Success does not provide insurance coverage for customer account balances. However, clients' assets are protected through measures such as segregation and custodianship, ensuring they remain separate from the company's own funds.

Safety Measures:

Success implements stringent security measures to protect its users' assets and data. These include encryption protocols to safeguard sensitive information and regular security audits to identify and address vulnerabilities.

Additionally, Success employs multi-factor authentication to prevent unauthorized access to accounts. Client assets are often held in segregated accounts, ensuring they remain separate from the company's own funds. Continuous monitoring of the platform for suspicious activities further enhances security.

What are Securities to Trade with Success?

Hong Kong Stock Market: Success facilitates trading in a wide range of stocks listed on the Hong Kong Stock Exchange (HKEX). Investors can access various categories of stocks, including blue-chip, small and mid-cap, and newly listed companies. With trading available during HKEX's standard hours, investors can engage in one of the world's vibrant financial markets.

Global Securities Market: In addition to Hong Kong stocks, Success enables trading in major global markets such as the USA, UK, China, Australia, Japan, Korea, Singapore, and Taiwan. This expanded offering allows investors to diversify their portfolios and capitalize on opportunities across different time zones and regions.

Success's provision of both Hong Kong and global securities trading offers investors significant breadth in their investment options. However, while they cover major global markets, the depth of available securities beyond these key regions might be limited.

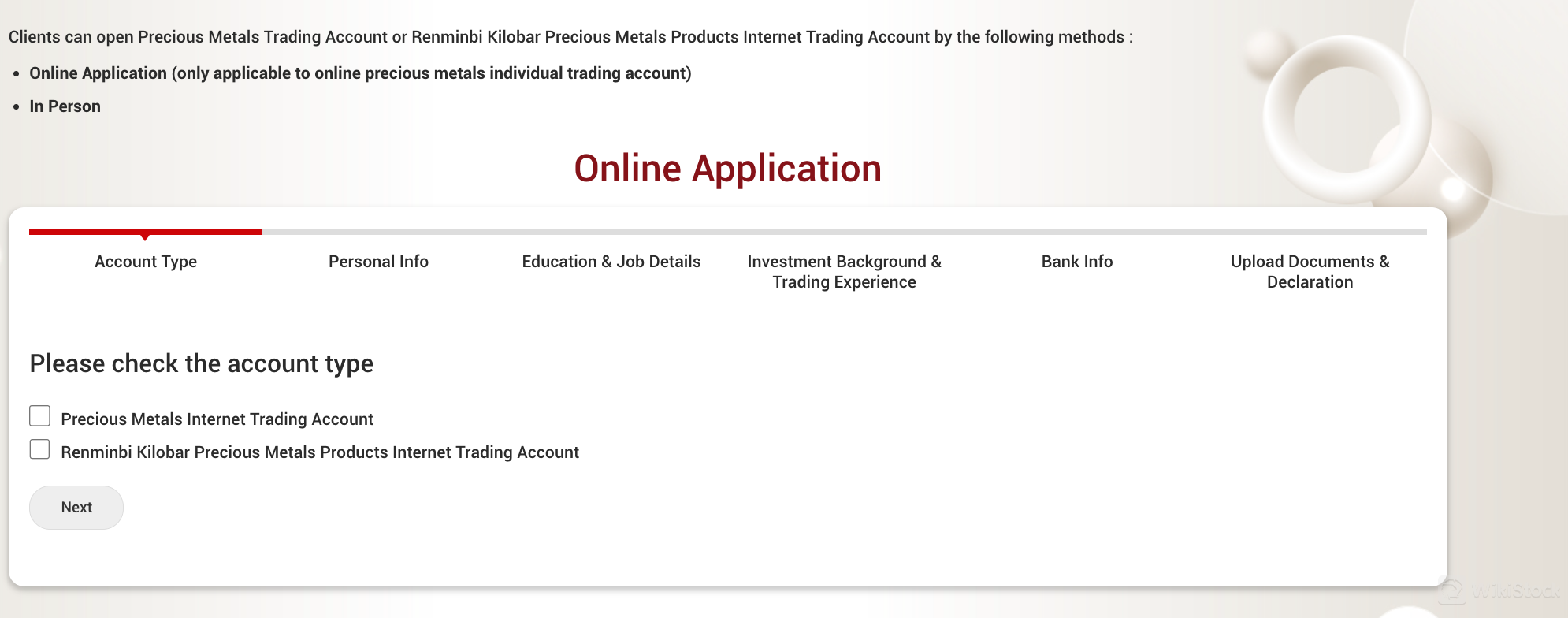

Success Accounts

Success offers different account types tailored to various investor needs.

