Win Wind Capital Limited (“Win Wind Capital”), through its subsidiaries, provides a full range of financial services, including money lending services, brokerage services for securities, bonds, funds and derivative products, corporate finance advisory and investment management services. The comprehensive and quality financial services delivered by Win Wind Capital have been widely recognized by the industry.

What is Win Wind?

Win Wind integrates advanced financial services with strategic market positioning to cater predominantly to High Net Worth individuals through its subsidiary Oshidori Securities. The company is celebrated for its secure trading environment and robust regulatory adherence, ensuring comprehensive protection for client investments. However, the lack of mutual funds and broader investment options may restrict its appeal to those seeking diversified investment portfolios.

Pros and Cons of Win Wind

Win Wind distinguishes itself with a strong regulatory foundation and strategic market access, appealing primarily to High Net Worth clients who require secure and direct entry into major Asian financial markets. The firm's commitment to strict regulatory compliance offers a high level of security, making it a trustworthy option for sophisticated investors. Moreover, the direct access to markets like Shanghai and Hong Kong through the Shanghai-Hong Kong Connect is a significant advantage for those looking to engage in these vibrant economies. However, the firm's offerings might be less attractive to a broader audience due to a limited range of investment products. Additionally, the lack of detailed information about their trading platforms could hinder those who prioritize technological tools and comprehensive platform features in their trading strategy. This deficiency in platform transparency, coupled with a narrow investment product lineup, might restrict Win Wind's appeal to new or diverse investors.

Is Win Wind safe?

Win Wind Securities Limited, as indicated by the regulatory information shown, is regulated by the China Hong Kong Securities and Futures Commission (SFC) under license number ACZ283. The regulation by SFC ensures that Win Wind adheres to strict financial and operational standards which enhance the safety and security of investments made through the firm.

What are securities to trade with Win Wind

Win Wind, through its subsidiary Oshidori Securities Limited, provides securities trading services primarily aimed at High Net Worth (HNW) clients.

Products Offered:

- Exchange Traded Funds (ETFs)

- Real Estate Investment Trusts (REITs)

- Shares listed on the Hong Kong Exchange and Shanghai Stock Exchange through the Shanghai-Hong Kong Connect

- Securities Dealing and Brokerage: Including cash and margin account services.

- Initial Public Offerings (IPOs): Subscription services for IPOs, along with detailed performance data.

Products Not Offered:

- Oshidori Securities does not specifically list trading in commodities, unlisted stocks, or mutual funds among its offerings.

