天眼評分

評分指數

券商鑒定

影響力

B

影響力指數 NO.1

日本

日本交易品種

5

現金業務、債券/固收、衍生性商品、選擇權、股票

交易牌照

擁有1個交易牌照

日本FSA證券交易執照

券商信息

更多

公司全稱

KAGAWA Securities Co., Ltd

公司簡稱

香川証券

平台註冊國家、地區

公司地址

隨時想查就查

WikiStock APP

互聯網基因

基因指數

APP評分

券商特色

傭金率

1.166%

槓桿交易

是

受監管國數量

1

可交易品類

5

| Kagawa Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | 範圍從1.166%(合約≤100萬日元)到0.110%+ 166 |

| 合約>5000萬日元的100日元(國內股票) | |

| Account Fees | 每年2200日元或每三年5280日元的受保護存款帳戶維護費 |

| 每年2200日元的外國證券帳戶管理費 | |

| Mutual Funds Offered | REIT,ETF |

| App/Platform | Net de Rakuda |

什麼是Kagawa Securities?

Kagawa Securities Co., Ltd.是一家位於日本的金融服務公司,受日本金融服務機構監管。Kagawa Securities專注於個人和企業的金融需求,提供多樣化的產品和服務,包括財富諮詢、商業配對和IR支持。他們還提供量身定制的投資解決方案,管理投資信託,並就併購活動和首次公開募股提供建議。

Kagawa Securities的優點和缺點

| 優點 | 缺點 |

|

|

|

|

|

優點:

監管監督:作為日本金融服務機構監管的實體,Kagawa Securities遵守嚴格的監管標準,確保投資者的保護和金融穩定。

廣泛的服務範圍:Kagawa Securities提供全面的金融產品和服務,包括財富諮詢、投資管理和企業諮詢服務。

市場專業知識:Kagawa Securities專注於市場信息傳播和資產管理,利用其專業知識為客戶提供明智的投資決策。

缺點:

複雜的費用結構: Kagawa Securities以其複雜的費用結構而聞名。這種複雜性可能使投資者難以完全理解與其投資相關的成本。

有限的教育資源:與一些競爭對手相比,Kagawa Securities為投資者提供有限的教育資源。因此,投資者可能需要尋求外部來源以獲得全面的金融教育和指導。

Kagawa Securities是否安全?

Kagawa Securities Co., Ltd. 受日本金融服務局(FSA)監管,持有金商第3號牌照,該機構以對日本金融機構的嚴格監督而聞名。作為受監管實體,Kagawa Securities有義務遵守嚴格的監管標準,旨在保護投資者並維護金融穩定。這種監管監督有助於確保Kagawa Securities在既定指南內運作,保護客戶資金並保持運營透明。