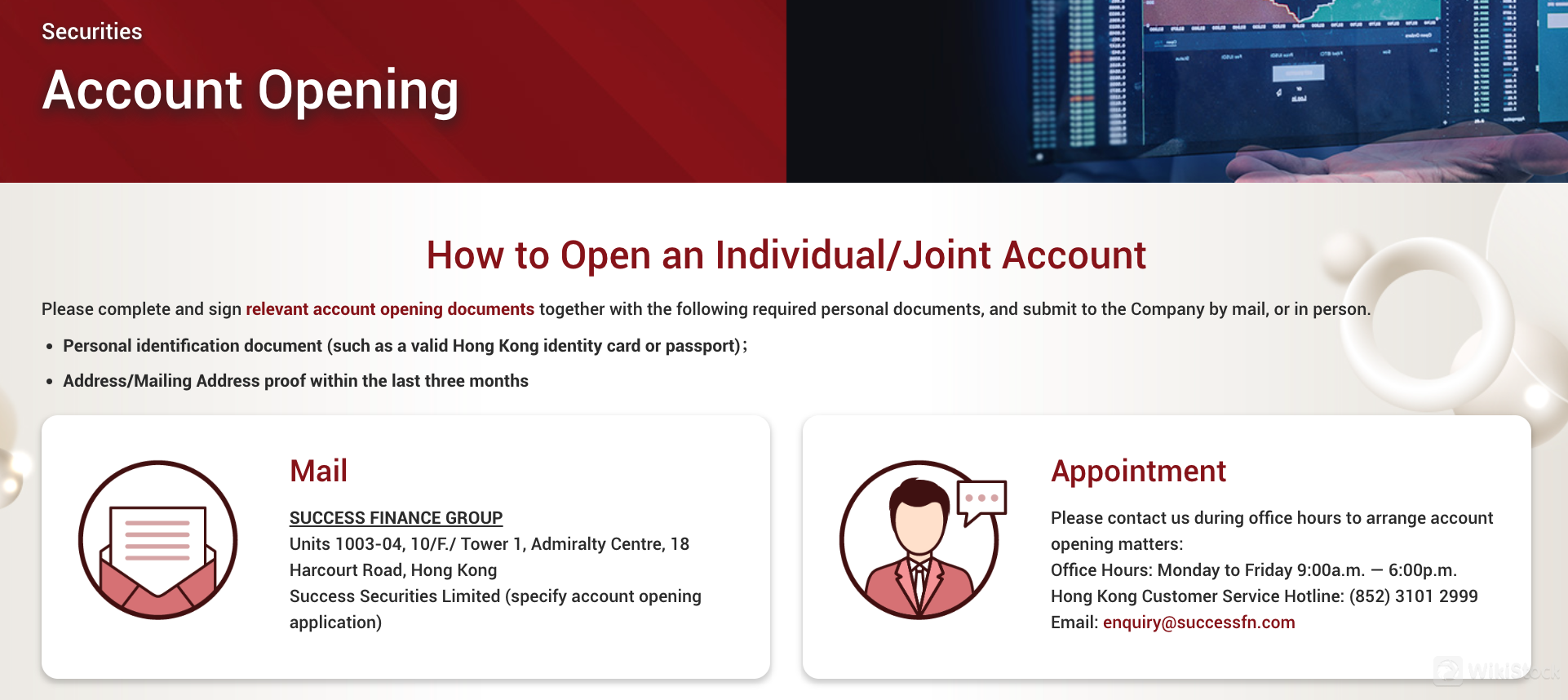

The Individual/Joint Account serves individual investors or groups who seek to trade securities and precious metals. It provides access to a wide range of investment products and allows for personalized trading strategies based on individual preferences and risk tolerance.

The Internet Trading Account is suitable for tech-savvy investors who prefer to manage their investments online. With convenient access via web platforms, this account type appeals to users looking for ease of use and quick execution of trades.

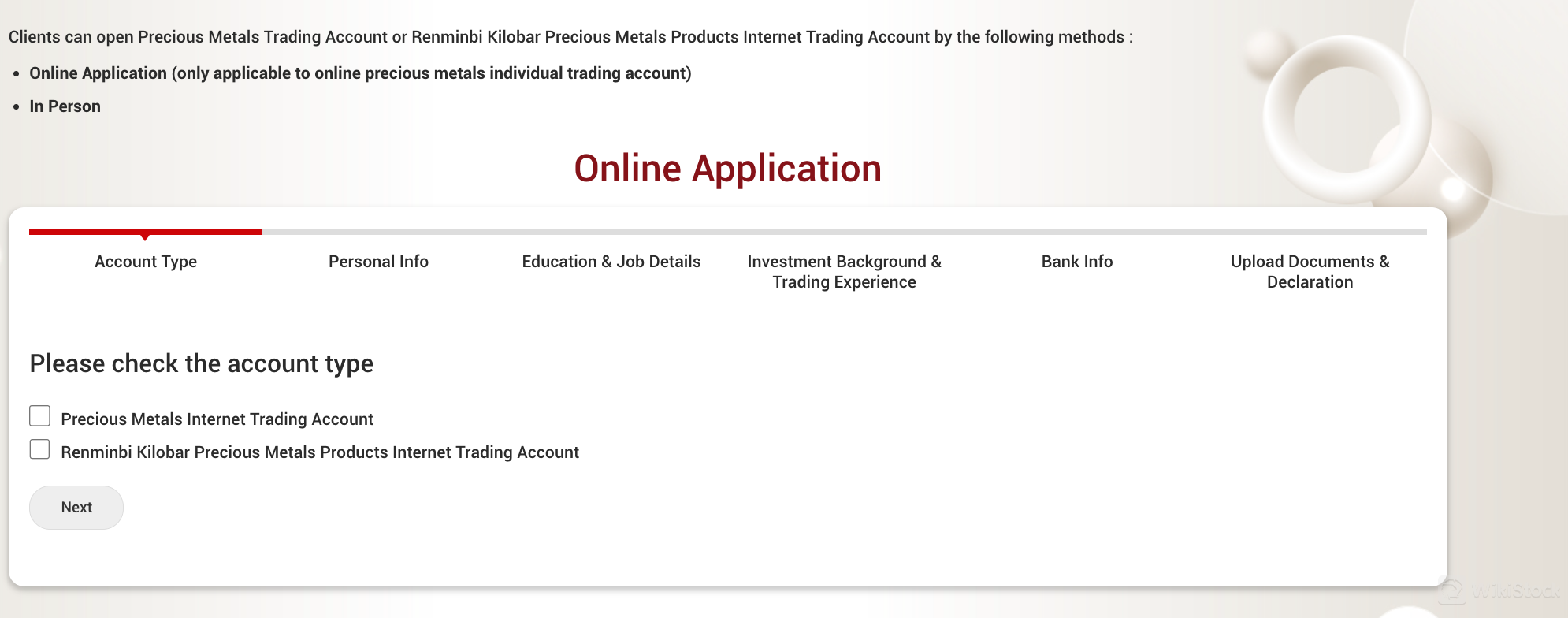

The Renminbi Kilobar Precious Metals Products Internet Trading Account targets investors interested specifically in trading Renminbi Kilobar precious metals products. This account provides focused access to this niche market.

Services

Success provides Precious Metals Trading and Property Loan Services.

