Score

三豊証券

http://www.mitoyo-sec.co.jp

Website

Rating Index

Brokerage Appraisal

Influence

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

三豊証券株式会社

Abbreviation

三豊証券

Platform registered country and region

Company address

Company website

http://www.mitoyo-sec.co.jpCheck whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Mitoyo Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 1944 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Japanese domestic stocks, Investment Trust, Bonds |

| Customer Service | Head office: 〒768-0060 1158-1 Kannonji-cho, Kagawa-ken, Kannonji-shi, Kagawa |

| Tel: 0875-25-1212 (workdays 9:00-17:00); fax: 0875-25-1221 |

Mitoyo Securities Information

Established in 1944, Mitoyo Securities is a financial services firm offering a diverse range of investment products, including Japanese domestic stocks, bonds, mutual funds, ETFs, and J-REITs etc. They provide options such as Japan Government Bonds (JGBs) with fixed and variable interest rates, as well as corporate bonds like Domestic Convertible Bonds (CBs).

Regulated by the Japan Financial Services Agency (FSA) with license number Director-General of Shikoku Finance Bureau (Kinsho) No. 7, Mitoyo Securities upholds stringent standards of integrity and credibility in all financial operations.

For more detailed information, you can visit their official website: http://www.mitoyo-sec.co.jp/index.html or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Online Support |

| Wide Range of Investment Products | |

| Established History |

- Regulated by the FSA: Mitoyo Securities is regulated by the Japan Financial Services Agency (FSA) under license number Director-General of Shikoku Finance Bureau (Kinsho) No. 7, which ensures the company adheres to stringent regulatory standards, providing a level of security and trust for investors.

- Wide Range of Investment Products: Mitoyo Securities offers a diverse selection of investment options, including Japanese domestic stocks, bonds, mutual funds, ETFs, and J-REITs. This allows investors to build a varied portfolio suited to their financial goals and risk tolerance.

- Established History: Mitoyo Securities has been operating since 1944, which is a long history that indicate stability and experience in the financial market. Cons:

- Limited Online Support: Mitoyo Securities lacks comprehensive online support options such as email, live chat, or social media customer service. This can be inconvenient for clients who prefer digital communication or require assistance outside of business hours.

- Is Mitoyo Securities regulated by any financial authority?

- What types of products does Mitoyo Securities provide?

- Is Mitoyo Securities suitable for beginners?

Is It Safe?

Regulation:

Mitoyo Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of Shikoku Finance Bureau (Kinsho) No. 7, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Mitoyo Securities's commitment to integrity and credibility in its services.

Safety Measures:

So far, we have not found security measures of Mitoyo Securities on their website. If you intend to trade with the company, seek for clarification about this to make sure your funds are protected before commiting any actual captials.

What are Securities to Trade with Mitoyo Securities?

Mitoyo Securities offers a diverse range of financial products.

Their offerings include Japanese domestic stocks listed on major exchanges such as the Tokyo Stock Exchange, Nagoya Stock Exchange, Sapporo Stock Exchange, and Fukuoka Stock Exchange. Investors can access Prime, Standard, Growth Markets, as well as Exchange Traded Funds (ETFs), Real Estate Investment Trusts (REITs).

For those preferring investment trust, Mitoyo Securities provides options like stock mutual funds, public and corporate bond investment trusts (MRFs), and ETFs. These products allow for diversified portfolios managed by investment specialists, suitable for medium to long-term investment goals.

