Score

四国アライアンス証券

https://www.shikoku-alliance-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Products

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Shikoku Alliance Securities Co.,Ltd.

Abbreviation

四国アライアンス証券

Platform registered country and region

Company address

Company website

https://www.shikoku-alliance-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Shikoku Alliance Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | Not mentioned |

| Fees | Investment trusts: up to 3.85% (tax included) and a dissolution fee up to 0.5% of the base value |

| Management fees for ongoing costs: up to 2.42% (tax included) | |

| Mutual Funds Offered | Yes |

Shikoku Alliance Securities Information

Shikoku Alliance Securities is a Japanese financial services firm with a focus on providing a secure investment environment. They offer a variety of investment options including stocks, investment trusts, ETFs, REITs, and bonds. The company is dedicated to legal compliance and customer service, emphasizing the prevention of money laundering and terrorist financing.

Pros & Cons of Shikoku Alliance Securities

| Pros | Cons |

| Securities Information | No Mention of Account Types |

| Regulatory Compliance | Lack of Info on Fees |

| Customer Service |

Pros:

- Securities Information: Shikoku Alliance Securities is distinguished by its professional online presence, which reflects the company's emphasis on transparency and investor communication. Regular updates on legal compliance and security measures are a hallmark of its commitment to regulatory standards.

- Regulatory Compliance: The firm is a paragon of integrity, actively engaging in anti-money laundering and counter-terrorism financing initiatives. And Shikoku Alliance Securities is steadfast in its efforts to uphold a secure and ethical financial environment.

- Customer Service: Shikoku Alliance Securities excels in providing personalized customer service, offering a suite of financial services including M&A, financing, and strategic advice. Cons:

- Account Types: There is no mention of the types of accounts offered, such as personal, joint, corporate, or retirement accounts, nor is there information on account fees or minimum balance requirements.

- Fees: There is no information on the competitiveness of fees, cash interest rates on uninvested funds, or the practice of payment for order flow.

- Domestic Stocks: Shikoku Alliance Securities deals in stocks listed on the Tokyo Stock Exchange, which allows investors to access a wide range of Japanese companies across different sectors.

- Foreign Stocks: The company also offers trading in some stocks listed on the New York financial exchanges. This service provides investors with the chance to expand their portfolios internationally, gaining exposure to companies and industries outside of Japan.

- Over-the-Counter (OTC) Trading: Shikoku Alliance Securities engages in domestic OTC trading, which is based on the Financial Instruments and Exchange Act. This type of trading involves transactions in securities not listed on a public exchange, offering investors access to a broader market with unique investment opportunities.

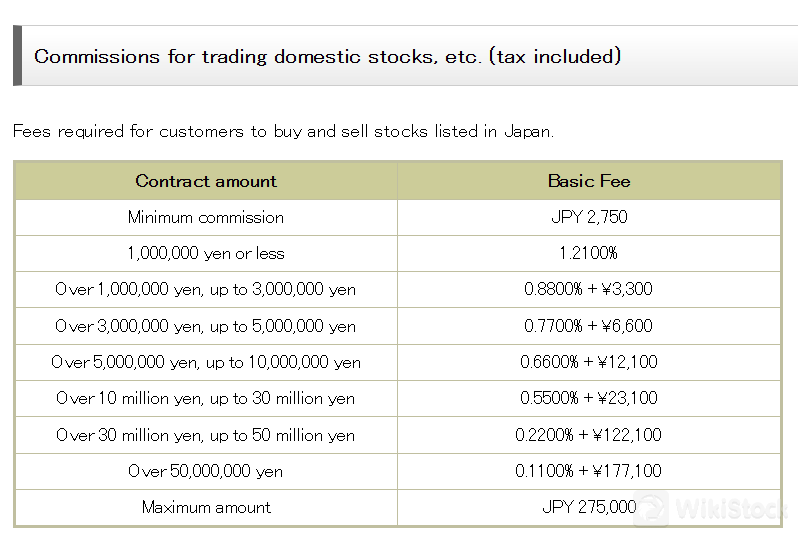

- Domestic Stock Trading Commissions: Start at 2,750 JPY with tiered rates based on the trading amount, capped at 275,000 JPY.

- Unit Fractional Stock Trading Fees: Calculated proportionally based on the number of shares traded relative to a unit.