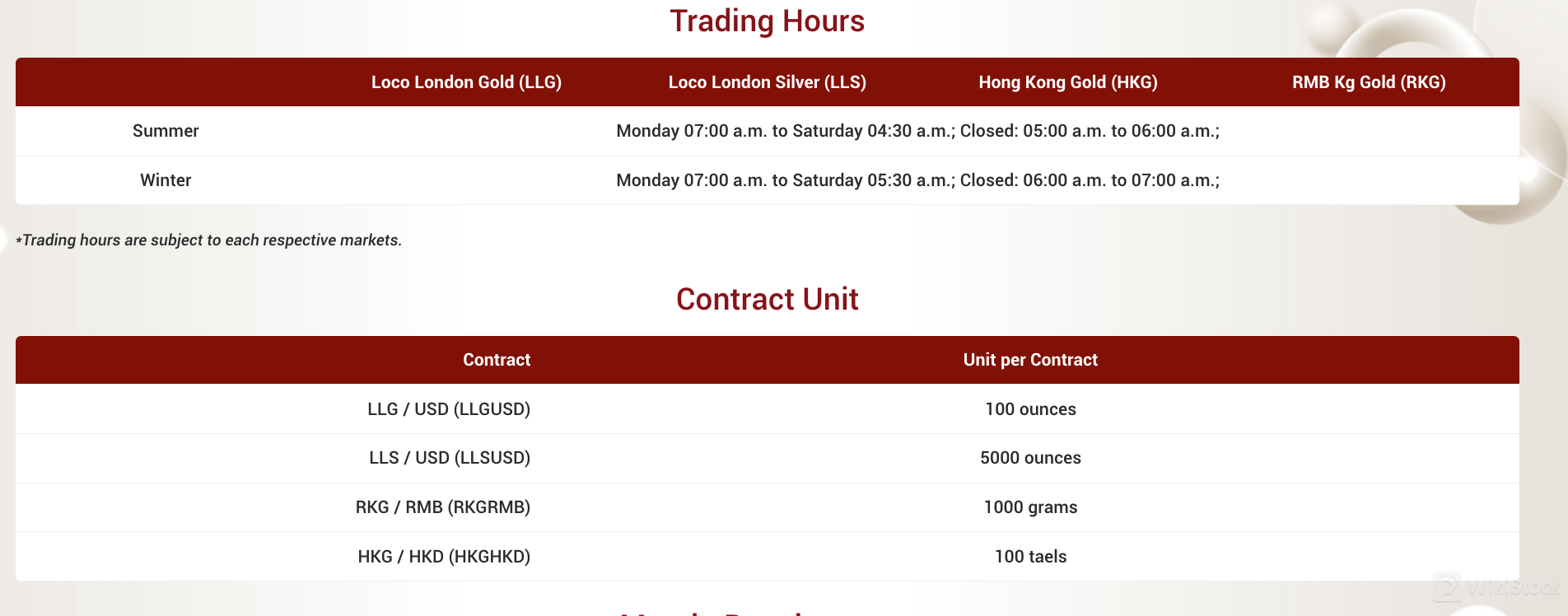

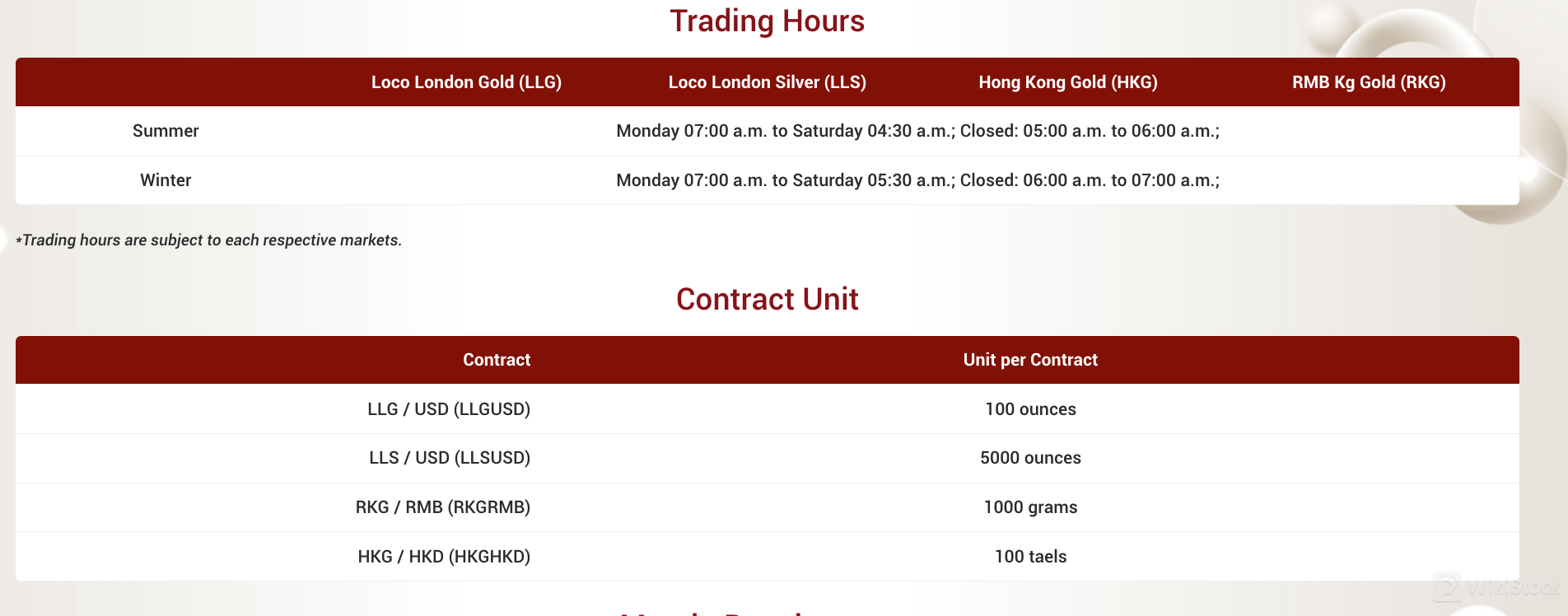

Precious Metals Trading: Success facilitates extensive trading in precious metals, including Loco London Gold (LLG), Loco London Silver (LLS), Hong Kong Gold (HKG), and RMB Kg Gold (RKG).

Property Loan Services: Success Credit Service Limited (SCS), a subsidiary of Success Finance Group, offers comprehensive property financing options. These include first and second mortgages, refinancing, and additional charges. Features of these services include free property valuation, no restrictions on the age of the property, and loan amounts up to 90% of the property's value.