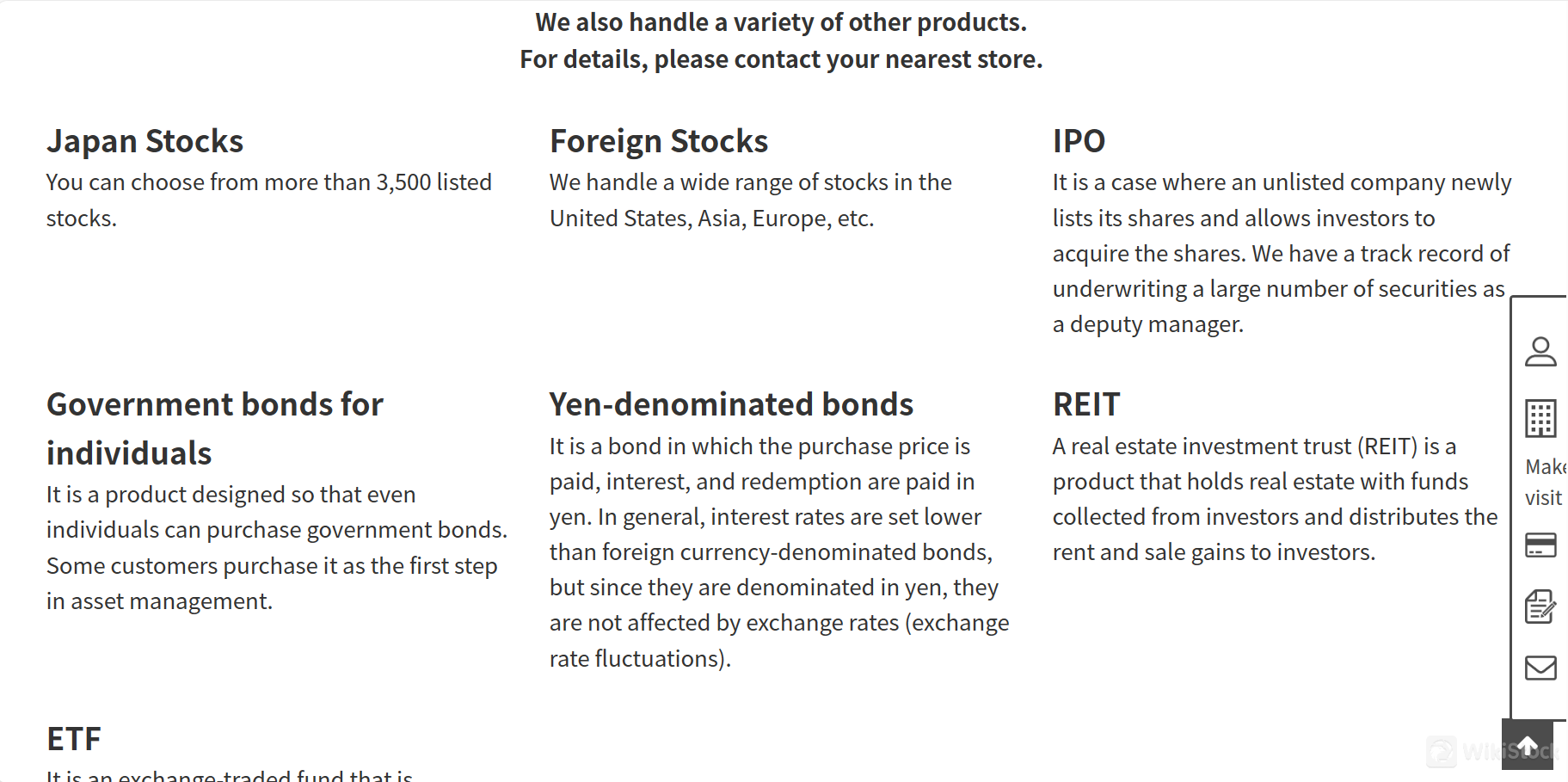

Kagawa Securities提供哪些證券交易?

Kagawa Securities Co., Ltd. 提供一系列針對企業客戶量身定制的金融產品和服務。這些產品包括國內股票、可換股債券、外國股票、指數期貨、指數期權、證券期權和政府債券期貨。這個廣泛的產品範圍使投資者能夠根據不同的投資策略和風險偏好定制自己的投資組合。

國內股票和外國股票使投資者能夠接觸本地和國際市場,而可換股債券和期權則提供了戰略對沖和資本增值的機會。指數期貨和期權通過提供對更廣泛市場指數的接觸,進一步增強了投資組合的靈活性,而政府債券期貨則提供了固定收益投資的途徑。

