Founded in 2019, Mighty Divine group is a private investment company that provides diversified investment products and consulting services for institutions and high-net-worth clients. Headquartered in the Cheung Kong Centre (Hong Kong) with over 100 staff and has businesses in different countries. The total asset under group's consultation is more than US$10 billion.

What is Mighty Divine?

Mighty Divine is a financial services firm based in Hong Kong, primarily focusing on alternative asset management and investment management. Established in 2019, the company specializes in investments across different asset classes, including equities, bonds, and real estate, and has a strong presence in global markets, particularly those related to China.

Despite being relatively new, it has quickly grown to employ over 100 staff and has expanded its services to various international markets.

Pros and Cons of Mighty Divine

Pros

Diversified Investment Products: They offer a variety of investment options across various asset classes, allowing for potential portfolio diversification and risk management.

Experienced Team and Subsidiaries: With over 100 employees and subsidiaries like Mighty Divine Securities and Investment Management (both licensed by the Hong Kong SFC), they have a team with expertise in different financial areas.

International Presence: Their presence in various countries could provide access to a wider range of investment opportunities.

Focus on High-Growth Areas: Their investment focus on sectors like technology, virtual assets, and luxury goods might be appealing if you believe these areas have high growth potential.

Catering to High Net Worth Clients: Their services are tailored to meet the specific needs of high net worth individuals and institutions.

Cons

Limited Track Record: Founded in 2019, they are a relatively young company. A longer track record with successful investments would provide more assurance.

High Minimum Investment: Since they cater to high net worth clients, the account minimum is HK$10,000, which might be significant and inaccessible to smaller investors.

High Fees: As a private investment firms, Mighty Divine has higher fees compared to traditional investment options, it charges 0.25% commissions for telephone transactions and 0.15% commissions for online transactions. It's crucial to understand their fee structure before investing.

Lack of Educational Resources: Except IPO information, Mighty Divine does not offer other resources, it may leave investors feeling unsupported and struggling to fully leverage market opportunities. Additionally, the absence of independent research and analysis may affect investors' trust in the company's service quality.

Is Mighty Divine safe?

Regulations

Mighty Divine is officially licensed and regulated by The Securities and Futures Commission (SFC) in Hong Kong under license numbers BCQ145 and BQH291 for a wide range of business activities.

Funds Safety

Mighty Divine ensures to to keep clients data confidential and only discloses such data to relevant parties under legal requirements. Furthermore, the company ensures that client's data is not disclosed to third parties, such as agents or contractors, without the client's consent. If the company must disclose client data, it must notify the client in advance and obtain their consent.

Additionally, the company takes measures to prevent unauthorized access and disclosure and is responsible for storing client data in a secure and reliable environment, ensuring that only authorized personnel can access it.

Safety Measures

Mighty Divine Group strictly complies with the requirements of the Personal Data (Privacy) Ordinance, Chapter 486 of the Laws of Hong Kong, and has developed detailed privacy policies to protect the security of customers' personal data.

What are securities to trade with Mighty Divine?

Mighty Divine mainly provides two types of securities services, which are Hong Kong Stocks and Shanghai/Shenzhen A Shares. They do not offer a broader range of securities like US stocks or international bonds, which can be seen as a drawback.

Hong Kong Stocks

Hong Kong is one of the leading international financial centers, with a sound financial system and legal system, providing a reliable platform of fundraising for companies all over the world. In addition to local companies, Europe, America and Mainland Chinas companies have also chosen to raise funds for listing in Hong Kong.

The Hang Seng Index is an important indicator that reflects the market conditions of the Hong Kong stock market. The index is calculated from the market value of more than 60HSI constituents. The main sectors include finance, information technology, real estate, and public utilities. The Hang Seng Index Company Limited will regularly calculate and review the constituents quarterly.