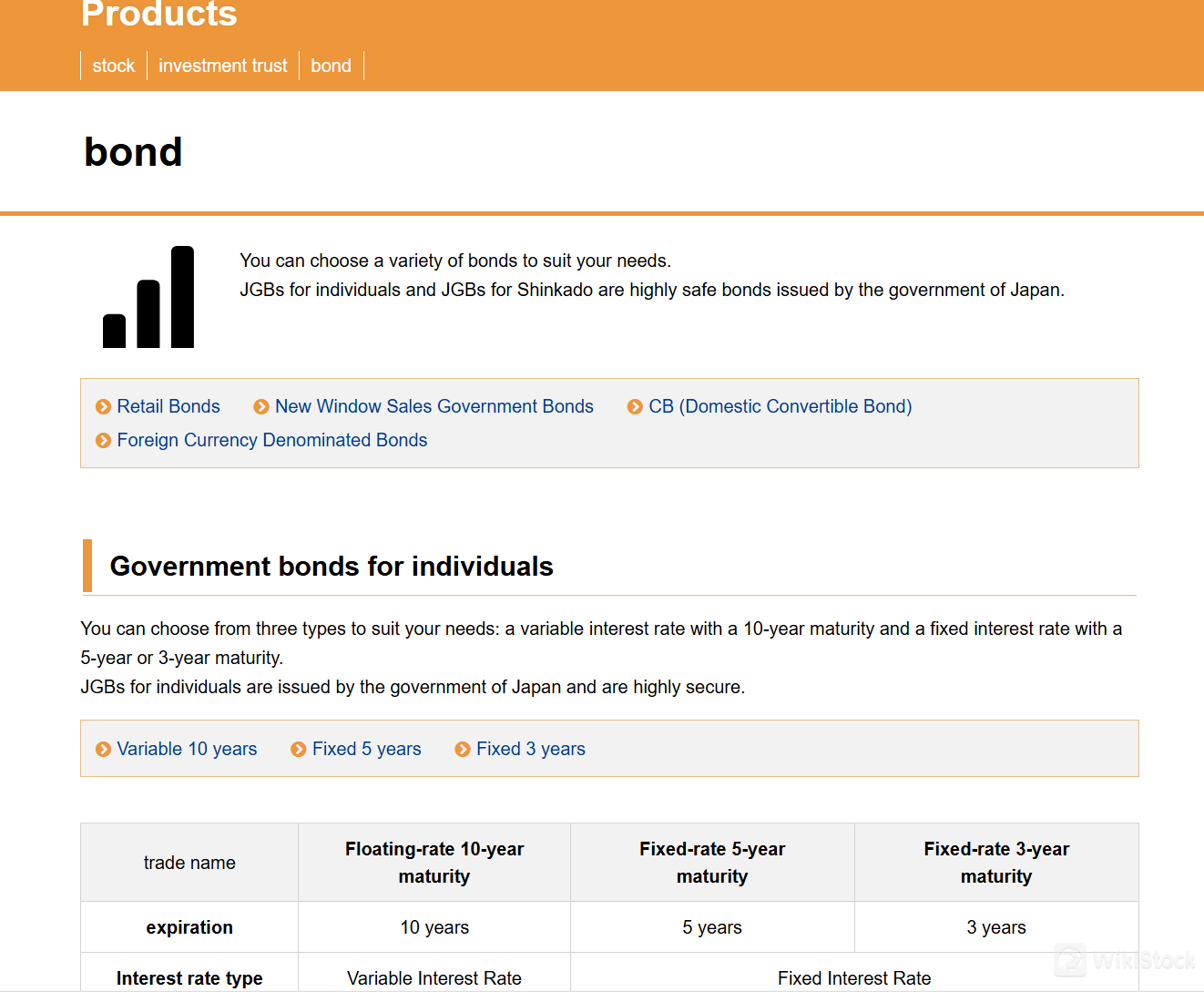

Additionally, they also facilitate investments in government bonds, including Japan Government Bonds (JGBs) with options such as Variable 10-year, Fixed 5-year, and Fixed 3-year bonds, ensuring stability and predictable returns.

Furthermore, Mitoyo Securities caters to investors interested in corporate bonds such as Domestic Convertible Bonds (CBs), blending features of stocks and traditional bonds by offering conversion into shares under specified conditions. For those seeking higher yields, they provide opportunities in Foreign Currency Denominated Bonds, which offer competitive interest rates alongside potential gains or losses based on currency fluctuations.

Research & Education

Mitoyo Securities, as a local securities firm, places a strong emphasis on thorough company (stock) analysis, research, and proposals. They meticulously examine financial results, briefing materials, and management plans of companies to ensure a deep understanding of the products and services handled. This diligent approach allows them to make well-informed investment proposals for their customers.

For first-time investors, Mitoyo Securities offers a wealth of educational resources designed to simplify the investment process. These resources include basic knowledge of various financial instruments, detailed guides on opening a new account, and step-by-step instructions for buying and selling stocks and mutual funds, equipping investors with the necessary knowledge to navigate the investment landscape confidently.

