Score

光証券株式会社

https://www.hikarishoken.com/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

JapanProducts

7

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

HIKARI SECURITIES CO.,LTD

Abbreviation

光証券株式会社

Platform registered country and region

Company address

Company website

https://www.hikarishoken.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

1.15%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Hikari Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | Not Mentioned |

| Fees | Not Mentioned |

| Interests on Uninvested Cash | Not Mentioned |

| Margin Interest Rates | Not Mentioned |

| Mutual Funds Offered | Not Mentioned |

| App/Platform | Not Mentioned |

| Products | Investment trust, Japanese stocks, US stocks, life insurance |

Hikari Securities Information

Hikari Securities Co., Ltd., founded in Kobe in 1948, positions itself as an independent securities company offering asset management, investment trusts, and trading in Japanese and international stocks. Regulated by the Japan Financial Services Agency, Hikari Securities claims to provide tailored investment strategies to clients, aiming to help them navigate the challenging economic landscape and boost their assets.

Pros & Cons of Hikari Securities

| Pros | Cons |

| Personalized Investment Strategies | Limited Investment Variety |

| Long-standing Reputation | Lack of Transparency |

| Regulatory Oversight |

Personalized Investment Strategies: Hikari Securities offers individualized investment proposals to cater to clients' specific needs and preferences, potentially providing a more tailored investment approach.

Long-standing Reputation: With over 70 years in the industry, Hikari Securities boasts a solid reputation and longevity, signaling stability and experience.

Regulatory Oversight: Hikari Securities operates under the regulatory oversight of the Japan Financial Services Agency and holds a Japan Securities Trading License. This regulatory oversight can provide clients with a sense of security and assurance that the firm operates within the bounds of official regulations and standards.

ConsLimited Investment Variety: Hikari Securities primarily focuses on Japanese and American stocks, potentially limiting clients' opportunities for diversification across different asset classes or regions.

Lack of Transparency: Hikari Securities does not provide clear information about crucial aspects such as fee structures, account types, and trading platforms, which can hinder clients' ability to make informed decisions.

Is Hikari Securities Safe?

- Regulatory Sight: Hikari Securities operates under the regulatory oversight of the Japan Financial Services Agency (No.30), holding a JapanSecurities Trading License. This regulatory authority ensures that financial institutions comply with relevant laws and regulations to protect investors and maintain market integrity.

- User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

- Security Measures: So far we haven't found any information about the security measures for this broker.

What are Securities to Trade with Hikari Securities?

With Hikari Securities, you can trade in Japanese and US stocks, offering a gateway to major stock markets and the opportunity to diversify your portfolio internationally.

Additionally, the firm offers investment trusts, which are great for those looking to invest in a pooled fund managed by professionals, allowing access to a broader range of assets that might be difficult to manage individually. For those interested in a more stable and long-term investment, Hikari Securities also provides life insurance products, blending investment with protection.

Customer Service

Realord Asia Pacific Securities offers comprehensive customer support to its clients.Clients can reach out to Realord Asia Pacific Securities through various channels.

- Telephone: 078-391-2305

- Fax: 078-391-5580

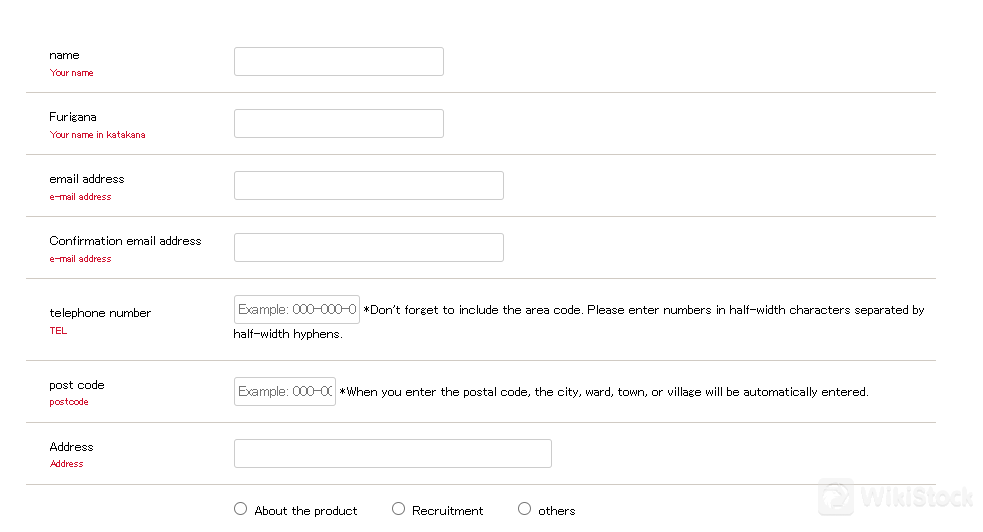

- Contact From

- Physical address: 4-2, Kano-machi 3-chome, Chuo-ku, Kobe 650-0001, Japan

Conclusion

Hikari Securities, as an independent securities company in Kobe, appears to have a longstanding presence in the industry and emphasizes tailored investment strategies. However, the lack of transparency in crucial areas such as fee structures, account types, and available services poses challenges for clients looking to assess the firm comprehensively. Potential clients may want to seek additional information and clarifications before considering Hikari Securities as their investment partner.

FAQs

Is Hikari Securities regulated?

Yes. Hikari Securities operates under the regulatory oversight of theJapan Financial Services Agency (FSA).

What investment products can I trade with Hikari Securities?

Hikari Securities offers trading in Japanese and American stocks, focusing on individual stock stories and market performance analysis.

Does Hikari Securities provide personalized investment advice?

Yes.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

10-15 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

播陽証券

Score

三縁証券

Score

ほくほくTT証券

Score

四国アライアンス証券

Score

三晃証券株式会社

Score

ワイエム証券

Score

池田泉州TT証券

Score

長野證券

Score

PayPay証券

Score

京銀証券

Score