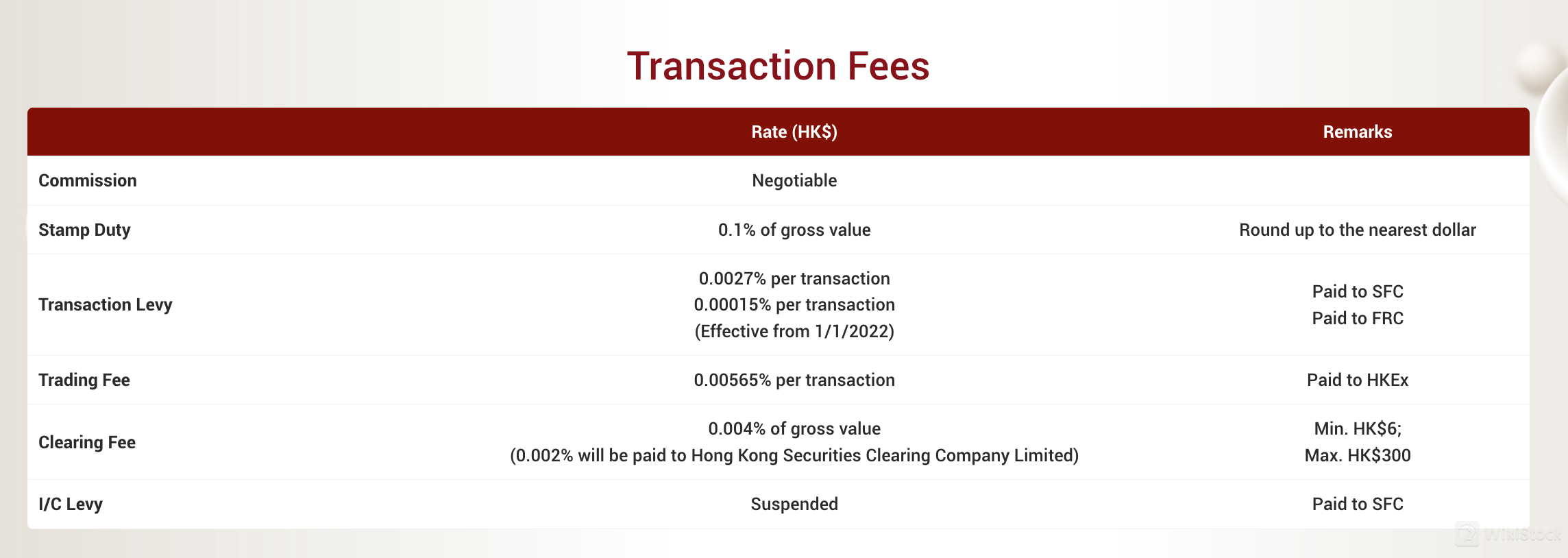

Success Fees Review

Stock Trading Fees

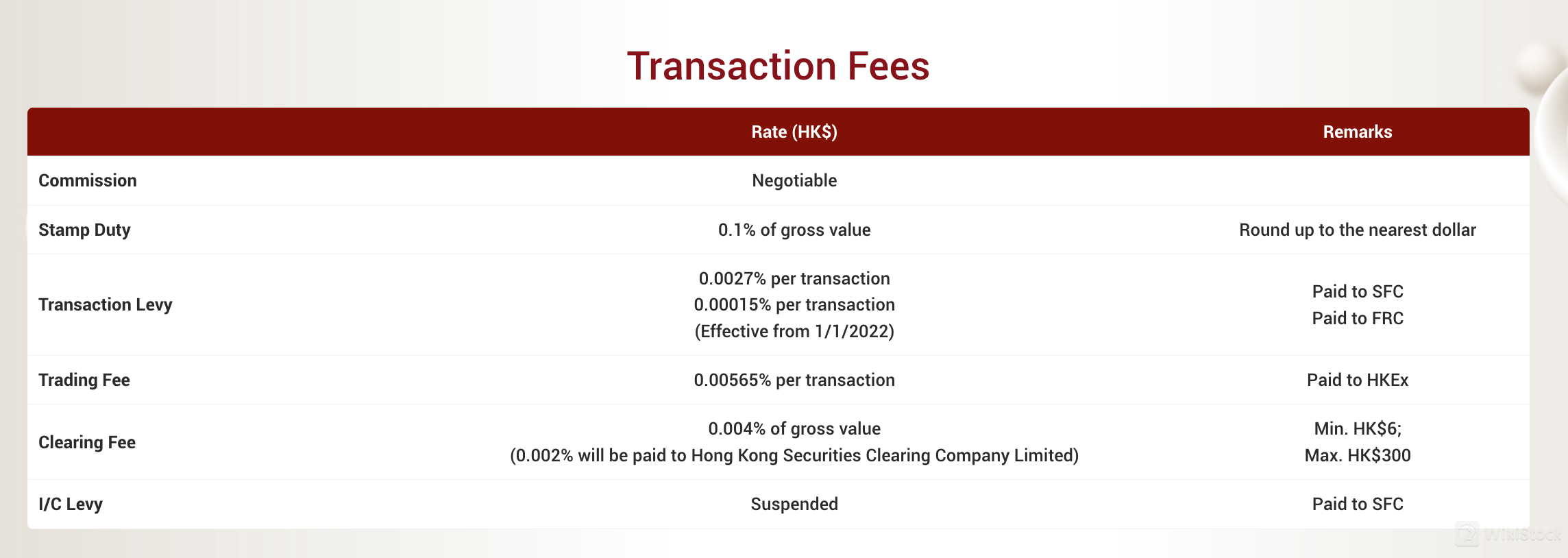

Commission: The commission rate for stock trading with Success is negotiable. However, this fee typically varies based on the volume and value of the transaction.

Stamp Duty: Investors are charged 0.1% of the gross value of each transaction, rounded up to the nearest dollar.

Transaction Levy: Two levies apply—0.0027% paid to the SFC and 0.00015% paid to the Financial Reporting Council (FRC).

Trading Fee: A fee of 0.00565% is applied per transaction and is paid to the Hong Kong Exchange (HKEx).

Clearing Fee: This fee is 0.004% of the gross value of the transaction, with a minimum of HK$6 and a maximum of HK$300. Half of this fee is paid to the Hong Kong Securities Clearing Company Limited.

I/C Levy: This is currently suspended.

