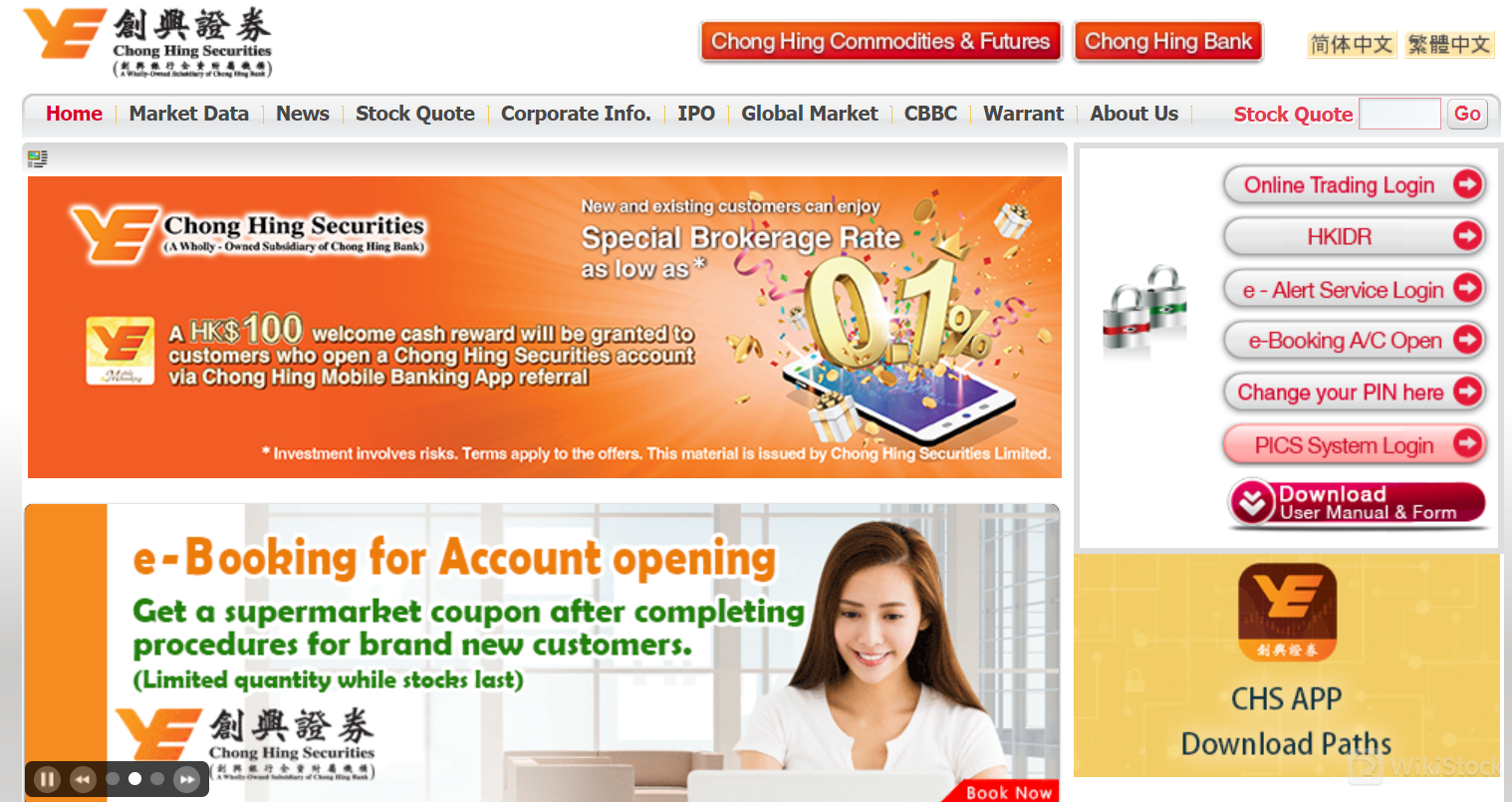

Chong Hing Securities Limited ("CHS") is a wholly owned subsidiary of Chong Hing Bank Limited. Since 1987, CHS has been offering quick, easy and convenient securities trading services to customers.

