監管中

0123456789

. 0123456789

0123456789

/10

天眼評分

評分指數

券商鑒定

影響力

C

影響力指數 NO.1

瑞典

瑞典交易品種

2

證券諮詢、股票

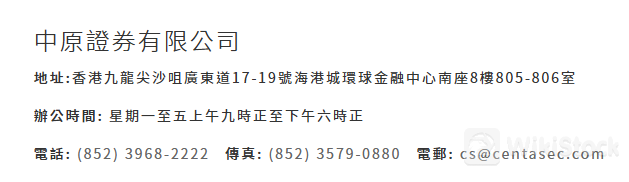

3968-2222

cs@centasec.com

https://www.centasec.com/

Suites 805-806, 8/F, South Tower, World Finance Centre, Harbour City, Nos. 17-19 Canton Road, Tsimshatsui, Kowloon, HK

https://www.facebook.com/centasec

交易牌照

擁有1個交易牌照

中國香港SFC證券交易執照

監管中

全球席位

![]() 擁有1家交易所席位

擁有1家交易所席位

香港交易所

席位號 01941

已休市

券商信息

更多

公司全稱

CENTALINE SECURITIES LIMITED

公司簡稱

中原證券

平台註冊國家、地區

公司電話

3968-2222

公司地址

Suites 805-806, 8/F, South Tower, World Finance Centre, Harbour City, Nos. 17-19 Canton Road, Tsimshatsui, Kowloon, HK

隨時想查就查

WikiStock APP

互聯網基因

基因指數

10

020406080100

基因指數較差,低於83%的券商

APP評分

0.0

01.02.03.04.05.0

APP評分較差,低於86%的同行

APP下載量

- 周期

- 下載量

- 2024-05

- 4198

統計規則:數據展示為APP在當前時間過去一年的下載量。

APP地區熱度

- 國家/地區下載量比例

中國香港

272564.91%中國

120928.80%中國澳門

2646.29%

統計規則:數據展示為APP在當前時間過去一年的下載量和地區佔比。

券商特色

傭金率

0.1%

融資利率

3%

新股交易

是

槓桿交易

是

「中原證券有限公司」為中原金融集團旗下成員,母公司為中原集團。秉承「以客為本,共同創富」的理念,公司主力為客戶提供買賣證券、債券、基金及融資交易等專業服務。

其他信息

註冊地

中國香港

經營時間

10-15年

可交易品類

證券諮詢、股票

相關企業

國家

公司名稱

關聯關係

--

中原金融集團

母公司

--

中原理財(國際)有限公司

集團公司

--

中原理財有限公司

集團公司

--

中原資產管理有限公司

集團公司

--

中原集團

母公司

中原證券 APP截圖10

評價

0條評價

寫評價

暫無評價

推薦券商更多

監管中

SDHG International Securities 山高國際證券

牌照級別 AAAA

中國香港監管選擇權傭金0.25%

7.16

天眼評分

監管中

佳兆業金融集團有限公司

牌照級別 AAAA

中國香港監管選擇權傭金0.25%

7.15

天眼評分

監管中

CVS 中薇證券

牌照級別 AAAA

中國香港監管選擇權傭金0.15%

7.15

天眼評分

監管中

Sino Grade Securities 華誠證券

牌照級別 AAAA

中國香港監管選擇權傭金0.25%

7.15

天眼評分

監管中

青石證券

牌照級別 AAAA

中國香港監管選擇權傭金0.2%

7.15

天眼評分

監管中

興偉

牌照級別 AAAA

中國香港監管選擇權傭金0.25%

7.14

天眼評分

監管中

Win Wind 萬贏

牌照級別 AAAA

中國香港監管選擇權

7.14

天眼評分

監管中

團結證券

牌照級別 AAAA

中國香港監管選擇權傭金0.15%

7.13

天眼評分

監管中

泰嘉證券

牌照級別 AAAA

中國香港監管選擇權傭金0.25%

7.13

天眼評分

監管中

益高證券

牌照級別 AAAA

中國香港監管選擇權傭金0.15%

7.13

天眼評分