Lego Securities Limited (“Lego Securities”) – the securities dealing arm of Lego Group which has obtained the licence granted by the Securities and Futures Commission to carry out type 1 (dealing in securities) regulated activity in January 2017 and is an Exchange Participant of The Stock Exchange of Hong Kong Limited since March 2017. Save for securities brokerage business, Lego Securities also engages in underwriting and placement of securities and acts as bookrunner or lead manager for initial public offerings.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is Lego Securities?

Lego Securities is a prominent financial services provider specializing in securities brokerage, underwriting, and placement of securities. Regulated by the Securities and Futures Commission (SFC), the company offers a comprehensive range of investment services, including the facilitation of trading across diverse financial instruments, managing initial public offerings (IPOs) as a bookrunner or lead manager, and providing tailored solutions for both individual and corporate clients.

Pros & Cons

Pros Regulated by SFC: Lego Securities is regulated by the Securities and Futures Commission (SFC), ensuring compliance with stringent standards for investor protection and market integrity.

Wide Range of Services: Offers comprehensive services including brokerage, underwriting, IPO management, and various account types.

Transparent Fee Structure: Maintains a competitive fee structure for trading Hong Kong Shares, providing clarity on costs with detailed breakdowns of commissions and charges.

Security and Compliance: Enhances online security with the AyersToken App for 2FA, ensuring compliance with SFC requirements and safeguarding client accounts.

Professional Customer Support: Provides accessible customer service through multiple channels, including email, phone, fax, and contact form.

Cons No Promotions Available: The absence of promotions or incentives for new clients can make the brokerage less attractive compared to competitors who offer bonuses or reduced fees as part of promotional campaigns.

Is Lego Securities Safe?

Regulation

Lego Securities is regulated by the oversight of the oversight of the Securities and Futures Commission (SFC), holding license No. BIE918. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market.

Safety Measures

Lego Securities prioritizes robust cybersecurity measures by implementing Two-factor Authentication (2FA) within its online trading system. This proactive approach is aimed at safeguarding the integrity and confidentiality of client accounts and transactions.

What are Securities to Trade with Lego Securities?

Lego Securities offers a comprehensive suite of services tailored to meet the diverse needs of its clients in the financial market. As a premier securities brokerage, Lego Securities facilitates seamless trading of a wide range of financial instruments. Additionally, the firm is actively involved in the underwriting and placement of securities.

Lego Securities also excels in handling initial public offerings (IPOs), often serving as the bookrunner or lead manager, guiding companies through the complex process of going public.

Lego Securities Accounts

Lego Securities offers a range of account options to cater to different financial needs, including individual/joint accounts and corporate accounts.

Individual/joint accounts are designed for personal investment purposes, allowing single investors or multiple parties to manage and grow their portfolios collaboratively. Corporate accounts, on the other hand, are tailored for businesses seeking to manage their financial assets and investment strategies effectively.

