Score

中信信期證券

https://www.cfisec.com.hk/

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

China Hong Kong

China Hong Kong Products

2

Investment Advisory Service、Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Brokerage Information

More

Company Name

CITIC CFI Securities Company Limited

Abbreviation

中信信期證券

Platform registered country and region

Company address

Company website

https://www.cfisec.com.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.2%

Funding Rate

2.5%

New Stock Trading

Yes

Margin Trading

YES

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

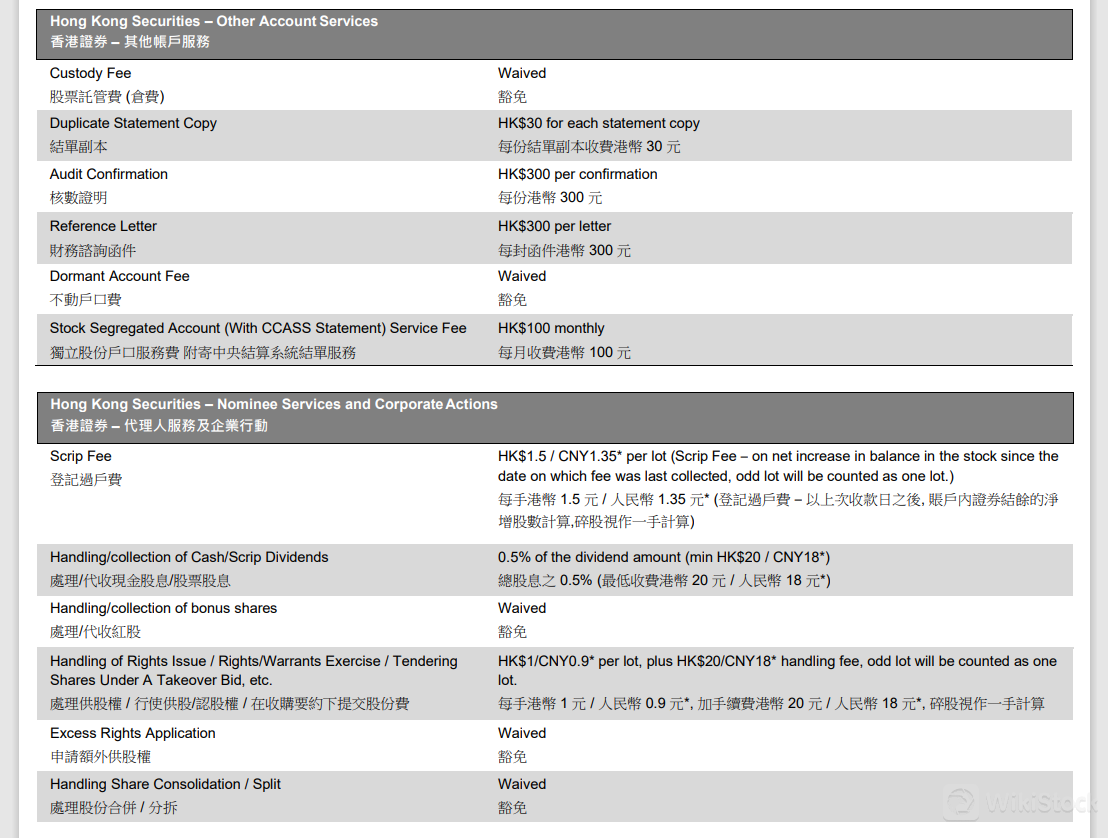

| CITIC CFI Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

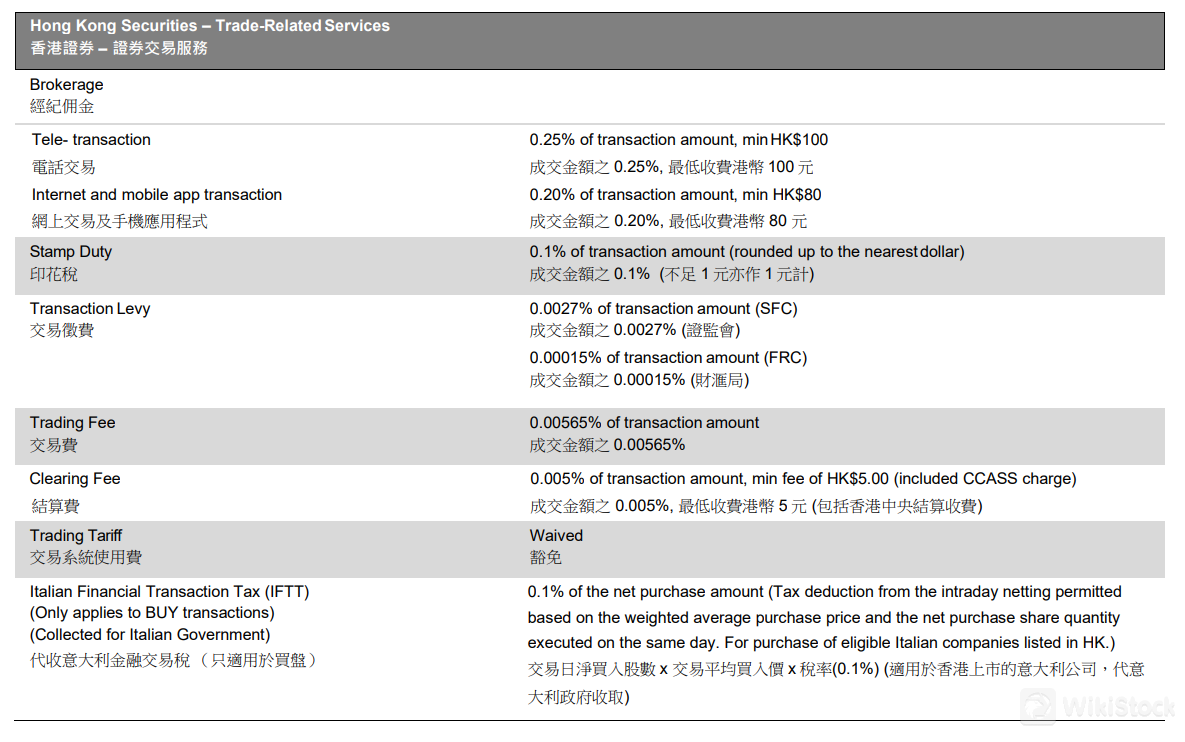

| Hong Kong Securities Fees | Brokerage: Tele-transaction: 0.25% of transaction amount, minimum HK$100. Internet and mobile app transaction: 0.20% of transaction amount, minimum HK$80 |

| Stamp Duty: 0.1% of transaction amount (rounded up to the nearest dollar) | |

| Transaction Levy: SFC: 0.0027% of transaction amount. FRC: 0.00015% of transaction amount | |

| Trading Fee: 0.00565% of transaction amount | |

| Clearing Fee: 0.005% of transaction amount, minimum fee of HK$5.00 (includes CCASS charge) | |

| Trading Tariff: waived | |

| Italian Financial Transaction Tax (IFTT) (Only applies to BUY transactions): 0.1% of the net purchase amount for eligible Italian companies listed in HK (tax deduction based on intraday netting rules) | |

