Yuen Meta (International) Securities Limited (“YMETA”), a subsidiary of Roma Group (Stock code:8072), was founded in 2013 which mainly offers comprehensive and quality securities brokerage services including underwriting, placement, margin financing and IPO subscription services. YMETA is registered in The Stock Exchange of Hong Kong Limited as an exchange participant and licensed by the Securities and Futures Commission of Hong Kong for Type 1 regulated Activities.

What is YMETA?

Yuen Meta (International) Securities Limited, known as YMETA, operates under the regulatory oversight of the SFC in Hong Kong. YMETA offers a comprehensive range of financial services, including underwriting, placement, margin financing, and IPO subscription services. Clients engaging with YMETA should be aware of additional fees beyond brokerage commissions, such as stamp duty, transaction levies, and various administrative charges like account maintenance and inactivity fees.

Pros & Cons of YMETA

Pros: Regulated by SFC: YMETA operates under the regulatory oversight of the Securities and Futures Commission (SFC) in Hong Kong. This ensures that the company adheres to strict compliance standards, providing a level of security and investor protection.

Comprehensive Financial Services: YMETA offers a broad range of financial services including underwriting, placement, margin financing, and IPO subscription services.

Cons: Complex Fee Structure: YMETAs fee structure can be intricate, involving multiple components such as stamp duty, transaction levies, and administrative charges (e.g., account maintenance fees). This complexity may require clients to carefully review and understand the total cost implications before engaging their services.

Limited Availability: Customer support provided by YMETA is available only during weekdays from 9:00 am to 5:30 pm, excluding public holidays. This limited availability may be restrictive for clients who require assistance outside of these hours or during holidays, potentially impacting accessibility and timely support.

Is YMETA Safe?

Yuen Meta (International) Securities Limited, known as YMETA, operates under the regulatory oversight of the Securities and Futures Commission (SFC) in Hong Kong, holding License No. BIL855. The SFC plays a crucial role as a financial regulator within Hong Kong's globally recognized financial hub. Its primary mandate is to bolster and safeguard the integrity and stability of Hong Kong's securities and futures markets. This oversight is aimed at fostering investor confidence and ensuring a fair and transparent marketplace.

Under the SFC's supervision, YMETA adheres to stringent regulatory standards designed to protect investor interests and uphold market integrity. These standards encompass various aspects of operational conduct, risk management, and compliance with regulatory requirements.

What are Securities to Trade with YMETA?

Underwriting: YMETA engages in underwriting services, which involve assuming the financial risk of buying a new issue of securities from a company or government entity and reselling them to investors.

Placement Services: YMETA facilitates the placement of securities by matching issuers with potential investors. This service involves connecting companies issuing securities with institutional investors or high-net-worth individuals who are interested in purchasing them.

Margin Financing: YMETA provides margin financing services, allowing clients to borrow funds from the firm to purchase securities.

IPO Subscription Services: YMETA offers services related to initial public offerings (IPOs), allowing clients to subscribe to new shares issued by companies going public. This service includes assisting clients in the subscription process and managing allocations of IPO shares.