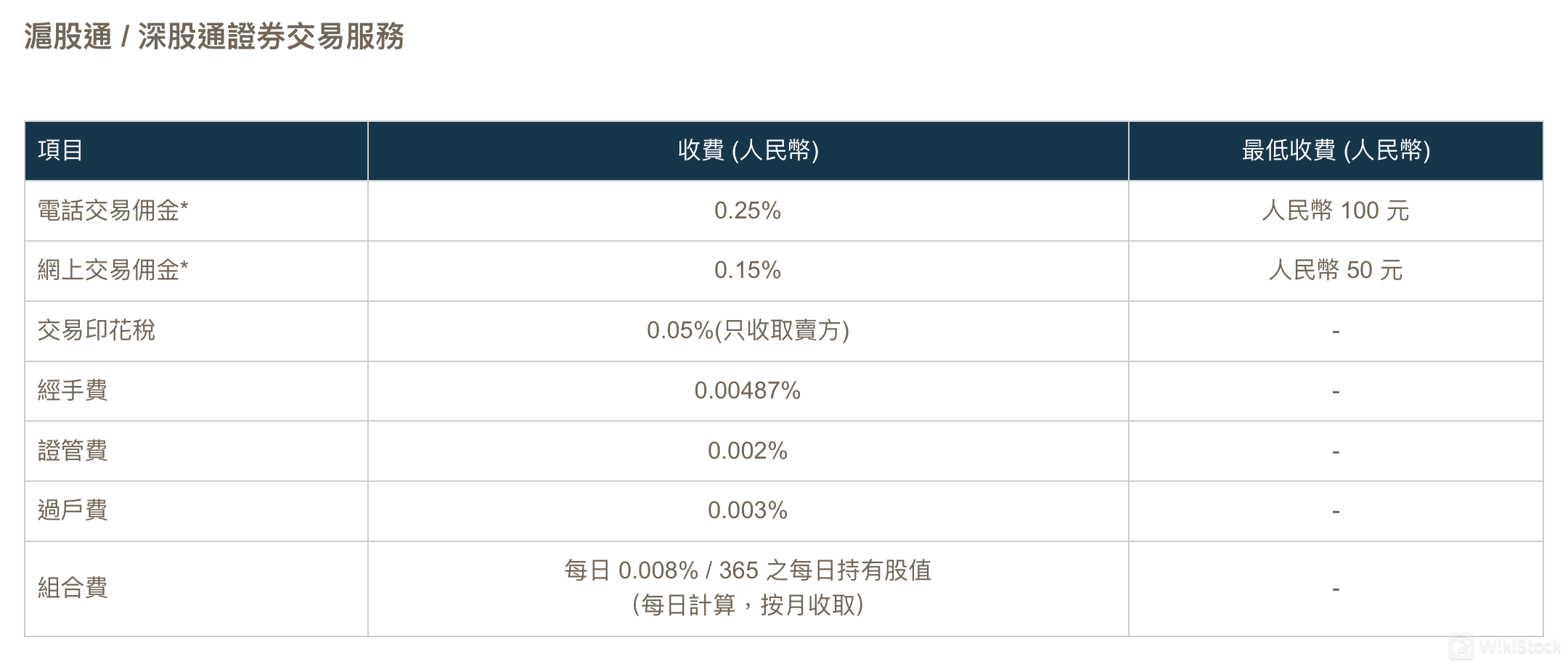

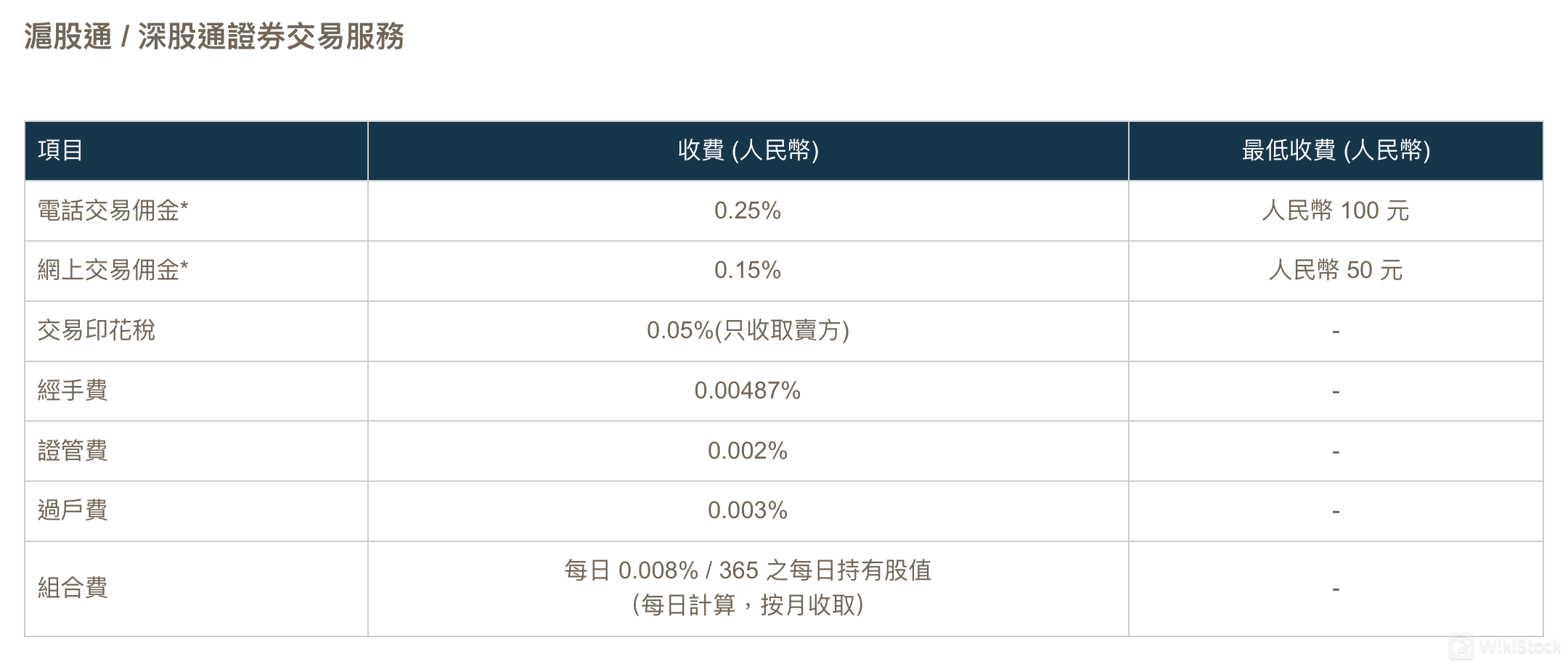

Shanghai/Shenzhen A Shares(Shanghai-Hong Kong Stock Connect and Shenzhen Connect):

Stock Connect is a Mutual Market Access program through which investors in the Mainland China and Hong Kong can trade and settle shares listed on the other market via the stock exchanges and clearing houses in their home market. It can motivate economic activities and increase funding liquidity between Hong Kong and Mainland China.