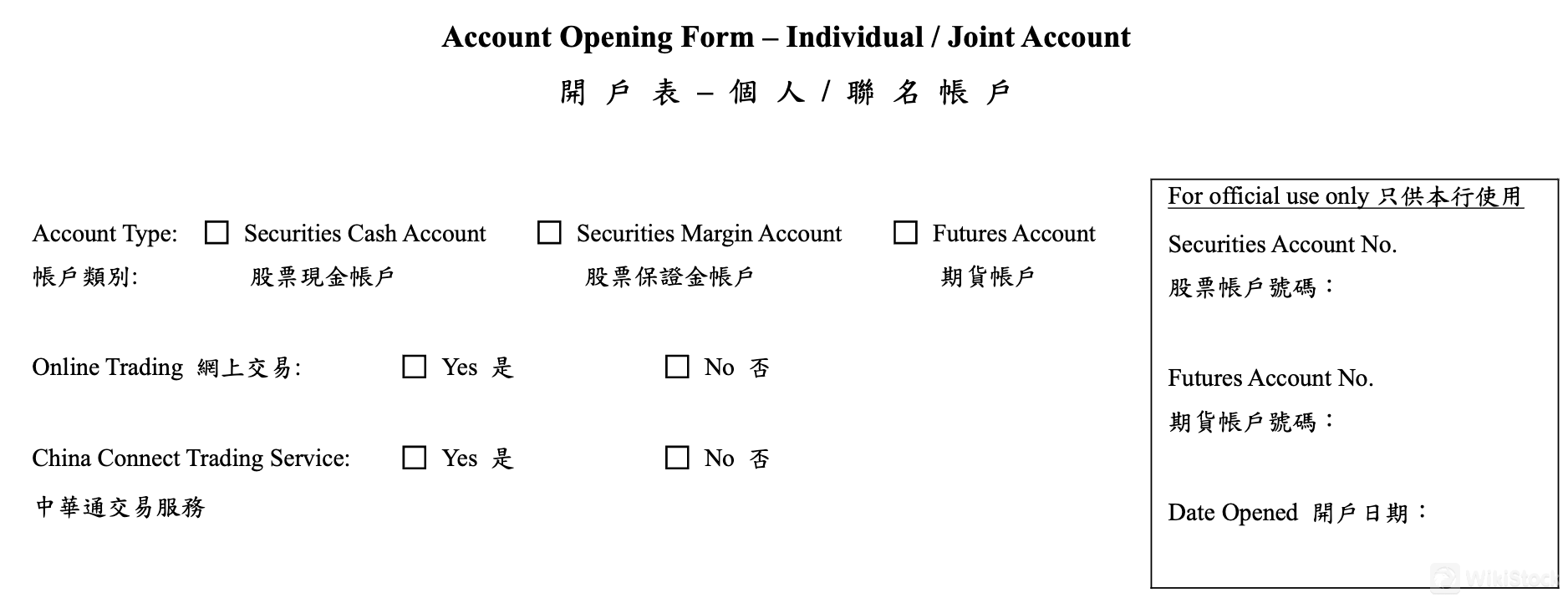

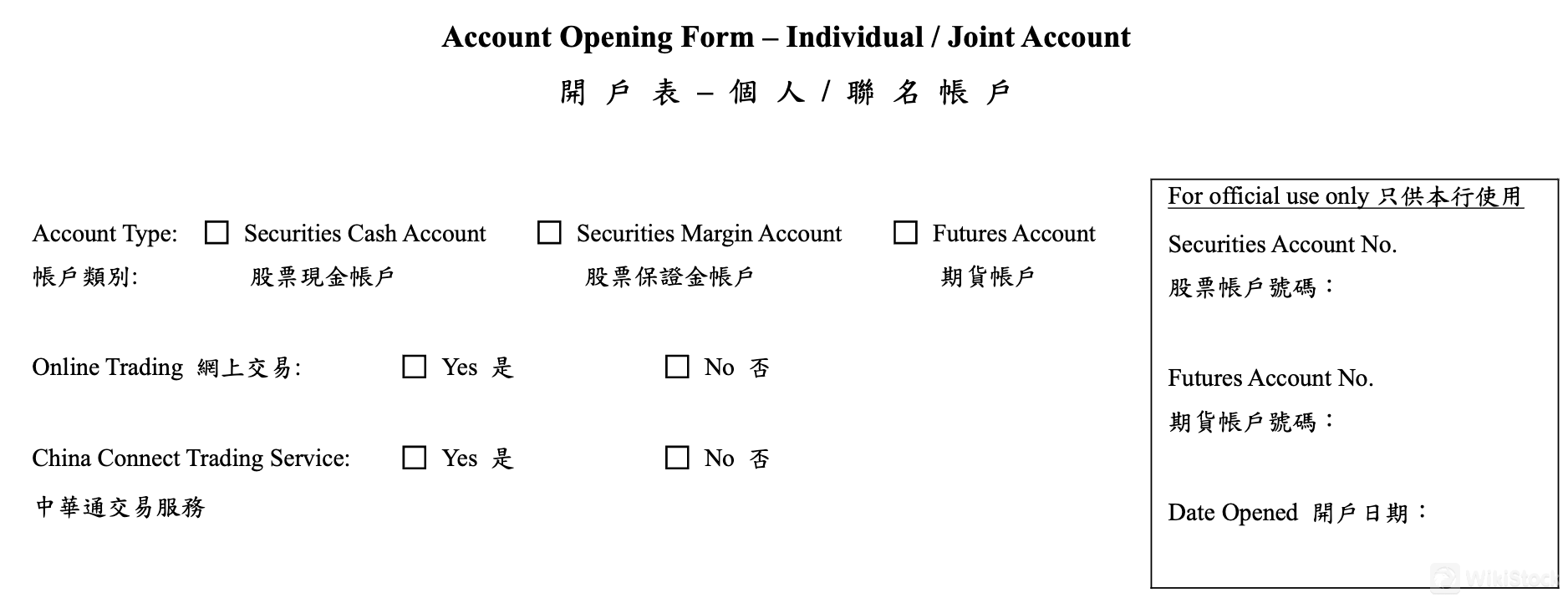

Win Wind Accounts

Win Wind offers several account types to accommodate different trading preferences and strategies:

