Since its establishment in 1986, Quam Securities (“QSEC”) provides global trading for individual and institutional clients. QSEC has a worldwide network and its investment services cover all major global markets.

QSEC operates 24/7 to trade on major exchanges around the world. Equipped with a highly efficient information technology infrastructure, QSEC is specialized in the rapid and efficient execution of purchases and sales of securities, options, and futures products including indices, currencies, precious metals, energy, and agricultural products.

Quam Securities Introduction

Since its establishment in 1986, Quam Securities (QSEC) has been providing global trading services for individual and institutional clients, covering all major global markets. Operating 24/7 with a highly efficient IT infrastructure, QSEC specializes in rapid execution of trades across securities, options, and futures products. Additionally, QSEC offers professional research, brokerage, and equity capital market services, along with independent financial planning through its wealth management department, all under the regulation of the SFC.

Pros & Cons of Quam Securities

Pros Regulated by SFC: Quam Securities operates under the supervision of the Securities and Futures Commission (SFC), ensuring adherence to strict regulatory standards and providing a high level of investor protection.

24/7 Operations: The firm offers round-the-clock operations, allowing clients to trade on major exchanges worldwide at any time, thus maximizing trading opportunities and flexibility.

Advanced Trading Platforms: Quam Securities provides sophisticated trading platforms such as QPlus, SP Trader, and Financial Plus, which offer real-time market data, multi-product support, and efficient trading capabilities.

Diverse Financial Instruments: Clients have access to a broad array of financial instruments, including equities, options, bonds, mutual funds, ETFs, futures, and more, allowing for diversified investment strategies and catering to various risk profiles.

No Minimum Balance Requirement: Quam Securities does not require an initial deposit or impose a minimum balance to open a trading account, making it accessible for new investors or those starting with smaller amounts.

Cons Fee Structure Complexity: The detailed and varied fee structure is complex for some clients to fully understand, potentially leading to unforeseen costs.

Technology Reliance: Heavy reliance on technology and internet-based platforms could pose challenges for clients who are less tech-savvy or have limited internet access. Technical issues or outages could also impact trading activities.

Is Quam Securities Safe?

Quam Securities operates under the oversight of the Securities and Futures Commission (SFC), a prominent regulatory body in Hong Kong. The SFC, known for its stringent regulatory standards, plays a crucial role in maintaining the stability and integrity of Hong Kong's securities and futures markets. Through a robust regulatory framework, the SFC ensures investor protection and promotes a fair and transparent financial environment. Quam Securities' License No. AAC577 underscores its firm commitment to adhering to these high standards, emphasizing its dedication to ethical conduct and regulatory compliance within the financial industry.

