Score

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

China

ChinaProducts

10

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Surpassed 58.73% brokers

Securities license

Obtain 1 securities license(s)

CSRCRegulated

ChinaSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China SSE

联储证券股份有限公司

Brokerage Information

More

Company Name

LIAN CHU SECURITIES CO.,LTD.

Abbreviation

联储证券

Platform registered country and region

Company address

Company website

https://www.lczq.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Funding Rate

8.35%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| LC Securities |  |

| WikiStock Rating | ⭐ ⭐ ⭐ ⭐ |

| Account Minimum | 5 yuan |

| Fees | Shanghai and Shenzhen A-shares: commission capped at 0.3‰ (min 5 yuan);Funds: commission capped at 0.3‰ (min 5 yuan);Bonds: commission capped at 0.02‰ (min 1 yuan) |

| Account Fees | No fees for closing securities accounts |

| Mutual Funds Offered | Yes |

| App/Platform | Lianchu Securities Shuyingtong (Tongdaxin), Lianchu Securities Shuyingshun (Tonghuashun), Lianchu Securities Qiquanbao, and more |

| Promotions | Not available yet |

What is LC Securities?

Established in 2001 and headquartered in Qingdao, Shandong Province, LC Securities is a fully licensed comprehensive securities firm with a mission centered on “creating value”. The firm is known for its competitive fee structure, user-friendly trading apps, and extensive educational resources designed to empower investors with knowledge. LC Securities facilitates access to IPOs and offers multiple trading platforms, appealing to investors looking to actively participate in the securities market. However, the firm does not support forex or cryptocurrency trading and does not provide promotional offers, which may be a consideration for investors seeking these specific services.

Pros and Cons of LC Securities?

LC Securities, regulated by the China Securities Regulatory Commission (CSRC), offers a comprehensive suite of services tailored to the needs of investors. Key advantages include access to IPOs, multiple trading platforms, and a wealth of educational resources designed to enhance investor knowledge and confidence. Clients benefit from a transparent fee structure, with no charges for closing securities accounts, making account management more straightforward and cost-effective.

However, there are some limitations to consider. LC Securities does not support forex or cryptocurrency trading, which may be a drawback for investors looking to diversify into these markets. Additionally, the lack of promotional offers or incentives could be a disadvantage for clients seeking added value from their brokerage service.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Is LC Securities safe?

Regulations

LC Securities is licensed by the China Securities Regulatory Commission (CSRC).

Safety Measures

LC Securities adheres to regulatory requirements when handling clients' personal identity information for securities account opening and related activities. Necessary information, such as personal identity and bank card details, is submitted to relevant institutions like the China Securities Depository and Clearing Corporation, stock exchanges, the National Equities Exchange and Quotations, tripartite custody banks, and fund companies. Only the essential information required by these institutions is submitted, solely for account opening and related purposes. If clients do not provide the necessary information or fail real-name verification, they cannot open an account with LC Securities. Client data is encrypted during transmission and securely stored on LC Securities' servers. LC Securities will not share client information with third parties unless clients choose to do so or as required by laws, regulations, or authorized authorities.