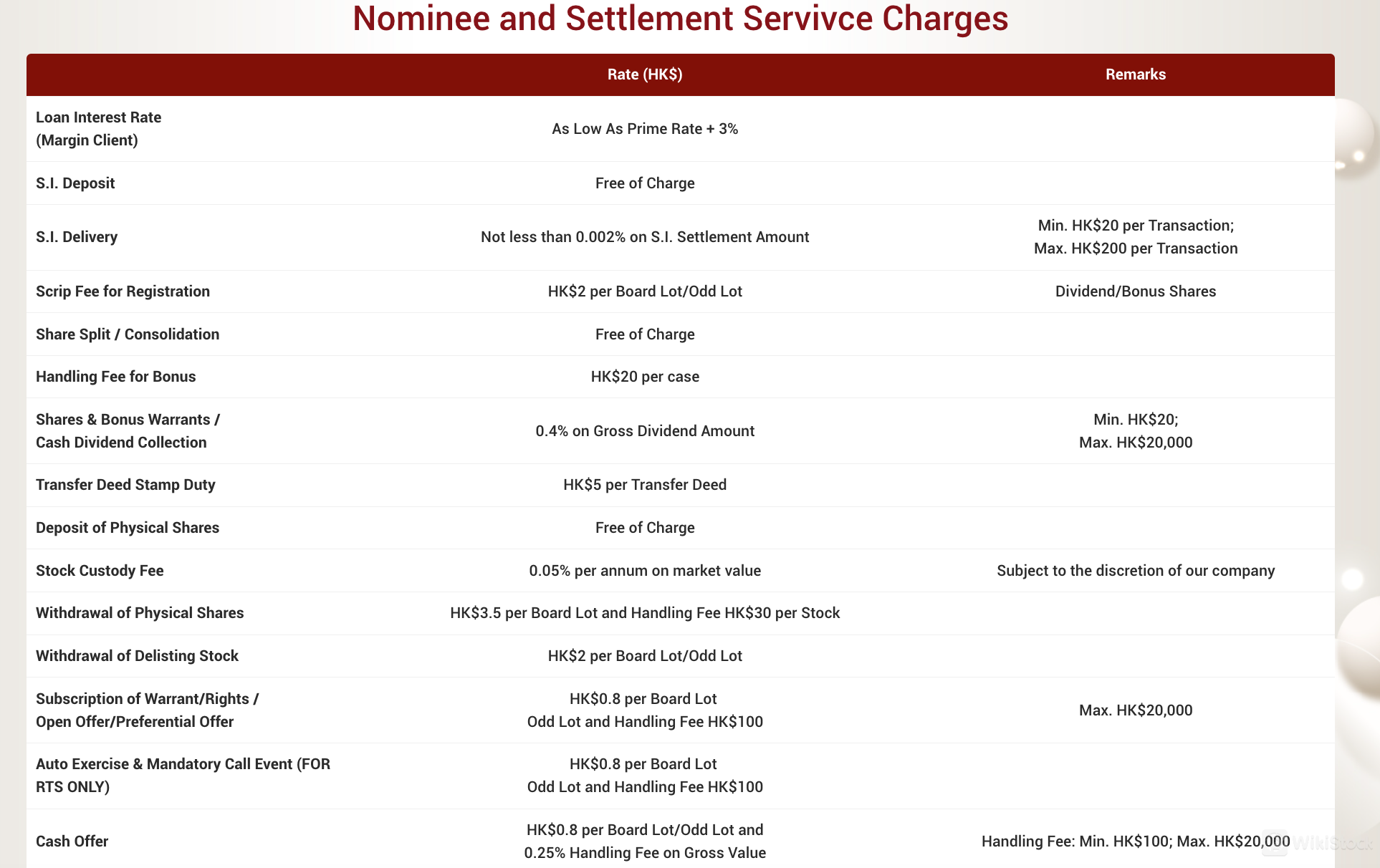

Margin Trading Fees

Nominee and Settlement Service Charges

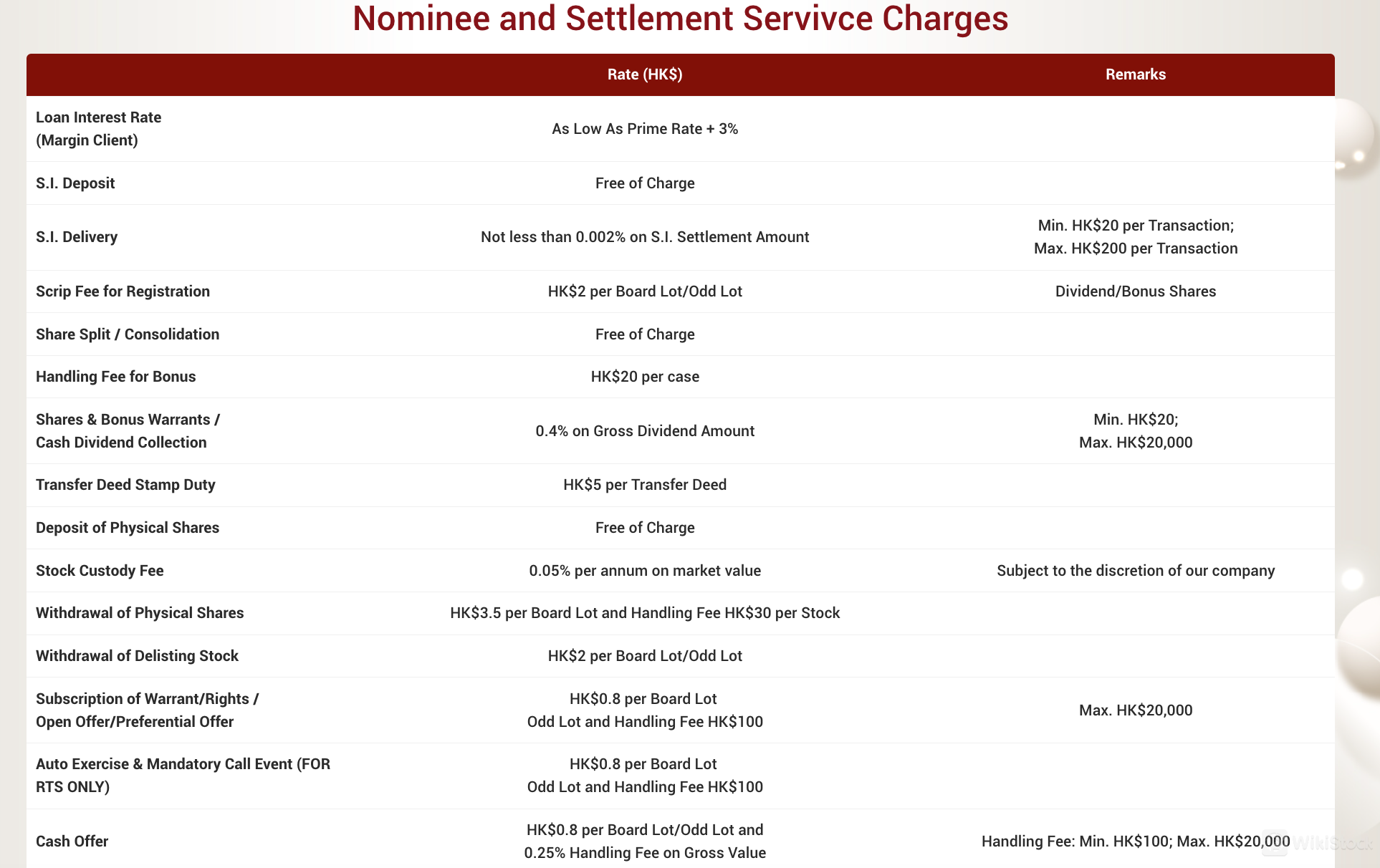

S.I. Deposit: There is no charge for Standard Instruction (S.I.) deposits.

S.I. Delivery: Charges for S.I. delivery are not less than 0.002% of the settlement amount, with a minimum of HK$20 and a maximum of HK$200 per transaction.

Scrip Fee for Registration: A fee of HK$2 per board lot or odd lot is charged for registration services related to dividend or bonus shares.

Handling Fee for Bonus: A handling fee of HK$20 per case is applied for processing bonus shares.

Cash Dividend Collection: The collection fee for cash dividends is 0.4% of the gross dividend amount, with a minimum charge of HK$20 and a maximum of HK$20,000.

Other Service Fees

Stock Custody Fee: An annual fee of 0.05% of the market value of the stocks held in custody is charged. The specific rate is subject to the discretion of the company.

Withdrawal of Physical Shares: For physical share withdrawals, the fee is HK$3.5 per board lot plus a handling fee of HK$30 per stock.

IPO Application Handling Fee: There is a handling fee of HK$30 per application per stock for IPO applications.

Success's fee structure shows a mix of competitive and average pricing across different service categories:

Stock Trading Commission: Given that the commission rate is negotiable and often lower for high-volume trades, it can be competitive. For comparison, brokers like Interactive Brokers offer commission rates that are typically under 0.1%, which is considered low. Thus, Success's negotiable rate could be low or average depending on the specifics of the negotiation.

Stamp Duty and Other Transaction Fees: The stamp duty of 0.1% is standard across the industry in Hong Kong, matching what most brokers charge.

Account-Related Fees: Success's various account-related charges, such as the stock custody fee at 0.05% per annum and the handling fees for IPO applications and dividend collections, are comparable to industry norms. Brokers like Charles Schwab and Fidelity often offer similar services at comparable or slightly lower rates.

Success's margin interest rate for loans starts at Prime Rate plus 3%. This rate is variable and applies to margin clients, offering a competitive option for borrowing against securities. The actual rate depends on the prime rate set by major banks and may fluctuate accordingly.

