Score

粤兴证券

http://www.yuexingsecurities.com.hk

Website

Rating Index

Brokerage Appraisal

Products

1

Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Brokerage Information

More

Company Name

粤兴证券有限公司

Abbreviation

粤兴证券

Platform registered country and region

Company address

Company website

http://www.yuexingsecurities.com.hkCheck whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| YueXing Securities |  |

| WikiStocks Rating | ⭐⭐ |

| Fees | Commissions:0.25% per trade |

| Interests on uninvested cash | 2.18% |

| Mutual Funds Offered | Yes |

| Platform/APP | YueXing Securities Onling Trading Platform |

| Promotion | N/A |

YueXing Securities Information

YueXing Securities is a financial services provider known for its competitive fee structure, charging a commission of 0.25% per trade.

The company offers a user-friendly online trading platform, appealing to both novice and experienced investors. On the downside, it does not currently offer any promotional incentives.

Pros & Cons

| Pros | Cons |

| Convenient and fast account opening | Limited Tradable Securities(Stocks Only) |

| Regulated by SFC | Limited Customer Ways(Phone Only) |

| Unique Online Trading Platform(YueXing Securities Online Trading Platform) | |

| Low Commissions(0.25%) |

Pros:

YueXing Securities offers a swift account opening process and is regulated by the SFC, adding a layer of trust. The platform's unique YueXing Securities Online Trading Platform and low commissions of 0.25% per trade make it economically appealing for traders focusing on stocks.

Cons:

The platform is limited to stock trading and lacks diverse account options, which could deter investors seeking variety. Customer support is restricted to phone only, potentially limiting assistance for complex issues.

Is YueXing Securities Safe?

Regulations:

YueXing Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong. SFC operates independently from the Hong Kong government and is primarily funded by transaction levies and licensing fees.

YueXing Securities holds a valid license (License No. ABN094) under the SFC, which helps ensure it adheres to strict regulatory standards and practices.

Funds Safety:

YueXing Securities operates under strict regulations mandated by the Securities and Futures Commission (SFC) of Hong KonG. The regulatory framework set by the SFC typically requires the segregation of client funds from company funds. This separation helps ensure that client assets are protected and can be returned to clients in the event of the company's insolvency or financial misconduct.

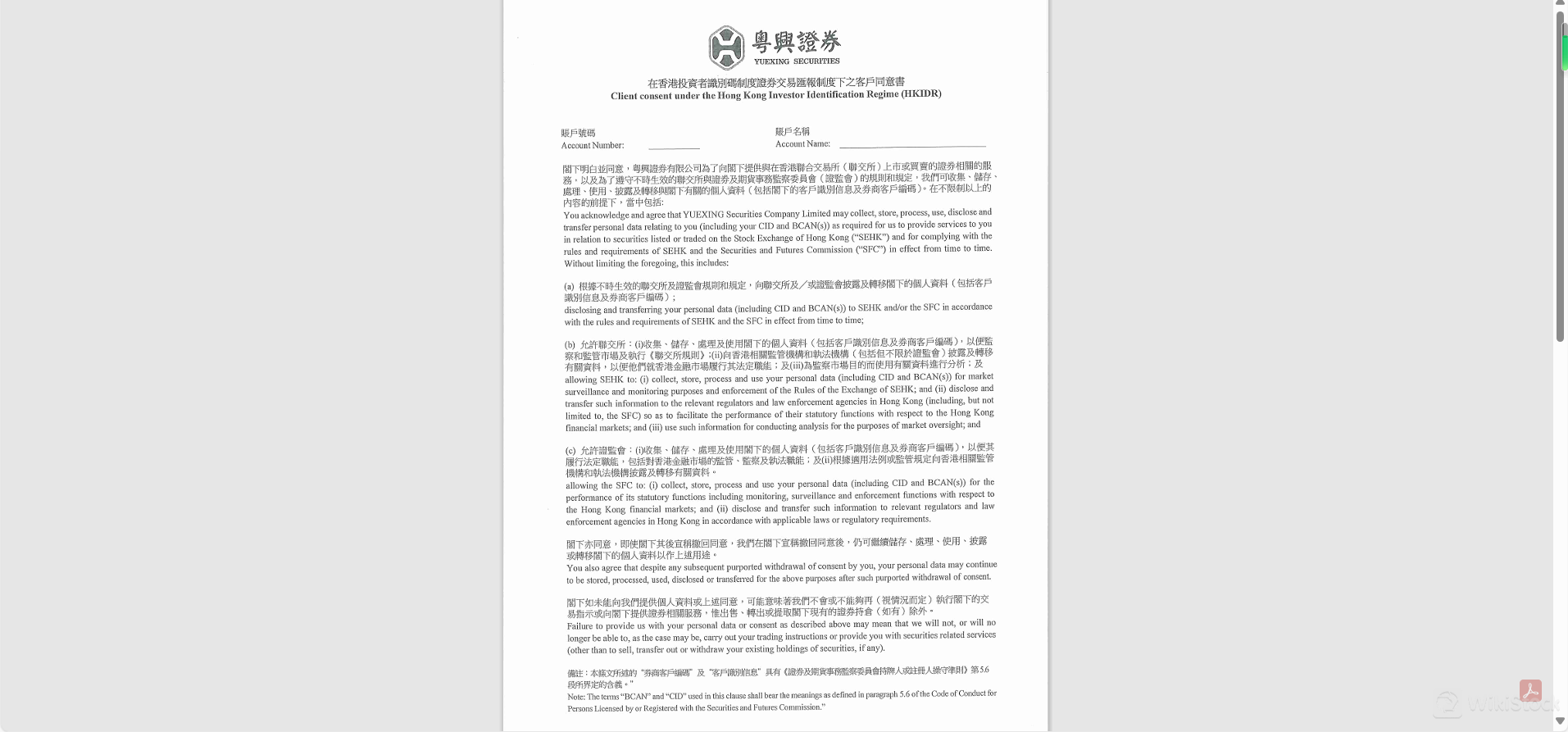

Additionally, the adherence to the Hong Kong Investor Identification Regime and the Securities Trading Reporting Regime further supports the integrity and security of transactions, indirectly contributing to the overall safety of client funds.

