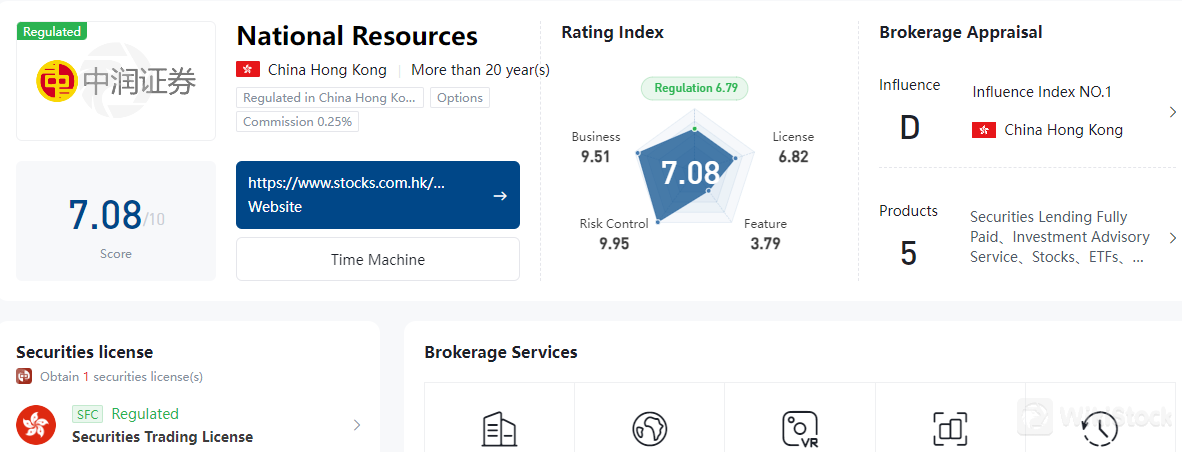

National Resources Securities Limited was established in 1988. We have three types of licenses. They are Dealing in Securities (Type 1), Advising on Securities (Type 4), and Asset Management (Type 9). Our company is an authorized financial institution under the Capital Investment Entrant Scheme.

What is National Resources?

National Resources Securities Limited offers low trading fees and a user-friendly mobile app that provides real-time trading and comprehensive market information. However, the company could improve by offering more detailed information on the insurance coverage for client funds.

Pros and Cons of National Resources

National Resources Securities Limited excels in providing a secure and comprehensive trading experience, with regulatory oversight from the SFC, a wide array of trading options, and advanced security measures. Their mobile app is particularly noteworthy, offering real-time trading, extensive research, and educational resources. However, the company could improve by providing specific details about insurance coverage for client funds and expanding their customer support options. Despite these areas for improvement, National Resources remains a strong choice for investors seeking a reliable and well-regulated trading platform.

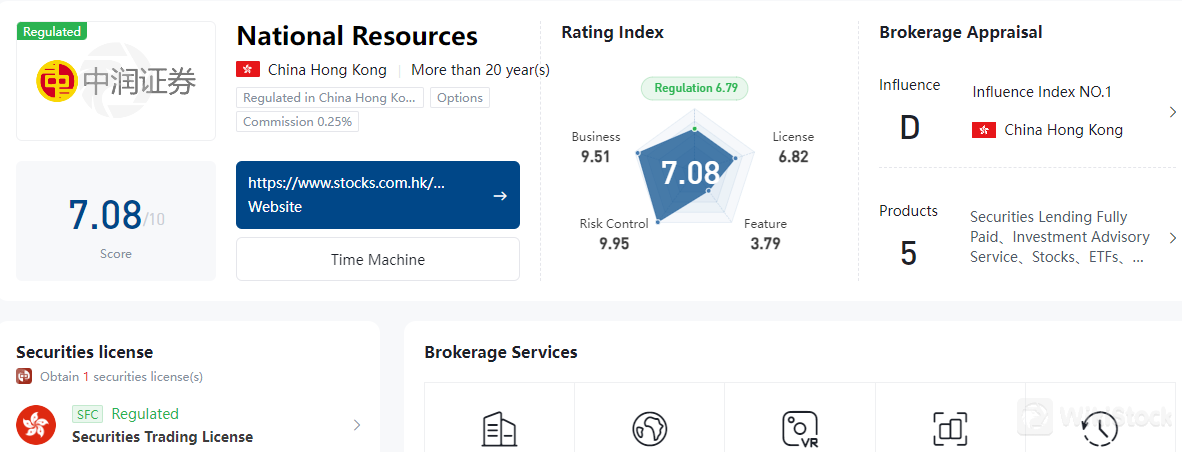

Is National Resources safe?