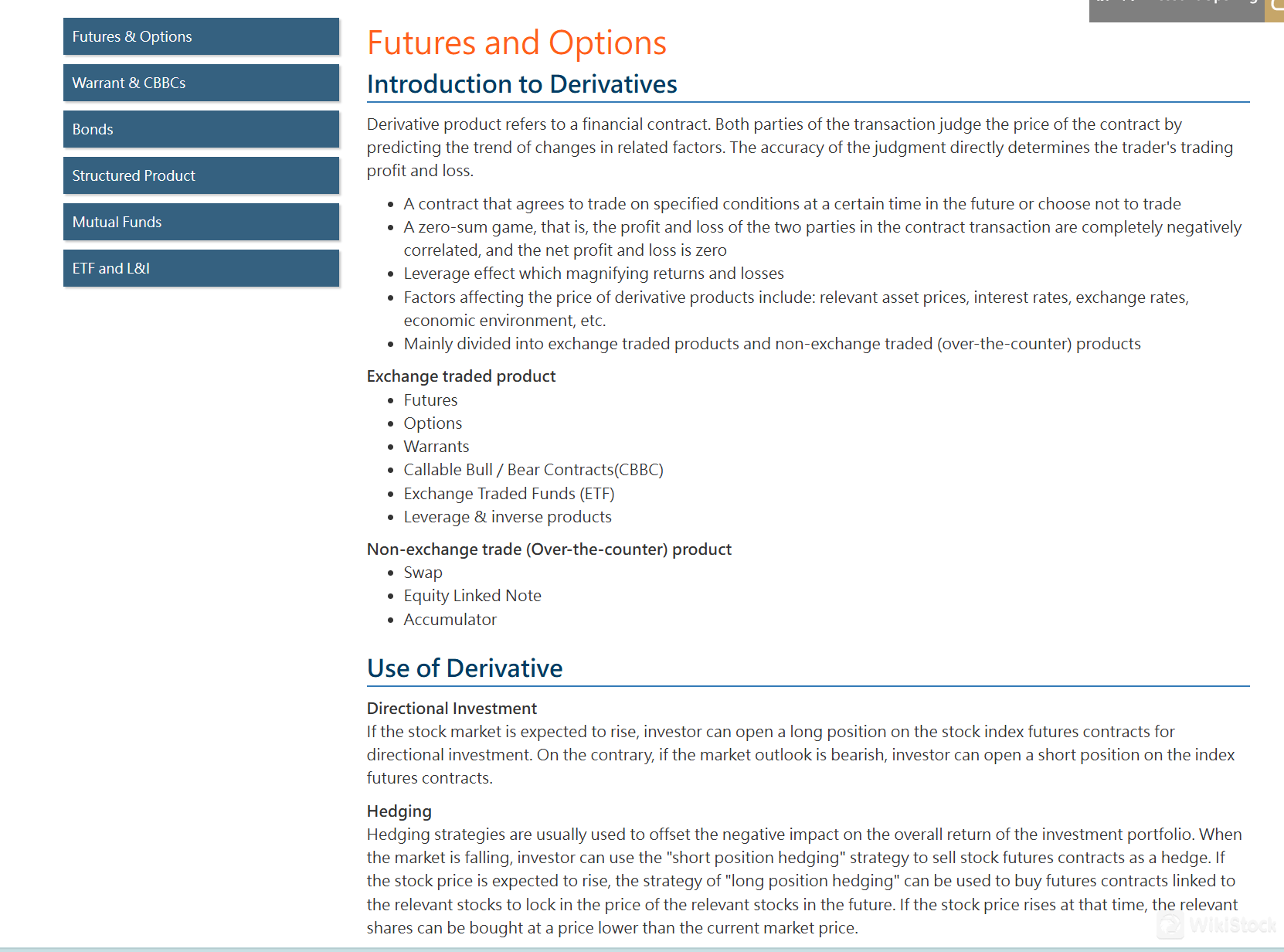

What are Securities to Trade with Quam Securities?

Securities offered by Quam Securities encompass a wide range of financial instruments designed to meet diverse investment objectives. These include options, bonds, mutual funds, structured products, stocks, ETFs, warrants, CBBCs (Callable Bull/Bear Contracts), and participation in the SH/SZ - HK Stock Connect program.

Options: These are contracts granting the right to buy or sell an underlying asset at a predetermined price within a specified period. Options provide flexibility and can be used for hedging or speculative purposes.

Bonds: Debt securities issued by governments, municipalities, or corporations to raise capital. Bonds typically offer regular interest payments and repayment of the principal amount upon maturity.

Mutual Funds: Investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities, managed by professional fund managers.

Structured Products: These are tailored investments linked to the performance of one or more underlying assets. Quam Securities offers Equity Linked Investments (ELI), Equity Linked Notes (ELN), and Fixed Coupon Notes (FCN) among others, providing varying levels of risk and return potential.

Stocks: Equity securities representing ownership in a company, entitling shareholders to dividends and voting rights.

ETFs (Exchange-Traded Funds): Investment funds traded on stock exchanges, mirroring the performance of an index, commodity, or a basket of assets.

Warrants: Derivative securities that give the holder the right to buy underlying securities at a specific price within a specified time frame.

CBBCs (Callable Bull/Bear Contracts): Leveraged derivative products providing investors with amplified exposure to underlying assets, either bullishly (increasing) or bearishly (decreasing).

In addition to traditional securities, Quam Securities also facilitates trading in futures products covering indices, currencies, precious metals, energy commodities, and agricultural products. These futures contracts allow investors to speculate on price movements and manage risk associated with these asset classes.

