated its management structure to enhance its internal control systems and efficiency, with changes officially taking place on specific dates such as June 21, 2024, and other past adjustments noted in their corporate announcements.

While additional services related to investment in bonds and other financial instruments are indicated as “coming soon,” the current offerings already provide a robust selection for both domestic and international trading.

One Asia Securities Fee Review

Here is a detailed breakdown of the fee structure at One Asia Securities for various types of trading and services:

1. Securities Trading Fees:

2. Margin Trading Fees:

3. Index Options & Futures and Options Trading Fees:

Consignment Fees:

Commissions:

4.Miscellaneous Expenses:

Additional Fees and Contract-Related Services:

| Fee Type | Details |

| Domestic Stocks Spot Trading | Up to 1M yen: 1.210%, Over 1M to 5M yen: 0.880% + ¥3,300, Over 5M to 10M yen: 0.704% + ¥12,100, 10M to 30M yen: 0.561% + ¥26,400, Over 30M to 50M yen: 0.330% + ¥95,700, 50M to 100B yen: 0.220% + ¥150,700, Over 100M yen: 0.165% + ¥205,700 |

| Domestic Stocks Margin Trading | Same as Domestic Stocks Spot Trading |

| Index Trading Consignment Fees | 100M yen or less: 0.088%, Over 100M to 300M yen: 0.066% + ¥22,000, Over 300M to 500M yen: 0.044% + ¥88,000, Over 500M to 1B yen: 0.022% + ¥198,000, Over 1B yen: 0.011% + ¥308,000 |

| Index Trading Commissions | Up to 1M yen: 4.40%, Over 1M to 3M yen: 3.30% + ¥11,000, Over 3M to 5M yen: 2.20% + ¥44,000, Over 5M to 10M yen: 1.65% + ¥71,500, Over 10M to 30M yen: 1.32% + ¥104,500, Over 30M to 50M yen: 0.99% + ¥203,500, Over 50M yen: 0.66% + ¥368,500 |

| Miscellaneous Expenses | Interest Rate on Purchases: 2.80% pa, Interest Rate on Sellers: 0% pa,Margin Trading Stock Lending Fees: 1.15% pa, Management Fee: ¥110 per unit (up to ¥1,100 per stock), Name Transfer Fee: ¥55 per unit, Rental Fee (Reverse Daily Rate): Variable |

Research & Education

One Asia Securities Co., Ltd. emphasizes investor education by providing detailed pre-contractual documents and regulatory information, such as insider trading guidelines and updates on management changes, to ensure clients are well-informed before trading.

They offer resources explaining the My Number system and the importance of separating client assets to safeguard them even in the event of a company's failure. This educational approach helps investors understand market complexities and regulatory compliance, enhancing their decision-making processes in the securities market.

Customer Service

One Asia Securities Co., Ltd. offers customer support primarily through phone and email.

For inquiries or to open an account, customers can contact the firm directly at their main phone number, 03-6273-4201, or by submitting details via an email inquiry form on their website.

The company ensures prompt sending of required documents and materials as requested. The head office is located at Nissin Building 3F, 1-6-4 Kudankita, Chiyoda-ku, Tokyo 102-0073, indicating accessibility for both local and potential clients looking for personalized and trustworthy service.

Conclusion

One Asia Securities Co., Ltd. is a financial services provider based in Tokyo, known for its robust regulatory compliance and a wide range of trading options.

The company emphasizes customer service and education, offering detailed information and updates on various financial products and market regulations.

With a commitment to transparency and integrity, One Asia Securities aims to be a trusted partner for both domestic and international investors seeking to navigate the complexities of the financial markets.

FAQs

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

其他信息

Registered region

Japan

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

评价

暂无评价

推荐券商更多

SOCIETE GENERALE

天眼评分

インヴァスト証券

天眼评分

中原証券

天眼评分

三津井証券株式会社

天眼评分

FFG証券

天眼评分

岡安証券株式会社

天眼评分

丸国証券

天眼评分

ばんせい証券株式会社

天眼评分

西村証券株式会社

天眼评分

永和証券株式会社

天眼评分