Regulation

National Resources Securities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong. This regulation ensures the company adheres to strict standards for market integrity and investor protection.

Safety Measures

National Resources Securities employs several security measures:

Encryption Technologies: They use advanced encryption to protect client data.

Two-Factor Authentication (2FA): The iToken app provides 2FA for added security.

Account Security: They implement secure login procedures and monitor for unusual account activities to prevent unauthorized access and data breaches.

What are securities to trade with National Resources?

National Resources offers a wide range of securities for trading, catering to diverse investment needs. Among the key instruments are stocks, which represent ownership in companies, allowing investors to benefit from corporate profits through dividends and potential capital gains.

Additionally, the company offers bonds, which are debt securities where investors lend money to entities (corporate or governmental) in exchange for regular interest payments and the return of the principal at maturity. These provide a more stable and predictable income compared to stocks.

For those seeking diversified investment options, National Resources facilitates trading in mutual funds and ETFs. Mutual funds pool money from various investors to invest in a diversified portfolio of assets, managed by professional fund managers. ETFs (Exchange-Traded Funds) are similar but trade on stock exchanges like individual stocks, offering the flexibility of intraday trading.

Moreover, investors can engage in trading derivatives, such as options and futures, which are financial contracts deriving their value from underlying assets. These instruments are used for hedging risks or speculative purposes, providing opportunities for significant returns, albeit with higher risk.

Overall, National Resources provides a comprehensive platform for trading a variety of securities, catering to both conservative and aggressive investment strategies.