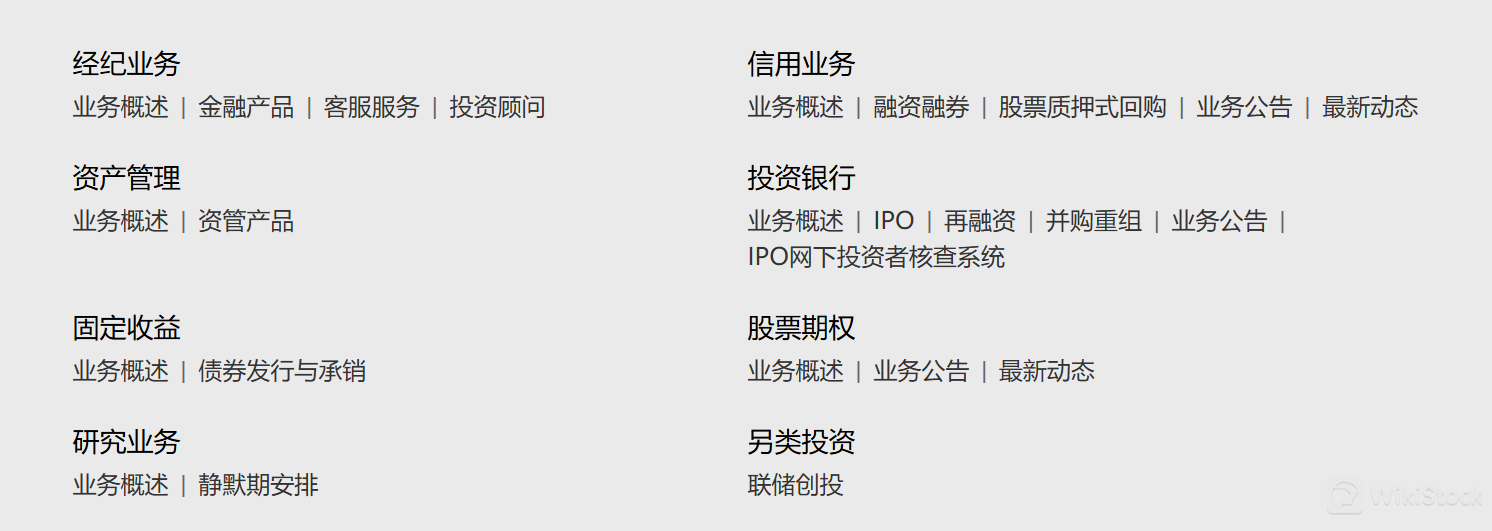

What are securities to trade with LC Securities?

LC Securities offers a variety of trading instruments, including stocks, funds, margin financing and securities lending, stock options, and bonds. Investors can trade A-shares listed on the Shanghai and Shenzhen stock exchanges, including those on the Growth Enterprise Market (GEM) and the Science and Technology Innovation Board (STAR Market). LC Securities also provides access to a wide range of funds, such as closed-end funds, exchange-traded funds (ETFs), listed open-ended funds (LOFs), and publicly offered real estate investment trusts (REITs).

The firm offers margin financing and securities lending services, allowing investors to borrow funds to purchase securities or lend securities to generate additional returns. Additionally, clients can trade stock options, enabling them to hedge risks or speculate on future movements of stock prices. LC Securities also facilitates bond trading, including government, corporate, and convertible bonds, providing investors with diverse fixed-income investment opportunities.

However, it does not provide cryptocurrency or foreign exchange trading.