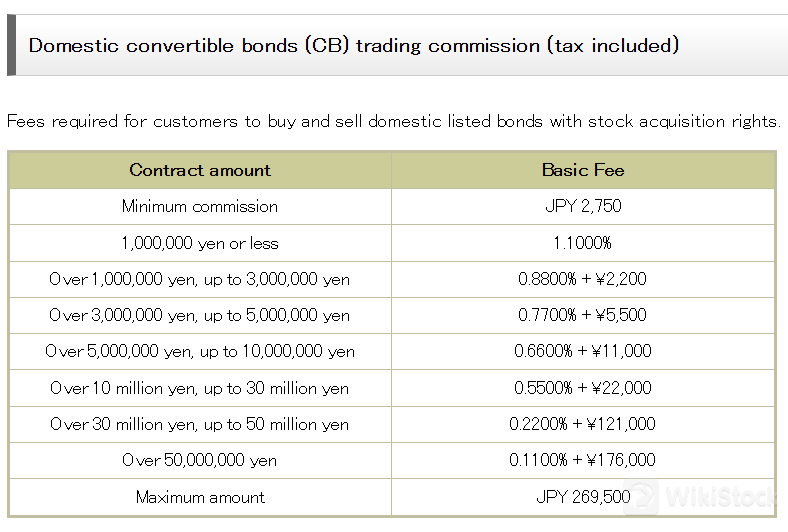

- Convertible Bond Trading Commissions: Similar to domestic stocks, with a cap of 269,500 JPY.

- Foreign Stock Trading Commissions: Range from 11% for amounts under 71,000 JPY to 0.1980% plus a base fee for transactions over 100 million JPY, with additional foreign market fees and taxes.

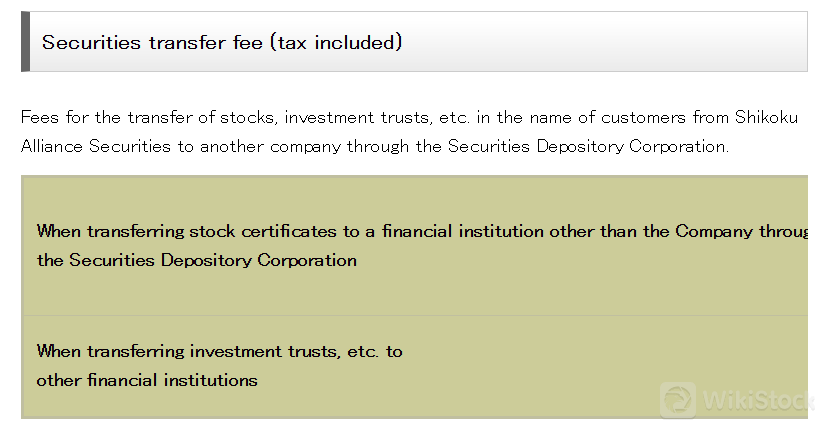

- Securities Transfer (Transfer) Fees: Vary based on the number of units and type of securities, with a maximum fee of 11,000 JPY for more than 19 units.

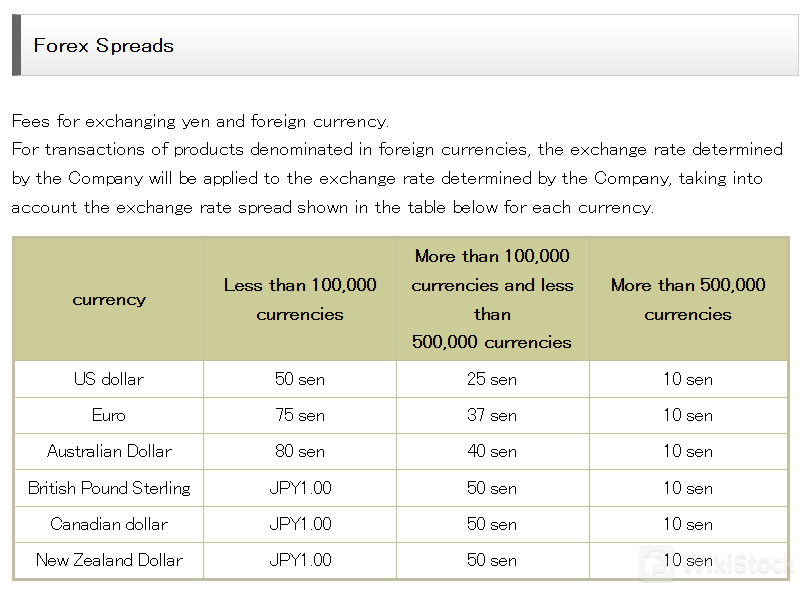

- Currency Exchange Spread: A spread is applied to the exchange rate for transactions involving foreign currencies, with varying fees for different amounts.