| Margin Interest Rates | Prime Rate + 2.5% per annum |

| Mutual Funds Offered | No |

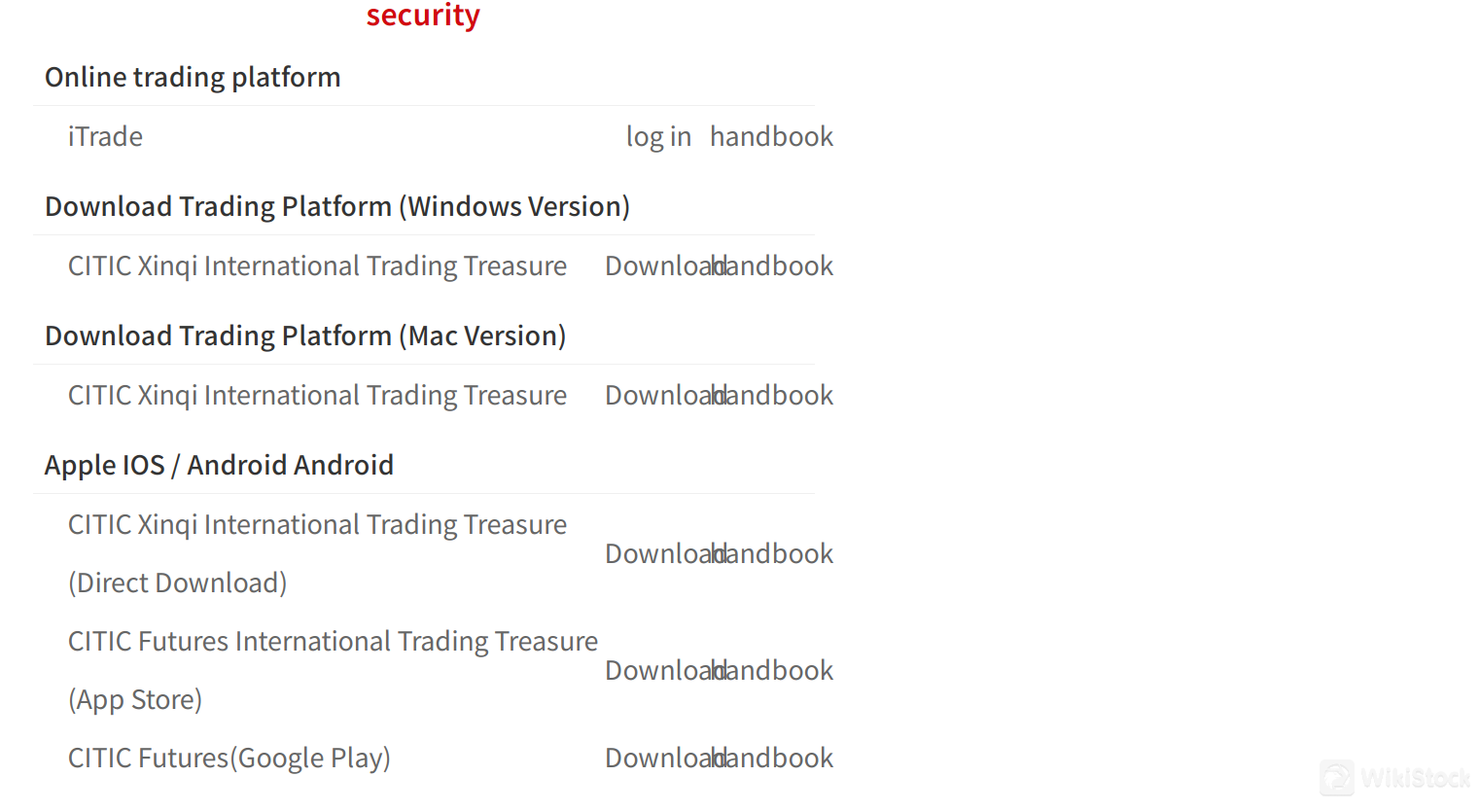

| App/Platform | iTrade, CITIC Xinqi International Trading Treasure |

| Promotions | Unavailable |

CITIC CFI Securities Information

CITIC CFI Securities is a regulated financial services firm known for its comprehensive range of investment and trading solutions. It provides access to Hong Kong stocks, facilitate trading through initiatives like the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, and offer opportunities to invest in overseas markets for diversification. Additionally, CITIC CFI Securities supports equity financing and IPO subscriptions, empowering clients with tools to optimize their investment strategies.

Pros & Cons

| Pros | Cons |

| Regulated by SFC | Lack of Mutual Funds |

| Comprehensive range of trading services | |

| Robust customer support |

Regulated by SFC: CITIC CFI Securities operates under the oversight of the SFC (license No. BRD739), ensuring compliance with stringent regulatory standards for investor protection.

Comprehensive range of trading services: Offers access to Hong Kong stocks, facilitates trading through Stock Connect programs, provides access to overseas markets, supports equity financing, and offers IPO subscriptions.

Robust customer support: Offers accessible customer support channels (phone, fax, and address) for client inquiries and assistance.

ConsLack of Mutual Funds: Limited options for investors looking to diversify through mutual funds, which can restrict some investment strategies.

Is CITIC CFI Securities Safe?

CITIC CFI Securities is regulated by the oversight of the oversight of the Securities and Futures Commission (SFC), holding license No. BRD739. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, CITIC CFI Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with CITIC CFI Securities?

CITIC CFI Securities distinguishes itself through a comprehensive array of trading services.

They provide access to Hong Kong stocks, allowing investors to participate in the vibrant Hong Kong market. Through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect programs, CITIC CFI Securities enables seamless trading between the Mainland China and Hong Kong markets, facilitating broader investment opportunities.

Additionally, their offering extends to overseas stocks, granting investors access to global markets for diversification. CITIC CFI Securities also supports equity financing, providing avenues for clients to optimize their investment strategies.

Furthermore, their IPO subscription services empower investors to participate in initial public offerings, ensuring they stay ahead in dynamic market opportunities.

CITIC CFI Securities Fees Review

When trading Hong Kong securities through CITIC CFI Securities, the brokerage fees vary based on the method of transaction. For tele-transactions, the fee is 0.25% of the transaction amount, with a minimum charge of HK$100. For transactions conducted through the internet or mobile app, the fee is reduced to 0.20% of the transaction amount, with a minimum charge of HK$80.

In addition to brokerage fees, there are several other charges to be aware of. Stamp duty is levied at 0.1% of the transaction amount, rounded up to the nearest dollar. The transaction levy, which is divided into two parts, includes a 0.0027% charge by the Securities and Futures Commission (SFC) and a 0.00015% charge by the Financial Reporting Council (FRC).

A trading fee of 0.00565% of the transaction amount is also applied. Furthermore, a clearing fee is charged at 0.005% of the transaction amount, with a minimum fee of HK$5.00. This fee includes charges from the Central Clearing and Settlement System (CCASS).