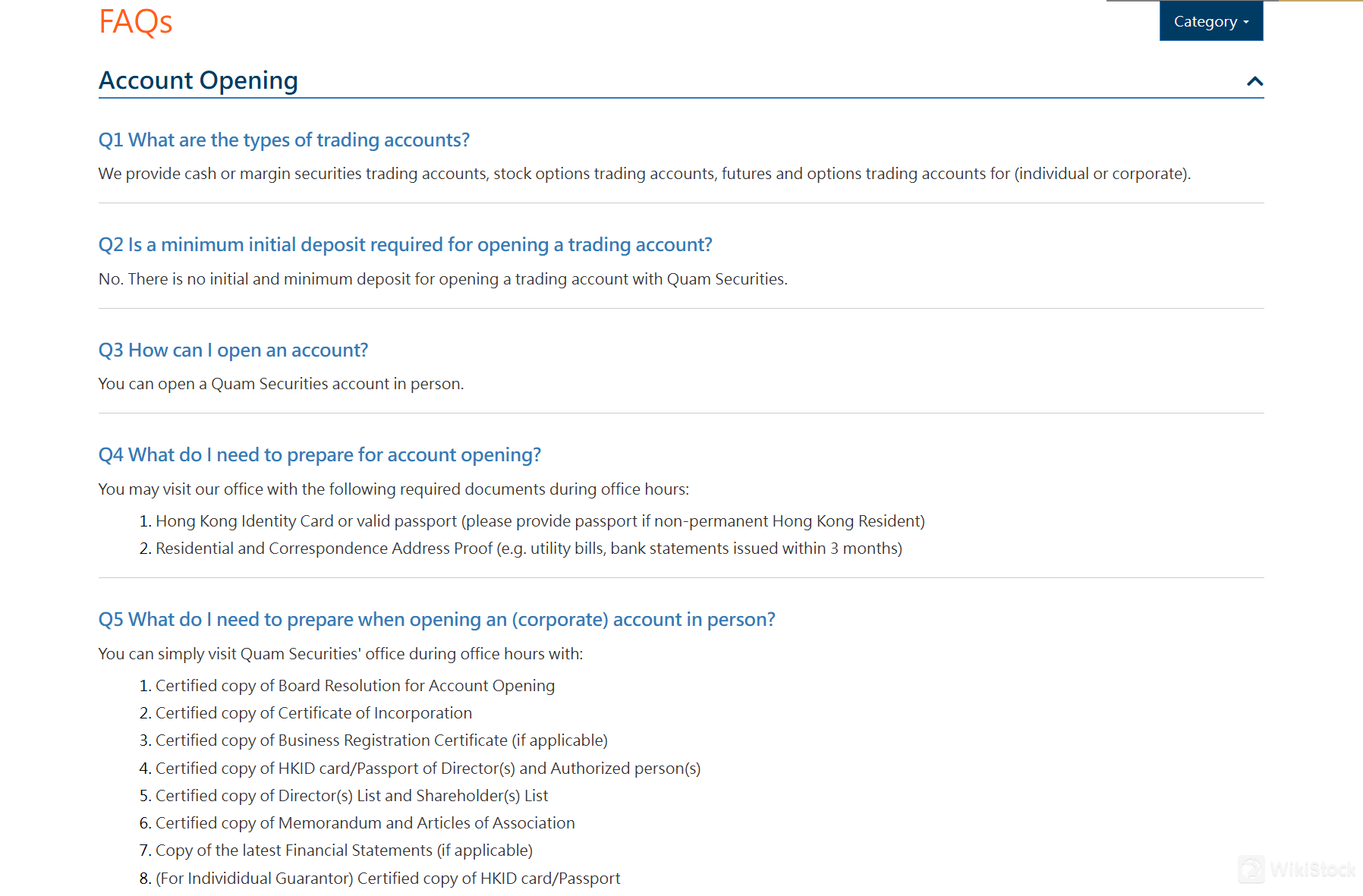

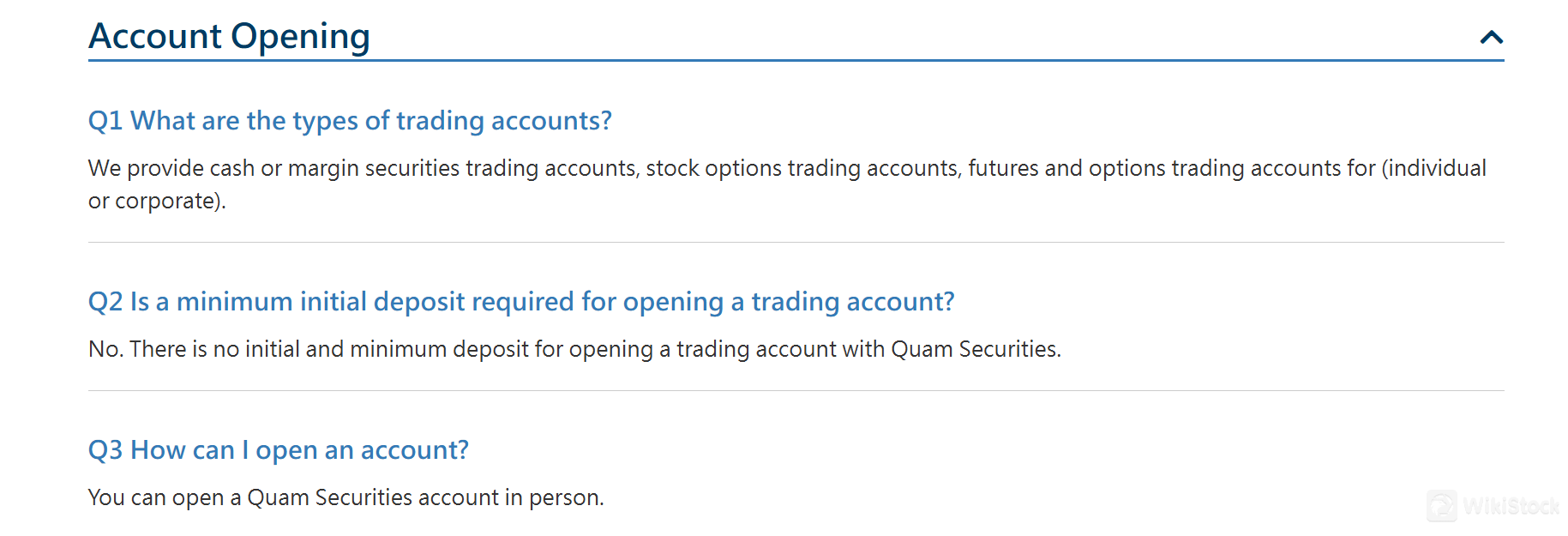

Quam Securities Accounts

Quam Securities offers a variety of trading accounts tailored to both individual and corporate clients.

Cash or Margin Securities Trading Accounts:

These accounts allow clients to trade securities (stocks, bonds, etc.) either using cash or by borrowing funds on margin. Clients can buy and sell securities based on available cash or utilize margin financing for additional leverage.

Stock Options Trading Accounts:

Quam Securities provides accounts specifically designed for trading stock options. Clients can engage in options strategies such as buying calls/puts, writing options, and spreads to capitalize on market movements.

Futures and Options Trading Accounts:

These accounts cater to clients interested in trading futures contracts and options on futures. Futures contracts allow clients to speculate on the future price movements of commodities, indices, or other financial instruments. Options on futures provide additional flexibility in hedging and speculative strategies related to futures positions.

Besides, Quam Securities does not require an initial deposit or impose a minimum balance requirement to open a trading account, making it accessible for new investors or those starting with smaller amounts. Clients have the flexibility to choose between cash-based or margin-based trading accounts based on their risk tolerance and investment objectives.