Chong Hing Securities Information

CHS provides a flexible trading platform accessible on iOS, Android, and the web. While the account minimum is not specified, CHS offers free account fees for new accounts and variable fees depending on the type of transaction. The platform does not offer mutual funds, and details on interests on uninvested cash and margin interest rates are not specified. This structure allows investors to start trading with minimal upfront costs, though they should be aware of potential fee variability.

Pros and Cons of CHS

CHS boasts several advantages, including regulation by the Securities and Futures Commission (SFC), ensuring compliance with stringent financial regulations. The platform also offers access to IPOs and is available across iOS, Android, Mac, Windows, and web, providing versatile accessibility for users. However, the firm has a complex fee structure, lacks specified interest on uninvested cash, and does not clearly outline specific account types, which may pose challenges for some investors.

Is CHS safe?

Chong Hing Securities Limited is a broker-dealer registered with the Securities and Futures Commission (SFC) of Hong Kong.

Segregated Client Accounts: Client funds are held in segregated accounts separate from Chong Hing Securities Limited's own assets, safeguarding them in case of the company's insolvency.

Investor Compensation Scheme (ICS) Participation: Chong Hing Securities Limited participates in the SFC's Investor Compensation Scheme (ICS), providing protection of up to HK$1,000,000 per investor if the firm becomes insolvent.

Internal Security Measures: Chong Hing Securities Limited implements internal security measures, including a secure trading platform, data encryption, and risk management protocols, to protect client funds and data.

What are securities to trade with CHS?

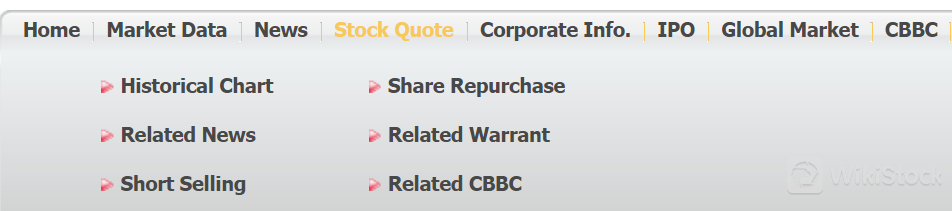

CHS provides a robust platform for trading a diverse range of securities, including stocks and IPOs. Investors can access a wide selection of publicly traded stocks, enabling them to build and manage their portfolios effectively. Additionally, CHS offers opportunities to participate in initial public offerings (IPOs), allowing investors to invest in companies at their market debut, potentially maximizing growth and investment returns.

Stocks: Direct investment in publicly listed companies, suitable for investors seeking capital appreciation and dividends.

IPOs: Participate in initial public offerings, ideal for investors looking to invest in companies at their market debut, with the potential for significant growth and early-stage investment returns.