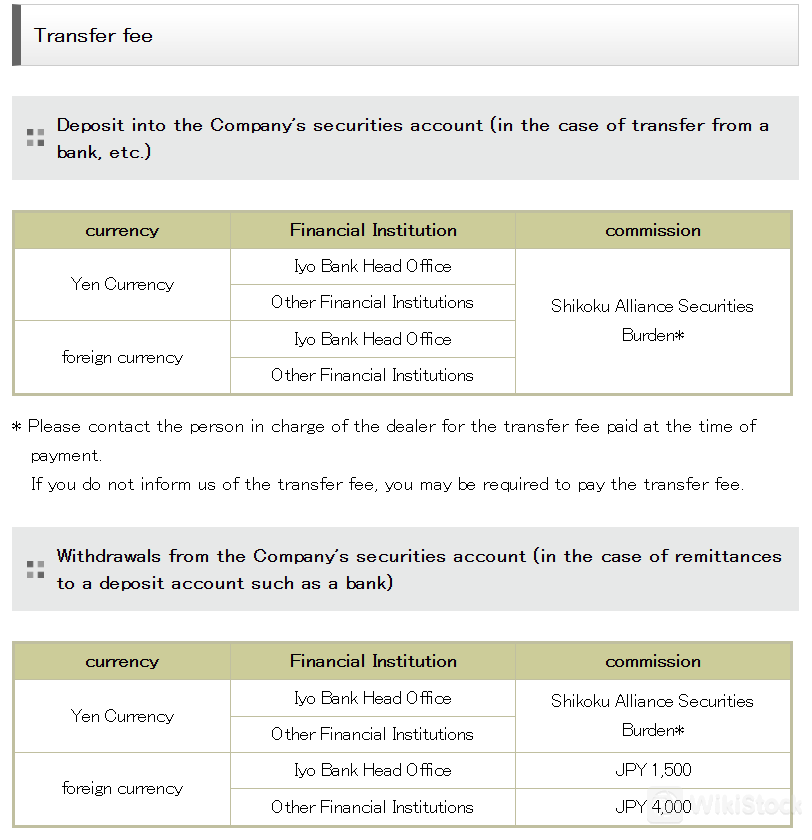

- Transfer Fees: For deposits into Shikoku Alliance Securities accounts, fees are generally borne by the company. For withdrawals, fees range from 1,500 JPY for foreign currencies at the same bank to 4,000 JPY for other financial institutions, with additional bank fees possible.

- Is Shikoku Alliance Securities safe to trade?

- Yes, Shikoku Alliance Securities is regulated by the Japan Financial Services Agency (FSA).

- Is Shikoku Alliance Securities a good platform for beginners?

- The platform's regulatory compliance and range of investment options make it suitable for investors of various experience levels, including beginners.

- Is Shikoku Alliance Securities good for investing/retirement?

- It offers a variety of investment products that can be part of a long-term investment or retirement strategy.

Is Shikoku Alliance Securities Safe?

Shikoku Alliance Securities is regulated by the Japan Financial Services Agency (FSA), which is the primary financial regulator in Japan overseeing all financial service providers, including Forex brokers. The company holds a license issued by the FSA, with the license number “四国财务局長(金商)第21号”. The regulator's website is provided for further verification. This regulatory oversight ensures that the company operates within a legal framework designed to protect investors and maintain market integrity.

What are Securities to Trade with Shikoku Alliance Securities?

For foreign stock transactions through domestic OTC trading, Shikoku Alliance Securities requires investors to review the “Foreign Securities Information” before making a purchase.