Kagawa Securities多樣化的產品組合凸顯了其致力於滿足客戶多樣化投資目標的承諾。

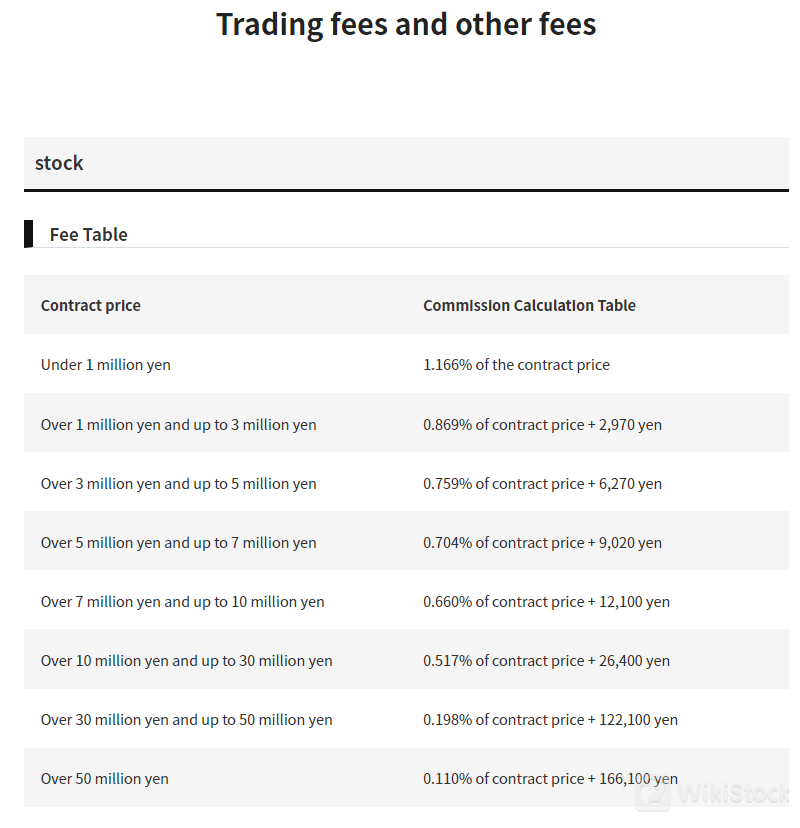

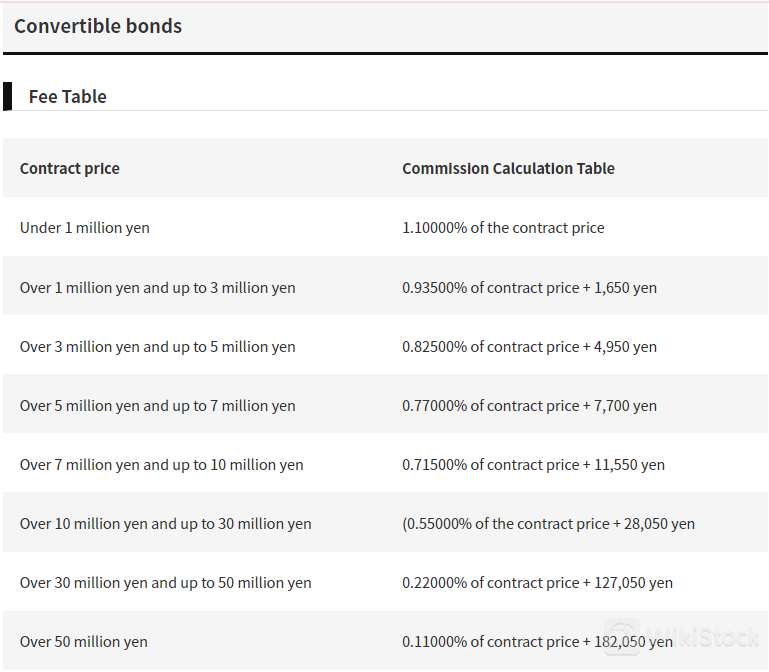

Kagawa Securities費用評論

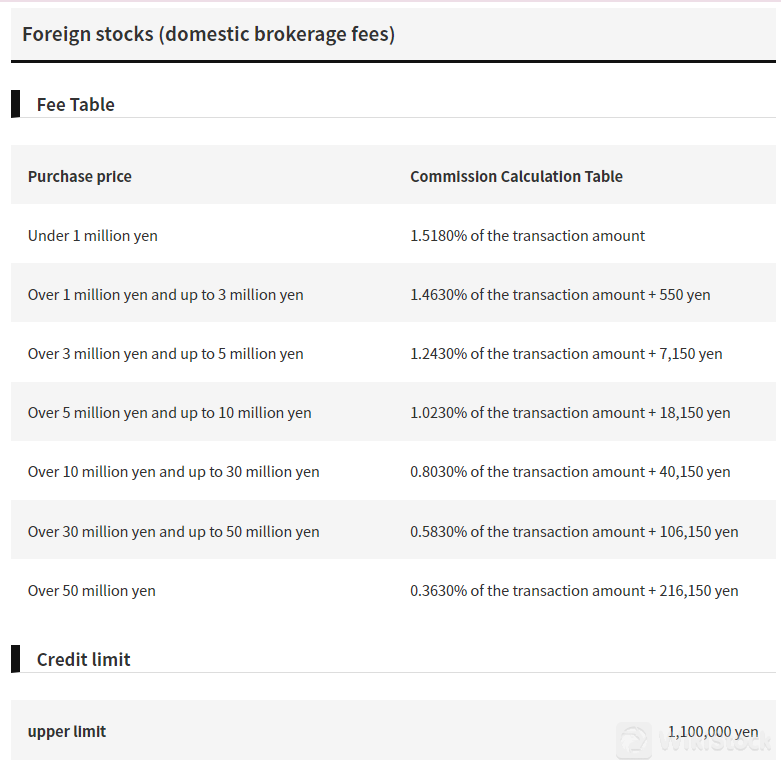

對於國內股票,費用按合約價格的百分比計算,範圍從1.166%(合約價值不超過1百萬日元)到0.110%加上166,100日元(合約價值超過5千萬日元)。