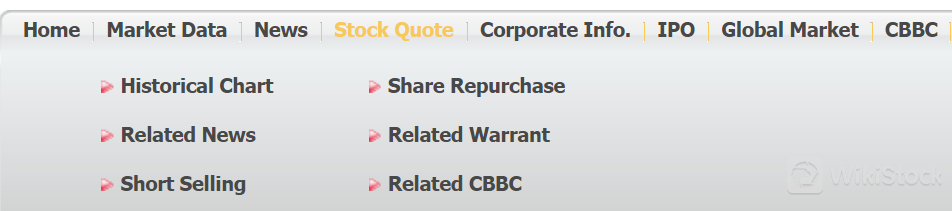

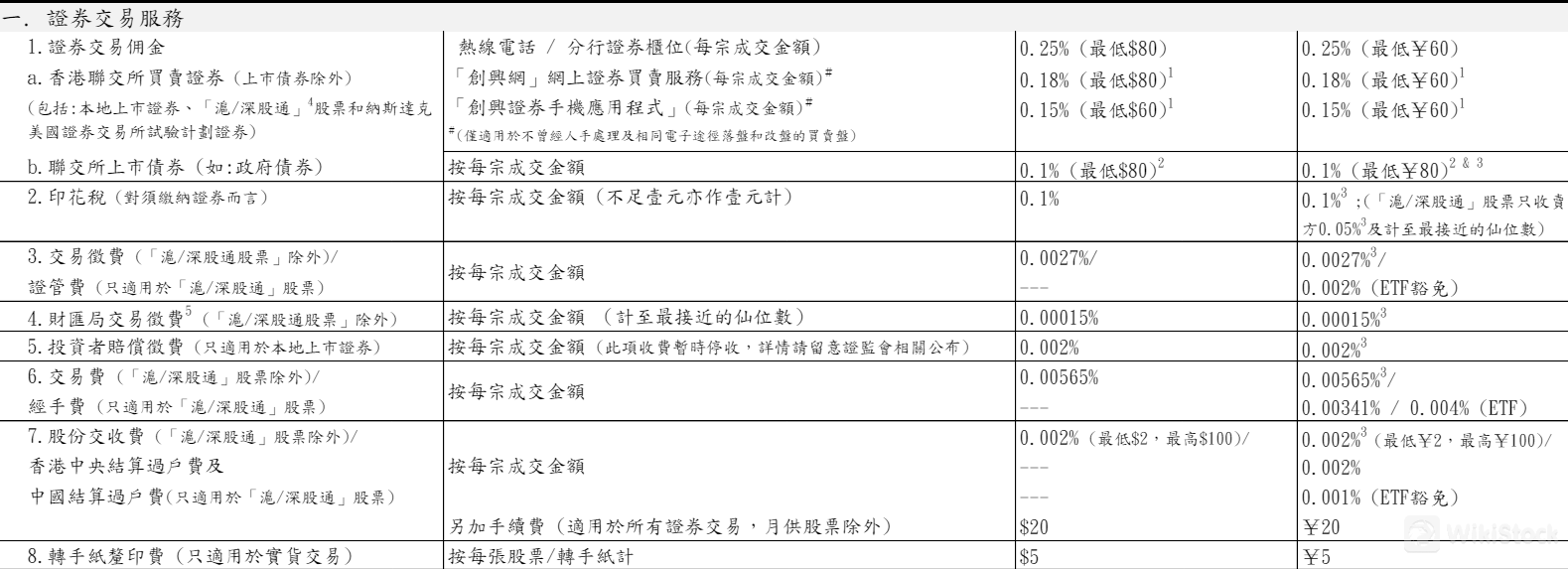

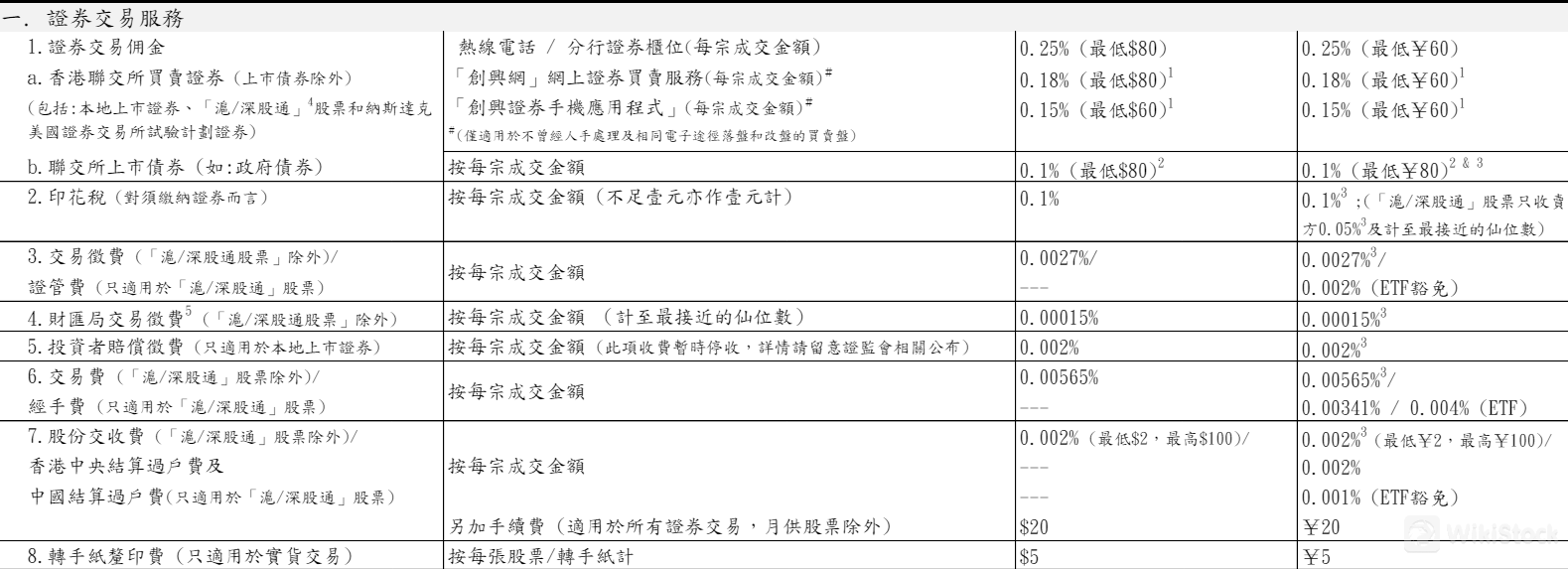

CHS Fees Review

CHS Fees:

Review Fees: There are two types of review fees applicable to commercially sponsored research studies.

Initial Review: $2,000 for the first evaluation by CHS CIRB (Committee on Institutional Review Board).

Continuing Review: $500 annually after the initial review for ongoing studies.

Fee Exceptions: CHS CIRB may reduce or waive fees in specific situations where the full fee might impede valuable research.

Additional Notes:

These fees seem to be related to research studies conducted at a medical institution, likely Community Healthcare System (CHS).

The fees are not based on the study size, budget, or number of participants.