1. Securities Cash Account: For trading securities using available funds without leverage.

2. Securities Margin Account: Allows trading on margin, providing the opportunity to leverage positions.

3. Futures Account: For trading in futures contracts across various markets.

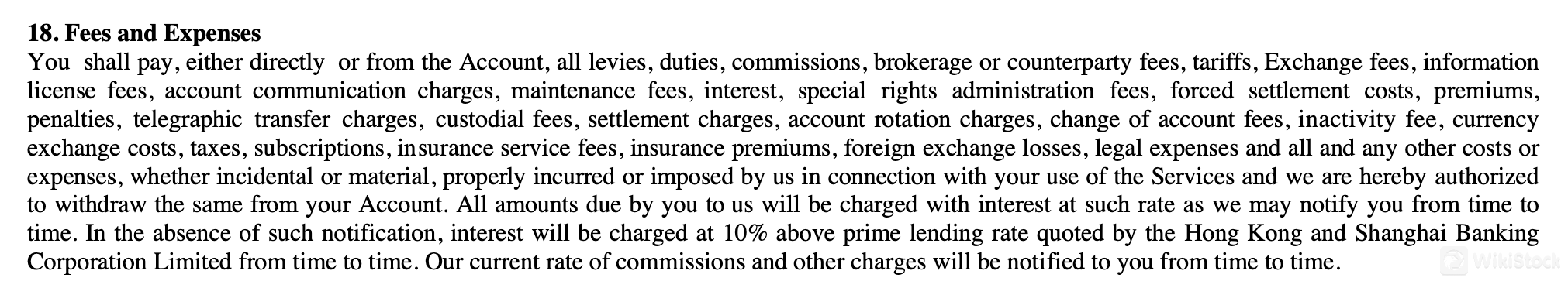

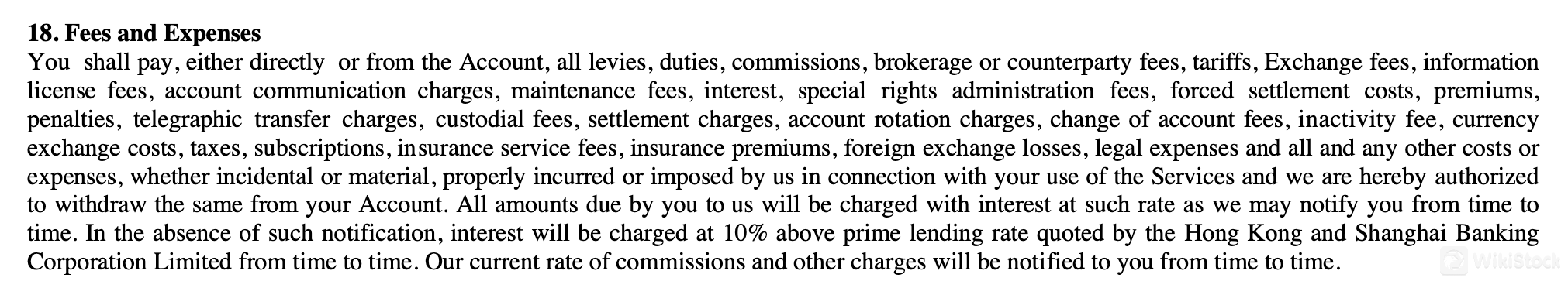

Win Wind Fees Review

Win Wind charges a comprehensive range of fees associated with the use of its services, which clients are required to pay either directly or through their accounts. These fees include:

- Trading Fees and Commissions: Variable rates for different transactions, updated periodically.