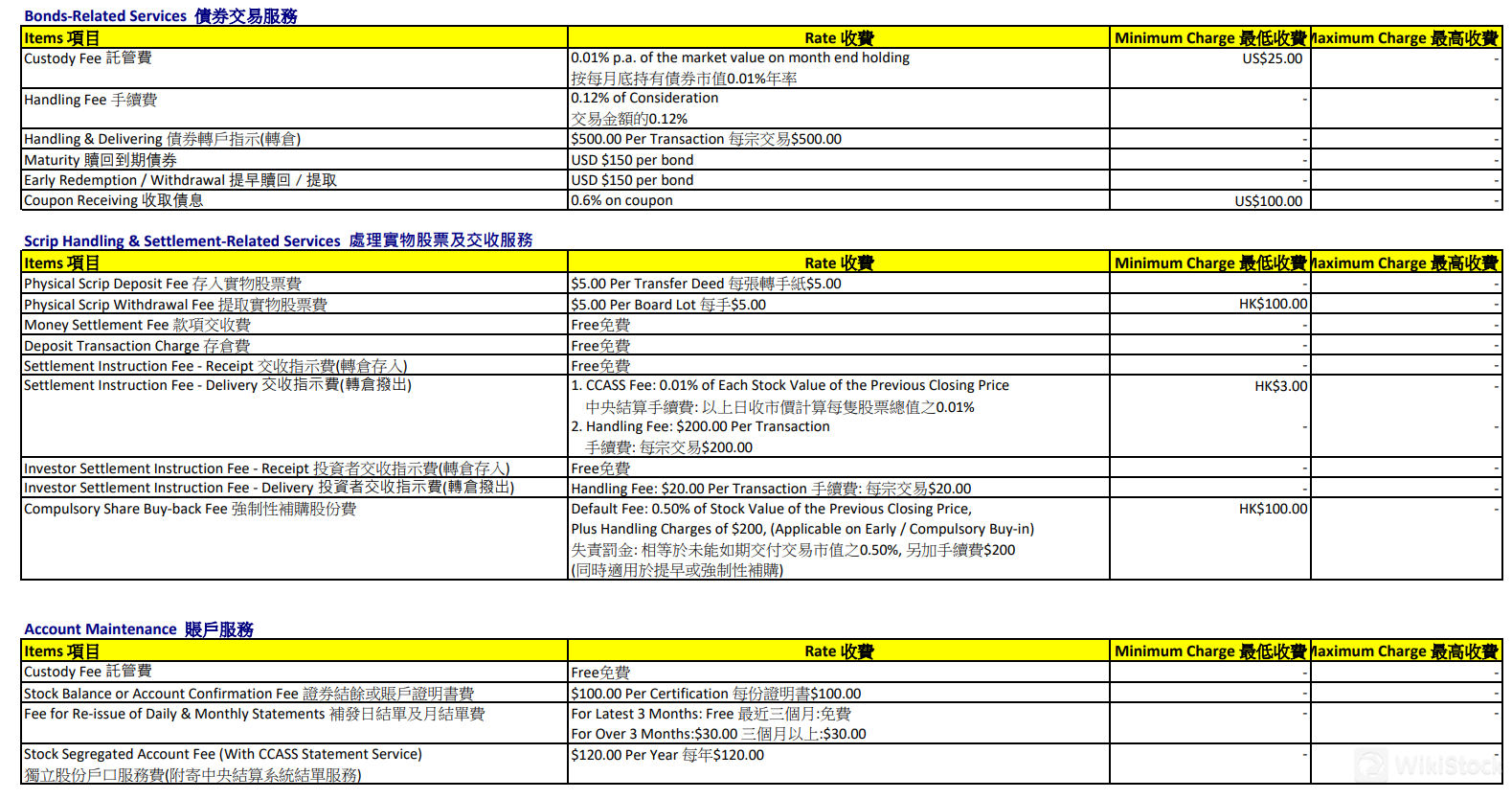

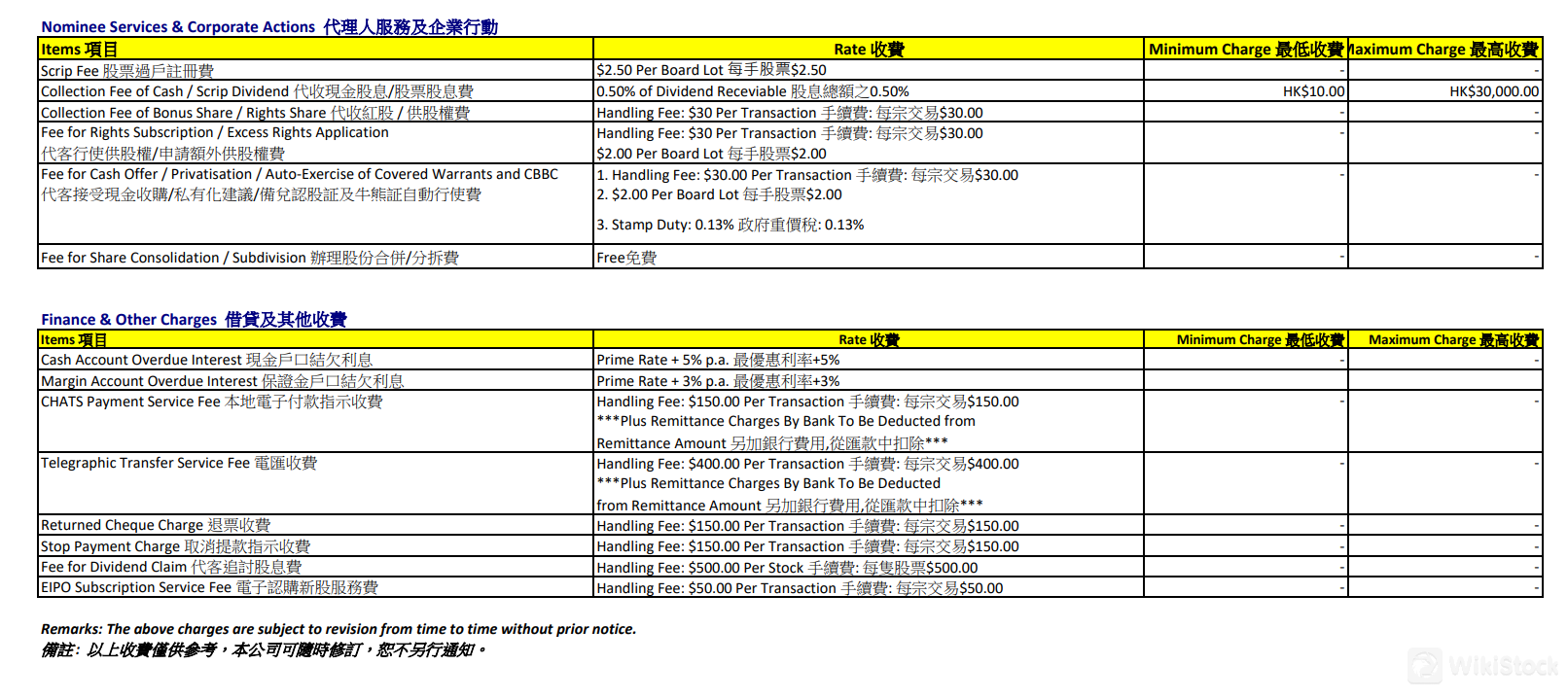

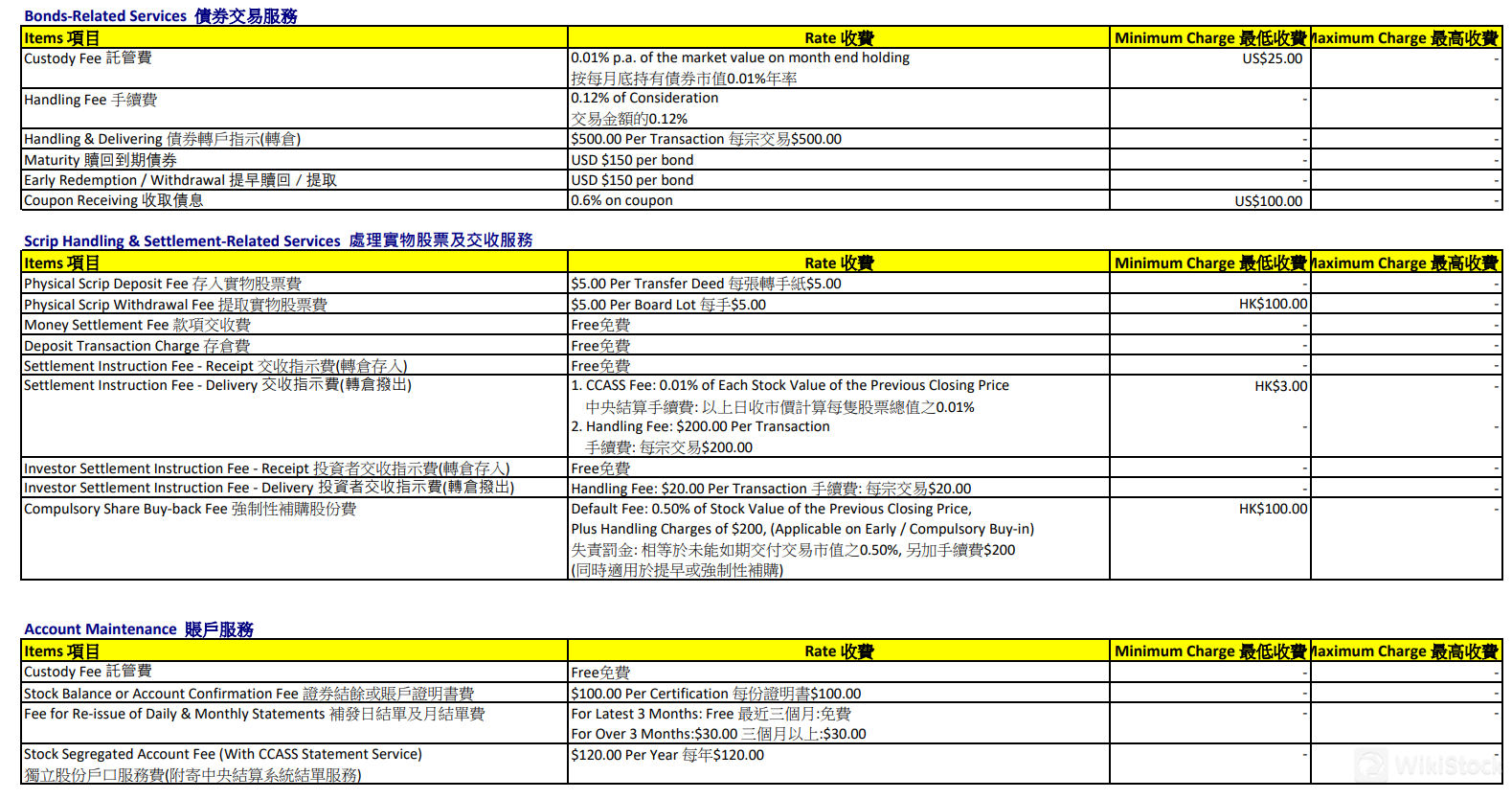

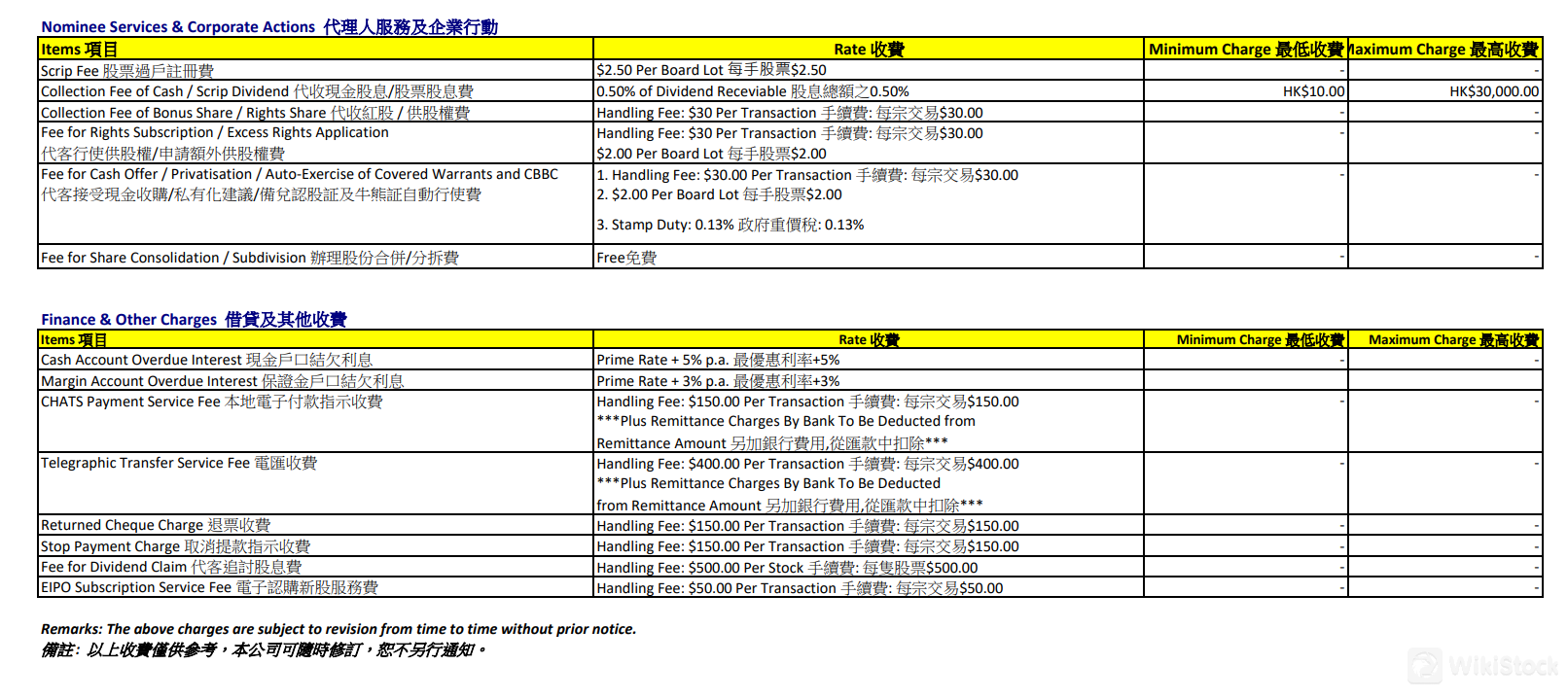

Lego Securities Fees Review

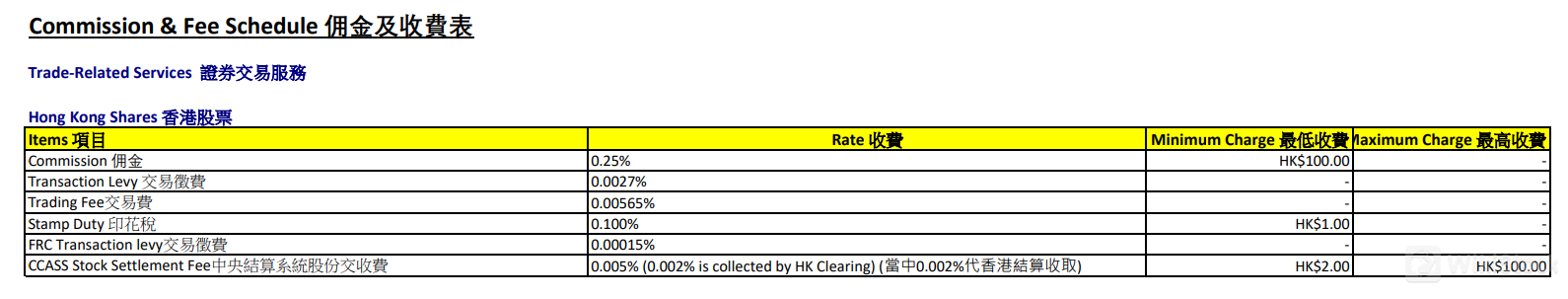

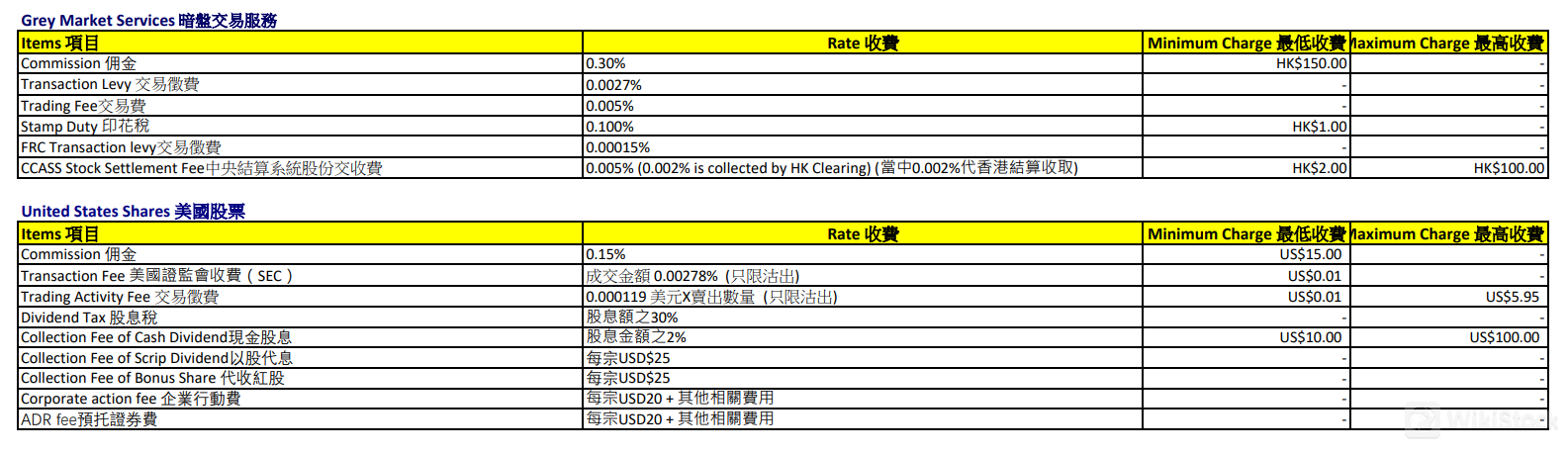

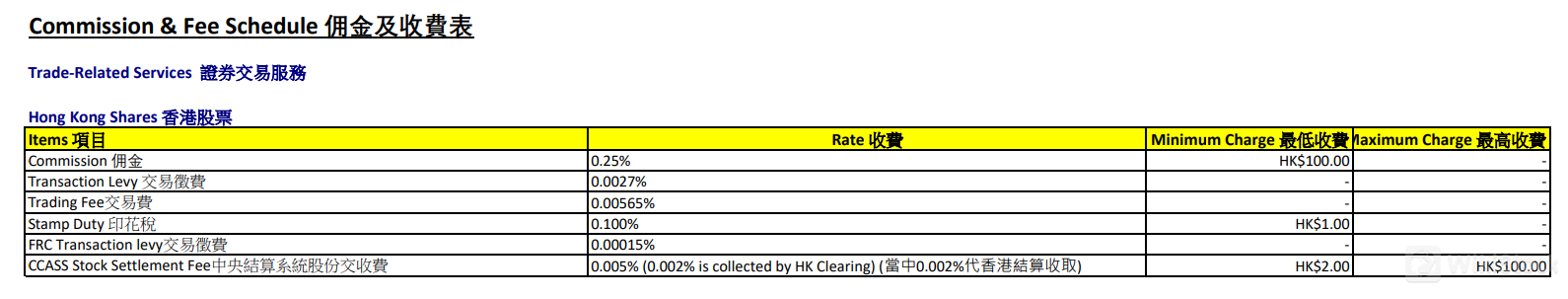

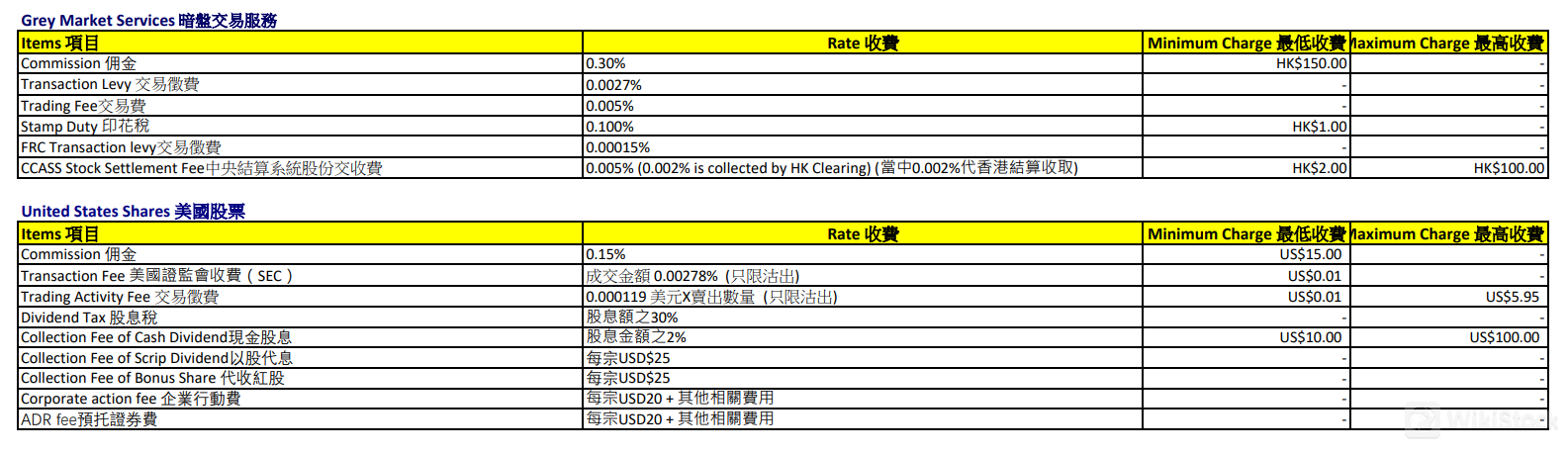

Lego Securities maintains a transparent and competitive fee structure for its services related to Hong