Quam Securities Fees Review

Quam Securities provides a detailed and transparent fee structure.

| Category | Detail |

| HK Index Futures | Exchange Fee | HSI: HKD 10.00 |

| MINI HSI: HKD 3.50 |

| Commission Levy | HSI: HKD 0.54 |

| MINI HSI: HKD 0.10 |

| Cash Settlement Fee | HSI: HKD 10.00 |

| MINI HSI: HKD 3.50 |

| HK Index Options | Exchange Fee | HSIO: HKD 10.00 |

| Mini HSIO: HKD 2.00 |

| Commission Levy | HSIO: HKD 0.54 |

| Mini HSIO: HKD 0.10 |

| Cash Settlement Fee | HSIO: HKD 10.00 |

| Mini HSIO: HKD 2.00 |

| HK Stock Futures | Exchange Fee | HKD 3.50 |

| Commission Levy | HKD 0.10 |

| Cash Settlement Fee | HKD 10.00 |

| HK Currency Futures/Options | Exchange Fee | USD/CNH Futures & Options: RMB 8.00 |

| Overdraft Interest Rates | HKD | SCB HKD Prime Rate + 6% p.a. |

| USD | SCB USD Prime Rate + 9% p.a. |

| Hong Kong Equities | Stamp Duty | 0.1% of transaction amount |

| Transfer Deed Fee | HKD 5.00 per deed |

| Trading Fee | 0.00565% on transaction amount |

| Transaction Levy | 0.0027% on transaction amount |

| Accounting and Financial Reporting Council Transaction Levy | 0.00015% on transaction amount |