LC Securities Accounts

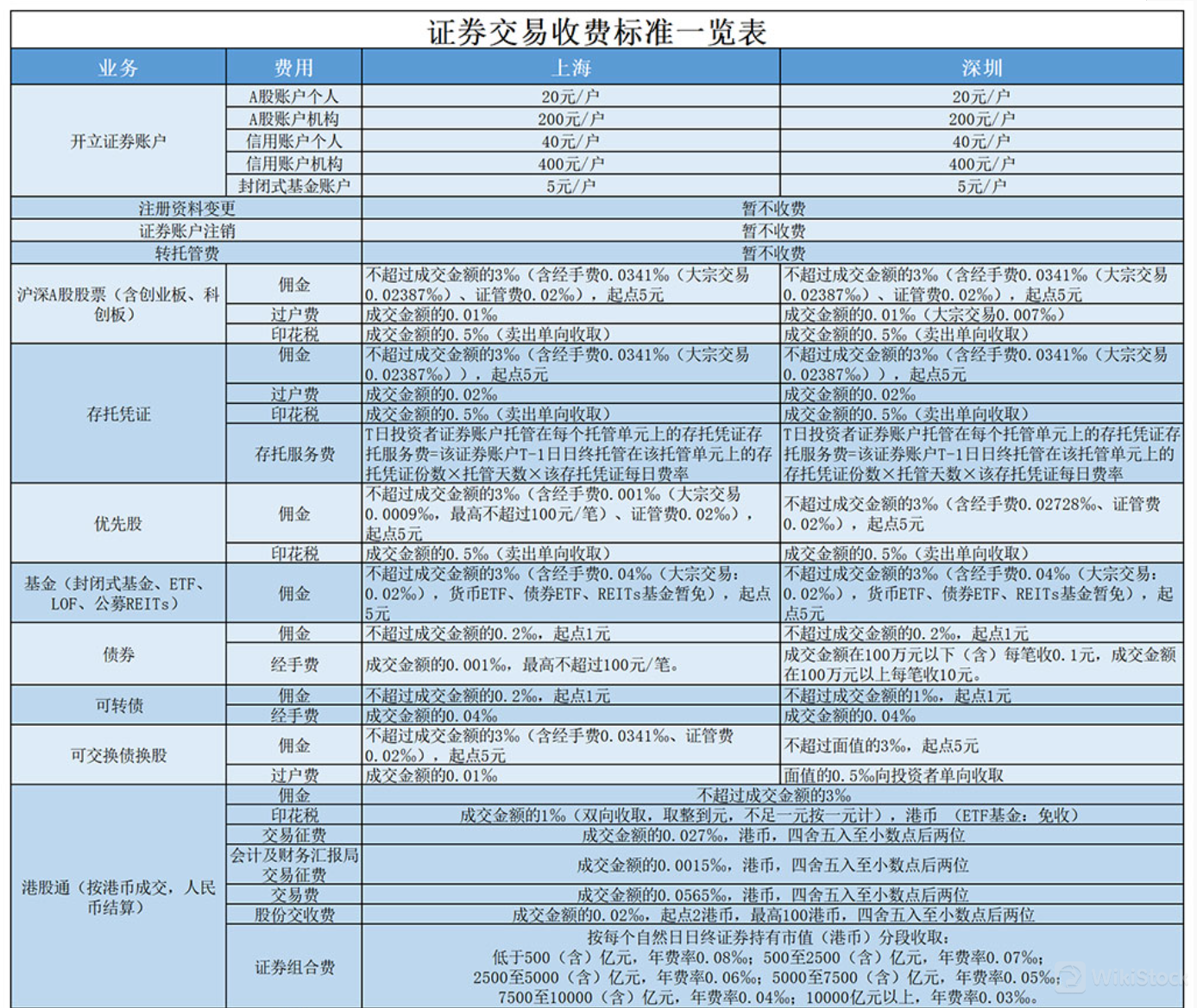

LC Securities offers a range of account types, with transparent and standardized fees across Shanghai and Shenzhen markets.

For A-share accounts, individuals are charged 20 yuan per account, while institutions are charged 200 yuan per account.

When opening a securities credit account, the fee is 40 yuan per account for individuals and 400 yuan per account for institutions.

For closed-end fund accounts, the fee is 5 yuan per account, applicable to both individual and institutional clients.

There are no charges for registering changes in account information, closing securities accounts, or custody transfers. This ensures flexibility and cost-efficiency for clients who need to update their details, close accounts, or transfer holdings.

LC Securities Fees Review

LC Securities provides a detailed and transparent fee structure for various financial instruments, ensuring clients are well-informed about the costs associated with their transactions.

For Shanghai and Shenzhen A-shares, including the Growth Enterprise Market (GEM) and the Science and Technology Innovation Board (STAR Market), the commission is capped at 3‰ of the transaction amount, with a minimum charge of 5 yuan. This includes a handling fee of 0.0341‰ (0.02387‰ for block trades) and a regulatory fee of 0.02‰. Additionally, there is a transfer fee of 0.01‰ of the transaction amount (0.007‰ for block trades) and a stamp duty of 0.5‰, which is only charged on the sell-side.

For funds, including closed-end funds, ETFs, LOFs, and publicly offered REITs, the commission is also capped at 3‰ of the transaction amount, with a minimum charge of 5 yuan. This includes a handling fee of 0.04‰ (0.02‰ for block trades), with monetary ETFs, bond ETFs, and REITs temporarily exempt from this fee.

For bonds, the commission does not exceed 0.2‰ of the transaction amount, with a minimum charge of 1 yuan. The handling fee is 0.001‰ of the transaction amount, capped at 100 yuan per transaction. For transactions below 1 million yuan, the handling fee is 0.1 yuan per transaction, and for transactions above 1 million yuan, it is 10 yuan per transaction.