Shikoku Alliance Securities Fees Review

Customer Service

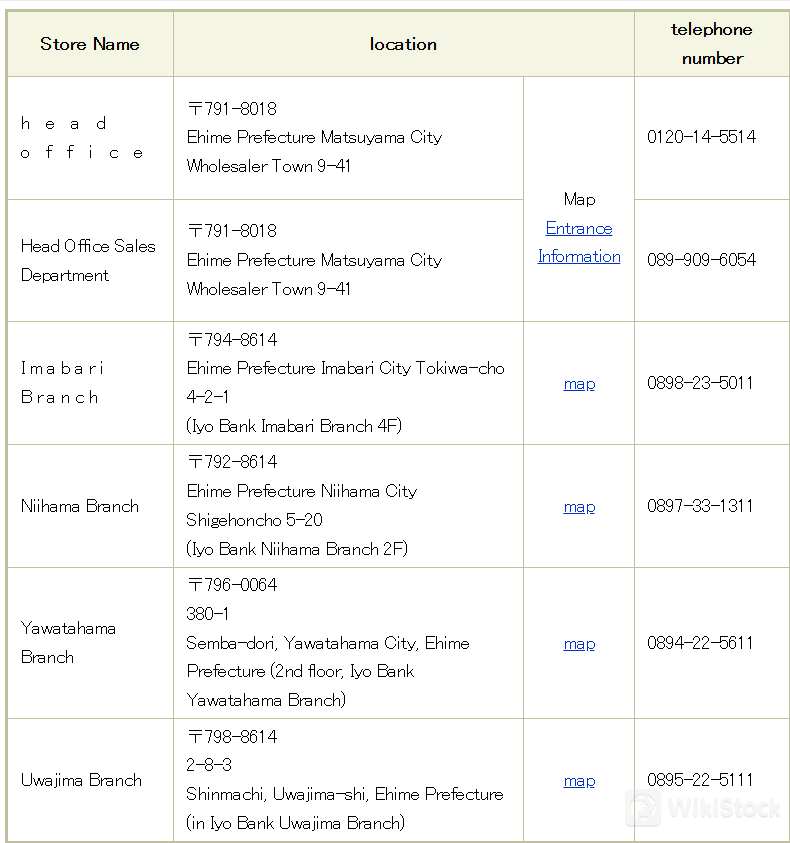

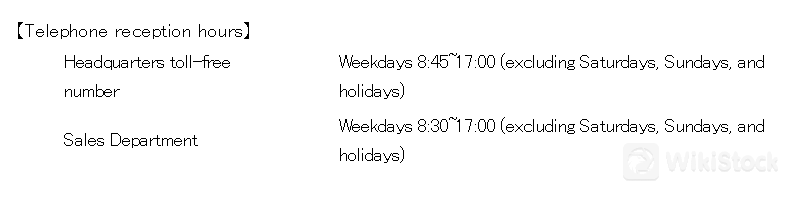

You can contact headquarters toll-free from 8:45 to 17:00 (excluding Saturdays, Sundays and holidays).

| Address | Phone | |

| Headquarters | 9-41 Momoyamachi, Matsuyama, Ehime Prefecture | 0120-14-5514 |

| Imabari Branch | 4-2-1 Tokiwa-cho, Imabari, Ehime Prefecture (4th Floor, Iyo Bank Imabari Branch) | 0898-23-5011 |

| Niihama Branch | 5-20 Hanamoto-cho, Niihama, Ehime Prefecture (2nd Floor, Iyo Bank Niihama Branch) | 0897-33-1311 |

| Yawatahama Branch | 380-1 Funatsudori, Yawatahama, Ehime Prefecture (2nd Floor, Iyo Bank Yawatahama Branch) | 0894-22-5611 |

| Uwajima Branch | 8-3 Shinmachi 2-chome, Uwajima, Ehime Prefecture (Inside Iyo Bank Uwajima Branch) | 0895-22-5111 |

Conclusion

Shikoku Alliance Securities is a regulated financial institution by the Japan Financial Services Agency, offering a range of investment options including stocks and bonds. Its focus on regulatory compliance and customer service makes it suitable for investors seeking a secure and compliant trading environment. The core highlights include a wide array of financial instruments and adherence to strict regulatory standards.

Frequently Asked Questions (FAQs)

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

5-10 years

Commission Rate

0.11%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

ワイエム証券

Score

ますも証券

Score

京銀証券

Score

武甲証券

Score

しんきん証券株式会社

Score

山二証券

Score

七十七証券

Score

島大証券

Score

とうほう証券

Score

UYS

Score