| Settlement Fee | 0.008% on transaction amount |

| (Min. HKD 3.00, Max. HKD 300.00) |

| Shanghai/Shenzhen A Shares | Handling Fee | 0.00341% of transaction amount |

| Securities Management Fee | 0.002% of transaction amount |

| Transfer Fee | 0.003% of face value |

| Stamp Duty (Seller) | 0.05% of transaction amount |

| Handling Fee (SSE/SZSE Listed ETFs) | 0.004% of transaction amount |

| Settlement Charges & Custody Services | Monthly Custody Fee | HKD 50.00 |

| Bond/Fixed Income Products Monthly Custody Fee | 0.06% p.a. of market value |

| Monthly Statement Postage Fee | HKD 50.00 per month |

| Monthly CCASS Custody Fee | HKD 0.012 per lot |

| CCASS Stock Segregated Accounts Fee | HKD 100.00 per month |

| Stock Withdrawal (Physical) | HKD 5.00 per lot |

| Handling Fee for Physical Stock Registration | HKD 2.50 per certificate + HKD 100.00 |

| Stock Withdrawal via CCASS (ISI) (Per Stock) | HKD 20.00 |

| Stock Withdrawal via CCASS (SI) (Per Stock) | 0.01% on market value (Max. HKD 300.00) + HKD 200.00 handling charges |

| Cash/Stock Dividend Collection Handling Fee | 0.50% on gross dividend |

| (Min. HKD 30.00, Max. HKD 20,000.00) |

| Bonus Shares Collection Handling Fee | HKD 1.00 per lot (Min. HKD 30.00) |

| Rights/Open Offer Collection Handling Fee | HKD 30.00 |

| Cash Offer, Warrants/Covered Warrants Exercise | HKD 1.50 per lot |

| (Min. HKD 100.00, Max. HKD 20,000.00) |

| Scrip Fee | HKD 2.00 per lot |

| Corporate Action Services Fee | HKD 1.50 per lot |

| (Min. HKD 30.00, Max. HKD 20,000.00) |

| Stock Conversion/Split/Consolidation | HKD 30.00 per stock |

| Claims for Dividend/Bonus | 0.20% on gross dividend |

| (Min. HKD 1,000.00) |

| IPO Application | Cash Application: Free of Charge |

| Margin Application: HKD 100 |

| Other Charges | Chats (Local Bank) | HKD 200.00 |

| Telegraphic Transfer (Overseas Bank) | HKD 600.00 |

| Returned Cheque | HKD 200.00 |

| Request for Historical A/C Statement | HKD 100.00 per month (for over 3 years) |

| Audit Confirmation Fee | HKD 200.00 |

| Out of Pocket Expenses | Billed at cost as incurred |

Quam Securities Platforms Review

Quam Securities provides a range of trading platforms for trading in equities, futures, options, and more.

QPlus is a mobile trading application that supports both Android and iOS devices. This app allows users to buy and sell stocks easily while providing real-time market monitoring.

Real-Time Market Monitoring: Keep track of market trends and seize investment opportunities quickly.

Ease of Trading: Facilitates fast and efficient stock trading from your mobile device.

Download Options: Available for download via QR code or APK.

SP Trader is a versatile internet trading platform available for Windows PCs, Android, and iOS devices. It supports trading in cash and derivatives markets, including stocks, futures, and options, across more than 20 global exchanges.

Multi-Product Support: Trade in stocks, futures, and options.

Multi-Exchange Connectivity: Access to over 20 exchanges worldwide, including the Hong Kong Exchange and Clearing Limited.

Comprehensive Trading Solution: A one-stop platform for all your trading needs.

Financial Plus is a mobile application for managing investment accounts and accessing the latest market information. It is compatible with Android and iOS devices.

Market Information: Access the latest product and market information, news, announcements, and research reports.

Price Alerts: Set and receive price alerts for various securities.

Bond Information: Search and view detailed bond information.

Account Management: View statements and issue fund movement instructions directly from the app.

Research & Education

Quam Securities is committed to providing research and educational resources to help investors make informed decisions and understand the risks associated with their investments.

Quam Securities offers robust research services aimed at keeping investors informed about the latest market trends and investment opportunities. This includes:

Latest Information:

Market Updates: Regular updates on market trends and conditions to help investors stay informed about the latest developments.

Research Reports: In-depth analysis and reports on various financial products and market sectors.

Announcements: Important announcements that may impact the market or specific investments.