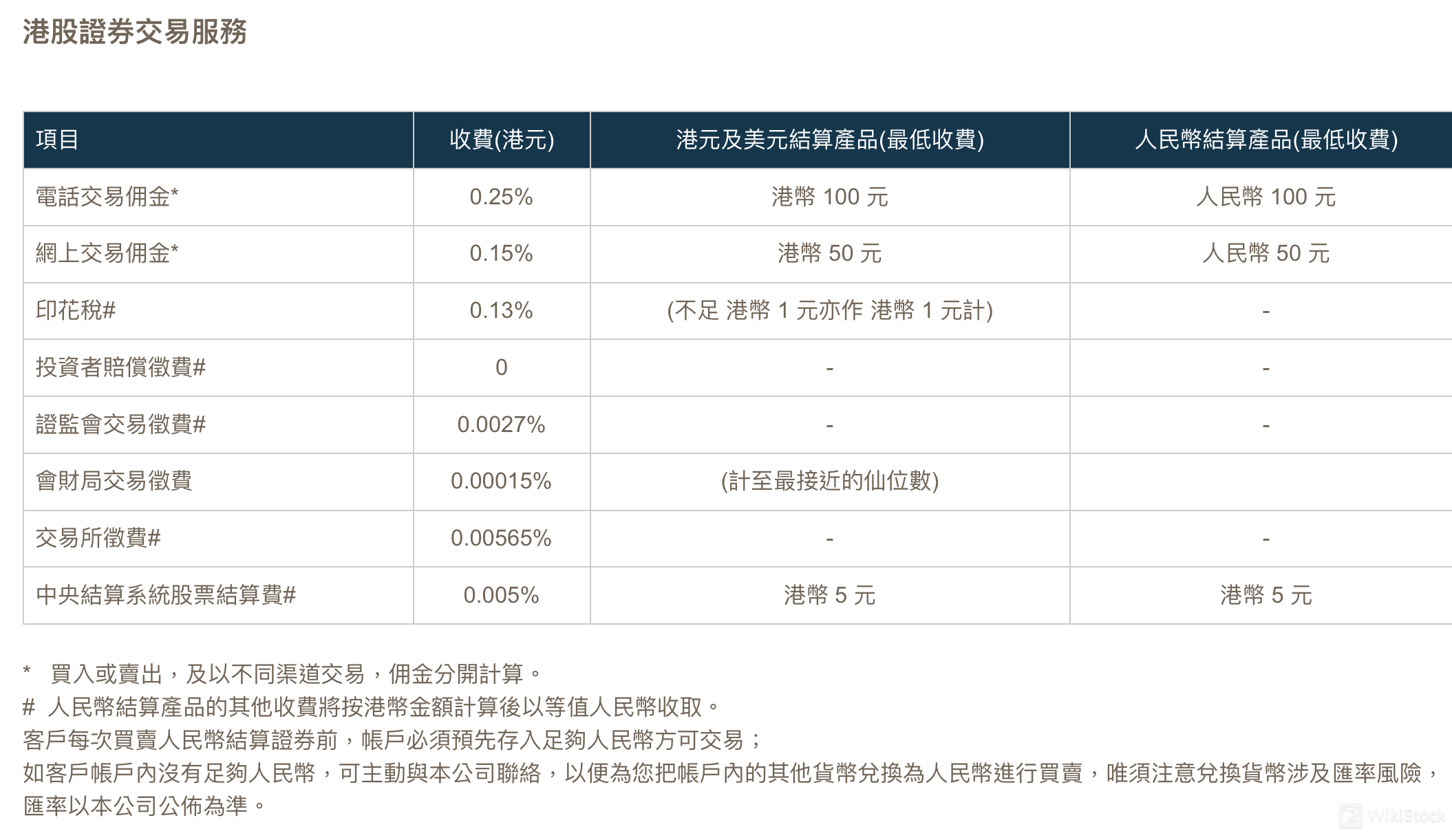

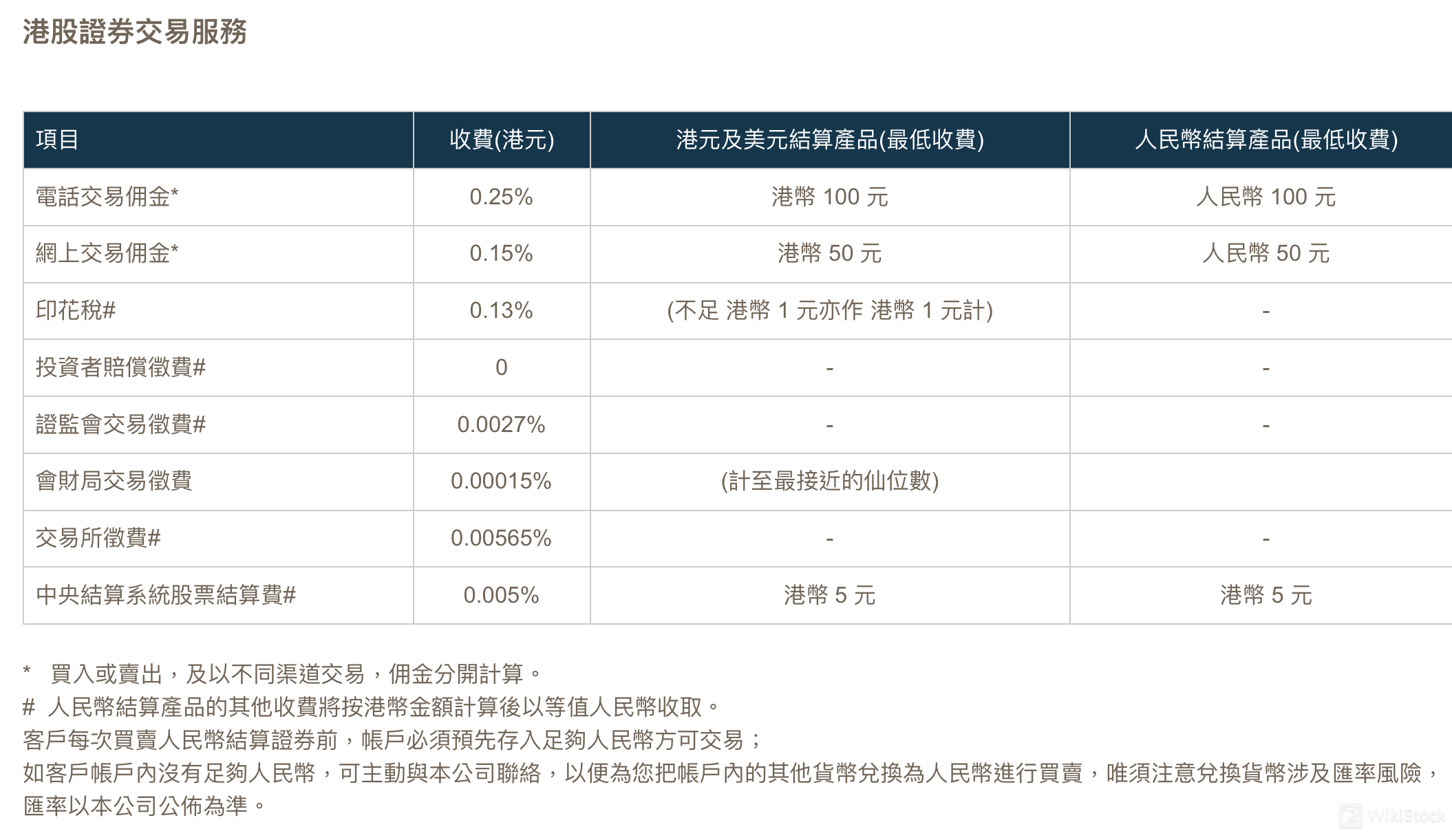

Mighty Divine Fees Review

Regarding fees, Mighty Divine provides two charging modes for Hong Kong Stocks and Shanghai/Shenzhen A Shares:

Hong Kong Stocks:

Phone Trading Commission*: 0.25%

Online Trading Commission*: 0.15%

Stamp Duty#: 0.13% (with a minimum charge of HKD 1 for any amount less than HKD 1)

Investor Compensation Levy#: 0.0027%

SFC Transaction Levy#: 0.0027%

Financial Services and Treasury Bureau Transaction Levy: 0.0027%

Exchange Levy#: 0.0027%

CCASS Stock Clearing Fee#: 0.0027%

There is also a “Maximum Charge per Person” for daily trading limits, but the exact amount is not specified. For settlement products denominated in Renminbi, additional fees are calculated based on standard amounts and charged per transaction.

Shanghai/Shenzhen A Shares:

Mighty Divine App Review

Mighty Divine offers a proprietary trading platform known as the “MD Securities Trading” app, available for both iOS and Android. This platform provides access to various financial instruments including stocks, bonds, and mutual funds. Key features include real-time market data, advanced charting tools, and secure trading capabilities.

The platform is designed to satisfy the needs of high-net-worth individuals and institutional investors, offering functionalities like order placement, portfolio management, and transaction history.

Research and Eduation

Mighty Divine provides latest IPO information such as IPO news and listing date. Through the convenient and fast procedure of subscribing for new shares, you can grasp investment opportunities easily.