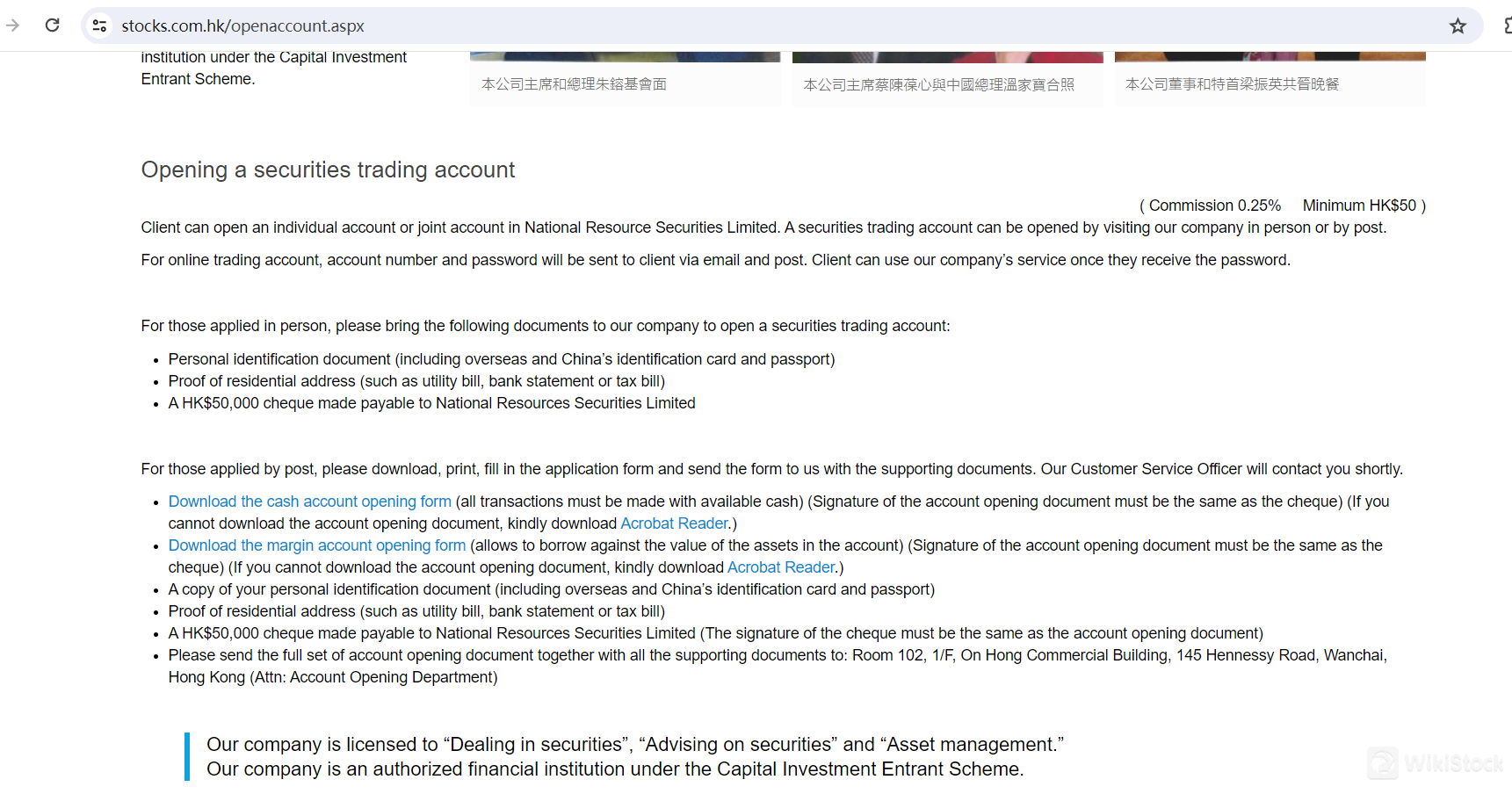

National Resources Accounts

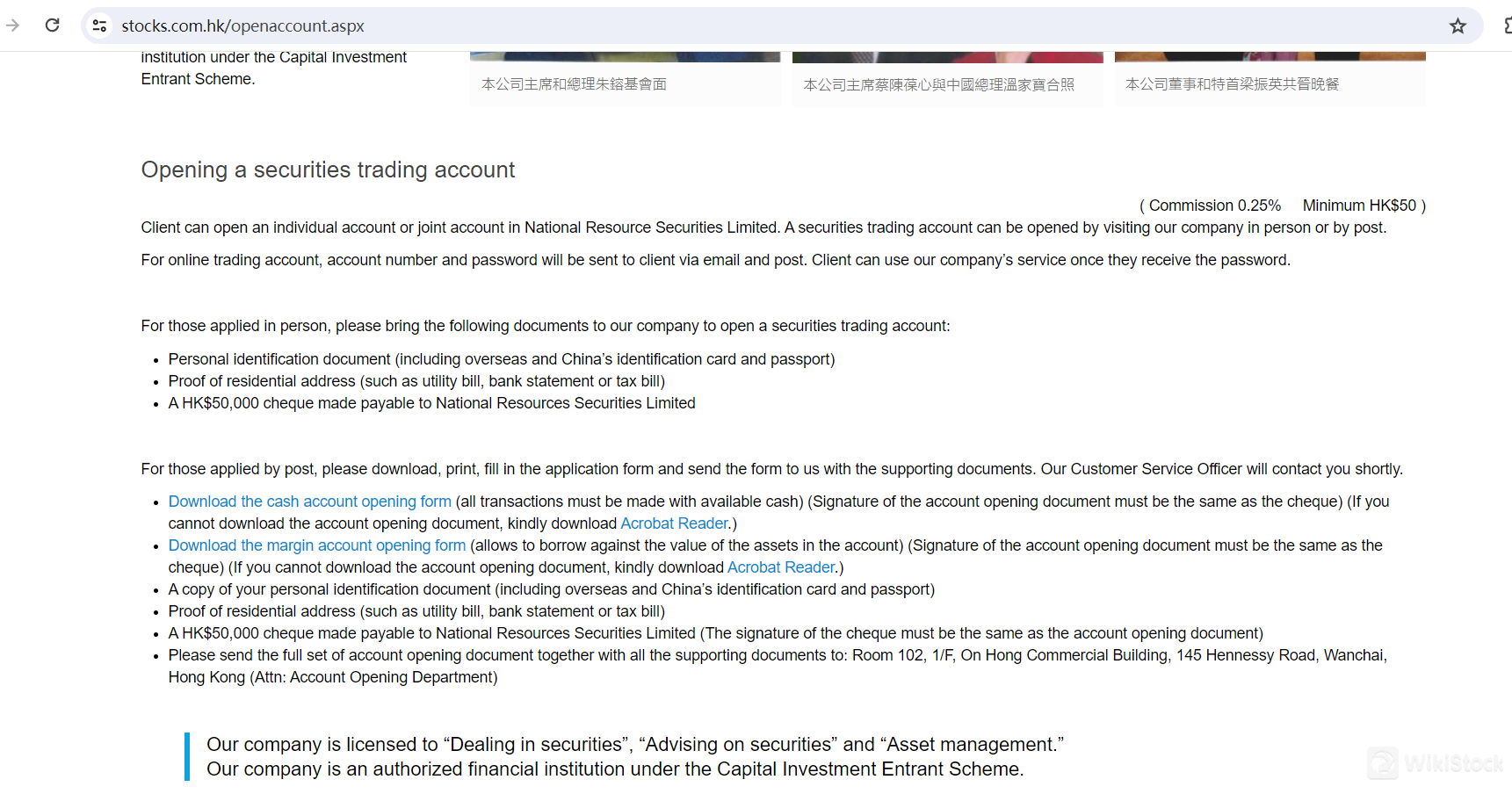

National Resources Securities Limited offers two types of trading accounts: individual and joint accounts. Clients can open these accounts in person or by post. For in-person applications, clients need to bring personal identification, proof of residential address, and a HK$50,000 cheque. For postal applications, clients must download and fill out the application form, then send it along with the required documents to the company.

For online trading, account numbers and passwords are sent via email and post, enabling clients to start trading once they receive the credentials. There are cash accounts, where transactions must be made with available cash, and margin accounts, allowing borrowing against the value of the assets in the account.

To open an account, clients need to provide personal identification, proof of residential address, and a HK$50,000 cheque payable to National Resources Securities Limited. The company is licensed to deal in securities, advise on securities, and manage assets, and is an authorized financial institution under the Capital Investment Entrant Scheme.

National Resources Fees Review

National Resources Securities Limited offers a detailed fee structure for their securities trading accounts. The primary trading commission is set at 0.25% per transaction, with a minimum charge of HK$50. This ensures that both high-volume traders and those with smaller trades can engage in the market efficiently.