Safety Measures:

YueXing Securities employs various safety measures to protect client information and funds. The broker is part of the Hong Kong Investor Identification Regime and the Securities Trading Reporting Regime, indicating robust protocols for client data handling and transparency in trading activities.

This includes the collection, storage, processing, and possible disclosure of personal data to regulatory bodies in compliance with market surveillance and legal requirements.

What are securities to trade with YueXing Securities?

YueXing Securities provides trading services for several types of securities:

Hong Kong Listed Stocks: As a Type 1 licensee, YueXing Securities facilitates trading in securities listed on the Hong Kong Stock Exchange, meeting primarily to high net worth clients and enterprises in the Greater Bay Area.

Senior Unsecured Bonds: These are bonds that are not backed by collateral. Issued primarily by corporations, they carry a higher risk compared to secured bonds, but also potentially offer higher yields.

Standby Letter of Credit Enhanced Bonds: These bonds are improved by a standby letter of credit which provides additional assurance on the bond's payment, increasing its creditworthiness and appeal to investors.

Hybrid Capital Instruments: These instruments combine features of both debt and equity, offering flexibility in capital structure and often used by companies to strengthen their balance sheets without diluting shareholders.

Secured Structured Notes: Structured notes backed by collateral that provide the holder with a return based on the performance of one or more underlying assets.

Profit-Linked Notes: These are debt securities whose returns are linked to the profitability of the issuing company, aligning the interests of investors with the financial success of the issuer.

Commission Fee: 0.25% (2.5‰) of the trade value.

Stamp Duty: 0.1% (1‰) on each transaction.

Transfer Fee: 0.03% (0.3‰) applied to the transfer of securities.

Account Opening Fee: Free of charge.

Platform Fee: Free of charge.

Settlement Fee: 0.005% (0.05‰) of the transaction value.

Trading Fee: 0.005% (0.05‰) of the transaction value.

Transaction Levy: This fee is not specified in the numbers provided but is typically a small percentage charged to cover regulatory costs.

YueXing Securities Fee Review

YueXing Securities' fee structure includes various charges related to trading activities:

| Fee Type | Percentage | Description |

| Commission Fee | 0.25% | Charged on the trade value |

| Stamp Duty | 0.10% | Applied to each transaction |

| Transfer Fee | 0.03% | Applied to the transfer of securities |

| Account Opening Fee | Free | No charge for opening an account |

| Platform Fee | Free | No charge for using the trading platform |

| Settlement Fee | 0.01% | Charged on the transaction value |

| Trading Fee | 0.01% | Charged on the transaction value |

| Transaction Levy | Unspecified | Typically a small percentage to cover regulatory costs |

YueXing Securities Trading Platform Review

YueXing Securities offers its clients a unique and proprietary trading platform known as the “YueXing Securities Online Trading Platform.”

This platform is designed to attract both novice and experienced traders, providing a range of tools and features that enhance trading efficiency and user experience.

The platform likely includes real-time market data, analytical tools, and customizable interfaces to facilitate trading in various securities, including stocks and debt instruments.

Customer Service

YueXing Securities offers customer support from their headquarters located on the 3rd Floor of the Jiangning Building, 100 Suhang Street, Sheung Wan.

Clients can reach out to their support team via telephone at (852) 2586 1011 for immediate assistance or inquiries.

Additionally, they provide a fax line at (852) 2586 1221 for document submissions and other communications, ensuring multiple channels are available for client support.

Conclusion

YueXing Securities, established in 1993 and formerly known as Baili Securities, is a well-regulated brokerage firm operating under the Hong Kong Securities and Futures Commission.

Offering a diverse range of trading services, including stocks and various debt instruments, YueXing Securities focuses on serving high net-worth individuals and enterprises in the Greater Bay Area.

With its proprietary online trading platform, competitive fees, and straightforward customer support accessible via phone and fax, the firm stands as a reliable choice for investors seeking trading solutions in Hong Kong.

FAQs

1. What types of securities can I trade with YueXing Securities?

You can trade Hong Kong listed stocks and a variety of debt instruments such as senior unsecured bonds, standby letter of credit enhanced bonds, and other structured products through YueXing Securities.

2. How can I contact customer support at YueXing Securities?

Customer support can be reached by telephone at (852) 2586 1011 or via fax at (852) 2586 1221.

3. What are the fees associated with trading through YueXing Securities?

YueXing Securities charges a commission fee of 0.25% on trades, along with other fees such as stamp duty at 0.1% and a transfer fee of 0.03%.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

More than 20 year(s)

Regulated Countries

1

Products

Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

Canfield Securities

Score

Sino Wealth Securities

Score

China Enterprise

Score

YMETA

Score

Ruibang Securities

Score

Safari Asia

Score

華信證券

Score

Lego Securities

Score

大田證券

Score

JQ Securities

Score