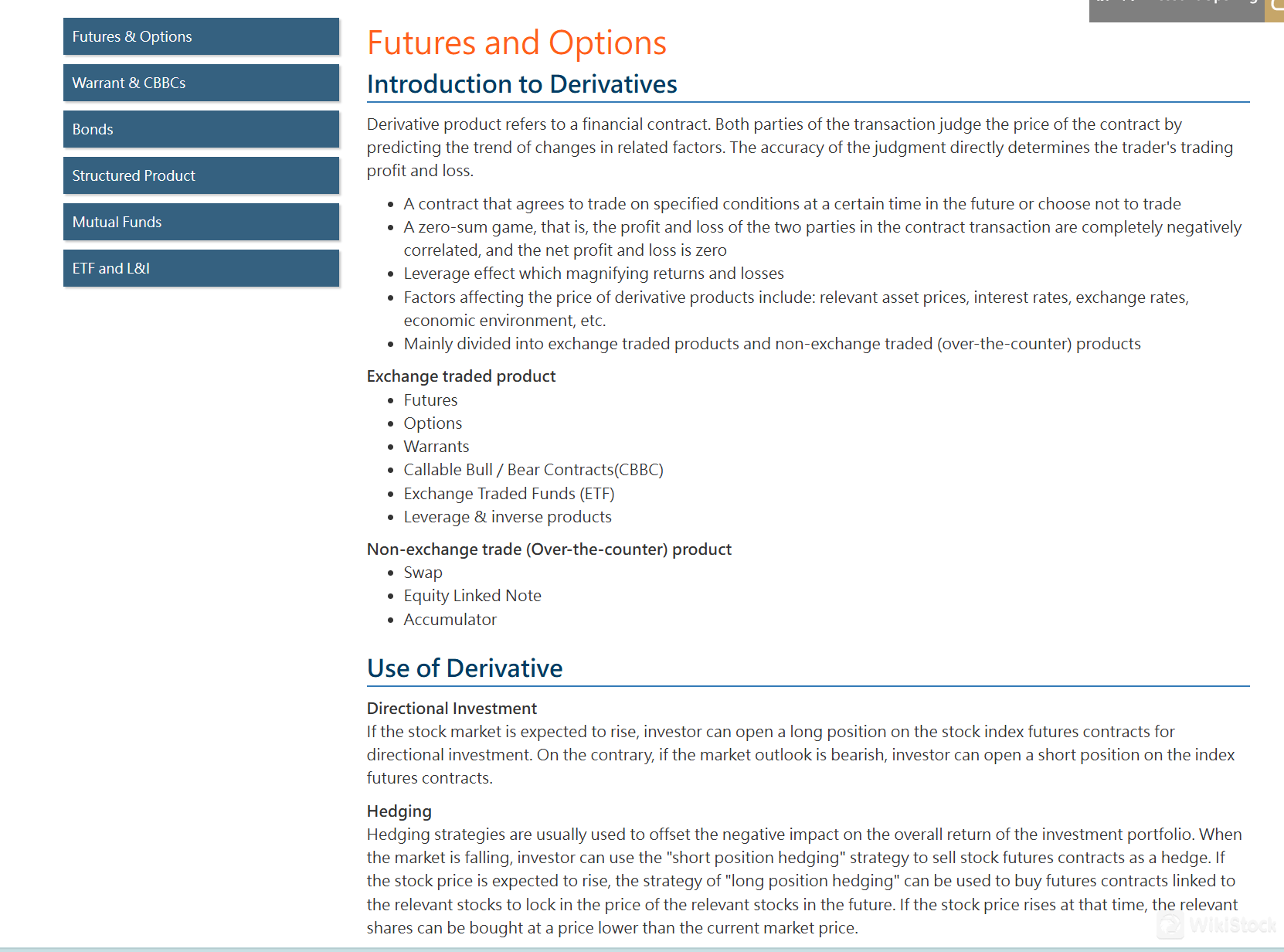

The Education Center at Quam Securities provides valuable resources designed to educate investors on various financial products and the associated risks. This includes:

Product Introductions:

Detailed Explanations: Comprehensive introductions to different financial products offered by Quam Securities, including equities, futures, options, and bonds.

Investment Guides: Step-by-step guides on how to invest in these products, tailored for both beginners and experienced investors.

Risk of Investing:

Risk Awareness: Information on the potential risks associated with different types of investments, helping investors understand what they are getting into.

Risk Management Strategies: Tips and strategies on how to manage and mitigate investment risks effectively.