National Resources App Review

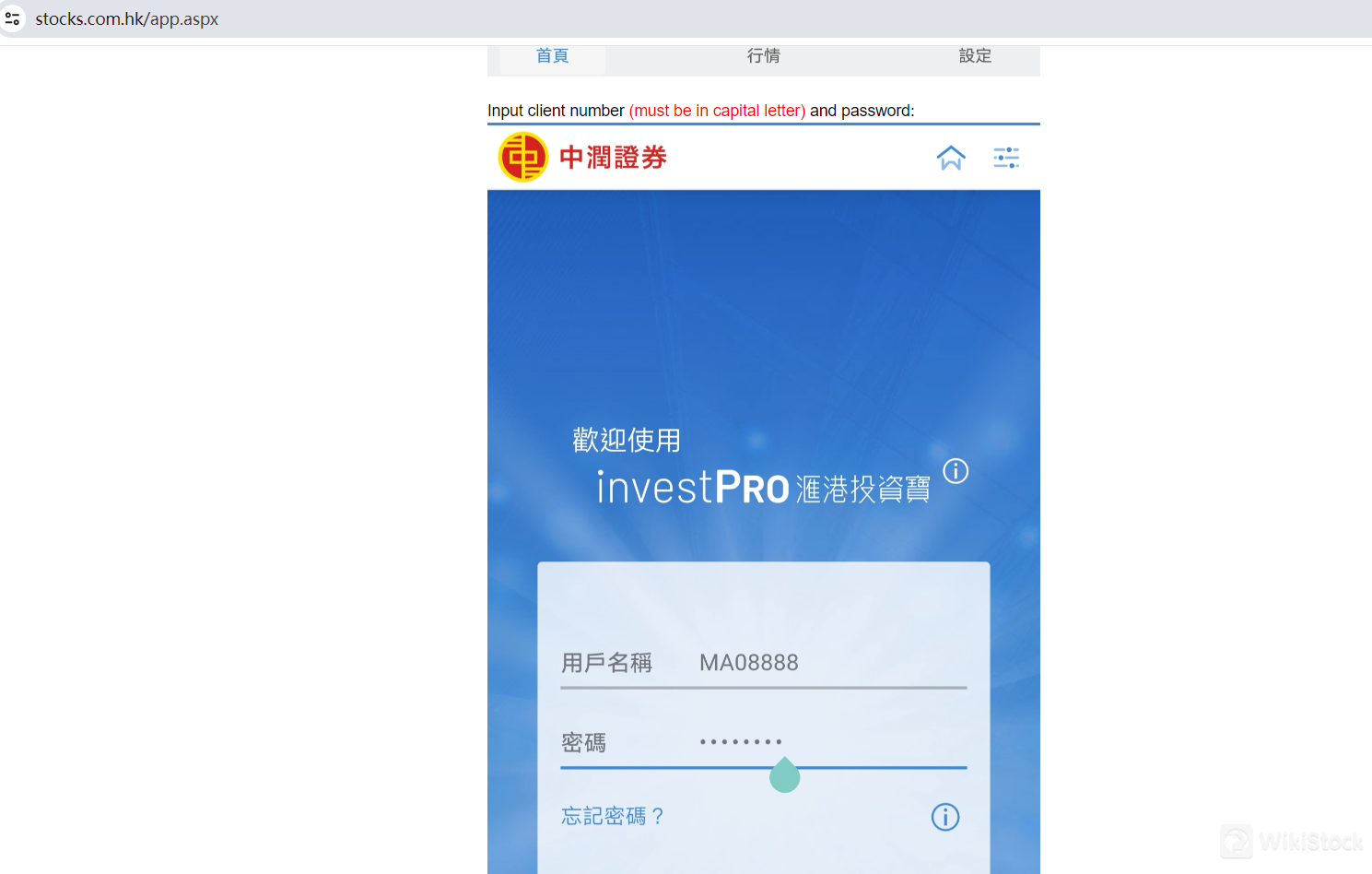

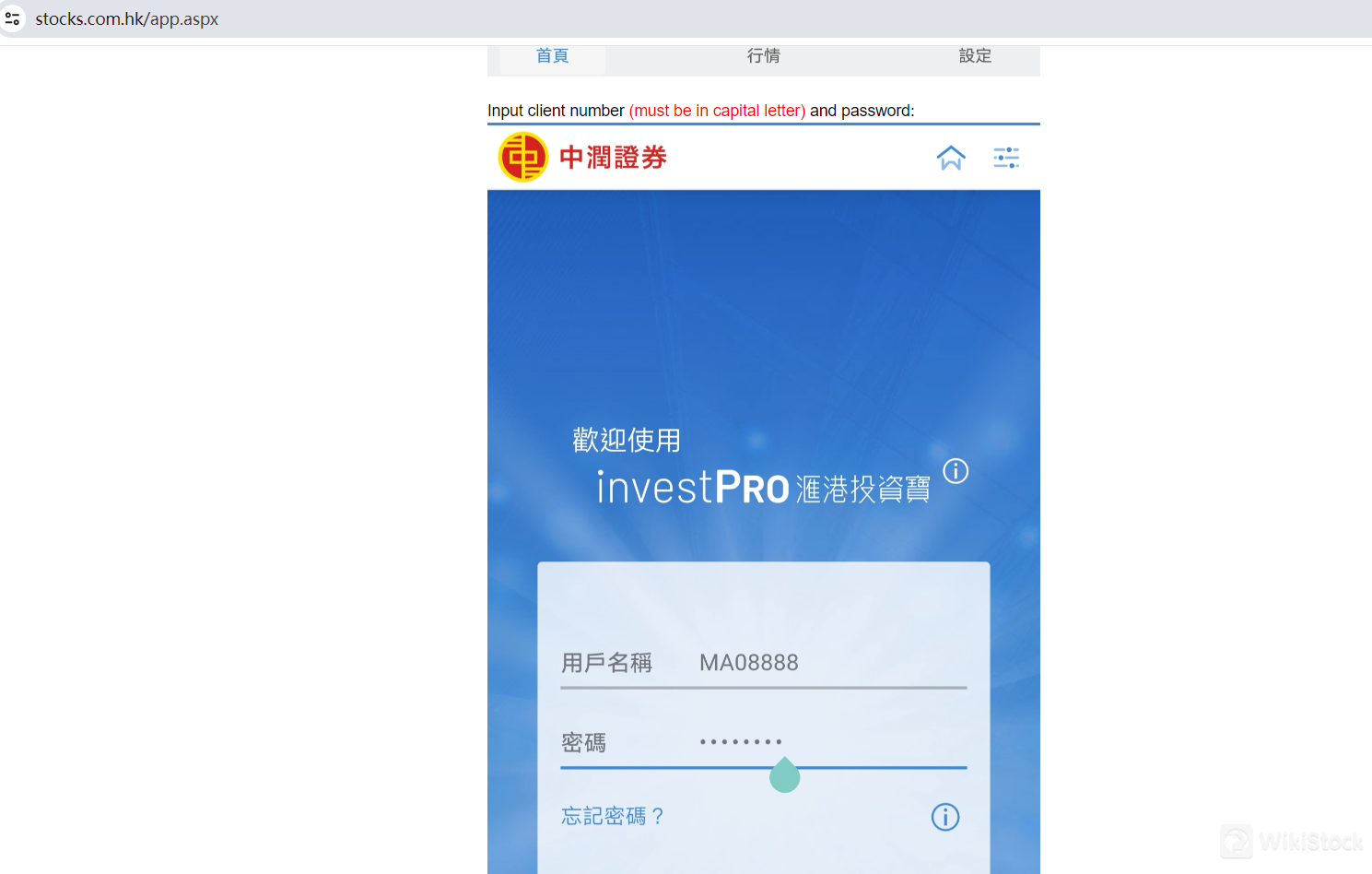

National Resources Securities has launched a comprehensive mobile app platform, integrating various securities trading and informational features. The app, available on both Android and iOS, allows users to engage in stock trading services with ease, providing real-time price quotes and enabling quick transactions. It includes features like real-time account status inquiries, stock streaming quote services, and a customizable stock monitor list. Additionally, users can access the National Resources Blog, top 20 stock rankings, and updates on Hong Kong and global market indices, enhancing their trading experience with timely information and insights.

To ensure secure and seamless access, the app supports 2-Factor Authentication through the National Resources iToken, which can be downloaded from the Google Play Store or App Store. This feature eliminates the need to wait for email or SMS passcodes, making the authentication process quicker and more stable. Users can also benefit from additional services such as forex quote services, stock analysis charts, and detailed updates from National Resources Securities. The app provides convenient access to the companys branch addresses and contact information, making it a one-stop platform for all securities trading needs.