For trading through the Hong Kong Stock Connect, the commission is capped at 3‰ of the transaction amount. The stamp duty is 1‰ of the transaction amount, charged on both the buy and sell sides, rounded to the nearest whole number, with a minimum charge of 1HKD (ETFs are exempt from this fee). Additionally, there is a transaction levy of 0.027‰ of the transaction amount, rounded to two decimal places.

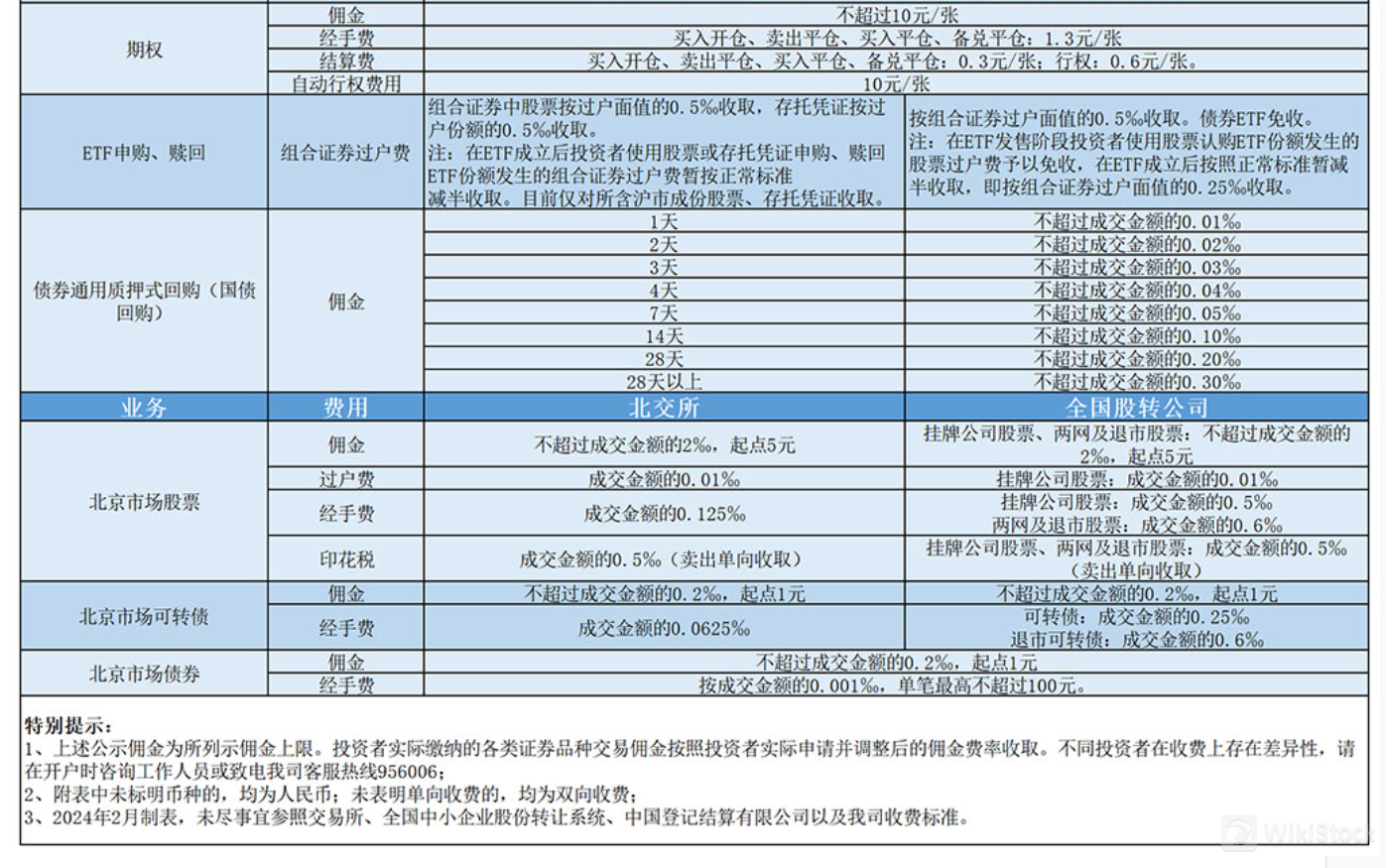

LC Securities App Review

LC Securities offers a suite of platforms designed to meet the diverse needs of investors, available both on desktop and mobile.