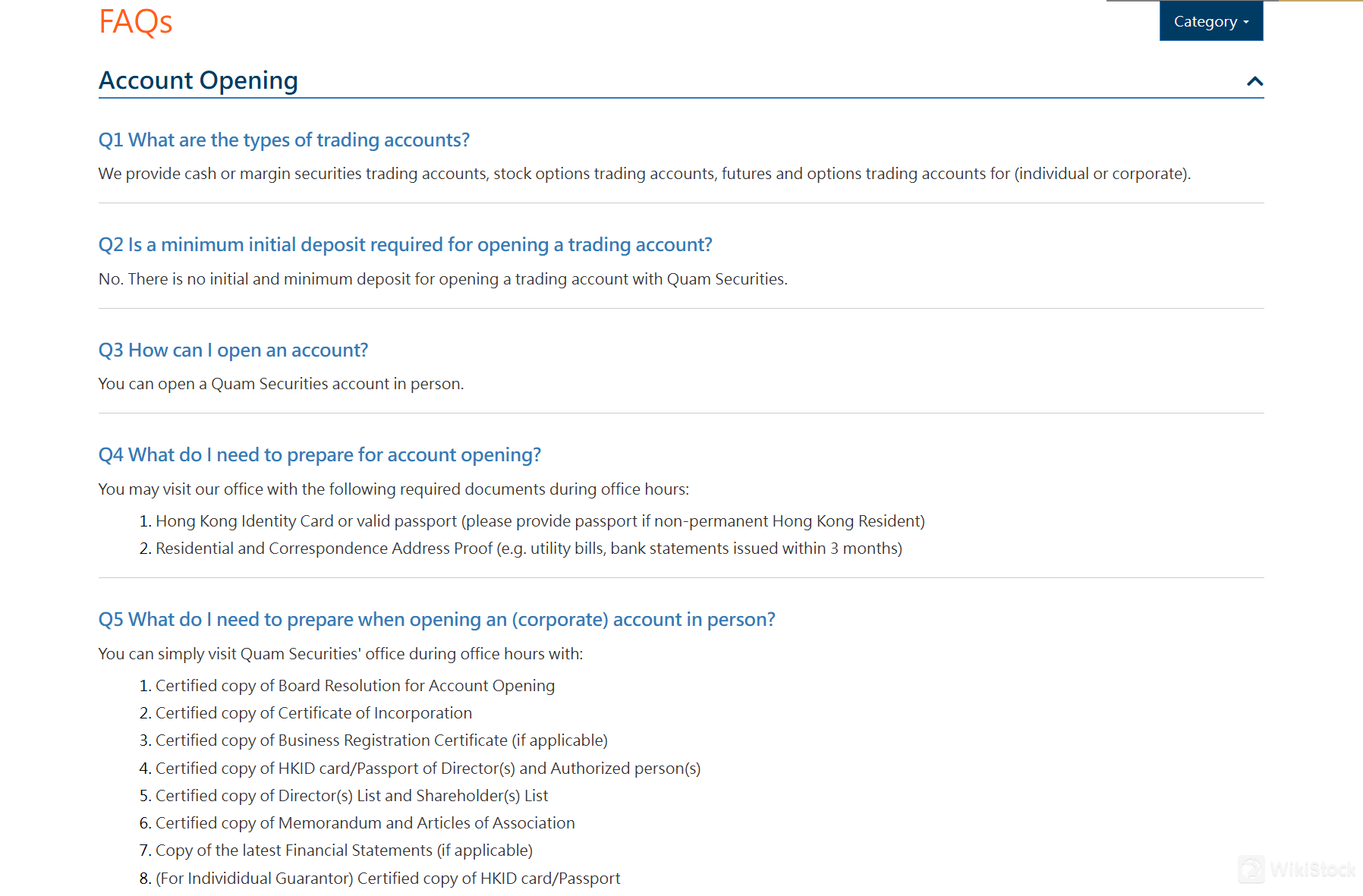

It also offers a frequently asked questions center, which addresses common queries and concerns from investors, providing clear and concise answers.