可換股債券的費用從1.10000%(合約價值不超過1百萬日元)到0.11000%加上182,050日元(合約價值超過5千萬日元)。

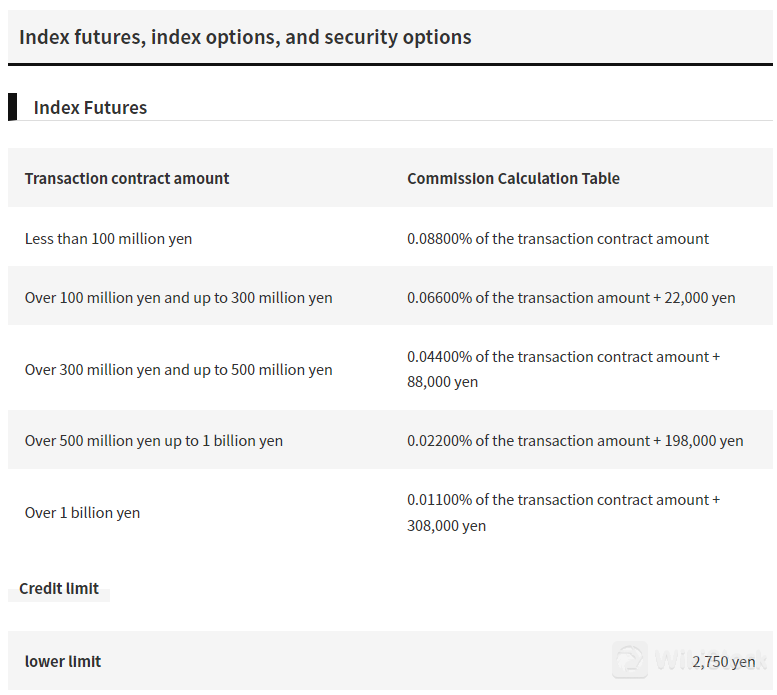

在國內交易所交易的外國股票的費用範圍從1.5180%(合約價值不超過1百萬日元)到0.3630%加上216,150日元(合約價值超過5千萬日元)。指數期貨交易的費用從合約金額的0.08800%起,交易金額不超過1億日元,額外固定費用範圍從308,000日元到10億日元以上的合約。