Customer Services

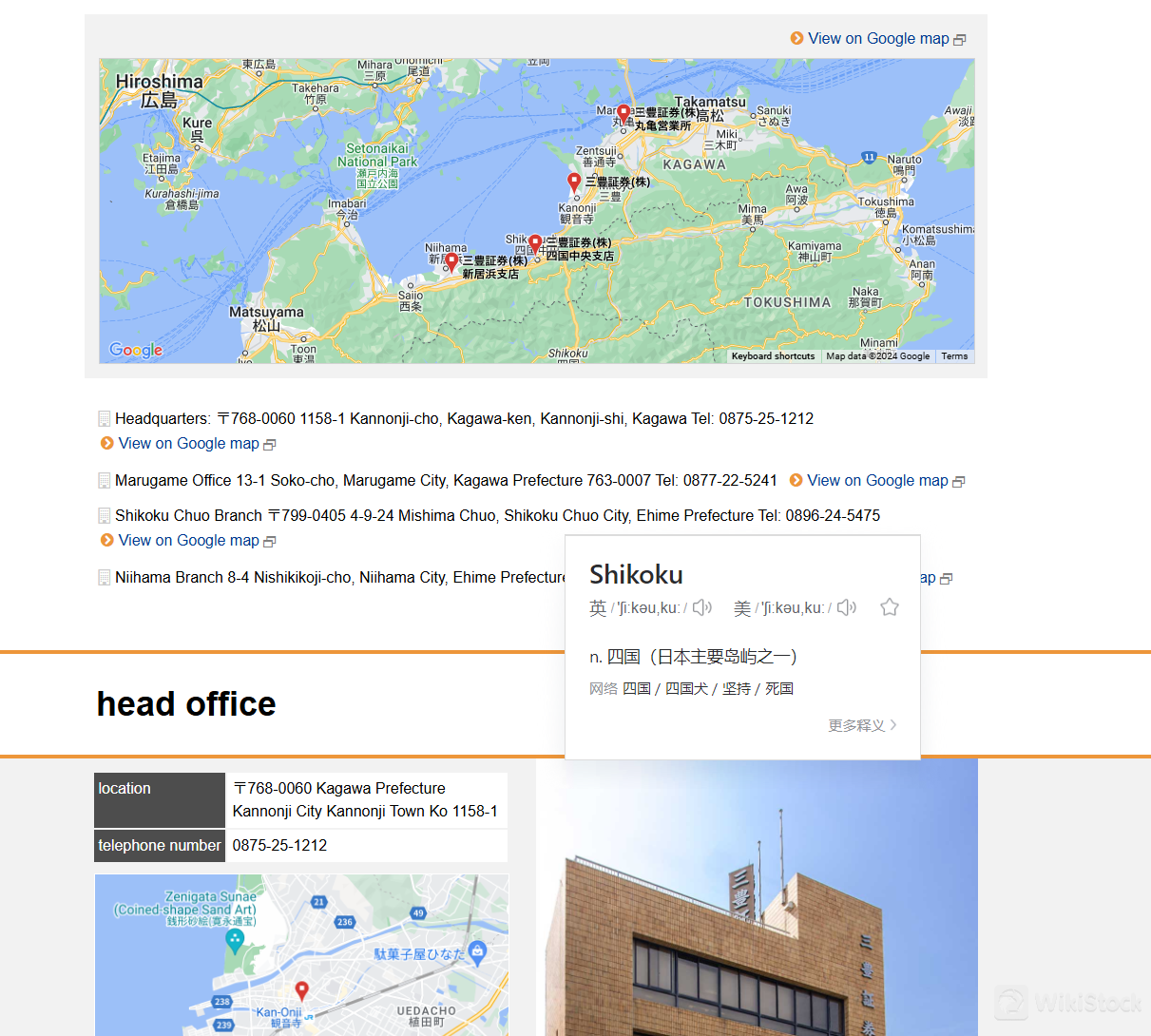

Mitoyo Securities provides physical address and phone contact for its head office and three branches across Japan as customer service for smooth and supportive experience for its clients.

The head office, located at 〒768-0060 1158-1 Kannonji-cho, Kagawa-ken, Kannonji-shi, Kagawa is easily accessible for in-person consultations.

Customers can reach out via telephone at 0875-25-1212 on workdays between 9:00 and 17:00 for general inquiries.

Contact for branches in Marugame, Shikoku Chuo, and Niihama can be found at http://www.mitoyo-sec.co.jp/branch/index.html.

However, some might find such customer service channels very limited, without comprehensive supports via email, live chat or social media platforms, there is chance that customer cannot address their inquiries timely.

Frequently Asked Questions (FAQs)

Yes, Mitoyo Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of Shikoku Finance Bureau (Kinsho) No. 7.

Japanese domestic stocks, bonds, mutual funds, ETFs, and J-REITs, etc.

Yes, Mitoyo Securities is suitable for beginners. It is well regulated by FSA and offers thorough company (stock) analysis, research, and proposals as well as basic knowledges for beginners to start their financial journey with ease.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Commission Rate

1.265%

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

Plus500

Score

BlackRock

Score

SBI THAI ONLINE

Score

Schroders

Score

AVA Trade

Score

Hantec Financial

Score

Monex

Score

Rakuten Trade

Score

LEADING

Score

auカブコム証券

Score