Kong Shares. The commission is set at 0.25% of the transaction value, with a minimum charge of HK$100.00.

Additionally, there are several levies and fees associated with each transaction: a Transaction Levy of 0.0027%, a Trading Fee of 0.00565%, and a Stamp Duty of 0.100%, with a minimum charge of HK$1.00. The FRC Transaction Levy is 0.00015%.

Furthermore, the CCASS Stock Settlement Fee is 0.005%, with 0.002% collected by HK Clearing, and it comes with a minimum charge of HK$2.00 and a maximum charge of HK$100.00.

More specific fee structures can be found on their official websiteor in the attached screenshot.

Lego Securities App Review

Lego Securities enhances the security of its online trading platform with the AyersToken App, a two-factor authentication (2FA) solution designed to safeguard client accounts. Available for both Apple iOS and Android devices, users can easily download the app by searching “Ayers Token” in the App Store or Play Store. The AyersToken App not only strengthens cyber-security but also ensures compliance with the Securities and Futures Commission (SFC) requirements.

Customer Service

Lego Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: Room 1505, 15/F, Wheelock House, 20 Pedder Street, Central, Hong Kong.

Email: info@legosecurities.hk

Tel: 852-2128-9435 / 852-2128-9433

Fax: 852-2127-4677

Contact form

Conclusion

In conclusion, Lego Securities emerges as a reputable and regulated brokerage firm offering a comprehensive array of services tailored to meet diverse investment needs. Regulated by SFC, the firm adheres to stringent standards ensuring investor protection and market integrity. It excels in facilitating seamless trading of various financial instruments, including its role in underwriting and managing initial public offerings (IPOs).

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Lego Securities suitable for beginners?

Yes. Lego Securities is suitable for beginners due to its user-friendly platform, transparent and competitive fee structure, and comprehensive customer support.

Is Lego Securities legit?

Yes. Lego Securities is regulated by SFC.

What services does Lego Securities offer?

Securities brokerage, underwriting and placement of securities, and management of initial public offerings (IPOs).

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)