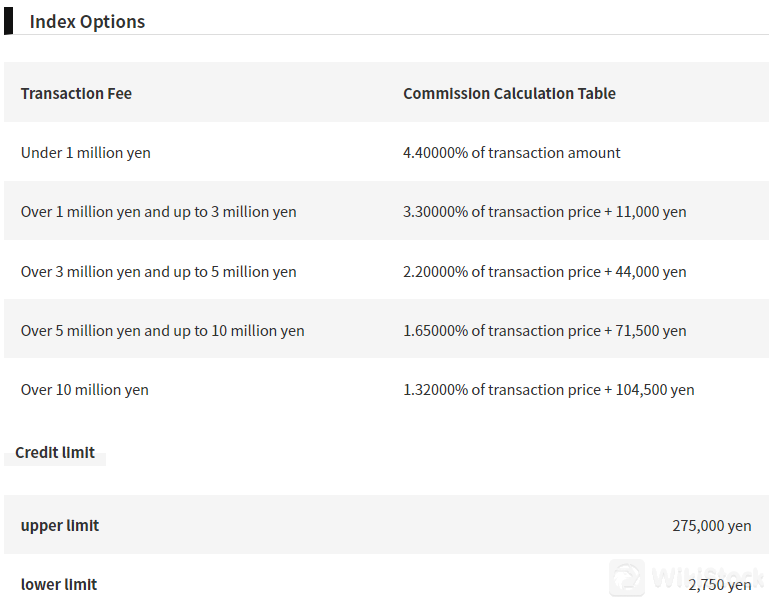

指數期權和證券期權的費用也根據交易金額分層收費,費率範圍從4.40000%(指數期權交易金額不超過1百萬日元)到0.66000%加上36,850日元(證券期權交易金額超過5千萬日元)。政府債券期貨的費用從合約面值的0.01650%起,交易金額不超過5億日元,額外固定費用範圍從220,000日元到50億日元以上的合約。

除了交易費用外,Kagawa Securities還根據轉入單位數收取保護存款帳戶的維護費和帳戶轉移費用。

Kagawa Securities應用程式評論

Kagawa Securities Co., Ltd. 提供 Net de Camel,一項可透過個人電腦和智能手機訪問的在線查詢服務。該服務允許客戶隨時隨地監控其資產狀況,提供便利和安心。要使用 "Net de Camel",客戶需要在Kagawa Securities開立一個一般證券帳戶並簽訂特定合約。該服務支持各種操作系統和瀏覽器,但需要滿足特定的系統要求以獲得最佳使用效果。

研究和教育

Kagawa Securities 提供多種資源,幫助投資者在市場中導航。

市場報告和每週更新:他們提供定期報告,包括市場分析和對其資產管理合作夥伴持有的更新。

企業IR和分行研討會:他們組織研討會,邀請行業領袖和投資專業人士參與。這些研討會可以涵蓋有價值的主題,如投資策略、不同的資產類別和市場展望。

客戶服務

您可以通過電話與Kagawa Securities聯繫,並找到您最近的分店。他們接受電話查詢,確保您可以直接尋求協助或信息。例如,總部位於日本香川縣高松市馬宮町4-8,可通過電話087-851-8181聯繫。Kagawa Securities還鼓勵您使用他們的在線表格。您可以輸入您的詳細信息並指定您的查詢或請求。

結論

Kagawa Securities是一家受監管的日本公司,為個人和企業提供廣泛的金融服務。他們提供財富管理、投資產品和業務諮詢,並提供用戶友好的在線平台。總的來說,Kagawa Securities是日本投資者尋求全面金融合作夥伴和個性化服務的不錯選擇,但注重成本的投資者可以考慮其他選擇。

常見問題(FAQ)

Kagawa Securities提供哪些服務?

財富諮詢、投資管理、企業諮詢以及股票、債券和衍生品等各種投資產品。

Kagawa Securities是否受監管?

是的,Kagawa Securities受到日本金融服務局(FSA)的監管。

Kagawa Securities的交易費用是多少?

費用因交易類型和規模而異。例如,國內股票交易的費用範圍從合約金額的1.166%到0.110%,並且對於較大的合約還有額外費用。

風險警告

所提供的信息基於WikiStock對該券商網站數據的專家評估,並可能會有所變動。此外,在線交易存在重大風險,可能導致投資資金的全部損失,因此在參與之前了解相關風險至關重要。

其他信息

註冊地

日本

經營時間

20年以上

可交易品類

現金業務、債券/固收、衍生性商品、選擇權、股票

評價

暫無評價

推薦券商更多

三菱UFJモルガン・スタンレー証券

天眼評分

Nissan Securities

天眼評分

水戸証券

天眼評分

東洋証券株式会社

天眼評分

豊証券株式会社

天眼評分

Kyokuto Securities

天眼評分

ちばぎん証券

天眼評分

あかつき証券

天眼評分

Money Partners

天眼評分

岩井コスモ証券

天眼評分