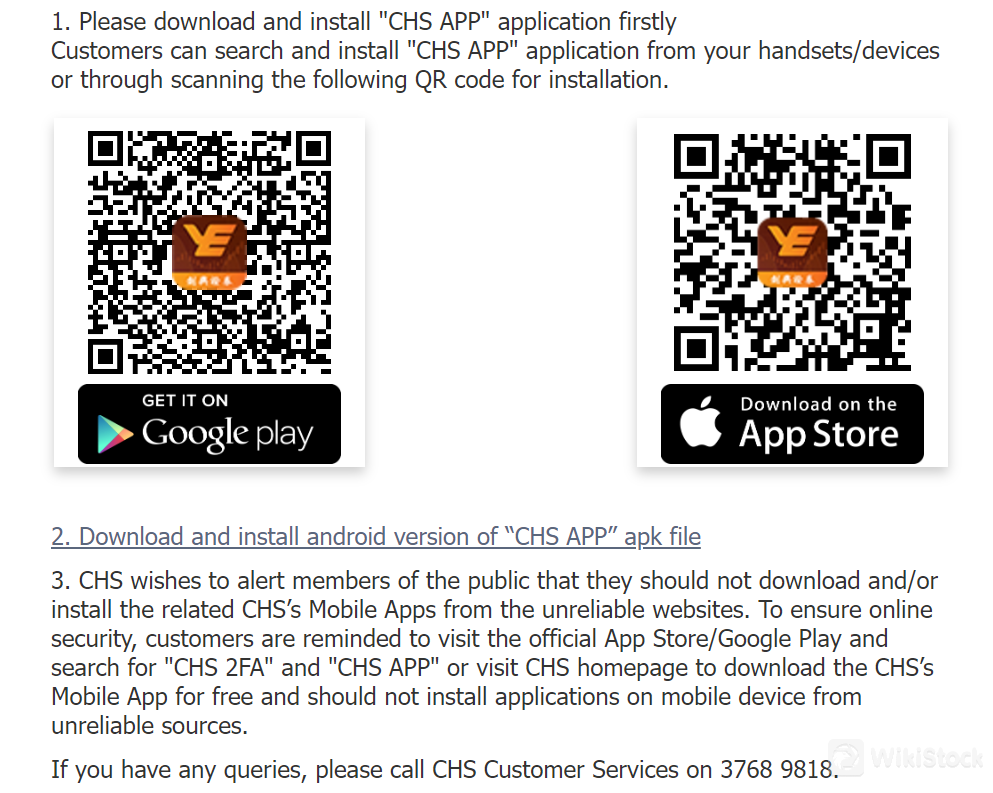

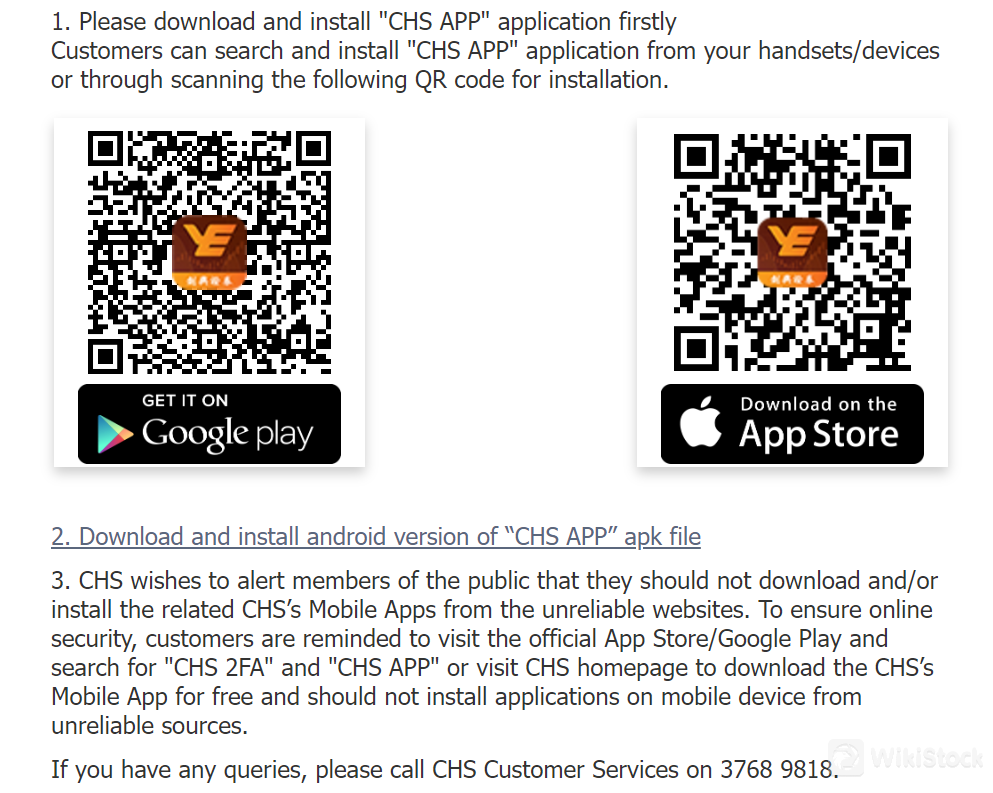

CHS App Review

CHS's mobile app is a cutting-edge and intuitive trading platform designed for on-the-go traders. It provides a comprehensive trading experience, available on iOS and Android devices, facilitating easy access to markets anytime, anywhere. In addition to the mobile app, CHS also offers a versatile range of platforms and tools for different devices and operating systems, including Web Trading platforms, as well as dedicated applications for Mac and Windows. This variety ensures that all users, regardless of their preferred device, can access the trading services seamlessly.