On the desktop side, LC Securities provides several applications: Lianchu Securities Shuyingtong (Tongdaxin), Lianchu Securities Shuyingshun (Tonghuashun), Lianchu Securities Qiquanbao, Lianchu Securities Qiquanbao (Full Simulation), and an MD5 Code Generator. These platforms offer robust tools for securities trading, options trading, and advanced financial analysis.

For mobile users, LC Securities offers Chubaobao, Chuyingjia, and Lianchu Qiquanbao apps. These mobile applications allow investors to manage their portfolios, trade options, and stay informed about market developments on the go.

Research and Education

LC Securities is dedicated to providing robust education and research services aimed at empowering investors and promoting a transparent market environment.

Their educational initiatives focus on several key areas including investor protection, which covers understanding company announcements, staying informed about delisting information, and accessing case studies that highlight best practices and potential pitfalls. They emphasize the importance of combating illegal securities activities and anti-money laundering measures, along with guidance on investor rights protection and specialized content on the Growth Enterprise Market (GEM).

LC Securities also offers a range of educational resources, such as the “Two Minutes to Understand ETFs” video and the “Lianchu Classroom” series on new stock subscriptions, to enhance investor knowledge.

In terms of research, LC Securities provides in-depth analysis and perspectives on macroeconomic trends and mergers and acquisitions (M&A). For example, their research discusses the potential of M&A to boost the bull market in the A-shares, re-evaluates the positioning of backdoor listings, and examines the implications of new regulations on M&A activities.

Customer Service

LC Securities provides comprehensive customer service support to meet the diverse needs of its clients. Their customer service center can be reached at 956006, ensuring that assistance is just a phone call away. For specific regional inquiries, LC Securities has designated contact numbers and office locations in major cities across China:

In Qingdao, the office is located at Building 8, Floors 11 and 15, No. 195 Hong Kong East Road, Laoshan District, with the postal code 266100, and can be contacted at 0532-80958800.

The Shanghai office is situated at Floors 9 and 10, Foxconn Building, No. 1366 Lujiazui Ring Road, Pudong New Area, postal code 200120, with the contact number 021-80295888.

In Beijing, the office is on Floor 27, Building 3, Zhongjian International Wealth Center, Yard 5, Anding Road, with the postal code 100029, and the contact number 010-86499400.

The Shenzhen office is located at Floors 28 to 30, Qiaocheng One Plaza, No. 2 Shenyun Road, Shahe Street, Nanshan District, with the postal code 518000, and can be reached at 0755-36991966.

Conclusion

LC Securities stands out for its low fees and user-friendly trading platforms, making it ideal for traditional securities investors and those seeking comprehensive educational resources. It provides access to IPOs and multiple trading tools, which are particularly beneficial for both novice and experienced investors looking to expand their portfolios. However, it does not support forex or cryptocurrency trading and lacks promotional offers, which may be a drawback for some users.

FAQs

Is LC Securities safe to trade?

LC Securities is licensed by the China Securities Regulatory Commission (CSRC). LC Securities securely handles clients' personal information as required by regulators for account opening. Necessary data is encrypted during transmission and storage and shared only with relevant institutions. If clients do not provide the required information, they cannot open an account. LC Securities does not share data with third parties unless legally required or chosen by the client.

Is LC Securities a good platform for beginners?

Yes, LC Securities provides a range of trading platforms and comprehensive educational resources, making it suitable for beginners looking to learn and engage in the financial markets.

Is LC Securities legit?

Yes, LC Securities is licensed and regulated by the China Securities Regulatory Commission (CSRC), confirming its legitimacy and adherence to regulatory standards in the securities industry.

Risk Warning

The information presented reflects WikiStock's assessment based on an evaluation of the brokerage's website data and may be subject to updates. Additionally, participating in online trading carries significant risks, including the potential for complete loss of invested funds. Therefore, it is essential to fully understand these risks before engaging in any trading activities.

Others

Registered region

China

Years in Business

1-2 years

Products

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

国融证券

Score

长城国瑞证券

Score

中天证券

Score

华金证券

Score

CGWS

Score

CICC

Score

东兴证券

Score

Shengang Securities

Score

国投证券

Score

国信证券

Score