- Standard Operating Fees: Including levies, duties, brokerage or counterparty fees, tariffs, exchange fees, and license fees.

- Administrative Charges: Such as communication charges, maintenance fees, special rights administration fees, and forced settlement costs.

- Financial Charges: Interest on amounts due, penalties, telegraphic transfer charges, and custodial fees.

- Miscellaneous Fees: Including settlement charges, account rotation charges, change of account fees, inactivity fees, and currency exchange costs.

- Legal and Regulatory Costs: Taxes, subscriptions, insurance service fees, premiums, foreign exchange losses, and legal expenses.

- Connectivity Fees: Additional fees for trading via Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, like new portfolio fees and dividend tax.

Interest on overdue amounts is charged at a rate of 10% above the prime lending rate quoted by the Hong Kong and Shanghai Banking Corporation unless otherwise notified. This structure ensures transparency in the financial obligations clients undertake when using Win Winds services.

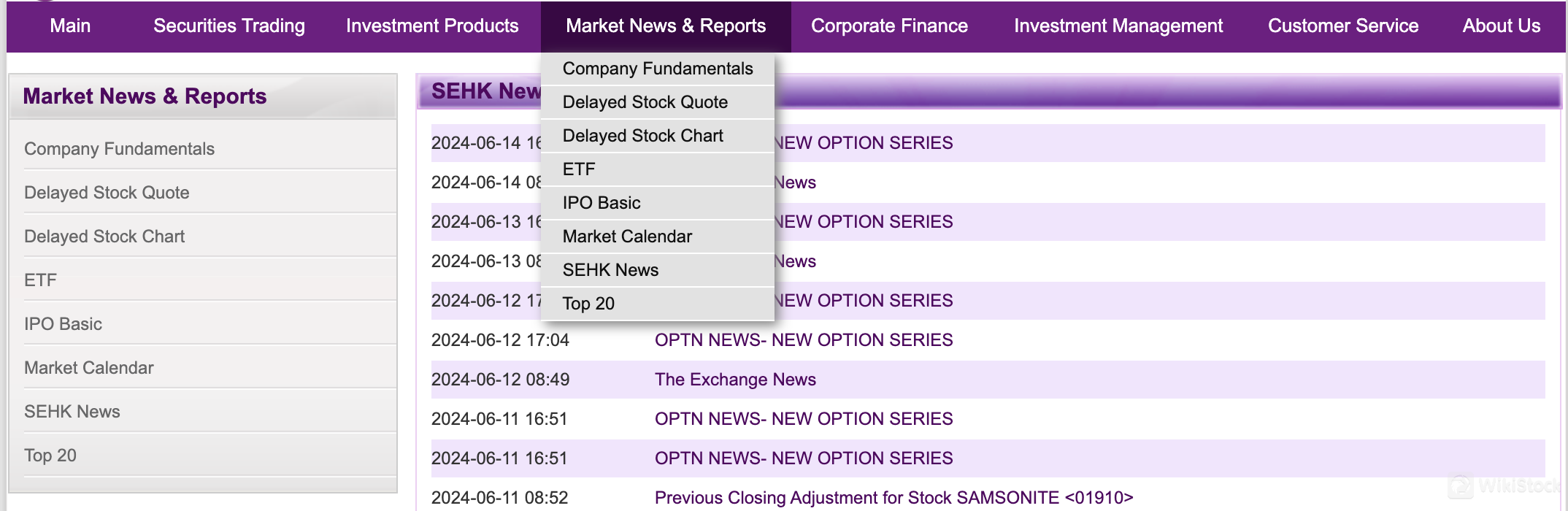

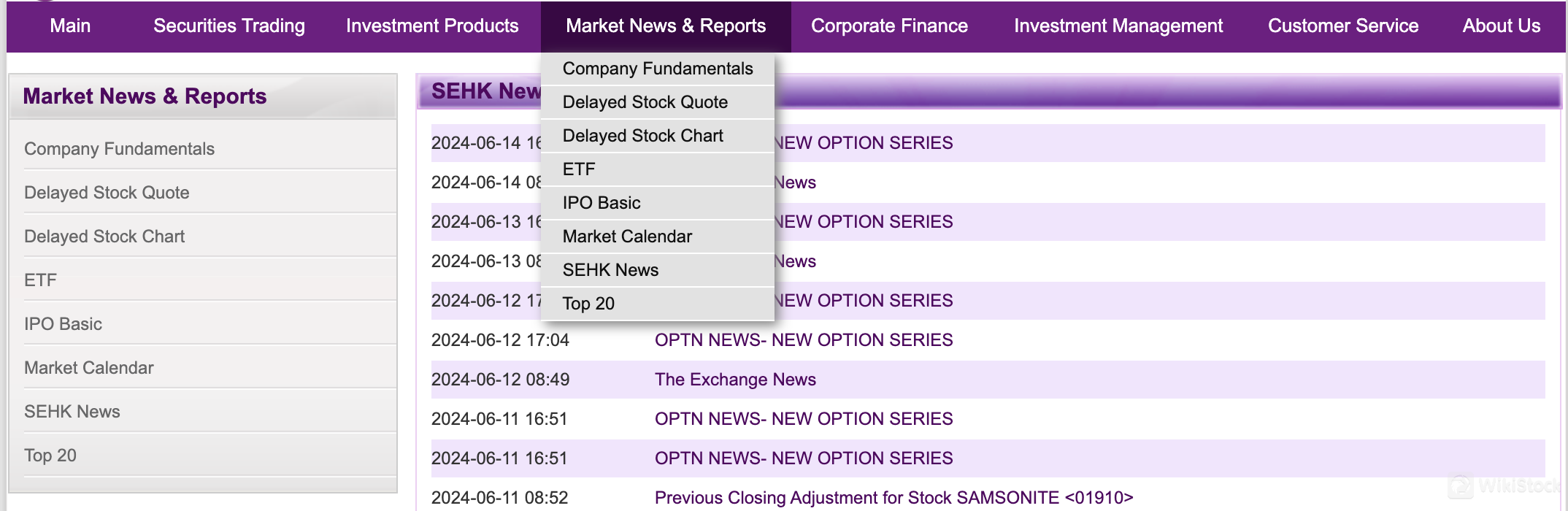

Research and Eduation

Win Wind provides a comprehensive set of research and educational resources tailored to both novice and experienced investors. These resources include:

- Company Fundamentals: Detailed insights into company financials and operational metrics.

- Delayed Stock Quote and Chart: Access to recent stock performance data with a slight delay, useful for trend analysis.

- ETF and IPO Basic: Information and basics on Exchange Traded Funds and Initial Public Offerings, helping users understand these investment vehicles.

- Market Calendar: Keeps investors informed about upcoming financial events and market schedules.

- SEHK News: Latest news from the Stock Exchange of Hong Kong, providing timely market updates.

- Top 20: Lists the top 20 performers in various categories, offering a snapshot of leading stocks.