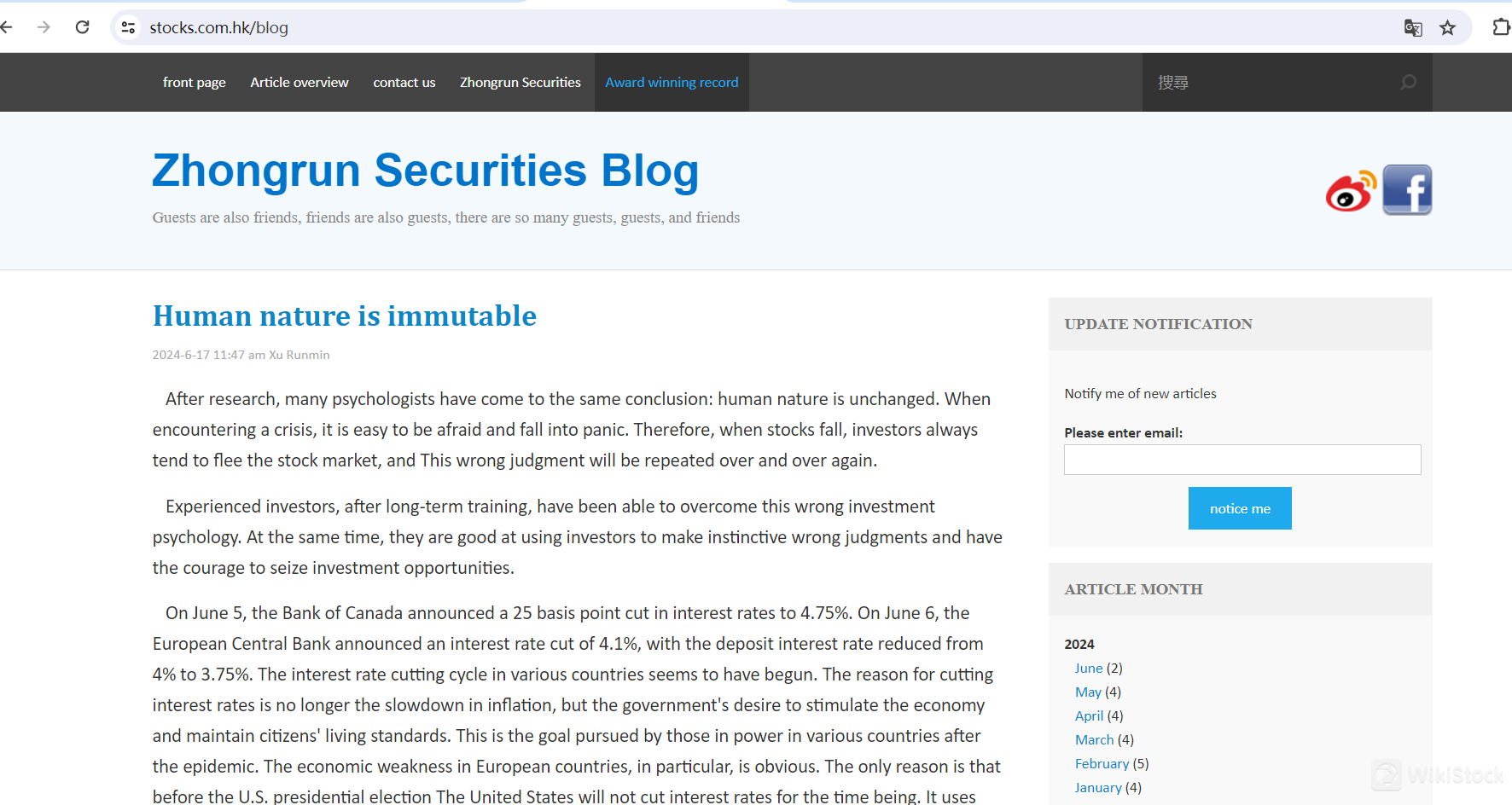

Research and Eduation

National Resources Securities' mobile app includes a robust research and education section within the blog area. This section features a wealth of articles aimed at educating investors and providing deep insights into market trends. The blog covers a variety of topics, from basic investment principles to advanced trading strategies, making it a valuable resource for both novice and experienced traders. By offering detailed analyses and market forecasts, the blog helps users make informed decisions and stay updated on the latest financial news and trends.

Additionally, the blog includes contributions from industry experts and analysts, providing professional perspectives on market movements and investment opportunities. Articles often delve into specific sectors, stock performances, and economic indicators, helping users understand the factors influencing the market. This educational content is designed to empower users with the knowledge and tools they need to navigate the complexities of the financial markets effectively. The integration of such comprehensive research and educational resources makes the National Resources Securities app a holistic platform for informed trading and continuous learning.