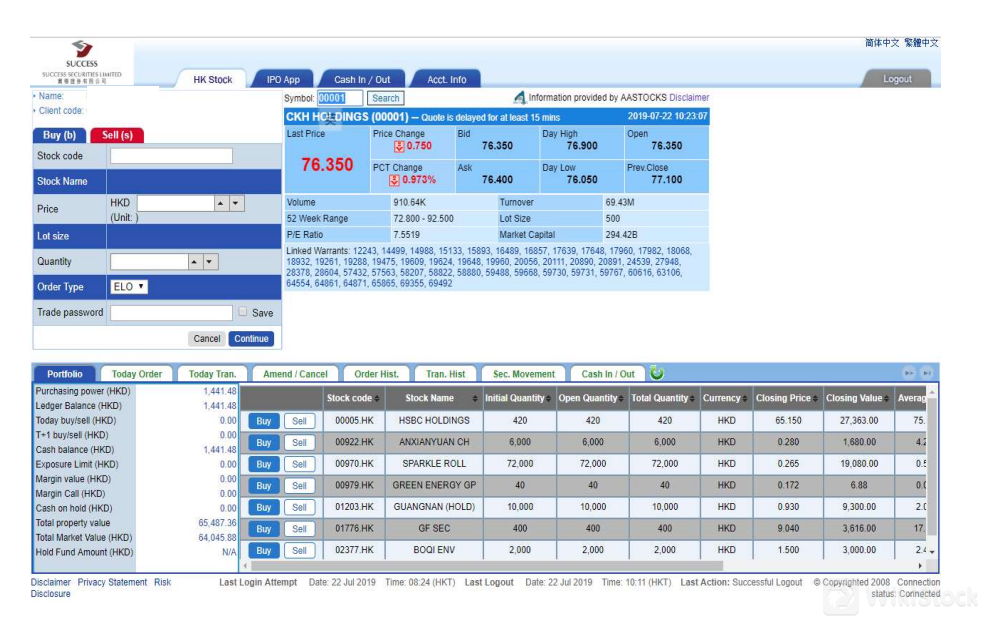

Success Trading Platform Review

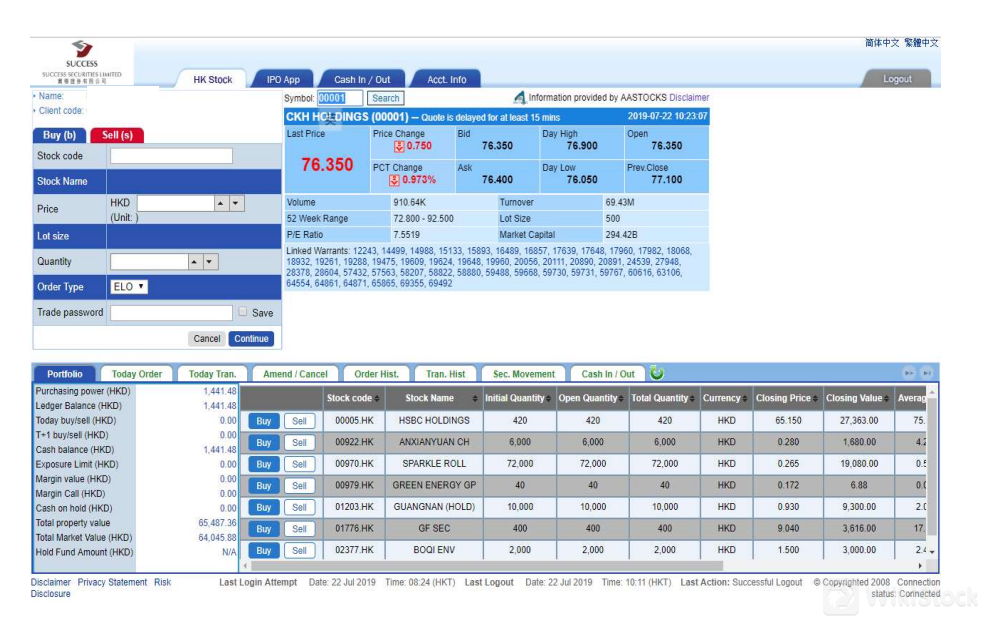

The Success Web Trading Platform provided by Success can be used for online securities trading and portfolio management.

User-Friendly Interface: The platform offers a clean and intuitive layout for easy navigation, suitable for all experience levels.

Real-Time Data and Quotes: Provides live market data and updates, helping users make timely trading decisions.

Order Management: Supports various order types, including market, limit, and stop orders, with efficient execution.

Portfolio Management: Users can view and manage their holdings, track performance, and review transaction history.

Research and Analysis: Includes tools for market analysis, trends, and economic calendars.

While functional and user-friendly, the Success Web Trading Platform lacks some advanced features compared to top brokers' platforms, which offer extensive customization and deeper research tools. It's suitable for basic trading needs but might not satisfy advanced traders looking for more robust capabilities.

Research & Education

Success offers a variety of educational resources and research tools. These include:

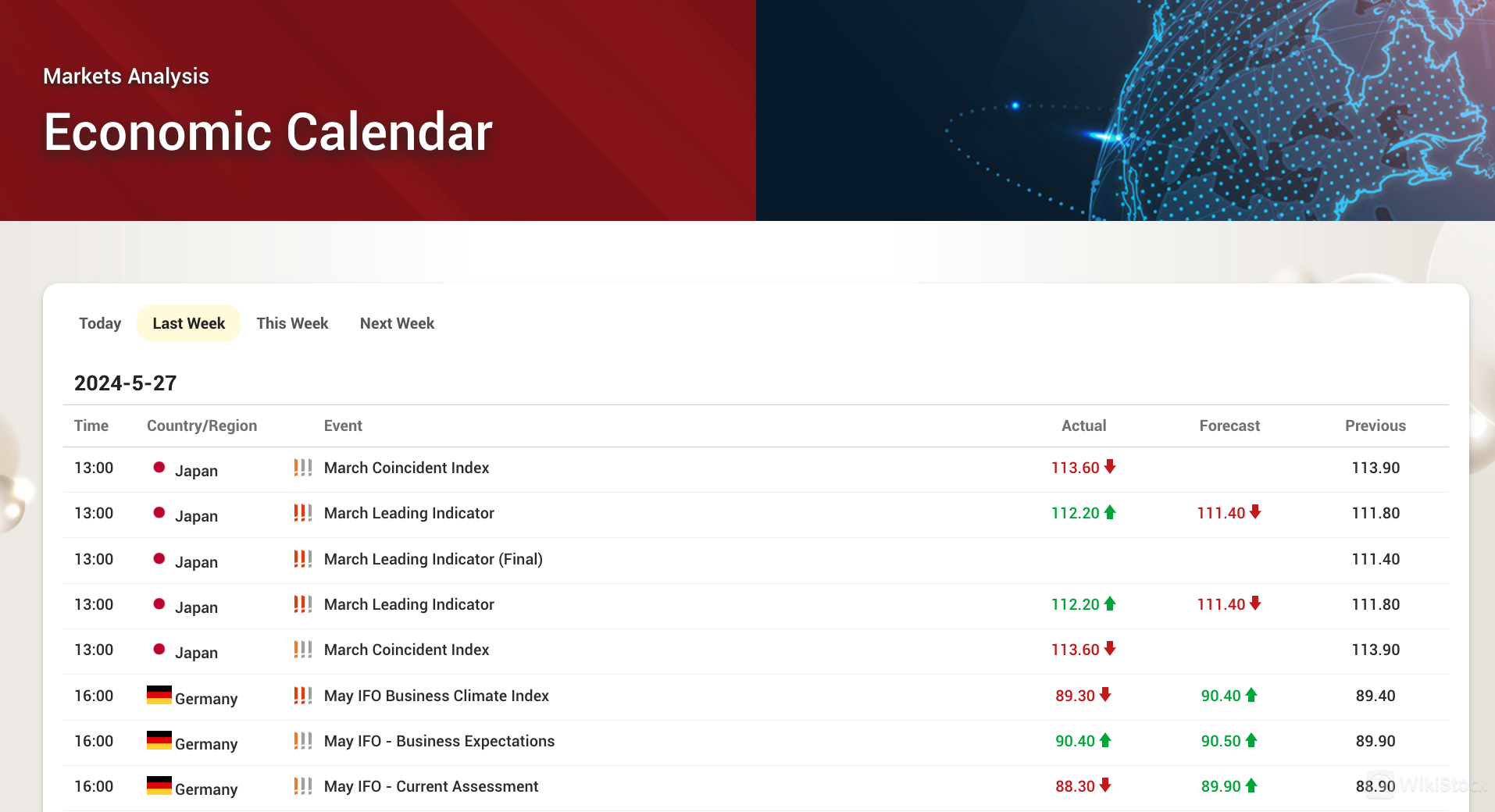

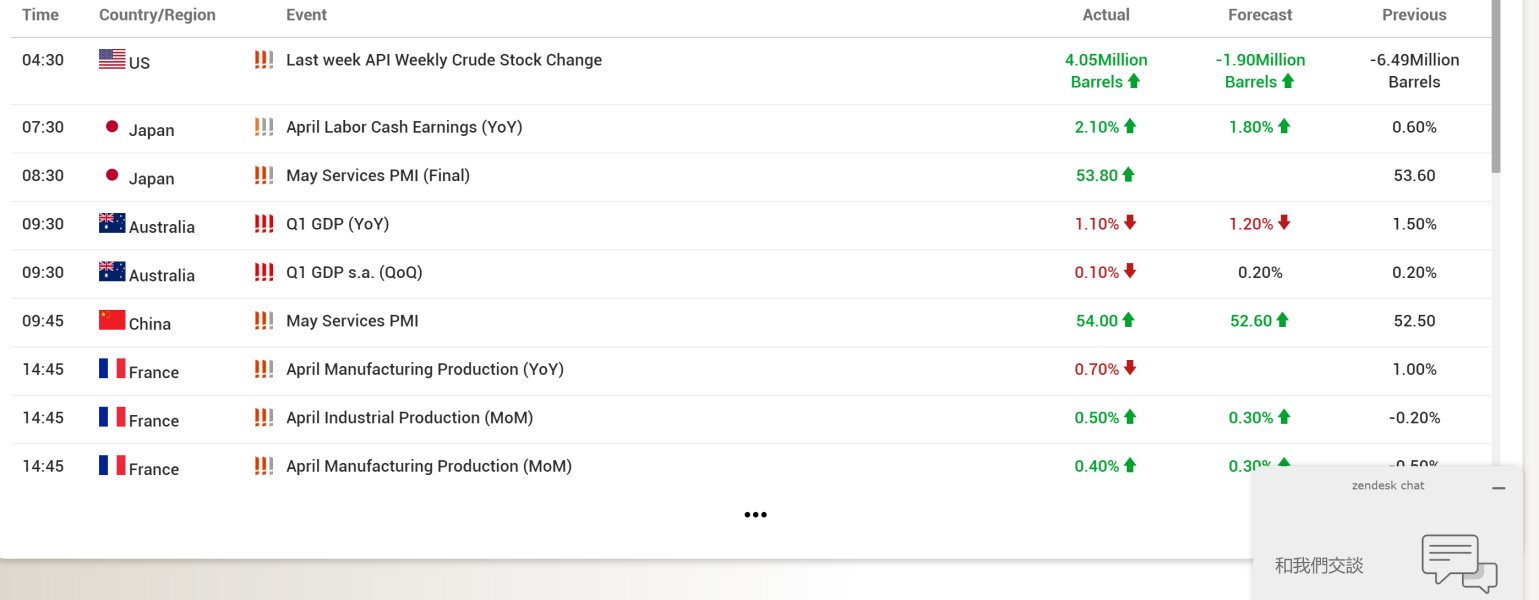

Market Analysis: Provides comprehensive reviews and forecasts of market trends, helping investors make informed decisions.

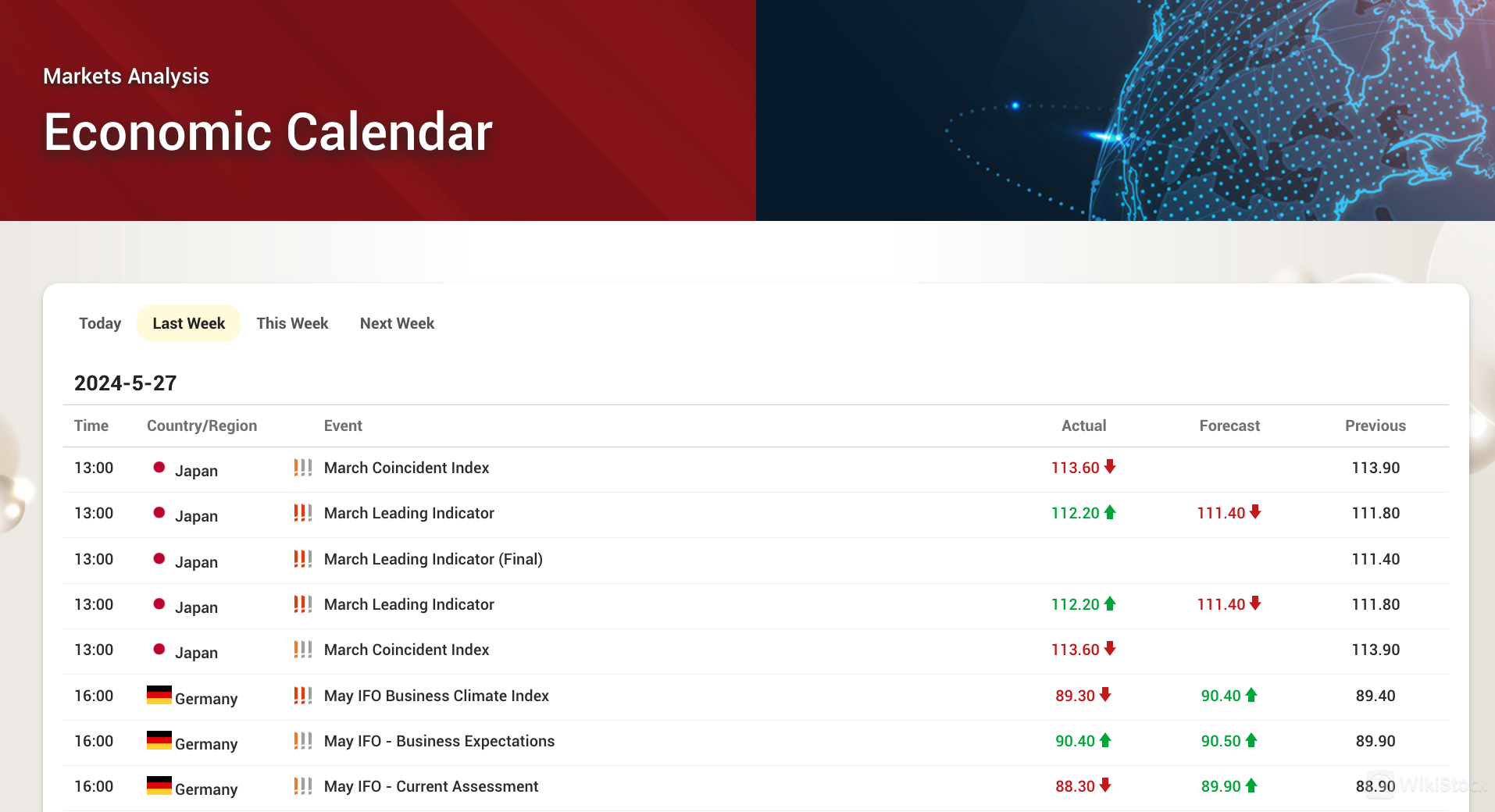

Economic Calendar: Features key financial events and economic indicators, enabling users to track upcoming data releases and events that could impact markets.