Customer Service

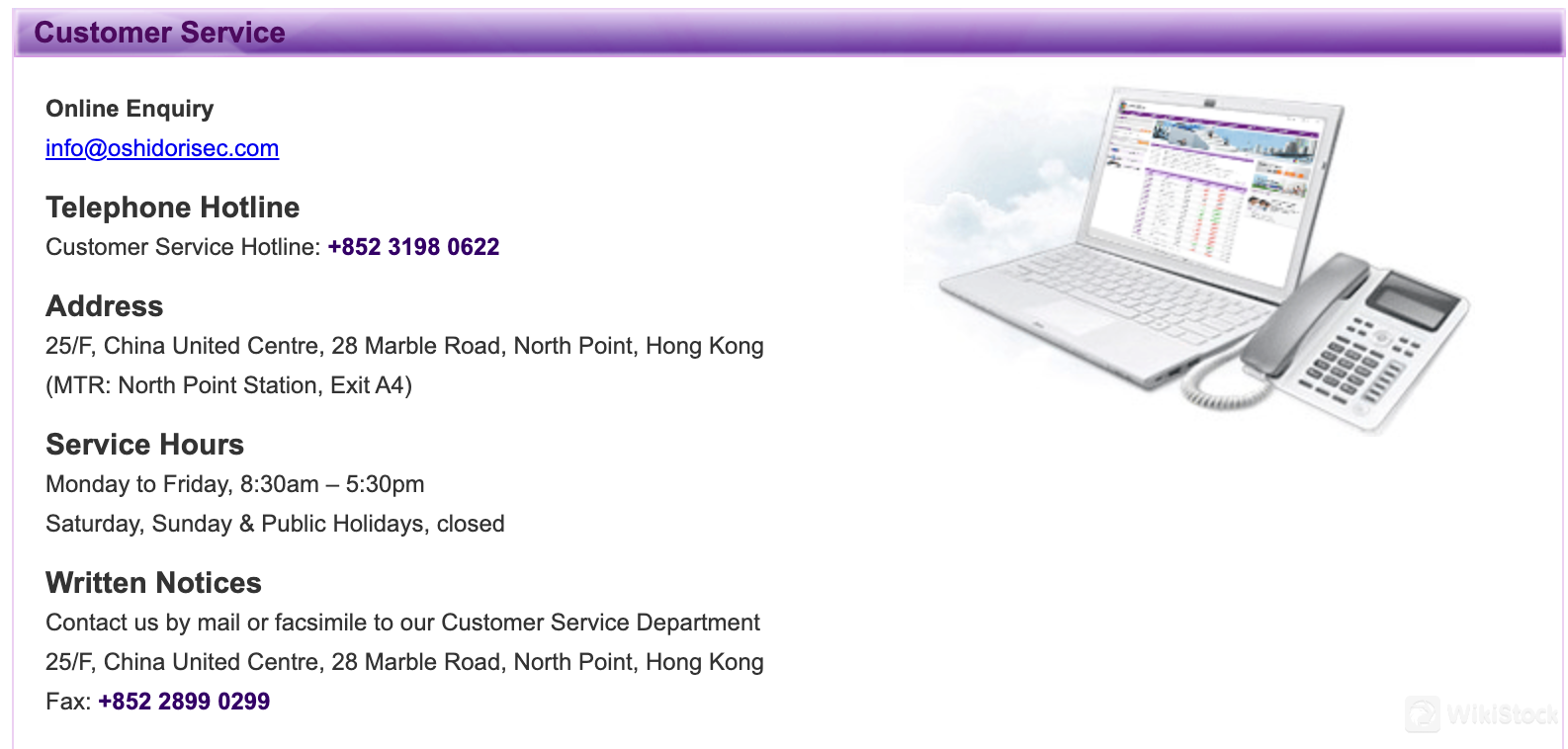

Win Wind offers robust customer service with several contact methods to cater to the needs of its clients:

- Online Enquiry: Clients can send queries via email to info@oshidorisec.com.

- Telephone Hotline: A customer service hotline is available at +852 3198 0622 for direct support.

- Physical Address: The customer service office is located at 25/F, China United Centre, 28 Marble Road, North Point, Hong Kong, accessible via MTR North Point Station, Exit A4.

- Service Hours: Open Monday to Friday from 8:30 am to 5:30 pm, and closed on Saturdays, Sundays, and public holidays.

- Written Notices: Clients can contact the customer service department by mail or facsimile at +852 2899 0299.

Conclusion

Win Wind effectively combines rigorous safety protocols with access to significant Asian markets, offering a secure and direct gateway for High Net Worth individuals into financial trading. The firm's strengths in security and market access are commendable; however, its limited investment product range and lack of detailed platform information might not fully meet the needs of investors seeking variety or technological sophistication in their trading activities.

FAQs

Is Win Wind safe to trade with?

Yes, Win Wind is regulated by the Hong Kong Securities and Futures Commission (SFC), ensuring high safety and compliance standards.

Is Win Wind a good platform for beginners?

Win Wind might be challenging for beginners due to its focus on High Net Worth individuals and limited educational resources.

Is Win Wind suitable for investing or retirement planning?

While Win Wind provides solid options for direct stock and ETF trading, the lack of mutual funds and broader investment products may limit its suitability for comprehensive retirement planning.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Canada

CanadaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--