However, Mighty Divine does not offer other educational, analytical, and third-party research resources, it may leave investors feeling unsupported and struggling to fully leverage market opportunities. Additionally, the absence of independent research and analysis may affect investors' trust in the company's service quality.

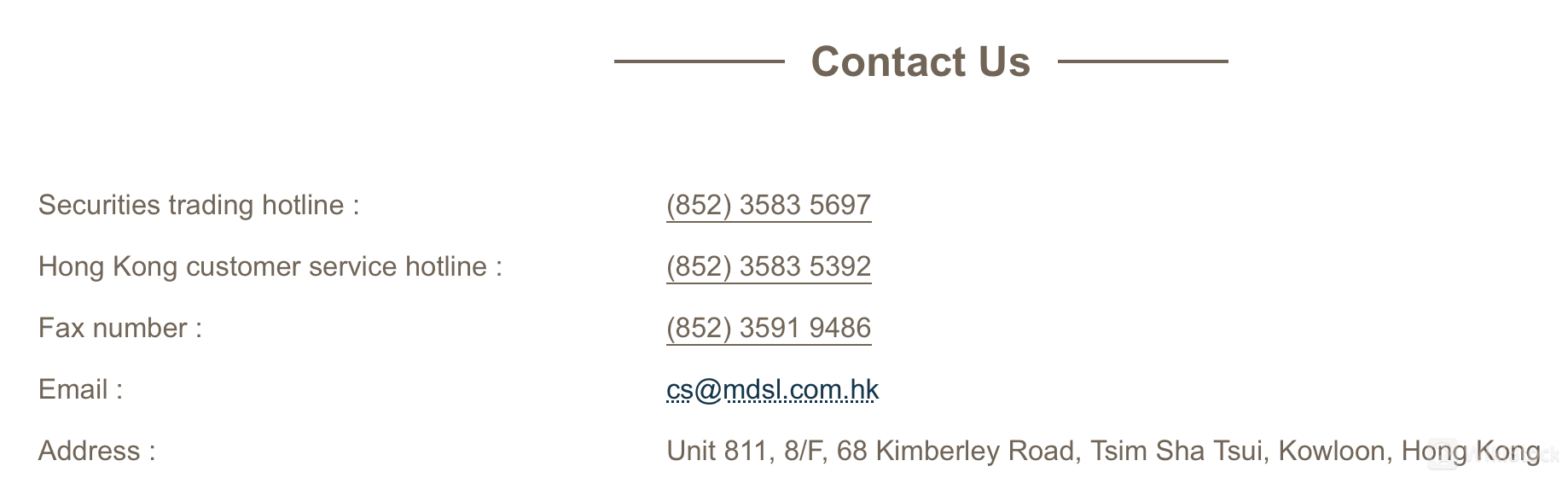

Customer Service

Mighty Divine is dedicated to providing exceptional customer service and support through multiple means, including phone and fax number, email and address:

Securities trading hotline: (852) 3583 5697

Hong Kong customer service hotline: (852) 3583 5392

Fax number: (852) 3591 9486

Email: cs@mdsl.com.hk.

Address: Unit 811, 8/F, 68 Kimberley Road, Tsim Sha Tsui, Kowloon, Hong Kong.

Additionally, there is no specific information provided on the customer service hours of Mighty Divine Group.

Conclusion

Mighty Divine Investment Management Limited is outstanding with its professional investment management capabilities and diverse investment strategies, which are suitable for active investors and those seeking expert advice to make informed investment decisions while balancing risk and reward.

FAQs

Is Mighty Divine safe to trade?

Founded in 2019, they have a limited track record. Though some subsidiaries are licensed in Hong Kong, details on fund safety measures and minimum investment amounts are unclear. Their focus on riskier assets and potentially high net worth clients might not suit everyone.

Is Mighty Divine a good platform for beginners?

Due to its focus on private equity, high minimum investments, and riskier assets, Mighty Divine Group might not be ideal for beginners

Are there any charges for opening an account?

No fees will be charged during the account opening process. Clients can open an account through the designated online account opening page. When the customer uses the services, fees will be incurred.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--