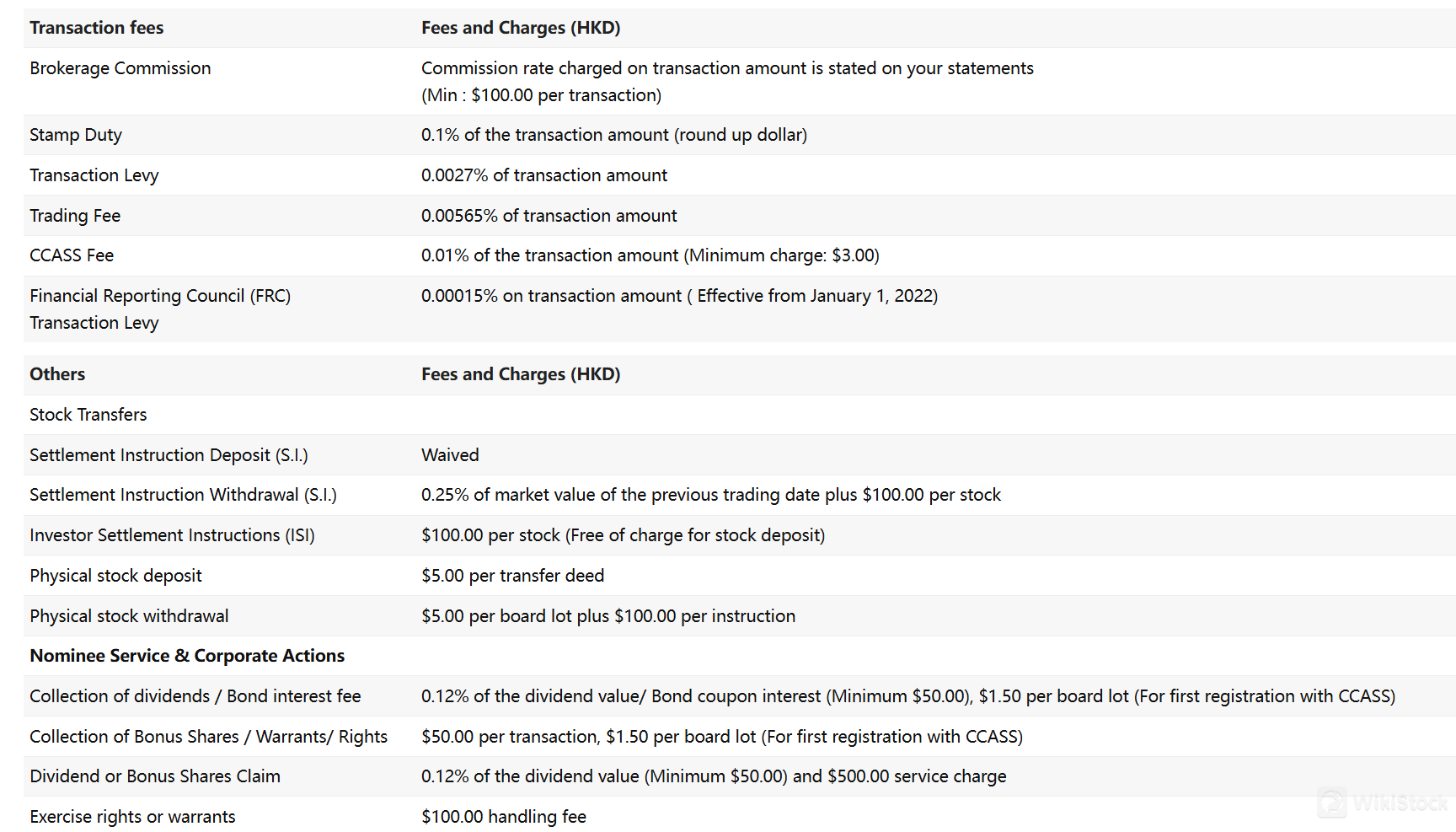

YMETA Fees Review

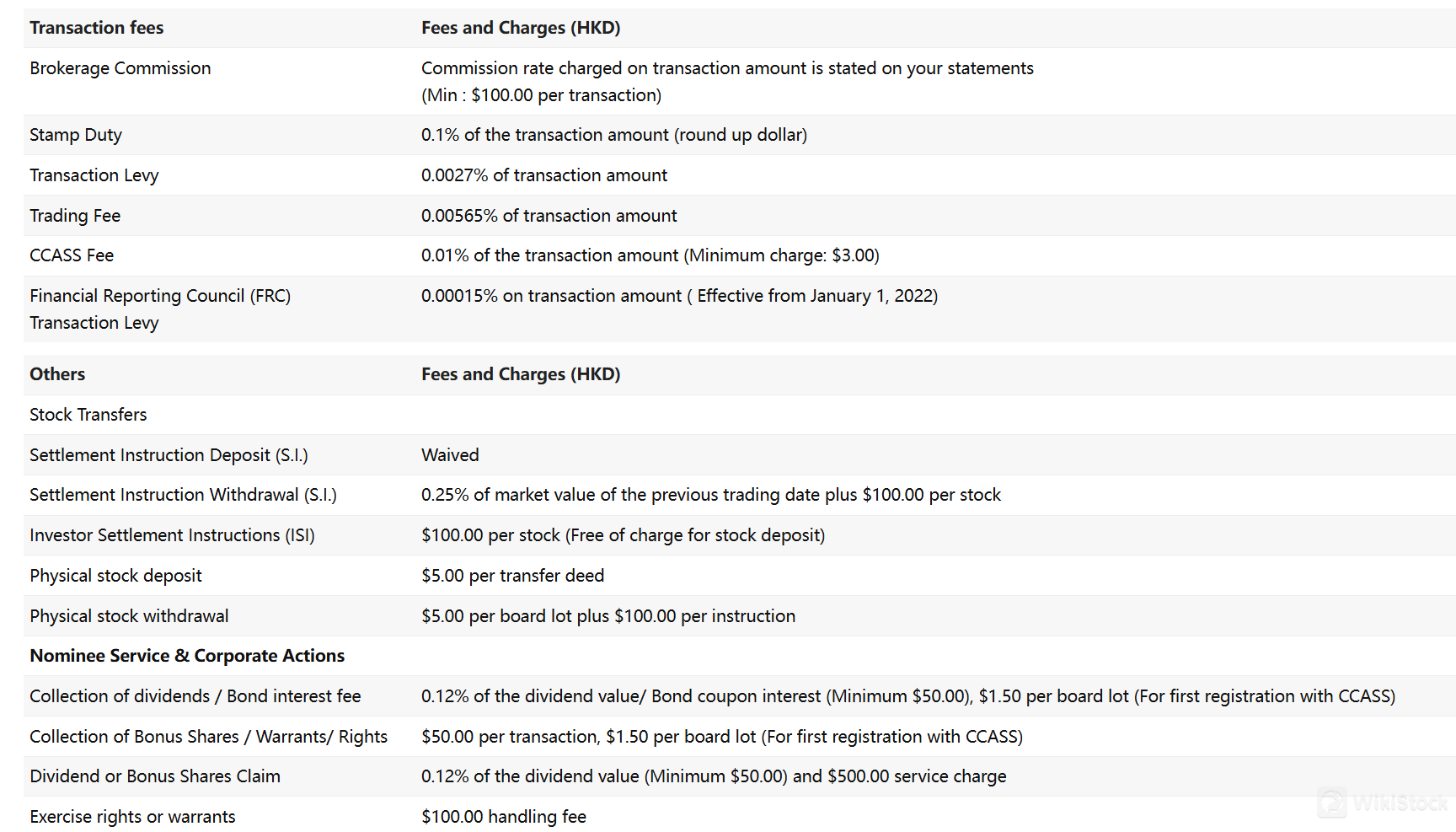

YMETA charges different types of fee items such as brokerage commission, exchange fee, clearing fees and so on.

Brokerage Commission: A flat fee or a percentage of the transaction amount. (e.g., Minimum HK$100 per trade, or 0.1% of transaction value)

Exchange Fees: Fees charged by the stock exchange for processing trades. (e.g., Stamp Duty: 0.1% of transaction amount)

Regulatory Fees: Fees charged by regulatory bodies to cover the cost of oversight. (e.g., Transaction Levy: 0.0027% of transaction amount)

Clearing Fees: Fees charged for settling trades. (e.g., CCASS Fee: 0.002% of transaction amount, minimum fee may apply)

Account Maintenance Fee: A monthly or annual fee for holding an account. (e.g., Free for electronic statements, HK$50 per month for paper statements)

Inactivity Fee: A fee charged for accounts with no activity for a certain period. (e.g., HK$200 per year for cash accounts with balance below HK$1,000)

Statement Retrieval Fee: A fee charged for accessing past account statements. (e.g., Free for electronic statements within 3 months, HK$100 per statement retrieval after 3 months)

| Category |

Detail |

| Transaction Fees (Hong Kong Stocks) |

| Brokerage Commission |