The trading tariff, which is a fee for using the trading system, is waived by CITIC CFI Securities. However, there is an additional tax for certain transactions involving Italian companies listed in Hong Kong. The Italian Financial Transaction Tax (IFTT) applies only to buying transactions and is 0.1% of the net purchase amount. This tax allows for deductions based on intraday netting rules, calculated using the weighted average purchase price and the net purchase share quantity executed on the same day.

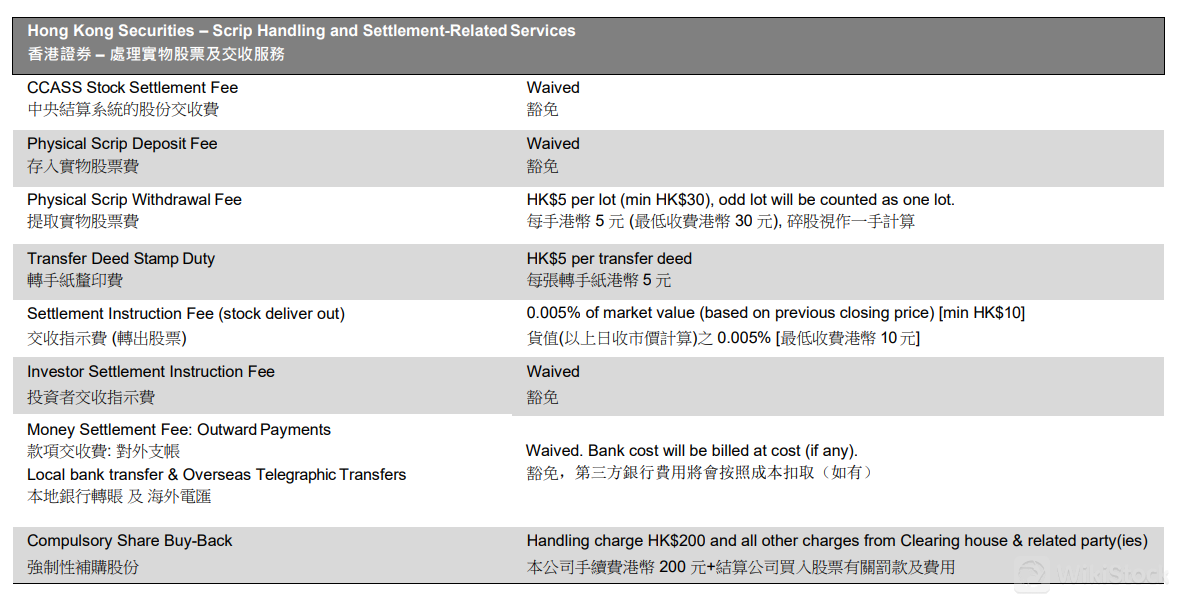

More specific fee structures can be found on their official websiteand in the attached screenshot.

CITIC CFI Securities App Review

CITIC CFI Securities provides a range of versatile trading platforms. Their flagship offerings include iTrade, an intuitive online trading platform designed for seamless execution of trades across various financial instruments.

For those preferring mobile accessibility, CITIC Xinqi International Trading Treasure offers robust solutions for both Apple iOS and Android devices, ensuring flexibility and convenience on the go. Additionally, CITIC Futures, available on Google Play, caters specifically to futures trading enthusiasts, offering comprehensive tools and real-time market data.

Customer Service

CITIC CFI Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

- Contact Number (Hong Kong, China): 00852-22863288

- Contact number (domestic toll-free line): 400-666-6698

- Fax: 00852-22863288

- Address: 2312-2316,23/F, CITIC Tower, 1 Tim Mei Avenue, Central, Hong Kong

Conclusion

In conclusion, CITIC CFI Securities presents itself as a regulated and comprehensive trading platform, offering a diverse range of investment services with advanced trading platforms. However, the lack of mutual funds can hinder a trader's decision-making process. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is CITIC CFI Securities suitable for beginners?

Yes, CITIC CFI Securities is suitable for beginners due to its user-friendly platform, transparent fee structure, and comprehensive customer support.

Is CITIC CFI Securities legit?

Yes, CITIC CFI Securities is regulated by SFC.

What trading services does CITIC CFI Securities offer?

CITIC CFI Securities provides access to Hong Kong stocks, facilitates trading through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect programs, offers access to overseas stocks, supports equity financing, and provides IPO subscription services.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Investment Advisory Service、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

信期國際金融控股有限公司

Parent company

--

中信期貨有限公司

Parent company

Review

No ratings

Recommended Brokerage FirmsMore

iGM

Score

KCG Securities

Score

MFG

Score

富士商品

Score

東海國際

Score

恒豐證券

Score

ACU

Score

INNOVATION SECURITIES

Score

I Win Securities

Score

Silverbricks Securities

Score