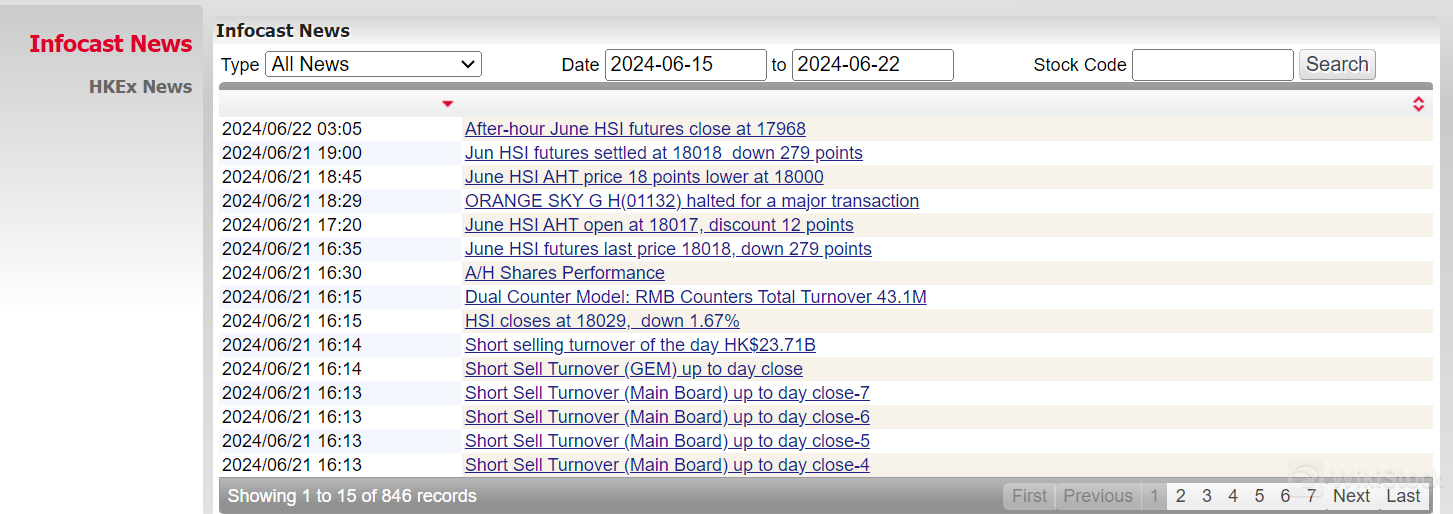

Research and Education

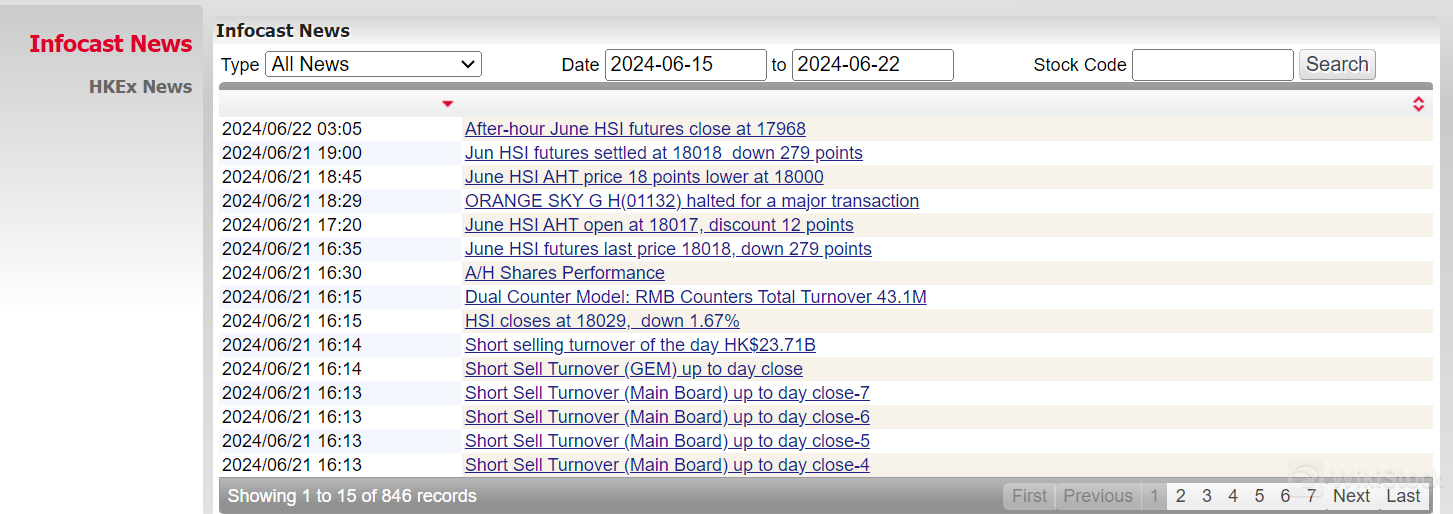

CHS provides robust research and education resources to empower investors with the latest market insights. Through Infocast News and HKEx News, clients receive timely updates and comprehensive analysis, helping them stay informed about market trends and make well-informed investment decisions. These resources ensure that investors have access to essential information for effective trading and portfolio management.

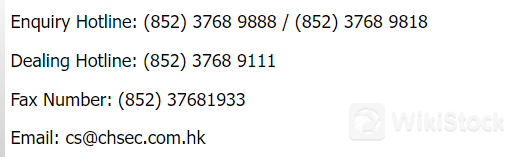

Customer Service

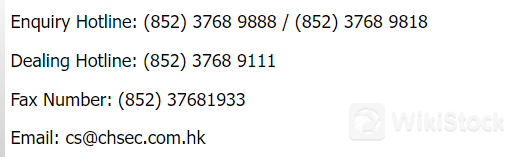

CHS offers comprehensive customer support through multiple channels to ensure client satisfaction and assistance. Clients can reach the enquiry hotline at (852) 3768 9888 or (852) 3768 9818, and the dealing hotline at (852) 3768 9111 for trading-related queries. Additionally, support is available via fax at (852) 3768 1933 and email at cs@chsec.com.hk, providing various convenient options for client communication and support.

Conclusion

In conclusion, CHS stands out for its regulatory compliance with the SFC and its accessibility across multiple platforms, including iOS, Android, and the web. With a focus on IPO offerings and a comprehensive support system, CHS is ideal for investors seeking early-stage investment opportunities and reliable customer service. However, prospective clients should be mindful of its complex fee structure and unspecified details on interest rates and account types.

FAQs

Is CHS safe to trade?

Yes, CHS is safe to trade with, as it is regulated by the Securities and Futures Commission (SFC) and complies with stringent financial regulations.

Is CHS a good platform for beginners?

CHS can be suitable for beginners due to its free account fees for new accounts and user-friendly platforms available on iOS, Android, and the web. However, beginners should be aware of its complex fee structure and the unspecified details on interest rates.

Is CHS legit?

Yes, CHS is a legitimate trading platform, regulated by the Securities and Futures Commission (SFC), ensuring it adheres to strict financial industry standards and regulations.

Is CHS good for investing/retirement?

CHS offers a range of investment opportunities, including stocks and IPOs, which can be beneficial for building a diverse investment portfolio. However, it does not offer mutual funds and lacks specified details on interest rates for uninvested cash, which may be a consideration for long-term retirement planning.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

--