Minimum HK$100 per transaction (details on commission rate provided on statements) |

| Exchange and Regulatory Fees |

| Stamp Duty |

0.1% of transaction amount (rounded up) |

| Transaction Levy |

0.0027% of transaction amount |

| Trading Fee |

0.00565% of transaction amount |

| CCASS Fee |

0.01% of transaction amount (minimum HK$3) |

| FRC Transaction Levy |

0.00015% of transaction amount |

| Stock Transfers |

| Settlement Instruction Deposit (SI) |

Free |

| Settlement Instruction Withdrawal (SI) |

0.25% of market value + HK$100 per stock |

| Investor Settlement Instructions (ISI) |

HK$100 per stock (free for deposit) |

| Physical Stock Deposit |

HK$5 per transfer deed |

| Physical Stock Withdrawal |

HK$5 per board lot + HK$100 per instruction |

| Nominee Services & Corporate Actions |

| Dividend/Bond Interest Collection |

0.12% of value (min HK$50) + HK$1.50 per board lot (first CCASS registration) |

| Bonus Share/Warrant/Right Collection |

HK$50 per transaction + HK$1.50 per board lot (first CCASS registration) |

| Dividend/Bonus Share Claim |

0.12% of value (min HK$50) + HK$500 service charge |

| Exercise Rights or Warrants |

HK$100 handling fee |

| Other Fees |

Book close fee, nominee service fee, tendering shares fee, consolidation/subdivision fee, redemption fee (HK$50-HK$100) |