Customer Service

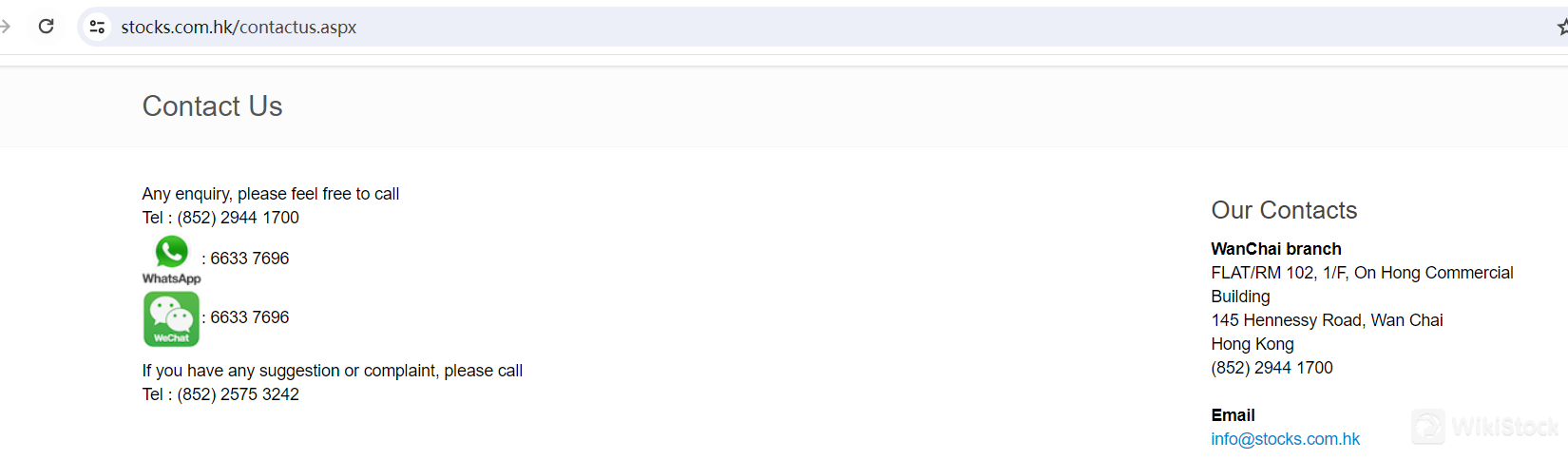

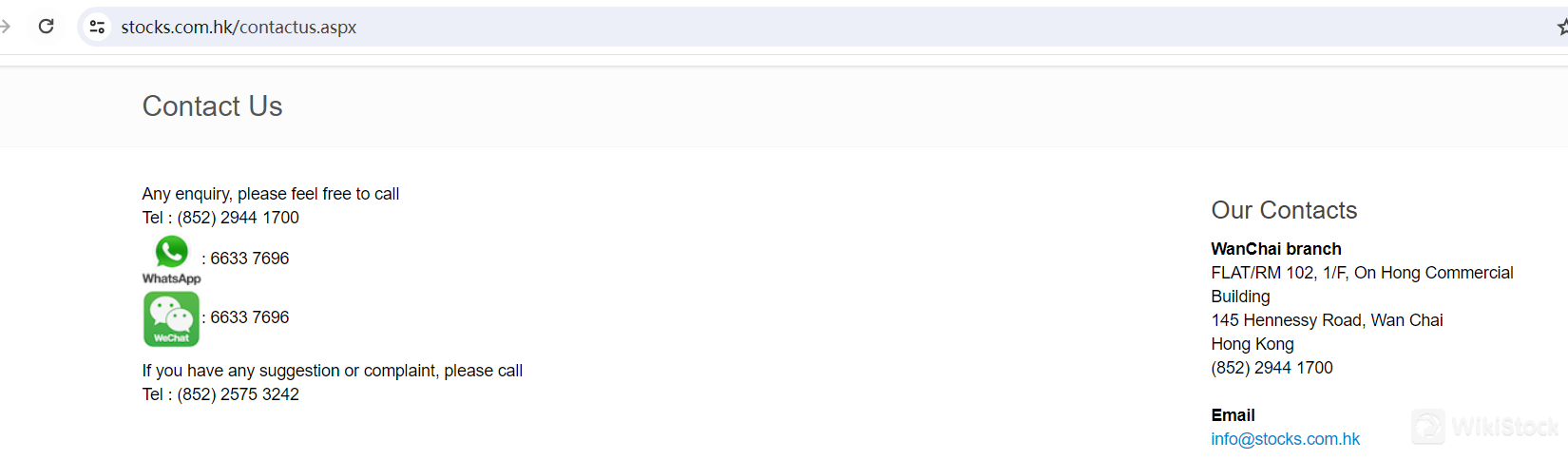

National Resources Securities Limited offers comprehensive customer support to address various enquiries and provide assistance to their clients. For general inquiries, clients can contact the support team via telephone at (852) 2944 1700, or through messaging services such as WhatsApp and WeChat at 6633 7696. This multi-channel support ensures that clients can reach out in their preferred manner for prompt assistance.

For suggestions or complaints, a dedicated line is available at (852) 2575 3242. This separate contact ensures that feedback and issues are handled efficiently and appropriately. Additionally, the WanChai branch of National Resources Securities is located at FLAT/RM 102, 1/F, On Hong Commercial Building, 145 Hennessy Road, Wan Chai, Hong Kong. Clients can visit the branch for in-person support or email their inquiries to info@stocks.com.hk. This multi-faceted support system demonstrates the company's commitment to providing accessible and responsive customer service.

Conclusion

National Resources Securities Limited is a reputable brokerage firm regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring high standards of integrity and investor protection. The company offers low trading fees, a user-friendly mobile app with real-time trading capabilities, and a diverse range of investment options including stocks, bonds, mutual funds, ETFs, and derivatives. While it excels in providing advanced security measures and a comprehensive trading platform, there is a lack of specific details regarding insurance coverage for client funds and certain interest rates. Overall, National Resources is a solid choice for investors seeking a reliable and well-regulated trading platform.

FAQs

Is National Resources Securities Limited safe to trade?

Yes, National Resources Securities Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which ensures that the company adheres to strict standards for market integrity and investor protection. They employ advanced security measures such as encryption technologies and two-factor authentication (2FA) to safeguard client data and funds.

Is National Resources Securities Limited a good platform for beginners?

Yes, National Resources Securities Limited offers a user-friendly mobile app with features like real-time trading, market information, and educational resources, making it accessible for beginners. The app also provides a comprehensive research and education section, helping new investors understand market trends and trading strategies.

Is National Resources Securities Limited legit?

Yes, National Resources Securities Limited is a legitimate brokerage firm, regulated by the SFC. The regulation by such a reputable authority ensures that the company operates under stringent guidelines to protect investors and maintain market integrity.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Indonesia

IndonesiaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)