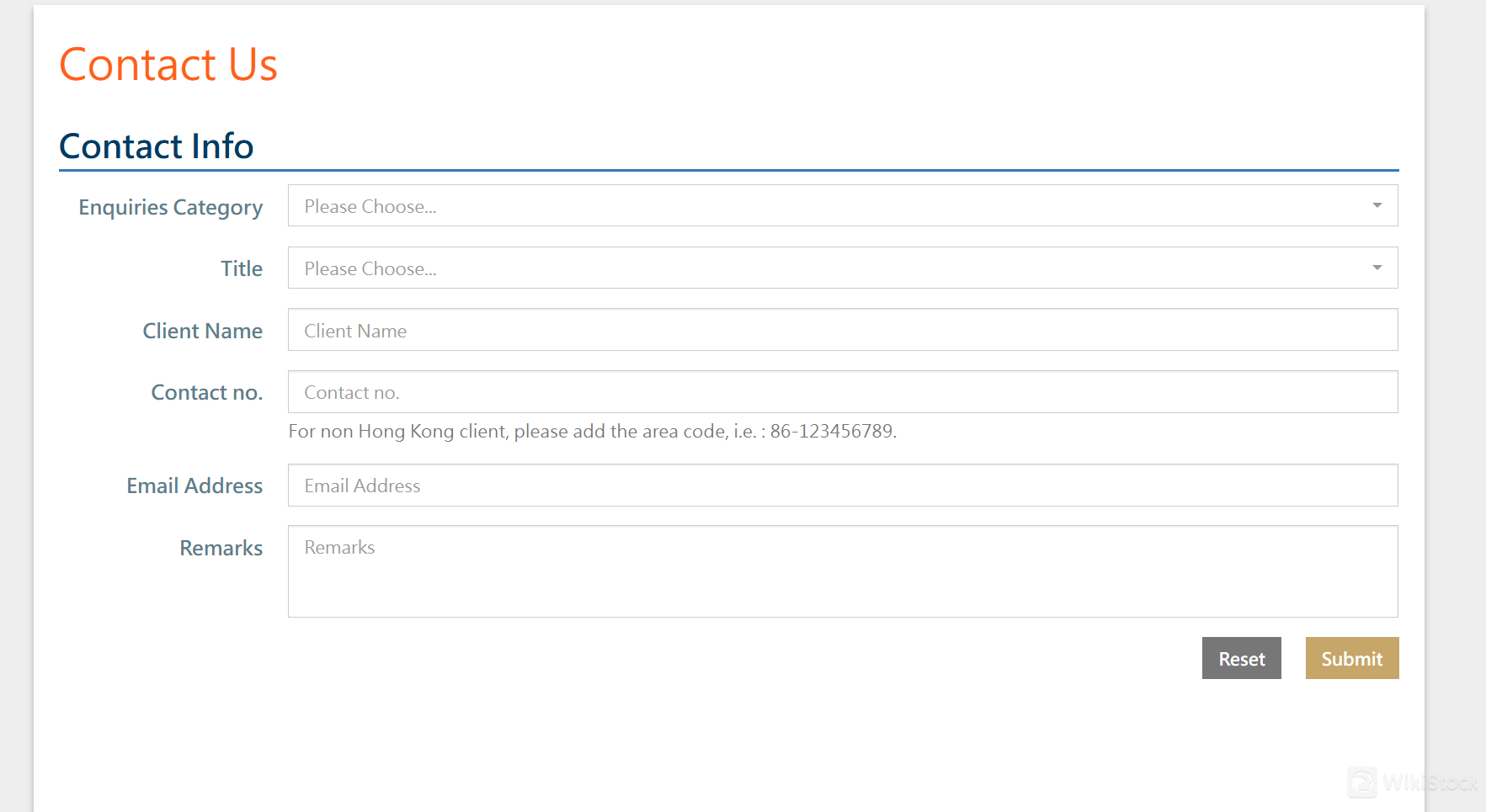

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Tel: (852) 2847-2222

Fax: (852) 2845-1935

Email: QSeccs@quamgroup.com

Address: 5/F, Wing On Centre, 111 Connaught Road Central, Hong Kong

Quam Securities offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform.

Conclusion

Quam Securities stands out as a comprehensive and dynamic financial services provider, offering a wide range of trading options and investment opportunities. With its 24/7 operations, advanced trading platforms, and diverse financial instruments, Quam Securities caters to both individual and institutional clients looking for efficient and flexible trading solutions. Targeted clients include individual investors and institutional clients. However, clients should be aware of the complex fee structure, the reliance on technology, and the risks associated with margin trading.

Frequently Asked Questions (FAQs)

Is Quam Securities regulated?

Yes. It is regulated by SFC.

Is there a minimum balance requirement to open a trading account with Quam Securities?

No, Quam Securities does not require an initial deposit or impose a minimum balance to open a trading account.

Can I trade on global markets with Quam Securities' platforms?

Yes, Quam Securities platforms allow you to trade on over 20 global exchanges, including the Hong Kong Exchange and Clearing Limited.

What fees and charges should I be aware of when trading with Quam Securities?

Quam Securities has a detailed and transparent fee structure, including fees for equity trading, futures and options trading, currency futures/options, custody and settlement, corporate actions, and other miscellaneous charges. Its important to review the fee schedule to understand the costs associated with your trading activities.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

--