| Other Services (Hong Kong Stocks) |

| IPO Subscription |

HK$100 per transaction |

| Telegraphic Transfer (TT) |

HK$150-HK$500 |

| Statement Retrieval |

Free (within 3 months), HK$100 per statement (over 3 months) |

| Postal Statements |

Not provided |

| Late Settlement Penalty |

Interest charged at prime rate + 8% on total late amount |

| CIES Annual Return Fee |

HK$5,000 annually |

| US Stock Fees |

| Transaction Fees |

| Commission |

Minimum 0.15%, minimum USD$3.5 per order |

| Settlement Fees |

Varies by share and transaction type (minimum USD$0.01/order, minimum USD$0.3/share) |

| Margin Fee |

USD$0.003/share (minimum USD$0.1/order), refundable application fee with failed applications. Interest rate is 8% per annum. |

| Collection Fees |

| Regulatory Fees (sells only) |

Minimum USD$0.01/order, calculated based on transaction amount |

| Trading Activity Fees (sells only) |

Minimum USD$0.01/order, maximum USD$7.27/order, calculated per share |

| Tax Withholding |

| Dividend Tax |

Varies depending on residency (10% for Mainland China, 30% for others) |

| Custody Fees |

| ADR Custody Fees |

USD$0.02-0.03 per share (charged by The Depository Trust Company) |

| Other Service Fees (US Stocks) |

| FOP/DRS/DWAC Transfers |

Negotiable fees based on transfer type (market value based on completion date for FOP) |