Financial Express – Securities and Bullion: Delivers detailed reports and analysis on equities and precious metals, offering depth and specificity for investors focused on these areas.

Customer Service

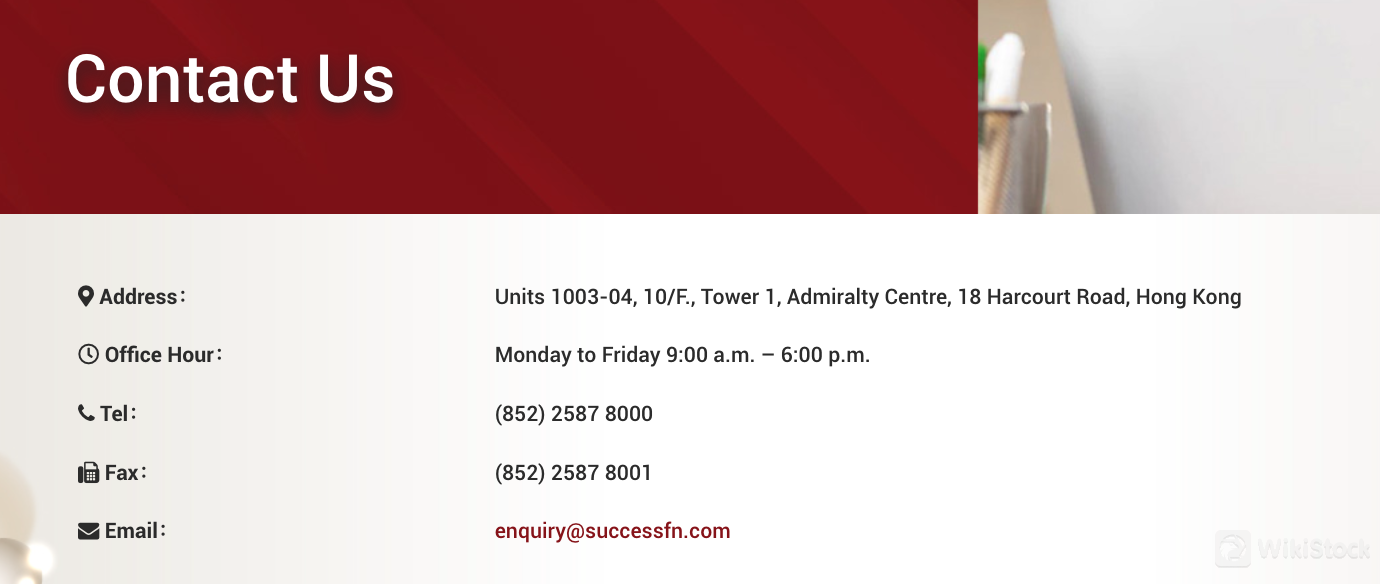

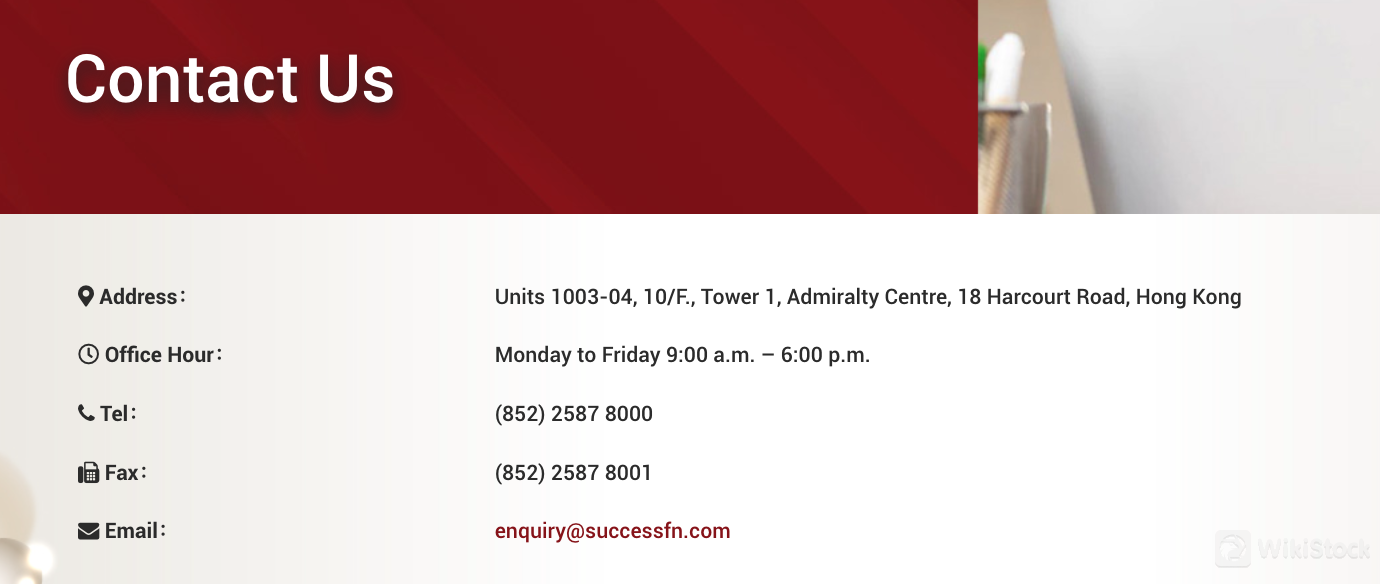

Success provides customer support through multiple channels.

You can reach their support team by phone at (852) 2587 8000 or send a fax to (852) 2587 8001. They also accept email inquiries at enquiry@successfn.com. Their office is located at Units 1003-04, 10/F, Tower 1, Admiralty Centre, 18 Harcourt Road, Hong Kong.

Customer service is available Monday to Friday from 9:00 a.m. to 6:00 p.m.

Conclusion

In conclusion, Success offers a user-friendly trading platform with competitive fees, making it attractive for cost-conscious investors.

However, its limited range of tradable securities and lack of a mobile trading app deter more experienced traders seeking broader investment options and convenient access.

The platform is suitable for individual investors and small to medium-sized traders who prioritize simplicity and affordability over advanced features.

FAQs

Uganda

UgandaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

--

--

--

--

--

Neutral

Neutral