| IPO Settlement |

Minimum fee negotiable, allocation of market value (1%) |

| Stock Mergers/Splits Handling |

USD$3 per stock |

| Dividend Collection Service Fee |

Minimum USD$0.01, 0.2% of dividend amount |

| Margin Interest |

Varies depending on account type (cash account P+5%, margin account P+1.5%) |

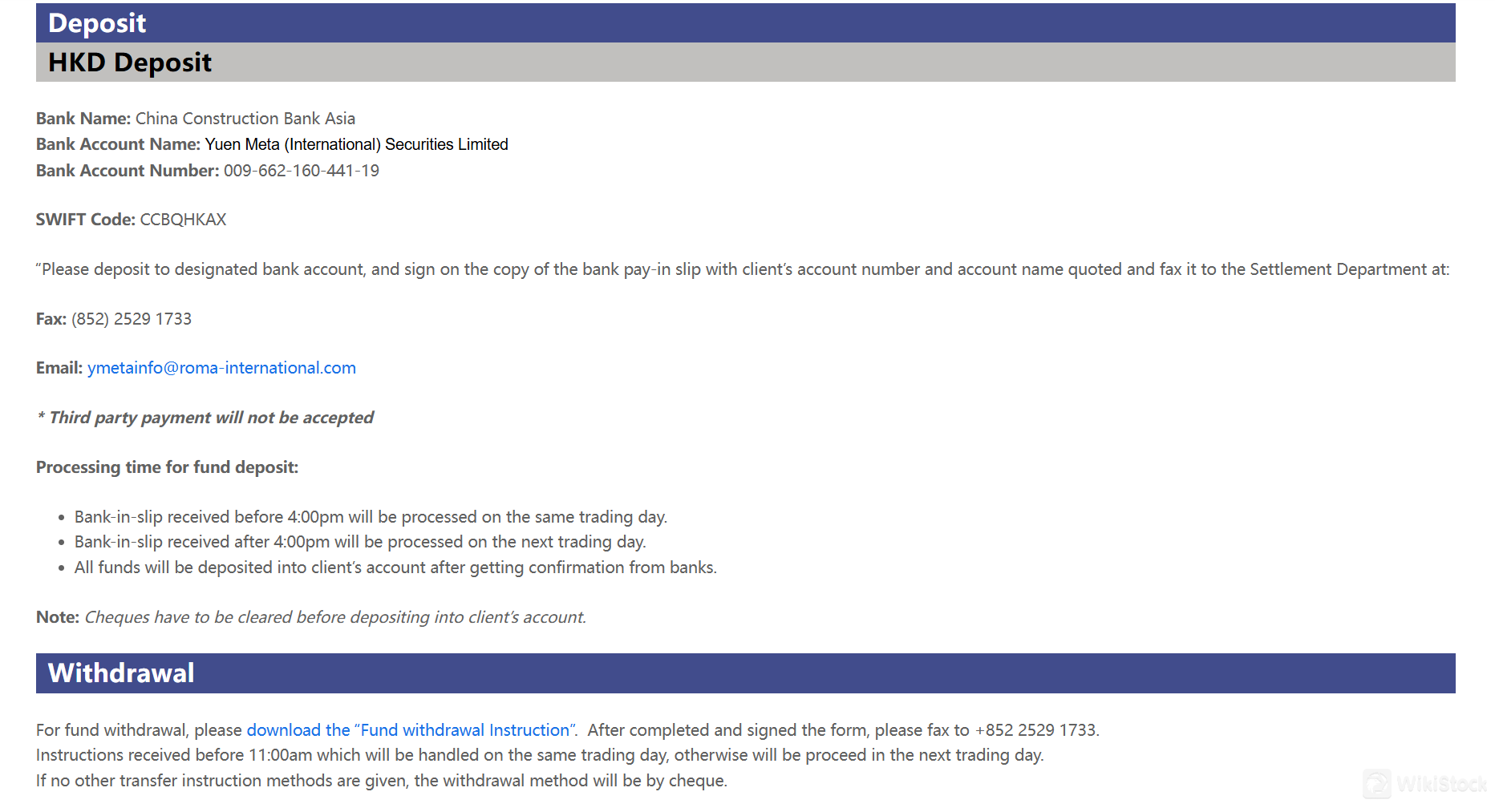

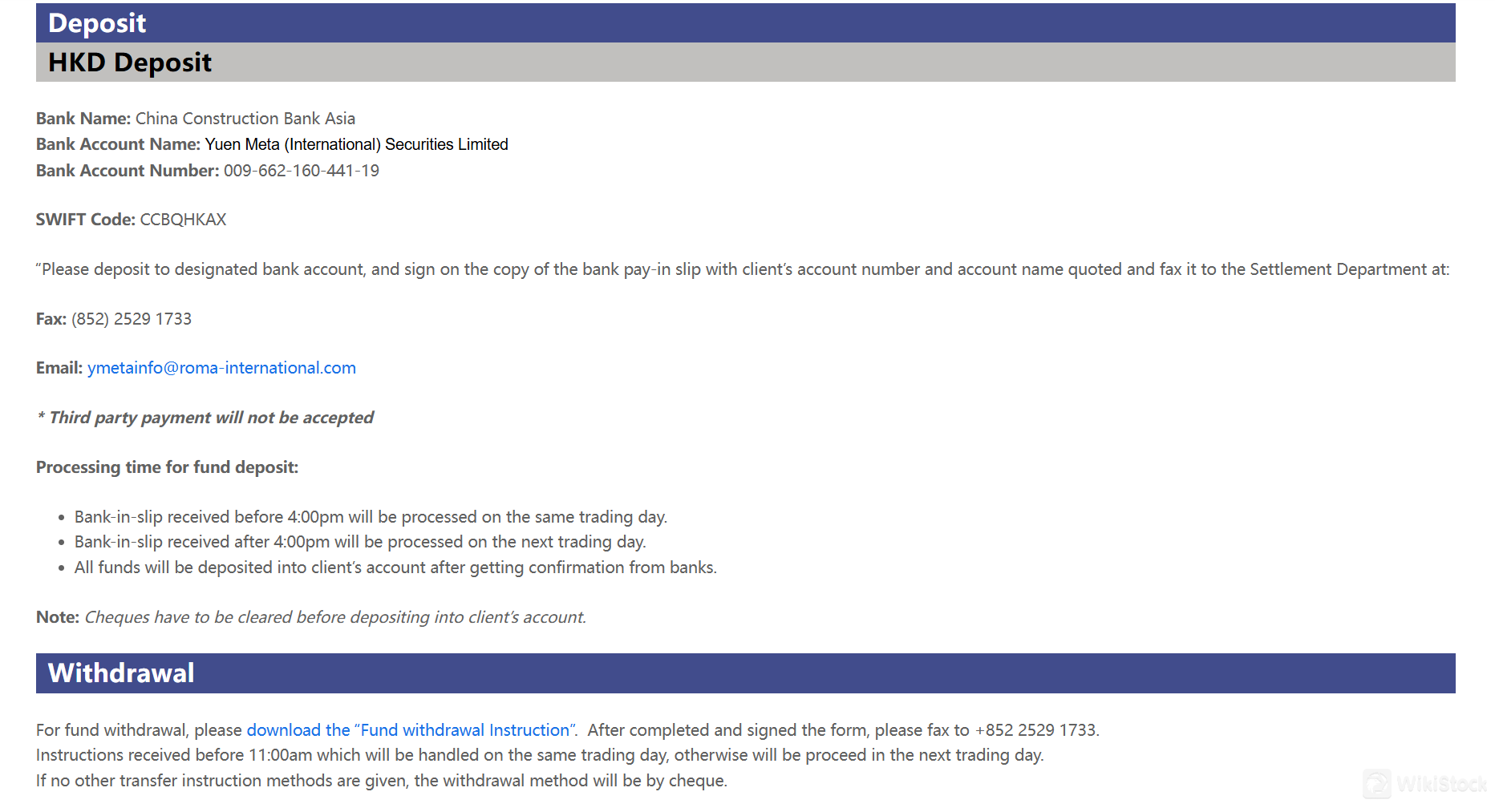

YMETA Deposit & Withdrawal Review

Funds can be deposited into the designated bank account (China Construction Bank Asia).

A signed copy of the bank pay-in slip with the client‘s account number and name must be faxed or emailed to Yuen Meta’s Settlement Department for processing.

Deposits received before 4:00 pm are processed on the same trading day; those received after 4:00 pm are processed on the next trading day.

Funds are deposited into the clients account upon confirmation from the bank.

The form should be faxed to the Settlement Department. Withdrawal instructions received before 11:00 am are processed on the same trading day; otherwise, they are handled the next trading day. By default, if no specific instruction is provided, withdrawals are processed via cheque.

Third-party payments are not accepted for deposits.

Cheques require clearance before funds are deposited into the clients account.

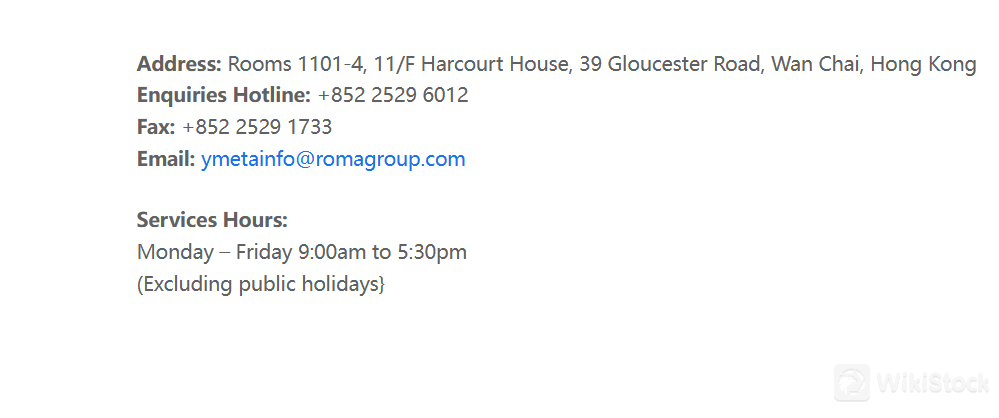

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Services Hours:

Monday – Friday 9:00am to 5:30pm

(Excluding public holidays}

Telephone: +852 2529 6012

Email: ymetainfo@romagroup.com

Fax: +852 2529 1733

Address: Rooms 1101-4, 11/F Harcourt House, 39 Gloucester Road, Wan Chai, Hong Kong

Conclusion

In conclusion, YMETA operates as a well-regulated financial entity under the oversight of the SFC. The company offers a comprehensive range of financial services, including underwriting, placement, margin financing, and IPO subscription services, catering to diverse client needs in the capital markets. Overall, YMETA presents itself as a reputable financial services provider with a strong foundation in regulatory compliance and market access, making it a viable choice for investors seeking a well-rounded approach to their financial needs.

Frequently Asked Questions (FAQs)

Is YMETA regulated?

Yes. It is regulated by SFC.

How can I contact YMETA?

You can contact via telephone: +852 2529 6012, email: ymetainfo@romagroup.com and fax: +852 2529 1733.

Is there any additional fees I should be aware of?

Yes, in addition to brokerage fees, clients incur other charges such as inactive account fees, stamp duty and transaction levies.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Turkey

TurkeyObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--